National Life Group vs. Nationwide Life Insurance in 2026 (Compare Rates & Options Here!)

National Life Group vs. Nationwide life insurance offers unique advantages in flexibility and wealth-building. Nationwide’s $44 term plans offer adjustable premiums, living benefits, and easy conversion. National Life Group’s $51 indexed universal life builds market-linked cash value with tax-free loans.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated August 2025

0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews 3,071 reviews

3,071 reviewsCompany Facts

Term Policy

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsNational Life Group vs. Nationwide life insurance provides distinct policy benefits, with Nationwide offering term, whole, and universal life plans, while National Life Group focuses on indexed universal life with market-linked cash value growth.

Nationwide’s policies include living benefits and seamless term-to-permanent conversion, ensuring adaptable coverage. National Life Group specializes in tax-free policy loans and long-term wealth accumulation through indexed returns, making it ideal for estate planning.

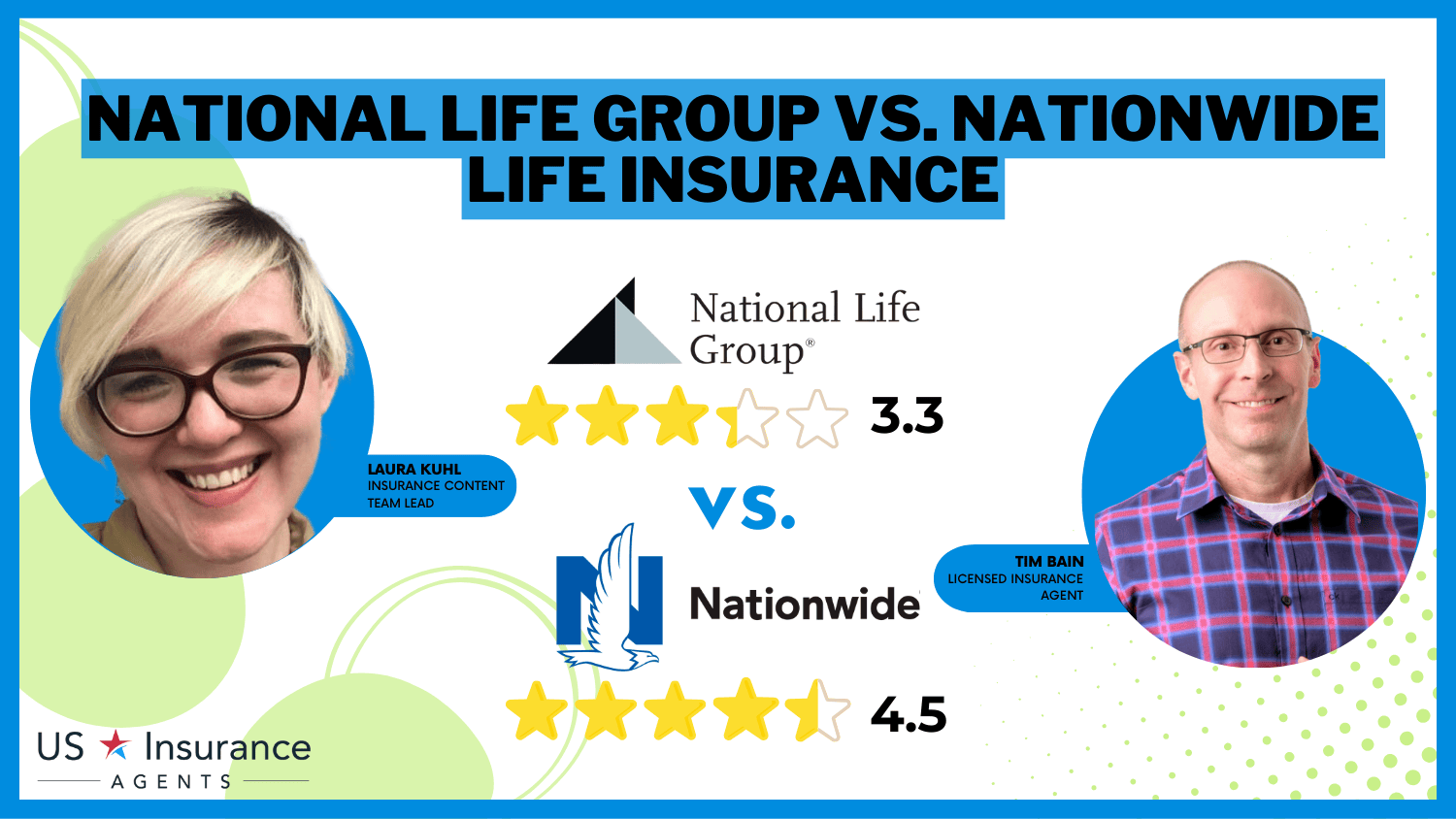

Nationwide vs. National Life Group Life Insurance Ratings

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.5 | 3.3 |

| Business Reviews | 4.5 | 3.0 |

| Claim Processing | 3.5 | 3.2 |

| Company Reputation | 4.5 | 3.0 |

| Coverage Availability | 4.3 | 2.8 |

| Coverage Value | 4.3 | 3.0 |

| Customer Satisfaction | 4.0 | 2.5 |

| Digital Experience | 4.5 | 2.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.5 | 3.0 |

| Plan Personalization | 4.5 | 3.0 |

| Policy Options | 4.7 | 3.8 |

| Savings Potential | 4.7 | 3.7 |

| Nationwide Review | National Life Group Review |

Nationwide offers underwriting perks and discounts, while National Life Group provides flexible premiums for security.

As two of the best insurance companies, choosing between them depends on whether affordability, market-driven growth, or policy flexibility aligns with your financial goals. Enter your ZIP code to find customized life insurance quotes.

- Nationwide’s term life starts at $44, while National Life Group’s IUL is $51

- National Life Group vs. Nationwide life insurance offers unique policy benefits

- Nationwide provides term conversions, while National Life Group builds cash value

Breaking Down Monthly Premium Differences

Life insurance rates vary based on age and gender, impacting affordability and coverage choices. The table below compares the monthly rates of the whole life policy for Nationwide and National Life Group across different ages and genders.

National Life Group vs. Nationwide Whole Life Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| Age: 16 Female | $411 | $230 |

| Age: 16 Male | $476 | $240 |

| Age: 30 Female | $124 | $185 |

| Age: 30 Male | $136 | $190 |

| Age: 45 Female | $113 | $170 |

| Age: 45 Male | $115 | $175 |

| Age: 60 Female | $99 | $160 |

| Age: 60 Male | $104 | $165 |

Nationwide generally offers lower insurance premiums, especially for younger policyholders. A 16-year-old female pays $230 with National Life Group, significantly lower than $411 with Nationwide, while a 16-year-old male pays $240 with National Life Group versus $476 with Nationwide. Rates become more competitive as age increases.

For a 30-year-old male, Nationwide’s $136 premium is lower than National Life Group’s $190. By age 60, Nationwide’s $99 for women and $104 for men remain lower than National Life Group’s $160 and $165, making Nationwide the more affordable option for older applicants.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Life Insurance Coverage Comparison: Nationwide and National Life Group

Both National Life Group and Nationwide offer a variety of life insurance options, but each caters to different financial needs. For affordable, short-term protection, both companies provide term life insurance, covering 10, 20, or 30 years with no cash value. If you need lifetime coverage with cash value, whole life insurance is available, featuring fixed premiums and borrowable savings.

Life Insurance Coverages at National Life Group vs. Nationwide

| Coverage Type |  |

|

|---|---|---|

| Term | ✅ | ✅ |

| Whole | ✅ | ✅ |

| Universal | ✅ | ✅ |

| Indexed Universal | ✅ | ✅ |

| Variable Universal | ✅ | ✅ |

For greater flexibility, both companies offer universal life insurance, which adjusts premiums and death benefits while accumulating market-based cash value. Those seeking higher returns may consider indexed universal life (IUL), which ties cash value growth to stock market indexes while offering downside protection.

National Life Group stands out with variable universal life (VUL) insurance, which Nationwide does not offer. This policy allows cash value investment in sub-accounts, giving higher growth potential but with market risk.

Comparing Discount Opportunities Across Policies

There are different types of life insurance policies available, and policyholders can save money by taking advantage of discounts on premiums. The table compares Nationwide and National Life Group based on the various discount kinds and percentages offered by each provider.

Life Insurance Discount Options and Percentages at National Life Group vs. Nationwide

| Discount Type |  | |

|---|---|---|

| Good Health | 12% | 14% |

| Employer-Sponsored | 10% | 9% |

| Non-Smoker | 11% | 12% |

| Healthy Lifestyle | 6% | 7% |

| Family History | 7% | 5% |

Nationwide leads in non-smoker and healthy lifestyle discounts, offering 20% and 15%, respectively, compared to National Life Group’s 18% and 10%. However, National Life Group offers more substantial savings in bundling, senior, loyalty, and automatic payment discounts, with rates like 15% for bundling versus Nationwide’s 12% and 8% for automatic payment versus Nationwide’s 7%.

Jeff Root Licensed Insurance Agent

Both companies tie at 5% for safe driving discounts, rewarding good habits equally. If you’re focused on personal health and workplace coverage, Nationwide offers better rewards, especially with Nationwide group life insurance, which provides employees with affordable protection through employer-sponsored plans. However, National Life Group remains a top choice for bundling and long-term savings.

National Life Group vs. Nationwide: Insurance Ratings and Consumer Feedback

Ratings and customer reviews give a solid idea of what to expect when choosing life insurance. The table below breaks down how Nationwide and National Life Group compare in terms of satisfaction, complaints, and financial strength.

Nationwide receives a J.D. Power and Associates insurance company rating score of 855/1,000, indicating above-average customer satisfaction, while National Life Group scores 730, ranking below average. In terms of financial strength, both companies hold a strong A+ rating from A.M. Best, reflecting superior financial stability.

Insurance Business Ratings & Consumer Reviews: National Life Group vs. Nationwide

| Agency |  | |

|---|---|---|

| Score: 855 / 1,000 Above Avg. Satisfaction | Score: 730 Below Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A- Accredited with a few complaints |

|

| Score: 75/100 Positive Customer Feedback | Score: 72/100 Good Consumer Advocacy |

|

| Score: 0.78 Fewer Complaints Than Avg. | Score: 1.5 Avg. Complaints |

|

| Score: A+ Superior Financial Strength | Score: A+ Excellent Financial Strength |

Consumer Reports scores show Nationwide at 75/100, slightly ahead of National Life Group’s 72/100, suggesting a marginal difference in consumer advocacy.

Nationwide has a complaint index of 0.78, which is lower than usual, but National Life Group reports a standard volume of complaints with an index of 1.5. These evaluations highlight the benefits of each company to help policyholders make an informed decision.

Nationwide has a strong position with 7% of the market because of the range of insurance it offers. National Life Group focuses on more customized products that meet specific customer needs with 5%.

The industry is highly competitive, as evidenced by the fact that other providers occupy 88% of the market. Nationwide’s more comprehensive products probably help it, but National Life Group’s emphasis on specialty plans keeps it competitive. This breakdown makes the position of each company in the market very evident.

A Reddit user offered their opinions about Nationwide and detailed their interactions with the company’s customer support and rules. They address whether they would suggest Nationwide in their Reddit remark, mentioning topics such as general satisfaction, support, and claims processing.

Seeing real customer experiences like this on Reddit can be helpful when deciding on an insurance provider. While one person’s experience may not tell the whole story, checking reviews, comparing policies, and seeing which company best fits your needs is always a good idea. If you’re considering Nationwide, taking a look at firsthand feedback like this could give you a better idea of what to expect.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Nationwide CareMatters: A Flexible Long-Term Care Solution

From its founding in 1926 till the present day, Nationwide Life Group has ranked among the top US suppliers of insurance and financial services. It offers investments, retirement plans, and life insurance. With a strong financial foundation and a reputation for reliability, Nationwide keeps evolving to meet the needs of its customers.

What started as a small mutual auto insurer has expanded into a one-stop shop for financial security. Nationwide CareMatters is a unique long-term care insurance policy combining life and long-term care coverage. This gives policyholders the flexibility to use funds for care while still leaving behind a death benefit for loved ones.

Aside from insurance products, Nationwide is firmly devoted to community engagement and philanthropy, supporting nonprofit groups and local projects.

Read more: How do you file a life insurance claim with Nationwide Life Insurance Company?

The Impact of National Life Group’s Do Good Programs

With life insurance, annuities, and retirement plans, National Life Group has been assisting people in safeguarding their financial futures since 1848. They are a reliable option for both individuals and families because of their solid reputation for stability and customer-focused solutions gained throughout their more than 170 years in the business.

National Life Group has made sure that its products satisfy the changing needs of policyholders by adapting to technological advancements and shifts in the economy throughout time. They truly distinguish out, though, thanks to their Do Good Programs, an effort that funds community initiatives, education, and charitable causes.

They actively make a difference by doing more than just selling insurance; they also finance disaster relief and schools. As a major force in the insurance sector, National Life Group has a strong financial base and a strong commitment to serving its clients and communities.

Learn More: Understanding Life Insurance

Pros and Cons of National Life Group Life Insurance

Pros

- Superior Bundling Discounts: Offers a 15% discount for bundling policies, higher than Nationwide’s 12%, making it ideal for consolidating multiple types of life insurance.

- Variable Universal Life Insurance: Provides investment-focused policies that combine cash value growth with market-linked performance, unavailable through Nationwide.

- Loyalty Rewards: Reward dedication over time by giving loyal clients a 7% discount, more than Nationwide’s 5%. Learn more in our National Life Group insurance review.

Cons

- Limited Healthy Lifestyle Discounts: Provides only a 10% discount for healthy lifestyle habits compared to Nationwide’s 15%, making it less appealing for health-focused individuals.

- Higher Complaint Index: A 1.5 complaint index indicates a higher volume of customer complaints than Nationwide’s 0.78.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Nationwide Life Insurance

Pros

- Leading Non-Smoker Discounts: Offers a 20% non-smoker discount, more than National Life Group’s 18%, making it affordable for people who uphold healthy lifestyles.

- Healthy Lifestyle Incentives: Provides a substantial 15% discount for leading a healthy lifestyle, which is far higher than the 10% offered by National Life Group.

- Low Complaint Index: Boasts a 0.78 complaint index, reflecting fewer customer complaints and greater satisfaction than National Life Group.

Cons

- No Variable Universal Life Insurance: Lacks the investment-driven options provided by National Life Group, which may limit choices for those seeking cash value growth tied to market performance.

- Lower Bundling Savings: It offers only a 12% discount for bundling multiple policies, less than National Life Group’s 15%. Discover more about offerings in our Nationwide insurance review.

Choosing Between Nationwide and National Life Group for Long-Term Security

National Life Group vs. Nationwide life insurance offers distinct advantages, with Nationwide leading in health-related savings through a 20% non-smoker discount and National Life Group excelling in bundling discounts at 15%.

However, Nationwide lacks variable universal life insurance, a key investment-driven policy with National Life Group. Customers who prioritize inexpensive premiums and health incentives benefit the most from Nationwide, but those who prioritize cash value growth and long-term estate planning may prefer National Life Group.

Both have a strong A+ A.M. Best rating, proving their financial strength and reliability. To find the best fit, compare multiple life insurance providers online and explore your options. Enter your ZIP code to get a Nationwide life insurance quote using our free comparison tool and find the best rates available.

Frequently Asked Questions

Is Nationwide a good life insurance company?

Yes, Nationwide is a good life insurance company, offering a variety of policies, including term, whole, and universal life insurance. It has an A+ A.M. Best rating, strong financial stability, and discounts like a 20% non-smoker discount, making it a solid choice for many policyholders.

Is National Life Group a good company?

National Life Group is a reputable organization with over 170 years of experience and an A+ A.M. Best rating. Its Do Good Programs, investment-focused variable universal life insurance, and 15% bundling discount distinguish it as a dependable choice for long-term financial planning.

What services does National Life customer service provide?

National Life customer service assists with policy management, claims processing, billing inquiries, life insurance beneficiary updates, and policyholder account troubleshooting.

What is the recent lawsuit filed against National Life Group about?

In November 2024, an Indiana woman filed a lawsuit against National Life Group, alleging that the company provided misleading illustrations for her indexed universal life (IUL) policy, which resulted in a 0% return after one year.

Can I withdraw money from the National Life Group?

National Life Group allows withdrawals from whole life and indexed universal life policies once sufficient cash value has accumulated. However, withdrawals over the available basis may trigger tax liabilities and reduce the death benefit.

Which insurance company denies the most claims?

Claim denials depend on policy exclusions, underwriting guidelines, and claim accuracy. According to NAIC complaint ratios, insurers with higher complaint rates tend to have stricter claim processes, making it crucial to review a company’s claim approval history.

To find the best coverage with a reliable insurer, compare free insurance quotes online and assess each provider’s track record before committing to a policy.

What life insurance company pays the most claims?

Nationwide and National Life Group, rated A+ by A.M. Best, have strong claims-paying ability and high approval rates. Nationwide’s CareMatters hybrid policy ensures seamless payouts for long-term care and life insurance benefits.

What are the best life insurance companies for your whole life?

National Life Group and Nationwide stand out for whole life insurance because they offer guaranteed cash value growth, dividend eligibility, and various premium options. National Life Group also offers policy loans, which allow you to get cash without having to sell your policy.

How long do you have to pay life insurance before it pays out?

Most term life insurance policies pay out immediately upon a valid claim. Still, a two-year contestability period applies, during which insurers may investigate fraud, misrepresentation, or pre-existing conditions before issuing a payout.

Does it matter what company you get life insurance from?

Selecting an insurer with an A.M. Best A+ rating, firm financial reserves, and low complaint index ensures long-term security and reliable claims processing. Nationwide and National Life Group both meet these criteria.

Can I cancel my National Life Group policy?

What age is best to buy whole life insurance?

What are the two disadvantages of whole life insurance?

What is the National Life Group’s average claim response time frame?

Does Nationwide offer whole life insurance?

Does National Life Group create a user-friendly experience for customers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.