Progressive Car Insurance Review & Ratings (2026)

Unveiling Progressive Car Insurance Review & Ratings: An In-Depth Analysis of Coverage Options, Benefits, Customer Experiences, and Financial Strength. Discover comprehensive insights into Progressive Car Insurance, including policy offerings, discounts, claims process, and customer satisfaction. Our unbiased analysis equips you with the knowledge needed to make an informed decision.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2026

Welcome to our comprehensive article on Progressive Car Insurance Review & Ratings. In this detailed review, we delve into key topics related to Progressive Car Insurance, including coverage options, benefits, customer experiences, and financial strength.

Make an informed decision about your car insurance coverage. Enter your ZIP code now to compare rates from the best insurance providers and secure the coverage that meets your needs and budget.

What are Progressive’s financial strength and customer satisfaction ratings?

Would you ever buy a product without checking its ratings? Especially if that product can protect you from the consequences of a severe accident?

Your answer is probably no. Whenever you plan to buy insurance, always make sure that you check the financial ratings of a provider before signing on the policy document.

| Agency | Rating |

|---|---|

| AM Best | A+ (Superior) |

| Better Business Bureau | C- (Average) |

| Moody's | A2 (Good) |

| S&P | AA (Very Strong) |

| NAIC Complaint Index Ratio | 0.0012 (2018) |

| J.D. Power | About Average |

| Consumer Reports | 87 out of 100 |

| Consumer Affairs | 3.5 out of 5 |

In the table above, we have collated the rating data from different agencies for Progressive. Let’s talk about each rating and agency in detail.

Though there are five agencies that assess the financial strength of insurance companies and each one has its own flavor.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are AM Best ratings?

To start with, we will talk about AM Best. Why?

AM Best is the only global credit rating agency that is uniquely focused on the insurance sector.

The financial strength rating of AM Best is an independent opinion of an insurer’s ability to meet its long-term insurance obligations.

So when AM Best rates a company good or excellent, you can be assured that if there’s an unfortunate accident, the insurer will reimburse your damages.

But, every agency has a different rating scale which is based on unique rating standards and assessment rules.

The AM Best financial strength scale assigns a rating from A+ to D to indicate the capability of an institution to meet its obligations. Within each scale, there’s a gradation denoted by “+ or -” to further break down the financial strength.

An A++ means a superior ability to pay off any future obligations Progressive’s A+ rating from AM Best should help auto owners trust the company with their insurance coverage.

What are Better Business Bureau ratings?

Better Business Bureau (BBB) works a little differently than other agencies who look mainly at the finances of an insurance company.

With BBB’s rating, you can get an idea about how a company would interact with you and what kind of experience you might have with them.

They use consumer complaint data mainly to assign ratings to an insurance company.

The rating elements used by BBB are quite interesting and the agency gives businesses a fair chance to represent their side rather than just listening to consumer complaints.

On a 100-point scale, BBB adds weight to factors like complaint volume, unanswered complaints, unresolved complaints, failure to address complaint patterns, and nine more elements.

The ratings of BBB start from A++ and end at F ranging from the highest to the lowest trust rating.

BBB which isn’t great considering consumer experience greatly matters in auto insurance. In the explanation, BBB mentions that Progressive failed to resolve eight complaints.

What are Moody’s ratings?

Moody’s started by rating bonds and stocks at the beginning of the 19th century and now tracks the debt of 135 countries, around 5,000 non-financial corporate issuers, 4,000 financial institutions issuers, and many more entities.

The ratings assigned by Moody’s are followed by many, which go from AAA for the highest quality to C for the lowest quality.

Moody’s has assigned a rating of A2 to Progressive which again strengthens the fact that their ability to meet their long-term obligations is good.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are S&P ratings?

Also known as Standard and Poor’s, S&P assesses the credit-worthiness of a company after analyzing its financial statements and general outlook.

The rating scale ranges from AAA for the best companies to D for companies with the lowest credit-worthiness.

Again, for Progressive, the S&P rating is AA which denotes a highly-strong ability of the company to meet its obligations.

What about the NAIC Complaint Index?

We think by now you know about the financial strength of Progressive.

That matters a lot, but what about its consumer service level? We have already seen that BBB has reported unresolved complaints at the company.

Let’s look at the complaint data from the National Association of Insurance Commissioners where you can find all complaints against an insurer.

| Private Passenger Policies | 2016 | 2017 | 2018 |

|---|---|---|---|

| Total Complaints | 32 | 35 | 34 |

| Complaint Index (better or worse than National Index) | 0.0011 (better) | 0.0000 (better) | 0.0012 (better) |

| National Complaint Index | 1.47 | 1.53 | 1.51 |

You can see that over the three-year period from 2016 to 2018, consumer complaint numbers for Progressive were stable.

Your Roadmap to Progressive Car Insurance Claims Success

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

When it comes to filing a claim with Progressive Car Insurance, policyholders have a range of options at their disposal, making the process convenient and accessible. Progressive offers an online claims portal that allows customers to submit their claims easily through the company’s website. Additionally, they provide a toll-free phone number for those who prefer to file a claim over the phone.

For the tech-savvy, Progressive’s mobile app offers a user-friendly interface, enabling customers to initiate claims directly from their smartphones. The multiple avenues for filing claims cater to the diverse preferences of policyholders.

Average Claim Processing Time

Progressive takes pride in its efficient claim processing system, aiming to resolve claims swiftly and minimize customer inconvenience. The average claim processing time may vary depending on the complexity of the claim and the extent of documentation required.

However, Progressive’s commitment to a seamless claims experience often results in relatively quick turnaround times, helping policyholders get back on the road with minimal disruption.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a crucial role in evaluating an insurance company’s claims process. Progressive’s reputation in this regard is mixed, with some policyholders expressing satisfaction with their claim resolutions and payouts. However, like any large insurer, there have been instances where customers have reported issues or disputes with claims.

It’s essential for potential customers to consider these factors and conduct thorough research before making a decision.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Your Digital Insurance Partner: Progressive Car Insurance

Mobile App Features and Functionality

Progressive’s mobile app offers an array of features and functionalities designed to enhance the overall customer experience. Users can conveniently manage their policies, view digital insurance ID cards, pay bills, and even initiate claims from the app. The user-friendly interface and intuitive design make it a valuable tool for policyholders seeking easy access to their insurance information and services on the go.

Online Account Management Capabilities

Progressive provides robust online account management capabilities through its website. Policyholders can log in to their accounts to review policy details, update personal information, make payments, and track claims. The online platform simplifies the insurance management process, allowing customers to access critical information and services at their convenience.

Digital Tools and Resources

In addition to its mobile app and online account management, Progressive offers various digital tools and resources to help policyholders make informed decisions. These include online quoting tools, coverage calculators, and educational resources to better understand insurance options. These digital resources empower customers to explore their insurance needs and tailor their policies accordingly.

Progressive Car Insurance’s commitment to leveraging digital and technological features reflects its dedication to providing a modern and user-friendly experience for policyholders. These tools not only streamline policy management but also contribute to the overall convenience and accessibility of Progressive’s services.

What are JD Power consumer ratings?

Apart from checking the complaints data, you should also try to research how satisfied consumers are with the services on an insurer.

To make it easy for consumers, JD Power – which conducts surveys on consumer satisfaction and buyer behavior – releases an annual survey report on the satisfaction level of auto insurance customers.

In the J.D. Power 2019 U.S. Auto Insurance Study, the survey found that consumer satisfaction has reached the highest levels as more and more insurers have introduced do-it-yourself tools.

In most of the regions of America, consumers rated Progressive as average and below average. JD Power uses five factors to rate insurers:

- Interaction

- Policy offerings

- Price

- Billing process and policy information

- Claims

Progressive JD Power Ratings

| Region | Consumer Satisfaction (Out of 100) | Power Circle Ratings |

|---|---|---|

| California | 821 | About Average |

| Central | 823 | About Average |

| Florida | 809 | Like The Rest |

| Mid-Atlantic | 828 | Like The Rest |

| New England | 825 | About Average |

| New York | 815 | Like The Rest |

| North Central | 828 | About Average |

| Northwest | 797 | Like The Rest |

| Southeast | 824 | Like The Rest |

| Southwest | 807 | Like The Rest |

| Texas | 816 | Like The Rest |

What about Consumer Reports?

Consumer Reports is a non-profit and independent organization that is working to bring transparency into the marketplace for consumers.

They work to help consumers with their purchase decision, drive fair competition, and improve the products that companies offer.

Consumer Reports is not only a great source if you’re looking for reviews of your daily use products but can also help you to assess your next auto insurance provider.

| Claims Handling | Score |

|---|---|

| Timely payment | Excellent |

| Agent courtesy | Very Good |

| Being kept informed of claim status | Very Good |

| Damage amount | Very Good |

| Ease of reaching an agent | Very Good |

| Freedom to select repair shop | Very Good |

| Promptness of response - very good | Very Good |

| Simplicity of the process | Very Good |

| Total | 87 |

The table above shows Progressive insurance reviews from Consumer Reports for its claims handling process. When you’re buying auto insurance, one of the most important aspects to check is how well the company responds to the first notice of loss.

Progressive scores 87 on the overall claims handling experience. Progressive’s insurance company reviews with Consumer Reports have received good ratings on each element of the process.

What about Consumer Affairs?

Consumer Affairs is another company that offers insights and reviews of products to help consumers in making buying decisions.

Progressive is rated 3.5 out of 5 based on 2,659 consumer reviews from the last year. Consumers specifically cite low coverage rates and fast claims process as the reasons behind the positive reviews.

Some of the pros quoted by Consumer Affairs are:

- A wide array of discounts for all drivers

- Fast claims process

- Good range of add-ons

- Direct distribution model leading to lower costs

By now, you’re aware of all the financial ratings and consumer reviews sources on the web to research an insurer.

We would always recommend checking a few sources before making a decision – because some of these ratings might be biased.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the history of Progressive?

Progressive was born when two lawyers, Joseph Lewis and Jack Green, thought about offering low-cost insurance to all drivers in 1937.

Even to this day, Progressive sells policies through a network of independent agents directly to consumers thus keeping costs low.

Progressive, true to its name, has brought many innovative changes to the insurance landscape.

1956: Progressive Casualty Company was established to cater to the needs of high-risk drivers.

1971: The Progressive Corporation went public this year.

1987: Progressive reached the whopping level of $1 billion in premiums and was listed on the New York Stock Exchange.

1995: This might seem like nothing in these times but Progressive was one of the first insurers to launch a website. In subsequent years, consumers could get online quotes as well as buy policies through their website.

Progressive continues to innovate and offer innovative digital tools for consumers even today with over 20 million active insurance policies. And because of their customer service and fast claims service, Progressive grew from $3.4 billion to $42 billion between 1996 and 2020.

What is the market share of Progressive?

The market share of an auto insurance provider determines how strong the company has become in the industry. Higher market share also means that an insurer is the preferred choice of consumers.

Let’s look at how Progressive has grown over the years.

| Year | Direct Premiums Written | Loss Ratio | Cumulative Market Share |

|---|---|---|---|

| 2015 | $21 billion | 61.37% | 33.05% |

| 2016 | $23 billion | 65.87% | 29.40% |

| 2017 | $27 billion | 64.49% | 30.43 % |

| 2018 | $33 billion | 61.03% | 26.14 % |

Progressive has witnessed continuous growth in its direct written premiums from 2015 to 2018. However, you can see that the company’s market share is on a downfall.

What is Progressive’s position for the future?

After looking at the consumer reviews, financial ratings, and market share data, we can safely say that Progressive is touted to grow in the future as well.

Though there are a few unresolved complaints against the insurance provider, it’s otherwise a preferred choice of many consumers.

When it comes to the financial strength of Progressive, all the rating agencies have a positive outlook towards its future paying abilities.

Progressive continues to offer innovative digital solutions to consumers the same way it pioneered many unique offerings in the past – such as the drive-in claims offices back in the 1940s.

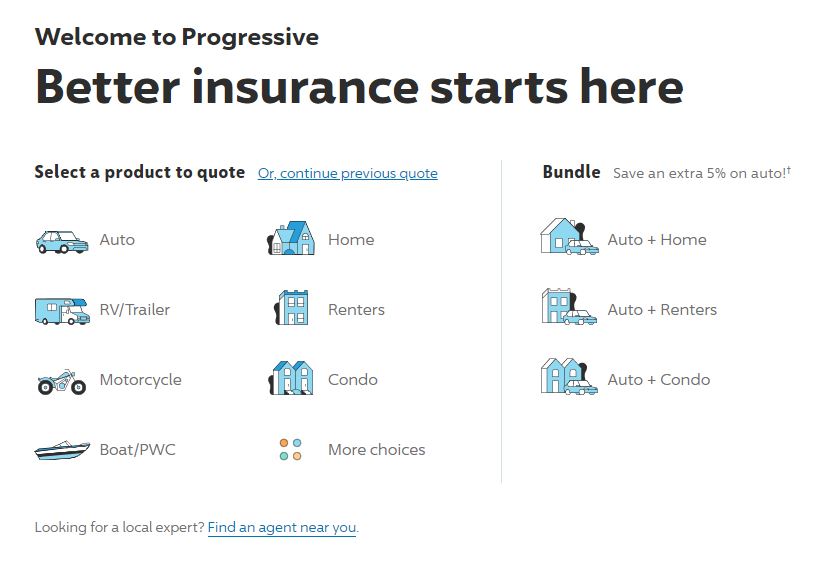

How about Progressive’s online presence?

A company that was the first in the auto insurance industry to launch a website would naturally have a stellar online presence now.

You can get quotes directly from Progressive’s website or connect with their independent agents to buy a policy.

Though Progressive offers insurance only for motor vehicles, it also allows its customers to seek quotes for homeowners, renters, and condo insurance through its affiliates.

Apart from its intuitive website, Progressive has a presence on Facebook, Instagram, Twitter, and Youtube. They regularly share content on these platforms to inform consumers of their products.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What about Progressive’s commercials?

In 2008, Progressive introduced a character, famously known now as Flo, in its ad campaigns and the rest is history. If you have ever watched television in the last 10 years, you must have seen Flo.

From zero brand recognition to becoming a staple in every household, Progressive has really come a long way – all because it decided to depict auto insurance as an interesting product to buy through its ads.

Can you notice the energy and enthusiasm that Progressive weaved into their brand mascot?

Since then, they have introduced many characters whom they use in their ads while Flo remains the main attraction.

- Babyman: To connect with millennials, they introduced Babyman who does weird things using technology and helps sell car insurance

- Motaur: To add more creativity, they introduced a human-machine combination character that helps in selling motorcycle insurance

What about Progressive in the community?

Being involved in the community around them is ingrained in the culture of Progressive.

Progressive encourages its employees to contribute to society by participating in local events and volunteering. The Progressive Insurance Foundation matches funds to charitable organizations to which their employees contribute.

In addition, Progressive runs a STEM Progress Program where they teach science and engineering concepts using insurance.

But, the most interesting of all their programs is the Keys to Progress Program that honors the veterans of our country.

Now in its seventh year, Progressive conducts a one-day annual giveaway event to donate vehicles to those who have served.

What about Progressive’s employees?

Progressive employs more than 43,000 people across its 400 offices in America. Unlike other insurers, Progressive has a casual dress code for its employees and houses contemporary artwork in some of its offices.

We searched a bit more to know what employees feel about working at Progressive. A company that treats its employees well can only keep the best interest of consumers first.

As per Great Place to Work, 92% of employees at Progressive feel that it’s a great place to work.

- Some of the reasons people like to work at Progressive are – people, culture, diversity, and flexibility.

- The majority of the workforce (47%) is constituted by millennials followed by Gen X (39%).

- Almost 28% of the people leave Progressive within two years while around 26% of employees work for two to five years.

Apart from these great reviews from employees, Progressive has won notable awards such as the Fortune 100 Best Companies to Work For in 2019.

We also checked employee reviews on Glassdoor to know about what they think of Progressive.

- In about 2,500 employee reviews, Progressive was rated 3.8 out of 5 with most of the reviews highlighting the great experience people have had working at the company.

- Almost 73% of the reviewers would recommend working at Progressive to their friends and around 92% approve of the company’s current CEO.

Are its car insurance rates cheap?

One of the major complaints of auto insurance consumers is that they pay exorbitant premiums almost, always.

While we can’t guarantee that you will get the cheapest rates because it varies depending on personal factors, we will discuss what rates Progressive offers in your state and how much you can expect to pay.

What is Progressive Insurance’s availability?

Progressive insurance is available in all states so if you’re looking for car insurance at the moment, you can get quotes from them. Though it’s available in every state, coverage options and discounts vary by state.

Progressive Rates by State

https://docs.google.com/spreadsheets/d/1nPw7wsF4TkTWRtZhga_7A7tx21yJF7mPBObxE1ZavRY/edit#gid=1577983431

| States | Annual Premium | Higher/Lower than State Average | Percentage Change from State Average (+/-) |

|---|---|---|---|

| Alabama | $4,450.52 | $883.56 | 24.77% |

| Alaska | $3,062.85 | ($358.66) | -10.48% |

| Arizona | $3,577.50 | ($193.47) | -5.13% |

| Arkansas | $5,312.09 | $1,187.11 | 28.78% |

| California | $2,849.67 | ($839.26) | -22.75% |

| Colorado | $4,231.92 | $355.53 | 9.17% |

| Connecticut | $4,920.35 | $301.43 | 6.53% |

| Delaware | $4,181.83 | ($1,804.49) | -30.14% |

| District of Columbia | $4,970.26 | $531.02 | 11.96% |

| Florida | $5,583.30 | $902.84 | 19.29% |

| Georgia | $4,499.22 | ($467.61) | -9.41% |

| Hawaii | $2,177.93 | ($377.71) | -14.78% |

| Idaho | Data Not Available | N/A | N/A |

| Illinois | $3,536.65 | $231.17 | 6.99% |

| Indiana | $3,898.00 | $483.03 | 14.14% |

| Iowa | $2,395.50 | ($585.78) | -19.65% |

| Kansas | $4,144.38 | $864.76 | 26.37% |

| Kentucky | $5,547.63 | $352.23 | 6.78% |

| Louisiana | $7,471.10 | $1,759.76 | 30.81% |

| Maine | $3,643.59 | $690.32 | 23.37% |

| Maryland | $4,094.86 | ($487.84) | -10.65% |

| Massachusetts | $3,835.11 | $1,156.26 | 43.16% |

| Michigan | $5,364.55 | ($5,134.09) | -48.90% |

| Minnesota | Data Not Available | N/A | N/A |

| Mississippi | $4,308.85 | $644.28 | 17.58% |

| Missouri | $3,419.14 | $90.21 | 2.71% |

| Montana | $4,330.76 | $1,109.92 | 34.46% |

| Nebraska | $3,758.01 | $474.33 | 14.44% |

| Nevada | $4,062.57 | ($799.13) | -16.44% |

| New Hampshire | $2,694.45 | ($457.32) | -14.51% |

| New Jersey | $3,972.72 | ($1,542.49) | -27.97% |

| New Mexico | $3,119.18 | ($344.46) | -9.94% |

| New York | $3,771.15 | ($518.73) | -12.09% |

| North Carolina | $2,382.61 | ($1,010.50) | -29.78% |

| North Dakota | $3,623.06 | ($542.78) | -13.03% |

| Ohio | $3,436.96 | $727.25 | 26.84% |

| Oklahoma | $4,832.35 | $690.03 | 16.66% |

| Oregon | $3,629.13 | $161.36 | 4.65% |

| Pennsylvania | $4,451.00 | $416.51 | 10.32% |

| Rhode Island | $5,231.09 | $227.73 | 4.55% |

| South Carolina | $4,573.08 | $791.94 | 20.94% |

| South Dakota | $3,752.81 | ($229.46) | -5.76% |

| Tennessee | $3,656.91 | ($3.98) | -0.11% |

| Texas | $4,664.69 | $621.41 | 15.37% |

| Utah | $3,830.10 | $218.21 | 6.04% |

| Vermont | $5,217.14 | $1,983.01 | 61.32% |

| Virginia | $2,498.58 | $140.71 | 5.97% |

| Washington | $3,209.52 | $150.20 | 4.91% |

| West Virginia | Data Not Available | N/A | N/A |

| Wisconsin | $3,128.91 | ($477.15) | -13.23% |

| Wyoming | $4,401.17 | $1,201.09 | 37.53% |

Every insurance company has different rates across states so you will need to obtain a new quote when you move from one state to a new state.

As you can see in the table above, Progressive is quite expensive than the average rates in some states like – Montana, Louisiana, Vermont, Massachusetts, and Arkansas.

While in states like Delaware, North Carolina, and New Jersey, Progressive offers cheaper rates than the average. Specifically in Michigan, the company offers a significantly lower rate.

What are the top 10 insurance companies by market share?

When you’re buying insurance, you obviously would seek a quote from many insurance providers to get the best rates and value. In that scenario, it will help if you have an idea about what each insurer offers.

In the table below, you can see the rates of Progressive in all states compared to other leading providers.

https://docs.google.com/spreadsheets/d/1nPw7wsF4TkTWRtZhga_7A7tx21yJF7mPBObxE1ZavRY/edit#gid=2102316878

| States | Average Annual Premiums | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $3,566.96 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | Data Not Available | $2,879.96 | $5,295.55 | Data Not Available | $3,062.85 | $2,228.12 | Data Not Available | $2,454.21 |

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| Arkansas | $4,124.98 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| California | $3,688.93 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | $4,074.05 | Data Not Available | $2,580.44 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | Data Not Available | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | Data Not Available | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | $1,040.28 | Data Not Available | $1,189.35 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | Data Not Available | Data Not Available | $6,154.60 | Data Not Available | Data Not Available | $7,471.10 | $4,579.12 | Data Not Available | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | Data Not Available | $2,770.15 | $2,823.05 | $4,331.39 | Data Not Available | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Michigan | $10,498.64 | $22,902.59 | Data Not Available | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | $2,066.99 | Data Not Available | $2,861.60 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | Data Not Available | $2,525.78 |

| Montana | $3,220.84 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | Data Not Available | $2,031.89 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | Data Not Available | $2,330.78 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | $7,527.16 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | $2,340.66 | Data Not Available | $2,296.77 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | Data Not Available |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | Data Not Available | $2,006.80 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | $2,816.80 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | Data Not Available | $4,691.85 | $3,178.01 | Data Not Available | $3,625.49 | $4,573.08 | $3,071.34 | Data Not Available | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | $2,879.94 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | Data Not Available | $2,491.10 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | Data Not Available | $1,903.55 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | $2,268.95 | Data Not Available | $1,858.38 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | Data Not Available | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | Data Not Available | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | Data Not Available | $2,126.32 | Data Not Available | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | Data Not Available | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | Data Not Available | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | Data Not Available | $2,779.53 |

No matter how controversial it might sound, insurance companies use gender as a factor to base their rates and more often males are charged higher than females.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Progressive male vs females car insurance rates?

No matter how controversial it might sound, insurance companies use gender as a factor to base their rates, and more often males, especially young males, are charged higher than females.

Through the table below, you can get an idea about how much your premiums would be depending on the demographic you’re a part of.

https://docs.google.com/spreadsheets/d/1nPw7wsF4TkTWRtZhga_7A7tx21yJF7mPBObxE1ZavRY/edit#gid=0

| Demographics | Average Annual Premiums |

|---|---|

| Single 17-year-old female | $8,689.95 |

| Single 17-year-old male | $9,625.49 |

| Single 25-year-old female | $2,697.73 |

| Single 25-year-old male | $2,758.66 |

| Married 35-year-old female | $2,296.90 |

| Married 35-year-old male | $2,175.27 |

| Married 60-year-old female | $1,991.49 |

| Married 60-year-old male | $2,048.63 |

Rates for young drivers are always exorbitantly higher than every other age group. This is because of their inexperience with driving – young male drivers are considered the riskiest drivers by insurance companies.

Except for the 35-year-old age group, male drivers are charged higher rates at Progressive.

You’re in luck if you live in one of the states – Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, California, and parts of Michigan – where the law bans insurance companies from using gender as a factor to determine rates.

What are Progressive rates by car make & model?

Your car’s make and model is another factor that has a huge influence on your rates. So, if you’re thinking about buying your favorite luxurious sports car, think twice.

Some car models are considered riskier than others. Moreover, if you buy a newer model or an expensive car, it will always cost more to repair or replace parts. That’s why car insurance rates vary as per the kind of car you buy.

https://docs.google.com/spreadsheets/d/1nPw7wsF4TkTWRtZhga_7A7tx21yJF7mPBObxE1ZavRY/edit#gid=0

| Car Make & Model | Average Annual Premiums |

|---|---|

| 2015 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,914.05 |

| 2015 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $4,429.56 |

| 2015 Toyota RAV4: XLE | $3,647.22 |

| 2018 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,962.58 |

| 2018 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $4,528.90 |

| 2018 Toyota RAV4: XLE | $3,730.78 |

Read more: Ford Car Insurance Discount

We have conducted an analysis to see how much car insurance rates differ when you buy a car with the same specification but the make. Resultantly, car insurance for a new make always costs more.

Read more: Toyota Car Insurance Discount

What about Progressive rates by commute level?

https://docs.google.com/spreadsheets/d/1nPw7wsF4TkTWRtZhga_7A7tx21yJF7mPBObxE1ZavRY/edit#gid=0

| Mileage | Average Annual Rates |

|---|---|

| 10 miles commute/ 6000 annual mileage | $4,030 |

| 25 miles commute/12000 annual mileage | $4,041 |

If you rarely use your car or commute by public transport mostly, you can save money on auto insurance.

Since the probability of being involved in an accident is low when you drive less, insurers offer a discounted rate to drivers who clock lower miles.

What about Progressive rates by coverage level?

https://docs.google.com/spreadsheets/d/1nPw7wsF4TkTWRtZhga_7A7tx21yJF7mPBObxE1ZavRY/edit#gid=0

| Coverage Level | Annual Average Premiums |

|---|---|

| Low | $3,737.13 |

| Medium | $4,018.46 |

| High | $4,350.96 |

As an auto owner, you have the right to choose as much coverage as you want. If you’re comfortable with the state minimum required coverage, you can just buy that from Progressive.

Auto insurance rates tend to be considerably low when you buy the minimum coverage or coverage with lower policy limits.

Do note that lower coverage can also mean more exposure to risk. If you have significant assets to protect, it’s recommended that you buy a high level of coverage.

What are Progressive rates by credit history?

Another factor that’s controversial and has received a lot of flak for influencing auto insurance rates is the credit history of auto owners. Most insurers punish people with poor credit scores.

Some states (California, Massachusetts, and Hawaii) have been successful in prohibiting insurers to use credit history for calculating rates, but the large majority of the states still use credit scores.

https://docs.google.com/spreadsheets/d/1nPw7wsF4TkTWRtZhga_7A7tx21yJF7mPBObxE1ZavRY/edit#gid=0

| Credit History | Average Annual Premiums |

|---|---|

| Poor | $4,737.64 |

| Fair | $3,956.31 |

| Good | $3,628.85 |

For those with poor credit scores, the rates charged by Progressive are much higher than if you had a good or fair score.

As per the research conducted by Consumer Reports, single drivers with good scores pay an additional $68 to $526 annually over what’s charged from drives with the best scores in their state.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Progressive rates by driving record?

Your driving history plays a major role in determining your auto insurance rates because if you’re a bad driver, you’re bad news for any insurance provider.

Specifically, at Progressive, an accident record can raise your rates considerably.

https://docs.google.com/spreadsheets/d/1nPw7wsF4TkTWRtZhga_7A7tx21yJF7mPBObxE1ZavRY/edit#gid=0

| Driving Record | Average Annual Premiums |

|---|---|

| Clean record | $3,393.09 |

| With 1 accident | $4,777.04 |

| With 1 DUI | $3,969.65 |

| With 1 speeding violation | $4,002.28 |

Progressive even mentions on its website that an at-fault accident may lead to a spike in your rates by 41% on average.

But, for incidents that are out of your control and where the claim amount is lower than $500, Progressive offers accident forgiveness to its customers.

What are coverages offered by Progressive?

Progressive is famously known for its unique focus on auto insurance. That’s how they started and progressed to offer coverage for all types of motor vehicles.

But, what are the coverage options offered by Progressive within auto insurance? Let’s take a look.

- Liability: When you’re at fault, you are responsible to cover the damages of the third party if you live in an at-fault state which can be covered by liability insurance. Also, liability coverage is mandatory in most states.

- Comprehensive: Certain events are out of your control such as fire, theft, thunderstorms, or any other acts of nature. Comprehensive insurance protects you from these damages.

- Collision: While driving, you might hit a tree or pavement and with collision insurance, you can pay off the damages to your vehicle.

- Uninsured/Underinsured Motorist: Despite the law for mandatory coverage, some auto owners choose to drive without insurance. UM/UIM immediately settles your damages if you get hit by an uninsured or underinsured driver.

- Medical Payments: This coverage provides for your or any of your passenger’s medical expenses in an accident irrespective of fault.

Apart from these basic coverage options, Progressive also offers a couple of additional coverages.

- Roadside Assistance: This would cover the cost of towing your car to the closest repair facility or to your preferred shop if it’s within 15 miles of your location. Other assistance offered includes tire changes, fuel delivery, and lock-out service.

- Loan/lease Payoff: This is for those drivers who either lease or finance their car. It covers the gap between your car’s value and what you owe.

- Rental Car Reimbursement: Progressive also pays the rental car fee up to your policy limits if your car is in a body shop getting repaired.

- Custom Parts and Equipment Value: Anything that you get installed in your car is covered by the CPE coverage such as a stereo or navigation system.

What are the bundling options at Progressive?

Bundling two or three policies can save you a lot of money. Bundling is basically an option offered by insurance providers to encourage consumers to buy all their policies from them.

At Progressive, you will receive multi-policy discounts when you buy more than one policy from them. Here are some bundling options that you can find at Progressive.

- Auto and home insurance

- Auto and renters insurance

- Motorcycle and boat

- Boat and RV

Bundling options at Progressive aren’t limited to only those combinations – if you have two or more products with them, you will get discounts.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there discounts at Progressive?

When you seek a quote through the Progressive website, you will be asked many questions that help their system calculate the discounts you’re eligible for.

When people switch to Progressive, they save close to $699 annually in auto insurance premiums. Let’s look at all the options you have to save money at Progressive.

Progressive Sample Discounts for Farm Managers and Owners

| Discount Name | Average Discount | Details |

|---|---|---|

| Automatic Payment | Varies | If you set up automatic payments from a checking account to pay for your policy (you cannot combine the automatic payment and pay in full discounts) |

| Continuous Insurance | Varies | If you switch to Progressive from another insurer, you won't lose any longevity benefits (the discount value will depend on how long you've been consistently insured with no gaps or cancellations) |

| Good Student | Varies | If you have a student on your policy who maintains a "B" average or better (this discount also applies to college students, students that are more than 100 miles from your residence, or if the student is 22-years old, or younger) |

| Homeowner | Nearly 10% | If you own a home (even if it is not insured through Progressive's network) |

| Multi-Car | 12% | If you have more than one vehicle listed on your policy |

| Multi-Policy | 5% | If you have two or more policies with Progressive (for example: if you were to have both an auto and homeowners policy with Progressive) |

| Online Quote | 4% | If you get your policy quote online (or if you start your quote online and a licensed Progressive representative finishes it for you over the phone) |

| Paperless | Varies | If you opt to receive your documents via email (dependent on signing your documents online, and is an addition to the sign online discount) |

| Pay in Full | Varies | If you pay for your six month policy in advance before they become due |

| Safe Driver | 31% | If you have had no accidents/traffic violations in the past three years |

| Sign Online | Nearly 8.5% | If you sign your documents online |

| Snapshot Program | $145 | The Snapshot program personalizes your rate based on your driving behavior |

| Teen Driver | Varies | If you're adding a teen driver to your policy |

Read more: Longevity Car Insurance Discount

What programs are offered by Progressive?

Other than offering the required coverage, Progressive also offers programs for auto owners to help them through specific situations or to reward them for their good driving behavior.

What about usage-based insurance?

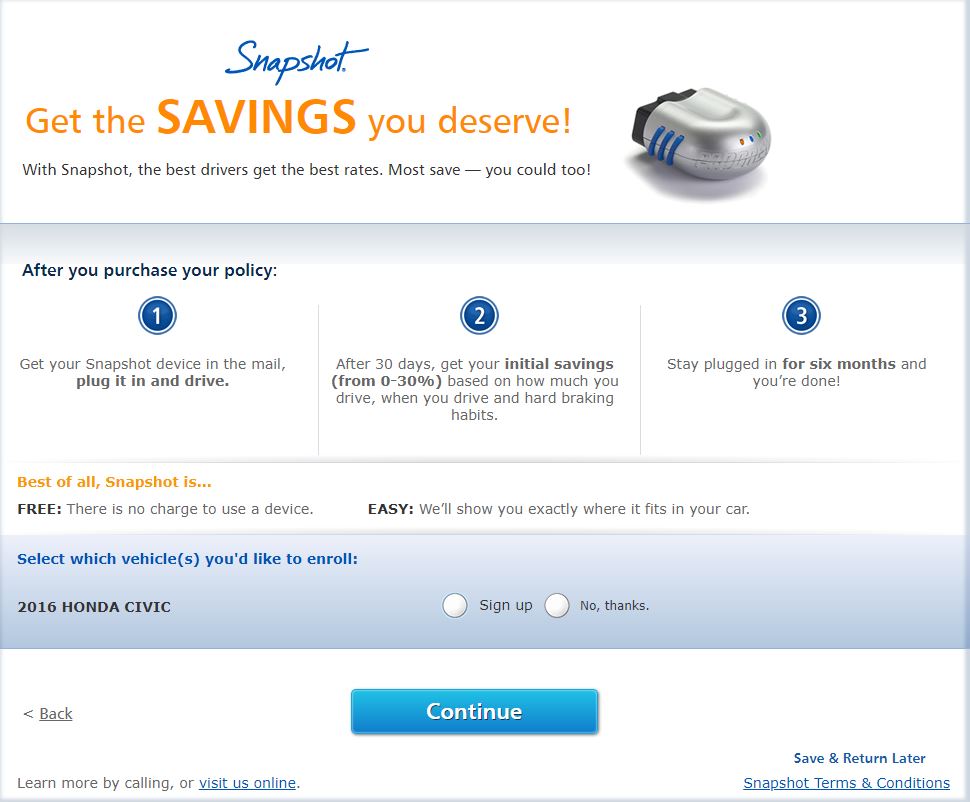

If you’re a good driver who takes special care while braking or accelerating hard, you can benefit from Progressive’s usage-based insurance program – Snapshot.

Progressive claims that it has helped people save almost $700 million through discounts on auto premiums when they used the Snapshot program.

Snapshot tracks your driving pattern to assess whether you’re a safe driver and applies a discount accordingly.

But, how does Snapshot work?

- Enrolling: You can enroll in the Snapshot program by either choosing the Snapshot mobile app or plug-in device which will be sent to you by mail.

- Drive: Your driving behavior will be recorded for a certain period, usually for the first policy period i.e. six months.

- Progress: After six months of enrollment, your rates would be recalculated and discounts applied, if eligible.

If you’re thinking about what exactly will be tracked about your driving, here’s what Progressive looks at:

- Try to limit hard braking and accelerations as much as possible.

- On weekends, avoid driving between the hours of midnight to 4 am because it’s dangerous during that time.

- Lower miles can mean more discounts.

- This one goes without saying but fight the temptation to use your cellphone while driving.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there any coupons?

If you’re a Progressive customer, you can save money through their coupons as well. Known as the PerkShare program, you can get the following benefits.

- You can save on Marathon Fuel gift cards

- Get a special discount at Enterprise car rental

- Get discounts on an oil change at NTB

- Get a 20% discount on rentals at National car rental

- Along with everyday low prices, you get an extra discount at Alamo car rental

- Enjoy a 10% discount at Enterprise truck rental

- Get a 15% discount on AutoCheck reports

Apart from these perkspot car insurance discount, you can also enjoy discounts on many outdoor, travel, and lifestyle offerings.

How does accident forgiveness at Progressive work?

Most of the insurance companies increase your rates if you get involved in an accident – Progressive raises rates by an average of 41% if you cause an accident.

But Progressive also offers accident forgiveness under specific circumstances.

- For at-fault accidents, your rates will almost always be raised except under certain conditions when the damages are less than a specific amount. Insurance companies usually bring back your rates to the normal level after a few years.

- For accidents that weren’t your fault, your rates might be increased in some states. But, the spike isn’t as high as in an at-fault accident.

- For accidents beyond your control, such as thefts or thunderstorms, insurers could increase your rates and these claims stay on your record usually for three years. At Progressive, your rates wouldn’t be raised if your claim value is lower than $500 except when you file a claim multiple times.

What stands out?

Progressive’s unique focus on the auto insurance segment gives it an edge over others. The company is well-positioned and experienced to handle motor vehicle crash claims of almost all kinds because that’s what they have always settled.

If you have anything that can be driven around, Progressive has coverage for you. Whether it’s your snowmobile or travel trailer – you can explore options at Progressive.

Progressive is also quite an innovative insurer and keeps introducing new solutions to help consumers.

- The Name Your Price tool is absolute bliss for auto owners who are looking to find coverage within a lower budget. You just have to fill in the basic details, quote a price you’re comfortable with paying, and the tool will generate coverage options accordingly.

- Progressive Google Action is a step by the insurer to help consumers with their insurance coverage questions. Progressive was the first company to team up with Google’s voice assistant technology to engage consumers with their questions related to buying cars, care tips, smart home technology, or moving.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s missing?

When it comes to customer reviews, Progressive hasn’t received a lot of positive responses.

In the BBB rating, it was reported that Progressive had a few unresolved complaints and in the JD Power survey also the company got about average reviews.

Is there a cancellation fee?

Since this guide includes everything about Progressive auto insurance, we want to cover the process of how to cancel your policy with the insurer. Because your needs might change or you may sell-off your car, so you should be aware of the cancellation process.

If you cancel your policy in between a billing cycle, you will get refunds for your unused premiums. However, the company might charge an early cancellation fee which you must confirm with your agent before making the decision.

Normally, the cancellation fee tends to be around 10% of your outstanding premiums.

How can you cancel?

Make sure first that you have bought another policy for your car before you cancel your Progressive coverage. Any gaps in insurance can raise your rates no matter how small the gap is.

So once you have made arrangements for another policy to kick in, you can call Progressive customer care at 1-800-776-4737 to cancel your policy. It’s just as simple as that.

You can also cancel your policy online if you live in a state that allows online cancellation. However, most of the time insurance providers don’t allow customers to cancel their policies online.

When can you cancel your policy?

You can cancel your policy anytime you feel like it, but don’t stop paying the premiums until it’s still in effect. If you don’t pay your premiums, it might raise your rates in the future.

What are the premiums written and loss ratio?

Progressive Premiums Written

| Year | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| 2015 | $16 billion | 64.23% | 8.7% |

| 2016 | $19 billion | 66.74% | 9.15% |

| 2017 | $22 billion | 63.32% | 9.84% |

| 2018 | $27 billion | 62% | 10.97% |

Progressive is increasingly writing more insurance policies over the years which is evident from the rise in direct written premiums.

When it comes to the company’s loss ratio, it has witnessed a downfall from 2015 to 2018.

A loss ratio is an indicator of what percentage of premiums an insurer is paying out in claims. If the loss ratio is 70%, it means that an insurer has paid out $70 in claims out of the $100 earned in premiums.

If an insurer has a high loss ratio it means that the insurance company might not be making any profit which isn’t an ideal situation in terms of financial strength.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

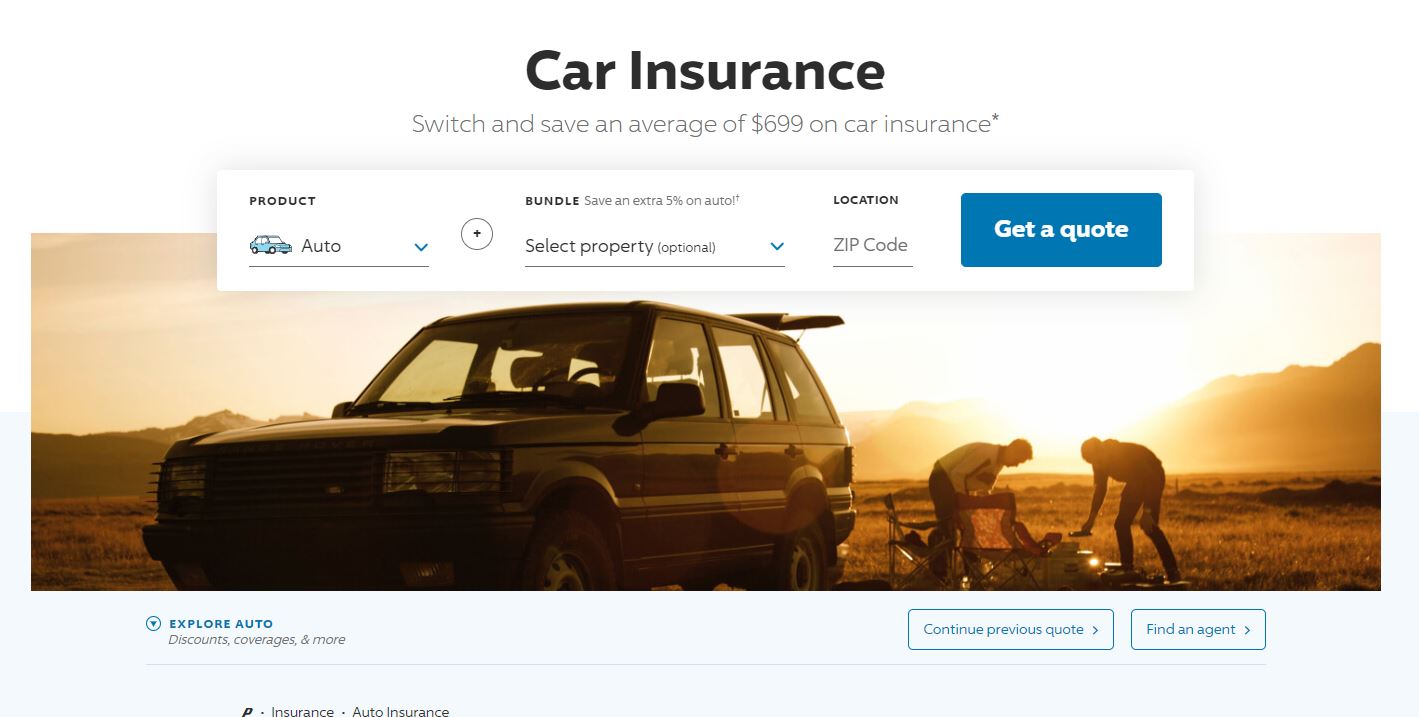

How can you get an online quote?

Buying auto insurance anyway involves a lot of research and thinking, getting a quote should be smooth. Let’s see how you can get an online quote with Progressive.

What if you are seeking an auto insurance quote?

You will see many options on the auto insurance quote page of Progressive’s website.

You can choose the product for which you need coverage, find bundling options, continue a previous quote, or find an agent near you.

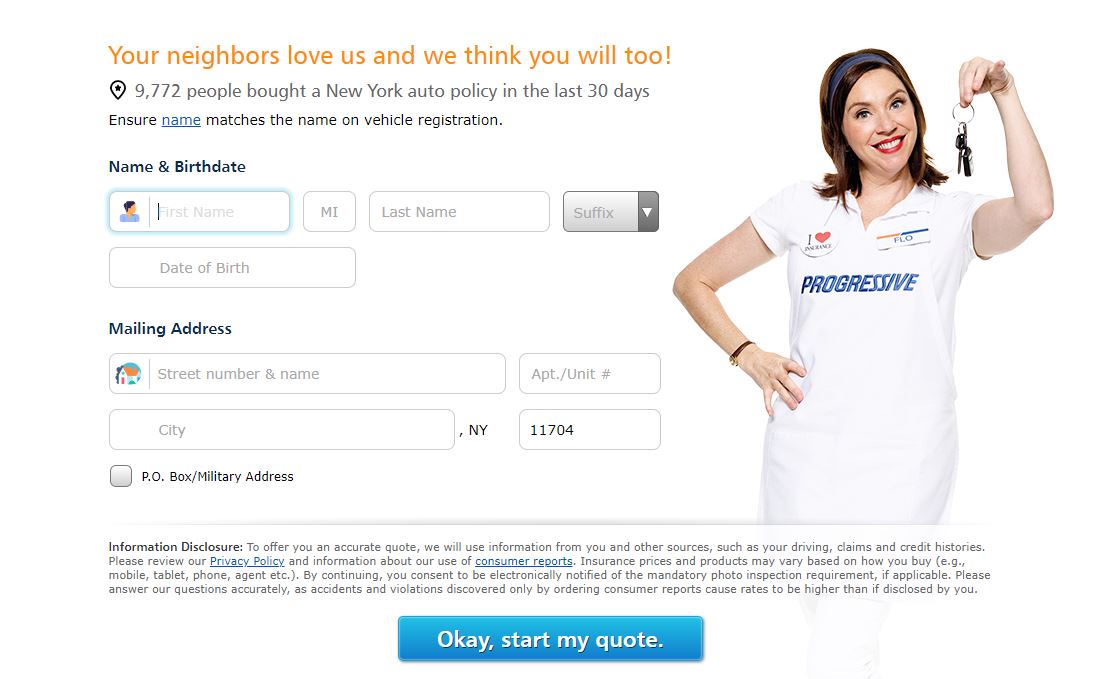

What about personal details?

Once you enter the basic details like zip code and select the option to get a quote, you will be directed to a page where you will have to enter some personal details – name, birthdate, and mailing address.

You will also see the familiar brand mascot, Flo, on this page.

What about vehicle details?

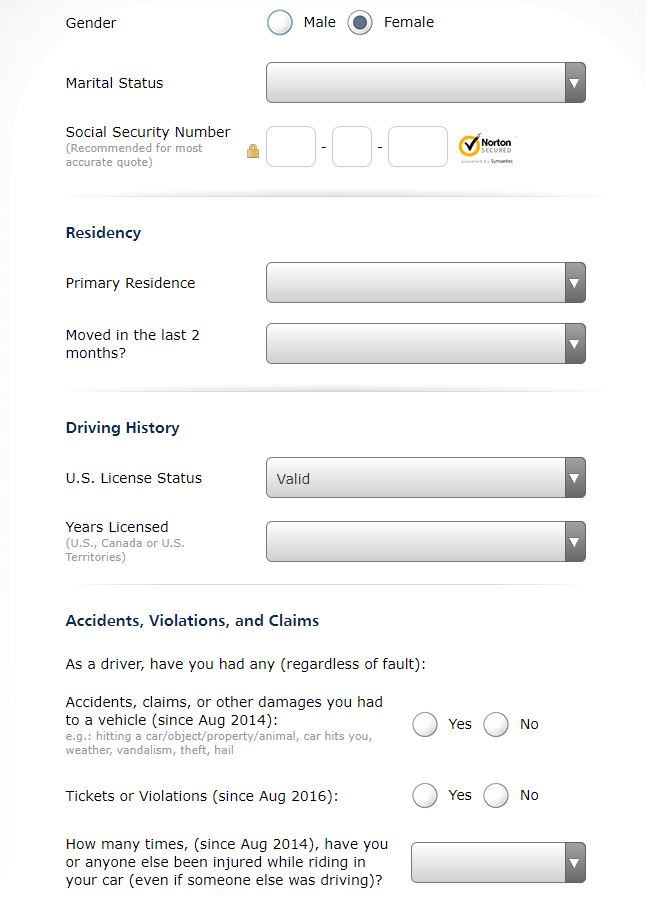

After you select the option to start your quote, you will be asked for your vehicle details.

You will need to fill in a lot of details in this section to get the right coverage for your make and model.

On this page, you will be asked for – your car’s body type, primary use, primary zip location, whether you own or lease it, and alarm system. You can even add other vehicles to your home if you’re thinking of bundling.

After this step, you will be asked questions about your driving history and residency.

If you’re married, you will be asked for details about your spouse in the next step. Similarly, if you have had any accidents in the past, you will have to enter the details of the incident along with the date.

Once you have confirmed the details about your spouse and any other adult who will be driving your car, you will have to choose the car’s primary driver. This helps an insurer assess the risk associated with insurance coverage.

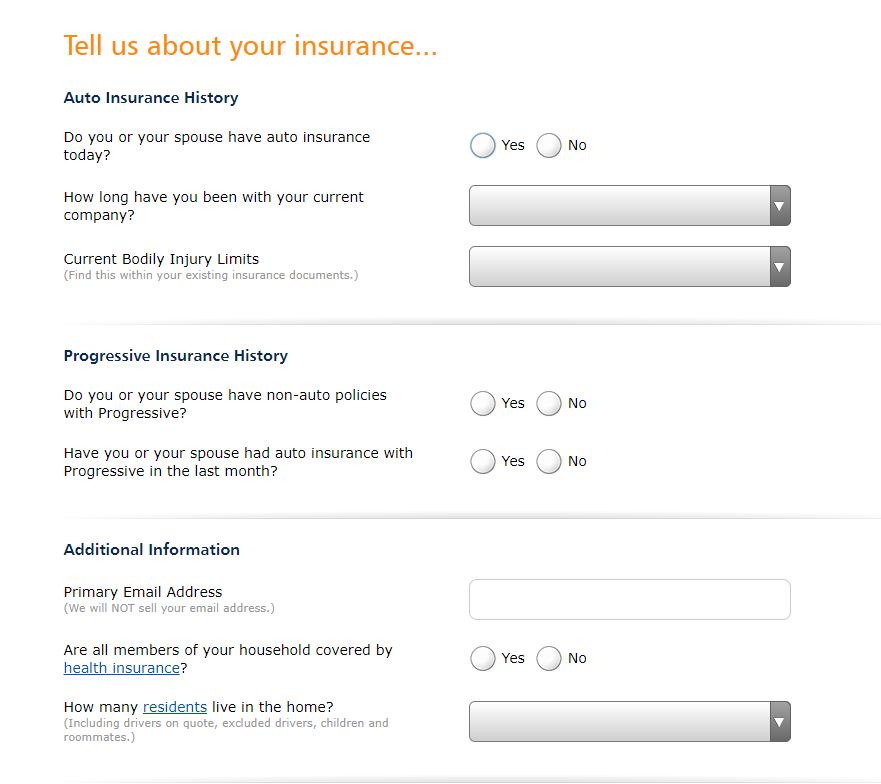

What about insurance history?

As you know that Progressive offers longevity discounts and continuous insurance means that you can get cheaper rates, you will be asked about your insurance history as well.

Are there more savings?

All these steps in the online quote process are meant to get you the best discounts available, so before disclosing your rates you will be asked to join their Snapshot program.

What about the final quote?

You will get the final quote with all the details about your coverage and options to edit policy limits/deductibles.

You will get three options to choose from – basic, choice, and recommended. Each option has higher policy limits than the previous option with the basic policy just offering the state minimum required limits.

On this page, you would also be able to see the Name Your Price tool and you can enter the amount you can pay. The system will adjust policy limits and deductibles to offer you coverage within your budget, if possible.

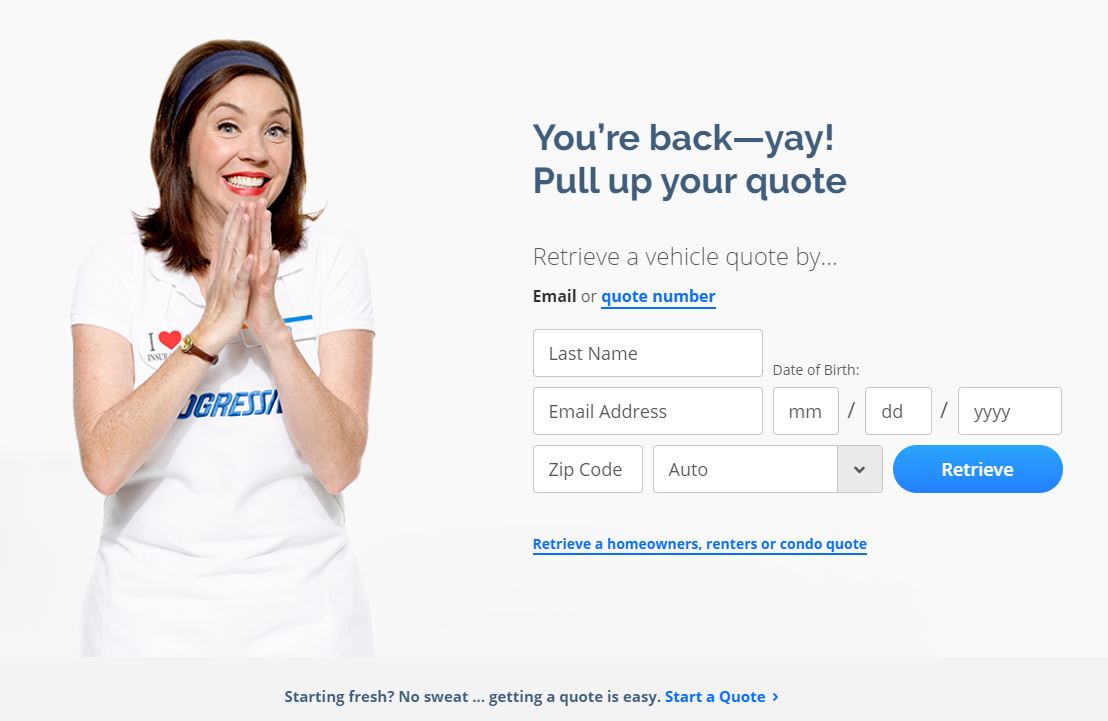

How is Progressive’s website/ mobile app designed?

Progressive’s website is quite intuitive and easy to use for anyone. If you’re browsing their website for the first time, you will see options on the home page to start a quote.

But, if you’re returning to their website, their homepage looks different.

So you get the option to pull up your old quote or start a new one.

When you scroll down a bit on the home page, you will also see their knowledge section where you can learn more about their products.

Progressive customers also have the option to download the Progressive app on their Apple or Android phones.

Having the Progressive mobile app will make your life quite easy. Here’s what you can do with the app.

- View coverages, policy details, and, ID cards

- Report a claim after an accident

- Pay your monthly/annual premiums

- Make any changes to your policy

- Request roadside assistance if you’re stuck somewhere

Progressive’s app is rated 4.3 out of 5 on the Android store on the basis of reviews from around 30,000 customers. On the apple store, it’s rated 3.4 out of 5.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the pros and cons?

Now that you have absorbed a ton of information about Progressive, let’s see the key takeaways from our analysis.

Progressive Pros and Cons

| Pros | Cons |

|---|---|

| 24/7/365 Support | High rates for poor driving history |

| "Name Your Price" option to help you buy policy you can actually afford | Not as many discounts as other competitors |

| Comparable rates despite commute distance in most states | Rates higher than state average in several states |

| Loss ratio is stable | Mobile app ratings spotty based on customer experience |

| Numerous discounts to help drivers offset cost of insurance | High rates for poor credit history |

| One of the only insurers who offers pet protection | Financial strength ratings not as high as other insurers |

| Reputation of helping high-risk drivers | Teen driver rates higher than other insurers |

| Snapshot program to personalize your rate as per your driving behavior | Supplemental Coverage options harder to find |

What’s the bottom line?

Though Progressive lacks positive customer reviews, it has been in the auto insurance business for long now and has always focused on offering motor vehicle insurance.

While you should look at consumer reviews, you must also consider other factors that are important to you – for instance, coverage options or rates.

Progressive can be a good option for those looking for stable rates and a multitude of coverage options.

Frequently Asked Questions

What kind of insurance does Progressive offer?

Progressive offers coverage for anything with wheels such as auto, RV, trailer, boat, motorcycle, etc. It also offers homeowners, condo, and renters insurance through its affiliates.

How can you check the details of your Progressive insurance policy?

You can log in to your account and go to the documents section to see your ID card and other insurance documents. You can also view, download, and fax the documents from here.

How can you contact Progressive to make changes or cancel your policy?

You can call Progressive customer care at 1-800-776-4737 to make any changes or cancel your policy. Alternatively, you can log in to the app for these actions.

Does Progressive offer auto insurance for RVs?

Yes, Progressive offers auto insurance coverage for recreational vehicles (RVs) as part of their insurance offerings.

How can I find local agents for auto insurance from Progressive?

To find local agents for auto insurance from Progressive, you can visit their website and use the “Find an Agent” tool, or call their customer service hotline for assistance in locating an agent in your area.

What discounts are available for auto insurance from Progressive?

Progressive offers various auto insurance discounts, including:

- safe driver discount

- multi-policy discount

- multi-car discount

- homeowner discount

- paying in full discount

- paperless billing discount

Discounts may vary by location and policy specifics, so it’s best to contact Progressive directly or visit their website for up-to-date information on available discounts.

How can I get a quote for auto insurance from Progressive?

You can get a quote for auto insurance from Progressive by visiting their website and using their online quote tool, or by calling their toll-free number to speak with a representative.

What is the process for adding a new driver to my auto insurance policy with Progressive?

To add a new driver to your auto insurance policy with Progressive, you can typically do so online by logging into your account, calling their customer service, or contacting your local Progressive agent. Provide the new driver’s information, such as their name, date of birth, driver’s license number, and other required details, and follow the prompts or instructions provided by Progressive to complete the process.

What is the process for filing a claim with Progressive for auto insurance?

To file a claim with Progressive for auto insurance, you can do so online, through their mobile app, or by calling their claims hotline. Provide details about the incident, cooperate with their process, and submit any necessary documentation for a smooth resolution.

Does Progressive offer auto insurance for commercial vehicles?

Yes, Progressive offers auto insurance for commercial vehicles, including trucks, vans, and trailers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.