Paycheck Protection Program for Female Business Owners [10 Best States + Insurance Advice]

Navigating the Paycheck Protection Program for Female Business Owners: Insights, Eligibility Criteria, Application Process, Loan Forgiveness, and Support. Discover essential information about the Paycheck Protection Program designed specifically for female entrepreneurs. Gain insights into eligibility requirements, the application process, loan forgiveness options, and the resources available to support female-owned businesses.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor of Nutrition & Kinesiology

Melissa Morris has a BS and MS in exercise science and a doctorate in educational leadership. She is an ACSM certified exercise physiologist and an ISSN certified sports nutritionist. She teaches nutrition and applied kinesiology at the University of Tampa. She has been featured on Yahoo, HuffPost, Eat This, Bulletproof, LIVESTRONG, Toast Fried, The Trusty Spotter, Best Company, Healthl...

Melissa Morris

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated October 2024

Welcome to our comprehensive guide on the “Paycheck Protection Program for Female Business Owners. Our comprehensive guide on the Paycheck Protection Program for Female Business Owners” provides valuable insights and guidance tailored to your needs.

Take the next step towards financial stability by entering your ZIP code now to compare rates from the best insurance providers in your area. Ensure your business is protected and prepared for the future.

The Rundown:

- Male business owners received an average of $6,655 more per PPP loan than female business owners

- Around 3.4 male-owned businesses received a PPP for every one female-owned business

- Eight out of the 10 worst states came from the South and West

- Five out of the 10 best states came from the Midwest

It seems there are more obstacles for women to overcome in the business and finance world, and the Paycheck Protection Program for female business owners is no different.

It wasn’t until the 1960s that women entered the workforce, and it was another 28 year before before females were allowed to take out business loans. Considering those historical facts, it should come as no surprise that there are fewer female business owners than male business owners.

Compare quotes from the top insurance companies and save!Compare The Best Insurance Quotes In The Country

Secured with SHA-256 Encryption

The coronavirus pandemic has highlighted this divide as banks have loaned male-owned businesses more money than female-owned businesses.

More male-owned businesses are also receiving Paycheck Protection Program loans than female-owned businesses.

Fortunately, there were some states that flipped the scripts. And a surprising trend developed—in some states, even when female-owned businesses received less loan money, they still saved more jobs than male-businesses in those states.

All the while dealing with the fallout from the coronavirus pandemic and issues like commercial insurance. While we’ll cover the top 5 commercial insurance companies later in the guide, check out our insurance company reviews page for more info about which insurance company is right for you.

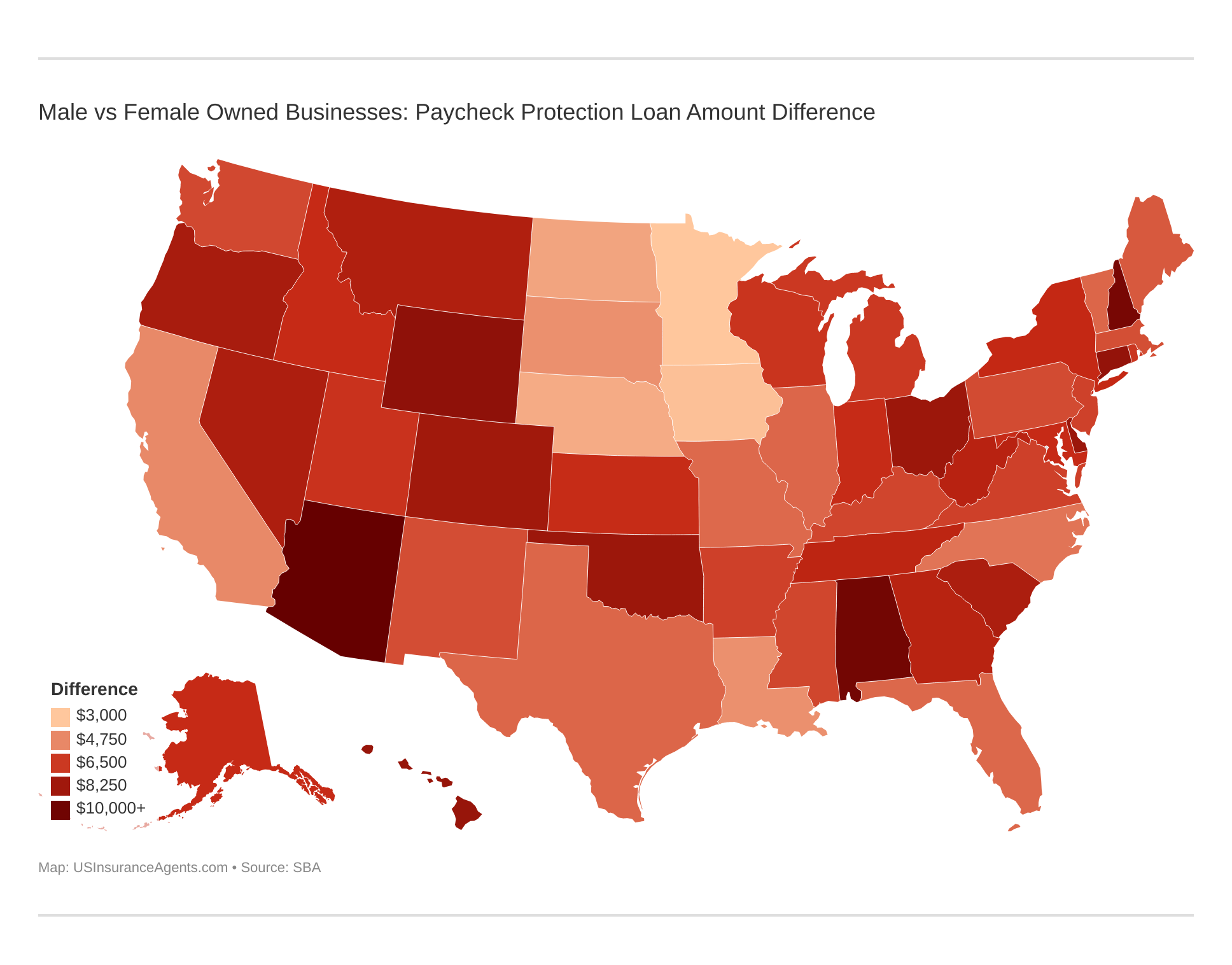

The interactive graph at the top of the page shows each state by its difference in the PPP loan amounts to men- and women-owned businesses. The bigger the difference in loan amount between male-owned businesses and female-owned businesses, the darker red the state.

It’s an interactive graph, so just hover your cursor to each state’s difference (on desktop) or press your finger on the state if you’re on mobile.

In this article, we cover the top 10 states for PPP loan assistance to women-owned businesses and the bottom 10 states as well. It’s a snapshot that shows the entire 50 states and in which women-owned businesses have fared the best.

We also cover various topics that affect not just female business owners but male business owners as well:

- Paycheck Protection Program forgiveness

- Paycheck Protection Program recipients

- Government small business payroll

- A PPP loan for self-employed individuals

- Frequently Asked Questions about PPP

Ready? Let’s get started.

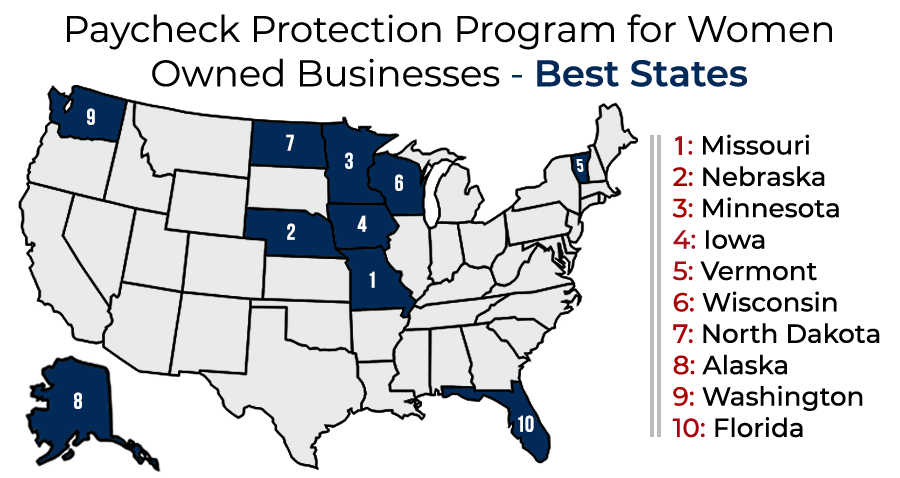

10 Best States for PPP Assistance to Female Business Owners

To complete our ranking of the 50 U.S. states for PPP assistance to female business owners, we looked at three categories:

- Number of male-owned businesses compared to female-owned businesses that received a PPP loan

- The average difference between loan amounts for a male-owned business compared to a female-owned business

- The number of jobs that were saved on average between male-owned and female-owned businesses

The 10 best states showed numerous similarities: There was a better balance between loans given to male-owned businesses and female-owned businesses, a closer disparity between the average loan to a male-owned business and a female-owned business, and an almost even split between the jobs a male-owned business saved versus a female-owned business.

Some of the challenges women business owners face might be mitigated a little bit due to a more accepting and productive business climate in these best 10 states.

This kind of thing helps, considering that many women face challenges outside of the workplace as well as taking care of their children, for instance. In this case, remote caregiving is an option.

In six of our 10 best states, female-owned businesses actually saved more jobs than male-owned businesses, even while receiving smaller overall loans. The following table shows the statistics for those 10 best states for the three categories, along with their final ranking.

For each of the statistics in the last three columns to the right, the “ratio loans approved” or “difference in average of loan amounts” is male-owned businesses compared to female-owned businesses.

For instance, “ratio loans approved” being 2.59 to 1 means that there were 2.59 male-owned businesses that had loans approved compared to one female-owned business.

10 Best States for Paycheck Protection Program Assistance to Female Business Owners

| Rank | State | Loans Approved Ratio (M:F) | Loan Difference (M vs F Amount) | Jobs Saved Ratio (M:F) |

|---|---|---|---|---|

| 1 | Missouri | 2.59 to 1 | +$5,434.40 | 0.94 to 1 |

| 2 | Nebraska | 2.91 to 1 | +$3,976.67 | 0.95 to 1 |

| 3 | Minnesota | 3.15 to 1 | +$3,367.01 | 0.95 to 1 |

| 4 | Iowa | 3.12 to 1 | +$3,525.24 | 0.98 to 1 |

| 5 | Vermont | 2.86 to 1 | +$5,506.76 | 1.04 to 1 |

| 6 | Wisconsin | 2.89 to 1 | +$6,613.52 | 0.98 to 1 |

| 7 | North Dakota | 3.48 to 1 | +$4,141.27 | 0.94 to 1 |

| 8 | Alaska | 2.82 to 1 | +$6,816.76 | 1.01 to 1 |

| 9 | Washington | 2.92 to 1 | +$6,160.86 | 1.04 to 1 |

| 10 | Florida | 3.15 to 1 | +$5,468.07 | 1.03 to 1 |

One interesting note is that the 10 best states are from all around the country. There is one in the West, one in the Northeast, two in the South, and five in the Midwest.

The remaining state is Alaska, which is not in the continental United States and doesn’t necessarily count to any region’s total. The graphic shows those 10 best states below and where they are in the country.

Our ranking starts with the No. 10 best state in the U.S. for PPP assistance to female business owners: Florida.

#10 Good – Florida

- Male- to Female-Owned Business PPP Loan Approval Ratio: 3.15 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$5,469

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.03 to 1

Florida, the Sunshine State, comes in at No. 10 in our best states for PPP assistance to women-owned businesses.

3.15 male-owned businesses received PPP loans compared to one female-owned business, which actually was higher than the average state. The other statistics were, however, much lower than the average.

The difference in loan amount for male-owned businesses to female-owned businesses was about $1,100 lower in Florida than the average for all states. The number of jobs saved by male-owned businesses compared to female-owned businesses was lower in Florida as well.

#9 Good – Washington

- Male- to Female-Owned Business PPP Loan Approval Ratio: 2.92 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$6,161

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.04 to 1

Washington, the Evergreen State, comes in at No. 9 on this list of best states for PPP assistance to women-owned businesses.

Washington has a smaller ratio of loans between male-owned and female-owned businesses compared to Florida. It also has a $500 difference in the average loan amount between male and female business owners.

The number of jobs saved in a male-owned business versus a female-owned business is lower than the average for all states as well.

#8 Good – Alaska

- Male- to Female-Owned Business PPP Loan Approval Ratio: 2.82 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$6,817

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.01 to 1

Alaska, the Last Frontier, comes in at No. 8 on this list of the best states for PPP loans to women-owned businesses.

It follows the pattern of Florida, with its ratio of men- to women-owned businesses receiving PPP loans and the number of jobs saved between men- to women-owned businesses being better than the average state.

The one statistic where Alaska is worse than average is with the loan amount difference between men- and women-owned businesses. It is about $150 higher than the average for all states.

One of the measures female business owners can take to reduce the impact of COVID-19 on their business is to create a strong sense of teamwork in their work environment. This can be challenging when teams are working remotely, but this often has major benefits to the success of a business even during a pandemic.

#7 Good – North Dakota

- Male- to Female-Owned Business PPP Loan Approval Ratio: 3.48 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$4,141

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 0.94 to 1

North Dakota, the Peace Garden State, comes in at No. 7 on this list of best states for PPP assistance to women-owned businesses.

North Dakota is an interesting state on this list because it is much better than the average for all states in two categories: the difference in loan amount between men- and women-owned businesses and the number of jobs saved for men-owned businesses compared to women-owned businesses.

Women-owned businesses outperformed male-owned businesses in the average number of jobs saved in North Dakota, even when receiving less money per loan.

The one category that is worse than the average for all states is the ratio of male-owned to women-owned businesses that received PPP loans. In this category, it is near dead last in the country.

The video above analyzes the first round of PPP funding and which industries or how many workers might be covered under the PPP loans.

The person interviewed in the video states that although many companies were approved for a PPP loan, some companies or industries that were hit the hardest — such as restaurants or bars — didn’t receive as much assistance compared to other industries.

#6 Good – Wisconsin

- Male- to Female-Owned Business PPP Loan Approval Ratio: 2.89 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$6,614

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 0.98 to 1

Wisconsin, the Badger State, comes in at No. 6 on this list. While Wisconsin is not the leader of the five best states we’ve covered in any category, what it has is consistency: For all three categories, it is better than the averages for all states.

Wisconsin’s best category is the ratio of jobs saved in male-owned businesses compared to jobs saved in women-owned businesses.

It is just one of six states where women-owned businesses saved more jobs than male-owned businesses, even with smaller loan amounts on average.

#5 Good – Vermont

- Male- to Female-Owned Business PPP Loan Approval Ratio: 2.86 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$5,507

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.04 to 1

Vermont, the Green Mountain State, comes in at No. 5 on this list. It ranks much better than the average state for all categories.

There is a smaller ratio between male-owned and female-owned businesses that receive loans in Vermont compared to the average state. The difference between a male business owner and female business owner loan amounts is $5,507 — $1,100 lower than the average for all states.

The average number of jobs saved in male-owned businesses is almost identical to the average number in female-owned businesses.

#4 Good – Iowa

- Male- to Female-Owned Business PPP Loan Approval Ratio: 3.12 to 1

- Male-Owners’ PPP Loans Amount Greater than Female Owners: +$3,525

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 0.98 to 1

Iowa, the Hawkeye State, comes in at No. 4 on this listing of the 10 best states for PPP assistance to women-owned companies. It ranks near the top for all states for two categories and is near the average for the third.

Its best ranking is for the difference in the amount of the average loan to male-owned businesses and female-owned businesses.

Iowa comes in second out of all states with a $3,500 difference between loans to men- and women-owned businesses.

This $3,500 difference is $3,100 less than the average for all states at $6,600. Like in a few other states, women-owned businesses in Iowa saved more jobs on average than male-owned businesses. This contributed to its high ranking as the fourth-best state for PPP assistance to female business owners.

#3 Good – Minnesota

- Male- to Female-Owned Business PPP Loan Approval Ratio: 3.15 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$3,367

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 0.95 to 1

Minnesota, the North Star State, comes in at No. 3 on this list of the 10 best states for PPP assistance to women-owned businesses.

It ranks near the best for two categories: difference in loan amount between male and female business owners and the ratio of average jobs saved in male- versus female-owned businesses.

Its $3,370 difference between loans to male-owned businesses and female-owned businesses is $3,300 less than the average of all states. It is also just one of the six states where female-owned businesses are saving more jobs than male-owned businesses.

#2 Good – Nebraska

- Male- to Female-Owned Business PPP Loan Approval Ratio: 2.91 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$3,977

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 0.95 to 1

Nevada, the Silver State, comes in at No. 2 in our list of the 10 best states for PPP assistance to female business owners. For two categories, it beats out 47 other states and in the other beats out 35 states.

The two categories where Nebraska beat out almost every other state are the difference in loan amount for men- versus women-owned businesses and the ratio of the number of jobs saved between them.

It is one of the few states where female-owned businesses save more jobs than male-owned businesses, even when female-owned businesses received around $2,700 less per loan than the average loan for a male-owned business.

This video from GoDaddy talks about the PPP loans and whether a small business owner should apply for one. The person featured in the video goes over some of the changes in the first round of funding compared to the second.

He interviews women entrepreneurs as well and asks them how the coronavirus pandemic has impacted their businesses, whether they applied for a PPP loan, and how they plan to use the funds or already have used the funds.

#1 Best – Missouri

- Male- to Female-Owned Business PPP Loan Approval Ratio: 2.59 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$5,434

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 0.94 to 1

Missouri, the Show-Me State, comes in at No. 1 on this list of the 10 best states for PPP assistance to women-owned businesses.

It ranked among the best states in each of the three categories, with its worst ranking being for the difference in loan amount between male-owned and female-owned businesses.

Missouri’s very small ratio of men versus women businesses that received PPP loans meant that the distribution of loans was a little more balanced compared to other states.

Its ratio of jobs saved from male-owned businesses to women-owned businesses is the second-best of all states. It is another state where female-owned businesses saved more jobs than male-owned businesses.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

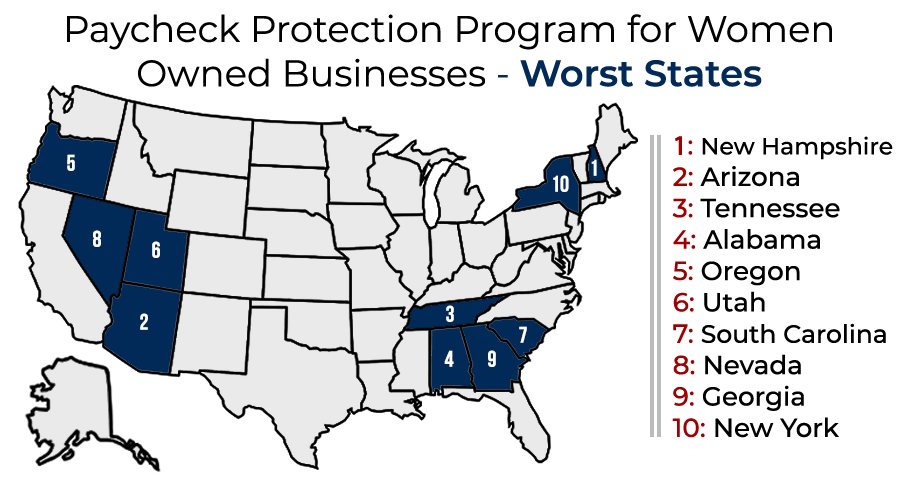

10 Worst States for PPP Assistance to Female Business Owners

We’ve seen the 10 best states for PPP assistance to female business owners. They represent all six states where female-owned businesses saved more jobs than male-owned businesses, even when receiving on average $1,550 less per loan.

But while those states did the best out of the entire country, there were some states that did the opposite. The following table contains the 10 worst states for PPP assistance to female business owners and their individual statistics within the three categories we used for our ranking.

As with the previous table, for each of the statistics in the last three columns to the right, the “ratio loans approved” or “difference in average of loan amounts” is a statistic based on male-owned businesses to female-owned businesses.

For instance, a “difference in average loan amounts” of $9,718.62 means the average loan for a male-owned business in that state was $9,718.62 higher than the average loan for a female-owned business.

10 Worst States for Paycheck Protection Program Assistance to Female Business Owners

| Rank | State | Loans Approved Ratio (M:F) | Loan Difference (M vs F Amount) | Jobs Saved Ratio (M:F) |

|---|---|---|---|---|

| 1 | New Hampshire | 3.44 to 1 | +$9,718.62 | 1.16 to 1 |

| 2 | Arizona | 3.02 to 1 | +$10,373.25 | 1.26 to 1 |

| 3 | Tennessee | 3.31 to 1 | +$7,147.67 | 1.15 to 1 |

| 4 | Alabama | 3.05 to 1 | +$9,880.53 | 1.15 to 1 |

| 5 | Oregon | 3.30 to 1 | +$7,952.82 | 1.10 to 1 |

| 6 | Utah | 4.61 to 1 | +$6,642.85 | 1.10 to 1 |

| 7 | South Carolina | 3.36 to 1 | +$7,782.93 | 1.10 to 1 |

| 8 | Nevada | 3.05 to 1 | +$7,743.41 | 1.21 to 1 |

| 9 | Georgia | 3.25 to 1 | +$7,348.83 | 1.10 to 1 |

| 10 | New York | 3.32 to 1 | +$6,891.26 | 1.08 to 1 |

Unlike our 10 best states, the 10 worst states are not from all regions in America. There are two from the Northeast, four from the South, and four from the West.

The graphic below shows the 10 worst states for PPP assistance to women-owned businesses throughout the country.

The Midwest is the only region in the country that does not have a state in the bottom 10 for PPP assistance to women-owned businesses.

The Midwest has five of the 10 best states for PPP assistance to female business owners in addition to having no states in the 10 worst states ranking.

Now, let’s head to the ranking, where we break down each state by those same three statistics that we used for the best states: the ratio of male-owned to female-owned businesses receiving loans, the difference in the loan amount, and jobs saved between male-owned and female-owned businesses.

#10 Bad – New York

- Male- to Female-Owned Business PPP Loan Approval Ratio: 3.32 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$6,891

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.08 to 1

New York, the Empire State, comes in at No. 10 on this list of the 10 worst states for PPP assistance to women-owned businesses.

It is below average in all three categories, with its worst score coming in the ratio of the male-owned businesses to female-owned businesses that received PPP loans.

The difference in the loan amount for male-owned businesses to female-owned businesses is New York’s second-worst category, with male-owned businesses receiving $6,891 more per average loan compared to the average loan for women-owned businesses. This is about $250 higher than the average for all states.

#9 Bad – Georgia

- Male- to Female-Owned Business PPP Loan Approval Ratio: 3.25 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: $7,349

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.10 to 1

Georgia, the Peach State, comes in at No. 9 on this list of the 10 worst states for PPP assistance to women-owned businesses.

Of all the states we’ve covered so far, Georgia is the worst state by far when it comes to the difference in loan amounts given to male-owned businesses compared to female businesses.

Male business owners receive $7,349 more than female business owners. This is $600 worse than the average for all states.

Likely due to this, male-owned businesses save more jobs on average than female-owned businesses. The number of male-owned businesses that receive loans compared to female-owned businesses is high as well.

#8 Bad – Nevada

- Male- to Female-Owned Business PPP Loan Approval Ratio: 3.05 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$7,743

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.21 to 1

Nevada, the Silver State, comes in at No. 8 on this list of the 10 worst states for PPP assistance to women-owned businesses.

While Nevada is better than Georgia in the ratio of male-owned to female-owned businesses that have received PPP loans, it has an even worse score when it comes to the difference in PPP loans given to male-owned businesses compared to women-businesses.

This $7,743 difference between loan amounts for men- versus women-owned businesses is $1,900 worse than the average for all states.

Its ratio of the number of jobs male-owned businesses saved compared to female-owned businesses is much worse as well. In this subcategory, Nevada ranks worse than all but one state. For every job a female-owned business saves, 1.15 jobs at a male-owned business are saved.

In this video, the Small Business Administration highlights small businesses in Harrisburg, Pennsylvania that have survived due to the PPP loans. The video includes some women business owners in different industries such as banking and bakeries.

Some experts believe that female-owned businesses have been hit harder than male-owned businesses during the coronavirus pandemic due to the different industries that have a higher degree of women business owners compared to men business owners.

#7 Bad – South Carolina

- Male- to Female-Owned Business PPP Loan Approval Ratio: 3.36 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$7,783

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.10 to 1

South Carolina, the Palmetto State, comes in at No. 7 in this ranking of the 10 worst states for PPP assistance to women-owned businesses.

Its statistics in all subcategories are worse than all three of the preceding states, with just one exception: For the number of jobs saved between male-owned and female-owned businesses, South Carolina ranks bad but not as bad as Nevada.

However, for the other two categories, South Carolina ranks worst out of all the states listed so far.

3.36 male-owned businesses received a PPP loan for every one female-owned business.

And the difference in loan amounts for men- versus women-owned businesses is $7,783. This is $1,140 worse than the average for all states.

#6 Bad – Utah

- Male- to Female-Owned Business PPP Loan Approval Ratio: 4.61 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$6,643

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.10 to 1

Utah, the Beehive State, comes in at No. 6 on this list of the 10 worst states for PPP assistance to women-owned businesses.

While our other four states that we’ve covered so far have had generally bad scores all around, Utah has a big split between its best score, its medium score, and its worst score.

Utah’s best category is the difference between loan amounts to male-owned and female-owned businesses. It ranks near the middle out of all states, and the difference is about equal to the average difference for all states.

But its worst score is dead last for all states — the ratio between male-owned businesses and female-owned businesses that received loans. For every female-owned business that received a loan, 4.61 male-owned businesses received a loan.

That a far worse ratio than the national average of 3.13 male-owned businesses to one female-owned business receiving a loan.

#5 Bad – Oregon

- Male- to Female-Owned Business PPP Loan Approval Ratio: 3.30 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$7,953

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.10 to 1

Oregon, the Beaver State, comes in at No. 5 on this list of the 10 worst states for PPP assistance to women-owned businesses.

Unlike Utah, which had a large spread between its worst score and best score, Oregon had bad scores all the way around.

Its worst scores were in the worst 10 states between two categories: difference in the average loan amount between male business owners and female business owners and the ratio of jobs saved between male-owned businesses and female-owned businesses.

Oregon’s $7,953 difference between the average loan amount given to male-owned businesses to female-owned businesses is $1,300 higher than the average for all states.

The number of jobs saved per male-owned business compared to a female-owned business is high as well, likely due in part to how much more money male-owned businesses are receiving in Oregon compared to female-owned businesses.

#4 Bad – Alabama

- Male- to Female-Owned Business PPP Loan Approval Ratio: 3.05 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$9,881

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.15 to 1

Alabama, the Cotton State, comes in at No. 4 on this list of the 10 worst states for PPP assistance to women-owned businesses.

While it has one score that is above average for all states, its other two scores are so low that they drag Alabama into the fourth-worst spot for states all around the country.

Alabama’s $9,881 difference between the average loan amount to male-owned businesses and female-owned businesses is worse than all states but one and is around $3,200 worse than the average for all states.

Its 1.15 male-owned business jobs saved compared to 1 female-owned business job saved is good for near the last of all states in that category. Alabama’s best category is the ratio of male-owned businesses to female-owned businesses that received PPP loans, where it’s ranked in the middle of all states.

#3 Bad – Tennessee

- Male- to Female-Owned Business PPP Loan Approval Ratio: 3.31 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$7,148

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.15 to 1

Tennessee, the Volunteer State, comes in at No. 3 on this list of the 10 worst states for PPP assistance to women-owned businesses.

Tennessee’s scores are bad in all three categories, scoring in the bottom fifth of all states in the number of jobs saved comparing male and female business owners.

Its best score is the average loan amount difference between male-owned businesses and female-owned businesses. At $7,148, it is just $500 more than the average for all states and $2,730 better than Alabama.

#2 Bad – Arizona

- Male- to Female-Owned Business PPP Loan Approval Ratio: 3.02 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$10,373

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.26 to 1

Arizona, the Grand Canyon State, comes in at No. 2 on this list of the 10 worst states for PPP assistance to women-owned businesses.

It actually does decently in one of the categories: the ratio of male-owned to female-owned businesses that received PPP loans. However, it was terrible when it came to the other two categories.

Arizona is the state with the largest loan amount difference between male-owned to female-owned businesses. Arizona’s loan difference between men and female-owned businesses is $10,373, $3,700 higher than the average for all states.

This likely contributes to the difference in the number of jobs saved between male-owned businesses and female-owned businesses. Here, Arizona is also ranked dead last.

In the video above, New America CA and the San Francisco Department on the Status of Women partnered to create a seven-woman virtual meeting where they discussed the challenges of being a female entrepreneur during the COVID-19 pandemic. Part of the discussion focuses on the disproportionate impact the coronavirus pandemic has had on women-owned and women-minority-owned businesses compared to male businesses.

The female business owners address this issue and talk about some ways people can help to reduce this inequity and support women-owned businesses.

#1 Worst – New Hampshire

- Male- to Female-Owned Business PPP Loan Approval Ratio: 3.44 to 1

- Male Owners’ PPP Loans Amount Greater than Female Owners: +$9,719

- Male- to Female-Owned Businesses PPP Jobs Saved Ratio: 1.16 to 1

New Hampshire, the Granite State, comes in at No. 1 on this list of the 10 worst states for PPP assistance to women-owned businesses. Really, it is just bad.

New Hampshire’s ratio of male-owned to female-owned businesses that received PPP loans is 0.31 higher than average.

NH’s $9,719 difference between male-owned businesses and female-owned business loans is $3,070 worse than the average for all states.

And it is ranked in the bottom five for the ratio between jobs saved in male-owned businesses versus female-owned businesses.

PPP Loan Assistance to Women-Owned Businesses in all 50 States

We’ve seen the 10 best states for PPP assistance to women-owned businesses and the 10 worst. Now, we’re going to cover the 50 states as a whole.

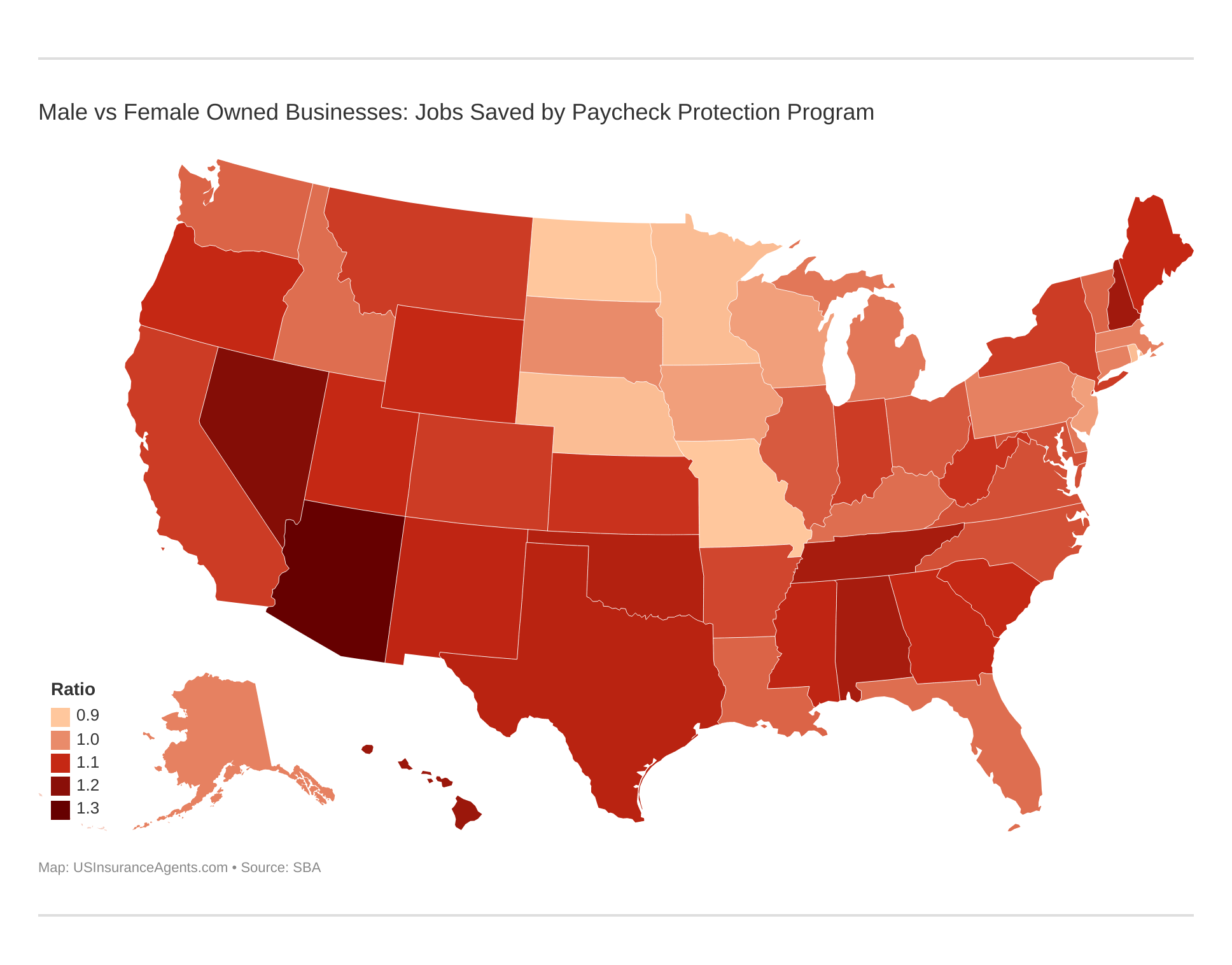

As with the graph at the top of this article, we’ve prepared two more interactive graphs — one in this section, one in the next section.

The interactive graph below shows each state by its ratio of the average number of jobs saved comparing male- and female-owned businesses. Most of the worst states for jobs saved comparing male- and female-owned businesses are in the West.

The darker the red, the worse the state was for that statistic. Hover your cursor over a state or press your finger down on a state if you’re on mobile to see that state’s statistics.

While the West has the worst states for this statistic, the South also has a number of states that are among the worst. The Northeast does as well. It is just the remaining region that fares well overall.

The states where this ratio is the best are predominantly in the Midwest, which, as we’ve seen, has five of the 10 best states for PPP assistance to women-owned businesses.

Those are all 50 states for that graph. The next section has another 50-state graph as well. For that graph, we’re looking at the ratio of average loans given to male- and female-owned businesses and which states were better or worse for allocating those resources to female-owned businesses.

Paycheck Protection Program Impact on Women-Owned Businesses

The Paycheck Protection Program was part of the CARES Act and allocated over $600 billion to small business owners who faced dwindling revenue and decreased sales due to stay-at-home orders all around the country.

Given that two rounds of PPP funding have passed, the question some are starting to ask is, “How did women business owners fare when it came to securing a PPP loan compared to their male counterparts?”

This issue of opportunity and resources between women and men has been a debate for quite some time, with advocates pushing to help women gain access to predominantly male industries like science or technology.

It is important that parents and teachers make a point of fostering the natural interest girls have in Science, Technology, Engineering, and Mathematics (STEM) early on.

Take the famous Chinese American experimental physicist’s word for it:

“It is shameful that there are so few women in science…There is a misconception in America that women scientists are all dowdy spinsters. This is the fault of men.” – Chien-Shiung Wu

According to some, female business owners fared worse than male business owners due to male business owners having existing relationships with banks. These pre-existing relationships led banks to approve male business owners quicker, limiting the chances of female business owners.

Women business owners were less likely to apply than men business owners due to hurdles such as not having prior relationships with banks or the legal requirements for PPP loans not being made clear to them.

The female business owners that actually applied fared better than the average business owner. But even with that increased success rate, their loans were smaller than those of the average business owner.

This led many advocates and legal experts to push Congress to adopt measures to protect women business owners and push more of the PPP’s resources their way rather than toward male business owners.

In the video above, CNBC covers the impact of the coronavirus pandemic not solely on female entrepreneurs but on female workers as a whole.

Within this issue, female workers may have to decide between their careers and their families, which could create economic distress that burdens female workers and business owners for years to come.

For female workers, some might be thrust back into dangerous health situations due to public policy and initiatives from groups that are predominantly male. Female teachers, for instance, are faced with the decision to give up their career or risk contracting the coronavirus.

Some U.S. school districts are more ready to handle the COVID pandemic than others, which may impact the spread of the virus within schools.

When it comes to women entrepreneurs, the economic distress on females was not helped by issues within the PPP and the indirect impact the program had on reducing the number of loans women business owners received.

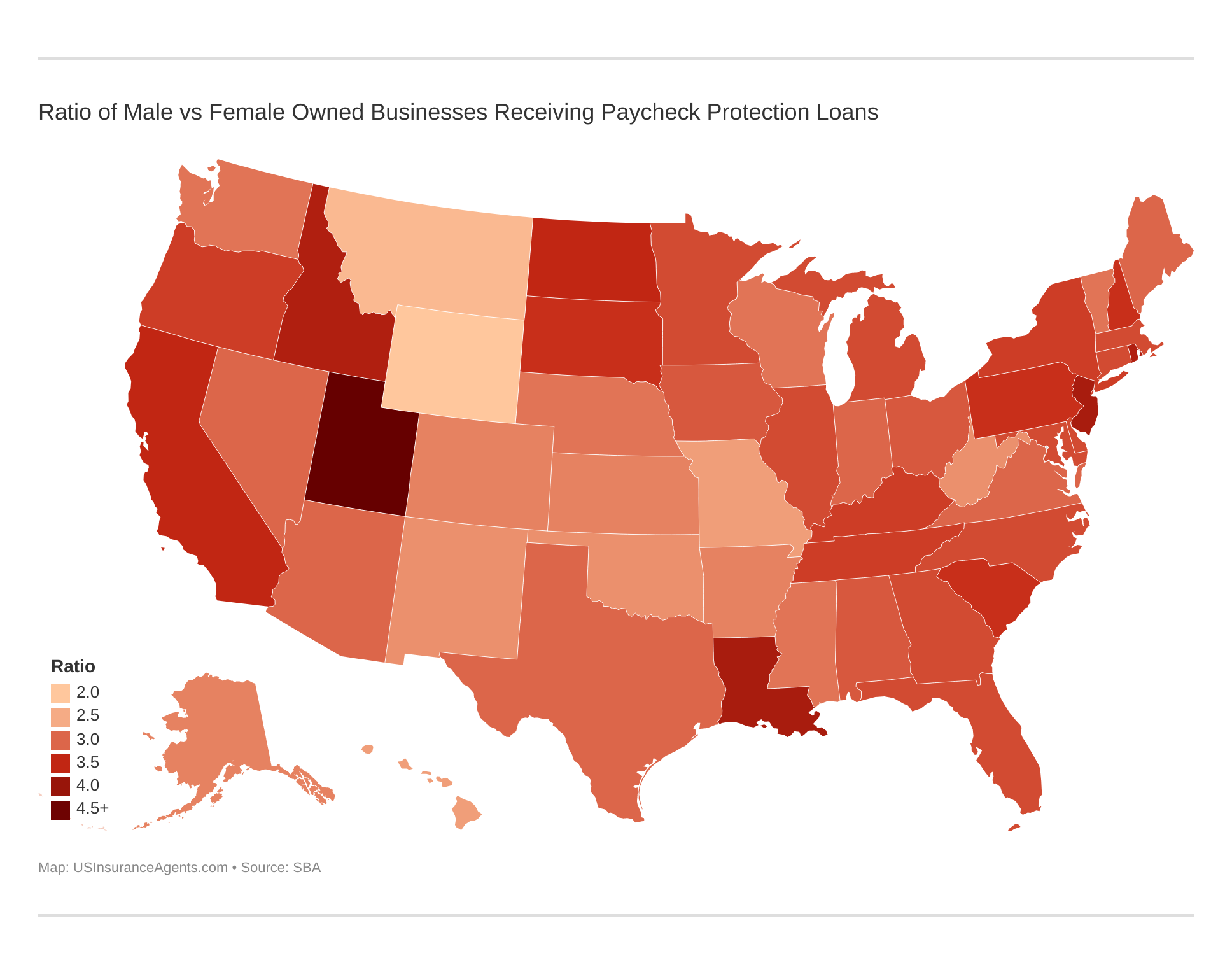

The following interactive graphic shows the ratio of male- to female-owned businesses that received PPP loans for all 50 states. The darker the red, the worse the state was in that ratio compared to other states.

The worst states for this statistic are spread out all around the country with the worst state — Utah — being in the West. Across the board, however, female business owners received fewer PPP loans than male business owners.

One of the issues that affected how many PPP loans female business owners received had to do with the big banks prioritizing male business owners for PPP loans.

While part of this had to do with male business owners having existing relationships with banks, female business owners were still denied more PPP loans compared to their approval rate at other lenders.

One step women business owners can take to mitigate this is to seek out alternative sources of funding other than those from big banks like fintech companies or credit unions.

As of now, it appears that the PPP still has money available, according to the Small Business Administration.

That implies that although the first round of PPP funding was tough on women business owners, it may have gotten better, as most companies who needed PPP funding have likely already received it.

The organization that is perhaps most adept at tracking information about the PPP loans and women-owned businesses in general is the Small Business Administration (SBA).

Data from the SBA shows that there are women-owned business benefits, including, as we’ve seen, an ability for a female business owner to get approved at a higher rate for a PPP loan than other business owners.

A look at the WOSB NAICS codes shows that female business owners, while perhaps being tilted towards specific industries, have an incredibly wide variety of companies in a multitude of industries in America.

On its website, the SBA has a WOSB directory that lists women-owned businesses and promotes funding opportunities at SBA women’s business centers.

If you’re a woman business owner, it may help to read material that keeps the positivity alive and see just how far women have come in America. To that end, we have an article that celebrates women’s rights milestones in the United States.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

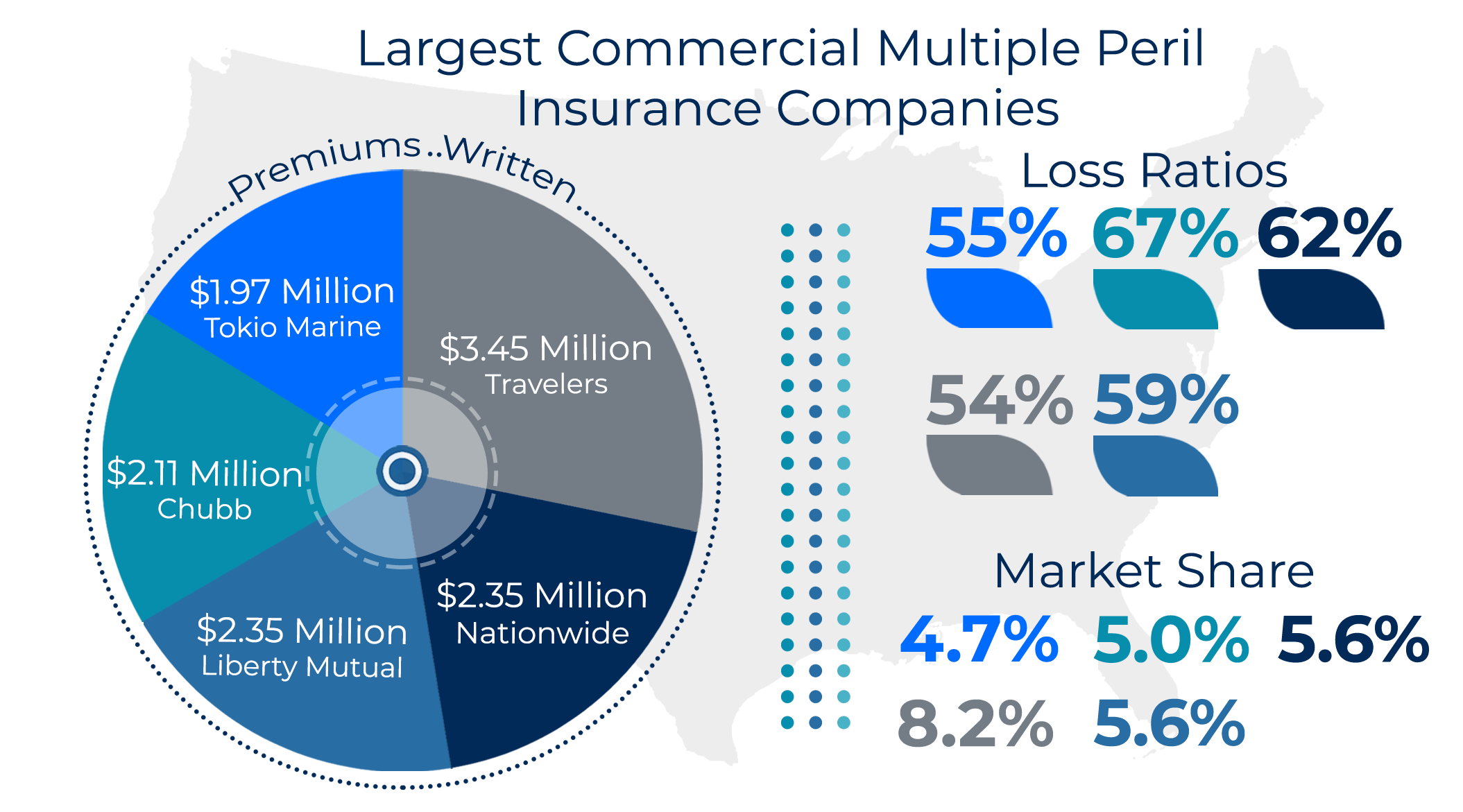

Commercial Insurance for Small Businesses

One of the challenges small business owners, whether men or women, have faced deals with insurance coverage during the coronavirus pandemic.

Most business owners are likely to have insurance protection from numerous business hazards. This includes protections from worker’s compensation, property damage, and lost wages protection.

These often are bundled under a general type of commercial insurance called “commercial multiple peril” insurance.

This commercial multiple peril insurance allows business owners to pick and choose which insurances they want, which may be specific to their situation.

If you’re a small business owner needing commercial insurance, check out our business insurance page which provides resources for business owners about different types of business insurance.

COVID-19 has put a test on these types of insurances. Although insurance companies have been refusing to pay business owners lost wages as a result of the stay-at-home orders, commercial multiple peril insurance still can cover issues like those we mentioned above.

The top five commercial multiple peril insurance companies in the United States are a mixture of foreign insurance companies and major U.S. insurance companies.

They are listed in the graphic below with their market shares, loss ratios, and premiums written.

These companies are considered the best due to their average costs of premiums, customer service, and stability of the company.

For a small business owner, male or female, commercial insurance can be helpful in navigating the “new normal” and protecting themselves from liability issues or property damage.

Commercial insurance goes hand-in-hand with new business owners as well, including those looking for small business loans for startups. These insurance policies are different than PPP loans, though, as they typically are not forgivable.

Regardless of loans you apply for, always remember that insurance plays a key role in protecting a business owner from professional and often even personal financial damage.

And, whether you’re a long-time business owner or just starting out, there are certain things that every business owner should know about commercial insurance, including some of the types, what incidents are covered, and specialized insurance for certain industries.

How the Paycheck Protection Program Loans Prioritized Men’s Over Women’s Businesses

We’ve gone through the 10 best states and 10 worst states for PPP assistance to women-owned businesses. Now, let’s hear from the experts. They are finance specialists, female business owners, and one leader of the National Women’s Business Council.

How did the PPP benefit male-owned businesses more than women-owned businesses? Let’s find out.

What challenges have women-owned businesses faced during the

coronavirus pandemic more than male-owned businesses?

“When you’re a black woman, no one really expects you to own anything, and with the influx of racism amidst the skeletal workforce in some government offices, it gets a little more difficult to run errands nowadays, whether or not it’s a business matter.

Also, being a black woman in the industry makes doing business more difficult because we are not allowed to get some loans, which is why we cannot just shift online.”

Do you believe that the PPP loan process benefits male-owned

businesses more than female-owned?

“Yes. I know a lot of women entrepreneurs who applied and had the same experience of being passed over throughout the process, leaving them unable to maximize the PPP advantage.

Some of my friends also shared instances where their approved loans are less than the national average despite proof that their businesses are better investments.

While there are cases where only the minimal loan was allowed, there are cases too when female-owned businesses did not even get the chance to step foot at the doorstep of PPP loans.”

Does being a woman business owner benefit or hurt you during the

coronavirus pandemic?

“I would say it hurt me during the course of this pandemic because I have to juggle far more difficult responsibilities, with the business, my work, and my kids as well.

Add the anxiety brought about by contracting the virus, and it feels more overwhelming for moms to handle all of these issues.”

Will the coronavirus pandemic impact the number of women

starting businesses and if so, why?

“Again, moms who are also business owners and employees are the ones having most of a hard time juggling all the emotional anxiety and responsibilities accompanied fulfilling these roles.

This all is amplified for women just starting out as entrepreneurs. The pressure is doubled, sometimes even tripled, with risks of what would happen in case it does not work out.”

As a woman business owner, why did you apply for a PPP loan and

what have you spent or plan to spend the money on?

“I am still waiting for the feedback on my application; however, I plan to spend it on adopting software to transition our business online and also help with compensating employees who have to be laid off.”

Alicia Hough is a corporate wellness expert at The Product Analyst.

She also owns a pastry business in her hometown of Tennessee.

“When the PPP was announced, I had no intention to apply. I saw many other businesses that had it worse than I did — restaurants, shops, and other nonessential businesses forced to close due to local mandates.

While the majority of my business relationships in the past have been face-to-face, I was able to move some of my services online and cut costs significantly.

To be honest, I applied for the PPP because a male entrepreneur friend encouraged me to put in an application. His point was clear and one I had not thought of: The PPP was intended for all small businesses — even those that could move their operations virtually.

The economic crisis caused by the coronavirus pandemic would likely cascade to every industry, even though the impact was felt immediately to those industries that physically had to shut down.

I am not sure that I would generalize to all women, but I can certainly say the emphasis on the limited nature of the PPP may have caused fewer women to apply, and the disparate impact may have been that fewer women-owned businesses would have received those funds.

I was glad I took his advice. I received funding and it has been a valuable resource as my business was eventually impacted by cost-cutting and the uncertainty in the market. All of my money has gone to paying for virtual upgrades and covering regular expenses as my revenue has slowed.

From my personal experience, it seems that women are more likely to have a scarcity mindset (i.e., if I take it, someone else cannot have it).

Women tend to be more cautious with risk statistically, so I certainly believe the pandemic may pose a high risk to those seeking to open a business.

While this is a broad generalization, my own story reinforced my realization that even after three years of self-employment I still have room to improve on advocating for my business and having an abundance mindset.”

Jessica Prater, owner of J. Prater Consulting, specializes in HR and talent development.

She is also a professor of social psychology at Middle Tennessee State University.

What challenges have women-owned businesses faced during the coronavirus pandemic more than male-owned businesses?

“Many of the types of businesses across America — personal care, mental health, professional development, personal improvement coaching — were all deemed non-essential during COVID-19 restrictions.

Hair salons, nail salons, Mom-n-Pop (non-chain/franchised) restaurants, body waxing centers, hand-made crafts, jewelry, art galleries, and museums, are all businesses that employ and/or are owned by women and which were disproportionately mandated to be closed for weeks upon weeks upon weeks.

Read more: Best Business Insurance for Art Galleries

Businesses that are predominantly male-dominated for employees and owners — autobody, auto mechanic, liquor stores, franchised/chain restaurants, pharmacies, medical practices, dental practices — were all permitted to remain open for business, despite COVID-19.”

Will the coronavirus pandemic impact the number of women starting businesses and if so, why?

“I suspect that the severe mental and emotional crisis we’ve been facing for so many months, in addition to the economic crisis, will actually trigger people — both men and women — to seek a new way of making a living.

I believe there will be a surge in self-employment as people choose to live a purposeful life with meaning, choosing a career that motivates us instead of obligating us.

I think an increased number of people will start their own business to afford a lifestyle that balances — with equal importance — work interests and demands with personal interests and demands.

I also believe that these triggers will cause women who have always been contemplating starting their own company to push past any fears that were stopping them.

With the entire world coming to a halt, people increasingly demonstrated the mentality ‘What have I got to lose now?’ This is the required mentality that sparks a person to push past their fears and take action to make it happen.”

Did you apply for a PPP loan? If so, what have you spent or plan to spend the money on?

“Yes, I did, and in order for the loan to be 100 percent forgiven, you must spend the money on the payroll of employees, business utilities, business rent, or mortgage interest.

Sadly, the amount of the loan amounted to enough to only cover two months’ worth of my salary and rent; however, I wanted to not have to repay the loan, and so that is what I spent the money on.

Although from February-June, my clientele paused their pursuit of providing leadership coaching as well as leadership training courses in person, business is picking back up with requests for online learning opportunities.”

Amy Beaulieu owns 3 Shoes Inc., a professional development training company.

Amy is a leadership facilitator, learning designer, and business coach.

“The PPP Loan program is designed to offer loans up to 2.5 times the borrower’s average monthly payroll in 2019. Since women (and minority) owned businesses tend to be smaller in general and have fewer employees this means that they will be eligible for smaller loans.

This is further compounded by the gender pay gap, which is currently estimated at a little over 80 percent. PPP Loan amounts will be proportionally less for women business owners because women earn less than men for the same work.

The mechanics of the loan submission process also work against women- and minority-owned businesses. Borrowers are required to apply for a loan through a bank. Most major banks prioritized loans for existing customers and bigger customers first.

Since women-owned businesses tend to be smaller and under-banked, this impacted women-owned businesses’ ability to secure loans.

During the early days of the PPP program, this was a major source of stress for women-owned business owners.

Most women business owners who were eligible for an (albeit smaller) loan were eventually able to secure one as the PPP program was eventually extended and appropriated funds weren’t completely used.

The PPP loan program is now closed to new applications. And the loan forgiveness process hasn’t really started yet, so it remains to be seen what the loan forgiveness rate will be for women- and minority-owned businesses relative to the overall forgiveness rate.

Business owners are bringing lawsuits against individual banks and the SBA claiming the process is discriminatory, while many believe that despite the PPP loan process being difficult to administer and flawed, it does not discriminate against women-owned businesses.”

Scott Ackerman is a remote CFO specializing in small businesses and startups.

He has advised multiple clients on navigating the PPP loan processes.

What is a paycheck protection program?

“There are many popular cars on the market that are worth more used than new. In this post, we’ll take a look at some of the most expensive used cars and how much they can be worth.

A paycheck protection program is a type of insurance policy that helps protect employees from losing their income in the event that they are unable to work due to an illness, injury, or other unforeseen circumstance.

Paycheck protection policies can provide up to $250,000 in coverage, which can be extremely helpful in times of need.”

What are the benefits of a paycheck protection program?

“A paycheck protection program is a great way to protect your money if you find yourself unemployed.

These programs allow you to set up a savings or investment account that will be used to pay your monthly bills if you are unable to work due to unemployment. This can help you avoid getting into debt and keep your family safe financially in tough times.”

How does a paycheck protection program work?

“A paycheck protection program is a great way to keep your finances safe in the event that you are unable to work due to an injury or illness.

The program helps you set up a savings account that will automatically withdraw money from your paycheck each month. This way, you will always have some money available to cover unexpected expenses.

A paycheck protection program is a service that helps employees protect their money when they work outside the home.

There are many different types of paycheck protection programs, but they all have the same goal: to help employees keep their money when they work outside the home. The best paycheck protection program for you will depend on your needs and budget.”

Emma Collins is the co-founder of Safe Trade Binary Options.

Their company provides guides on forex, cryptocurrencies, and trading.

What is a paycheck protection program?

“A paycheck protection program is a service offered by some businesses that allow their employees to access their funds if they are unable to work due to an emergency.

It can be tough enough to manage your money without worrying about a major financial shortfall. That’s why it’s important to have a paycheck protection program in place. This type of program helps protect you from losing your income if you are unable to work due to a temporary illness, injury, or layoff.

In some cases, the program will even cover salary missed because of pregnancy or childbirth. Paycheck protection programs can provide peace of mind in times of need, which is why it is important to investigate the options available to you.”

How does a paycheck protection program work?

“A paycheck protection program is a type of insurance that helps to ensure that employees receive their wages if they are unable to work due to an illness, injury, or other unforeseen circumstance.

Typically, these programs provide coverage for a set period of time following an employee’s return to work, and may also include provisions for income replacement. In addition, many programs offer additional benefits such as accident insurance and extended health coverage.

By providing protection for employees during times when they may be unable to earn a living wage, paycheck protection programs help to ensure that families have the resources they need to weather difficult financial times. Many programs are also affordable and easy to use, making them an ideal solution for businesses of all sizes.”

What types of emergencies are covered by a paycheck protection program?

“A paycheck protection program can help you protect your income in the event of an emergency. These programs can cover a variety of emergencies, including:

- Death of a spouse or partner

- Job loss

- Financial hardship caused by a natural disaster or recession

Some programs also offer coverage for medical expenses and other costs related to an emergency. To find out if a paycheck protection program is right for you, talk to your employer or consult a financial advisor.

A paycheck protection program is a great way to protect your employees’ funds in case of an emergency.”

Vlad Mishkin is the founder of WebScraping.Ai.

He has experience running a business during turbulent economic times.

What are the different types of paycheck protection programs?

“There are a few types of paycheck protection programs available to employees. Some are offered by employers as part of their benefits package, while others are offered individually by insurance companies or banks. All of these programs work in the same way, they protect the employee’s income if they become unable to work due to a medical issue or other unforeseen circumstances.

The most common types of programs include medical leave insurance and disability insurance. Medical leave insurance pays an employee their full salary while on leave, and disability insurance protects against unemployment if an employee is unable to work due to a permanent disability.

These programs can be expensive to purchase, so many employers offer them as part of their benefits package.

Other paycheck protection programs include accidental death and dismemberment insurance, job protection insurance, and workers’ compensation coverage.

Accidental death and dismemberment insurance pays out a set amount if someone is killed or injured at work, while job protection Insurance pays out a set amount if an employee is fired or laid off for reasons unrelated to their job performance.

Workers’ compensation coverage provides financial assistance if an employee is injured at work and cannot return.”

How do I choose the right paycheck protection program?

“When it comes to protecting your income, there are a variety of different options available. Some people use a paycheck protection program, while others may choose to put money into a savings account or invest in stocks. Choosing the right option for you is important, as the wrong one could result in lost income.

Many factors should be considered when choosing a paycheck protection program. These include the amount of money you need to protect, the type of protection program offered, and the associated fees.

It is also important to understand what will happen if your employer terminates your service before your leave expires. Before signing up for any protection program, it is important to read the terms and conditions carefully.

A paycheck protection program is a great way to protect your money in an emergency. There are many different types of paycheck protection programs available. You should choose the right program for you.”

Asako Ito is the founder of DivineLashes.ca.

They provide eyelash extensions and other salon services.

What is a paycheck protection program?

“When starting a business, it is important to protect your paycheck. It would be best if you considered setting up a paycheck protection program for female business owners.

A paycheck protection program is a service that can help female business owners protect their income in the event of an unforeseen event, such as a job loss. These programs offer a variety of benefits, including the ability to set up a direct deposit and receive funds immediately, reimbursement for missed work, and assistance with filing for unemployment.

In addition, these programs can provide peace of mind during times of stress and help businesses attract new talent.”

Why should I set one up?

“A paycheck protection program can be a valuable safeguard for business owners who rely on their income. There are many reasons why establishing a program may be beneficial for your business.

First, a program can help you maintain control over your finances in the event of an unexpected loss of income. If something were to happen that disrupts your regular paycheck, having a protection plan in place would help ensure that you still have enough money to cover basic needs.

Second, a payday protection plan can also help protect your credit score if you ever need to borrow money in the future. By having an established backup plan in place, you will show lenders that you are capable of meeting important financial obligations.

Finally, setting up a payday protection plan can act as an insurance policy for your business. If something catastrophic were to happen and you lost all of your revenue, for example, having a protective measure in place could help cushion the blow and prevent a total shutdown of your business.”

John Burton is the CEO of EntrepreneursTutor.com.

His site provides advice on investing and business finance.

How do I choose the right program?

“When starting or running a business, protecting yourself and your assets is important. One way to do this is through a paycheck protection program. There are a number of different programs available, so it is important to choose the right one for you.

Some factors to consider may include the duration of the program, the amount of coverage provided, and the company’s reputation. Once you have selected a program, ensure you understand the terms and conditions. This will help protect your rights and ensure you are fully protected in an emergency.”

What are the benefits of setting up a paycheck protection program for female business owners?

“A paycheck protection program can be a valuable tool for female business owners. Here are some of the benefits:

- Ensures a regular source of income in case of an unexpected layoff or illness.

- Provides financial stability in case of a divorce or other legal issues.

- Prevents money from being stolen or misused by an unauthorized person(s).

- Provides peace of mind during challenging times.

A paycheck protection program can provide peace of mind for female business owners. Considering all of the potential disasters that could happen due to loss of income for your business, taking extra precautions will help provide a little peace of mind to you and your employees.”

How can I use my paycheck protection program to protect my income?

“When a business is in danger of closing down, making ends meet cannot be easy. A paycheck protection program can help prevent this by providing a backup income if the business does not reopen.

Programs vary in terms of how much money they offer, but all offer some form of financial protection. Business owners should research their options carefully before selecting one, as there are many to choose from.”

André Disselkamp is the CEO of Finsurancy.com.

His company provides financial business consulting.

What is the Paycheck Protection Program for female business owners?

“The Paycheck Protection Program for female business owners is offered by the American Express Card Company that helps protect female business owners from losing their jobs due to missed paychecks.

The program provides several benefits, including access to emergency financial assistance and reimbursement of lost wages. In addition, the program provides education and support resources to help female business owners protect their careers.”

How does the Paycheck Protection Program for female business owners work?

“The Paycheck Protection Program for female business owners provides female business owners with the peace of mind that their wages will be protected in a personal or business emergency.

This program allows female business owners to set up a trust account that will automatically pay their wages directly from the account should they be unable to work due to illness, injury, or other unexpected circumstances. This program is available as a standalone service or as an insurance package.”

What are the common money mistakes that female business owners make?

“The common money mistakes that female business owners make can include not setting aside enough money each month, not having a solid budget, and not being able to pay bills on time.”

What types of emergencies are covered by a Paycheck Protection Program?

“A Paycheck Protection Program is a legal mechanism that allows employees to receive their wages in case of an emergency. This could include situations such as being unable to work due to illness or injury, being fired, or experiencing other unexpected financial hardships.

The program can provide employees with up to three months’ worth of wages to help them cover their costs while they cannot work. There are a variety of different programs available, so it is important to research the specifics of the one that is right for you.

Some programs also offer additional benefits, such as accidental death and dismemberment insurance, which can provide some peace of mind in difficult times.”

Lily Wili is the CEO of Ever Wallpaper.

Her company designs custom mural wallpaper.

What challenges have women–owned businesses faced during the coronavirus pandemic more than male–owned businesses?

“According to a study by the National Women’s Law Center (NWLC), women–owned businesses have faced a number of challenges during the coronavirus pandemic more than male–owned businesses.

For example, female entrepreneurs are more likely than male entrepreneurs to lack access to capital and insurance, which can make it difficult to survive during a pandemic. In addition, women are often responsible for family responsibilities and may be less able to take time off from work.

As a result, they may be less likely than men to invest in preparedness measures or take steps necessary for business survival in the event of a pandemic. Although there is still much we don’t know about the coronavirus pandemic, understanding how women–owned businesses are faring can help us identify areas where we can support them.

NWLC has suggested policies that could help female entrepreneurs, such as providing access to capital and insurance, developing workplace policies that promote creativity and flexibility, and creating public awareness around the importance of female entrepreneurship.”

Do you believe the PPP loan process benefits male–owned businesses more than female–owned ones?

“PPP loans are designed to help businesses of all sizes, but there is evidence that the process benefits male–owned businesses more than female–owned businesses. One study found that women–owned businesses received less favorable terms and had a more challenging time securing PPP loans than male–owned businesses.

In addition, women are more likely to use their own money to finance their businesses rather than rely on outside sources of financing, which can limit their access to PPP loans. These factors may make it harder for female–owned businesses to access PPP loans and benefit male–owned businesses over female–owned businesses.”

Rita Farruggia is the CEO of HappyBeingWell.com.

Her company provides self-care products and health guides.

What challenges have women-owned businesses faced during the coronavirus pandemic more than male-owned businesses?

“I have found that women have been less likely to pursue PPP loans and the EIDL (Economic Injury Disaster Loan) or to pursue as large amounts as men.

It’s the same thinking that stops some women from going for the top spots in companies (ignoring sexism, for a moment) or from growing large businesses. This lack of or reduced emergency capital causes HUGE issues and challenges.”

Do you believe that the PPP loan process benefits male-owned businesses more than female-owned?

“Not directly. But indirectly, yes.

More males have banking relationships or will reach out to a banker to get the relationship needed to get the loan.

In this PPP process, especially the first month to six weeks, you needed to have a banking relationship with a community bank or be a larger small business (i.e., $10 million in revenues and up) at a national bank to get attention and get your loan processed.

Banks were so swamped and the rules were in flux so they, wrongly or rightly, prioritized, which favored male-owned businesses.

I stress the need for a relationship with a business banker, who is typically a VP or above or the equivalent, and here was where that need strongly played out.

Also, women-owned businesses tend to be smaller. It was even more confusing for those women who had no employees and so fell under the self-employed classification.”

Does being a woman business owner benefit or hurt you during the coronavirus pandemic?

“For me personally, I believe it was neutral. But I provide a service that firms need to help them navigate crises like this and have a finance degree and banking relationships.”

Will the coronavirus pandemic impact the number of women starting businesses and if so, why?

“Yes. I think the number will increase. Necessity is the mother of invention.

The same way that more women of color and women overall started businesses at a higher rate during the last recession, women who have lost their retail jobs or been downsized elsewhere will do the same so that they can support themselves and their families.”

Did you apply for a PPP loan? If so, what have you spent or plan to spend the money on?

“Yes. I spent the money on wages.”

Tiffany C. Wright is a published author and serial entrepreneur.

Her firm, The Resourceful CEO, helps B2B companies generate higher profits & freedom.

What challenges have women-owned businesses faced during the coronavirus pandemic more than male-owned businesses?

“According to the latest Annual Business Survey published in May by the U.S. Census Bureau, women owned 1.1 million employer firms.

Of those 1.1 million firms, 45 percent were in the health care and social assistance industry (16.9 percent or 192,159), professional, scientific, and technical services (16.4 percent or 185,649), and retail trade industry (11.7 percent or 132,894).

We all have witnessed the devastating effect of the pandemic —imposed closures on companies in our own communities — from closures of child day care centers to retail stores.

Whether home-based businesses or brick and mortar businesses, many are still shuttered — and shattered.

Compounding this, 90 percent of all women-owned businesses are sole proprietors. For many of these solopreneurs, business ground to a complete and swift halt — permanently. Without a backup person to help financially or through their hands-on resources, months of being closed without customers have sadly led to a permanent ‘out of business’ sign.”

Do you believe that the PPP loan process benefits male-owned businesses more than female-owned?

“The process itself was fairly simple and straightforward regardless of your gender. However, women-owned businesses could have faced obstacles in applying for the loan if they lacked the required financial documents.

As the National Women’s Business Council crisscrossed the country last year hosting roundtables with women business owners, we learned about the widespread lack of financial literacy in general. So, at NWBC, we do have some concerns but lack the data to actually know how female-owned applications fared compared to male-owned firms.

NWBC is currently working on this financial literacy problem among female founders, I’m happy to report as the chair, and we plan to offer recommendations to SBA and other agencies later this year to remedy it.

In addition, we are in active communications with members of Congress as well as SBA on the need to obtain this gender-related data related to PPP loans.

A woman business owner may have missed the window of opportunity to apply for a PPP loan since time was of the essence. This includes if a women-owned business lacked those necessary financial documents from the onset.

However, the second round of PPP funding provided that important second chance at-bat. As chair of NWBC, I actively communicated with SBA officials and the administrator about the unique business needs of these very, very small women business owners to ensure they got equal access to these emergency funds in that second cycle.

We were pleased when $60 billion was set aside for small lenders to administer loans. Small businesses tend to bank with small lenders.”

Does being a woman business owner benefit or hurt you during the coronavirus pandemic?

“My gender has had zero impact on my business during this time. My company, a marketing strategy firm to technology companies, has done very well during the pandemic simply because of my focus on them.

Since tech companies have thrived due to a swift widespread adoption of all types of technology, my business has fortunately followed suit. So, it has nothing to do with my being a woman and everything to do with the target market I serve.”

Will the coronavirus pandemic impact the number of women starting businesses and if so, why?

“Necessity is truly the mother of invention. And women are very entrepreneurial, especially millennial women. NWBC published a research report on the profile of millennial women, available on the council’s website.

By 2025, millennials will comprise 75 percent of the workforce, and many will become entrepreneurs. Millennial women are more racially and ethnically diverse than prior generations of entrepreneurial women, they are the most educated generation to date, and their participation in entrepreneurship courses has been growing significantly.

Interestingly, women entrepreneurs are more likely to be married and have children than non-entrepreneur women. So, perhaps if the pandemic closes one door of employment for women, it opens the entrepreneurial door for women to enter.

I personally hope more women continue to take their entrepreneurial aspirations to actuality. Women-owned businesses constitute 42 percent of all businesses today. Let’s get to 50 percent and beyond!”

Liz Sara is chair of the National Women’s Business Council and CEO of Best Marketing LLC.

NWBC is the only independent federal advisory committee for the 13 million U.S. women-owned businesses.

Methodology: PPP Assistance for Male vs Female Run Companies

To achieve our ranking of the 10 best states for PPP assistance to women-owned businesses and the 10 worst states for the same category, we looked at the U.S. Small Business Administration’s information regarding individual loans for all 50 states.

We looked at three specific categories:

- The ratio of male-owned businesses that received loans compared to women-owned businesses

- The difference between the average loan to male-owned businesses compared to women-owned businesses

- The average jobs saved from male-owned businesses compared to women-owned businesses

To calculate these numbers, we looked at total numbers for men and women-owned businesses within a state, then either averaged them (the ratio and average jobs categories) or subtracted them (the difference category).

Overall, 3,548,608 individual data points were analyzed. Those millions of data points included 214,237 women-owned businesses and 672,915 male-owned businesses and the four categories we looked at.

Though we didn’t include these in our analysis, the dataset from the SBA that we looked at included WOSB NAICS codes

We also looked at the National Association of Insurance Commissioners for data about the top five commercial multiple peril insurance companies. And for information about the different types of PPP loan lenders, we turned to the U.S. Treasury.

Lastly, if you’re a female business owner and are looking for a little inspiration when managing your business, check out our article featuring quotes from extraordinary women in the U.S.

Get inspiration from the astronaut, doctor, and a STEM icon for women and girls, Mae Jemison. Mae was the first African American woman to go into space.

“Don’t let anyone rob you of your imagination, your creativity, or your curiosity. It’s your place in the world; it’s your life. Go on and do all you can with it and make it the life you want to live.” – Mae

She and countless other strong, determined women have changed the “norm” in our country. Keep it going.

References:

Frequently Asked Questions

Are there specific benefits for female business owners under the Paycheck Protection Program?

Female business owners can benefit from the PPP in the same way as male business owners. However, there are specific efforts by the government and some lenders to reach out to female business owners and make sure they are aware of the program and how to apply.

How much funding can female business owners receive under the Paycheck Protection Program?

Eligible businesses can receive up to 2.5 times their monthly payroll costs, up to a maximum loan amount of $10 million.

How do I apply for the Paycheck Protection Program?

You can apply for the PPP through participating lenders, such as banks or credit unions. You will need to submit an application and provide documentation of your payroll costs and other eligible expenses.

Can I use the Paycheck Protection Program to cover my own salary as a female business owner?

Yes, you can use the PPP to cover your own salary as a female business owner, as long as it is included in your payroll costs and meets certain eligibility requirements.

How do I apply for loan forgiveness under the Paycheck Protection Program?

You can apply for loan forgiveness through your lender after you have spent the PPP funds on eligible expenses within a specified time frame and provided documentation of those expenses.

What qualifies you for a PPP loan?

Any small business that has 500 or fewer employees is eligible for a Paycheck Protection Program loan. This runs the gamut from small businesses of different types (S-Corp, LLCs, etc.), private nonprofit groups, tribal groups, and veterans groups. It’s not just business owners who qualify for PPP loans, however.

Self-employed individuals and independent contractors can apply for PPP loans as well.

The PPP loan still needs to be used for payroll, mortgage payments, rent payments, and utilities. You might be able to spend it on women-owned office supplies for instance, but you may have to pay that money back.

Who is not eligible for PPP loans?

There are quite a few situations where a business owner wouldn’t be eligible for a PPP loan.

These include if the owner has committed or is under investigation for a crime, is a non-U.S. citizen owner of a business, owns a passive income business (like an apartment complex), owns a speculative business, or has a business as part of a pyramid scheme.

Are PPP loans still available?

Yes, there is still money left in the Paycheck Protection Program, which means that small businesses can still apply for and receive PPP loans. Some experts speculate that this remaining balance signifies that small businesses as a whole have received the support they needed to stay afloat.

Can you get approved for two PPP loans?

No, the general rule for PPP loans is that the owner of a business is only able to receive one — for that business. If a business owner owns more than one business, they can receive two loans or more, depending on how many businesses they have.

How do you get approved for a PPP loan?

The main issue for business owners getting approved for a PPP loan comes down to thoroughness and the type of lender they select.

The first thing a business owner will want to do is to calculate how much they are eligible for when it comes to a PPP loan.

Find out how much of your loan will be forgiven, based on what expenses you will use it for.