AmerUs Life Insurance Review & Ratings (2026)

Find affordable life insurance coverage from AmerUs Life Insurance: protecting your loved ones and securing their future has never been easier or more affordable. Explore a range of coverage options tailored to your needs and gain peace of mind knowing that your family's financial well-being is safeguarded. With AmerUs Life Insurance, you can plan for tomorrow with confidence.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Kristine Lee is a licensed insurance agent and one of The Zebra’s in-house content strategists. With a background in copywriting, she covers the ins and outs of the home and car insurance industries. She has been a contributor to numerous publications focused on the nuances of insurance, including on The Points Guy.

Kristine Lee

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2025

In conclusion, AmerUs Life Insurance is an experienced and reliable provider of life insurance coverage in the United States. With a long history of serving families and individuals, the company offers comprehensive coverage options at an affordable cost, making it an excellent choice for those looking to secure their financial future.

With a history spanning a century, AmerUS Life Insurance offers reliable and affordable coverage options backed by a strong reputation. Whatever your life insurance needs, AmerUS Life Insurance has plans and options ready for you.

What You Should Know About AmerUs Life Insurance

Welcome to our comprehensive guide on life insurance, with a focus on AmerUs Life Insurance. AmerUs Life Insurance is a crucial financial tool that provides security and peace of mind for you and your loved ones. We will discuss the key features, benefits, and limitations of each policy type, helping you understand which one aligns best with your specific needs and financial goals.

- Comprehensive coverage options

- Affordable life insurance policies

- Experienced provider with a long history in the industry

AmerUs Life Insurance can assist you in this endeavor. Ready to take the next step? Enter your zip code below to compare rates from the best insurance providers in your area and secure the ideal life insurance policy for your needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AmerUs Life Insurance Coverage Options

AmerUs offers a range of life insurance coverage options, including term life insurance, whole life insurance, and universal life insurance. The company also offers additional coverage options, such as accidental death and dismemberment coverage, to further protect its customers. Here is a detailed look at the main products and services offered by AmerUs:

- Term life insurance: This type of coverage provides protection for a specific period of time, usually 10, 20, or 30 years. Term life insurance is often the most affordable type of life insurance coverage and is ideal for individuals who are looking for coverage during their working years.

- Whole life insurance: Whole life insurance provides coverage for the entire lifetime of the policyholder and also includes a savings component. This type of coverage is typically more expensive than term life insurance, but it provides a level of security for policyholders and their beneficiaries.

- Universal life insurance: Universal life insurance provides flexible coverage options, allowing policyholders to adjust the death benefit and premium payments over time. This type of coverage is ideal for individuals who want the security of permanent life insurance, but with the flexibility to adjust their coverage as their needs change.

- Accidental death and dismemberment (AD&D) coverage: AD&D coverage provides additional protection for policyholders in the event of accidental death or dismemberment. This coverage can be added to a life insurance policy to provide additional peace of mind for policyholders.

In addition to these core products, AmerUs also offers a range of other services, including policyholder support, online account management, and more. With its comprehensive coverage options and experienced customer service team, AmerUs is well-equipped to meet the needs of its customers.

AmerUS Life Insurance Coverage Area

AmerUs Life Insurance coverage is available in all states except for New York. This means that individuals and families in the majority of states are able to take advantage of the comprehensive life insurance coverage options offered by AmerUS.

Coverage options and pricing may vary depending on the state in which the policyholder resides. Additionally, certain regulations and laws may also vary by state, so it is important for individuals to consult with an AmerUS representative to learn about the specific coverage options available in their state.

Regardless of the state, AmerUS is committed to providing affordable and reliable life insurance overage to its customers. With its comprehensive coverage options and experienced customer service team, AmerUS is well-equipped to meet the needs of individuals and families across the country.

AmerUs Life Insurance Rates Breakdown

The cost of AmerUs life insurance coverage varies based on the type of coverage selected, the amount of coverage, and the individual’s age, health, and other factors.

For example, term life insurance is often the most affordable type of life insurance coverage, and premiums may start at just a few dollars per month. Whole life insurance, on the other hand, is typically more expensive than term life insurance, as it provides lifelong coverage and includes a savings component.

The cost of universal life insurance can also vary depending on the policyholder’s needs and preferences, as this type of coverage allows for flexible premium and death benefit adjustments over time. It is also important to note that certain discounts may be available to AmerUs customers, including multi-policy discounts and more.

In order to determine the specific cost of coverage, it is recommended that individuals get in touch with an AmerUs representative to receive a personalized quote. This quote will take into account the policyholder’s specific coverage needs and budget, helping to ensure that they are able to find the right coverage at an affordable price.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AmerUs Life Insurance Discounts Available

AmerUs offers several discounts to its customers, including multi-policy discounts for those who have multiple policies with the company, as well as discounts for individuals who are non-smokers and have a good driving record. Here is a look at some of the main discounts available:

- Multi-policy discounts: This discount is available to customers have multiple policies with the company, including life insurance and other types of coverage.

- Health and wellness discounts: This discount is offered to customers who engage in healthy habits and activities, such as non-smoking and regular exercise.

- Group discounts: This discount is available for groups, including employees of large companies and members of certain organizations.

These are just a few examples of the discounts available from AmerUs. To determine if you are eligible for any discounts, it is recommended that you contact an AmerUs representative to discuss your specific coverage needs and budget.

It is important to note that discounts may vary depending on the state in which the policyholder resides and other factors, so it is important to speak with an AmerUs representative to learn about the specific discounts available in your area. Regardless of the discounts offered, AmerUs is committed to providing affordable and reliable life insurance coverage to its customers.

The AmerUs Life Insurance Claims Advantage

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

AmerUs Life Insurance offers multiple convenient options for filing insurance claims. Policyholders can choose to submit their claims online through the company’s website, over the phone by contacting AmerUs customer support, or even through the user-friendly mobile app. This flexibility ensures that customers can choose the method that best suits their preferences and needs when they need to file a claim.

Average Claim Processing Time

AmerUs strives to provide a quick and efficient claims processing experience for its policyholders. While the exact processing time can vary depending on the complexity of the claim and the required documentation, the company is committed to processing claims as promptly as possible to provide financial support when it’s needed most.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback on AmerUs Life Insurance’s claim resolutions and payouts has been mixed. While many customers appreciate the company’s efforts to resolve claims efficiently, some have expressed concerns about delays in the process and difficulties navigating it.

To make an informed decision, potential policyholders should consider various factors, including customer reviews, when evaluating AmerUs as their insurance provider.

AmerUs Life Insurance Digital Insurance Innovations

Mobile App Features and Functionality

AmerUs Life Insurance offers a mobile app that allows policyholders to manage their accounts conveniently. The app provides features such as policy information access, premium payment processing, and the ability to file claims from the comfort of your mobile device. This user-friendly app enhances the overall customer experience by putting essential insurance functions at policyholders’ fingertips.

Online Account Management Capabilities

AmerUs places a strong emphasis on online account management. Policyholders can log in to their accounts on the company’s website, where they can access policy details, update personal information, review payment history, and make premium payments online. This digital convenience empowers customers to manage their policies with ease and stay informed about their coverage.

Digital Tools and Resources

AmerUs Life Insurance provides various digital tools and resources to assist policyholders in making informed decisions about their coverage. These resources may include online calculators to estimate insurance needs, educational articles, and FAQs to address common queries.

The availability of such digital assets demonstrates AmerUs’s commitment to empowering its customers with valuable information and tools.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

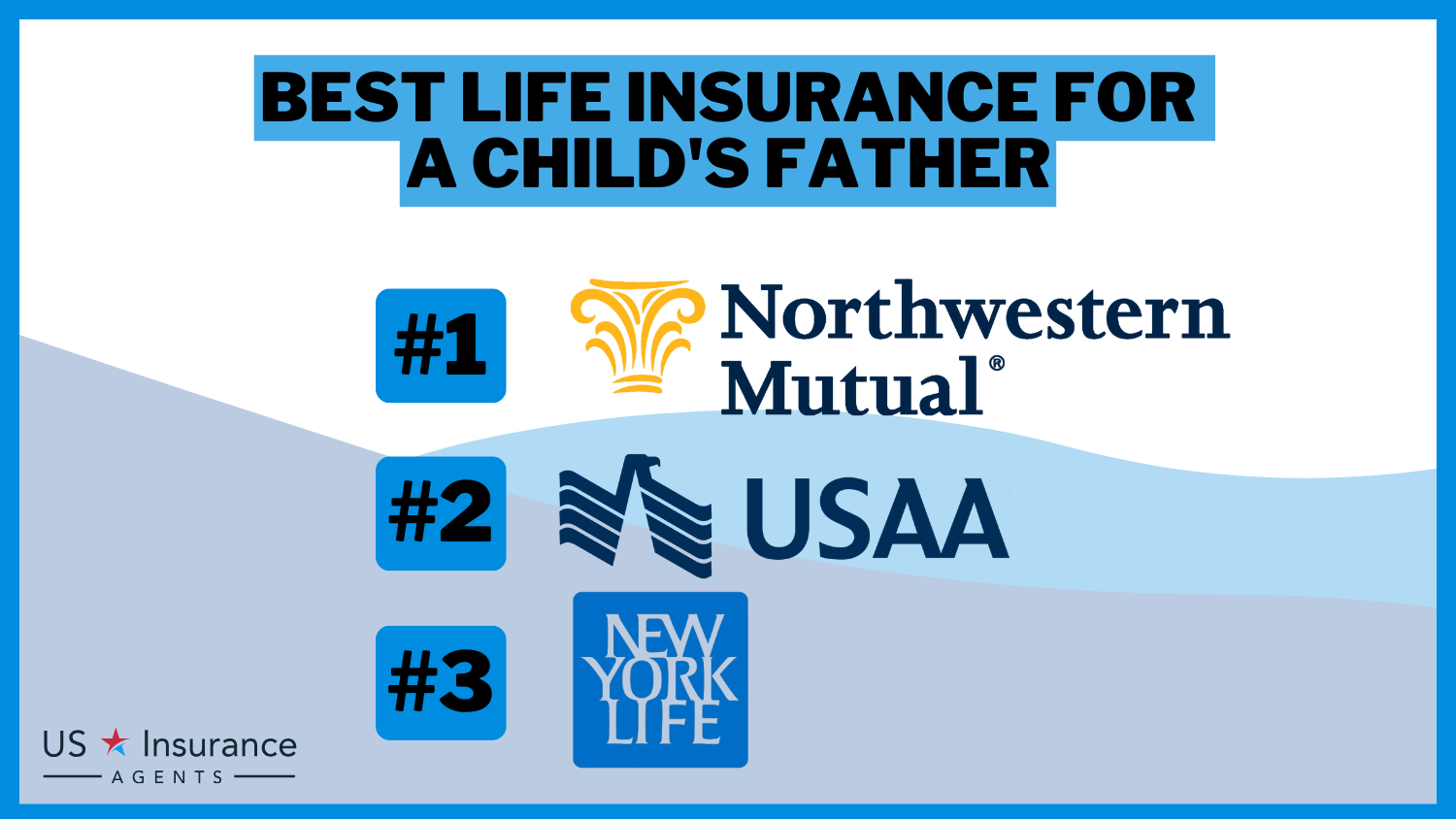

How AmerUs Life Insurance Ranks Among Providers

The specific ranking of AmerUs Life Insurance among providers, as rankings can vary based on different criteria and sources. Insurance company rankings can change over time, and new information may have emerged since then.

To determine the current ranking and assess AmerUs Life Insurance’s position among providers, it’s recommended to refer to recent industry reports, customer reviews, and ratings from reputable sources such as A.M. Best, J.D. Power, or other independent insurance rating agencies.

Additionally, consulting consumer feedback and reviews on platforms like the Better Business Bureau (BBB) and other insurance review websites can offer insights into the company’s standing in the market.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

AmerUS Life Insurance Customer Reviews

AmerUs Life Insurance has received mixed reviews from its customers. While some customers praise the company for its comprehensive coverage options and affordable prices, others have criticized its customer service and claims process.

Many customers have reported that AmerUs offers competitively priced life insurance coverage, with a range of options to meet the unique needs of each policyholder. Customers also appreciate the flexibility of the company’s coverage options, as well as the ability to adjust coverage and premiums over time.

However, some customers have expressed dissatisfaction with the customer service provided by AmerUs. Some customers have reported lengthy wait times when trying to reach a representative, as well as issues with the claims process.

Overall, AmerUs has received generally positive feedback from its customers. Many customers praise the company for its affordable coverage options, reliable customer service, and comprehensive coverage options. However, some customers have reported issues with the claims process, saying that it can be slow and difficult to navigate.

It is important to note that customer experiences with AmerUs will vary, and it is recommended that individuals considering the company speak with multiple customers to get a better understanding of the company’s strengths and weaknesses. Additionally, it is important to research multiple life insurance providers in order to find the right coverage for your specific needs and budget.

Frequently Asked Questions

What types of life insurance policies does AmerUs offer?

AmerUs offers term life insurance, universal life insurance, and indexed universal life insurance policies.

How do I get a quote for a policy from AmerUs?

You can get a quote for an AmerUs life insurance policy by visiting their website and filling out their online quote form. You can also speak with an agent directly to get a quote.

What factors affect the cost of a life insurance policy from AmerUs?

Factors that affect the cost of a life insurance policy from AmerUs include your age, health, and lifestyle habits, as well as the type and amount of coverage you need.

Is AmerUs a reputable life insurance company?

AmerUs has received strong financial ratings from reputable rating agencies, such as A.M. Best, which gives the company an A rating. AmerUs has also been accredited by the Better Business Bureau since 1987 and currently holds an A+ rating with the organization.

How do I file a claim with AmerUs?

To file a claim with AmerUs, you can contact their claims department by phone or by email. You will need to provide them with the policyholder’s name, policy number, and date of death.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.