Missouri Car Insurance Requirements in 2026 (Coverage All MO Drivers Need)

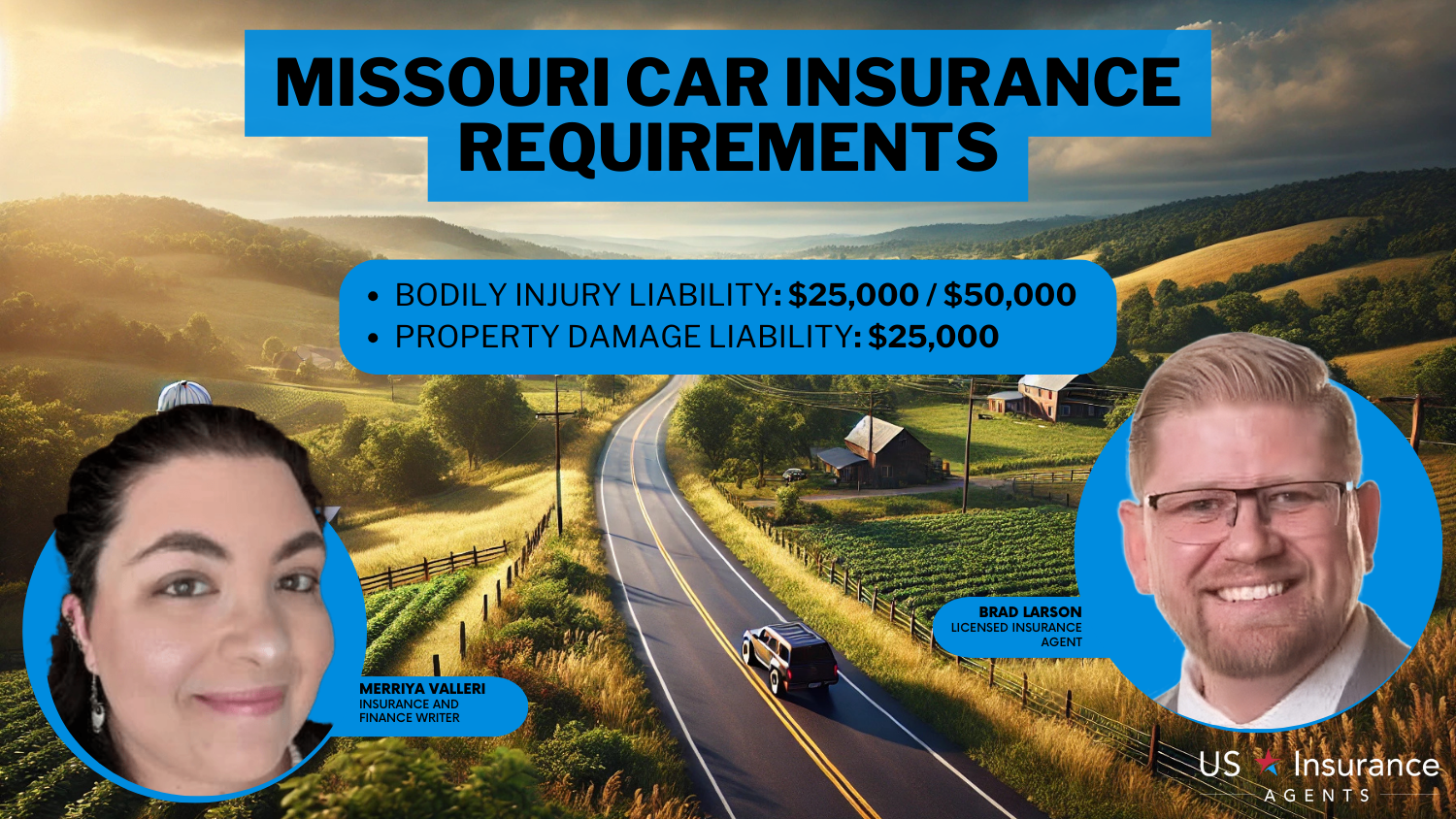

Missouri car insurance requirements mandate minimum liability coverage of 25/50/25 for bodily injury and property damage. Uninsured motorist coverage of 25/50 is also required. Optional coverages like collision, comprehensive, and MedPay provide added financial protection for drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated February 2025

Missouri car insurance requirements mandate minimum liability coverage of $25,000 per person and $50,000 per accident for bodily injury, plus $25,000 for property damage.

Uninsured motorist coverage is also required, with limits of $25,000 per person and $50,000 per accident. Optional coverages like comprehensive, collision, and medical payments (MedPay) can offer additional protection for vehicle damage, accidents, or medical expenses, regardless of fault.

Drivers must carry proof of insurance at all times and present it when requested by law enforcement or during vehicle registration. Penalties for driving without insurance include fines, license suspension, four license points, and possible SR-22 filing, which requires proof of financial responsibility.

Missouri Minimum Car Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

Understanding your car insurance and meeting car requirements is crucial for avoiding legal and financial consequences. Enter your ZIP code to find the best rates that meet Missouri’s car insurance requirements.

- Missouri requires 25/50/25 minimum liability coverage for all drivers

- Uninsured motorist coverage of 25/50 is mandatory in Missouri

- Optional coverage includes collision, comprehensive, and MedPay

MO Minimum Coverage Requirements & What They Cover

Missouri law requires all personal vehicles to carry minimum liability insurance coverage to ensure financial responsibility in the event of an accident. So, what is the minimum insurance required? The mandatory coverages include:

- Bodily Injury Liability: Provides up to $25,000 per person and $50,000 per accident to cover injuries or death you cause to others in an accident.

- Property Damage Liability: Pays up to $25,000 for damage you cause to another person’s property, such as their vehicle, fence, or other structures.

- Uninsured/Underinsured Motorist Bodily Injury: Covers up to $25,000 per person and $50,000 per accident if you are hit by a driver who has no insurance or inadequate coverage.

For additional financial protection, you can opt for:

- Comprehensive Coverage: Covers damage from non-collision events like theft, vandalism, floods, or fallen objects.

- Collision Coverage: Pays for repairs or replacement of your vehicle if damaged in a collision, regardless of who is at fault.

Carrying the proper coverage ensures compliance with state laws and helps protect you from out-of-pocket expenses after an accident or unforeseen event.

Missouri Min. Coverage Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Blue Springs | $68 |

| Cape Girardeau | $62 |

| Chesterfield | $73 |

| Columbia | $66 |

| Florissant | $82 |

| Independence | $72 |

| Jefferson City | $65 |

| Joplin | $64 |

| Kansas City | $77 |

| Lee's Summit | $69 |

| O'Fallon | $71 |

| Springfield | $68 |

| St. Charles | $70 |

| St. Louis | $84 |

| St. Peters | $69 |

Missouri’s minimum car insurance monthly rates vary by city due to factors such as local accident rates, population density, and weather risks, which can make adding optional coverage more beneficial in certain areas.

Proof of Insurance and Financial Responsibility

Missouri law requires drivers to maintain proof of insurance at all times. You must present proof when requested by law enforcement, during vehicle registration or renewal, after an accident, or anytime you are operating a vehicle. Acceptable proof or certificate of insurance includes:

- Insurance ID Card: Issued by your insurer, showing your name, policy number, and vehicle details.

- Actual Insurance Policy or Binder: A document that confirms the active coverage.

- Receipt of Insurance Payment: Must display policy information and payment confirmation.

- Self-Insurance Card: For those who qualify as self-insured through the Department of Revenue.

- Financial Responsibility Card: Issued for alternative proof methods, such as surety bonds or deposits filed with the state.

Failure to provide proof of insurance can lead to severe penalties, including license suspension, reinstatement fees, SR-22 requirements, and license points.

Maintaining valid proof ensures compliance with Missouri’s financial responsibility laws and helps avoid costly legal consequences.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Missouri

Several companies are known for offering affordable car insurance options in Missouri while meeting state-mandated coverage requirements.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Missouri

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage in Missouri

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in Missouri

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsBelow are some of the cheapest car insurance companies, along with tips to help you save even more:

- State Farm: Provides competitive rates for younger drivers and those who bundle policies. To maximize savings, consider signing up for the Drive Safe & Save program, which monitors driving habits for additional State Farm car insurance discounts. Accident-free and good student discounts can also help lower premiums.

- USAA: USAA car insurance discounts offer military members and their families discounts for storing cars on military bases, maintaining a clean driving record, and bundling multiple policies. Long-term members also qualify for loyalty discounts and reduced premiums.

- Nationwide: Nationwide car insurance discounts lower rates through bundling, accident-free rewards, and the SmartRide program. They also offer comprehensive, collision, MedPay, and roadside assistance.

Regularly reviewing discounts and following these tips helps you secure the most affordable coverage without sacrificing essential protection.

Penalties for Driving Without Insurance in MO

Driving without car insurance in Missouri is illegal and comes with serious consequences. If you’re caught without valid insurance, you may face the following penalties:

- License and Registration Suspension: Your driver’s license and vehicle registration can be suspended for up to one year, depending on whether it’s a first, second, or third offense.

- Reinstatement Fees: You’ll be required to pay $20 for a first offense, $200 for a second offense, and $400 for subsequent offenses to reinstate your license and registration.

- SR-22 Requirement: If you’re found to be uninsured after an accident or citation, you must file an SR-22 certificate of financial responsibility for three years to prove you have the required insurance coverage.

- License Points: Four points will be added to your driving record, which can lead to higher insurance premiums and potential license suspension.

Avoiding these penalties by maintaining valid insurance is essential for staying on the road legally and protecting your financial future. It’s crucial to regularly review your coverage to ensure it meets both state requirements and your unique needs.

Consider exploring additional coverage options like comprehensive, collision, and MedPay to further protect your vehicle and finances. Staying informed and responsible with your insurance can help you drive confidently on Missouri roads.

Other Coverage Options to Consider in Missouri

In addition to Missouri’s minimum car insurance requirements, drivers can choose from several optional coverages to enhance their financial protection:

- Comprehensive Coverage: Covers non-collision-related incidents such as theft, vandalism, natural disasters, and damage from falling objects. This coverage is especially useful if you live in an area prone to severe weather or vehicle theft.

- Collision Coverage: Pays for repairs or replacement of your vehicle after an accident, regardless of who is at fault. This coverage is valuable if you have a newer or financed vehicle.

- Medical Payments Coverage (MedPay): Provides coverage for medical expenses resulting from a car accident, regardless of fault. It can help cover hospital bills, doctor visits, and even funeral expenses. Check out this article if you’re looking for the “Best Car Insurance for Medical Payments Coverage” to secure optimal protection.

- Rental Reimbursement: Pays for a rental vehicle if your car is damaged in an accident and undergoing repairs. Read our “Best Car Insurance for Rental Reimbursement Coverage” to find the top providers offering this valuable protection.

- Roadside Assistance: Provides services such as towing, jump-starts, flat tire repairs, and fuel delivery if your vehicle breaks down.

These coverages can offer peace of mind and protect you from out-of-pocket costs in a variety of situations.

Read More: Best Missouri Insurance Agents & Brokers

Frequently Asked Questions

What is the minimum auto insurance coverage required for Missouri drivers?

What is the minimum insurance coverage in Missouri? Missouri law requires $25,000 per person and $50,000 per accident for bodily injury liability, $25,000 for property damage liability, and uninsured motorist coverage with the same limits for bodily injury.

Do you have to have full coverage insurance in Missouri?

No, full coverage is not legally required unless your vehicle is financed or leased.

Do you have to have full coverage on a financed car in MO?

Yes, most lenders require full coverage until the car loan is paid off.

What vehicles are required to be insured in Missouri?

All registered motor vehicles in Missouri must have at least the state’s minimum liability insurance. Enter your ZIP code to compare policies from local insurers.

What are the rules for car insurance claims in Missouri?

Missouri is an at-fault state, meaning the at-fault driver’s insurance pays for damages in a car accident.

What is the minimum insurance coverage a driver needs?

What is the minimum insurance coverage you must carry? Drivers in Missouri must carry liability insurance with the minimum limits of $25,000/$50,000 for bodily injury and $25,000 for property damage.

How much is full coverage insurance in Missouri?

Full coverage typically costs around $1,200 annually, though rates may vary by provider and personal factors.

Can you drive in Missouri without insurance?

No, driving without insurance is illegal and may result in fines, license suspension, and SR-22 requirements.

What does not full coverage insurance cover?

Liability-only insurance doesn’t cover damage to your vehicle. Full coverage typically adds comprehensive and collision protection.

When did car insurance become mandatory in Missouri?

Car insurance became mandatory in Missouri in 1986, ensuring drivers meet the state’s minimum coverage requirements to stay legal on the road. For more information on local insurance options and rates in your area, enter your ZIP code to explore coverage options.

What happens if you get in an accident without insurance in Missouri?

Is Missouri a no-fault insurance state?

What happens if you don’t have car insurance in Missouri?

What does fully comprehensive insurance cover?

What is the average cost of auto insurance in Missouri?

What is the minimum legal insurance coverage required to drive on the road?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.