Best Car Insurance in 2026 (Top 10 Company Ranking)

The best car insurance companies are Nationwide, Liberty Mutual, and State Farm, with rates starting at $43 a month. Nationwide offers SmartRide pay-per-mile options. Liberty Mutual provides rental reimbursement coverage, while State Farm delivers away-from-school programs for young drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated December 2025

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsNationwide, Liberty Mutual, and State Farm are the top picks for the best car insurance, known for their comprehensive coverage and competitive rates as low as $43 a month.

Our Top 10 Company Picks: Best Car Insurance

| Company | Rank | Claims Satisfaction | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 728 / 1,000 | A+ | Flexible Policies | Nationwide |

| #2 | 717 / 1,000 | A | Coverage Options | Liberty Mutual |

| #3 | 710 / 1,000 | A++ | Young Drivers | State Farm | |

| #4 | 706 / 1,000 | A | Essential Workers | Farmers | |

| #5 | 701 / 1,000 | A+ | Customer Service | The Hartford |

| #6 | 692 / 1,000 | A++ | Digital Experience | Geico | |

| #7 | 692 / 1,000 | A | Customer Satisfaction | American Family |

| #8 | 691 / 1,000 | A+ | Usage-Based Savings | Allstate | |

| #9 | 684 / 1,000 | A++ | Financial Strength | Travelers | |

| #10 | 672 / 1,000 | A+ | Customizable Premiums | Progressive |

Nationwide leads with a strong combination of affordability and full coverage car insurance policy. These highest rated car insurance providers consistently earn recognition in best auto insurance reviews for their comprehensive coverage options.

- Best Car Insurance

- Allstate Milewise Review: Pros, Cons, & Alternatives (2026)

- Northwestern Mutual vs. Primerica Life Insurance in 2026 (See Who Has the Best Savings)

- American Bankers Insurance Company of Florida Car Insurance Review & Ratings (2026)

- Safety Car Insurance Review (2026)

- GoAuto Car Insurance Review & Ratings (2026)

- Garrison Property and Casualty Car Insurance Review & Ratings (2026)

- Encompass Car Insurance Review & Ratings (2026)

- Gainsco Car Insurance Review & Ratings (2026)

- Freeway Car Insurance Review & Ratings (2026)

- Progressive Snapshot Review: Pros, Cons, & Alternatives (2026)

- Good2Go Car Insurance Review & Ratings (2026)

- TruStage Car Insurance Review & Ratings (2026)

- Mile Auto Car Insurance Review & Ratings (2026)

- Auto Insurance America Auto Insurance Review & Ratings (2026)

- Safepoint Insurance Review & Ratings (2026)

- All Star General Insurance Review & Ratings (2026)

- Carolina Casualty Car Insurance Review & Ratings (2026)

- Brotherhood Mutual Insurance Company Review & Ratings (2026)

- Rockingham Insurance Review & Ratings (2026)

- Safe Harbor Insurance Company Review & Ratings (2026)

- Proper Insurance Review & Ratings (2026)

- Old American County Mutual Insurance Review & Ratings (2026)

- UniCare Insurance Review & Ratings (2026)

- Foresters Financial Insurance Review & Ratings (2026)

- Main Street America Insurance Review & Ratings (2026)

- Lincoln Financial Insurance Review & Ratings (2026)

- Bamboo Insurance Review & Ratings (2026)

- Hastings Mutual Insurance Review & Ratings (2026)

- Allstate App Review: Pros, Cons, & Alternatives (2026)

- Florida Peninsula Insurance Review & Ratings (2026)

- Columbia Insurance Review & Ratings (2026)

- Allianz travel Insurance Review & Ratings (2026)

- Encova personal Insurance Review & Ratings (2026)

- Greek Catholic Union Insurance Review & Ratings (2026)

- Gabi Insurance Review & Ratings (2026)

- AssuranceAmerica Car Insurance Review & Ratings (2026)

- North Star Mutual Insurance Review & Ratings (2026)

- AIC Car Insurance Review & Ratings (2026)

- Colonial Penn Medicare Insurance Review & Ratings (2026)

- Rivian Car Insurance Review & Ratings (2026)

- Inshur Car Insurance Review & Ratings (2026)

- Haulers Car Insurance Review & Ratings (2026)

- HTH Worldwide travel Insurance Review & Ratings (2026)

- Aspire Car Insurance Review & Ratings (2026)

- Palomar Specialty Insurance Review & Ratings (2026)

- Pacific Specialty Insurance Review & Ratings (2026)

- Medjet Insurance Review & Ratings (2026)

- J.C. Taylor Car Insurance Review & Ratings (2026)

- Tower Hill Insurance Review & Ratings (2026)

- Universal Insurance Company Insurance Review & Ratings (2026)

- Young America Car Insurance Review & Ratings (2026)

- CIG Insurance Review & Ratings (2026)What is the claims process for CIG Insurance?CIG Insurance Review & Ratings (2026)

- Hallmark Group Insurance Review & Ratings (2026)

- Prepared Insurance Review & Ratings (2026)

- Maison Insurance Review & Ratings (2026)

- Philadelphia Contributionship Insurance Review & Ratings (2026)

- Farmers roadside assistance Review: Pros, Cons, & Alternatives (2026)

- Qualitas Car Insurance Review & Ratings (2026)

- Geico vs. State Farm Car Insurance (2026)

- Traders Car Insurance Review & Ratings (2026)

- K&K Car Insurance Review & Ratings (2026)

- United Equitable Insurance Review & Ratings (2026)

- Vern Fonk Car Insurance Review & Ratings (2026)

- Truck Insurance Exchange Insurance Review & Ratings (2026)

- Physicians Mutual Dental Insurance Review & Ratings (2026)

- Fred Loya Car Insurance Review & Ratings (2026)

- MAPFRE Car Insurance Review & Ratings (2026)

- Neptune Flood Insurance Review & Ratings (2026)

- Universal Property Insurance Review & Ratings (2026)

- NJM Car Insurance Review & Ratings (2026)

- Northern Neck Car Insurance Review & Ratings (2026)

- Geico App Review: Pros, Cons, & Alternatives (2026)

- CURE Car Insurance Review & Ratings (2026)

- Falcon Car Insurance Review & Ratings (2026)

- Victoria Car Insurance Review & Ratings (2026)

- Key Insurance Car Insurance Review & Ratings (2026)

- Founders Insurance Review & Ratings (2026)

- Western Reserve Group Car Insurance Review for 2026 (See Rates & Discounts Here)

- Meemic Insurance Review & Ratings (2026)

- Bear River Mutual Insurance Review & Ratings (2026)

- Great Northern Car Insurance Review & Ratings (2026)

- Freedom National Car Insurance Review & Ratings (2026)

- ASPCA pet Insurance Review & Ratings (2026)

- Windhaven Car Insurance Review & Ratings (2026)

- Best Car Insurance Companies for Teslas (2026)

- Say Insurance Car Insurance Review & Ratings (2026)

- Root Car Insurance Review & Ratings (2026)

- Clearcover Car Insurance Review & Ratings (2026)

- Noblr Car Insurance Review & Ratings (2026)

- WAEPA Insurance Review & Ratings (2026)

- Liberty Mutual RightTrack Review: Pros, Cons, & Alternatives (2026)

- USAA SafePilot Review: Pros, Cons, & Alternatives (2026)

- Nationwide SmartRide Review: Pros, Cons, & Alternatives (2026)

- Farmers Signal Review: Pros, Cons, & Alternatives (2026)

- American Family KnowYourDrive Review: Pros, Cons, & Alternatives (2026)

- Travelers IntelliDrive Review: Pros, Cons, & Alternatives (2026)

- Tesla Telematics Review: Pros, Cons, & Alternatives (2026)

- Safeco RightTrack Review: Pros, Cons, & Alternatives (2026)

- Allstate Drivewise Review: Pros, Cons, & Alternatives (2026)

- State Farm Drive Safe and Save Insurance Review & Ratings (2026)

- Allstate Drivewise vs. USAA SafePilot: Which Service Is the Best (2026)

- Allstate Drivewise vs. Travelers IntelliDrive: Which Service Is the Best (2026)

- Allstate Drivewise vs. State Farm Drive Safe and Save: Which Service Is the Best (2026)

- Allstate Drivewise vs. Nationwide SmartRide: Which Service Is the Best (2026)

- Allstate Drivewise vs. Liberty Mutual RightTrack: Which Service Is the Best (2026)

- Allstate Drivewise vs. Progressive Snapshot: Which Service Is the Best (2026)

- Allstate Drivewise vs. Geico DriveEasy: Which Service Is the Best (2026)

- Allstate Drivewise vs. Farmers Signal: Which Service Is the Best (2026)

- Allstate Drivewise vs. American Family KnowYourDrive: Which Service Is the Best (2026)

- Progressive Car Insurance Review & Ratings (2026)

- State Farm Car Insurance Review & Ratings (2026)

- AARP Auto Insurance Program from The Hartford Review: Pros, Cons, & Alternatives (2026)

- CSE Insurance Review & Ratings (2026)

- MMG Insurance Company Insurance Review & Ratings (2026)

- Protect Your Bubble Insurance Review & Ratings (2026)

- Stillwater Insurance Review & Ratings (2026)

- eFinancial Insurance Review & Ratings (2026)

- Plymouth Rock Assurance Insurance Review & Ratings (2026)

- Germania Insurance Review & Ratings (2026)

- Pure Insurance Review & Ratings (2026)

- Direct General Insurance Review & Ratings (2026)

- Metromile Insurance Review & Ratings (2026)

- A Abana Insurance Review & Ratings (2026)

- American Access Casualty Company Review & Ratings (2026)

- Concord Group Insurance Companies Review & Ratings (2026)

- Mendota Insurance Review & Ratings (2026)

- Acadia Insurance Review & Ratings (2026)

- American Medical Security Insurance Review & Ratings (2026)

- Amerigroup Insurance Review & Ratings (2026)

- AMERISAFE Insurance Review & Ratings (2026)

- Amtrust Insurance Review & Ratings (2026)

- Andover Companies Insurance Review & Ratings (2026)

- Bolt Insurance Review & Ratings (2026)

- Connecticare Health Insurance Review & Ratings (2026)

- CRC Insurance Review & Ratings (2026)

- Eastern Alliance Insurance Review & Ratings (2026)

- Employers Insurance Review & Ratings (2026)

- Everett Cash Mutual Review & Ratings (2026)

- Firstcare Insurance Review & Ratings (2026)

- GEHA Insurance Review & Ratings (2026)

- Guard Insurance Group Insurance Review & Ratings (2026)

- Hagerty Insurance Review & Ratings (2026)

- Harvard Pilgrim Health Care Insurance Review & Ratings (2026)

- Heritage Insurance Review & Ratings (2026)

- Highmark Health Insurance Review & Ratings (2026)

- IHC Group Review & Ratings (2026)

- IlliniCare Health Insurance Review & Ratings (2026)

- iSurity Insurance Review & Ratings (2026)

- Medica Insurance Review & Ratings (2026)

- Meritus Insurance Review & Ratings (2026)

- Molina Healthcare Insurance Review & Ratings (2026)

- The Main Street Group Insurance Review & Ratings (2026)

- MVP Health Care Insurance Review & Ratings (2026)

- New London County Mutual Insurance Review & Ratings (2026)

- OneAmerica Insurance Review & Ratings (2026)

- PacificSource Insurance Review & Ratings (2026)

- Philadelphia Insurance Review & Ratings (2026)

- Physicians Plus Insurance Review & Ratings (2026)

- Preferred Mutual Insurance Review & Ratings (2026)

- PreferredOne Insurance Review & Ratings (2026)

- Presbyterian Healthcare Insurance Review & Ratings (2026)

- Prevea360 Insurance Review & Ratings (2026)

- QBE Insurance Review & Ratings (2026)

- QualChoice Insurance Review & Ratings (2026)

- RLI Insurance Review & Ratings (2026)

- Securian Insurance Review & Ratings (2026)

- Stonewood Insurance Review & Ratings (2026)

- Summit Insurance Review & Ratings (2026)

- Synergy Coverage Solutions Insurance Review & Ratings (2026)

- United States Liability Insurance Group (USLI) Review & Ratings (2026)

- Utica First Insurance Review & Ratings (2026)

- Wellcare Insurance Review & Ratings (2026)

- Zenith Insurance Review & Ratings (2026)

- Bankers Insurance Group Insurance Review & Ratings (2026)

- Walmart Car Insurance Review & Ratings (2026 Update + Coverage Explained)

- 21st Century Insurance Review & Ratings (2026)

- AAA Insurance Review & Ratings (2026)

- Access Insurance Review & Ratings (2026)

- Aegis Security Insurance Review & Ratings (2026)

- Aflac Insurance Review & Ratings (2026)

- AIG Insurance Review & Ratings (2026)

- AIU Insurance Review & Ratings (2026)

- Alliance for Affordable Services Insurance Review & Ratings (2026)

- Alliance Mutual Insurance Review & Ratings (2026)

- Allianz Insurance Review & Ratings (2026)

- Allied Insurance Review & Ratings (2026)

- Allstate Insurance Review & Ratings (2026)

- AMCO Insurance Review & Ratings (2026)

- American Empire Group Insurance Review & Ratings (2026)

- American Family Insurance Review & Ratings (2026)

- American Insurance Review & Ratings (2026)

- American National Insurance Review & Ratings (2026)

- American Pioneer Insurance Review & Ratings (2026)

- American Reliable Insurance Review & Ratings (2026)

- American Republic Insurance Review & Ratings (2026)

- American Sentinel Insurance Review & Ratings (2026)

- American Sterling Insurance Review & Ratings (2026)

- American Underwriters Insurance Review & Ratings (2026)

- Ameriprise Insurance Review & Ratings (2026)

- Amerisure Insurance Review & Ratings (2026)

- Ameritas Insurance Review & Ratings (2026)

- Amwest Insurance Group Review & Ratings (2026)

- API Insurance Review & Ratings (2026)

- Arbella Insurance Review & Ratings (2026)

- Arizona General Insurance Review & Ratings (2026)

- Armed Forces Insurance Review & Ratings (2026)

- Assigned Risk Insurance Review & Ratings (2026)

- Associated Indemnity Insurance Review & Ratings (2026)

- Atlantic Indemnity Insurance Review & Ratings (2026)

- Austin Mutual Insurance Review & Ratings (2026)

- Auto-Owners Insurance Review & Ratings (2026)

- Avomark Insurance Review & Ratings (2026)

- Badger Mutual Insurance Review & Ratings (2026)

- Balboa Insurance Review & Ratings (2026)

- Bankers Shippers Insurance Review & Ratings (2026)

- BCS Insurance Review & Ratings (2026)

- Blue Cross Blue Shield Insurance Review & Ratings (2026)

- Bonneville Insurance Review & Ratings (2026)

- Bristol West Insurance Group Insurance Review & Ratings (2026)

- California Farm Insurance Review & Ratings (2026)

- California Casualty Insurance Review & Ratings (2026)

- California State Automobile Association Car Insurance Review & Ratings (2026)

- Camden Fire Insurance Review & Ratings (2026)

- Cascade National Insurance Review & Ratings (2026)

- Celtic Insurance Review & Ratings (2026)

- Centennial Insurance Review & Ratings (2026)

- Charter Oak Insurance Review & Ratings (2026)

- Chubb Insurance Review & Ratings (2026)

- Church Mutual Insurance Review & Ratings (2026)

- Cigna Insurance Review & Ratings (2026)

- Citizens Insurance Review & Ratings (2026)

- Clarica Insurance Review & Ratings (2026)

- Cloverleaf Insurance Review & Ratings (2026)

- CMA Insurance Services Review & Ratings (2026)

- CNA Insurance Review & Ratings (2026)

- Combined Insurance Review & Ratings (2026)

- Commercial Union Insurance Review & Ratings (2026)

- Commonwealth Insurance Review & Ratings (2026)

- Conseco Review & Ratings (2026)

- Continental Insurance Review & Ratings (2026)

- Cotton States Insurance Review & Ratings (2026)

- Cottonwood Review & Ratings (2026)

- Country Financial Insurance Review & Ratings (2026)

- Countryway Insurance Review & Ratings (2026)

- Coventry Health Care Insurance Review & Ratings (2026)

- Credit Unions Review & Ratings (2026)

- Criterion Insurance Review & Ratings (2026)

- CUNA Mutual Insurance Review & Ratings (2026)

- Dairyland Insurance Review & Ratings (2026)

- Deerbrook Insurance Review & Ratings (2026)

- Depositors Emcasco Insurance Review & Ratings (2026)

- Dixie Speciality Insurance Review & Ratings (2026)

- Eastern Mutual Insurance Review & Ratings (2026)

- Ebco general Insurance Review & Ratings (2026)

- Economy Insurance Review & Ratings (2026)

- Electric Insurance Review & Ratings (2026)

- EMC Insurance Review & Ratings (2026)

- Empire Blue Cross Blue Shield Insurance Review & Ratings (2026)

- Ensure Insurance Review & Ratings (2026)

- Equitable Insurance Review & Ratings (2026)

- Erie Insurance Review & Ratings (2026)

- Esurance Insurance Review & Ratings (2026)

- Family Heritage Insurance Review & Ratings (2026)

- Farm Bureau Insurance Review & Ratings (2026)

- Farm Family Insurance Review & Ratings (2026)

- Farmers Insurance Review & Ratings (2026)

- Farmland Insurance Review & Ratings (2026)

- Federal Insurance Review & Ratings (2026)

- Federated Insurance Review & Ratings (2026)

- Fidelity Insurance Insurance Review & Ratings (2026)

- Financial Indemnity Insurance Review & Ratings (2026)

- Fire and Casualty Company of CT Insurance Review & Ratings (2026)

- Fireman’s Fund Insurance Review & Ratings (2026)

- Acceptance Insurance Review & Ratings (2026)

- First American Insurance Review & Ratings (2026)

- First Financial Insurance Review & Ratings (2026)

- First General Insurance Review & Ratings (2026)

- First Investors Insurance Review & Ratings (2026)

- First National Insurance Review & Ratings (2026)

- Reliance Standard Insurance Review & Ratings (2026)

- First United American Insurance Review & Ratings (2026)

- Florida Family Insurance Review & Ratings (2026)

- Ford Motor Credit Insurance Review & Ratings (2026)

- Foremost Insurance Review & Ratings (2026)

- Fortis Group Insurance Review & Ratings (2026)

- Frankenmuth Mutual Insurance Review & Ratings (2026)

- General Accident Insurance Review & Ratings (2026)

- National General Insurance Review & Ratings (2026)

- Golden Rule Insurance Review & Ratings (2026)

- Golden State Mutual Insurance Review & Ratings (2026)

- Grange Insurance Review & Ratings (2026)

- GRE Insurance Review & Ratings (2026)

- Great West Insurance Review & Ratings (2026)

- Grinnell Mutual Insurance Review & Ratings (2026)

- Guaranty National Insurance Review & Ratings (2026)

- GuideOne Insurance Review & Ratings (2026)

- Halcyon Insurance Review & Ratings (2026)

- Hanover Lloyd’s Company Insurance Review & Ratings (2026)

- Happy Days Insurance Review & Ratings (2026)

- The Hartford Insurance Review & Ratings (2026)

- Hawkeye Security Insurance Review & Ratings (2026)

- Horace Mann Insurance Review & Ratings (2026)

- Humana Insurance Review & Ratings (2026)

- IDS RiverSource Insurance Review & Ratings (2026)

- Illinois Mutual Insurance Review & Ratings (2026)

- Indiana Lumbermens Mutual Insurance Review & Ratings (2026)

- Infinity Insurance Insurance Review & Ratings (2026)

- Insurance of Evanston Review & Ratings (2026)

- Integon Insurance Review & Ratings (2026)

- Investors Heritage Insurance Review & Ratings (2026)

- John Deere Insurance Review & Ratings (2026)

- John Hancock Insurance Review & Ratings (2026)

- Kemper Insurance Review & Ratings (2026)

- Kemper Lloyds Insurance Review & Ratings (2026)

- Kingsway Financial Services Insurance Review & Ratings (2026)

- Knights of Columbus Insurance Review & Ratings (2026)

- Landmark American Insurance Review & Ratings (2026)

- Leader National Insurance Review & Ratings (2026)

- League General Insurance Review & Ratings (2026)

- Liberty Insurance Corp Insurance Review & Ratings (2026)

- Liberty Mutual Review & Ratings (2026)

- Liberty National Insurance Review & Ratings (2026)

- Liberty Northwest Insurance Review & Ratings (2026)

- Lumbermens Mutual Insurance Review & Ratings (2026)

- Markel American Review & Ratings (2026)

- Maryland Casualty Insurance Review & Ratings (2026)

- MassMutual Insurance Review & Ratings (2026)

- MBA Insurance Review & Ratings (2026)

- Merastar Insurance Review & Ratings (2026)

- Mercury Insurance Review & Ratings (2026)

- Mid-Century Insurance Review & Ratings (2026)

- Mid-Continent Casualty Insurance Review & Ratings (2026)

- Mid-West National Insurance Review & Ratings (2026)

- MiddleOak Insurance Review & Ratings (2026)

- Middlesex Insurance Review & Ratings (2026)

- Midwest Family Mutual Insurance Review & Ratings (2026)

- Millbank Insurance Review & Ratings (2026)

- Millers Mutual Insurance Review & Ratings (2026)

- Milwaukee Mutual Insurance Review & Ratings (2026)

- Minnehoma Insurance Review & Ratings (2026)

- Missouri General Insurance Review & Ratings (2026)

- Mountain Laurel Insurance Review & Ratings (2026)

- MSI Insurance Review & Ratings (2026)

- Mutual of America Insurance Review & Ratings (2026)

- Mutual of Enumclaw Insurance Review & Ratings (2026)

- Mutual Of Omaha Insurance Review & Ratings (2026)

- N.A.S.E. Insurance Review & Ratings (2026)

- National Alliance Insurance Review & Ratings (2026)

- National Continental Insurance Review & Ratings (2026)

- National Farmers Union Insurance Review & Ratings (2026)

- National Indemnity Insurance Review & Ratings (2026)

- National Merit Insurance Review & Ratings (2026)

- Nationwide Insurance Review & Ratings (2026)

- New England Financial Insurance Review & Ratings (2026)

- NYCM Insurance Review & Ratings (2026)

- North American Insurance Review & Ratings (2026)

- North Carolina Mutual Insurance Review & Ratings (2026)

- North Pacific Insurance Review & Ratings (2026)

- North Pointe Insurance Review & Ratings (2026)

- North Shore Insurance Review & Ratings (2026)

- Northern Capital Insurance Review & Ratings (2026)

- Northland Insurance Review & Ratings (2026)

- Northwestern Mutual Insurance Review & Ratings (2026)

- Ohio Casualty Insurance Review & Ratings (2026)

- Ohio Security Insurance Review & Ratings (2026)

- Olympia Insurance Review & Ratings (2026)

- Omni Insurance Review & Ratings (2026)

- OneBeacon Insurance Review & Ratings (2026)

- Oregon Mutual Insurance Review & Ratings (2026)

- Orion Insurance Review & Ratings (2026)

- Pafco General Insurance Review & Ratings (2026)

- Paloverde Insurance Review & Ratings (2026)

- Partners Mutual Insurance Review & Ratings (2026)

- Patriot General Insurance Review & Ratings (2026)

- Patriot Insurance Review & Ratings (2026)

- Peak Property and Casualty Insurance Review & Ratings (2026)

- PEMCO Insurance Review & Ratings (2026)

- Penn America Insurance Review & Ratings (2026)

- Penn Mutual Insurance Review & Ratings (2026)

- Pennsylvania Lumbermens Mutual Insurance Review & Ratings (2026)

- Pennsylvania National Insurance Review & Ratings (2026)

- Phoenix Insurance Review & Ratings (2026)

- Physicians Mutual Insurance Review & Ratings (2026)

- Pinnacle Insurance Review & Ratings (2026)

- Pioneer State Mutual Insurance Review & Ratings (2026)

- Preferred Abstainers Insurance Review & Ratings (2026)

- Premera Blue Cross Insurance Review & Ratings (2026)

- Premier Insurance Review & Ratings (2026)

- Athene Annuity Insurance Review & Ratings (2026)

- Prestige Insurance Review & Ratings (2026)

- Primerica Insurance Review & Ratings (2026)

- Principal Financial Insurance Review & Ratings (2026)

- Proformance Insurance Review & Ratings (2026)

- Progressive Insurance Review & Ratings (2026)

- Protective Casualty Insurance Review & Ratings (2026)

- Prudential Insurance Review & Ratings (2026)

- Quality Insurance Review & Ratings (2026)

- Ranger Insurance Review & Ratings (2026)

- RBC Insurance Review & Ratings (2026)

- Regal Insurance Review & Ratings (2026)

- Regence Blue Shield Insurance Review & Ratings (2026)

- Reliant Insurance Review & Ratings (2026)

- Republic Indemnity Insurance Review & Ratings (2026)

- Response Insurance Review & Ratings (2026)

- RiverSource Insurance Review & Ratings (2026)

- Rockford Mutual Insurance Review & Ratings (2026)

- SafeAuto Car Insurance Review & Ratings (2026)

- Safeco Insurance Review & Ratings (2026)

- Safeway Insurance Review & Ratings (2026)

- SeaWest insurance Review & Ratings (2026)

- Secura Insurance Review & Ratings (2026)

- Security National Insurance Review & Ratings (2026)

- Sedgwick James Insurance Review & Ratings (2026)

- Sentry Insurance Review & Ratings (2026)

- Shelter Company Insurance Review & Ratings (2026)

- Spectrum Insurance Review & Ratings (2026)

- St. Paul Protective Insurance Company Review & Ratings (2026)

- Standard Fire Company Insurance Review & Ratings (2026)

- State Auto Car Insurance Review & Ratings (2026)

- State Farm Car Insurance Review for 2026 (See Rates & Discounts Here)

- State National Insurance Review & Ratings (2026)

- Sublimity Insurance Review & Ratings (2026)

- Sun Coast Insurance Review & Ratings (2026)

- Superior Insurance Review & Ratings (2026)

- Sutter Insurance Review & Ratings (2026)

- The General Car Insurance Review & Ratings (2026)

- TIAA-CREF Insurance Review & Ratings (2026)

- TICO Insurance Review & Ratings (2026)

- TIG Countrywide Insurance Review & Ratings (2026)

- Titan Insurance Review & Ratings (2026)

- Total Insurance Review & Ratings (2026)

- Tower Insurance Review & Ratings (2026)

- Transamerica Insurance Review & Ratings (2026)

- Travelers Insurance Review & Ratings (2026)

- Tri-State Consumer Insurance Review & Ratings (2026)

- Trinity Universal Insurance Company Review & Ratings (2026)

- Twin City Fire Insurance Review & Ratings (2026)

- Unigard Insurance Review & Ratings (2026)

- Union Insurance Review & Ratings (2026)

- Union Bankers Life Insurance Review & Ratings (2026)

- Union Central Life Insurance Review & Ratings (2026)

- Union Mutual of Vermont Insurance Review & Ratings (2026)

- United American Insurance Review & Ratings (2026)

- United Concordia Insurance Review & Ratings (2026)

- United Farm Family Insurance Review & Ratings (2026)

- United Financial Insurance Review & Ratings (2026)

- UnitedHealthCare Insurance Review & Ratings (2026)

- United Heritage Insurance Review & Ratings (2026)

- United Security Insurance Review & Ratings (2026)

- Unitrin Insurance Review & Ratings (2026)

- Universal American Financial Insurance Review & Ratings (2026)

- Unsure Insurance Review & Ratings (2026)

- Unum Insurance Review & Ratings (2026)

- USAA Insurance Review & Ratings (2026)

- USF&G Insurance Review & Ratings (2026)

- Utica National Insurance Group Insurance Review & Ratings (2026)

- Vasa North Atlantic Insurance Review & Ratings (2026)

- Vigilant Insurance Review & Ratings (2026)

- Viking County Mutual Insurance Review & Ratings (2026)

- Wawanesa Insurance Review & Ratings (2026)

- Wellpoint Insurance Review & Ratings (2026)

- West American Insurance Review & Ratings (2026)

- West Bend Mutual Insurance Review & Ratings (2026)

- Western Mutual Insurance Review & Ratings (2026)

- Western National Insurance Review & Ratings (2026)

- Westfield Insurance Review & Ratings (2026)

- Windsor Insurance Review & Ratings (2026)

- Windstar Insurance Review & Ratings (2026)

- Wisconsin Mutual Insurance Review & Ratings (2026)

- Worldwide Insurance Review & Ratings (2026)

- Yellow Key Insurance Review & Ratings (2026)

- Yosemite Insurance Review & Ratings (2026)

- Zurich Insurance Group Review & Ratings (2026)

- Americo Insurance Review & Ratings (2026)

- Oscar Health Insurance Review & Ratings (2026)

- Royal Neighbors of America Insurance Review & Ratings (2026)

- Symetra Financial Insurance Review & Ratings (2026)

- Voya Financial Insurance Review & Ratings (2026)

- Northwestern Mutual vs. Primerica Life Insurance in 2026 (See Who Has the Best Savings)

- Geico vs. State Farm Car Insurance (2026)

- Allstate Drivewise vs. USAA SafePilot: Which Service Is the Best (2026)

- Allstate Drivewise vs. Travelers IntelliDrive: Which Service Is the Best (2026)

- Allstate Drivewise vs. State Farm Drive Safe and Save: Which Service Is the Best (2026)

- Allstate Drivewise vs. Nationwide SmartRide: Which Service Is the Best (2026)

- Allstate Drivewise vs. Liberty Mutual RightTrack: Which Service Is the Best (2026)

- Allstate Drivewise vs. Progressive Snapshot: Which Service Is the Best (2026)

- Allstate Drivewise vs. Geico DriveEasy: Which Service Is the Best (2026)

- Allstate Drivewise vs. Farmers Signal: Which Service Is the Best (2026)

- Allstate Drivewise vs. American Family KnowYourDrive: Which Service Is the Best (2026)

- One-Day Car Insurance: A Complete Guide (2026)

- Best Car Insurance for DoorDash Drivers in 2026 (Save Money With These 10 Companies)

- What to Know Before Becoming an Uber or Lyft Driver (2026)

- Uber Car Insurance: A Complete Guide (2026)

- Hungry Howie’s Pizza Car Insurance: A Complete Guide (2026)

- Pizza Delivery Car Insurance: A Complete Guide (2026)

- 10 Cheap Car Insurance Companies for 60-Year-Old Drivers (2026)

- Cheap Car Insurance for 30-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Cheap Car Insurance for 25-Year-Old Drivers in 2026 (9 Affordable Companies)

- Cheapest Car Insurance for 21-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Best Car Insurance for UPS Drivers in 2026 (Your Guide to the Top 10 Companies)

- Best Car Insurance for Uber Eats Drivers in 2026 (Find the Top 10 Companies Here!)

- Best Auto Insurance for Teachers in 2026 (Top 10 Companies)

- Best Auto Insurance for Taxi Drivers in 2026 (Top 10 Companies)

- Best Auto Insurance for Sales Representatives With Company Cars in 2026 (Top 10 Companies)

- Best Auto Insurance for Postmates Drivers in 2026 (Top 10 Companies)

- Best Car Insurance for Postal Employees in 2026 (Top 10 Companies)

- Best Car Insurance for Police Officers in 2026 (Top 10 Companies)

- Best Car Insurance for Ontrac Drivers in 2026 (Top 10 Companies)

- Best Car Insurance for Nurses in 2024 (Top 10 Companies)

- Best Car Insurance for Non-Emergency Medical Transportation Drivers in 2026 (Top 10 Companies)

- Best Car Insurance for College Professors in 2026 (Top 10 Companies)

- Best Car Insurance for Lyft Drivers in 2026 (Top 10 Companies)

- Best Car Insurance for Limousine Drivers in 2026 (Top 10 Companies)

- Best Car Insurance for Pilots in 2026 (Top 10 Companies)

- Best Car Insurance for Uber Drivers in 2026 (Your Guide to the Top 10 Companies)

- Best Car Insurance for DoorDash Drivers in 2026 (Top 10 Companies Ranked)

- Best Car Insurance for Librarians in 2026 (Top 10 Companies)

- Best Car Insurance for Commercial Truck Drivers in 2026 (Top 10 Companies)

- Best Car Insurance for Fleet Managers in 2026 (Top 10 Companies)

- Best Car Insurance for FedEx Drivers in 2026 (Top 10 Companies Ranked)

- Best Car Insurance for Engineers in 2026 (Top 10 Companies Ranked)

- Best Car Insurance for Doctors in 2026 (Top 10 Companies)

- Best Car Insurance for DHL Drivers in 2026 (Top 10 Companies)

- Best Car Insurance for Delivery Drivers in 2026 (Top 10 Companies)

- Best Car Insurance for Divorced Person in 2026 (Top 10 Companies)

- Best Auto Insurance for Students in 2026 (Your Guide to the Top 10 Companies)

- Best Car Insurance for Architects in 2026 (Top 10 Companies)

- Best Car Insurance for Instacart Drivers in 2026 (Top 10 Companies)

- Best Car Insurance for Private Chauffeurs in 2026 (Top 10 Companies)

- Best Car Insurance for Paramedics in 2026 (Top 10 Companies)

- Best Car Insurance for Lawyers in 2026 (Top 10 Companies)

- Best Car Insurance for Firefighters in 2026 (Top 10 Companies)

- Best Car Insurance for Federal Employees in 2026 (Top 10 Companies)

- Best Car Insurance for CPAs in 2026 (Top 10 Companies)

- Best Car Insurance for Amazon Delivery Drivers in 2026 (Top 10 Companies)

- Best Car Insurance for Bus Drivers in 2026 (Top 10 Companies Ranked)

- Best Car Insurance for Dentists in 2026 (Top 10 Companies)

- Best Car Insurance for Rideshare Drivers in 2026 (Top 10 Companies)

- Best Car Insurance for Driving Instructors in 2026 (Top 10 Companies)

- Best Car Insurance for College Students in 2026 (Top 10 Companies Ranked)

- Cheapest Car Insurance for 19-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Cheapest Car Insurance for 23-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Cheap Car Insurance for 30-Year-Old Drivers in 2026 (Top 9 Low-Cost Companies)

- Cheapest Car Insurance for 70-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Cheapest Car Insurance for 16-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Cheapest Car Insurance for 24-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Cheapest Car Insurance for 20-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Cheapest Car Insurance for 22-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Cheapest Car Insurance for 17-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Cheapest Car Insurance for 60-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Cheapest Car Insurance for 35-Year-Old Drivers in 2026 (Save Big With These 9 Companies!)

- Cheapest Car Insurance for 50-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Cheapest Car Insurance for 18-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Cheapest Car Insurance for 40-Year-Old Drivers in 2026 (Save With These 10 Companies!)

- Best Car Insurance for OEM Parts Coverage in 2026 (Top 10 Companies)

- Best Car Insurance for Uninsured/Underinsured Motorist Coverage in 2026 (Top 10 Companies)

- Best Car Insurance for Personal Injury Protection (PIP) in 2026 (Top 10 Companies)

- Best Car Insurance for UBI/Pay-Per-Mile in 2026 (Find the Top 10 Companies Here!)

- Best Car Insurance for High-Risk Drivers in 2026 (Top 10 Companies)

- Best Car Insurance for Medical Payments Coverage in 2026 (Top 10 Companies)

- Best Car Insurance for Towing and Roadside Assistance in 2026 (Top 10 Companies)

- Best Car Insurance for Comprehensive Coverage in 2026 (Top 10 Companies)

- Best Car Insurance for Rental Reimbursement Coverage in 2026 (Top 10 Companies Ranked)

- Best Gap Car Insurance in 2026 (Top 10 Companies)

- Best Car Insurance for New Car Replacement Coverage in 2026 (Top 10 Companies)

- Best Car Insurance for Windshield Replacement in 2026 (Your Guide to the Top 10 Companies)

- Best Car Insurance for Liability Insurance in 2026 (Top 10 Companies)

- Best Car Insurance for Collision Coverage in 2026 (Top 10 Companies)

- Best Car Insurance for Young Adults in 2026 (Top 10 Companies Ranked)

- Disability Car Insurance for 2026

- Best Car Insurance for Domestic Partnerships in 2026 (Top 10 Companies)

- Best Car Insurance for 21-Year-Old Drivers in 2026 (Top 10 Companies Ranked)

- Best Car Insurance for 26-Year-Old Drivers in 2026 (Top 10 Companies Ranked)

- Best Car Insurance for People With Bad Credit in 2026 (Top 10 Companies)

- Best Car Insurance for Single Parents in 2026 (Find the Top 10 Providers Here)

- Best Car Insurance for Healthcare Professionals in 2026 (Top 10 Companies)

Choosing among them ensures high-quality and best car insurance by vehicle that meets specific individual requirements.

- Explore discounts up to 25% for tailored best car insurance

- Nationwide offers competitive rates and extensive coverage

- Assess your needs to find the ideal car insurance policy

When selecting a provider, consider their reputation for customer satisfaction and the breadth of coverage options they offer. Find the best auto insurance company near you by entering your ZIP code into our free quote tool above.

Comparing Car Insurance Rates

When shopping for a car insurance policy, cost is an essential factor to consider, though not the only one. A comparison of average rates from top U.S. insurers reveals that Geico and State Farm generally offer more affordable options than Liberty Mutual and Allstate.

However, it’s crucial to gather and compare quotes from multiple companies in your area. Reading car insurance ratings from reliable car insurance companies helps identify who offers competitive pricing.

Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $61 | $161 |

| $53 | $141 |

This table displays monthly car insurance rates by coverage level for various insurers, comparing minimum and full coverage costs. It includes Allstate, American Family, Farmers, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, and USAA.

Rates vary from Geico’s low of $43 for minimum coverage to Liberty Mutual’s high of $248 for full coverage, highlighting the pricing diversity and coverage options across insurers. This data assists consumers in finding cost-effective rates for their required insurance coverage.

How Driving Record Impacts Car Insurance Costs

Your driving history significantly affects your car insurance rates; a clean record often results in lower premiums compared to having accidents, traffic violations, or DUIs. Interestingly, poor credit can impact your rates more adversely than a DUI.

Car Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $87 | $103 | $124 | $152 | |

| $62 | $73 | $94 | $104 |

| $76 | $95 | $109 | $105 | |

| $43 | $56 | $71 | $117 | |

| $96 | $116 | $129 | $178 |

| $63 | $75 | $88 | $129 |

| $56 | $74 | $98 | $75 | |

| $47 | $53 | $57 | $65 | |

| $61 | $74 | $89 | $93 |

| $53 | $72 | $76 | $112 |

The table compares average monthly car insurance rates from various providers for drivers with a clean record versus those with one accident. This information helps you choose an insurance company that suits your needs and budget.

Since insurance companies evaluate these factors differently, and rates vary by location, it’s crucial to compare quotes online to avoid overpaying for coverage. Additionally, it’s important to understand how long a DUI stays on your record, as this can influence your rates over time.

Selecting best car insurance review resources helps identify reliable car insurance providers that fairly evaluate driving records.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why Car Insurance Quotes Matter

Comparing quotes online is the best way to find how much insurance coverage you need. Even if you have a car insurance policy you’re comfortable with, it’s important to compare car insurance quotes with other companies at least once a year.

Doing so will help you ensure you aren’t overpaying for your policy. By taking advantage of an online car insurance discount program while comparing quotes can make the process even more rewarding, as you might unlock additional savings and benefits unique to the online platform.

In addition to the cost of coverage, policyholders often consider purchasing car insurance with a different provider if they have had a negative experience filing a claim with their current provider or want to change their car insurance coverage.

Key Factors Affecting Your Car Insurance Rates

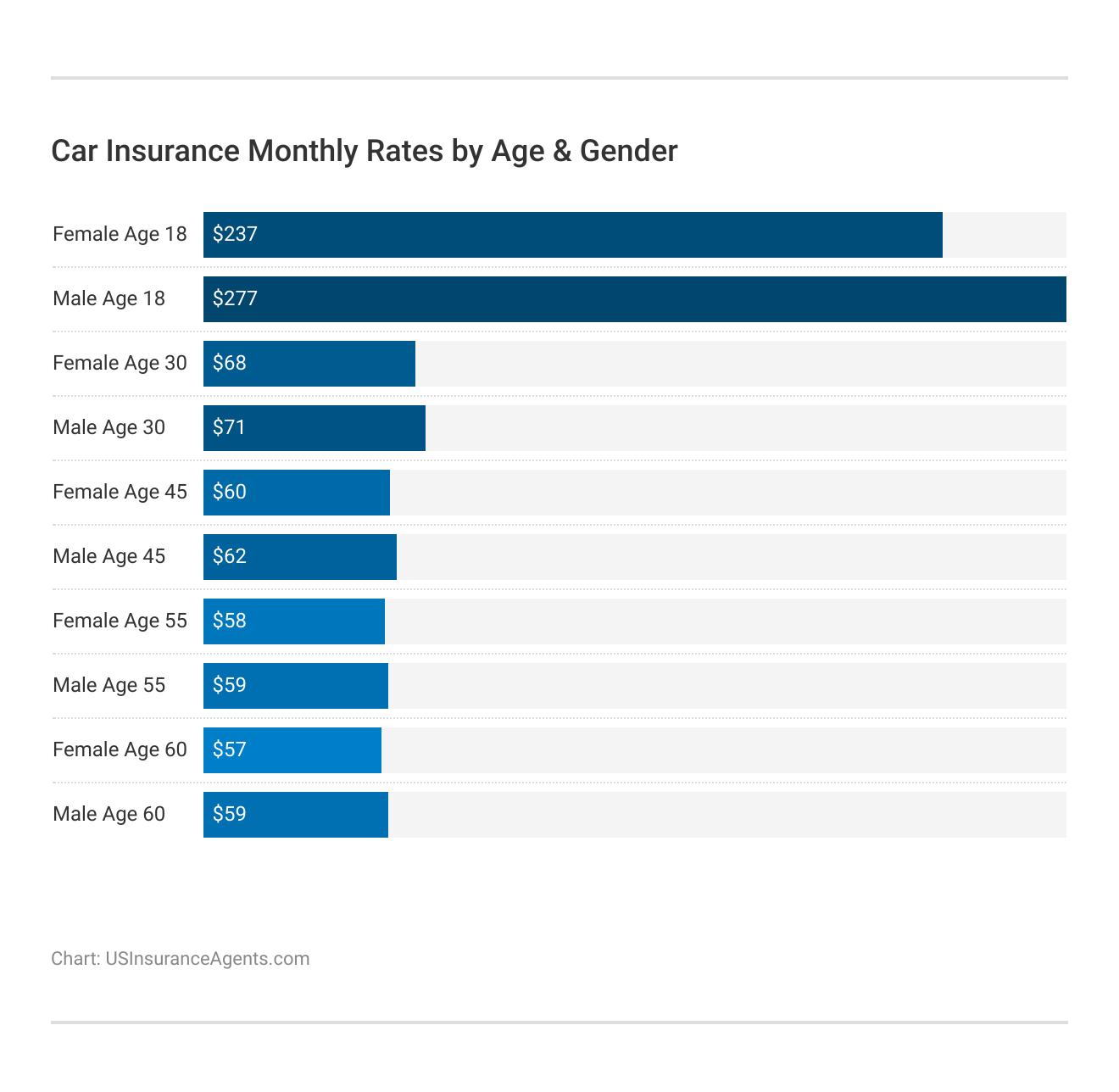

Insurance companies determine your premiums using factors such as age, gender, ZIP code, credit score, driving history, coverage type, deductible, and vehicle make and model.

Different insurers weight these factors uniquely, so comparing quotes is essential to find a provider that may deemphasize a negative aspect like a poor credit score, thus reducing your costs. This variation makes it essential to research good car insurance companies that may offer more favorable terms for your specific situation.

Full Coverage Car Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $170 | $200 | $280 | |

| $150 | $180 | $250 |

| $160 | $190 | $270 | |

| $140 | $170 | $230 | |

| $180 | $210 | $300 |

| $155 | $180 | $240 |

| $160 | $190 | $260 | |

| $145 | $170 | $215 | |

| $170 | $195 | $260 |

| $160 | $185 | $250 |

For example, one company might charge more if you have poor credit, while another might not view it as significantly, potentially saving you money on your premiums.

Lowering Your Car Insurance Costs

To secure the best American Access car insurance discounts in your area, start by shopping online and comparing quotes from multiple insurers, as this could save you a substantial amount on your policy. Be sure to ask about car insurance discounts, which can reduce your premiums by up to 25%.

This table outlines various car insurance discounts available from top providers, helping you identify ways to reduce your premiums based on specific eligibility criteria.

Top Car Insurance Discounts

| Company | Anti-Theft | Bundling | Good Driver | Good Student | Loyalty |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 22% | 15% | |

| 25% | 25% | 25% | 20% | 18% |

| 10% | 20% | 30% | 15% | 12% | |

| 25% | 25% | 26% | 15% | 10% | |

| 35% | 25% | 20% | 12% | 10% |

| 5% | 20% | 40% | 18% | 8% |

| 25% | 10% | 30% | 10% | 13% | |

| 15% | 17% | 25% | 35% | 6% | |

| 10% | 5% | 15% | 12% | 7% |

| 15% | 13% | 10% | 8% | 9% |

Common discounts include bundling policies, insuring multiple vehicles, being a good driver or student, and having safety features or taking defensive driving courses. Additionally, raising your car insurance deductible could lower your monthly or annual premiums, though it increases your out-of-pocket expense in an accident.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

For those who drive less, mileage-based car insurance can offer significant savings by charging based on the miles you drive. Also, consider usage-based insurance, where your driving behavior is monitored to potentially lower your rates, but be aware of the implications of a negative driving score.

Geico Discounts

Geico provides a wide range of insurance products, including coverage for cars, motorcycles, ATVs, and more, with optional additions like roadside assistance and rental car reimbursement. Geico car insurance discounts are extensive and can help policyholders save up to 25% on their coverage.

Discounts include reductions for vehicle equipment, maintaining a good driving history, completing driver’s education, being a good student, federal employment, certain memberships and affiliations, military service, and having multiple vehicles or policies with Geico.

Additionally, Geico’s accident forgiveness can prevent your rates from rising after your first at-fault accident, adding further value to their insurance offerings.

Nationwide Discounts

Nationwide provides a comprehensive range of insurance products, enabling easy bundling and savings. The company features benefits like a vanishing deductible and accident forgiveness.

For those interested in telematics-based savings, Nationwide SmartRide offers a pay-per-mile option ideal for infrequent or short-distance drivers, along with a Nationwide SmartRide car insurance discount that can significantly reduce premiums.

Additionally, Nationwide offers various discounts such as multi-policy, accident-free, defensive driving, good student, anti-theft, and paid-in-full reductions. A notable saving opportunity is the paperless car insurance discount, rewarding customers who opt for digital documentation. To explore potential savings, contacting a Nationwide representative is recommended.

Travelers Discounts

Travelers provides a broad range of insurance options, covering cars, boats, motorcycles, and more, with additional benefits like roadside assistance, rental car reimbursement, and gap insurance for financed vehicles.

In terms of savings, Travelers car insurance discounts are plentiful, offering reductions for multiple policies, multiple cars, homeownership, safe driving, hybrid vehicles, new cars, full upfront payments, and academic excellence. These discounts can help policyholders save 15% or more on their car insurance.

For a deeper understanding of what Travelers offers, consider reading a Travelers car insurance review to learn more about the benefits and savings potential.

Auto-Owners Discounts

Auto-Owners also provides discounts for multi-policy, good payment history, green initiatives, paying in full, multiple cars, safety features, good students, students away at school, and teen driver monitoring, potentially saving up to 20% on insurance costs. Learn more in our Auto-Owners insurance review.

State Farm Discounts

When purchasing car insurance from State Farm, customers can access several discounts that may reduce their coverage costs by up to 25%.

These discounts include safe driver, accident-free, good student car insurance discount, student away at school, safe vehicle, anti-theft, multi-vehicle, multi-policy, loyal customer, defensive driving, and driver training. Such savings make State Farm a compelling choice for comprehensive insurance coverage.

Allstate Discounts

Allstate provides several car insurance discounts that can save policyholders up to 25%. These include discounts for early signing, responsible payment, multi-policy benefits, new cars, anti-lock brakes, anti-theft systems, paperless billing, full upfront payments, automatic payments, and safe driving.

Notably, Allstate’s best safe driver car insurance discounts specifically reward safe driving habits, significantly reducing insurance costs for cautious drivers.

Erie Discounts

Erie’s discounts, which reduce insurance costs, include safe driving, car safety, multi-car, multi-policy car insurance discounts, reduced usage, young driver, annual payments, and college credits, benefiting families with young drivers. These features make Erie a cost-effective choice for diverse insurance needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Essential Car Insurance Coverages to Consider

Every driver needs car insurance to comply with legal requirements, which typically include property damage and bodily injury liability. Some states also mandate personal injury protection (PIP), medical payments (MedPay), and uninsured/underinsured motorist coverage.

Additional requirements can vary, so checking with your state’s department of motor vehicles is advisable. If you have a loan or lease, you might need full coverage, which includes collision car insurance and comprehensive insurance.

Collision coverage is crucial as it pays for your vehicle’s repair costs if you cause an accident, avoiding out-of-pocket expenses. Comprehensive insurance covers damages from non-collision incidents like weather, theft, or vandalism.

Car Insurance Coverage Add-ons

| Company | Classic Car Insurance | Mechanical Breakdown | Umbrella Insurance | International Coverage |

|---|---|---|---|---|

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ❌ | ✅ | ❌ | |

| ❌ | ❌ | ✅ | ❌ |

| ✅ | ✅ | ✅ | ✅ |

For those using their vehicle in specific scenarios like ridesharing, additional coverages such as rideshare insurance, accident forgiveness, gap insurance, new car replacement, and roadside assistance coverage may also be essential to consider for complete protection.

Finding the Right Car Insurance Across U.S. States

As you search for the best car insurance companies, you may be surprised that rates and coverage options vary from state to state, so the best and cheapest car insurance company in Vermont may differ from the best and cheapest car insurance company in California.

Car Insurance Monthly Rates by State & Coverage Level

| States | Minimum Coverage | Full Coverage |

|---|---|---|

| Alabama | $50 | $139 |

| Alaska | $50 | $147 |

| Arizona | $59 | $156 |

| Arkansas | $56 | $162 |

| California | $72 | $219 |

| Colorado | $51 | $169 |

| Connecticut | $87 | $169 |

| Delaware | $96 | $183 |

| Florida | $64 | $190 |

| Georgia | $72 | $179 |

| Hawaii | $37 | $100 |

| Idaho | $30 | $106 |

| Illinois | $57 | $150 |

| Indiana | $49 | $143 |

| Iowa | $26 | $104 |

| Kansas | $43 | $135 |

| Kentucky | $64 | $176 |

| Louisiana | $54 | $201 |

| Maine | $51 | $115 |

| Maryland | $126 | $237 |

| Massachusetts | $56 | $144 |

| Michigan | $163 | $339 |

| Minnesota | $90 | $220 |

| Mississippi | $53 | $142 |

| Missouri | $55 | $156 |

| Montana | $42 | $153 |

| Nebraska | $39 | $148 |

| Nevada | $61 | $144 |

| New Hampshire | $50 | $122 |

| New Jersey | $126 | $197 |

| New Mexico | $56 | $142 |

| New York | $90 | $174 |

| North Carolina | $55 | $131 |

| North Dakota | $49 | $177 |

| Ohio | $44 | $114 |

| Oklahoma | $52 | $160 |

| Oregon | $75 | $147 |

| Pennsylvania | $60 | $179 |

| Rhode Island | $61 | $143 |

| South Carolina | $79 | $191 |

| South Dakota | $20 | $127 |

| Tennessee | $37 | $130 |

| Texas | $77 | $207 |

| Utah | $66 | $147 |

| Vermont | $43 | $133 |

| Virginia | $56 | $132 |

| Washington D. C. | $81 | $192 |

| West Virginia | $52 | $141 |

| Wisconsin | $47 | $133 |

| Wyoming | $24 | $105 |

| U.S. Average | $61 | $165 |

Finding the most reliable car insurance in your state will depend on your unique situation. The table above shows how much you can expect to pay depending on where you live. Some states have higher annual premiums because of coverage requirements, cost of living, and other factors.

Finding the best car insurance in your state will depend on your unique situation. For example, someone with a clean driving history and good credit in their 30s or 40s may find that one company is perfect for them, while a teen driver with no credit or someone with several accidents on their driving record may need coverage with a different company.

Because different companies cater to different types of drivers, you have to take time to find and compare policies with multiple companies before you make a final decision on which company in your area offers the best rated car insurance coverage.

Understanding Car Insurance Coverage Requirements

Many policyholders don’t have a good understanding of the car insurance coverage they purchase. For example, some individuals don’t know what’s included in their state’s required car insurance, while others believe they have car insurance coverage that is not available to them.

Car Insurance Minimum Coverage Requirements by State

| State | Coverage Limits | Required Coverages |

|---|---|---|

| Alabama | 25/50/25 | Bodily injury liability and property damage liability |

| Alaska | 50/100/25 | Bodily injury liability and property damage liability |

| Arizona | 15/30/10 | Bodily injury liability and property damage liability |

| Arkansas | 25/50/25 | Bodily injury liability, property damage liability and personal injury protection |

| California | 15/30/5 | Bodily injury liability and property damage liability |

| Colorado | 25/50/15 | Bodily injury liability and property damage liability |

| Connecticut | 25/50/20 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Delaware | 25/50/10 | Bodily injury liability, property damage liability and personal injury protection |

| Florida | 10/20/10 | Property damage liability and personal injury protection |

| Georgia | 25/50/25 | Bodily injury liability and property damage liability |

| Hawaii | 20/40/10 | Bodily injury liability, property damage liability and personal injury protection |

| Idaho | 25/50/15 | Bodily injury liability and property damage liability |

| Illinois | 25/50/20 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Indiana | 25/50/25 | Bodily injury liability and property damage liability |

| Iowa | 20/40/15 | Bodily injury liability and property damage liability |

| Kansas | 25/50/25 | Bodily injury liability, property damage liability and personal injury protection |

| Kentucky | 25/50/25 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| Louisiana | 15/30/25 | Bodily injury liability and property damage liability |

| Maine | 50/100/25 | Bodily injury liability, property damage liability, uninsured/underinsured motorist coverage and medical payments coverage |

| Maryland | 30/60/15 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| Massachusetts | 20/40/5 | Bodily injury liability, property damage liability and personal injury protection |

| Michigan | 20/40/10 | Bodily injury liability, property damage liability and personal injury protection |

| Minnesota | 30/60/10 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| Mississippi | 25/50/25 | Bodily injury liability and property damage liability |

| Missouri | 25/50/25 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Montana | 25/50/20 | Bodily injury liability and property damage liability |

| Nebraska | 25/50/25 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Nevada | 25/50/20 | Bodily injury liability and property damage liability |

| New Hampshire | NA | Financial responsibility (coverage unspecified, may vary by state) |

| New Jersey | 15/30/5 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| New Mexico | 25/50/10 | Bodily injury liability and property damage liability |

| New York | 25/50/10 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| North Carolina | 30/60/25 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| North Dakota | 25/50/25 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| Ohio | 25/50/25 | Bodily injury liability and property damage liability |

| Oklahoma | 25/50/25 | Bodily injury liability and property damage liability |

| Oregon | 25/50/20 | Bodily injury liability, property damage liability, personal injury protection and uninsured/underinsured motorist coverage |

| Pennsylvania | 15/30/5 | Bodily injury liability, property damage liability and personal injury protection |

| Rhode Island | 25/50/25 | Bodily injury liability and property damage liability |

| South Carolina | 25/50/25 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| South Dakota | 25/50/25 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Tennessee | 25/50/15 | Bodily injury liability and property damage liability |

| Texas | 30/60/25 | Bodily injury liability, property damage liability and personal injury protection |

| Utah | 25/65/15 | Bodily injury liability, property damage liability and personal injury protection |

| Vermont | 25/50/10 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Virginia | 25/50/20 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Washington, D.C. | 25/50/10 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| West Virginia | 25/50/25 | Bodily injury liability, property damage liability and uninsured/underinsured motorist coverage |

| Wisconsin | 25/50/10 | Bodily injury liability, property damage liability, uninsured/underinsured motorist coverage and medical payments coverage |

| Wyoming | 25/50/20 | Bodily injury liability and property damage liability |

Knowing what types of car insurance coverage you have and what insurance might be helpful based on your unique situation is important. Otherwise, if you’re in an accident, you could find yourself in hot water and expect your insurance company to help pay for repairs.

If you have car insurance coverage, review your policy to see what is and isn’t included. If you’re searching for the perfect car insurance coverage, remember to carefully consider what you need and assess which add-ons you might find useful.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Strategic Choices: Three Diverse Car Insurance Case Studies

Choosing the right car insurance involves considering personal circumstances, vehicle specifics, and financial incentives. We present three case studies to illustrate different strategies for securing optimal car insurance, highlighting approaches based on vehicle type, driving records, and available discounts.

- Case Study #1 – Optimal Coverage for a Family Vehicle: Jane, a mother with a new SUV, seeks affordable car insurance. She selects insurers offering a multi-vehicle car insurance discount for her clean driving record. She chooses a provider that bundles home and car insurance, reducing her premiums with a multi-policy discount.

- Case Study #2 – Affordable Insurance for a College Student: Tom, a college student, seeks affordable insurance for his sedan. He chooses insurers with good student discounts for a B average or higher and uses a student away at school discount, as he attends college over 100 miles away and drives only during breaks. This approach minimizes his insurance costs.

- Case Study #3 – Comprehensive Insurance for a High-End Sports Car: Alicia, an executive with a high-performance sports car, selects full coverage insurance, including collision and comprehensive, and eyes new car replacement given her car’s value. To lower costs, she leverages a safe vehicle discount for security features and enrolls in a defensive driving course for further savings.

These case studies underscore the importance of tailoring car insurance to individual needs. By assessing factors like vehicle type, driving history, and discount eligibility, individuals can find cost-effective and appropriate car insurance.

How to Pick the Best Car Insurance Company

Choosing the right car insurance involves assessing your types of car insurance coverage needs based on your vehicle type, driving frequency, and location, and comparing prices to avoid overpaying.

To find the best car insurance, research the top 10 car insurance companies, read customer reviews, and compare quotes from multiple providers to find the most competitive rates.

When evaluating insurers, consider their claims process and service quality. Look for companies that offer multiple ways to file claims—online, by phone, or through mobile apps—and have reasonable claim processing times.

Read customer feedback about claim resolutions and payouts, as a transparent, efficient claims process ensures you can get back on the road quickly without unnecessary delays.

Modern insurers also offer cutting-edge digital tools to enhance your experience. Evaluate mobile app functionality for policy management, claims filing, digital ID cards, and roadside assistance.

Scott W. Johnson Licensed Insurance Agent

A comprehensive set of digital tools and resources demonstrates an insurer’s commitment to supporting and empowering its customers in understanding their policies and making sound choices. These tools are essential components included in comprehensive car insurance.

#1 – Nationwide: Top Overall Pick

Pros

- Travel-Friendly Vanishing Deductible: Nationwide car insurance offers vanishing deductible benefits that reduce costs during travel emergencies and accidents.

- SmartRide Travel Savings: Pay-per-mile car insurance options provide significant travel-based savings for infrequent drivers with minimum coverage starting at $63.

- Comprehensive Travel Protection: Nationwide car insurance review highlights extensive bundling options that protect travelers with multiple policy discounts and flexible coverage.

Cons

- Limited Travel Roadside Options: Some car insurance policies lack comprehensive roadside assistance coverage for extended travel situations beyond basic services.

- Geographic Travel Restrictions: Certain Nationwide car insurance benefits may not extend to all travel destinations, limiting coverage effectiveness for frequent travelers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Liberty Mutual: Best for Coverage Options

Pros

- Extensive Travel Coverage Varieties: Liberty Mutual car insurance provides diverse coverage options, including gap insurance and travel-related accident forgiveness benefits.

- Travel Emergency Assistance: Comprehensive car insurance policies include 24/7 travel support with rental reimbursement starting from full coverage at $248 monthly.

- Multi-State Travel Benefits: Liberty Mutual car insurance review confirms consistent coverage across states, ensuring seamless protection during interstate travel and relocations.

Cons

- Premium Travel Costs: Higher full coverage rates at $248 monthly make Liberty Mutual car insurance less affordable for budget-conscious travelers.

- Complex Travel Claims: Some policyholders report complicated claims processes for travel-related incidents, potentially delaying reimbursements during emergencies.

#3 – State Farm: Best for Young Drivers

Pros

- Student Travel Discounts: State Farm car insurance offers substantial savings for young drivers traveling to college with away-from-school discount programs.

- Affordable Travel Coverage: Competitive full coverage rates at $123 monthly make State Farm car insurance review particularly favorable for young travelers and students.

- Travel Safety Programs: Comprehensive car insurance includes defensive driving courses and safety programs specifically designed for young driver travel protection.

Cons

- Limited Travel Technology: The State Farm car insurance mobile app lacks advanced travel tracking features compared to other providers in the market.

- Restrictive Travel Policies: Some coverage limitations apply to young drivers during extended travel periods, potentially reducing protection for college students.

#4 – Farmers: Best for Essential Workers

Pros

- Essential Worker Travel Benefits: Farmers car insurance provides specialized coverage for essential workers who travel frequently for work-related duties.

- Travel Incident Forgiveness: Comprehensive policies include accident forgiveness programs that protect essential workers during their daily travel commutes and assignments.

- Flexible Travel Scheduling: Farmers Insurance review highlights accommodating claim processing that works around essential workers’ demanding travel schedules and shifts.

Cons

- Higher Travel Premiums: Full coverage car insurance rates at $198 monthly may strain essential workers’ budgets despite specialized travel benefits.

- Limited Travel Hours: Some Farmers car insurance customer service hours may not align with essential workers’ unconventional travel and work schedules.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – The Hartford: Best for Customer Service

Pros

- 24/7 Travel Support: The Hartford car insurance provides round-the-clock customer service for travelers experiencing emergencies or needing immediate assistance.

- Travel Claims Excellence: Superior customer service ratings ensure efficient processing of travel-related car insurance claims (Read More: The Hartford insurance review & ratings).

- Comprehensive Travel Resources: Full coverage policies at $161 monthly include extensive travel planning resources and emergency contact services for policyholders.

Cons

- Limited Travel Discounts: The Hartford car insurance offers fewer travel-specific discounts compared to competitors, potentially increasing costs for frequent travelers.

- Geographic Travel Coverage: Some specialized car insurance benefits may not extend to all travel destinations, limiting comprehensive protection for international trips.

#6 – Geico: Best for Digital Experience

Pros

- Advanced Travel Apps: Geico car insurance features cutting-edge mobile applications that streamline travel claims reporting and provide real-time assistance.

- Competitive Travel Rates: Minimum coverage starting at $43 monthly makes Geico insurance review particularly attractive for budget-conscious travelers and commuters.

- Digital Travel Tools: As mentioned in our Geico App Review, its innovative car insurance technology includes GPS tracking, travel route optimization, and automated emergency response.

Cons

- Limited Travel Agents: Heavy emphasis on digital services means fewer local agents available for in-person travel emergency assistance and support.

- Travel Coverage Gaps: Some Geico car insurance policies may lack comprehensive travel protection features available through traditional full-service insurance providers.

#7 – American Family: Best for Customer Satisfaction

Pros

- Personalized Travel Service: American Family insurance review mentioned its exceptional customer satisfaction through individualized travel coverage and dedicated claim representatives.

- Travel Loyalty Rewards: Long-term policyholders receive enhanced car insurance benefits and discounts for consistent loyalty during travel-related claims and renewals.

- Regional Travel Expertise: American Family insurance review emphasizes strong regional presence providing specialized travel knowledge for local driving conditions and requirements.

Cons

- Limited Travel Availability: American Family car insurance operates in fewer states, restricting coverage options for travelers who relocate frequently.

- Higher Travel Costs: Full coverage rates at $166 monthly may exceed budget expectations for travelers seeking affordable comprehensive car insurance protection.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Usage-Based Savings

Pros

- Smart Travel Monitoring: Allstate insurance review & ratings mentioned its advanced telematics to track travel patterns and reward safe driving behavior with significant discounts.

- Travel Mileage Savings: Usage-based car insurance programs provide substantial savings for low-mileage travelers and occasional drivers through personalized rate adjustments.

- Travel Behavior Rewards: Allstate insurance review highlights innovative programs that reduce premiums based on safe travel habits and responsible driving patterns.

Cons

- Travel Privacy Concerns: Usage-based car insurance monitoring may raise privacy issues for travelers uncomfortable with constant tracking and data collection.

- Higher Travel Premiums: Full coverage starting at $228 monthly makes Allstate car insurance among the more expensive options for comprehensive travel protection.

#9 – Travelers: Best for Financial Strength

Pros

- Travel Financial Security: As highlighted in our Travelers insurance review & ratings, it offers exceptional financial stability, ensuring reliable claim payments even during major travel emergencies.

- Travel Investment Protection: Strong A++ rating provides confidence that car insurance benefits will remain available for long-term travel coverage and future claims.

- Travel Risk Management: Travelers insurance review demonstrates superior risk assessment capabilities that protect policyholders during high-risk travel situations and conditions.

Cons

- Limited Travel Innovation: Traditional approach may lack modern car insurance features and digital travel tools available from more technology-focused competitors.

- Travel Service Availability: Some specialized car insurance services may not be readily available in all travel destinations or remote locations.

#10 – Progressive: Best for Customizable Premiums

Pros

- Flexible Travel Pricing: Progressive car insurance allows extensive customization of coverage levels and deductibles to match individual travel needs and budgets.

- Name Your Price Tool: Innovative car insurance pricing tools help travelers find coverage options that fit specific budget constraints and coverage requirements.

- Travel Bundle Savings: Progressive insurance review highlights excellent bundling opportunities that reduce costs when combining travel-related coverage options and additional policies.

Cons

- Complex Travel Options: Extensive customization choices may overwhelm travelers seeking straightforward car insurance solutions. Learn more in our Progressive car insurance review & ratings.

- Variable Travel Rates: Highly personalized pricing means car insurance costs can fluctuate significantly based on individual travel patterns and risk factors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Smart Strategies for Choosing the Right Car Insurance

Finding the best car insurance involves researching, understanding coverage needs, and comparing market offerings. Evaluating multiple providers and considering factors such as driving history, vehicle type, and available discounts helps drivers secure insurance that fits their budget and provides extensive protection.

The best policy offers necessary coverage at an affordable price, customized to individual circumstances. To ensure adequate coverage, compare quotes, read reviews, and make informed choices.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Frequently Asked Questions

What are the best auto insurance companies?

The top 10 best auto insurance companies are renowned for their comprehensive coverage options, competitive pricing, strong customer service, and reliability. Companies like Nationwide, Liberty Mutual, and State Farm top our list, reflecting their market strength and customer satisfaction rates.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.

How are the top-ranked car insurance companies determined?

The top-ranked car insurance companies are evaluated based on several criteria, including customer satisfaction scores, financial strength ratings from agencies such as A.M. Best, claim resolution efficiency, and the breadth of coverage options they offer.

What does the Good2Go car insurance review say about their coverage options?

The Good2Go auto insurance reviews often highlights affordable coverage options, quick policy initiation, and their targeted service for drivers needing basic auto insurance. However, reviews suggest evaluating customer service and claims response times for a balanced view.

To enhance your knowledge, dive into our detailed guide on insurance coverage titled “Good2Go Car Insurance Review & Ratings” for essential insights.

What does Metromile accident forgiveness entail?

Metromile accident forgiveness typically means that your rates won’t increase after your first at-fault accident if you’ve been a customer for a certain period or have maintained a clean driving record, offering a significant benefit for long-term, safe drivers.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

How does State Farm Drive Safe & Save work?

The Drive Safe & Save program typically uses a mobile app or a plug-in device in your car to monitor driving behaviors like speed, braking, and time of day driven. Safe driving habits can lead to discounts on your car insurance, promoting safer driving while potentially lowering costs.

For a comprehensive overview, explore our detailed resource titled “State Farm Drive Safe and Save Insurance Review & Ratings” for key insights.

Is Geico cheaper than Allstate for most drivers?

In comparing whether Geico is cheaper than Allstate, many find Geico offers more competitive rates for drivers with clean driving records and those who qualify for numerous discounts. However, Allstate’s rates can be more favorable for those with accident histories.

How does Good2Go roadside assistance compare to other providers?

Good2Go roadside assistance is noted for its accessibility and reliability, providing services such as towing, flat tire changes, and emergency fuel delivery. It’s often compared favorably with similar programs, offering a basic safety net for drivers at a competitive price.

For an in-depth look, consult our detailed guide titled “Roadside Assistance Coverage: A Complete Guide” for thorough insights.

Which companies are considered the most reliable auto insurance providers?

The most reliable auto insurance providers often include those ranked in the top ten car insurance companies, known for excellent customer service, robust coverage options, and financial stability. This list often features names like Nationwide, Liberty Mutual, and State Farm.

Is Allstate cheaper than State Farm for auto insurance?

Whether Is Allstate cheaper than State Farm depends on various factors, including your driving history, vehicle type, and location. Generally, State Farm may offer lower rates for safe drivers, while Allstate could be cheaper for those utilizing multiple discounts.

For detailed information, refer to our comprehensive report titled “What age do you get cheap car insurance?” for a quick summary.

What benefits do the top rated auto insurance companies in USA offer?

The top rated auto insurance companies in USA typically offer benefits such as extensive coverage options, including accident forgiveness, roadside assistance, and customizable policies, along with competitive pricing and strong customer support, ensuring they meet a wide range of driver needs.

Get a FREE Quote in Minutes