Progressive vs. USAA Homeowners Insurance (Head-to-Head Review)

Progressive vs. USAA homeowners insurance varies in coverage, beginning at $92/mo for Progressive and $53/mo for USAA. USAA stands out for its military-specific perks and top-rated customer service, and Progressive for being able to customize its plans. Compare policies to find coverage that matches your needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated August 2025

Company Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

Check out Progressive vs. USAA homeowners insurance coverage rates that starts at $53/month.

Before we begin comparing Progressive vs. USAA home insurance, you have to consider factors such as coverage options, business ratings and customer reviews.

This article will guide you through these key differences, helping you make an informed decision. We’ll also answer the crucial question of how much homeowners insurance costs with both Progressive and USAA.

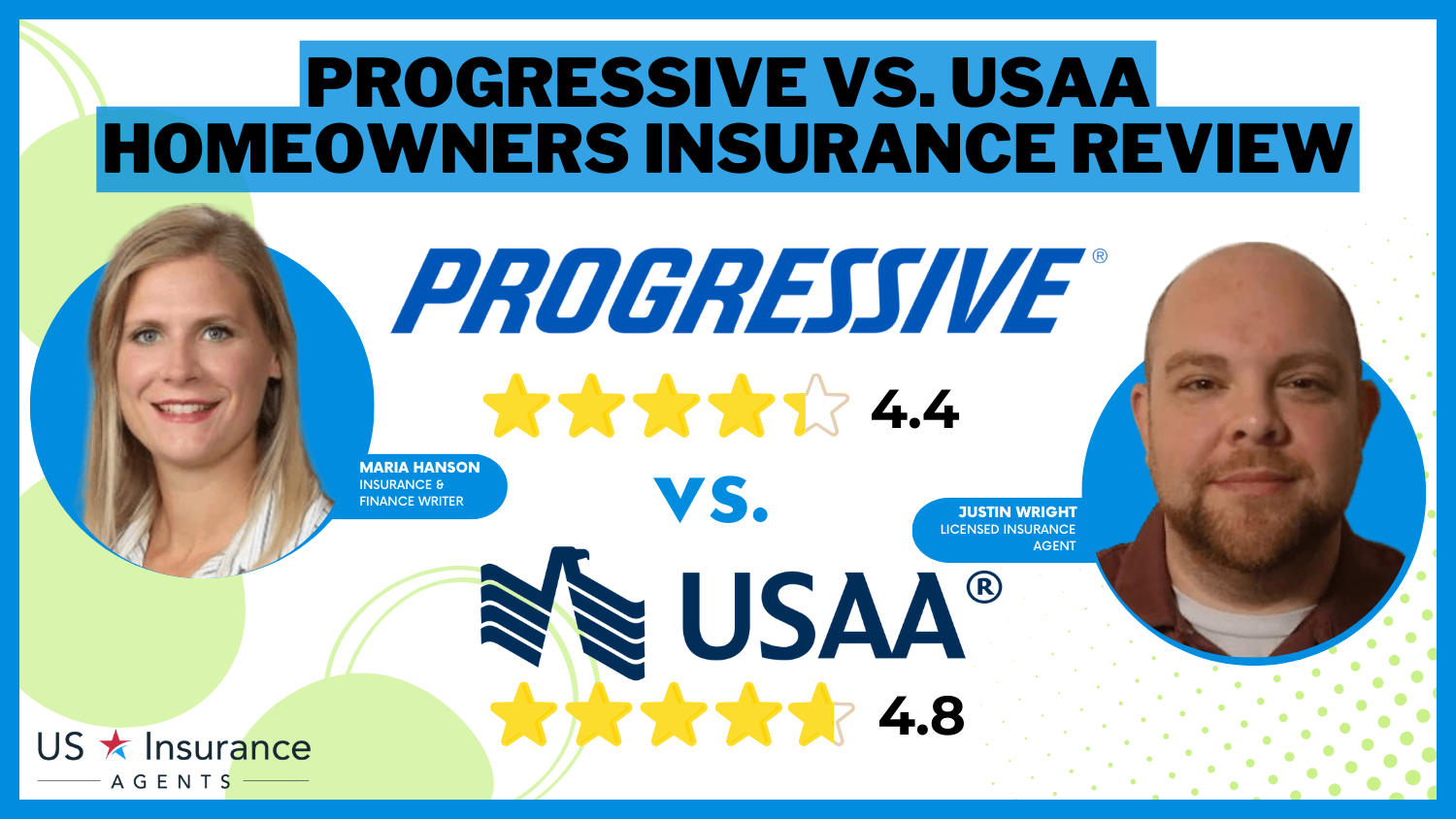

Progressive vs. USAA Homeowners Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.4 | 4.8 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.5 | 5.0 |

| Company Reputation | 4.5 | 5.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.2 | 4.7 |

| Customer Satisfaction | 4.1 | 4.7 |

| Digital Experience | 4.5 | 5.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 4.6 |

| Plan Personalization | 4.5 | 5.0 |

| Policy Options | 5.0 | 4.7 |

| Savings Potential | 4.5 | 4.7 |

| Progressive Review | USAA Review |

Secure cheap insurance for your home by entering your ZIP code into our free quote comparison tool.

- Compare homeowners insurance plans from Progressive and USAA

- Learn how rates differ between Progressive and USAA

- Explore customer service ratings for both insurers

The Essentials and Importance of Homeowners Insurance

Property insurance for homeowners is designed to protect both the physical structure of the home and the homeowner’s personal belongings from fire, windstorms, theft, vandalism, and other perils. It typically includes several components:

The dwelling coverage that is home for the structure, the personal property coverage for your stuff, the liability coverage to protect you legally if someone gets hurt on your property, and additional living expenses that take care when your home is not inhabitable. Such protection is comprehensive enough to allow homeowners full financial security against unseen damages and losses.

Kristine Lee LICENSED INSURANCE AGENT

This type of insurance protects your significant investment in your home by paying the costs of repair or rebuilding and protects your belongings by giving you compensation if they are damaged or stolen.

Homeowners insurance also provides liability protection, which means you’re covered financially if someone sues you for injuries suffered on your property. This allows you to dwell on your home and family more without having to worry about financial burdens that may come on you because of unforeseen events.

Read More: I only want to insure my personal property. What type of insurance should I get?

USAA vs. Progressive Homeowners Insurance Overview

USAA and Progressive provide solid homeowners insurance with special features customized to different requirements. Progressive offers you customizable coverage options, like “Guaranteed Replacement Cost,” and add-ons like identity protection.

Being a military family, USAA caters to only military families and offers specific coverage to military uniforms and equipment and is also known for its excellent customer service. For both companies, you get comprehensive protection for your home and your belongings.

When it comes to the price of homeowners insurance, it is important to remember that it can vary based on several factors. These factors include the location of your home, its value, and the coverage options you select. Both Progressive and USAA offer competitive rates, but it is advisable to obtain quotes from both providers to compare prices directly.

Progressive vs. USAA Full Coverage Homeowners Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $801 | $245 |

| Age: 16 Male | $814 | $249 |

| Age: 30 Female | $131 | $74 |

| Age: 30 Male | $136 | $79 |

| Age: 45 Female | $112 | $59 |

| Age: 45 Male | $105 | $60 |

| Age: 60 Female | $92 | $53 |

| Age: 60 Male | $95 | $54 |

Just remember, the cheapest choice isn’t always the best one. Price matters, but you also need to think about coverage and customer service. You need to figure out what that perfect balance is between what you can afford to spend and what you will get as a policyholder.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Progressive Homeowners Insurance Coverage

Progressive’s homeowners insurance offers a level of flexibility tailored to the distinct needs and budgetary constraints of each homeowner. That’s why they give you the option of customized coverage options so that you can customize your policy to meet your specific needs. Progressive has the right coverage options whether you own a small apartment or a large estate.

Progressive provides a range of coverage choices designed to meet the needs of various homeowners.

- Standard Coverage: This broad coverage option covers the structure of your home, personal property, liability, and additional living expenses. It ensures that you are protected against the usual perils of fire, theft, vandalism, and a few weather events.

- Enhanced Coverage: Additional coverage on valuable items, higher limits on some coverages, and extended replacement cost coverage are a few examples. If you want that little bit more peace of mind and extra protection for your assets, then this is the option for you.

- Add-Ons: Progressive has standard and enhanced coverage options, as well as a variety of add-on options to tailor your policy even further. Other add-ons include identity theft, water backup, and personal injury protection coverage. Progressive also offers these additional coverages so that you have complete coverage for your home and personal life.

This variety enables people to make informed decisions, so they have the confidence and peace of mind they want when it comes to safeguarding their homes and property.

Progressive puts customers first, giving the customer the choice and flexibility to ensure they have the best homeowner’s insurance experience possible so they know they’re covered and their investment is secure.

USAA Homeowners Insurance Coverage

USAA knows home insurance is important for protecting your home. That’s why their homeowners insurance policies cover not only the structure of your home, but also your personal belongings, liability, and additional living expenses. Below are USAA’s homeowners insurance coverage options:

- Standard Coverage: USAA also covers the structure of your home, your personal belongings, liability, and additional living expenses. As this coverage includes all aspects of an unexpected event, you are financially protected in respect of any such event.

- Enhanced Coverage: They also offer extra coverage options to help you be even more covered. Replacement cost coverage, earthquake coverage, and identity theft coverage are all among these options. Select the enhanced coverage and your policy will be customized to your exact needs and concerns.

- Valuable Personal Property Coverage: Some items are worth more than just their financial value. That’s why they offer coverage on high-value items like jewels, artwork, and collectibles. This coverage helps you to relax, knowing that your most precious possessions are protected.

With so many coverage options, USAA provides homeowners with the coverage they need to protect their homes and possessions. If you’re a first time homeowner or have lived in your home for years, USAA has the right coverage for you.

Read More: Replacement Cost Homeowners Insurance

Comparing Progressive and USAA Homeowners Insurance Discounts

Both Progressive and USAA offer a variety of discounts to help lower homeowners insurance premiums. Progressive provides savings like home and car insurance discounts by bundling the policies, having a new home, installing home security systems, and more. USAA also offers discounts for bundling, maintaining a claims-free record, and having home security systems.

Both insurers offer similar discount options. Even if Progressive’s military discount for homeowner insurance is great, USAA is tailored specifically to military families and is, therefore, particularly good for anyone eligible to use it. It’s best to compare both companies’ quotes to find the best savings.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Progressive vs. USAA: Customer Service, Business Rating & Claims Handling

Progressive and USAA both offer good customer service. USAA is known for high customer satisfaction, receiving better ratings and more approval from customers because of its great service and business practices.

Insurance Business Ratings & Consumer Reviews: Progressive vs. USAA

| Agency | ||

|---|---|---|

| Score: 832 / 1,000 Avg. Satisfaction | Score: 882 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A++ Excellent Business Practices |

|

| Score: 72/100 Avg. Customer Feedback | Score: 96/100 High Customer Satisfaction |

|

| Score: 1.11 More Complaints Than Avg. | Score: 1.74 More Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A++ Superior Financial Strength |

On the other hand, based on Progressive home insurance reviews they are financially strong but has slightly lower customer satisfaction scores and more complaints than what USAA home insurance reviews says. Still, Progressive is a reliable choice when it comes to financial stability. Below is an authentic customer review regarding Progressive and USAA, sourced from discussions on Reddit:

By examining these firsthand accounts, potential customers can gain a better understanding of what to expect when dealing with Progressive and USAA, helping them make more informed decisions about their insurance needs

Also, comparing market share helps policyholders assess each company’s stability, reliability, and customer trust, influencing their decision-making when choosing an insurance provider.

Read More: J.D. Power and Associates Insurance Company Ratings Explained

Progressive vs. USAA Claims Handling

Both Progressive and USAA are great at handling claims, making the process quick and easy for their customers. Progressive provides a smooth experience with ongoing help from their customer service team, while USAA focuses on being professional and fast, offering straightforward service with skilled representatives to assist policyholders at every stage.

Progressive Casualty Insurance Company Pros & Cons

Pros

- Flexibility: As mentioned in Progressive homeowners insurance review, Progressive offers customizable coverage options that will address your home ownership needs and budget constraints.

- Guaranteed Replacement Cost: Progressive’s “Guaranteed Replacement Cost” coverage means that even if the dwelling coverage limit is exceeded, Progressive will pay the cost of rebuilding your home.

- Additional Coverage Options: Extras like identity theft protection, water backup coverage and personal injury liability coverage are also provided by Progressive.

Cons

- Availability: Progressive’s homeowners insurance may not be available to certain demographics or geographical areas.

- Military Exclusivity: Unlike USAA, Progressive does not specialize in serving military members and their families.

Garrison Property and Casualty Insurance Company Pros & Cons

Pros

- Military Focus: USAA serves those who have worn the uniform and their families. They provide coverage designed to fit the distinct needs of these people. (Read More: USAA Insurance Review & Ratings)

- Exceptional Customer Service: USAA has earned a reputation for excellence in customer service; in fact their staff is available 24/7 if you have any questions or concerns.

- Additional Benefits: USAA benefits include coverage for military uniforms and equipment, identity theft coverage, and protection against earthquakes and floods.

Cons

- Eligibility Requirements: USAA homeowner’s insurance is open only to military members and their families, so it is not available to the general public.

- Limited Availability: Not everyone may be able to access USAA’s services.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Key Takeaways: USAA vs. Progressive Home Insurance

Competitive offers between homeowners insurance from Progressive and USAA, with its own plusses and minuses. USAA is great for military families, they have amazing customer service and discounts, but it’s only available to those that are eligible. Progressive, on the other hand, offers broader access and customizable coverage options, but can have higher premiums and limited discounts for certain customers.

You want your stuff to be repaired or replaced when you file a claim. USAA Homeowners Insurance gets it done right.

— USAA (@USAA) June 21, 2023

When considering the home features that can make homeowners insurance more expensive, both insurers factor in these features differently, with Progressive offering more flexibility in pricing based on these factors, while USAA tends to offer more consistent pricing for its eligible members.

Protecting your home doesn’t have to be expensive. Enter your ZIP code into our free tool to find affordable homeowners insurance today.

Frequently Asked Questions

Is Progressive good for home insurance?

Progressive home insurance is a solid choice for homeowners seeking customizable coverage options. Its Progressive home insurance ratings highlight flexibility, with add-ons like identity theft insurance and discounts for security systems.

Is USAA better than Progressive?

USAA often scores higher in customer satisfaction and tailored coverage for military families, as reflected in USAA home warranty reviews. However, Progressive excels in offering flexibility and discounts, including Progressive liability insurance limits.

Is USAA cheaper than Progressive?

USAA is typically cheaper for eligible members, starting at $22/month, according to USAA home insurance quotes. Progressive’s premiums depend on factors like Progressive home insurance ratings and the use of security systems for discounts.

Compare quotes from the cheapest home insurance companies by entering your ZIP code into our free tool.

What does the USAA Preferred Protection Plan cover?

The USAA Preferred Protection Plan provides comprehensive coverage for your home, personal property, and liability. It also includes enhanced options like identity theft insurance USAA and support for home security systems.

Read More: Home Features That Can Make Homeowners Insurance More Expensive

Does USAA have homeowners insurance?

Yes, USAA offers homeowners insurance with strong coverage options, including liability protection and additional features like USAA home security integration and rental car discounts.

Is USAA the best homeowners insurance?

USAA is highly rated, especially for military families, thanks to its tailored policies and excellent service. However, alternatives like Progressive, with strong Progressive home insurance ratings, are better for broader accessibility.

Does Progressive offer discounts for security systems?

Yes, Progressive offers discounts for homeowners who install security systems. This is highlighted in many Progressive home advantage reviews, making it a good choice for cost-conscious policyholders.

Can Progressive and USAA help with identity theft protection?

Both companies provide identity theft coverage, with Progressive offering it as an add-on and USAA incorporating it into its enhanced plans. Check USAA home warranty reviews for additional insights.

Are Progressive and USAA good for bundled coverage?

Both Progressive and USAA offer attractive bundling options. Progressive provides discounts for combining home and auto insurance, while USAA home insurance quotes show savings for eligible military members bundling multiple policies.

Read More: Can I bundle my car insurance with other policies?

What are Progressive’s liability limits?

Progressive liability limits are flexible, allowing homeowners to customize policies to their specific needs. Progressive home insurance ratings often commend this adaptability for diverse customer profiles.

If you’re looking to protect your most valuable asset with home insurance, compare rates now with our free quote tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.