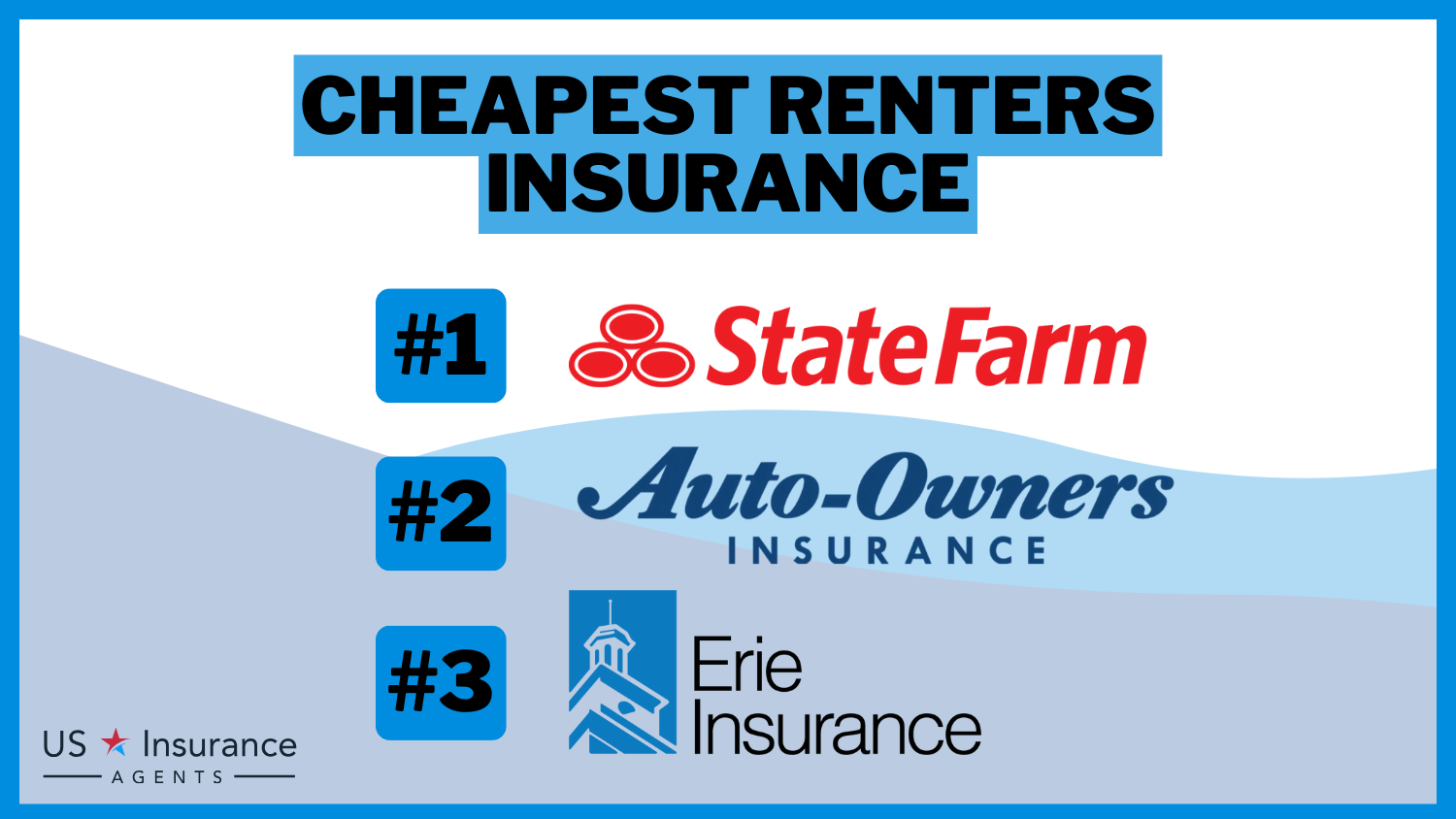

Cheapest Renters Insurance in 2026 (Save Money With These 8 Companies!)

State Farm, Auto-Owners, and Erie are the top three picks for cheapest renters insurance. State Farm is our frontrunner for cheap renters insurance, offering competitive rates at $10 per month along with comprehensive coverage options and excellent customer service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated February 2025

Company Facts

Avg. Monthly Rate for Renters

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Avg. Monthly Rate for Renters

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Avg. Monthly Rate for Renters

A.M. Best Rating

Complaint Level

Pros & Cons

When it comes to choosing the cheapest renters insurance that won’t strain your budget, options like State Farm, Auto-Owners, and Erie offer the most budget-friendly renters coverage.

Among these frontrunners, State Farm stands out as the most attractive choice, offering competitive rates at $10 per month alongside a reputation for comprehensive coverage and dependable customer service.

Our Top 8 Company Picks: Cheapest Renters Insurance

Company Rank Monthly Rates Bundling Discount Best For Jump to Pros/Cons

![]()

#1 $10 5-25% Value Service State Farm

![]()

#2 $11 10-20% Customer Focus Auto-Owners

#3 $12 5-25% Coverage Options Erie

#4 $13 5-25% Customer Relations Country Financial

#5 $14 5-15% Policy Flexibility Travelers

#6 $15 10-25% Discount Variety Allstate

#7 $16 5-20% Review Process Nationwide

#8 $17 5-10% Service Personalization Farmers

Cheap renters insurance quotes are available from other reputable insurance companies. You can find cheap renters insurance by comparing rates from the top renters insurance companies.

Don’t miss out on securing your peace of mind. Enter your ZIP code now to compare renters insurance rates from the cheapest renters insurance providers.

- Renters insurance may cover thunderstorm, hurricane, and tornado damage

- It provides coverage for a personal property and liability

- At $10/mo, the cheapest renters insurance company is State Farm

#1 – State Farm: Highly-Rated Customer Service

Pros

- Good Customer Service: State Farm is renowned for its responsive and helpful customer service. The company scored above average for overall customer satisfaction in the J.D. Power 2023 U.S. Auto Insurance Study.

- Many Coverage Options: State Farm renters insurance includes personal property coverage, liability coverage, and additional living expenses coverage.

- Multi-Policy Discounts: Policyholders can save by bundling their renters insurance with other policies such as auto insurance, further maximizing affordability of their policy. Learn more in our State Farm insurance review.

Cons

- Limited Online Resources: While State Farm offers online tools for obtaining quotes and managing policies, these may be less robust compared to some competitors.

- No Live Chat: The absence of live chat may be a drawback for policyholders who prefer real-time online assistance or have inquiries that could be quickly addressed through chat.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Auto-Owners: Personal Touch

Pros

- Customizable Policies: Auto-Owners allows you customize your renters insurance policy by selecting the preferred coverage limits, deductibles, and add-ons. Learn more in this State Farm vs. Auto-Owners renters insurance review.

- Optional Coverages: Auto-Owners offers optional coverages, such as identity theft and water backup, protecting you against specific risks that may not be adequately addressed by standard policies.

- Personalized Service: Auto-Owners works with a network of independent agents who provide expert advice, assistance with claims filing, and ongoing support.

Cons

- Limited Availability: Our Auto-Owners insurance review finds that the company is not available in every state, so you must find a local independent agent to obtain a quote or coverage.

- No Quotes or Claims Online: The lack of an online option to obtain quotes or file claims means that you may need to contact an agent or visit a local office for assistance.

#3 – Erie: Extensive List of Discounts

Pros

- Competitive Rates: Erie offers budget-friendly rates combined with a comprehensive list of coverage options. Learn more our Erie’s rates in our Erie insurance review.

- Great Customer Satisfaction: Erie is known for its dedication to customer satisfaction, boasting an above-average J.D. Power customer satisfaction score.

- Generous Discounts: Renters who install safety features in their rental properties can benefit from significant cost savings on their insurance premiums.

Cons

- Not in All States: Erie offers renters insurance coverage in 12 states, including Washington, D.C..

- Few Optional Coverages: Erie’s offerings for optional renters coverages are not as extensive as those of other insurance providers.

#4 – Country Financial: Lower Than Average Complaint Rate

Pros

- Many Discounts: Country Financial’s discounts may include but are not limited to discounts for non-smokers, alarm systems, multi-policy bundling, and more. Find out more in this Country Financial insurance review.

- Additional Coverage Options: Country Financial offers specialized coverage that protects valuable items (such as jewelry or electronics) and which may exceed the limits of standard renters insurance policies.

- Few Complaints: Given its size, Country Financial sees far fewer consumer complaints than the national average regarding its renters insurance.

Cons

- Limited Availability: Country Financial’s availability is limited to 19 states.

- Few Online Resources: One limitation is that you cannot obtain online quotes for renters coverage, which may seem inconvenient for those who prefer to shop from the convenience of their home.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Coverage for Expensive Items

Pros

- Nationwide Availability: Travelers offers renters coverage in 45 U.S. states and Washington, D.C. The only states where it doesn’t sell renters insurance are Alaska, Florida, Louisiana, West Virginia and Hawaii. Read more in our Travelers vs. Country Financial renters insurance review.

- Valuable Items Insurance: With this optional add-on rider, you can extend your standard renters coverage to include a broader range of losses for special possessions such as art pieces, or musical instruments.

- Generous Discounts: You can reduce your renters insurance premiums by qualifying for Travelers’ insurance discounts, e.g., for installing security systems, fire protective devices, and smart home technologies.

Cons

- Little Information Online: Our Travelers insurance reviews report that the online quote process may be less streamlined compared to competitors. Customers need to contact the company by phone.

- Poor Customer Service: Travelers operates through a network of independent agents, which means the level of customer service can differ depending on your location.

#6 – Allstate: Streamlined Quote Shopping

Pros

- Nationwide Availability: As one of the largest insurers in the U.S., Allstate sells renters insurance coverage through a network of independent agents in all 50 states. Learn more in our Allstate insurance review.

- Innovative Features: Allstate’s Digital Locker tool is a convenient and user-friendly platform for inventory management and seamless claims filing.

- Easy Online Buying Process: Customers can easily navigate through Allstate’s intuitive website interface, accessing relevant information about renters coverage, policy options, and pricing details with just a few clicks.

Cons

- Rates May Be Higher: The average U.S. renter pays about $15 per month for renters insurance with Allstate, but rates may vary by state.

- Few Optional Coverages: In some states, customers will find that Allstate doesn’t have the most generous list of optional endorsements.

#7 – Nationwide: Strong Emphasis on Customer Service

Pros

- Extensive Agency Network: Nationwide works with more than 11,000 U.S. independent agents selling personal lines, commercial lines, agribusiness, excess and surplus and financial services solutions.

- Great Financial Ratings: Our Nationwide insurance reviews suggest that the company received an A+ rating from A.M. Best for its strong financial stability. According to the NAIC, Nationwide’s customer complaint index is significantly lower than the national median, indicating fewer complaints.

- Several Discounts: Nationwide’s renters insurance discounts include: protective device discount, claims-free discount, Nationwide Associate Discount, and multi-policy discount. Learn more in our Nationwide vs. Erie renters insurance review.

Cons

- High Rates: Nationwide’s renters insurance rates may be higher compared to other insurers, making it a less affordable option for renters on tight budgets.

- Limited Availability: Renters in seven U.S. states, including: Alaska, Florida, Hawaii, Louisiana, Massachusetts, New Jersey, and New Mexico will need to seek renters coverage elsewhere.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Robust Add-Ons

Pros

- Comprehensive Add-ons: Farmers renters insurance may include: identity theft protection, refrigerated food replacement, replacement cost coverage, and personal article floaters. Learn more in this Farmers vs. Allstate renters insurance review.

- Numerous Discounts: According to our Farmers insurance review, the company offers various discounts, such as customer loyalty discount, claims-free discount, or smoke-free discount that can reduce higher-than-average premiums.

- Good Online Platform: Farmers has a user-friendly mobile app and online customer platform that allows you to conveniently view policy details, request policy changes, get quick renters insurance quotes online, and more.

Cons

- High Premiums: At $17 per month, Farmers has the highest average renters insurance rates compared to top competitors, e.g., State Farm in our analysis.

- Not Available in All States: Unlike its home and car insurance policies which are available in all 50 U.S. states, renters coverage is only offered in 42 U.S. states, excluding states such as Alaska, Delaware, Hawaii, and Maine.

What Renters Insurance Typically Covers

Typically, renters insurance includes coverage for:

- Your personal property

- Liability for injuries incurred within your home

- Extra living expenses if your rented house becomes uninhabitable

- Liability for any property damage that occurs within your rented property

- Liability for any injuries you, your family members, and pets cause to others or those that occur within your property

It is worth noting that renters insurance will not cover the actual structure in which you live and any structural problems — that is the property owner’s responsibility.

Below is a breakdown of what your renters insurance will cover. You need to understand the protection available to choose the right insurance.

Personal Property Protection

According to the FBI, over 1.11 million burglaries happen each year, losing each victim an average of $2,661 worth of property. So, renters insurance comes in handy, ensuring you will be financially protected from losing some of your personal property to burglars.

In addition, renters insurance will compensate you if you lose your property to fire, electrical or plumbing malfunctions, vandalism, riots, and explosions. Also, some forms of weather-related damage to your belongings will be covered. For example, if a hailstorm damages your possessions, renters insurance will likely cover that.

Liability Protection

If something terrible happens to someone or their property while in your home and they get injured, you could get sued. The same rule applies if you and members of your household, including pets, harm others or cause damage to their property in or outside your property.

For example, if your dog bites your neighbor’s child while they are playing with your children, you will likely be held responsible. And you could end up getting sued and paying fines and legal fees.

However, if you have renters insurance, you will be protected from liability to a specified extent. Most liability insurance limits start at $100,000 and include funds for paying your legal fees. You can also pay an extra $300 for an additional $1 million worth of liability protection.

In addition, your renters insurance may provide for $5000 worth of no-fault medical insurance. This coverage will protect you if someone is injured on your property.

Extra Living Expenses

About 10.5 million Americans have been displaced in the past decade due to disasters. Renters insurance provides coverage for any extra expenses you incur once a disaster occurs.

In addition, renters insurance will reimburse you for the difference between your usual spending and what you spend after the disaster. Other expenses it will cover include temporary living accommodations and restaurant meals.

The renters insurance policy is a special type of homeowners insurance, called the HO-4 policy. This type of policy includes personal property coverage and liability damage and injury protection. All property covered by a landlord policy is excluded from a renters policy. It is meant to insure a person or family’s possessions and financial stability, regardless of the liabilities of the building owner.

Read more: Best Renters Insurance for Famillies

Perils Covered by Renters Insurance

Named perils differ from policy to policy, but typically include as many as 17 different potential risks. The likelihood of each risk will affect the cost of insurance in the region, and may affect what perils are included in the standard policy. Here is a partial list of perils that are covered by most policies:

- Fire or lightning

- Windstorm or hail

- Explosion

- Riot or civil disturbance

- Vehicles, including aircraft

- Smoke

- Vandalism or malicious mischief

- Theft

- Volcanic eruption

- Falling objects

- Weight of ice, snow, or sleet

- Accidental discharge or overflow of water

- Freezing

- Lost items

Most renters insurance plans provide protection against certain types of water-related harm to your possessions, excluding damage resulting from floods caused by weather conditions.

Chris Abrams Licensed Insurance Agent

So, if your personal belongings suffer water damage from a burst pipe, you might be eligible for coverage. However, damages incurred due to the overflow of a nearby body of water are typically not covered under such policies.

Read more: What’s the difference between flood insurance and water backup coverage?

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why Landlords Require Renters Insurance Coverage

Landlords typically require tenants to have renters insurance because it offers valuable protection for both parties involved. Renters insurance includes liability coverage, which protects tenants if they accidentally cause damage to the rental property or injure someone while on the premises. This coverage can help cover legal expenses and any damages awarded in a lawsuit. For landlords, this reduces their own liability risks, as they can hold tenants accountable for damages they cause.

While landlords have insurance for the structure of the building, including fixtures and appliances they provide, it doesn’t cover tenants’ personal belongings. Renters insurance ensures that tenants’ possessions are protected against risks like theft, fire, or natural disasters. If a tenant’s belongings are damaged or destroyed, they can file a claim with their renters insurance to replace or repair them.

Renters Insurance May Cover Pet Liability

Most renters insurance policies include personal liability coverage, which can be beneficial if your pet causes harm to someone else or damages someone else’s property. For example, if your dog accidentally bites a visitor in your home or damages a neighbor’s property, your renters insurance may help cover the resulting medical bills or property damage expenses.

However, renters insurance generally does not extend to cover damages caused by your own pets. For instance, if your cat scratches up your furniture or your dog chews through your belongings, renters insurance is unlikely to provide coverage for these types of damages.

Actual Cash Value vs. Replacement Cost Renters Insurance

Renters insurance can be purchased for cash value or replacement cost coverage. Replacement cost will cost a little more on the premiums but will replace your lost property regardless of the current price. Actual cash value coverage will only pay out the depreciated value of your property, which is typically a percentage of the actual cost to replace lost items.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Renters Insurance Costs

In the table below, we compared rates from the top renters insurance companies across various states to see which ones offer some of the cheapest renters insurance in the U.S. We’ve excluded USAA from our list because its policies are exclusive to military members, veterans and their families. However, USAA is the best renters insurance company for military personnel.

Renters Insurance Monthly Rates by Coverage Type

Insurance Company Minimum Coverage Full Coverage

$15 $39

![]()

$11 $32

$13 $35

$12 $34

$17 $41

$16 $40

![]()

$10 $30

$14 $37

As you can see, renters insurance premiums tend to be more affordable compared to what you would pay for homeowners insurance because, unlike homeowners, renters are not liable for the structural damages, leading to lower rates.

However, if you still think you’re paying too much on your renters insurance, it’s important to shop around for multiple quotes to reduce your renters insurance costs.

Read more: Allstate vs. USAA renters insurance

How to Save on Your Renters Insurance Policy

You can save money on renters insurance, as with other home policies, by taking advantage of discounts offered by the insurance company.

Discounts may be related to the location of the home, security devices installed on the property, or related to your personal information. There are over a dozen discounts available, but not all discounts will be available from every company.

For instance, you may wonder, “Can I bundle my Auto-Owners car insurance policy with other policies?” Yes, you can bundle your car and renters insurance to maximize your savings.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

In addition to understanding the various discounts available, it’s essential to review your renters insurance policy regularly to ensure you’re getting the coverage you need at the best possible price.

Renters Insurance Case Studies

The following case studies highlight the importance of renters insurance in providing financial protection and peace of mind to tenants facing unexpected events.

- Case Study #1 – Fire Damage: Amy, a tenant in a multi-story apartment building, experienced a devastating fire that originated from a neighboring unit. The fire spread rapidly, causing extensive damage to her personal belongings, including furniture, electronics, and clothing. Fortunately, Amy had renters insurance, which covered the cost of replacing her damaged possessions.

- Case Study #2 – Theft: John, a student living off-campus, returned home to find his apartment had been broken into. His laptop, smartphone, and valuable jewelry were stolen. Thanks to his renters insurance, John was able to file a claim and receive reimbursement for the stolen items, allowing him to replace them without incurring a significant financial burden.

- Case Study #3 – Water Damage: Sarah, a renter in a ground-floor apartment, experienced a pipe burst in the building, resulting in extensive water damage to her furniture, flooring, and electronics. With renters insurance, Sarah was able to receive compensation for the cost of repairs and replacements, reducing her financial strain in dealing with the unexpected incident.

- Case Study #4 – Liability: Mark hosted a small gathering at his rented house, and one of his guests accidentally tripped over an exposed wire, resulting in injuries. The guest decided to pursue a legal claim against Mark for the medical expenses incurred. Luckily, Mark had renters insurance, which covered the liability costs associated with the incident, including legal fees and the guest’s medical bills.

- Case Study #5 – Loss of Personal Belongings During Travel: Lisa, a frequent traveler, was on vacation when her luggage was lost during a flight. Her luggage contained valuable items, including clothing, electronics, and jewelry. Fortunately, Lisa’s renters insurance extended coverage to her personal belongings, even when she was away from her rented residence. As a result, Lisa was able to file a claim and receive reimbursement for the lost items. (Read More: What is contents insurance for renters?).

- Case Study #6 – Michael’s Stolen Bicycle: Michael, an avid cyclist, had his bicycle stolen from the communal bike rack in his apartment complex. Being an expensive and cherished possession, Michael was devastated by the loss. However, since he had renters insurance, he was able to file a claim and receive compensation for the stolen bicycle. This helped him replace his bike and continue pursuing his passion for cycling.

- Case Study #7 – Emily’s Temporary Accommodation: Emily’s rented house suffered severe damage due to a storm, rendering it uninhabitable. She was forced to find temporary accommodation while her home was being repaired. Fortunately, Emily had renters insurance with additional living expenses coverage. This coverage helped cover the cost of her temporary accommodation, allowing her to maintain her standard of living until she could move back into her home.

- Case Study #8 – David’s Dog Bite Incident: David’s dog accidentally bit a guest in his rented apartment, causing injury. The injured person required medical attention and subsequently filed a lawsuit against David. Thankfully, David had renters insurance that included personal liability coverage. His insurance policy covered the legal expenses and the damages awarded to the injured person, sparing him from significant financial strain.

- Case Study #9 – Jessica’s Loss due to Natural Disaster: Jessica’s rented house was severely damaged by a natural disaster, leaving her without a place to live. However, Jessica had renters insurance that included coverage for loss due to natural disasters. She contacted her insurance provider, documented the damage, and was provided with the necessary financial assistance to find alternative housing until her rented house was restored.

Whether it’s fire damage, theft, liability claims, or natural disasters, renters insurance can offer invaluable support in times of need.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Renters Insurance is Beneficial

No matter how secure your neighborhood may seem, your rented property may still get burglarized. It can be expensive to replace all the personal possessions you lose. In addition, accidents happen, and someone may get injured on your property or by a member of your family.

Rather than risk getting sued for events you have no control over or doing without items you need, you should shop around with the best renters insurance companies. You are better off having it and not needing it, than needing it and not having the coverage. Use our free quote comparison tool below to find the cheapest renters insurance coverage in your area.

Frequently Asked Questions

What is renters insurance?

Renters insurance is a type of insurance policy that provides coverage for a renter’s personal property and liability in the event of certain covered losses or damages.

What does renters insurance usually cover?

Renters insurance typically covers personal property such as furniture, electronics, and clothing in the event of theft, damage or loss due to covered perils such as fire, smoke, lightning, windstorms, and certain types of water damage.

Renters insurance may also provide liability coverage for bodily injury or property damage the policyholder is responsible for, both inside and outside of the rented property. Additionally, some renters insurance policies may offer additional coverages such as temporary living expenses if the rented property becomes uninhabitable due to a covered loss.

What does renters insurance not cover?

Renters insurance typically does not cover damage or loss caused by earthquakes or floods. It also may not cover losses due to intentional acts, war, or nuclear hazards. In addition, renters insurance typically does not cover damage or loss to property that is not owned by the policyholder, or damage caused by pets or business activities.

Is renters insurance required by law?

Renters insurance is not required by law, but some landlords may require tenants to have renters insurance as a condition of the lease.

What does renters insurance cover in California?

The cheapest renters insurance in California provides coverage for:

- Personal Property

- Liability Protection

- Additional Living Expenses

- Medical Payments

- Loss of Use

Is renters insurance worth it?

Renters insurance can provide valuable financial protection for renters, especially in the event of a major loss. It is generally affordable, with premiums starting as low as $10 per month, making it a good investment for most renters.

Read more: Reasons why you need renters insurance

How much does renters insurance cost?

The average cost of renters insurance can vary depending on factors such as the amount of coverage, the location of the rented property, and the policyholder’s claims history. However, renters insurance is generally affordable and can provide valuable protection for personal property and liability.

How much coverage do I need for renters insurance?

The amount of renters insurance coverage needed will vary based on the value of the policyholder’s personal property and the level of liability protection they desire. To determine the appropriate amount of coverage, policyholders can create an inventory of their personal property and estimate its total value.

Why should college students have their own renters insurance policy?

Since your landlord’s insurance won’t cover repairing or replacing your possessions in case of theft, fire, or other commonly covered damages, you should get renters insurance. But first look into your parents home policy, which may include coverage for children who are attending college full time.

How do I get a renters insurance quote?

The quickest and easiest way to compare renters insurance quotes from top insurance companies is to use our free online quote tool. Just enter your ZIP code to get started.

Read more: How to Get Free Insurance Quotes

Is water damage covered by renters insurance?

What is the cheapest rent insurance?

What is the most common renters insurance?

How much is USAA renters insurance?

Can you cancel renters insurance?

Do I need renters insurance in California?

What is the average renters insurance in the U.S.?

What is the average cost of renters insurance in Texas?

How much is renters insurance in Hawaii?

Does renters insurance cover pets?

Why do landlords require renters insurance coverage?

Does renters insurance cover car damage?

Does renters insurance cover earthquakes?

Does renters insurance cover flooding?

Does renters insurance cover personal injury?

Does renters insurance cover theft of cash?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.