Northwestern Mutual vs. Mutual of Omaha Life Insurance in 2026 (Side-by-Side Review)

Term life policies from Northwestern Mutual cost $63/month and include dividend earnings for long-term value. Mutual of Omaha offers a $48/month term life with a no-medical exam option, ensuring quick, budget-friendly coverage. These key differences define Northwestern Mutual vs. Mutual of Omaha life insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated August 2025

0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

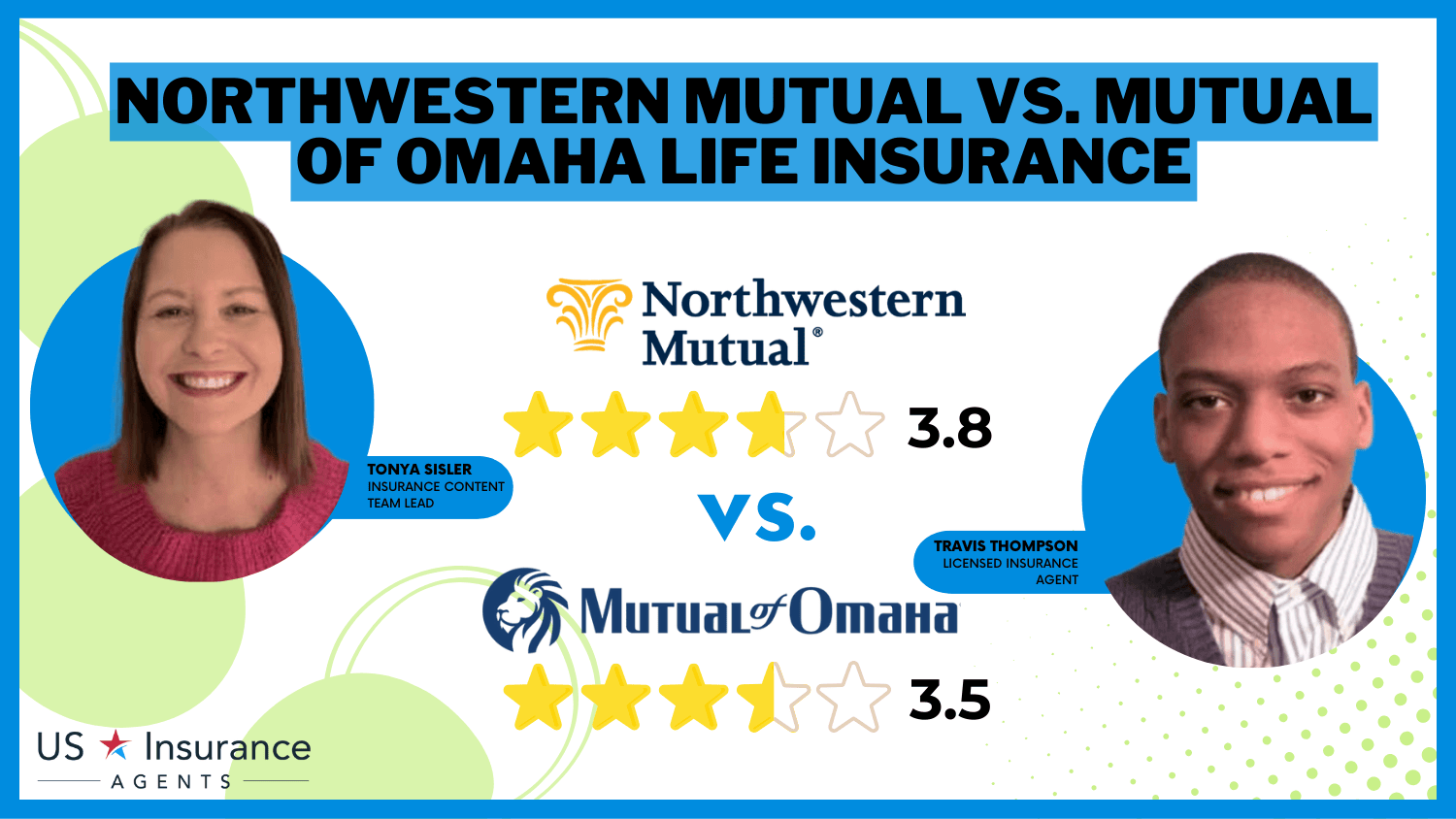

0 reviewsWith dividend earnings averaging 5% annually, Northwestern Mutual vs. Mutual of Omaha life insurance presents distinct advantages in coverage and accessibility.

Northwestern Mutual provides whole life insurance, ensuring long-term cash value growth. Mutual of Omaha offers term life insurance policies up to $1 million, including a no-medical exam option for applicants under 60. Both companies have top ratings from A.M. Best, proving their financial strength.

Northwestern Mutual vs. Mutual of Omaha Life Insurance

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.8 | 3.5 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.5 | 3.5 |

| Company Reputation | 4.0 | 4.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.8 | 3.7 |

| Customer Satisfaction | 2.5 | 2.5 |

| Digital Experience | 4.0 | 4.0 |

| Discounts Available | 5.0 | 2.0 |

| Insurance Cost | 3.0 | 3.1 |

| Plan Personalization | 3.5 | 3.0 |

| Policy Options | 4.5 | 3.5 |

| Savings Potential | 3.7 | 2.1 |

| Northwestern Mutual Review | Mutual of Omaha Review |

Northwestern Mutual lets policyholders borrow against their cash value, while Mutual of Omaha includes an accelerated death benefit at no extra cost.

Use our comparison tool to get the most economical policy that meets your demands if you’re searching for reasonably priced life insurance rates.

- Mutual of Omaha offers a term life of up to $1 million with no medical exam

- Northwestern Mutual provides a whole life with 5% average dividend earnings

- Compare Northwestern Mutual vs. Mutual of Omaha life insurance policies

Northwestern Mutual vs. Mutual of Omaha Premium Breakdown

Whole life insurance rates vary based on age and gender, influencing long-term affordability. The table below details how pricing shifts over time, helping policyholders make informed decisions.

Northwestern Mutual vs. Mutual of Omaha Whole Life Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age-16-Old Female | $220 | $210 |

| Age-16-Old Male | $230 | $220 |

| Age-30-Old Female | $180 | $175 |

| Age-30-Old Male | $185 | $180 |

| Age-45-Old Female | $165 | $160 |

| Age-45-Old Male | $170 | $165 |

| Age-60-Old Female | $155 | $150 |

| Age-60-Old Male | $160 | $155 |

At 16 years old, Northwestern Mutual charges $220 for females and $230 for males, while Mutual of Omaha offers $210 for females and $220 for males. By 30, rates decrease, with Northwestern Mutual at $180 for females and $185 for males, while Mutual of Omaha offers $175 for females and $180 for males.

At 45, premiums continue to drop, and by 60, the lowest rates appear. Females pay $155 with Northwestern Mutual and $150 with Mutual of Omaha, while males pay $160 and $155. These figures show that enrolling earlier can lead to significant long-term savings.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverage Options from Northwestern Mutual and Mutual of Omaha

Understanding the differences between Northwestern Mutual and Mutual of Omaha life insurance can help you choose the right policy. Both companies, considered among the best insurance companies, offer term, whole, universal, final expense, and no-medical-exam policies, but their features vary.

Term life insurance from both providers covers 10, 20, or 30 years with a guaranteed payout if the policyholder passes during the term. Whole life insurance offers lifelong coverage, fixed premiums, and cash value growth, but Northwestern Mutual’s policies also earn dividends, which can be used for premium reductions, withdrawals, or reinvestment.

Comparison of Life Insurance Coverages: Northwestern Mutual vs. Mutual of Omaha

| Coverage Type | ||

|---|---|---|

| Term | ✅ | ✅ |

| Whole | ✅ | ✅ |

| Universal | ✅ | ✅ |

| Final Expense | ✅ | ✅ |

| No-Medical-Exam | ✅ | ✅ |

Both companies offer adjustable coverage and flexible premiums for universal life insurance. Still, Mutual of Omaha’s AccumUL Answers guarantees a 2% interest rate on cash value accumulation, making it a predictable option for long-term planning. Final expense insurance, designed for funeral costs and small debts, is available from both.

However, Mutual of Omaha’s Guaranteed Whole Life offers $2,000–$25,000 with no medical exam, making it ideal for seniors. Both companies provide simplified underwriting for no-medical-exam life insurance, but Mutual of Omaha’s Term Life Express offers up to $300,000 without a medical exam, making it one of the most accessible options for quick approval.

Maximizing Life Insurance Discounts for Long-Term Savings

Life insurance discounts help lower premiums by rewarding good health, lifestyle choices, and employer benefits. Both Northwestern Mutual and Mutual of Omaha offer savings based on these factors, but the percentages vary.

Life Insurance Discount Options and Percentages: Northwestern Mutual vs. Mutual of Omaha

| Discount Type | ||

|---|---|---|

| Good Health | 25% | 22% |

| Employer-Sponsored | 20% | 18% |

| Non-Smoker | 10% | 12% |

| Healthy Lifestyle | 7% | 8% |

| Family History | 20% | 15% |

A good health discount applies to those with ideal BMI, no chronic conditions, and strong medical records, with Northwestern Mutual offering up to 25% off and Mutual of Omaha at 22%. Employer-sponsored discounts, at 20% for Northwestern Mutual and 18% for Mutual of Omaha, apply to policies obtained through workplace programs.

Non-smoker savings range from 10-12%, rewarding those who have been tobacco-free for at least 12 months, which applies across different types of life insurance. Healthy lifestyle discounts of 7-8% reward policyholders for exercise and preventive care. Lastly, family history discounts (20% at Northwestern Mutual, 15% at Mutual of Omaha) reward those with low genetic health risks.

Northwestern Mutual vs. Mutual of Omaha: Customer Satisfaction Breakdown

Selecting the best provider requires understanding consumer evaluations and insurance company ratings. The following table provides customer happiness, complaint volume, and financial strength information by breaking down essential ratings from J.D. Power, Consumer Reports, and A.M. Best.

Insurance Business Ratings & Consumer Reviews: Northwestern Mutual vs. Mutual of Omaha

| Agency | ||

|---|---|---|

| Score: 789 / 1,000 Lower-Than-Average Satisafaction | Score: 858 / 1,000 Above Avg. Satisfaction |

|

| Score: B+ Good Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 65 /100 Mixed Customer Feedback | Score: 80/100 Positive Customer Feedback |

|

| Score: 1.5 Avg. Complaints | Score: 0.90 Fewer Complaints Than Avg. |

|

| Score: B Marginal Financial Strength | Score: A Excellent Financial Strength |

J.D. Power insurance company rating scores indicate customer satisfaction, with Mutual of Omaha Insurance Company scoring 858 out of 1,000, reflecting above-average service, while Northwestern Mutual holds 789, signaling lower-than-average satisfaction.

Consumer Reports ratings show an 80 out of 100 for Mutual of Omaha, indicating strong consumer approval, whereas Northwestern Mutual Investment Services, LLC scores 65, suggesting mixed feedback.

The average number of complaints received by Mutual of Omaha is 0.90, far less than Northwestern Mutual’s 1.5 A.M. Northwestern Mutual has a B, indicating marginal strength. In contrast, United of Omaha Life Insurance Company has an A, indicating great financial health, according to A.M. Best. These findings demonstrate which business provides the best customer service and financial stability.

Mutual of Omaha takes 7% of the market, just ahead of Northwestern Mutual at 6%. That may not seem huge, but it shows both companies have strong customer trust. The remaining 87% is spread across other insurers, proving just how competitive the industry is.

Northwestern Mutual stands out for its whole-life policies with dividends, while Mutual of Omaha Insurance Company attracts customers with budget-friendly term life and no-medical-exam options. These numbers show why shopping around for the right policy is so important.

A Reddit member discussed their personal experience with Mutual of Omaha’s policies and customer service while offering their opinions on the company’s long-term care insurance. Reddit users state that they emphasize important elements like the speed at which claims are processed, the advantages of the insurance, and general happiness with Mutual of Omaha’s services.

Comment

byu/GSDBUZZ from discussion

inretirement

This kind of discussion on Reddit gives a real insight into what it’s like to have a policy with Mutual of Omaha. While everyone’s experience is different, checking out feedback from actual customers on Reddit can help you get a better idea of what to expect before choosing a life insurance provider.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Right Policy: Term, Whole, and Universal Life

The death benefit from a life insurance policy can replace income and cover expenses, protecting your loved ones financially. There are different types of policies to fit various needs. Mortgage life insurance vs. term life insurance is an important comparison to consider.

Term life insurance lasts for 10, 20, or 30 years and pays out if you pass away during that time, making it a great option for covering things like mortgages or childcare costs.

Jeff Root Licensed Insurance Agent

Long-term financial planning may benefit from whole life insurance since it offers lifetime coverage and gradually increases in value. Because universal life insurance has adjustable coverage and variable premiums, policyholders have greater control over their protection when their financial circumstances change.

Life insurance is a safety net for your family, helping cover funeral costs, debts, and everyday expenses so they don’t struggle financially. It also facilitates the transfer of assets and is essential to estate planning. Numerous policies offer tax advantages, such as tax-deferred cash value growth and income tax-free death benefits.

Northwestern Mutual: A Legacy of Financial Security and Stability

In 1857, Northwestern Mutual became a well-known brand in the life insurance industry. Companies like Northwestern Mutual focus on helping families plan for their financial future, and John C. Johnston founded this organization with that goal in mind. As a result of its solid financial status, it has been rated as one of the biggest and most stable mutual insurance firms in the United States.

Northwestern Mutual has been around for a long time and offers a wide variety of financial products and services, not limited to insurance. Expert guidance is available through the Investment Advisory Program to customers in the areas of wealth management, portfolio construction, and retirement planning. If you want a straightforward, expert way to build your money, it’s a great alternative.

For people thinking about income protection, the Disability Insurance Calculator is a helpful resource. Based on their income, expenses, and existing plans, it assists customers in determining the amount of coverage they require. Policyholders will be better equipped to handle unforeseen health problems that may affect their income in this way.

With a strong financial foundation and smart planning resources, Northwestern Mutual Wealth Management Company offers more than insurance—it helps people build a secure financial future.

While Northwestern Mutual is a top-rated provider, the Northwestern Mutual life insurance competitors include New York Life, MassMutual, and Guardian Life, which also offer whole life insurance with dividends and strong financial ratings.

Learn more: How to Cancel Your The Northwestern Mutual Life Insurance Company Life Insurance Policy

Mutual of Omaha: Reliable Life Insurance With Flexible Options

Since 1909, Mutual of Omaha, a reputable and customer-focused insurance company, has helped families protect their futures. Like Mutual of Omaha competitors such as Northwestern Mutual, its solid ratings from industry organizations show that it is reliable in helping policyholders.

Customers have a choice between term, whole, and universal life insurance plans from this provider, so they may find something that works for them. Types of term life insurance offered include Term Life Express, which provides up to $300,000 with no medical exam, and Term Life Answers, which starts at $100,000 and may require an exam.

Term life is an affordable way to get coverage for a period, while whole life builds cash value over time. If you need more flexibility, universal life lets you adjust your premiums and death benefits to match your changing financial situation.

As another way for the Mutual of Omaha Foundation to demonstrate its commitment to giving back, the company’s Matching Gift Program matches employee contributions to qualifying organizations dollar for dollar, up to a specific maximum.

Employees may double their impact on causes like healthcare, education, and community service through this initiative, showcasing the company’s commitment to doing more than just offering insurance.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Northwestern Mutual Life Insurance: Pros and Cons

Pros

- Dividend-Earning Whole Life Policies: Northwestern Mutual offers Whole Life One and Whole Life Plus, both featuring dividend earnings averaging 5% annually, ensuring long-term cash value growth.<

- Superior Financial Strength: An A++ rating from A.M. Best indicates exceptional financial stability and a strong claims-paying ability. To learn more, explore our Northwestern Mutual insurance review.

- High Universal Life Coverage: Custom UL policies start at $500,000, significantly higher than competitors, offering long-term financial security.

Cons

- Higher Minimum Coverage for Whole Life: Requires at least $50,000 in whole life coverage, whereas competitors like Mutual of Omaha offer lower minimums, making entry harder for some.

- No No-Medical-Exam Term Life: Unlike Mutual of Omaha’s Term Life Express, which offers up to $300,000 without a medical exam, Northwestern Mutual requires full underwriting for all term policies.

Mutual of Omaha Life Insurance: Pros and Cons

Pros

- Quick Approval with No-Medical-Exam Option: Term Life Express covers $25,000 to $300,000 without requiring a medical exam, making it a faster, more accessible option for applicants.

- Top-Tier Financial Strength: Backed by an A++ rating from A.M. Best, meaning strong financial stability and reliable claims payouts. To find out more, explore our Mutual of Omaha insurance review.

- High Universal Life Coverage Limits: Custom UL policies start at $500,000, making it a solid choice for those wanting larger, long-term coverage.

Cons

- Lower Financial Strength Rating: Rated A+ by A.M. Best, which, while strong, is lower than Northwestern Mutual’s A++, meaning slightly less long-term financial security.

- No Dividend-Earning Policies: Unlike Northwestern Mutual’s whole life plans, Mutual of Omaha does not provide dividend-earning options, limiting long-term cash value accumulation.

Finding the Best Life Insurance Policy for Your Needs

Understanding life insurance is key when comparing Northwestern Mutual vs. Mutual of Omaha life insurance, as the differences come down to coverage options and flexibility. Northwestern Mutual offers high-value universal life policies starting at $500,000, making it a great choice for those seeking substantial long-term coverage.

However, it lacks a no-medical-exam term life option, which Mutual of Omaha provides. Term Life Express from Mutual of Omaha covers up to $300,000 without a medical exam, making it perfect for a speedy and easy approval process.

Mutual of Omaha’s wide range of policy rider choices, which let policyholders personalize coverage with riders for chronic illnesses and accidental death, is a significant differentiation. Since insurance needs vary, comparing multiple life insurance companies online is the best way to find the right policy with the best rates and coverage for your situation.

Northwestern Mutual competitors, such as New York Life, MassMutual, and Guardian Life, also offer strong financial ratings and whole life insurance with dividend options. To save time and money, use our free tool to enter your ZIP code if you need life insurance coverage.

Frequently Asked Questions

Which is better for financial planning, Fidelity or Northwestern Mutual?

Fidelity is best for investment management, retirement accounts, and brokerage services, while Northwestern Mutual specializes in life insurance, financial planning, and wealth management through its Investment Advisory Program.

Does Mutual of Omaha renters insurance cover theft and natural disasters?

Yes, Mutual of Omaha renters insurance covers personal property loss due to theft, fire, smoke, and some natural disasters. It also provides liability protection starting at $100,000 for injuries or damages in your rental unit. It is considered one of the best renters insurance options for those seeking affordable coverage with strong financial backing.

Is Northwestern Mutual the best life insurance company?

Northwestern Mutual is highly rated for its A++ financial strength rating from A.M. Best, a 5% average dividend return on whole-life policies, and a strong reputation for long-term financial stability.

Should I choose Mutual of Omaha or United of Omaha for life insurance?

Choose Mutual of Omaha for a wider range of financial products. United of Omaha specializes in term and whole life insurance, including Term Life Express, with up to $300,000 no-medical-exam coverage. This makes it a strong option for those seeking no-medical-exam life insurance with quick approval.

What is the lawsuit against Northwestern Mutual?

Northwestern Mutual has faced lawsuits for alleged misrepresentation of policy benefits and sales practices. Still, it remains financially strong with an A++ rating and over $2 trillion of life insurance.

What is the 2-year rule for Mutual of Omaha life insurance?

The 2-year contestability period allows Mutual of Omaha to review claims for fraud or misrepresentation within the first two years, meaning a claim could be denied if false information was provided.

Is Mutual of Omaha a good life insurance company?

Yes, Mutual of Omaha is well-regarded for its Term Life Express, which offers up to $300,000 without a medical exam, and Guaranteed Whole Life coverage up to $25,000 for ages 45-85, with an A+ A.M. Best rating.

Why are advisors leaving Northwestern Mutual?

Some advisors leave Northwestern Mutual due to its commission-based pay structure, aggressive sales quotas, and preference for fee-based financial planning outside the company’s product offerings.

What life insurance company pays the most claims?

Mutual companies like Northwestern Mutual and New York Life consistently pay high claim amounts, with Northwestern Mutual holding over $34 billion in policyholder benefits paid out annually.

What insurance company denies the most claims?

While denial rates vary, reports indicate larger insurers like State Farm and Allstate have higher denial rates. In contrast, mutual insurers like Northwestern Mutual and Mutual of Omaha have strong claims payment records. Reading an Allstate insurance review can provide more insight into its claims process, customer satisfaction, and policy offerings.

What age should you stop getting term life insurance?

Does Mutual of Omaha have guaranteed issues?

Should seniors get whole life or term life insurance?

How long does it take Mutual of Omaha to pay life insurance?

Which insurance company has the highest customer satisfaction?

Does Northwestern Mutual have a good reputation?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.