The Hartford vs. AIG Renters Insurance for 2026 (Side-by-Side Comparison)

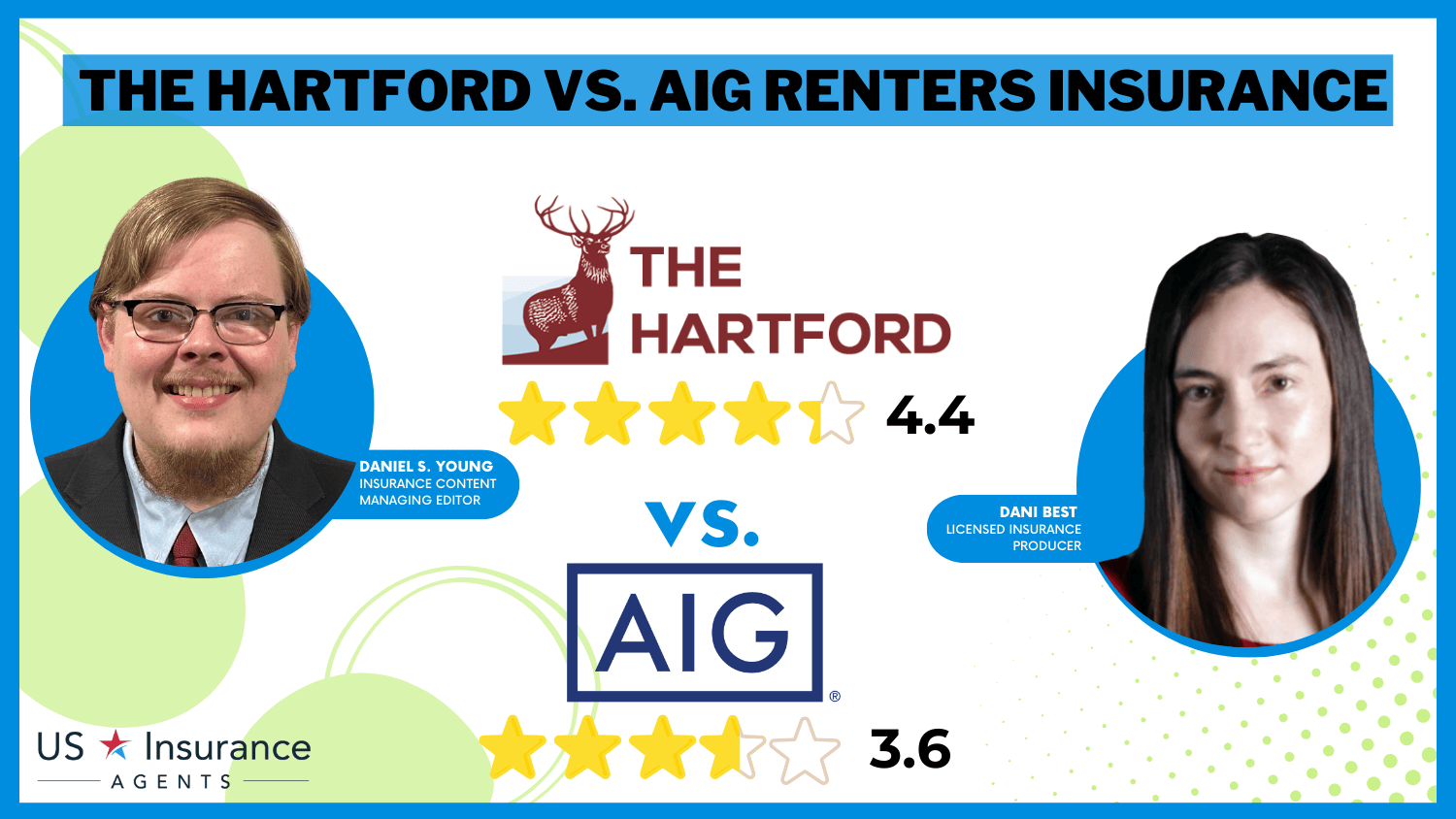

The Hartford is the better choice for most renters when comparing The Hartford vs. AIG renters insurance. The Hartford's rates are cheaper, starting at $12/mo compared to $14/mo at AIG. Hartford Insurance Company also has better customer service reviews and higher business ratings than AIG.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated August 2025

765 reviews

765 reviewsCompany Facts

Renters Policy Cost

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 163 reviews

163 reviewsCompany Facts

Renters Policy Cost

A.M. Best Rating

Complaint Level

Pros & Cons

163 reviews

163 reviewsIn this detailed comparison of The Hartford vs. AIG renters insurance, we delve into the coverage options, pricing, and customer service.

When it comes to securing your rented space, choosing the right renters insurance provider is crucial. When comparing The Hartford and AIG, The Hartford Insurance stands out as the better company.

The Hartford vs. AIG Renters Insurance Rating

| Rating Criteria |  |  |

|---|---|---|

| Overall Score | 4.4 | 3.6 |

| Business Reviews | 4.5 | 4.0 |

| Claim Processing | 4.8 | 3.0 |

| Company Reputation | 4.5 | 4.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.3 | 3.5 |

| Customer Satisfaction | 4.1 | 4.1 |

| Digital Experience | 4.5 | 4.0 |

| Discounts Available | 5.0 | 3.1 |

| Insurance Cost | 3.9 | 2.6 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 4.1 | 4.5 |

| Savings Potential | 4.3 | 2.8 |

| The Hartford Insurance Review | AIG Insurance Review |

By understanding the nuances of their policies, potential discounts, and customer reviews, you can make an informed decision on which company has the best renters insurance for your needs.

Whether you prioritize personalized service or competitive pricing, this article will guide you toward the best choice for your renters insurance. Need to find affordable renters insurance today? Enter your ZIP in our free quote tool to get started.

- Both AIG and The Hartford offer several coverages for renters

- The Hartford has better business ratings than AIG

- AIG has fewer discount opportunities than The Hartford

The Hartford vs. AIG Renters Insurance Rate Comparision

While coverage is crucial, pricing is also a significant factor for many renters when selecting an insurance provider. Let’s compare The Hartford vs. AIG renters insurance cost.

The Hartford vs. AIG Renters Insurance Monthly Rates by Age & Gender

| Age & Gender |  |  |

|---|---|---|

| Age: 25 Female | $15 | $18 |

| Age: 25 Male | $16 | $19 |

| Age: 35 Female | $14 | $16 |

| Age: 35 Male | $15 | $17 |

| Age: 45 Female | $13 | $15 |

| Age: 45 Male | $14 | $16 |

| Age: 60 Female | $12 | $14 |

| Age: 60 Male | $13 | $15 |

The Hartford is slightly cheaper than AIG for renters insurance, making it the better choice price-wise for most renters. Bear in mind that the cost of your renters and home insurance will vary based on several factors (Read More: Home Features That Can Make Homeowners Insurance More Expensive).

The Hartford Renters Insurance Pricing

The Hartford’s renters insurance policies are competitively priced. The cost of your policy will depend on several factors, including the value of your possessions, the level of coverage you choose, your location, and any additional endorsements or discounts applied.

It is important to obtain a personalized quote from The Hartford to determine the exact cost of your policy.

Furthermore, The Hartford takes into consideration the level of coverage you choose. They offer different policy options, allowing you to select the one that best suits your needs and budget. Whether you prefer a basic policy that covers the essentials or a more comprehensive plan that includes additional protections, The Hartford has you covered.

Your location can also affect the cost of your renters insurance policy. Factors such as crime rates, natural disaster risks, and the overall cost of living in your area can impact the pricing. The Hartford takes these factors into account when determining the cost of your policy, ensuring that you receive a fair and accurate quote.

AIG Renters Insurance Pricing

Similarly, AIG offers competitive pricing for their renters insurance policies. The final cost will depend on various factors, such as the value of your belongings, your chosen coverage limits, your location, and any applicable discounts or endorsements. To obtain an accurate quote, it is recommended to reach out to AIG directly and provide the necessary details.

Kristine Lee Licensed Insurance Agent

AIG understands that the cost of replacing your possessions can quickly add up, which is why they offer comprehensive coverage options. Whether you own high-value electronics, furniture, or other personal belongings, AIG’s renters insurance policies can provide the necessary coverage to protect your investments.

Your location plays a significant role in determining the cost of your renters insurance policy with AIG. Factors such as crime rates, proximity to fire stations, and the overall risk of natural disasters in your area can influence the pricing. AIG takes these factors into consideration to provide you with an accurate quote that reflects the specific risks associated with your location.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Hartford vs. AIG Renters Coverage Options

When comparing The Hartford and AIG, it’s important to assess the coverage options they offer for renters insurance.

Renters Insurance Coverage Options with The Hartford & AIG

| Coverage Type |  |  |

|---|---|---|

| Personal Property | ✔ | ✔ |

| Liability | ✔ | ✔ |

| Loss of Use/Additional Living Expenses | ✔ | ✔ |

| Medical Payments | ✔ | ✔ |

| Replacement Cost Coverage | ✔ | ✔ |

| Scheduled Personal Property | ✔ | ✔ |

| Water Backup | ✔ | ✔ |

| Identity Theft Protection | ✔ | ✔ |

| Earthquake Coverage | ✔ | ✔ |

| Pet Damage Liability | ✔ | ✔ |

The Hartford provides comprehensive coverage options that can be customized to suit your specific needs. Their renters insurance policies typically include coverage for personal belongings, liability protection, and additional living expenses. The company prides itself on offering flexible coverage limits and optional add-ons to enhance protection against risks that are important to you.

When considering the value of your possessions, it is essential to take into account not only the cost of replacing them but also their sentimental value. The Hartford understands this and offers comprehensive coverage options to ensure that you are adequately protected.

Whether you own valuable electronics, jewelry, or artwork, The Hartford’s renters insurance policies can provide the necessary coverage to give you peace of mind.

Read More: Is tenant liability the same as renters insurance?

Similarly, AIG offers a range of coverage options for renters insurance. Whether you are a student renting a small apartment or a family renting a house, AIG has policies designed to meet your specific requirements. By customizing your coverage, you can ensure that you are adequately protected without paying for unnecessary protections.

Their policies typically encompass coverage for personal property, liability, and additional living expenses. AIG also provides the flexibility to customize coverage limits and offers additional endorsements to extend protection. Their focus on tailoring policies ensures that renters can select the coverage options that align with their individual circumstances and preferences.

Renters Discounts at The Hartford vs. AIG

Both The Hartford and AIG offer a few discount options to help customers save on their renters insurance policies.

The Hartford vs. AIG Renters Insurance Discounts by Savings Potential

| Discount Name |  |  |

|---|---|---|

| Bundling | 20% | 15% |

| Claims-Free | 15% | X |

| Association/Membership | 5% | 5% |

| Employer Affiliation | 5% | 5% |

| Anti-Theft | 10% | 10% |

| Renewal | 5% | X |

| AARP Membership | 10% | X |

The Hartford offers various discounts and endorsements that can help lower the cost of your renters insurance. These discounts may include multi-policy discounts, claims-free discounts, or security system discounts. By discussing your specific situation with a representative from The Hartford, you can explore all the available options and potentially save money on your policy.

Read More: Home and Car Insurance Discounts

AIG also offers discounts, but fewer than The Hartford. These discounts may include bundling your renters insurance with other policies, having a security system installed in your rental property, or maintaining a claims-free history. By discussing your eligibility for these discounts with an AIG representative, you can potentially reduce the cost of your policy while still maintaining comprehensive coverage.

Customer Reviews of The Hartford and AIG

When it comes to insurance providers, customer service and the claims process play a significant role in ensuring a seamless experience during periods of distress. Let’s examine The Hartford vs. AIG renters insurance reviews.

The Hartford is widely recognized for its exceptional customer service. Their representatives are trained to assist policyholders with any inquiries, provide guidance during the policy selection process, and address concerns promptly. The company is known for its dedication to customer satisfaction and strives to make the experience of obtaining renters insurance as smooth as possible.

In terms of the claims process, The Hartford is committed to efficient and hassle-free claims resolution. They provide multiple channels to report claims and have a dedicated team available to guide policyholders through the process. The Hartford aims to settle claims fairly and swiftly, ensuring that policyholders receive the assistance they need during challenging times.

However, this doesn’t mean all customers are satisfied with The Hartford, as you can see in the Yelp review below.

Read Moistra S.‘s review of Metlife Auto & Home Insurance on Yelp

One of the complaints about The Hartford is rate increases over time, as well as poor communication.

AIG also places great importance on providing excellent customer service. Their representatives are available to assist policyholders throughout their insurance journey, from selecting the right coverage to resolving any concerns that may arise. AIG strives to deliver a positive customer experience, addressing inquiries and providing comprehensive support to renters seeking reliable insurance protection.

Of course, some customers are unhappy with AIG. The company has low reviews on sites like TrustPilot, with customers having issues with denied claims, poor customer service, and more.

So, while AIG prides itself on a claims process designed to be straightforward and efficient and offers multiple channels for reporting claims, making it convenient for policyholders to initiate the process, this is not what most customers experience with claims at AIG, with negative AIG theft and loss reviews (Read More: How to Document Damage for a Renters Insurance Claim).

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Hartford vs. AIG Business Ratings

The Hartford has a larger market share than AIG, meaning it serves more customers in the insurance world than AIG.

However, market share is just one piece of the picture. It’s important to see how businesses rate The Hartford and AIG.

Insurance Business Ratings & Consumer Reviews: The Hartford vs. AIG

| Agency |  | |

|---|---|---|

| Score: 905 / 1,000 Above Avg. Satisfaction | Score: 835 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A Good Business Practices |

|

| Score: 74/100 Good Customer Feedback | Score: 77/100 Good Customer Feedback |

|

| Score: 1.10 Avg. Complaints | Score: 0.98 Avg. Complaints |

|

| Score: A+ Superior Financial Strength | Score: A Excellent Financial Strength |

The Hartford’s ratings are better than AIG’s in most instances, so customers will be less likely to cancel renters insurance at The Hartford (Read More: How To Cancel The Hartford Renters Insurance).

AIG has a lower financial rating from A.M. Best, as well as a lower satisfaction rating from J.D. Power. Additionally, when you look at The Hartford vs. AIG renters insurance reviews from BBB, AIG has lower ratings.

Pros and Cons of The Hartford Renters Insurance

Pros

- Comprehensive Coverage: The company offers comprehensive renters insurance coverage, including options for protecting personal belongings, liability, and additional living expenses.

- Optional Endorsements: The Hartford provides optional endorsements, allowing renters to customize policies to fit specific needs, whether looking for the best renters insurance for people in gated communities or duplexes.

- Customer Service: Widely recognized for exceptional customer service, The Hartford prioritizes personalized support and efficient claims processing.

Cons

- Pricing: While competitive, The Hartford’s pricing may vary based on factors such as location, coverage limits, and endorsements.

- Limited Global Presence: The Hartford’s reach may be limited compared to AIG, potentially impacting coverage options for renters in certain regions.

Pros and Cons of AIG Renters Insurance

Pros

- Tailored Solutions: AIG emphasizes providing tailored solutions, offering a wide range of coverage options that can be customized to suit individual renter requirements.

- Additional Benefits: AIG’s renters insurance often includes additional benefits, such as coverage for temporary living expenses in case of a covered loss.

- Competitive Pricing: AIG offers competitive pricing with discounts and endorsements, ensuring affordability for renters seeking comprehensive coverage.

Cons

- Less Historic Presence: While reputable, AIG may not have the same historical presence as The Hartford, potentially influencing perceptions of stability.

- Customer Service: Individual experiences with AIG’s customer service may vary, and since your insurance agent’s role in the claim process is important, you may be frustrated by AIG’s customer service.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Verdict: The Hartford

After a thorough examination of both The Hartford and AIG renters insurance offerings, one company emerges as the superior choice for renters seeking comprehensive coverage and overall value: The Hartford.

- Historical Stability and Reliability: The Hartford’s remarkable history spanning over two centuries signifies unparalleled stability and reliability in the insurance industry. This long-standing presence instills confidence in renters looking for a company with a proven track record.

- Exceptional Customer Service: The Hartford is widely acknowledged for its commitment to customer satisfaction. Its emphasis on personalized support and efficient claims processing ensures that renters receive prompt and helpful assistance when needed the most.

- Comprehensive Coverage with Optional Endorsements: The Hartford’s renters insurance not only offers comprehensive coverage for personal belongings, liability, and additional living expenses but also allows renters to tailor their policies with optional endorsements like pet liability (Read More: Best Pet Liability Insurance for Renters).

- Competitive Pricing and Discounts: While pricing is a crucial factor, The Hartford offers competitive rates that align with the industry standard. Moreover, the company provides various discounts and endorsements, allowing renters to save money without compromising on coverage quality.

- Reputation for Financial Stability: The Hartford’s enduring reputation for financial stability adds an extra layer of assurance for policyholders. This stability is vital for renters seeking a reliable partner to safeguard their possessions and financial well-being.

The Hartford outshines AIG in historical stability, customer service, coverage flexibility, and overall value. While AIG presents a formidable option, The Hartford’s combination of a rich history, exceptional service, and comprehensive coverage options positions it as the best overall choice for renters insurance.

Prospective policyholders are encouraged to prioritize the factors that matter most to them, and in doing so, The Hartford consistently emerges as the top contender in the renters insurance landscape.

Overview of The Hartford

The Hartford is a well-established insurance company with a strong focus on customer satisfaction and outstanding claims service. Known for its long history in the insurance industry, The Hartford offers a range of insurance products, including renters insurance, to meet the needs of its policyholders. The company values personalized customer support and strives to deliver efficient claims processing promptly.

Founded in 1810, The Hartford has been providing insurance services for over two centuries. With such a rich history, the company has built a solid reputation for reliability and financial stability.

The Hartford’s commitment to its customers is evident in its extensive network of agents and dedicated customer service team, ensuring policyholders have access to assistance whenever needed. You can also get quotes directly from Hartford Insurance Company’s website (Read More: How to Get Free Insurance Quotes Online).

When it comes to renters insurance, The Hartford offers comprehensive coverage options that protect policyholders against various risks, such as theft, fire, and liability. In addition to standard coverage, The Hartford also provides optional endorsements that allow renters to customize their policies to fit their specific needs.

Whether it’s protecting valuable possessions or ensuring financial security in the event of a lawsuit, The Hartford’s renters insurance offers peace of mind to policyholders.

Overview of AIG

AIG, also known as American International Group, is another reputable insurance provider, serving customers worldwide. With its global presence, AIG offers extensive insurance coverage options, including renters insurance, to renters across different markets. AIG emphasizes providing tailored solutions like AIG landlord insurance, making it a popular choice for landlords and renters seeking reliable coverage.

Established in 1919, AIG has grown to become one of the largest insurance companies in the world.

The company’s global reach allows it to understand the diverse needs of renters in various regions, enabling AIG to offer localized coverage that meets local regulations and preferences. AIG’s commitment to customer service is reflected in its dedicated claims team, which is available 24/7 to assist policyholders in times of need.

When it comes to renters insurance, AIG Insurance offers a wide range of coverage options that can be customized to suit individual needs. From basic plans that provide essential protection to comprehensive policies that cover a broad range of risks, AIG ensures that renters have options to choose from.

Additionally, AIG’s renters insurance policies often include additional benefits, such as coverage for temporary living expenses if the insured property becomes uninhabitable due to a covered loss. Bear in mind that you can’t get an AIG quote online to see what you’ll pay for different coverages. Instead, you’ll have to contact an agent.

If you want to compare rates from different companies, such as Chubb vs. AIG, the company’s lack of online quotes will make it difficult.

Both The Hartford and AIG Insurance have established themselves as leading insurance providers in the industry. Their commitment to customer satisfaction, extensive coverage options, and outstanding claims service make them reliable choices for renters seeking insurance protection.

Whether it’s The Hartford’s long-standing reputation or AIG’s global presence, renters can find peace of mind knowing that their insurance needs are in capable hands.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Renters Insurance

Let’s establish what renters insurance is and why it’s important. Renters insurance is a policy designed to protect individuals who rent their homes or apartments. While the landlord’s insurance typically covers the building or structure, renters insurance offers coverage for personal belongings, liability, and additional living expenses in case of a covered event, such as theft, fire, or natural disasters.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Renters insurance covers personal property, including furniture, electronics, and clothing, against theft, vandalism, fire, water damage, or other covered perils.

Read More: Reasons Why You Need Renters Insurance

When it comes to renters insurance, it’s important to understand the different types of coverage. The two main types are actual cash value (ACV) and replacement cost value (RCV). ACV coverage takes into account depreciation and pays out the value of the damaged or stolen item at its current worth. On the other hand, RCV coverage pays for the cost of replacing the item with a similar one without considering depreciation.

It’s crucial to carefully review the renters policy to determine which type of coverage is most suitable for your needs.

Additionally, renters insurance also provides liability coverage. This means that if someone gets injured while on your rented property and decides to file a lawsuit, your insurance can help cover legal fees and any resulting medical expenses. This liability coverage is especially important as it protects you from potential financial ruin in case of an accident or injury.

Why Renters Insurance is Important

Renters insurance offers several key benefits that make it important for anyone living in a rented property. Firstly, it protects your personal belongings, ensuring that you can recover their value in case of theft or damage. Imagine coming home to find that your apartment has been broken into, and your valuable electronics, jewelry, and other prized possessions are gone.

Read More: Will renters insurance cover you and your belongings if there is ever a fire, theft, or vandalism?

Without renters insurance, you would be left to bear the financial burden of replacing these items on your own. However, with renters insurance, you can file a claim and receive compensation to help you recover from the loss, whether it’s theft or a fire.

Secondly, renters insurance provides liability coverage, which protects you in the event that someone gets injured in your rented property and files a lawsuit. Accidents can happen, and if a guest slips and falls or is injured in any way while visiting your home, you could be held legally responsible for their medical expenses and other damages. Renters insurance can help cover these costs and protect your financial well-being.

Daniel Walker Licensed Insurance Agent

With renters insurance, you can usually receive compensation for additional living expenses, making it easier for you to find a safe and comfortable place to stay during the recovery process.

It’s important to note that while renters insurance provides valuable coverage, it does have certain limitations and exclusions. For example, most policies do not cover damage caused by floods or earthquakes.

It’s essential to carefully review your policy and consider additional coverage if you live in an area prone to these types of natural disasters.

In conclusion, renters insurance is a crucial investment for anyone living in a rented property. It provides financial protection for your personal belongings, offers liability coverage in case of accidents or injuries, and helps cover additional living expenses if your home becomes uninhabitable.

By understanding the importance of renters insurance and selecting the right policy for your needs, you can have peace of mind knowing that you are financially protected against unexpected events.

Choosing Between The Hartford and AIG for Renters Insurance

In conclusion, both The Hartford and AIG offer competitive renters insurance policies with comprehensive coverage options. While The Hartford emphasizes personalized customer service and satisfaction, AIG focuses on tailored solutions to meet individual needs.

Pricing may vary based on personal factors, such as your credit score, and obtaining personalized quotes from both providers is essential to make an accurate comparison (Read More: Cheap Renters Insurance With No Credit Check).

Ultimately, selecting the right renters insurance provider depends on your specific requirements, preferences, and the level of customer service and claims support you value most.

Remember, whether you choose The Hartford or AIG, obtaining renters insurance can provide you with peace of mind, knowing that your personal belongings are protected and you have liability coverage in place. Don’t underestimate the importance of renters insurance – it is a valuable investment towards safeguarding your possessions and ensuring financial security in the face of unforeseen events.

If neither company is right for you, compare rates with our free tool to find affordable renters insurance in your area.

Frequently Asked Questions

What is the difference between The Hartford and AIG renters insurance?

The Hartford and AIG are both insurance companies that offer renters insurance policies. However, there are differences in coverage options, pricing, and customer service between the two. It is recommended to compare their policies and consider factors such as coverage limits, deductibles, and additional benefits before making a decision.

Which company has better customer service, The Hartford or AIG?

Both The Hartford and AIG have customer service departments dedicated to assisting renters insurance policyholders. However, the quality of customer service can vary depending on individual experiences. It is advisable to read reviews and consider factors such as responsiveness, helpfulness, and overall satisfaction when evaluating customer service for these companies.

Can I get a quote for renters insurance from both The Hartford and AIG?

Yes, both The Hartford and AIG provide online platforms where you can request a quote for renters insurance.

By visiting their respective websites to get insurance quotes online or contacting their customer service, you can provide the necessary information and receive a personalized quote based on your requirements and location.

What factors should I consider when choosing between The Hartford and AIG renters insurance?

When choosing between The Hartford and AIG renters insurance, it is important to consider factors such as coverage options, pricing, customer reviews, financial stability of the companies, claims process, and any additional benefits or discounts offered. Evaluating these factors will help you make an informed decision based on your specific needs and preferences.

Are there any discounts available for renters insurance from The Hartford or AIG?

Both Hartford Fire Insurance Companyand AIG may offer discounts on renters insurance policies. These discounts can vary and may be based on factors such as bundling multiple policies, having safety features in your rental property, maintaining good credit, or being a loyal customer.

It is recommended to inquire about available discounts when obtaining a quote from either company. Compare rates with our free tool to find cheap renters insurance today.

Which company has the cheapest renters insurance?

AIG has cheaper renters insurance rates than The Hartford. However, just because AIG provides the cheapest renters insurance between the two companies doesn’t mean it’s the best.

When comparing two companies, like State Farm vs. The Hartford or Nationwide vs. The Hartford, it’s important to also look at business ratings, customer reviews, and coverage options.

Where is The Hartford renters insurance login?

You can find the login button on the upper right side on The Hartford’s website.

What is The Hartford renters insurance phone number?

The phone number for renters insurance from Hartford Insurance Company is 800-624-5578.

What is the best insurance company for renters insurance?

Hartford insurance for renters is better than renters insurance from AIG, as Hartford Insurance Company has better ratings.

Hartford also has an AARP program, making it better if you are shopping for the best renters insurance for people in assisted living facilities. Call The Hartford’s AARP renters insurance phone number if you are interested.

What type of insurance is the Hartford?

The Hartford sells home, renters, auto, and business insurance.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.