Total Insurance Review & Ratings (2026)

Discover the right coverage for your needs with Total Insurance: A comprehensive review & ratings. Compare rates, customer satisfaction, claims experience, cost, and service for an informed insurance comparison. Enter your ZIP code to access the best insurance options in your area and secure your assets with Total Insurance. Get the protection you deserve today!

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated January 2025

Total Insurance is a car insurance company that offers a variety of coverage options and discounts to help customers save money on their premiums. The company operates in several states across the United States, and its mission is to provide affordable and flexible insurance solutions to drivers of all backgrounds.

Some of the coverage options available from Total Insurance include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. The company also offers a variety of discounts, including multi-policy discounts, safe driver discounts, and good student discounts, among others.

While Total Insurance has many satisfied customers, there are also some negative reviews and complaints to be found online. Customers have praised the company’s affordable rates and customer service, but some have reported issues with claims processing, billing, and policy cancellations.

If you’re considering Total Insurance for your car insurance needs, be sure to carefully review the coverage options and discounts available, and speak with a Total Insurance agent to get a better sense of what the company has to offer.

What You Should Know About Total Insurance

Welcome to our comprehensive guide on Total Insurance. In this article, we will provide you with valuable information about Total Insurance, including its review and ratings, coverage options, customer satisfaction, claims process, cost, and service quality. Whether you’re looking for auto, home, or any other type of insurance, we’ve got you covered.

- Total Insurance offers a variety of coverage options to meet the needs of different drivers.

- The company has a strong commitment to customer satisfaction and offers excellent customer service.

- Total Insurance provides discounts to customers who meet certain criteria, making their coverage even more affordable.

To ensure you find the best insurance rates and providers in your area, enter your zip code and compare quotes from top insurance companies. Take control of your insurance needs and secure your future with Total Insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Total Insurance History and Mission

Total Insurance was founded in 2000 with the goal of providing affordable and reliable car insurance coverage to drivers in the United States. The company’s mission is to meet the changing needs of drivers by offering a wide range of coverage options, exceptional customer service, and competitive pricing.

Total Insurance is dedicated to making car insurance accessible to as many drivers as possible, regardless of their driving history or financial situation. Since its founding, Total Insurance has grown to become one of the leading providers of car insurance in the United States.

The company has expanded its coverage to include many states across the country and has a reputation for providing high-quality service to its customers. Total Insurance’s commitment to customer satisfaction is evident in its mission statement, which emphasizes the importance of building lasting relationships with customers.

The company believes that by listening to customers and providing personalized service, they can offer the best possible insurance solutions to meet their unique needs.

Total Insurance Coverage Options

Total Insurance offers a wide range of coverage options to meet the needs of drivers. Whether you’re looking for basic liability coverage or more comprehensive protection, Total Insurance has you covered. Here’s an overview of the main products and services the company offers:

- Liability coverage: This type of coverage is required by law in most states and helps cover the cost of damage or injury to other people or their property in an accident where you are at fault.

- Collision coverage: This type of coverage helps pay for damage to your car in the event of a collision with another vehicle or object.

- Comprehensive coverage: This type of coverage helps pay for damage to your car from events like theft, vandalism, or natural disasters.

- Personal injury protection: This type of coverage helps cover medical expenses and lost wages for you and your passengers in the event of an accident, regardless of who is at fault.

- Uninsured/Underinsured motorist coverage: This type of coverage helps protect you if you are involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages.

States Where Total Insurance is Available

Total Insurance is currently available in many states across the United States. Here’s a list of some of the states where Total Insurance operates:

- Arizona

- California

- Florida

- Georgia

- Illinois

- Missouri

- New York

- Ohio

- Pennsylvania

- Texas

- Virginia

If you’re looking to find out which states Total Insurance operates in, there are the four steps you can take:

- The company’s website should have a list of the states where they offer coverage. Look for a “Coverage Area” or “Locations” page to find this information.

- If you’re not able to find the information you’re looking for on the website, you can contact Total Insurance customer service directly. They should be able to tell you which states they operate in and provide you with more information about their coverage options.

- Many comparison websites allow you to compare car insurance rates and coverage options from different companies. Some of these websites may also provide information about which states Total Insurance operates in.

- If you have an insurance agent in your area, they may be able to tell you which companies offer coverage in your state, including Total Insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Total Insurance Rates Breakdown

The cost of Total Insurance coverage will vary depending on a number of factors, including the level of coverage you select, your driving history, the type of vehicle you drive, and where you live. Here are some of the factors that can affect the cost of your Total Insurance policy:

- Age: Drivers under the age of 25 typically pay more for car insurance than older drivers.

- Driving history: Your driving record and history of accidents or tickets can affect your insurance rates.

- Vehicle type: The make, model, and year of your car can affect your insurance rates.

- Location: Insurance rates can vary depending on where you live, as certain areas may have higher rates of accidents or thefts.

- Coverage level: The more coverage you select, the higher your insurance rates will typically be.

Total Insurance Discounts Available

Total Insurance offers a variety of discounts to help customers save money on their car insurance premiums. Here are some of the discounts available:

- Multi-policy discount: If you have multiple insurance policies with Total Insurance, such as home or renters insurance, you may be eligible for a discount on your car insurance premium.

- Safe driver discount: If you have a clean driving record and no recent accidents or traffic violations, you may be eligible for a safe driver discount.

- Good student discount: If you are a student with good grades, you may be eligible for a discount on your car insurance premium.

- Multi-car discount: If you insure multiple cars with Total Insurance, you may be eligible for a discount on your car insurance premiums.

- Anti-theft discount: If your car has anti-theft devices or security features, you may be eligible for a discount on your car insurance premium.

- Defensive driving discount: If you complete a defensive driving course, you may be eligible for a discount on your car insurance premium.

- Military discount: If you are an active-duty or retired member of the military, you may be eligible for a discount on your car insurance premium.

Effortless Claims Handling With Total Insurance

Ease of Filing a Claim

Total Insurance offers multiple options for filing a claim, ensuring convenience for its policyholders. You can file a claim through their user-friendly online portal, over the phone with their dedicated customer service team, or even through their mobile app. This flexibility allows you to choose the method that suits your preferences and needs.

Average Claim Processing Time

Total Insurance is committed to providing efficient claim processing services. While specific processing times may vary depending on the nature of the claim, they strive to handle claims promptly and fairly. Customers can generally expect a reasonable turnaround time when filing a claim with Total Insurance.

Customer Feedback on Claim Resolutions and Payouts

Total Insurance’s approach to customer satisfaction extends to their claims process. They aim to provide fair and satisfactory resolutions to their customers’ claims. However, customer feedback on their claim resolutions and payouts is mixed.

While many customers have reported positive experiences with the company’s claims handling, there have also been some complaints about issues such as delays and disputes. It’s important for policyholders to review their policy terms and maintain clear communication with Total Insurance during the claims process to ensure a smooth experience.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Total Insurance – Cutting-Edge Digital and Technological Offerings

Mobile App Features and Functionality

Total Insurance offers a mobile app that provides policyholders with convenient access to their insurance information and services. The app allows users to view their policy details, make payments, file claims, and even access digital insurance cards. It’s designed to streamline the insurance experience, making it easier for customers to manage their policies on the go.

Online Account Management Capabilities

Total Insurance’s online account management platform empowers customers to take control of their insurance policies. Policyholders can log in to their accounts to review and update their coverage, access policy documents, make premium payments, and track the status of claims. The online portal offers a user-friendly interface that simplifies the management of insurance policies.

Digital Tools and Resources

Total Insurance provides a range of digital tools and resources to help customers make informed decisions about their insurance coverage. These resources may include articles, calculators, and educational materials that offer insights into various insurance products and topics. By leveraging these digital tools, policyholders can gain a better understanding of their insurance needs and options.

How Total Insurance Ranks Among Providers

While Total Insurance strives to offer comprehensive coverage and stellar services, it faces stiff competition from various other companies in the insurance sector. Let’s spotlight a few notable competitors:

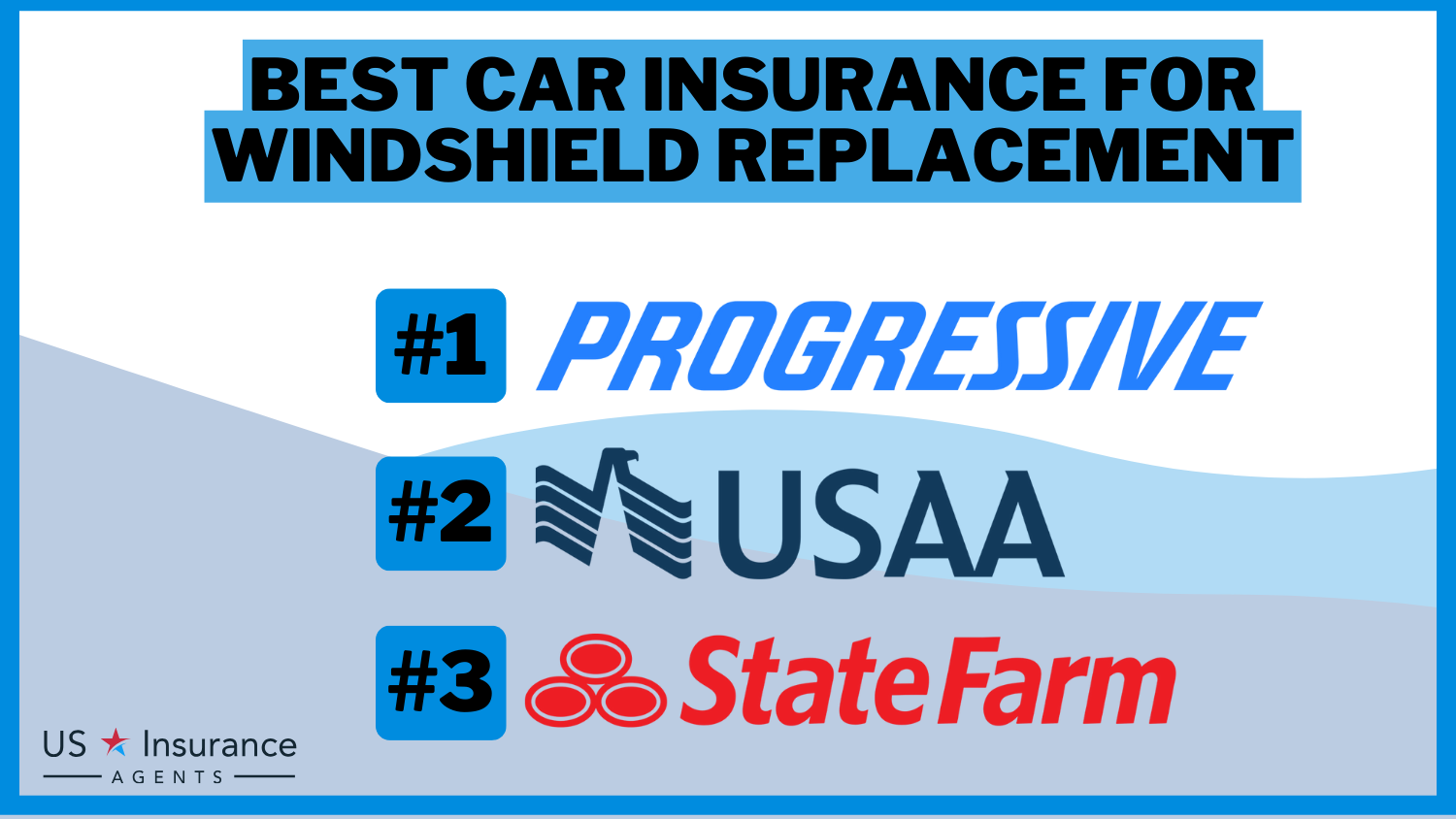

- Geico: Geico, known for its clever advertising and competitive rates, is a significant competitor to Total Insurance. Both companies aim to provide affordable coverage, and Geico’s extensive marketing efforts have made it a popular choice for many insurance seekers.

- State Farm: State Farm, with its vast network of agents and diverse insurance offerings, poses a substantial challenge. Like Total Insurance, State Farm emphasizes personalized service, making the competition fierce in delivering tailored insurance solutions.

- Progressive: Progressive, renowned for its innovative approach and user-friendly policies, competes directly with Total Insurance. Both companies focus on leveraging technology to enhance the customer experience and streamline insurance processes.

- Allstate: Allstate, with a robust presence in the insurance market, offers a range of coverage options and discounts. Similar to Total Insurance, Allstate prioritizes customer satisfaction and aims to provide reliable and flexible insurance solutions.

These competitors share the common goal of meeting the diverse needs of insurance seekers, and each brings its unique strengths to the table. As consumers navigate the insurance landscape, exploring offerings from these competitors alongside Total Insurance can help in making informed decisions.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Customer Reviews of Total Insurance

When it comes to customer reviews of Total Insurance, the company has a mixed reputation online. Here’s an overview of what customers are saying:

Strengths:

- Many customers praise Total Insurance for its affordable rates and flexible coverage options.

- The company is often praised for its customer service, with many customers reporting positive experiences with Total Insurance agents.

- Customers appreciate the easy online access to their policy information and the ability to make changes to their policy online.

Weaknesses:

- Some customers report issues with claims processing, including long wait times and difficulty getting their claims approved.

- A few customers have reported issues with billing and payment processing, including incorrect billing amounts and unexpected charges.

- Some customers have reported issues with policy cancellations and non-renewals, often citing unclear or inconsistent communication from Total Insurance.

Frequently Asked Questions

What is Total Insurance Review & Ratings?

Total Insurance Review & Ratings is a platform that provides consumers with comprehensive reviews and ratings of different types of insurance policies offered by various insurance companies. It helps individuals make informed decisions while purchasing insurance policies.

How do I access Total Insurance Review & Ratings?

Total Insurance Review & Ratings can be accessed online by visiting their website, which is available 24/7. The website is user-friendly, and you can easily find the information you are looking for.

What types of insurance policies are reviewed on Total Insurance Review & Ratings?

Total Insurance Review & Ratings reviews and rates different types of insurance policies, including life insurance, health insurance, auto insurance, home insurance, and many more.

How are the insurance companies rated on Total Insurance Review & Ratings?

The insurance companies are rated on Total Insurance Review & Ratings based on various factors, such as the company’s financial stability, customer service, policy offerings, and customer satisfaction. The ratings are based on a five-star scale, with five stars being the highest rating.

Can I trust the ratings on Total Insurance Review & Ratings?

Yes, you can trust the ratings on Total Insurance Review & Ratings as they are based on a thorough analysis of various factors, including customer feedback and industry experts’ opinions. However, it’s always recommended to do your research and compare different insurance companies and policies before making a final decision.

Is Total Insurance Review & Ratings free to use?

Yes, Total Insurance Review & Ratings is free to use. You don’t need to pay any fee or sign up for any subscription to access the platform.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.