Northwestern Mutual vs. Ameriprise Financial Life Insurance in 2026 (Side-by-Side Review)

Discover Northwestern Mutual and Ameriprise Financial life insurance with rates from $33 and $28 per month. Northwestern Mutual offers tailored term and whole life plans, while Ameriprise excels in universal life options. Compare Northwestern Mutual vs. Ameriprise Financial life insurance now.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Updated January 2025

0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviewsNorthwestern Mutual vs. Ameriprise Financial life insurance showcases distinct advantages tailored to varying needs.

Northwestern Mutual gives term and whole life policies that you can tailor, planned to provide security for the entirety of your life with growth potential. Ameriprise Financial is noticeable due to its flexible universal life choices which carry features such as accumulation of cash value and premiums that are adjustable.

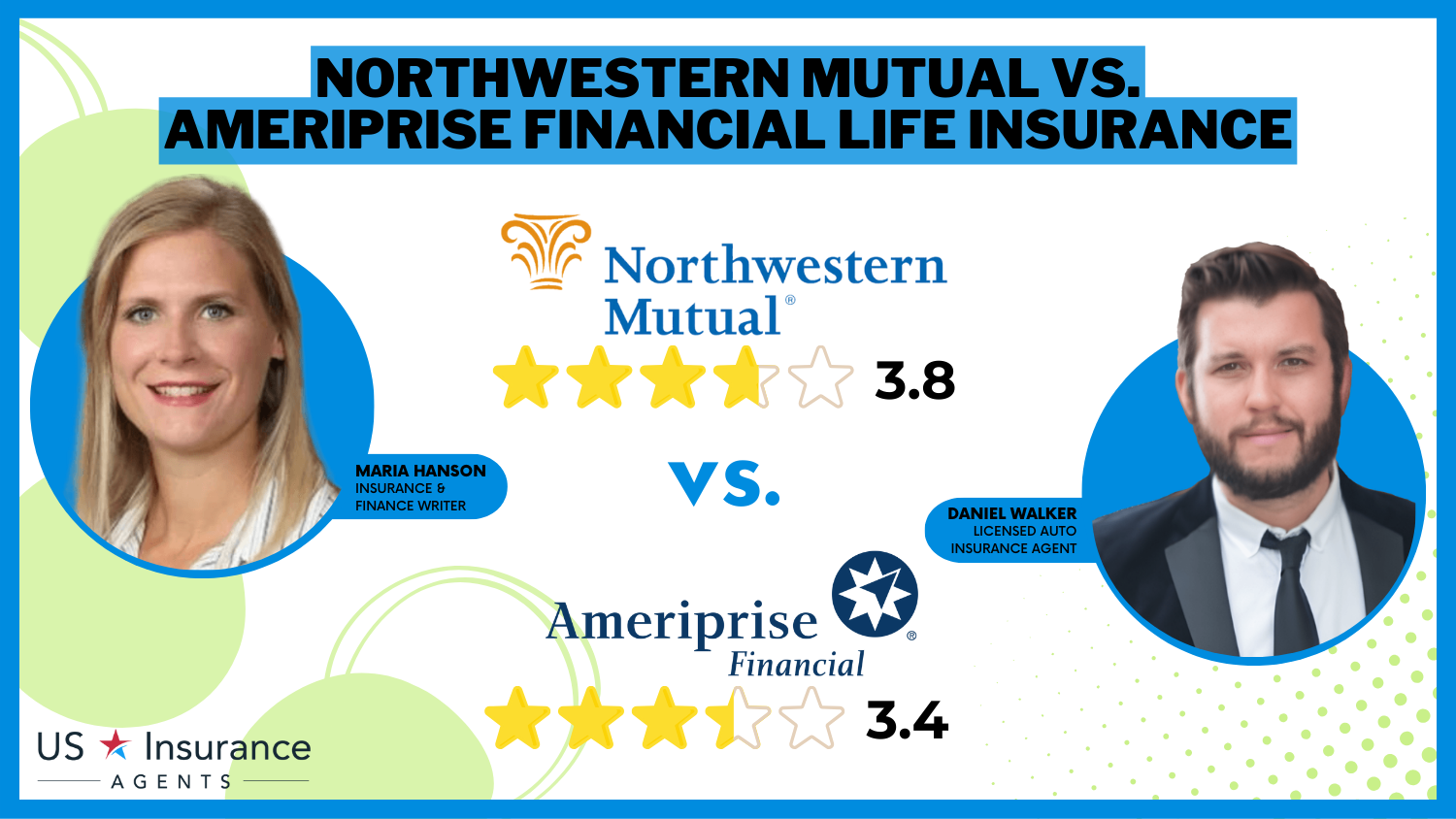

Northwestern Mutual vs. Ameriprise Financial Life Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.8 | 3.4 |

| Business Reviews | 4.0 | 3.0 |

| Claim Processing | 3.5 | 3.0 |

| Company Reputation | 4.0 | 3.5 |

| Coverage Availability | 5.0 | 4.7 |

| Coverage Value | 3.8 | 3.2 |

| Customer Satisfaction | 2.5 | 2.5 |

| Digital Experience | 4.0 | 3.5 |

| Discounts Available | 5.0 | 3.8 |

| Insurance Cost | 3.0 | 3.1 |

| Plan Personalization | 3.5 | 3.5 |

| Policy Options | 4.5 | 3.5 |

| Savings Potential | 3.7 | 3.3 |

| Northwestern Mutual Review | Ameriprise Financial Review |

Both firms offer special advantages for people looking for solutions in long-term monetary planning. Look closely at the specifics to identify which supplier matches perfectly with your objectives.

Discover affordable Northwestern Mutual vs. Ameriprise Financial options by entering your ZIP code into our free life insurance quote tool.

- Northwestern Mutual and Ameriprise start at $33 and $28

- Northwestern Mutual offers flexible term and whole-life plans

- Ameriprise excels with cash value and adjustable premiums

Understanding Northwestern Mutual and Ameriprise Financial Life Insurance Rates

The table looks at Northwestern Mutual and Ameriprise Financial’s whole coverage life insurance prices for different age groups and genders. It shows how the costs change, helping to see which one is cheaper for people in various stages of their lives.

Northwestern Mutual vs. Ameriprise Financial Life Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $220 | $280 |

| Age: 16 Male | $230 | $240 |

| Age: 30 Female | $180 | $190 |

| Age: 30 Male | $185 | $185 |

| Age: 45 Female | $165 | $180 |

| Age: 45 Male | $170 | $175 |

| Age: 60 Female | $155 | $160 |

| Age: 60 Male | $160 | $165 |

For younger drivers, like 16-year-olds, women pay $220 with Northwestern Mutual and $280 with Ameriprise. But for men of the same age, it costs a bit more at Northwestern Mutual but less at Ameriprise, where they pay $230 and $240, respectively. When these drivers turn 30 years old, the rates become similar for men; both companies charge them $185.

For women aged 30, it’s slightly cheaper with Northwestern Mutual as they pay only $180 there. As age goes up, it becomes more affordable. For example, 60-year-old women get the best prices: $155 from Northwestern Mutual and $160 from Ameriprise. These numbers show Northwestern Mutual usually gives better deals for older females than Ameriprise.

The table spotlights the monthly premiums for term and whole life insurance that Northwestern Mutual, Ameriprise Financial, and other top providers offer. This comparison show up how affordable and flexible each insurer’s plans are which help customers to make knowledgeable decision.

Northwestern Mutual vs. Ameriprise Financial Monthly Life Insurance by Coverage Type and Provider

| Insurance Company | Term Coverage | Whole Coverage |

|---|---|---|

| $30 | $400 | |

| $28 | $390 | |

| $32 | $410 | |

| $31 | $405 |

| $29 | $395 | |

| $35 | $420 |

| $33 | $415 | |

| $30 | $400 | |

| $28 | $390 | |

| $30 | $400 |

Term coverage from Northwestern Mutual has a cost of $33 per month. This is little more than other providers such as Ameriprise that offer it for $28. But, the financial stability they provide is very good and strong. For whole life insurance, premium amount from Northwestern Mutual comes to $415. It shows their solid benefits over lifetime though it slightly lags behind New York Life which demands premium at rate of $420.

Ameriprise presents a total coverage which is competitive at $390, showing its good price. Guardian and Prudential give similar rates for whole coverage, underlining steadiness from providers. This chart brings out the balance between cost of premiums and advantages of policies among leading life insurance companies.

The table below highlights how driving records influence monthly life insurance premiums for Northwestern Mutual vs. Ameriprise Financial. Different scenarios like accidents and traffic violations significantly affect costs.

Northwestern Mutual vs. Ameriprise Financial Life Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $170 | $175 |

| Not-At-Fault Accident | $140 | $155 |

| Speeding Ticket | $175 | $180 |

| DUI/DWI | $300 | $315 |

For clean records, rates remain close at $170 for Northwestern Mutual and $175 for Ameriprise. Drivers with not-at-fault accidents see lower premiums, $140 with Northwestern Mutual and $155 with Ameriprise.

Laura Walker Former Licensed Agent

A speeding ticket raises costs to $175 and $180, while a DUI/DWI leads to the steepest increase, with $300 for Northwestern Mutual and $315 for Ameriprise. These figures emphasize the impact of driving history on life insurance affordability.

Read more: How does the insurance company determine my premium?

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

An Overview of Northwestern Mutual Life Insurance

Northwestern Mutual has a very interesting history that starts in 1857 when it was founded. It began as a mutual company, which means the people who have insurance policies with Northwestern Mutual own the company, not shareholders. This special setup lets Northwestern Mutual focus mainly on what is best for its policyholders, putting their needs and interests first.

Over many years, Northwestern Mutual has faced different economic problems and financial crises but always comes out stronger. This toughness gave them a name for being stable and trustworthy, which shows in the high scores they get from rating companies.

19 years old. That’s the average age when people have their first conversation about family finances with their parents. Navigate these crucial conversations with the help of a financial advisor. We’re ready when you are.

*Planning and Progress Study, 2023. pic.twitter.com/2fcpxDWzjw

— Northwestern Mutual (@NM_Financial) November 15, 2023

But it is not only their past and ratings that make Northwestern Mutual special. The company also famous for its dedication to helping the community. Northwestern Mutual gave many millions of dollars to different charities, helping with things like childhood cancer research and education programs through their foundation.

Life Insurance Products Offered by Northwestern Mutual

Northwestern Mutual offers many life insurance options like term, whole, and universal life insurance. These products are made to fit different money needs for people. Compare rates and details in the Northwestern Mutual insurance review & ratings.

Term life insurance is good to use during key times like when paying off mortgage. Whole life insurance offers protection for entire lifetime and also accumulate cash value slowly over time. Universal life insurance is very flexible, allowing you to change the policy to fit new needs and goals. This type of adjustable policy offers personalized solutions for both families and individuals.

Customer Service and Claims Process at Northwestern Mutual

Northwestern Mutual is known for very good customer service and easy claims process. Their experienced representatives help policyholders understand coverage choices, premiums, and handle claims with much professionalism and attention. Using digital tools and easy steps, they make sure claims process goes smoothly. This shows how much they care about helping people with insurance during hard times.

An Overview of Ameriprise Financial Life Insurance

History and Reputation of Ameriprise Financial

Another important company in life insurance industry is Ameriprise Financial. Started in 1894, Ameriprise Financial has made a strong name for itself. Ameriprise Financial has long history and helps clients for more than hundred years. They focus on giving customized financial solutions, so many people and families trust them. Explore detailed insights through the Ameriprise review & ratings.

Life Insurance Products Offered by Ameriprise Financial

Ameriprise Financial company offers different life insurance choices, such as term life, whole life, and universal life policies. They make these options to fit many kinds of needs and money situations. Term life gives coverage for a certain period which is good for things like paying off home loan or other big expenses that will not last forever.

Whole life insurance gives lifelong protection and includes a cash value part. Universal life insurance offers flexibility by mixing term coverage with cash-value benefits. There are extra options, called riders, like accelerated death benefits and premium waivers that improve the policy. These added features help make sure people feel secure about their coverage.

Customer Service and Claims Process at Ameriprise Financial

Ameriprise Financial is very known company for life insurance. They have good reputation because they help customers really well and make claiming process easy.

The team there helps people with questions about their policies, different coverage choices, and how to file a claim. This makes sure that support is given quickly and smoothly when needed by the customer. With many different life insurance options, they want to satisfy what policyholders need and give dependable financial security.

Comparing Northwestern Mutual and Ameriprise Financial Life Insurance

Comparison of Life Insurance Products

When looking at life insurance from Northwestern Mutual and Ameriprise Financial, both companies have term, whole, and universal life insurance for different financial needs. Term policies give protection for a set period. Whole life offers lifetime coverage with the added benefit of cash value growth over time. Universal life mix death benefits with a savings element that can build up money too.

The companies are not the same in flexibility and customization. Northwestern Mutual gives options for riders like disability income or long-term care to make coverage better, but Ameriprise Financial offers adjustable coverage and premiums so they can change with your needs, giving more flexibility.

Comparison of Customer Service

Northwestern Mutual and Ameriprise Financial are famous for their good customer service and special teams that help people with their policies. Northwestern Mutual tries hard to make long-lasting connections with clients. On the other hand, Ameriprise Financial focuses on providing tailored services and online tools so customers can manage their policies easily.

Our chief economist provides insights on the state of the economy and what to watch for in the second half of the year. https://t.co/EBftJLoGqr pic.twitter.com/gZ7Tyojd2K

— Ameriprise Financial (@ameriprise) July 14, 2022

Before you decide, try to contact their customer service team first. This will help you see how quick and helpful they are in responding. Talking with them can give you useful information about the support you’ll get while having your policy.

Comparison of Claims Process

Northwestern Mutual and Ameriprise Financial emphasize offering a seamless process for claims. They have set methods and devoted departments for managing claims, which effectively help clients.

As trustworthy providers of life insurance, these two companies offer a variety of products and put a high emphasis on great customer care. To choose the top provider relies on your individual needs, hence you need to compare prices, assess policies and think about what you prefer most in order to make the right decision for the future of your family.

Discover more by reading our guide: Your Insurance Agent’s Role in the Claims Process

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Northwestern Mutual Life Insurance Pros and Cons

Pros

- Established Reputation: Established in 1857, offering over 160 years of financial security.

- Diverse Policy Options: Comprehensive range of policies from term to permanent life insurance.

- Financial Stability: Consistently high ratings from agencies like AM Best and Standard & Poor’s.

Cons

- Possibly Higher Premiums: Long-standing reputation and diverse options may come with higher costs.

- Limited Online Information: Insufficient online details may require direct contact for specific queries.

Ameriprise Financial Life Insurance Pros and Cons

Pros

- Flexibility in Products: Offers term, whole, and universal life insurance, allowing customization.

- Strong Customer Service: Commitment to personalized service and efficient claims handling.

- Policy Flexibility: Options to adjust coverage and premiums as needs change.

Cons

- Publicly Traded Company: Not a mutual company, which could impact policyholder focus.

- Possibly Limited Add-Ons: May have fewer additional riders compared to competitors.

Northwestern Mutual vs. Ameriprise Financial Insurance Business Ratings & Customer Reviews

The table shows how Ameriprise vs. Northwestern Mutual compare satisfaction, complaints, and financial strength. This summary helps future customers understand each company’s trustworthiness and standing.

Insurance Business Ratings & Consumer Reviews: Northwestern Mutual vs. Ameriprise Financial Life Insurance

| Agency | ||

|---|---|---|

| Score: 789 / 1,000 Lower-Than-Average Satisafaction | Score: 850/1000 Above Avg. Satisfaction |

|

| Score: B+ Good Business Practices | Score:A- Excellent Business Practices |

|

| Score: 65 /100 Mixed Customer Feedback | Score: 78/100 Positive Customer Feedback |

|

| Score: 1.5 Avg. Complaints | Score: 1.5 Avg. Complaints |

|

| Score: A++ Marginal Financial Strength | Score: A+ Excellent Financial Strength |

Northwestern Mutual ratings are excellent, such as an A++ for financial strength from A.M. Best and a score of 850/1,000 on J.D. Power for customer satisfaction. Ameriprise Financial gets strong scores, such as an A+ for economic stability and a pretty good satisfaction level of 789 out of 1,000.

Consumer Reports show mixed opinions for both companies. Northwestern Mutual gets a score of 78 out of 100 for good customer feedback, while Ameriprise has a lower score of 65 out of 100. Both have average levels of complaints, which means customers generally have balanced experiences with these companies overall.

The above illustration shows how much market share Northwestern Mutual, Ameriprise Financial, and other life insurance companies have. Knowing this spread helps to see how strong each company is in the market and where they stand compared to others. Explore the best insurance companies offering tailored coverage options and affordable rates.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why You Should Consider Life Insurance

Life insurance is very important for planning your money matters. It acts like a safety cushion for your family, making sure they have financial support if something bad happens to you. This helps you feel calm and secure because you know your loved ones will be looked after in terms of money situation.

The death benefit can help with paying for funeral costs, any debts that are still owed, and mortgage bills. It also gives money to support your family if you pass away. This money can be used for your kids’ schooling or to leave something valuable behind for the next generations of the family.

There are two big types of life insurance: term life insurance and permanent life insurance. Term life insurance gives coverage for certain time period, often 10, 20, or 30 years. It is the cheapest choice and very good for people who need it for a short time, like paying off a home loan or giving money support while taking care of kids.

- Term Life Insurance: This gives flexibility, so you can pick how long the coverage lasts based on your money plans. Also, if what you need changes, it can be changed into permanent life insurance.

- Permanent Life Insurance: This type of insurance gives protection for whole life. It can grow cash value over the years, which you might borrow or give up to get a one-time payment.

Life insurance is very important financial thing that helps make sure your family has money and good life if you are not there. It makes people feel safe, no matter how old they are, from young workers to older people who have stopped working, because it gives help when things get tough. Exploring the right policy helps protect your loved ones and secure their future.

Best Overall: Northwestern Mutual

Many think Northwestern Mutual is better overall than Ameriprise Financial for life insurance. This happens for a few reasons, making it the best choice for those who want full coverage and strong financial stability in the long term.

- Financial Stability and Reputation: Northwestern Mutual has a long history, starting in 1857. This shows their strong promise to keep financial stability for many years.

- Different Types of Coverage: Northwestern Mutual is special because it offers many different life insurance products. This means they can meet various needs and likes of people.

- Community Promise: The company’s taking part in charity works, shown by its foundation giving money to things like childhood cancer research and education projects, shows a promise towards the good of the community.

Ameriprise insurance has good options and focuses on providing its clients with personal service. But Northwestern Mutual has a long history, strong finances, and cares about people with policies with them. Because of these reasons, many think Northwestern Mutual is the best choice for life insurance overall.

Kristine Lee Licensed Insurance Agent

Northwestern Mutual stands out as the best option when considering the significance of lasting stability, various coverage choices, and a history of engaging with communities. Discover the best whole life insurance options to secure your financial future. Use our free quote comparison tool to find the best Northwestern Mutual and Ameriprise Financial rates. Enter your ZIP code to get started.

Frequently Asked Questions

What does Ameriprise life insurance offer?

Ameriprise life insurance provides term, whole, and universal life policies with flexible premiums and cash value options to meet diverse financial needs. Find out how term life insurance works to meet temporary financial needs.

What coverage does Ameriprise renters insurance provide?

Ameriprise renters insurance covers personal property, liability, and additional living expenses, offering affordable monthly rates.

What does Ameriprise homeowners insurance cover?

Ameriprise homeowners insurance includes coverage for your home, personal belongings, liability, and additional living expenses, with customizable policies. Discover Northwestern Mutual vs. Ameriprise Financial rates by entering your ZIP code into our free life insurance comparison tool.

Who are Northwestern Mutual’s competitors?

Northwestern Mutual’s competitors include MassMutual, Guardian Life, and New York Life, offering similar term, whole, and universal life insurance products.

What is the A.M. Best rating for Northwestern Mutual?

Northwestern Mutual holds an A++ rating from A.M. Best, reflecting exceptional financial strength and stability.

What is Northwestern Mutual’s BBB rating?

Northwestern Mutual has an A+ rating from the Better Business Bureau (BBB), highlighting its strong customer service and reliability.

What does Northwestern Mutual Life Insurance Company offer?

Northwestern Mutual Life Insurance Company offers term, whole, and universal life insurance policies with options for lifetime coverage and cash value growth.

Where can I find Ameriprise home insurance reviews?

Ameriprise home insurance reviews are available online, highlighting customer satisfaction with its customizable coverage and claims service.

Is Ameriprise insurance good?

Ameriprise insurance is known for reliable customer service, flexible coverage options, and competitive monthly rates across life, home, and renters insurance policies. Discover how to get affordable insurance quotes online in minutes.

What are AAA-rated companies like Northwestern Mutual?

Northwestern Mutual is AAA-rated for its financial strength, offering superior stability compared to many competitors in the insurance market.

Where can I find Ameriprise car insurance reviews?

Who are Ameriprise Financial’s competitors?

What does Ameriprise’s term life insurance cover?

What is Northwestern Mutual ISA?

What is the Northwestern Mutual claims process?

How does Northwestern Mutual compare to Fidelity?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.