USAA vs. Chubb Homeowners Insurance in 2026 (Head-to-Head Review)

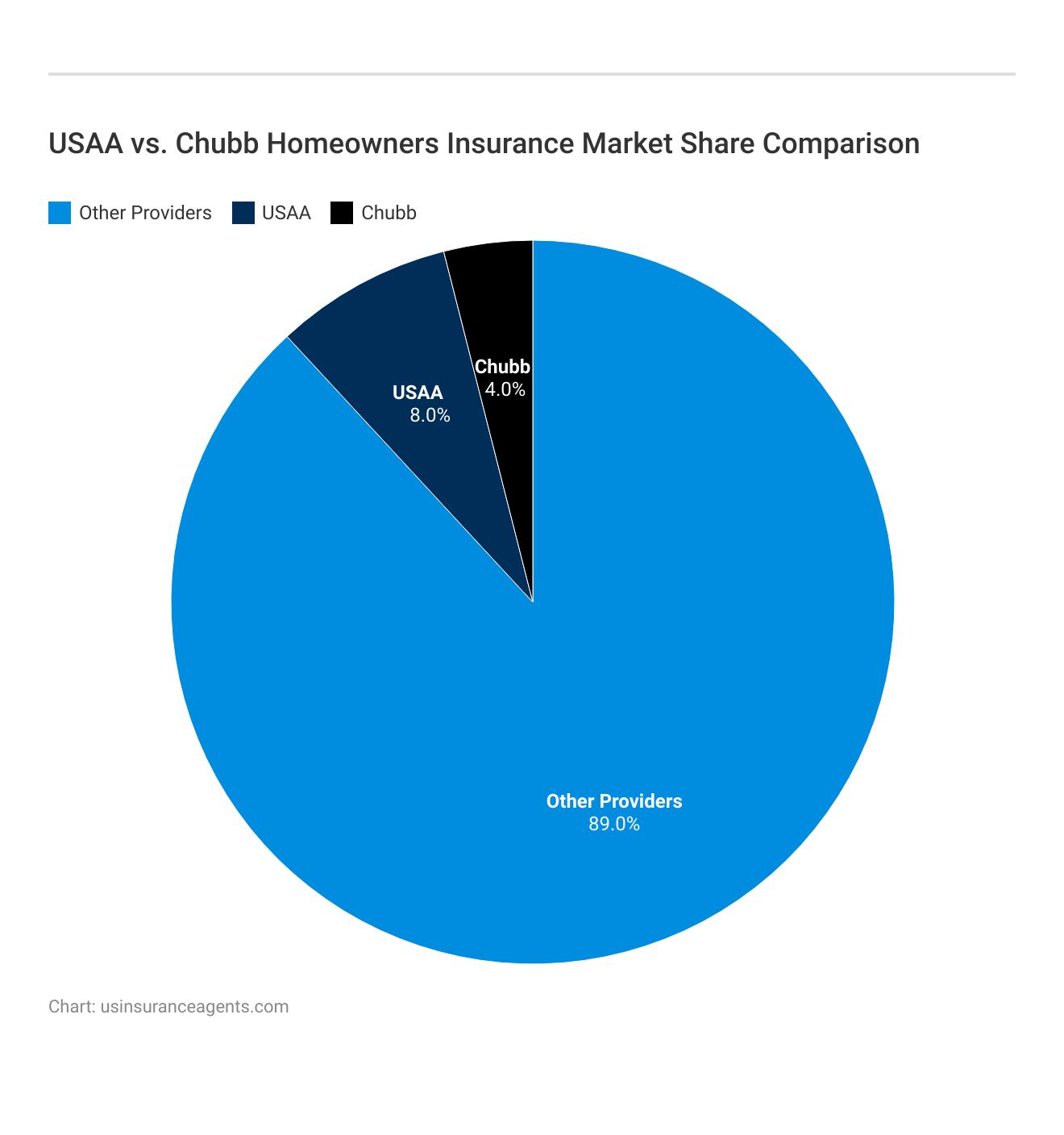

USAA vs. Chubb homeowners insurance examines how these two providers meet homeowners' needs. USAA offers military families affordability at $22/month, compared to Chubb, which services high-value properties with premiums ranging from $44/month. The comparison of Homeowners Insurance reveals value differences.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated April 2025

6,590 reviews

6,590 reviewsCompany Facts

Home Insurance Cost

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 82 reviews

82 reviewsCompany Facts

Home Insurance Cost

A.M. Best Rating

Complaint Level

Pros & Cons

82 reviews

82 reviewsUSAA vs. Chubb home insurance comparison shows that USAA’s insurance charges are as low as $22/month, while Chubb’s charges are as much as $44/month.

These insurance companies benefit military families differently than high-value homeowners who require comprehensive coverage.

USAA vs. Chubb Homeowners Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.8 | 4.5 |

| Business Reviews | 4.5 | 5.0 |

| Claim Processing | 5.0 | 4.8 |

| Company Reputation | 5.0 | 4.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.7 | 4.6 |

| Customer Satisfaction | 4.7 | 4.1 |

| Digital Experience | 5.0 | 3.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.6 | 4.2 |

| Plan Personalization | 5.0 | 3.5 |

| Policy Options | 4.7 | 4.4 |

| Savings Potential | 4.7 | 4.5 |

| USAA Review | Chubb Review |

USAA, particularly, has highly budget-friendly options, and Chubb offers extraordinary luxury property coverage. Ultimately, always compare multiple quotes to find your absolute best fit.

Finding affordable homeowners insurance premiums is simple with our free quote comparison tool. Enter your ZIP code to see affordable premiums for USAA vs. Chubb homeowners insurance and find the best coverage for your home.

- USAA offers $22/month premiums with military family benefits

- Chubb covers high-value homes starting at $44/month

- USAA provides exclusive discounts for military member

Coverage Options

Coverage Options Offered by USAA

USAA recognizes the necessity of full coverage options for protecting your home and possessions. Devoted to providing the best possible insurance solutions, USAA offers coverage options to meet the requirements of its policyholders. One of the main types of coverage supplied by USAA is dwelling coverage. Dwelling coverage protects your home’s structure, along with any attached structures.

Whether it is from a storm or fire, USAA has you covered. In addition to dwellings, the USAA also provides personal property coverage. Under this coverage, your goods are protected, with replacements or repairs available if damaged or lost. Liability coverage is another optional coverage offered by USAA.

USAA vs. Chubb HomeInsurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $150 | $250 |

| Age: 16 Male | $150 | $260 |

| Age: 30 Female | $100 | $100 |

| Age: 30 Male | $100 | $110 |

| Age: 45 Female | $80 | $80 |

| Age: 45 Male | $80 | $85 |

| Age: 60 Female | $70 | $75 |

| Age: 60 Male | $70 | $80 |

Accidents happen; sometimes, you are held responsible for injuries or property damage, so this coverage offers financial protection. USAA also knows that sometimes unfortunate things can make your house uninhabitable. They offer coverage for additional living expenses to ensure you are covered while the house is uninhabitable. This coverage helps you pay for temporary living arrangements in case your home becomes uninhabitable due to a covered event, helping to give you peace of mind during a difficult time.

But that is not all. USAA does even more than that. There are additional endorsements and add-ons to tailor your policy even further. You can add earthquake coverage if you live in an earthquake-prone area. If you live in a flood-prone area, USAA has flood insurance options to protect you. The coverage for valuable personal property also protects jewelry or fine art you may have; in the event of theft or damage, USAA can be relied upon to counterbalance the loss or repair.

Coverage Options Offered by Chubb

Chubb, a preeminent high-value home insurance provider, recognizes affluent homeowners’ distinct insurance coverage needs. That’s why Chubb offers ample coverage options to meet the specific requirements of high-value homes and their assets. One of the standout coverages Chubb offers includes extended replacement cost coverage.

This coverage exceeds the standard policy limits to ensure that the full cost of replacing your home will be covered, even when it exceeds the policy limit. Chubb guarantees complete protection for your home. Chubb also provides extended replacement cost coverage and cash settlement options.

This option allows for a cash settlement compared to rebuilding; therefore, you get a cash option if you face any covered loss. This flexibility allows for making the best decisions based on the specific circumstances. Chubb takes upon liability coverage and allows increased coverage above standard limits that can cover one well and more than unforeseen liabilities.

In addition, Chubb understands the importance of your prized possessions. It is the reason why Chubb extended coverage for your valuables. This protection has a higher limit than that provided by other general home and property insurance covers, thus providing you with a more significant amount to ensure the most prized possession of jewelry and fine arts is in good hands. Chubb’s comprehensive coverage ensures that your most prized possession in your high-value home is safe.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Best Homeowners Insurance: Chubb vs. USAA

We can compare USAA and Chubb using various criteria to determine which is superior. Although both companies have their strengths, USAA is the best choice for most homeowners.

- Affordable and Competitive Pricing: USAA offers broad coverage, but the cost is competitive and determined by location, home age, and coverage needs. Serving military members and their families is not just a motto; it also means having affordable solutions.

- Tailored Military-Focused Coverage: USAA focuses on serving military members and tailoring policies to this unique demographic. The flexibility of policies to accommodate frequent relocations and deployments adds an important convenience layer.

- Extensive Coverage Options: USAA offers wide coverage options that would suit a homeowner’s needs. It is comprehensive and flexible, from dwelling to personal property, liability, and additional living expenses.

USAA emerges as the winner because it commits to affordability, military-tailored coverage, and a comprehensive range of options. Chubb is superior to USAA if one looks at the capacity to take care of very high net-worth individuals. Still, when it comes to providing affordable, strong coverage to the masses, USAA comes out on top as the best homeowner insurance provider.

Understanding Homeowners Insurance

Protecting your home is crucial, and homeowners insurance covers you in case of damage or loss. Such insurance covers your property while offering liability coverage if somebody gets injured.

Kristine Lee Licensed Insurance Agent

When choosing your homeowners insurance, the perfect policy for you is vital as it depends on what and how you want. For this review, we will use USAA and Chubb, two of the most well-known insurance companies.

Importance of Homeowners Insurance

Homeowners insurance is essential since it provides financial protection against injury or loss from various factors such as fire, theft, natural disasters, or vandalism. It covers your home’s structure, including attached structures such as garages and personal belongings. Moreover, homeowners insurance protects you from liability claims if someone gets injured on your prope

This range can cover medical expenses, legal fees, and potential damages recovered in a lawsuit. Envision a guest slipping on your icy driveway. You might be liable for medical costs and attorney’s fees without homeowners insurance. What is the difference between personal liability and liability with renters insurance? Personal liability covers occurrences on your premises, whereas renters insurance could extend to off-premises situations.

Besides, homeowners insurance protects your physical house and its contents. If there happens to be a fire or theft, the insurance policy will replace or repair furniture, electronics, clothing, and many other valuable possessions. For individuals who have spent much money on high-end electronics, such coverage would be worthwhile because they could lose them altogether.

Key Features of a Good Homeowner Insurance Policy

A comprehensive homeowners insurance policy should contain the following main features to provide adequate coverage:

- Dwelling coverage: This will repair or reconstruct your home in case of damage caused by covered perils.

- Personal property coverage: This helps replace or repair items within your house, including furniture, electronics, and clothing.

- Liability coverage: This will cover you against loss if a person files a lawsuit against you for injuries sustained on your property.

- Additional living expenses coverage: This additional coverage pays for temporary living costs if your home becomes uninhabitable due to any covered event, such as fire or storm.

Comprehensive dwelling coverage ensures you can return your home to its former state following a covered event. Whether it’s a significant storm that devastates your roof or a fire that ruins a large percentage of your property, the coverage will give you the finances to rebuild and recover. Personal property coverage is crucial as it covers the goods inside your home.

From furniture and household appliances to personal items such as jewelry and artwork, that coverage will ensure you can replace or repair them if they get lost or stolen. Liability coverage is an essential part of your homeowner’s insurance because it provides protection against financial disaster brought about by a lawsuit filed against you. Whether it’s a slip-and-fall accident on your property or a dog bite incident, this coverage helps cover medical payments, legal fees, and any damages awarded in a lawsuit.

Also known as additional living expense insurance, this provides another vital safety net in that when the result of any covered event makes the insured home uninhabitable until repair or rebuilding is made possible, you have dollars at your disposal to support keeping a temporary residence either within a hotel or out while paying for meals from your pocket.

Company Overview

Introduction to USAA

USAA is a worthy insurance provider that works hard to serve the military family and its members. Since 1922, USAA has built on a great reputation as an excellent insurance coverage company with exceptional customer service. In this regard, with an even sharper understanding of the uniqueness of challenges posed by individuals in the military, USAA does a lot to ensure that its policies cut across what other insurers do.

It provides insurance coverage and discounts on homeowner insurance policies with flexible features. USAA insures the armed forces and protects their houses and possessions. The company understands the uncertainty of army life since its customers are often transferred and deployed. The flexibility shown by the company makes it possible to transfer and change coverage to a new location whenever coverage is needed.

In addition, USAA always stands ready to support members in difficult military situations. Upon a natural calamity, USAA has dedicated teams that make claims easier to handle so that policyholders have coverage sooner and life can be restored quickly.

Comprehensive Overview of USAA Home Insurance and Specialty Coverages

USAA offers a range of home-related insurance products, including USAA home insurance and USAA homeowners insurance, both of which received mixed reviews. Customers seeking coverage can obtain a USAA home insurance quote or contact the USAA homeowners insurance phone number for more information.

Specific products like USAA high-value home insurance and USAA valuable personal property insurance are available, with the latter often reviewed under USAA jewelry insurance reviews, USAA home insurance reviews, and USAA valuable personal property insurance reviews.

Chris Abrams Licensed Insurance Agent

For those with special needs, USAA home warranty reviews and USAA earthquake insurance reviews can help with these special coverages. USAA’s home and homeowners insurance reviews offer customers a comprehensive overview of the options.

Introduction to Chubb

Chubb is an insurance company that has been in operation for over 140 years. Chubb is an insurance company specializing in providing high-quality coverage, and they offer homeowners policies suitable for affluent individuals or families. Chubb knows the value of their high-value homes and possessions and, therefore, knows they need specialized cover.

They offer wide-ranging coverage options beyond the basic policies protecting valuable art, jewelry, and other collectibles. Regarding customer service, Chubb takes pride in providing individualized attention to each policyholder. The company’s experienced insurance professionals collaborate with the clients to identify their needs and then craft a tailored program to give maximum coverage.

In addition to great coverage, Chubb offers more services to its policyholders. It includes risk management consultancy, security review, and several professional persons one can seek for home repairs and maintenance. Chubb knows that it deals with people who are always busy in their spare time to handle complex insurance matters.

Therefore, this provides a dedicated claims team available 24/7 to handle all claims with utmost care and efficiency. Chubb has been in the business for a long time and has always tried to meet the needs of its policyholders in the most unique way possible.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pricing Comparison

USAA Homeowners Insurance Pricing

USAA offers competitive pricing for home insurance. However, the cost of any insurance policy depends on various factors, including the home’s location, age, the amount of coverage needed, and claims history. That’s not all, however. USAA makes all efforts to help its clients save money.

They give discounts that can significantly lower the total cost of your premium. For example, bundling homeowners’ insurance with other types, like auto insurance, can lead to a bundling discount. If you have installed a security system in your house, you can also benefit from a security system discount.

Not to mention the discounts for military personnel and their families, as USAA has a strong commitment to serving those who serve our country; with USAA, you can rest assured knowing that you get competitive pricing and the opportunity to maximize your savings through discounts based on USAA homeowners insurance reviews and the best renters insurance for military personnel.

Chubb Homeowners Insurance Pricing

Chubb’s homeowners policies are customized to meet the specific needs of high-end property owners. As a result, premium charges may be higher than those of standard insurance providers. However, Chubb offers unmatched benefits and coverage options. Multiple factors influence the cost of Chubb policies.

Your home’s location and value count, as does the type of coverage you require. Chubb fully knows that high-value items need special protection, and these policies reflect that. Although their premiums may be steeper, Chubb policyholders can sleep soundly at night, understanding they have comprehensive coverage and personalized service.

Extremely high replacement cost for Chubb homeowner insurance

byu/Worried_Event_7566 inInsurance

Chubb goes out of its way to ensure policyholders have the protection needed for their valuable assets. From luxury homes to fine art collections or high-end jewelry, Chubb’s homeowners’ insurance gives peace of mind and understanding your prized possessions are well taken care of.

It covers those seeking complete protection with peace of mind for their homes. If you are asking around about a Chubb Home Insurance quote or checking Chubb Home Insurance reviews, this would be one of the service providers with outstanding service, considering the type of policies each provider offers.

With positive Chubb Insurance reviews that feature excellent customer service and unique coverage options like Chubb Jewelry Insurance reviews, it’s easy to see why many opt for Chubb for their homeowner insurance. Find out why Chubb Insurance is trusted by so many today. So, though Chubb may be a little pricier, its value and coverage make it well worth the investment for affluent homeowners who need specialized insurance protection.

Customer Service Review

Customer Service at USAA

USAA is always known for having the best customer service. It continually receives higher ratings for being responsive to clients, communicating compellingly, and handling claims hassle-free. USAA’s 24/7 customer service also allows policyholders to get aid whenever they want.

Insurance Business Ratings & Consumer Reviews: USAA vs. Chubb

| Agency | ||

|---|---|---|

| "Score: 882 / 1,000 Above Avg. Satisfaction" | "Score: 870 / 1,000 Above Avg. Satisfaction" |

|

| "Score: A++ Excellent Business Practices" | "Score: A++ Excellent Business Practices" |

|

| "Score: 96/100 High Customer Satisfaction" | "Score: 82/100 Positive Customer Feedback" |

|

| "Score: 1.74 More Complaints Than Avg." | "Score: 0.60 Fewer Complaints" |

|

| "Score: A++ Superior Financial Strength" | "Score: A++ Superior Financial Strength" |

USAA also provides online tools and resources to help policyholders manage their policies, initiate claims, and access helpful information.

Customer Service at Chubb

Based on Chubb home insurance reviews, Chubb is famous for giving good customer service to its insured clients. It offers personal services, and claims help to ensure that its buyers receive timely and effective services when needed.

Chubb has expert customer support staff that are proactive in trying to help insurance policyholders, providing good information and suggestions that ease them through their claims. USAA and Chubb provide reliable coverage of homeowners’ policies with several alternatives to cater to people’s divergent needs.

USAA provides coverage at affordable rates, specifically for military members and their families, including a comprehensive 4-point home insurance inspection. In contrast, Chubb has high-value coverage and personalized service primarily serving high-income households and families. Select the best homeowners’ insurance company based on your requirements and preferences.

USAA Homeowners Insurance

Pros:

- Military-Focused Coverage: USAA offers this service to military members and their families, explicitly designing coverage based on their needs.

- Competitive Pricing: USAA provides competitive pricing to homeowners insurance, considering location, home age, coverage amount, and discounts.

- Comprehensive Coverage Options: USAA offers a range of coverage options, including coverage for dwelling, personal property, liability, and additional living expenses.

- Flexible Policies: USAA understands that military life is unpredictable, and policy transfers to new locations and adjustments in coverage are easy.

Cons:

- Limited Eligibility: Membership in the USAA is exclusively available to military personnel, veterans, and their families. As a result, the general public cannot access USAA.

- Niche Features: Some benefits cater exclusively to military-specific needs, which may appeal to something other than broader homeowner needs. Find out more by reading our “USAA Insurance Review & Ratings“

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chubb Homeowners Insurance

Pros:

- High-Value Coverage: The company covers high-value customers, including affluent individuals and families, with extended replacement cost coverage and higher limits for valuables.

- Personalized Service: Chubb can offer personalized attention to their policyholders, including services such as a dedicated team for claims, which is available on a 24/7 basis, and other supporting services like risk management consultancies.

- Comprehensive Protection: Chubb’s protection exceeds the standard coverage for high-value homes and properties.

- Cash Settlement Option: Chubb gives the policyholder flexibility, providing an option for a cash settlement giving one the freedom to decide after a covered loss.

Cons:

- Potentially Higher Premiums: Chubb’s policy premiums are higher, given their all-inclusive cover and exceptional service.

- Focus on Luxury Homes: Chubb focuses more on luxury homes, and thus, its offerings are only suitable for the owners of high-value homes. Its “Chubb Insurance Review & Ratings” will help you understand the issue better.

Comprehensive Comparison: USAA and Chubb Homeowners Insurance

USAA offers specialized homeowners insurance designed for military families with affordable monthly premiums and unique benefits such as coverage for active-duty relocations. With rates beginning at $22 per month, USAA is distinctive for its cost-effective options combined with reliable service.

Chubb is about high-value home protection with full coverage and premium service, which is perfect for the elite homeowner. Although its average monthly premiums start at $44, the wide value coverage, affordable coverage options, and concierge-level claims support make it more than worth the price. Comparing such providers will ensure homeowners find the right balance between affordability and premium protection.

Ready to compare rates for homeowners insurance? Enter your ZIP code below to find the best options for your property.

Frequently Asked Questions

Chubb vs USAA: Which homeowners insurance is better?

USAA typically offers lower rates for military families, while Chubb is known for high-value home insurance, offering comprehensive coverage for luxury properties.

USAA vs Progressive: Which offers better coverage?

USAA is often favored for its military-focused benefits and low rates for veterans, while Progressive offers more customizable policies and discounts for bundling.

USAA vs Allied: Which insurance company provides the best value?

USAA provides excellent value for military families with discounts and specialized coverage, while Allied offers competitive rates for standard homeowners insurance. Enhance your comprehension with our “Allied Insurance Review & Ratings.”

The Hartford vs USAA: Which is the better choice for homeowners?

USAA provides strong support for military families and affordable rates, while Hartford offers unique benefits like the “AARP Home Insurance” discount for seniors.

What is valuable personal property insurance with USAA?

Valuable personal property insurance from USAA covers high-end items like jewelry, collectibles, and fine art, offering additional protection beyond standard policies. Exploring affordable home insurance premiums is simple with our free quote comparison tool. Enter your ZIP code below to discover budget-friendly coverage options tailored to your needs.”

USAA vs 21st Century: Which company offers better rates?

USAA offers competitive rates for military families, whereas the 21st Century provides low premiums for standard homeowners insurance without specific military discounts. Unlock additional information in our “21st Century Insurance Review & Ratings”

USAA vs Safeco: Which company offers superior home insurance?

USAA is ideal for military families, with lower premiums and military discounts, while Safeco offers flexible coverage and discounts for bundling home and auto policies.

USAA vs Nationwide: Which offers better homeowners insurance coverage?

USAA excels in serving military families with affordable rates, while Nationwide provides extensive options for both standard and high-risk homeowners.

USAA vs. State Farm: Which is better for your property?

USAA stands out for its military-oriented benefits and discounts, while State Farm is a good choice for customers looking for nationwide availability and customizable options. Elevate your knowledge with our “Does State Farm home insurance cover trampolines?”

Farmers vs USAA: Which offers better insurance policies?

USAA offers competitive rates and unique military benefits, while Farmers provides broader options for general homeowners insurance and discounts for bundling policies.

Is USAA good homeowners insurance for military families?

USAA vs Esurance: Which is the best for homeowners insurance?

USAA vs AAA: Which company provides the best insurance?

What does Chubb homeowners insurance offer?

USAA vs. Allstate: Which offers the best coverage and rates?

USAA vs Geico car insurance: Which is the better option for drivers?

Liberty Mutual vs USAA: Which has better insurance options?

USAA vs Erie: Which offers the best home insurance coverage?

Travelers vs USAA: Which is the top choice for homeowners insurance?

American Family vs USAA: Which is better for your home insurance needs?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.