State Farm vs. American Family Homeowners Insurance in 2026 (Who’s Better?)

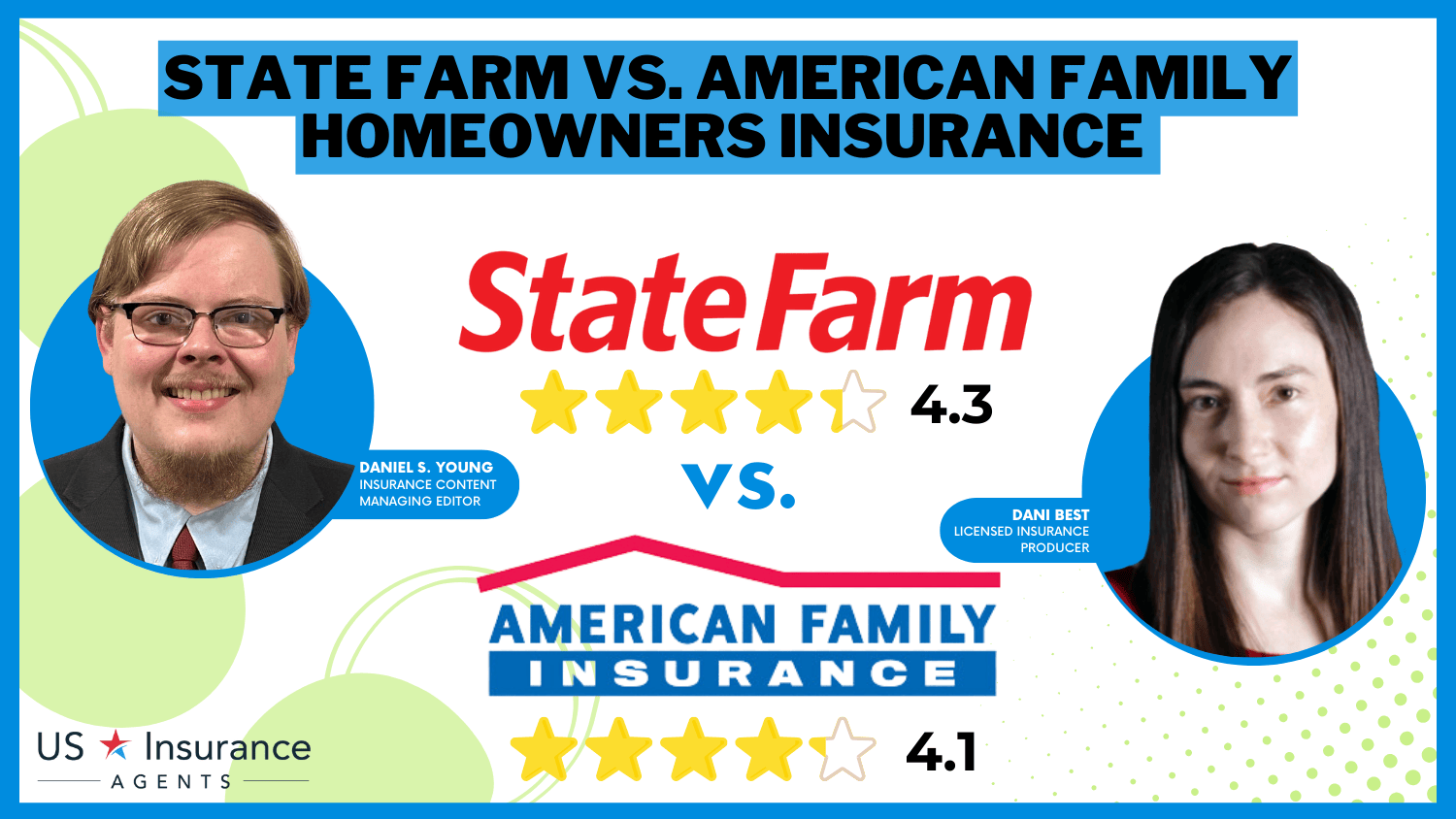

When analyzing State Farm vs. American Family homeowners insurance, State Farm is the cheaper option, with rates starting at $33/mo. State Farm home insurance is also available in more states. However, American Family home insurance has better financial business ratings than State Farm.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated November 2024

18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsIn this extensive comparison of State Farm vs. American Family homeowners insurance, we meticulously examine State Farm and American Family. We found that while State Farm is the best choice for cheap home insurance and serves more states, American Family has better ratings from businesses.

From coverage offerings and pricing structures to discounts and customer feedback, we dissect the crucial components of American Family Insurance vs. State Farm Insurance.

State Farm vs. American Family Homeowners Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.3 | 4.1 |

| Business Reviews | 5.0 | 4.0 |

| Claim Processing | 4.3 | 4.8 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 3.9 |

| Coverage Value | 4.2 | 4.0 |

| Customer Satisfaction | 4.1 | 4.0 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.9 | 3.7 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.8 | 3.4 |

| Savings Potential | 4.3 | 4.1 |

| State Farm Review | American Family Review |

Join us as we navigate through State Farm and American Family home insurance to pinpoint the ultimate choice in the dynamic landscape of homeowners insurance.

Ready to find the best home insurance policy for your home? Compare rates with our free quote finder.

- State Farm is available in more states than American Family

- Both have affordable home insurance rates, but State Farm is slightly cheaper

- American Family has better business insurance ratings

State Farm vs. American Family Homeowners Insurance Rate Comparision

When it comes to protecting your home and belongings, it’s important to choose an insurance provider that you can trust. State Farm and American Family Insurance are two well-known companies that offer homeowners insurance policies to individuals and families across the United States. Let’s take a closer look at the rates of these two insurance giants.

State Farm vs. American Family Full Coverage Homeowners Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $311 | $414 |

| Age: 16 Male | $349 | $509 |

| Age: 30 Female | $94 | $116 |

| Age: 30 Male | $103 | $137 |

| Age: 45 Female | $86 | $115 |

| Age: 45 Male | $86 | $117 |

| Age: 60 Female | $76 | $104 |

| Age: 60 Male | $76 | $105 |

When it comes to pricing, State Farm offers competitive rates for homeowners insurance. American Family also offers competitive pricing for homeowners insurance. The cost of coverage can vary depending on factors such as the location of the property, the age of the home, the coverage limits, and the deductible chosen

Read More: Home Features That Can Make Homeowners Insurance More Expensive

State Farm and American Family both provide homeowners with the option to customize their policies to fit their budget and needs.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm vs. American Family Homeowners Insurance Coverage Options

When it comes to coverage options, State Farm and American Family both offer comprehensive homeowners insurance policies tailored to meet the needs of homeowners. Let’s take a closer look at what each company has to offer.

Comparison of Home Insurance Coverages: State Farm vs. American Family

| Coverage | ||

|---|---|---|

| Dwelling Protection | ✅ | ✅ |

| Personal Property | ✅ | ✅ |

| Loss of Use | ✅ | ✅ |

| Liability Coverage | ✅ | ✅ |

| Medical Payments to Others | ✅ | ✅ |

| Earthquake Insurance (Optional) | ✅ | ✅ |

| Flood Insurance (Optional) | ✅ | ✅ |

| Identity Theft Protection | ✅ | ✅ |

| Equipment Breakdown Coverage | ❌ | ✅ |

| Hidden Water Damage Coverage | ❌ | ✅ |

| Matching Siding Protection | ❌ | ✅ |

When it comes to homeowners insurance, both State Farm and American Family have you covered. Their comprehensive coverage options, optional add-ons, and specialized policies ensure that homeowners can find the protection they need for their most valuable asset – their home (Learn More: What a Typical Homeowners Insurance Policy Covers).

If you are looking into a specific coverage type, such as covered lines at State Farm, make sure to read reviews like State Farm service line coverage reviews or State Farm condo insurance reviews before purchasing.

State Farm Homeowners Insurance Coverage

State Farm goes above and beyond to provide homeowners with a wide range of coverage options. Their standard policy typically includes coverage for the dwelling, which protects the structure of your home in case of damage from covered perils such as fire or storms.

But State Farm’s homeowners insurance doesn’t stop there. They also include coverage for personal property, ensuring that your belongings, such as furniture, electronics, and clothing, are protected in the event of theft, vandalism, or damage caused by covered perils.

Michelle Robbins Licensed Insurance Agent

In addition to the above coverage, State Farm provides additional living expenses coverage. This means that if your home becomes uninhabitable due to a covered loss, State Farm will help cover the costs of temporary housing, meals, and other necessary expenses.

Furthermore, State Farm understands that some homeowners may have valuable items that require extra protection. That’s why they offer optional coverage for valuables such as jewelry and fine arts. With this additional coverage, you can have peace of mind knowing that your precious possessions are safeguarded.

Lastly, State Farm offers specialized coverage options for condominiums, manufactured homes, and rental properties. These policies are specifically designed to protect the unique risks associated with each type of property. Whether you own a condo, a manufactured home, or you’re a landlord, State Farm has you covered.

American Family Homeowners Insurance Coverage

American Family is committed to providing homeowners with comprehensive coverage options that suit their specific needs. Their standard policy generally includes coverage for the structure, which protects your home’s physical structure, including roof replacement, against covered perils.

Just like State Farm, American Family also includes coverage for personal property. This means that your belongings, such as furniture, appliances, and electronics, are covered in case of theft, damage, or loss caused by covered perils.

Liability coverage is another essential aspect of American Family’s homeowners insurance. This coverage helps protect you financially if someone is injured on your property and decides to file a lawsuit against you. It can cover legal expenses, medical payments, and even damages awarded by a court. Similar to State Farm, American Family offers additional living expenses coverage.

Daniel Walker Licensed Insurance Agent

American Family also understands that homeowners may have unique insurance needs. That’s why they provide specialized coverage options for situations such as home businesses, farms, and rental properties. These policies offer increased protection for homeowners with specific requirements, ensuring that their investments are safeguarded.

Additionally, American Family offers optional coverage for valuable items. If you own jewelry, fine arts, or other high-value possessions, you can add this coverage to your policy for extra peace of mind.

State Farm vs. American Family Homeowners Insurance Discounts

When it comes to finding the right homeowners insurance, it’s important to consider not only the coverage and customer service but also the potential for discounts and savings. Both State Farm and American Family are known for offering a wide range of discounts that can help homeowners save money on their insurance premiums.

Home Insurance Discounts: State Farm vs. American Family

| Discount Name | ||

|---|---|---|

| Bundling | 17% | 29% |

| Claim-Free | 20% | 10% |

| Gated Community | X | 5% |

| Home Safety Features | 15% | 10% |

| Loyalty | X | 5% |

| New Home | 20% | 15% |

| Paperless Billing | 10% | 10% |

| Pay-in-Full | 10% | 5% |

| Renovation | X | 15% |

| Smart Home | 10% | X |

By taking advantage of these savings opportunities, such as a home and car bundling discount, homeowners can further reduce their insurance costs while still enjoying comprehensive coverage.

Learn More: Home and Car Insurance Discounts

Whether it’s through bundling policies, installing safety devices, having a claims-free history, or being a loyal customer, both State Farm and American Family offer discounts that can make homeownership more affordable and secure.

Discounts Available with State Farm

State Farm is a well-established insurance company that offers homeowners numerous opportunities to save. One of the advantages of State Farm is its extensive range of discounts. Homeowners can save money by bundling their homeowners insurance with other policies such as auto insurance. This not only simplifies the insurance process but also allows homeowners to enjoy significant savings.

State Farm also rewards customers with a State Farm home insurance security system discount for installing safety devices in their homes.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Additionally, State Farm offers discounts for having a claims-free history, meaning homeowners who have not filed any claims in a specified period can enjoy lower premiums. This encourages homeowners to maintain a safe and secure living environment.

By taking advantage of these discounts, homeowners can further reduce their insurance costs. State Farm also provides educational resources and tools to help homeowners understand their coverage options and make informed decisions.

Another unique discount offered by State Farm is for being a new homeowner. This discount is designed to support individuals or families who have recently purchased a home and may be facing higher expenses. By providing this discount, State Farm aims to alleviate some of the financial burden associated with homeownership.

Furthermore, State Farm offers loyalty discounts for customers who have been with the company for an extended period. These discounts can add up over time, resulting in significant savings for homeowners. By staying loyal to State Farm, homeowners can enjoy not only reliable coverage but also financial benefits.

Discounts Available with American Family

Similar to State Farm, American Family provides homeowners with various discounts to help reduce their insurance premiums. Bundling policies is a popular option, as it allows homeowners to save money by combining their homeowners insurance with other types of insurance such as auto or life insurance. This not only simplifies the insurance process but also provides homeowners with comprehensive coverage at a more affordable price.

American Family also offers discounts for installing safety devices in the home. By taking proactive steps to enhance the security of their property, homeowners can reduce the risk of accidents, theft, or damage, which in turn can lead to lower insurance premiums.

Additionally, having a claims-free history can also earn homeowners a discount with American Family. This encourages homeowners to maintain a safe and responsible living environment.

Furthermore, American Family values customer loyalty and rewards it with discounts. Homeowners who have been with American Family for a longer period can enjoy additional savings on their insurance premiums. This not only fosters a strong relationship between the company and its customers but also provides homeowners with financial benefits for their continued trust and support.

State Farm vs. American Family Homeowners Insurance Customer Reviews

State Farm is known for its local agent customer service. The company has a vast network of agents who are available to assist homeowners with their insurance needs. Whether it’s answering questions, providing policy information, or assisting with claims, State Farm’s agents are knowledgeable and responsive.

In the event of a claim, State Farm has a streamlined process in place. Homeowners can report claims either online, through the mobile app, or by contacting their local agent. State Farm aims to make the claims process as straightforward and convenient as possible for its customers.

However, this doesn’t mean that all State Farm home insurance reviews from customers are positive, such as the Reddit review below.

State Farm customers aren’t always pleased with State Farm, stating increased rates, nonrenewal, and other issues in State Farm insurance reviews for homeowners insurance. Similarly, while American Family prides itself on delivering outstanding customer service, there aren’t always positive American Family insurance reviews for homeowners insurance on Reddit due to rate hikes.

However, the company does have a team of dedicated agents who work closely with homeowners to address their insurance concerns. American Family’s agents are well-trained and committed to providing top-notch service to their clients. In terms of claims, American Family has a user-friendly online claims filing system.

Learn More: How to File a Home Insurance Claim

Homeowners can also report claims over the phone or through their local agent. American Family strives to ensure that its customers’ claims are handled efficiently and with utmost care.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm vs. American Family Homeowners Insurance Business Ratings

In addition to AmFam and State Farm homeowner insurance reviews from customers, make sure to examine the business ratings of State Farm and American Family.

Insurance Business Ratings & Consumer Reviews: State Farm vs. American Family

| Agency | ||

|---|---|---|

| Score: 877 / 1,000 Above Avg. Satisfaction | Score: 831 / 1,000 Avg. Satisfaction |

|

| Score: C- Below Avg. Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 75/100 Positive Customer Feedback | Score: 78/100 Positive Customer Feedback |

|

| Score: 0.78 Fewer Complaints Than Avg. | Score: 0.77 Fewer Complaints Than Avg. |

|

| Score: B Fair Financial Strength | Score: A Excellent Financial Strength |

Both companies scored similarly for claim complaint ratios from the NAIC, but American Family has better BBB and A.M. Best ratings than State Farm (Read More: Are there many State Farm claims complaints?).

State Farm Homeowners Insurance Pros and Cons

Pros

- Comprehensive Coverage Options: State Farm General Insurance Company offers a wide range of coverage options, including coverage for dwelling, personal property, liability, additional living expenses, and optional coverage for valuables.

- Competitive Pricing: State Farm provides competitive pricing with customizable options, allowing homeowners to tailor their policies to fit their budget. State Farm also offers various discounts, such as bundling policies, safety device installations, claims-free history, and new homeowner discounts.

- Local Agents: State Farm is known for its vast network of knowledgeable agents (Learn More: Buying Insurance from Independent Insurance Brokers vs. Direct Writers).

Cons

- Mixed Customer Reviews: The cost of coverage can vary depending on factors such as location, home age, and coverage limits, potentially resulting in higher premiums for some homeowners, which has led to some mixed customer reviews based on rate hikes and nonrenewal.

- Financial Strength: State Farm is one of the largest insurers in the U.S., but it has a lower A.M. Best rating than American Family.

American Family Homeowners Insurance Pros and Cons

Pros

- Tailored Coverage Options: American Family Mutual Insurance Company offers customizable policies with coverage for dwelling, personal property, liability, additional living expenses, and more.

- Competitive Discounts: Similar to State Farm, American Family also offers various discounts, including bundling policies, safety device installations, claims-free history, and loyalty discounts.

- Strong Customer Service: American Family is committed to delivering outstanding customer service, with a team of well-trained agents and a user-friendly online claims filing system.

Cons

- Limited Geographic Presence: American Family may not be available in all states, limiting access for homeowners in certain regions.

- Higher Pricing: American Family has competitive pricing, but its rates can be high after a claim (Read More: Does American Family homeowners insurance go up after a claim?).

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Overall: State Farm Homeowners Insurance

After a thorough examination of the content comparing State Farm and American Family homeowners insurance, it is clear that State Farm stands out as the best overall choice.

- Coverage and Customization: State Farm provides a comprehensive range of coverage options, including dwelling protection, personal property coverage, liability, and additional living expenses.

- Competitive Pricing and Discounts: State Farm provides various discount opportunities, from bundling policies to a claims-free history (Learn More: Does State Farm homeowners insurance go up after a claim?).

- Widespread Availability: As one of the largest insurers in the U.S., State Farm sells home insurance in the majority of states.

- Exceptional Customer Service: State Farm is renowned for its exceptional customer service, with an extensive network of knowledgeable agents.

While American Family offers competitive features and coverage, State Farm’s overall package of comprehensive coverage, competitive pricing, extensive discounts, financial strength, and outstanding customer service positions it as the best choice for homeowners insurance.

History of State Farm and American Family Homeowners Insurance

Both American Family and State Farm Insurance have been around for a while, but State Farm has a larger market share than American Family.

State Farm Insurance was founded in 1922 by G.J. Mecherle, a retired farmer and insurance salesman with a vision to provide reliable and affordable insurance to individuals and families. Mecherle established State Farm as a mutual automobile insurance company, offering coverage for cars and other vehicles.

However, recognizing the need for comprehensive protection, State Farm soon expanded its offerings to include homeowners insurance to protect everything in your home, whether it’s your roof or solar panels.

Read More: Does State Farm homeowners insurance cover solar panels?

Over the years, State Farm Insurance has grown to become one of the largest insurers in the United States. With a strong focus on customer service and a wide range of coverage options, State Farm has earned positive State Farm manufactured home insurance reviews and ratings.

Whether you’re a first-time homeowner or have been protecting your property for years, State Farm offers tailored insurance solutions to meet your individual needs.

American Family Insurance, founded in 1927 by Herman Wittwer, has a slightly different background compared to State Farm. Originally based in Wisconsin, American Family Insurance initially specialized in providing auto insurance to farmers. Recognizing the unique needs of this demographic, the company quickly gained popularity among rural communities.

As American Family Insurance continued to grow, it expanded its coverage to include homeowners insurance and other lines of insurance. With a commitment to personalized service and a strong emphasis on community involvement, American Family Insurance has become a trusted name in the insurance industry.

Today, the company operates in multiple states across the country, offering a wide range of insurance products to individuals and families alike.

Kristine Lee Licensed Insurance Agent

Take the time to compare State Farm vs. American Family offerings and speak with an insurance agent to determine which policy best suits your needs. With the right coverage in place, you can rest easy knowing that your home and belongings are protected.

Choosing Between State Farm vs. American Family Homeowners Insurance

Overall, both State Farm and American Family offer reliable homeowners insurance coverage. When comparing American Family vs. State Farm home insurance, State Farm stands out with its extensive coverage options and competitive pricing, while American Family provides tailored policies for unique insurance needs.

When it comes to customer service at State Farm vs. American Family home insurance, both companies have a strong reputation for delivering exceptional support. By carefully evaluating your specific needs and preferences, you can make an informed decision on your homeowners insurance provider when getting insurance quotes online.

If you are looking to find affordable home insurance, enter your ZIP in our free quote tool to get started.

Frequently Asked Questions

What is the difference between State Farm and American Family homeowners insurance?

The main difference between State Farm and American Family homeowners insurance lies in their coverage options, pricing, and customer service. State Farm is known for its extensive coverage options and competitive pricing, while American Family offers customizable policies and various discounts.

Which company has better customer service, State Farm or American Family?

Both State Farm and American Family have a strong reputation for customer service. However, customer experiences may vary depending on individual needs and preferences. It is recommended to research and read State Farm and American Family home insurance reviews to determine which company aligns better with your specific requirements.

Can I customize my homeowners insurance policy with State Farm and American Family?

Both State Farm and American Family offer customizable homeowners insurance policies. They provide various coverage options and additional endorsements that allow policyholders to tailor their policies to meet their specific needs and preferences, whether its an AC unit or valuable goods (Read More: Does State Farm homeowners insurance cover AC units?).

What factors should I consider when choosing between State Farm and American Family homeowners insurance?

When comparing State Farm and American Family homeowners insurance, some key factors to consider include coverage options, pricing, discounts available, customer service reputation, financial strength, and any specific needs or preferences you have for your policy.

How does American Family compare to other companies?

American Family is a strong contender for home insurance, even when comparing American Family vs. Nationwide or American Family vs. Safeco. Likewise, State Farm is one of the better choices for home insurance when you compare it to other companies, such as State Farm vs. Nationwide home insurance.

What discounts are available with State Farm and American Family homeowners insurance?

State Farm and American Family offer several discounts to homeowners, such as an auto and home insurance discount (Learn More: Can I bundle my car insurance with other policies?). Other discounts include claims-free discounts, loyalty discounts, home safety device discounts, and more.

It is recommended to contact each company directly or visit their websites to explore the specific discounts available.

Is State Farm cheaper than American Family?

Yes, State Farm Fire and Casualty Company is cheaper on average than American Family. To find cheap home insurance in your state, compare rates with our free quote tool.

Is State Farm home insurance good?

State Farm home insurance ratings and reviews are decent, although AmFam’s ratings are slightly better.

Does State Farm sell townhouse insurance?

Yes, State Farm sells townhouse homeowners insurance, as does American Family.

What is dwelling extension coverage at State Farm?

State Farm dwelling extension is an optional coverage that helps pay for repairs or replacement to your house that are more more expensive than your dwelling coverage limit.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.