Northwestern Mutual vs. MassMutual Life Insurance in 2026 (Best Value Revealed)

Compare Northwestern Mutual vs. MassMutual life insurance, with term rates at $25 and $22 monthly. Northwestern Mutual’s Group life insurance program offers custom financial planning, while MassMutual’s LifeBridge program provides free life insurance for low-income parents.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Updated August 2025

0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviewsThis Northwestern Mutual vs. MassMutual life insurance features Northwestern Mutual’s Group life insurance program and MassMutual’s LifeBridge program.

Northwestern Mutual’s Group life insurance offers custom financial planning with advisor support for long-term security. Discover how life insurance works and get a free quote for the right policy now.

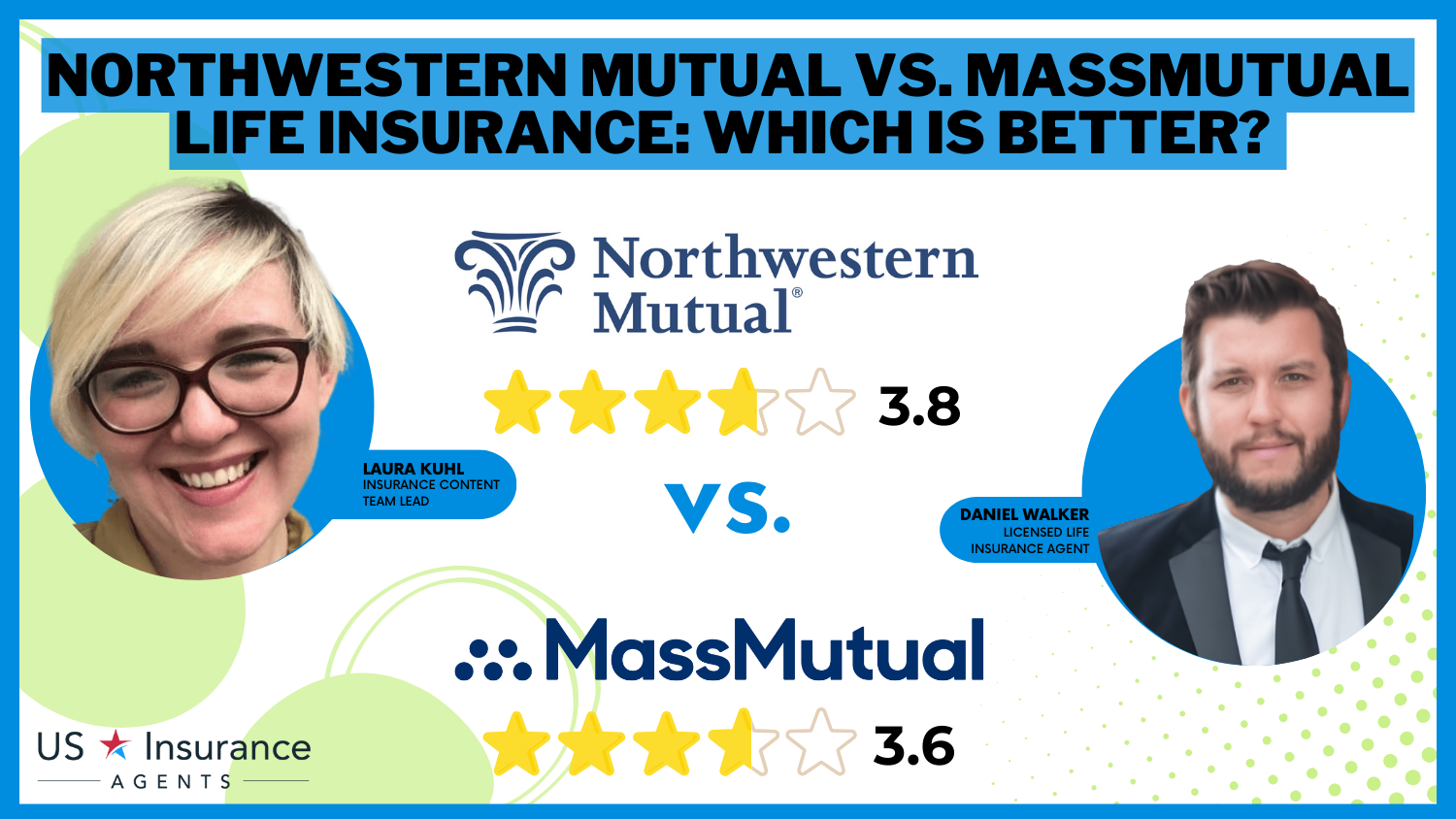

Northwestern Mutual vs. MassMutual Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.8 | 3.6 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 3.5 | 3.0 |

| Company Reputation | 4.0 | 4.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.8 | 3.5 |

| Customer Satisfaction | 2.5 | 2.5 |

| Digital Experience | 4.0 | 4.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.0 | 2.6 |

| Plan Personalization | 3.5 | 3.5 |

| Policy Options | 4.5 | 4.5 |

| Savings Potential | 3.7 | 3.4 |

| Northwestern Mutual Review | MassMutual Review |

MassMutual’s LifeBridge program offers free life insurance for low-income parents, guaranteeing financial safety for their children’s future.

Each company’s program serves distinct financial needs. Use our comparison tool to compare MassMutual vs. Northwestern Mutual life insurance rates.

- Northwestern Mutual vs. MassMutual life insurance plans

- Group life insurance offers custom financial planning

- LifeBridge gives free coverage to low-income parents

Northwestern Mutual vs. MassMutual Life Insurance: Monthly Rate Breakdown

This table shows the cost difference between term insurance and whole life insurance across important providers.

Northwestern Mutual vs. MassMutual Life Insurance Monthly Rates by Coverage Type & Provider

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $20 | $138 |

| $24 | $155 | |

| $22 | $146 | |

| $24 | $149 | |

| $27 | $161 |

| $25 | $151 | |

| $23 | $150 |

| $22 | $144 | |

| $27 | $163 | |

| $21 | $140 |

The monthly rates for term policies range from $20 to $27, but the premiums for whole life range from $138 to $163. Northwestern Mutual and MassMutual stay competitive with their term rates, Northwestern at $25 while MassMutual at $22, giving clear financial benefits.

This table showcases how age and gender impact whole life insurance costs with Northwestern Mutual and MassMutual. Understand what age you get cheap car insurance and lock in the lowest rates available.

Northwestern Mutual vs. MassMutual Whole Life Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age 16 Female | $287 | $146 |

| Age 16 Male | $334 | $169 |

| Age 30 Female | $440 | $408 |

| Age 30 Male | $542 | $472 |

| Age 45 Female | $1,000 | $920 |

| Age 45 Male | $1,200 | $1,081 |

| Age 60 Female | $2,500 | $1,540 |

| Age 60 Male | $2,000 | $1,802 |

Rates increase significantly with age, with 16-year-old females paying $287 monthly while 60-year-old males face premiums up to $2,000. MassMutual consistently offers lower rates, especially for younger policyholders.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insurance Business Ratings & Consumer Reviews: Northwestern Mutual vs. MassMutual

This table compares customer satisfaction, financial strength, and complaint resolution between Northwestern Mutual and MassMutual.

Insurance Business Ratings & Consumer Reviews: Northwestern Mutual vs. MassMutual

| Agency | ||

|---|---|---|

| Score: 877 / 1,000 Above Avg. Satisfaction | Score: 741 / 1,000 Avg. Satisfaction |

|

| Score: A+ Great Complaint Resolution | Score: A+ Excellent Business Practices |

|

| Score: 75/100 Positive Customer Feedback | Score: 84/100 High Customer Satisfaction |

|

| Score: 1.70 More Complaints vs. Competitors | Score: 0.12 Fewer Complaints Than Avg. |

|

| Score: A++ Superior Financial Strength | Score: A++ Superior Financial Strength |

Northwestern Mutual scores 877/1,000 in J.D. Power ratings, ranking above average, while MassMutual holds 741/1,000 with average satisfaction. MassMutual has fewer consumer complaints overall despite both earning A++ financial strength ratings.

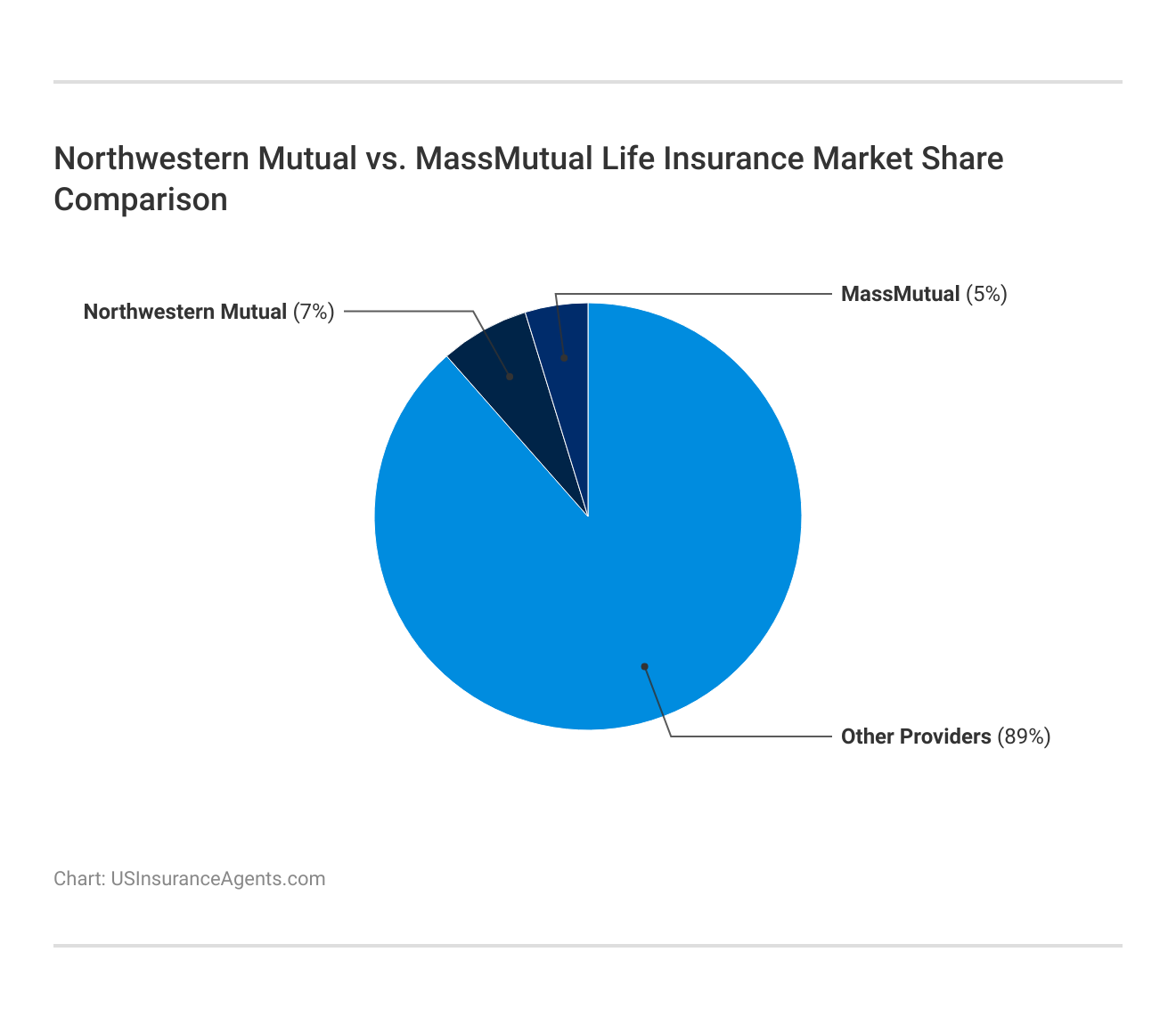

The table below illustrates the market share distribution between Northwestern Mutual, MassMutual, and other providers.

Northwestern Mutual holds 7% of the market, while MassMutual controls 5%, leaving 89% to other competitors. Despite their strong reputations, both companies compete against larger insurers dominating the industry.

Comment

byu/ducmai97 from discussion

inLifeInsurance

A Reddit user shared their experience with a MassMutual whole life policy, emphasizing that while it’s not the cheapest option, they believe it provides significant value.

Read more: MassMutual Insurance Review & Ratings

Northwestern Mutual vs. MassMutual: Life Insurance Discounts Breakdown

This table shows possible savings for policyholders from Northwestern Mutual and MassMutual through different discount opportunities. Find the best car insurance discounts to ask for and compare top savings options.

Northwestern Mutual vs. MassMutual Life Insurance Discounts by Savings Potential

| Discount Name | ||

|---|---|---|

| Multi-Policy | 10% | 12% |

| Healthy Lifestyle | 15% | 18% |

| Loyalty | 5% | 7% |

| Safe Habits | 8% | 10% |

| Preferred Customer | 12% | 14% |

| Automatic Payment | 3% | 4% |

| Annual Payment | 5% | 6% |

| Group Membership | 7% | 9% |

| New Customer | 6% | 8% |

| Bundled Services | 9% | 11% |

Normally, MassMutual offers greater discounts, like their Healthy Lifestyle discount, which can go up to 18%, while it is only 15% at Northwestern Mutual. Both companies offer benefits if you combine services or stay loyal with safe habits. This can lower your total insurance costs.

Northwestern Mutual Life Insurance

Pros:

- Good Reputation: Since the year 1857, Northwestern Mutual has had a strong and respected place in the life insurance world.

- Wide Coverage Choices: Northwestern Mutual offers many policies, such as term, whole life, and universal life insurance, to meet people’s financial needs.

- Access to Financial Advisors: Many financial advisors give personalized help to policyholders, making customer support better.

Cons:

- Potentially Higher Premiums: Northwestern Mutual may charge higher premium costs than some other companies, but it offers very complete protection.

- Limited Online Presence: Because the company focuses on personal service, this might lead to a weaker online experience for customers who like using technology.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

MassMutual Life Insurance

Pros:

- Long History: MassMutual began in 1851, and for more than 170 years, it has focused on helping people with their financial futures by using life insurance.

- Different Policy Choices: MassMutual offers choices like term life, whole life, and universal life insurance, which offer flexibility to fit different needs.

- Reasonable Prices: MassMutual is famous for its good prices. It attracts people who care about costs and want full coverage.

Cons:

- Policy Customization Complexity: Although MassMutual gives flexible choices, some people might find their policy options complicated if they want something simple.

- Online Tools and Resources: The company’s online tools and resources may not be as strong or advanced as other companies. This could negatively affect customers’ overall digital experience.

Discover more by reading our guide: Reasons to Choose Term Life Insurance

An Overview of Northwestern Mutual Life Insurance

Northwestern Mutual, founded in 1857, is a dependable life insurance company noted for its strong financial status and stability. This Northwestern Mutual Insurance review offers expert insights, and coverage options can be compared.

Having over 160 years of expertise in this area, it adapts to changes in the market while putting innovation first. It is proud of its wide-ranging network of financial consultants who provide individually tailored solutions, helping policyholders reach their unique financial goals.

Northwestern Mutual offers term, whole, and universal life insurance to fit various financial goals. Term policies provide affordable coverage for a set period. A whole life includes lifelong protection with cash value growth. Universal life combines flexible premiums with savings. Customizable options help policyholders tailor coverage to their needs and budgets.

An Overview of MassMutual Life Insurance

MassMutual life insurance company has been established for a very long time and has an extensive history. The birth of this business traces back to 1851, and its main aim is to facilitate people’s securing their financial prosperity through life insurance services. See how the insurance company determines your premium and discover ways to lower your costs.

Jeff Root Licensed Insurance Agent

MassMutual has existed for more than 170 years and has always been committed to providing financial stability and safety to its policyholders. During this time, the company has changed according to the needs of its customers but has never lost sight of its main principles.

MassMutual offers options for term, whole, and universal life insurance. Term policies give adaptable coverage for a set duration. Whole life offers lifelong protection with the potential to grow cash value. Universal life allows for the modification of premiums and coverage and the accumulation of cash value. These policies meet an array of financial requirements, like education planning or preparation for retirement.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Northwestern Mutual and MassMutual Life Insurance

Policy Options Comparison

When you compare Northwestern Mutual and MassMutual, it is important to look at each offer’s policy selections. Either companies provide term life insurance, whole life insurance, or universal life insurance, which gives a broad selection to fulfill different demands.

It is wise to thoroughly assess the characteristics, costs, and adaptability of each policy proposed by both firms to better determine which best matches your targets and situation.

Pricing Comparison

When we compare life insurance providers, price is an important aspect to consider. Northwestern Mutual and MassMutual have different premium costs. Therefore, getting quotes from these two companies is necessary to determine which gives you the best rates for the coverage amount and duration you want.

When it comes to piecing together a good financial plan, everyone’s puzzle is different. No matter what personal goals you have, the pieces should always come together. And that’s where we come in. Find out more about what goes into a good financial plan. https://t.co/r5F2HVRFex pic.twitter.com/M7GTNxDm39

— Northwestern Mutual (@NM_Financial) October 24, 2023

It’s important to know that the cost of premiums can be influenced by factors such as your age, health condition, lifestyle decisions, and the type of coverage you select.

Customer Service Comparison

Northwestern Mutual and MassMutual are reputable life insurance providers with extensive financial networks. Their policies cater to various needs, making policy options, pricing, and customer service key factors in choosing. Compare quotes, features, and financial stability to make an informed decision and ensure the right support from financial professionals.

Learn more by checking out our guide: How To Get Free Insurance Quotes Online

See how Northwestern Mutual and MassMutual stack up by entering your ZIP code for free rate comparisons.

Frequently Asked Questions

Who are the main competitors of Northwestern Mutual life insurance?

Northwestern Mutual’s competitors include MassMutual, Penn Mutual, New York Life, and Guardian Life. These companies offer similar whole and term life policies, with varying premium rates, investment options, and dividend payments. Explore the key differences between New York Life vs. Farmers Insurance life insurance plans.

How do MassMutual and Northwestern Mutual differ in their policy features?

MassMutual and Northwestern Mutual offer term, whole, and universal life insurance. Northwestern Mutual emphasizes financial planning with advisor support, while MassMutual provides free life insurance for low-income families through its LifeBridge program.

What do reviews say about Northwestern Mutual’s whole life insurance?

Northwestern Mutual’s whole life reviews highlight the company’s strong financial ratings, cash value growth, and high dividend payouts. However, some policyholders note higher premiums compared to competitors like MassMutual and Penn Mutual. Discover the best Northwestern Mutual and MassMutual life insurance rates by entering your ZIP code.

Which company offers better whole life insurance, MassMutual or Northwestern Mutual?

MassMutual vs. Northwestern Mutual’s whole-life policies provide long-term security and cash value accumulation. MassMutual tends to have lower monthly premiums, while Northwestern Mutual is known for higher dividend payments and financial advisor support.

How can you cancel your Northwestern Mutual life insurance policy?

You can cancel your Northwestern Mutual life insurance policy by contacting your agent or calling customer service. You may need to submit a written request, and any cash value in a whole-life policy could be subject to surrender fees. Find out how your insurance agent’s role in the claims process simplifies claim approvals.

How does Northwestern Mutual compare to New York Life?

Northwestern Mutual vs. New York Life policies offer strong financial stability and high dividend payouts. Northwestern Mutual emphasizes personalized financial planning, while New York Life provides more customizable term and whole-life options.

Which company offers better coverage, MassMutual or New York Life?

MassMutual vs. New York Life policies include term, whole, and universal life options. MassMutual offers lower monthly premiums and a LifeBridge program for low-income families, while New York Life provides more investment-focused policies.

What do reviews say about MassMutual financial advisors?

MassMutual financial advisor reviews are generally positive, highlighting strong financial guidance and customized investment strategies. However, some customers report high fees and sales-driven approaches from advisors.

Does Northwestern Mutual offer home insurance?

Northwestern Mutual home insurance is not available, as the company primarily focuses on life insurance and financial planning. However, you can explore home insurance options through its network of financial advisors. Compare homeowners insurance options to find the best coverage for your home.

How can you contact MassMutual customer service?

MassMutual customer service can be reached by phone, email, or through its online portal. It offers support for policy management, claims, and financial planning assistance.

How does MassMutual’s life insurance rating compare to its competitors?

Who are MassMutual’s main competitors?

What do reviews say about MassMutual’s whole life insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.