Progressive vs. MetLife Renters Insurance in 2026 (Side-by-Side Comparison)

Progressive vs. MetLife renters insurance offers plans starting at $12/mo for Progressive and $15/mo for MetLife. Progressive offers customizable coverage and bundling discounts. Meanwhile, MetLife provides extensive claims support and identity theft protection, suited for comprehensive security needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated August 2025

13,285 reviews

13,285 reviewsCompany Facts

Renters Policy Cost

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 1,027 reviews

1,027 reviewsCompany Facts

Renters Policy Cost

A.M. Best

Complaint Level

Pros & Cons

1,027 reviews

1,027 reviewsProgressive and MetLife renters insurance offers solid coverage for personal property, liability and loss of use, providing renters with essential coverage.

Progressive has flexible policies and gives discounts for bundling, while MetLife scores well for its claims process and coverage options.

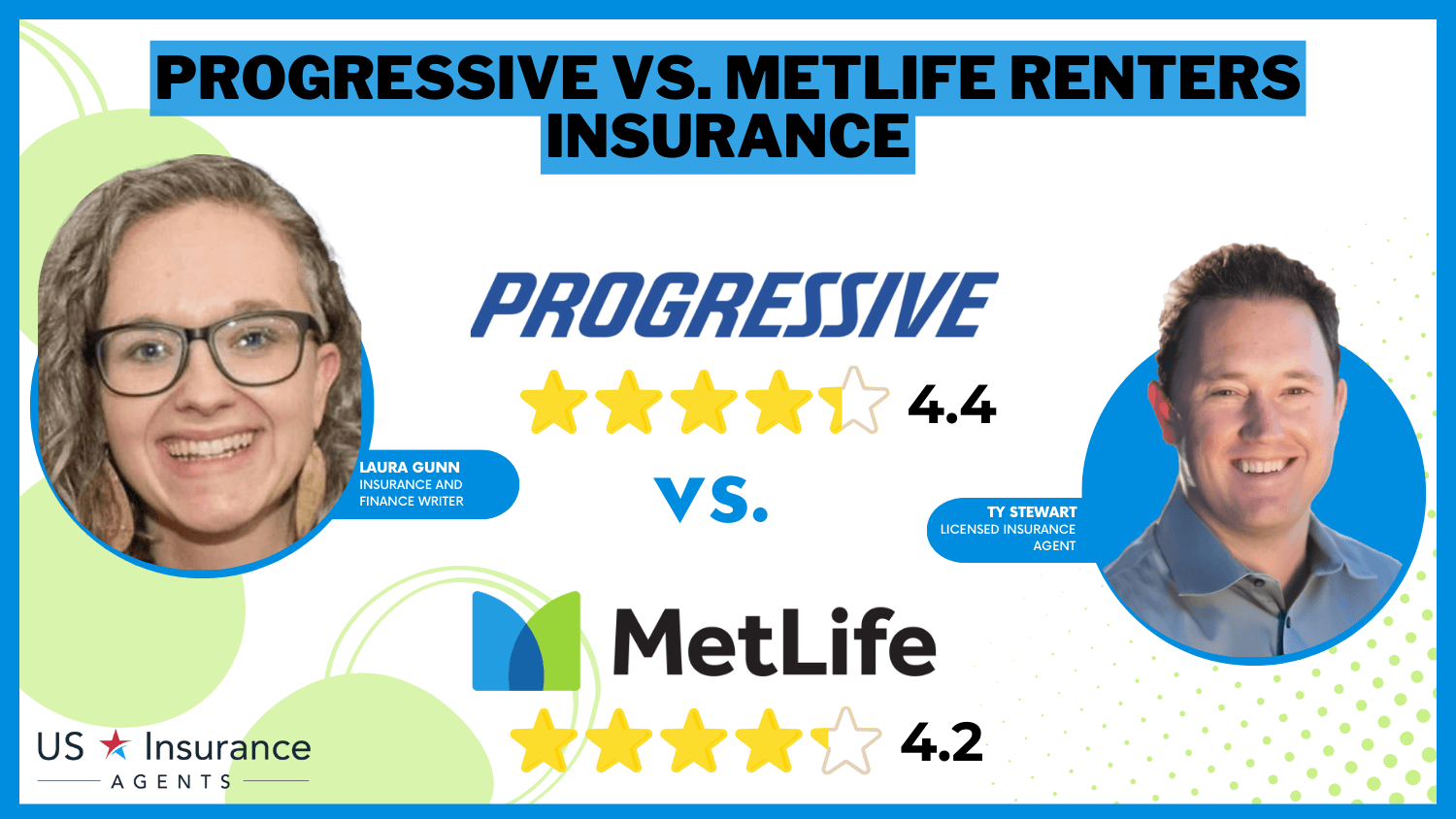

Progressive vs. MetLife Renters Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.4 | 4.2 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 3.5 | 3.3 |

| Company Reputation | 4.5 | 4.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.2 | 4.0 |

| Customer Satisfaction | 4.1 | 4.0 |

| Digital Experience | 4.5 | 4.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 4.1 |

| Plan Personalization | 4.5 | 4.0 |

| Policy Options | 5.0 | 4.7 |

| Savings Potential | 4.5 | 4.4 |

| Progressive Review | Metlife Review |

Both provide extras like identity theft and natural disaster protection, highlighting key reasons why you need renters insurance. This guide outlines these features so you can prioritize and choose the coverage that best fits your needs.

Protect your rental insurance by comparing policies with our free tool—just enter your ZIP code to explore Progressive and MetLife renters insurance options.

- Progressive covers property, liability, and bundles from $12/month

- MetLife offers claims support and loss of use coverage from $15/month

- Compare identity theft protection, discounts, and services to decide

Compare Affordable Renters Insurance: Progressive vs. MetLife

If you’re looking at renters insurance from Progressive and MetLife, it stands out for its efficient claims processing and wide coverage options, making it a competitive choice for renters of all age groups. Progressive tends to offer slightly cheaper options overall, though the costs are higher for younger renters—like 16-year-olds, who are seen as riskier to insure.

Progressive vs. MetLife Renters Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $28 | $33 |

| Age: 16 Male | $30 | $35 |

| Age: 30 Female | $20 | $25 |

| Age: 30 Male | $22 | $27 |

| Age: 45 Female | $18 | $22 |

| Age: 45 Male | $20 | $24 |

| Age: 60 Female | $17 | $21 |

| Age: 60 Male | $19 | $23 |

On the flip side, as people get older, those rates start to drop and level out, which is great news for older renters. Both companies provide competitive pricing for these age groups, so it’s worth taking a close look at your options. You might wonder if it is bad to cancel renters insurance. Understanding how factors like age influence premiums and the importance of consistent coverage can help you make the right decision.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Renters Insurance Showdown: Progressive vs. MetLife

Choosing between Progressive and MetLife for renters insurance means looking closely at what each offers and how it matches your needs. Progressive and MetLife renters insurance provide a solid base of coverage for personal property, liability, and living expenses if you need to move out temporarily, with extras like identity theft protection.

Chris Abrams Licensed Insurance Agent

To see which gives you the best bang for your buck, compare personalized quotes that take into account where you live, what you own, and your deductible choices. On top of that, both Progressive and MetLife are known for their strong customer service, which includes several ways to get in touch and a reputation for handling claims smoothly.

To make the best choice, think about which features matter most to you, like cost, liability insurance, or overall coverage, and how the company supports you when it counts. This way, you’ll feel confident knowing your renter’s insurance has you covered.

Progressive vs. MetLife: Guide to Picking the Right Coverage

Progressive renters insurance covers theft and damage to personal items like electronics and furniture, and it includes liability protection for legal or medical bills if someone is injured in your rental. Progressive also provides loss-of-use coverage, which pays for alternative living arrangements if your rental is damaged and becomes uninhabitable.

MetLife renters insurance adds a unique benefit: identity theft protection with every policy at no extra cost. Their coverage ensures full replacement costs for stolen or damaged items without depreciation. For those with high-value belongings, MetLife allows policy customization to include extra protection for items such as expensive jewelry and advanced electronics.

When looking at the differences between renter’s insurance and landlord’s insurance on your primary residence, it’s about understanding who covers what. Renters insurance is your personal shield against in-house incidents, covering everything from individual items to potential accidents. Landlord insurance, however, secures the property owner against broader risks that come with renting out their space.

What Customers Say About Progressive vs. MetLife

This table compares Progressive and MetLife renters insurance based on ratings from trusted agencies. MetLife leads in customer satisfaction with a J.D. Power score of 886, while Progressive scores 832. Both companies excel in business practices, earning an A+ from the BBB.

Insurance Business Ratings & Consumer Reviews: Progressive vs. MetLife

| Agency | ||

|---|---|---|

| Score: 832 / 1,000 Avg. Satisfaction | Score: 886 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 72/100 Avg. Customer Feedback | Score: 76/100 Good Customer Feedback |

|

| Score: 1.11 Avg. Complaints | Score: 1.00 Avg. Complaints |

|

| Score: A+ Superior Financial Strength | Score: A Excellent Financial Strength |

Progressive rates are better for financial strength (with an AM Best A+ versus an A for MetLife), and consumer reports polling slightly favor the latter for customer service, but NAIC figures show MetLife has far fewer complaints.

Additionally, J.D. Power and Associates insurance company ratings provide another benchmark for evaluating their offerings. These ratings are designed to showcase strengths to assist renters in selecting the correct one.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

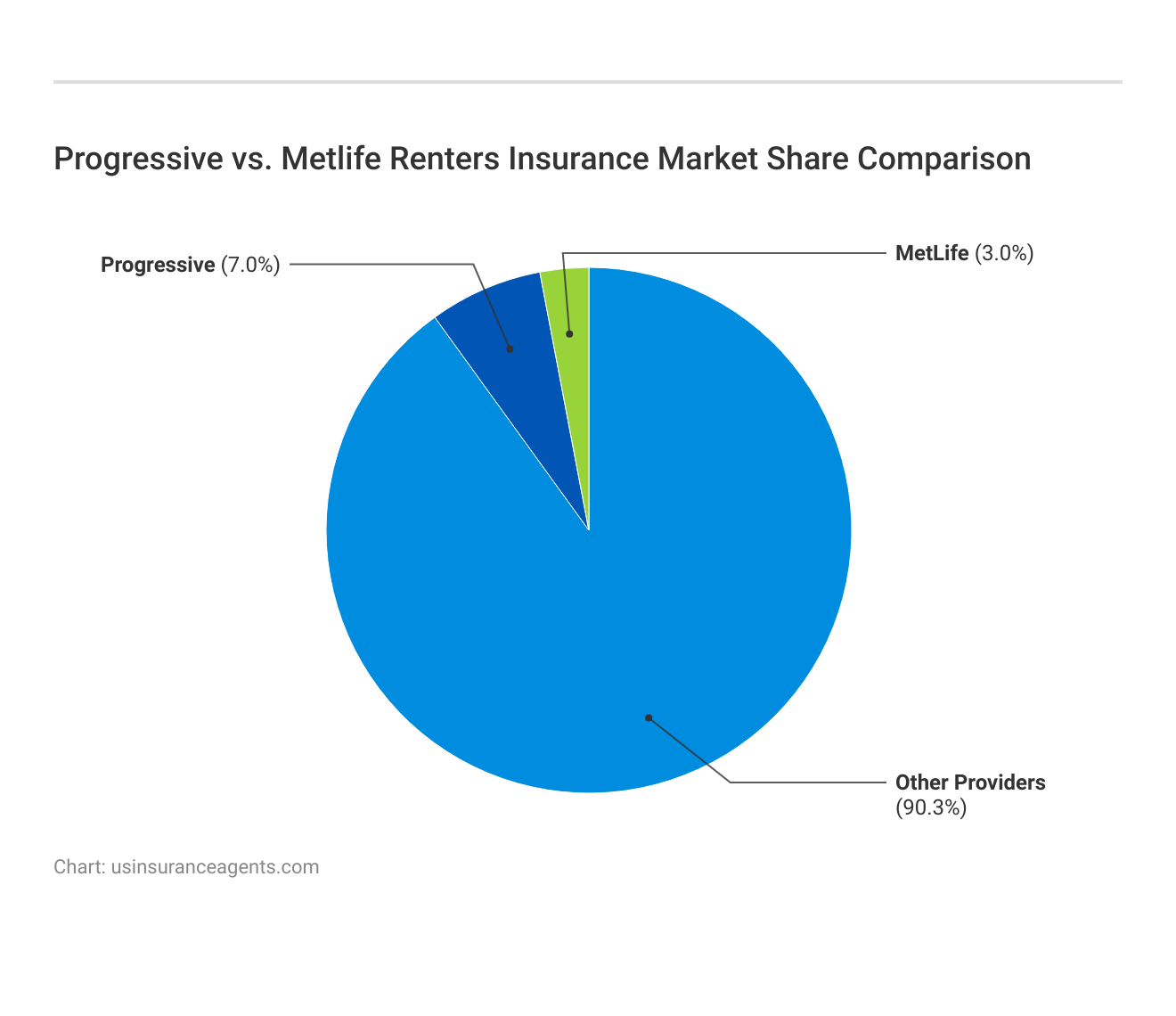

How Progressive vs. MetLife Renters Insurance Compare in the Market

A clear comparison of market shares in the renter’s insurance industry for Progressive, MetLife, and other providers. A respectable 7% for Progressive and a more modest 3% for MetLife. The other 90.3% is fragmented among other suppliers, a demonstration of the many companies competing for the vast proportion of customers.

That puts it in the competitive landscape of Progressive and MetLife being the big players, but the majority of the market is small or regional insurers, often tailored to specific service areas.

Choosing the Right Fit: Progressive vs. MetLife Renters Insurance

Progressive Renters Insurance policies begin at $12 per month, covering personal property, liability, and additional living expenses, with options for water backup and pet damage coverage. They offer customizable deductibles and coverage limits, catering to different budget needs, which is especially beneficial for renters seeking flexibility in managing pet liability insurance.

Comment

byu/Blueshark1728 from discussion

inhomeowners

MetLife renters insurance, starting at $15 per month, includes standard coverage for personal liability and loss of use, with additional customization available for extending coverage to meet specific needs, such as high-value item insurance.

is mold coverage worth it through home insurance? (right now with Metlife)

byu/imthenachoman inhomeowners

Both Progressive and MetLife excel in customer service and are straightforward to work with when you need to file a home insurance claim. They understand the complexities families and young professionals face today and provide robust solutions that ensure peace of mind in your rented home—because knowing you’re well-covered is essential, no matter where you are in life.

Pros and Cons of Progressive Renters Insurance

Progressive is one of a few renters insurance options to consider, especially for flexible and often cheap coverage. Here’s a breakdown of the strengths and weaknesses that are specific to their policy positions.

Pros

- Bundle Savings: Progressive really excels when you bundle renters with their auto insurance, as you’ll be receiving a higher reduction in price, which will save you more on insurance overall. See the best car insurance discounts to ask for here.

- 24/7 Help: Customer service helps no matter what time of the day it is, which is a significant advantage in the case of urgent issues or claims at certain hours that are outside normal business hours.

- Adjustable Weights: Their various add-ons, including coverage for water damage from backed-up sewers and coverage for legal costs for libel or slander, help you get a policy exactly as you need.

Cons

- Inconsistent Service Quality: While many customers do express satisfaction, there are also reports of some unhappy experiences with customer service, which could influence your experience in the event of a claim or policy change.

- Rate Increases: Some customers have shared their policy rates increasing at renewal due to what may have been an unexpected price change that up-ends your budgeting.

Among the reasons for choosing Progressive are lower prices through bundling and customizable coverage options. An important caveat: Service may be sketchy, and rates are all over the place.

Consider these factors carefully and see if Progressive Insurance review & ratings align with what matters most to you in a renters insurance company.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of MetLife Renters Insurance

MetLife is a recognized name in the insurance field, and solid renters insurance coverage is available for varied needs. Here are some of the pros and cons to keep in mind if you’re considering getting a policy with MetLife.

Pros

- Comprehensive Standard Coverage: MetLife’s renter’s coverage includes a high level of standard protection, including personal property, liability, and loss of use, with strong foundation coverage.

- Replacement Cost Coverage: One of their highlighted features is replacement cost coverage, meaning they will pay for the replacement of your items without depreciation deduction so you can fully replace your lost or damaged items.

- Efficient Claims Processing: Users say that MetLife’s claims process is relatively quick and hassle-free, which on its own can help ease the stress during times of loss.

Cons

- Higher Premiums: To provide such coverage, MetLife is usually pricier than some other carriers, which is a complicated product that not all consumers can afford to pay.

- Limited Discount Opportunities: MetLife also clearly offers fewer opportunities to place discounts on renters insurance than a few of its opponents, which could increase consumers’ total prices.

MetLife Insurance reviews and ratings indicate that, while the company provides high-quality coverage and straightforward claims processing, some potential buyers may find it pricier than expected and the available discounts limited.

Evaluating these advantages and disadvantages will help you determine if MetLife’s renters insurance aligns with your needs and budget, enabling you to make a well-informed choice.

Progressive vs. MetLife: Finding the Perfect Renters Insurance Match

Progressive and MetLife renters insurance provide coverage that gets the job done, but which one you choose depends on your priorities. While MetLife ranks best overall for claim efficiency and wide coverage options, Progressive is best for flexibility and customizable plans.

Maria Hanson Insurance and Finance Writer

Ultimately, both companies provide solid protection for your valuable belongings and peace of mind, so determining which one’s a better fit for your lifestyle comes down to comparing and contrasting things like coverage add-ons, service ease, and other individual priorities. Incorporating tools like insurance quotes online can further simplify the decision-making process.

Secure Progressive and MetLife renters insurance for your home by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

What is typically not covered by renters insurance?

Renters insurance generally does not cover flood damage, earthquakes, or high-value items beyond policy limits. Learn more about your insurer’s policy exclusions to avoid surprises when filing a claim, even with Progressive or MetLife policies.

Is Progressive good at paying claims?

Progressive has a solid overall customer satisfaction rating and a reputation for a simple claims process and speedy payments. The company has an A+, or superior, rating from A.M. Best, meaning you can rely on them for speedy and efficient claims.

Additionally, Progressive discounts, such as bundling renters and auto insurance, make it a popular choice for affordable, reliable coverage.

Does MetLife have renters insurance?

Yes, MetLife offers renters insurance with comprehensive coverage for personal property, liability, and loss of use. MetLife discounts are also available for bundling policies, safety features like smoke detectors, and being a loyal customer, making it a competitive option.

Why choose MetLife?

MetLife renters insurance is an excellent choice for its comprehensive standard coverage, efficient claims handling, and available MetLife discounts. Customers with good credit scores also benefit from competitive insurance rates by credit score, making it an attractive option.

What are the three major parts of a renters insurance policy?

The three main parts of renters insurance are personal property coverage, liability insurance, and loss of use coverage. These elements form the foundation of both Progressive and MetLife renters insurance policies, offering value enhanced by discounts and competitive rates.

Who is Progressive’s biggest competitor?

The biggest competitors to Progressive include MetLife, Geico, State Farm, and Geico renters insurance. These companies frequently compete in categories such as customer satisfaction ratings, insurance rates by credit score, and tailored coverage options specific to renters’ needs, highlighting the importance of understanding credit when comparing options.

Which insurance company has the fewest complaints?

Based on customer satisfaction ratings and complaint data, MetLife often reports fewer complaints than competitors. This highlights its strong focus on claims efficiency and customer service, making it a reliable choice for renters.

Find top policies like Progressive and MetLife renters insurance using our free comparison tool.

Does Progressive renters insurance cover floods?

Progressive renters insurance usually won’t cover flooding unless you buy a separate policy. Fortunately, Progressive discounts can lower the costs of add-on coverage, allowing you to obtain the optimum protection at the most affordable rates possible.

What is MetLife known for?

MetLife is known for its broad range of insurance products, including renters insurance. Its efficient claims processing and competitive customer satisfaction ratings set it apart, providing reliable protection and options such as MetLife discounts to reduce premiums.

What is Progressive Insurance best known for?

Progressive is best known for its competitive pricing, innovative online tools, and customer-friendly policies. Features like insurance rates by violation and Progressive discounts for bundling make it a top choice for renters looking for tailored solutions.

Is MetLife more affordable than Progressive?

Is MetLife reliable for renters insurance?

Does Progressive have renters insurance?

What does renters insurance from Progressive cover?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.