State Farm vs. Top Life Insurance Companies Life Insurance: Which is better?

We analyze the practical merits of both State Farm and Top Life Insurance Companies, emphasizing coverage rates, policy options, discounts, and customer reviews.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2025

As we explore the landscape of life insurance, we delve into crucial aspects such as coverage rates, policy options, discounts, and customer reviews. In this succinct guide, we’ll navigate through the intricacies to reveal which company emerges as the frontrunner, offering the most advantageous rates tailored to diverse customer profiles. Get ready for a concise exploration that unveils the best life insurance provider, ensuring you make an informed decision aligned with your unique needs and preferences.

State Farm:

Pros:

- Long-standing Reputation: State Farm has a nearly century-long history and a strong reputation for reliability.

- Comprehensive Coverage: Offers a variety of life insurance products, including term, whole, and universal life insurance.

- Competitive Pricing: Provides competitive rates for life insurance coverage.

- Customer Service: Known for excellent customer service with dedicated agents and prompt claims processing.

Cons:

- Limited Comparison: Comparison is limited to State Farm’s own products; does not provide a broader industry perspective.

- Pricing Variation: Life insurance premiums may vary based on individual factors, potentially making it challenging to predict exact costs.

- Optional Riders: While State Farm offers optional riders, the variety may be limited compared to other providers.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Life Insurance Companies (New York Life, Northwestern Mutual, MassMutual, Prudential, Transamerica):

Pros:

- Diverse Options: A selection of top-tier companies provides diverse policy options catering to different needs.

- Financial Strength: Companies like New York Life, Northwestern Mutual, and MassMutual boast long histories and financial stability.

- Innovative Solutions: Some companies, such as Prudential, are recognized for innovative solutions and diverse product portfolios.

- Customer Reviews: Positive customer reviews and ratings for several of these companies indicate strong customer satisfaction.

Cons:

- Potential Complexity: With multiple companies, navigating through various policies, pricing structures, and benefits may be more complex.

- Variable Pricing: Pricing structures may differ among companies, and obtaining personalized quotes is essential.

- Decision Overload: The abundance of choices may lead to decision overload for some consumers.

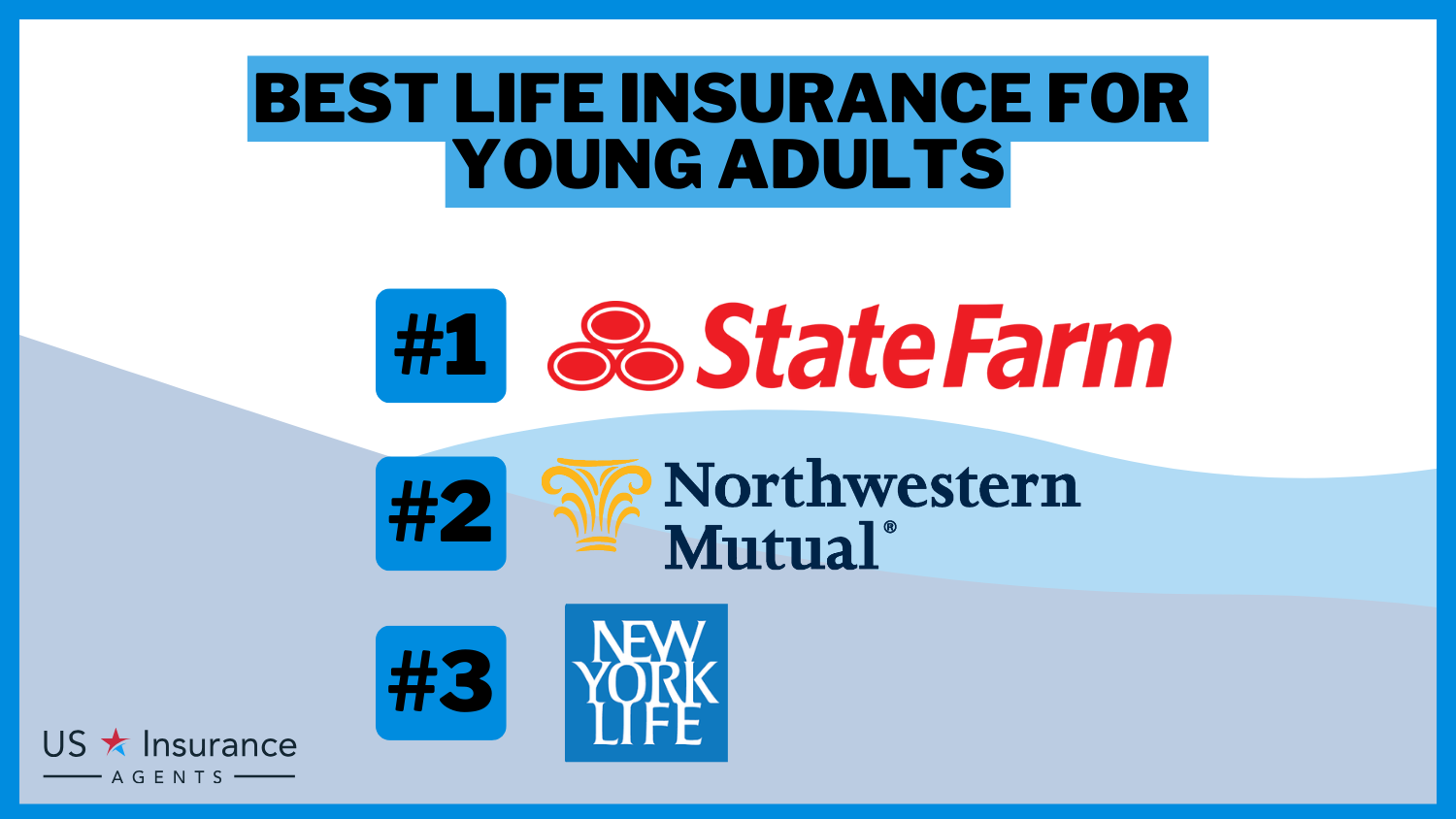

Best Overall: State Farm

When evaluating State Farm and other top life insurance companies, it becomes evident that State Farm stands out as the best overall choice. Several factors contribute to this conclusion.

Long-standing Reputation and Stability: State Farm’s nearly century-long history and commitment to providing reliable insurance solutions underscore its stability and reputation. This long-standing presence in the industry suggests a track record of financial strength and customer satisfaction.

Comprehensive Coverage Options: State Farm offers a diverse range of life insurance products, including term, whole, and universal life insurance. This comprehensive selection allows individuals to choose policies that align with their specific needs, whether it’s short-term coverage or lifelong protection with cash value accumulation.

Competitive Pricing and Value: State Farm provides competitive rates for life insurance coverage, ensuring that customers receive value for their investment. While pricing is influenced by individual factors, State Farm’s commitment to affordability positions it as an attractive option for a broad range of consumers.

Proven Customer Service: State Farm is renowned for its excellent customer service, characterized by dedicated agents and efficient claims processing. Positive customer experiences further enhance its appeal, instilling confidence in policyholders that they are supported throughout their insurance journey.

Streamlined Decision-Making: Choosing State Farm simplifies the decision-making process for consumers. With a single, reputable provider, individuals can navigate their options with clarity, avoiding the potential complexity and decision overload associated with comparing multiple companies.

While other top life insurance companies, such as New York Life, Northwestern Mutual, MassMutual, Prudential, and Transamerica, offer notable strengths, State Farm’s combination of reputation, coverage options, competitive pricing, and customer service positions it as the best overall choice.

Understanding Life Insurance

Before delving into the specific details of State Farm and other top life insurance companies, let’s take a moment to understand the concept of life insurance. Life insurance is essentially a contract between the policyholder and the insurance company. The policyholder pays regular premiums, and in return, the insurance company promises to pay out a sum of money, known as a death benefit, to the designated beneficiaries upon the policyholder’s death.

What Is Life Insurance?

Life insurance is a way to protect your loved ones financially in the event of your death. It provides a payout, known as a death benefit, to your beneficiaries, who can use the funds to cover funeral expenses, mortgage payments, education costs, and other financial obligations. Life insurance ensures that your loved ones are not burdened with financial difficulties during an already challenging time.

Why Is Life Insurance Important?

Life insurance is important for several reasons. First and foremost, it provides financial security for your family. If you are the primary breadwinner or have dependents relying on you financially, life insurance can help ensure that they are taken care of financially if something happens to you. It can provide a safety net and peace of mind knowing that your loved ones won’t face financial hardships.

Secondly, life insurance can be used to cover funeral expenses, which can be quite costly. The grieving process is difficult enough, and having to worry about the financial burden of funeral costs can add unnecessary stress to an already emotional time.

Additionally, life insurance can be used to pay off any outstanding debts, such as mortgages or student loans. By doing so, you can help alleviate the financial burden on your loved ones and ensure that they are not left with significant debts to repay.

Moreover, life insurance can also serve as an investment tool. Certain types of life insurance policies, such as whole life insurance, have a cash value component that grows over time. This accumulated cash value can be accessed during the policyholder’s lifetime and used for various purposes, such as supplementing retirement income or funding a child’s education.

Furthermore, life insurance can provide business continuity. If you are a business owner, life insurance can be used to ensure that your business can continue to operate smoothly in the event of your untimely death. It can provide the necessary funds to cover business expenses, pay off debts, and facilitate a smooth transition of ownership.

Another important aspect of life insurance is its ability to provide tax benefits. In many countries, the death benefit paid out to beneficiaries is generally tax-free. This means that your loved ones can receive the full benefit amount without having to worry about paying taxes on it. Additionally, certain types of life insurance policies may offer tax-deferred growth on the cash value component, allowing you to accumulate wealth on a tax-advantaged basis.

Lastly, life insurance can also be used for charitable purposes. If you have philanthropic goals, you can name a charitable organization as a beneficiary of your life insurance policy. This allows you to leave a lasting legacy and support causes that are important to you.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

An Overview Of State Farm Life Insurance

When it comes to life insurance, State Farm is one of the most well-known and respected insurance companies in the industry. Let’s take a closer look at the history and reputation of State Farm, as well as the life insurance products they offer.

History And Reputation Of State Farm

State Farm has been in the insurance business for nearly a century. The company was founded in 1922 by George J. Mecherle, a retired farmer and insurance salesman. Mecherle saw a need for reliable and affordable insurance options for farmers, and thus State Farm was born.

Since its inception, State Farm has grown to become one of the largest insurance companies in the United States, offering a wide range of insurance products, including life insurance. The company’s commitment to providing excellent service and financial stability has earned it a strong reputation in the industry.

State Farm has received numerous accolades for its customer satisfaction, further solidifying its reputation as a reliable and trustworthy insurance provider. The company’s dedicated agents work closely with customers to understand their unique needs and provide personalized solutions.

Life Insurance Products Offered By State Farm

State Farm offers a variety of life insurance products to meet the needs of different individuals and families. These products include term life insurance, whole life insurance, and universal life insurance.

Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. It offers a death benefit to the beneficiaries if the insured passes away during the policy term. Term life insurance is generally more affordable compared to other types of life insurance and is suitable for individuals who need coverage for a specific period, such as while their children are young or to cover a mortgage.

Whole life insurance, on the other hand, provides permanent coverage for the insured’s entire life. It not only offers a death benefit but also accumulates cash value over time. Whole life insurance is often chosen by individuals who want lifelong coverage and the option to build cash value. This can be particularly beneficial for those who want to leave a financial legacy for their loved ones.

Universal life insurance combines the flexibility of permanent coverage with the potential for cash value growth. It allows policyholders to adjust the premium and death benefit as needed, making it a versatile option for those who want more control over their life insurance policy. With universal life insurance, individuals have the ability to adapt their coverage to meet changing financial needs.

State Farm Life Insurance Pricing And Benefits

When it comes to pricing, State Farm offers competitive rates for its life insurance coverage. The cost of life insurance premiums is determined by various factors, including the policyholder’s age, health, and coverage amount. State Farm provides personalized quotes based on these factors, allowing individuals to choose a policy that fits within their budget.

In addition to competitive pricing, State Farm offers a wide range of options to enhance its life insurance policies. These include optional riders, such as accelerated death benefit and child term rider, which provide additional coverage and flexibility to policyholders. These riders can be particularly valuable in times of unexpected financial strain or when planning for the future of a child.

State Farm is committed to helping its customers navigate the complexities of life insurance and ensure they have the coverage they need to protect their loved ones. With its long-standing history, strong reputation, and comprehensive product offerings, State Farm continues to be a leader in the life insurance industry.

An Overview Of Top Life Insurance Companies

When it comes to protecting your loved ones and securing their financial future, life insurance is an essential tool. While State Farm is a well-known and trusted name in the life insurance industry, there are several other top life insurance companies worth considering. Let’s take a closer look at some of these companies, the life insurance products they offer, and how they stack up against State Farm.

Who Are The Top Life Insurance Companies?

There are many top life insurance companies in the market, each with its own strengths and offerings. One such company is New York Life, a stalwart in the industry with over 175 years of experience. Known for its financial strength and stability, New York Life has consistently been recognized as one of the top life insurance providers.

Another top contender is Northwestern Mutual, a company that has been serving policyholders for over 160 years. With a focus on financial planning and comprehensive coverage options, Northwestern Mutual has earned a reputation for its commitment to policyholders’ long-term financial security.

MassMutual is also among the top life insurance companies, offering a wide range of products and services. With a strong emphasis on customer service and financial strength, MassMutual has been a trusted choice for individuals and families seeking life insurance protection.

Prudential, a company with a rich history dating back to 1875, is another top player in the life insurance industry. Known for its diverse portfolio of products and innovative solutions, Prudential has been at the forefront of providing financial security to millions of policyholders.

Transamerica, a subsidiary of Aegon N.V., is a global leader in life insurance and financial services. With a focus on personalized solutions and a commitment to customer satisfaction, Transamerica has established itself as a top choice for life insurance coverage.

Life Insurance Products Offered By Top Companies

Like State Farm, these top life insurance companies offer a variety of life insurance products to cater to different needs. From term life insurance to whole life insurance and universal life insurance, these companies provide a range of options for individuals and families to choose from.

It’s worth noting that some of these companies may specialize in certain types of life insurance, such as New York Life’s strong focus on whole life insurance. However, they generally offer a comprehensive suite of products to meet various needs and preferences.

Term life insurance, for example, provides coverage for a specified period, typically 10, 20, or 30 years. It offers a death benefit to beneficiaries if the insured passes away during the term of the policy. This type of insurance is often chosen by individuals who want coverage for a specific period, such as while their children are young or to cover a mortgage.

Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured. It not only offers a death benefit but also accumulates cash value over time. This cash value can be accessed during the insured’s lifetime and can serve as a source of funds for various financial needs, such as education expenses or retirement planning.

Universal life insurance is another popular option, offering both a death benefit and a cash value component. It provides flexibility in premium payments and death benefit amounts, allowing policyholders to adjust their coverage as their needs change over time.

Comparing Pricing And Benefits Of Top Companies

When it comes to pricing and benefits, there are several factors to consider. The cost of life insurance premiums can vary depending on factors such as age, health, and coverage amount. Each company has its own underwriting guidelines and rating system, which can affect the pricing of their policies.

Additionally, the benefits offered by different companies can vary. Some companies may offer unique features or optional riders that provide added benefits and flexibility. For example, some policies may include a critical illness rider, which provides a lump sum payment if the insured is diagnosed with a specified critical illness.

It’s important to carefully compare the pricing and benefits of different companies to find a policy that meets your needs and fits within your budget. Working with a licensed insurance agent or financial advisor can help you navigate the options and make an informed decision.

In conclusion, while State Farm is a reputable life insurance company, there are several other top contenders worth considering. New York Life, Northwestern Mutual, MassMutual, Prudential, and Transamerica are among the top life insurance companies that offer a wide range of products and services to meet the diverse needs of individuals and families. By comparing pricing and benefits, you can find a policy that provides the necessary coverage and peace of mind for you and your loved ones.

Comparing State Farm And Top Life Insurance Companies

Now that we have explored the details of State Farm and other top life insurance companies, let’s compare them in terms of coverage, price, and customer service.

Coverage Comparison

Both State Farm and the top life insurance companies offer a range of coverage options, including term life insurance, whole life insurance, and universal life insurance. The specific coverage available will depend on the company and the policy chosen.

It’s important to carefully consider your needs when comparing coverage options. For example, if you only need coverage for a specific period or want lifelong protection with cash value, you may lean towards different types of policies offered by different companies.

Price Comparison

When comparing prices, it’s essential to obtain personalized quotes from each company based on your specific circumstances. Factors such as age, health, and coverage amount can impact the cost of life insurance premiums.

It’s worth noting that while State Farm offers competitive rates, the top life insurance companies mentioned earlier may have different pricing structures. Comparing prices from multiple companies can help you find the best rates for your desired coverage.

Customer Service Comparison

Both State Farm and the top life insurance companies have established reputations for excellent customer service. They strive to provide personalized attention, prompt claims processing, and responsive support to their policyholders.

However, the experiences of individual policyholders may vary. It may be beneficial to read reviews and seek recommendations from trusted sources to get a better understanding of the customer service offered by different companies.

Ultimately, the decision of which life insurance company is better will depend on your specific needs, preferences, and budget. It’s important to carefully evaluate the coverage, price, and customer service offered by each company to make an informed decision.

Remember, comparing insurance quotes with our free tool and reviewing insurance rates from different companies online can help save money and find the best rates for your desired coverage. It’s always a smart move to explore multiple options and seek the best value for your life insurance needs.

In conclusion, both State Farm and the top life insurance companies offer a range of life insurance products to provide financial protection for you and your loved ones. By understanding the key differences and similarities between these companies, you can make an informed decision about which life insurance policy is best suited for your unique needs and circumstances.

Frequently Asked Questions

What is the difference between State Farm and other top life insurance companies?

The main difference between State Farm and other top life insurance companies lies in their offerings, pricing, and customer service. While State Farm is known for its comprehensive coverage and personalized service, other top life insurance companies may offer different policy options, rates, and customer experiences.

How can I determine which life insurance company is better for me?

Choosing the right life insurance company depends on your individual needs and preferences. It is recommended to compare various factors such as coverage options, premiums, financial stability, customer reviews, and any additional benefits offered by the companies. This can help you make an informed decision based on your specific requirements.

What factors should I consider when selecting a life insurance policy?

When selecting a life insurance policy, it is important to consider factors such as the coverage amount you need, the duration of coverage, your budget, the company’s financial strength, the policy’s terms and conditions, any riders or additional benefits offered, and the reputation and customer service of the insurance provider.

Can I switch my life insurance policy from State Farm to another company?

Yes, it is possible to switch your life insurance policy from State Farm to another company. However, before making the switch, it is advisable to carefully review the new policy’s terms, coverage, and pricing to ensure it meets your needs. Additionally, consider any potential penalties or fees associated with terminating your State Farm policy.

What are some of the top life insurance companies besides State Farm?

There are several top life insurance companies besides State Farm, including but not limited to: Allstate, Prudential, New York Life, Northwestern Mutual, MetLife, Mutual of Omaha, Guardian Life, MassMutual, and Transamerica. It is recommended to research and compare the offerings of these companies to find the best fit for your life insurance needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.