Best Homeowners Insurance in 2026 (Your Guide to the Top 10 Companies)

State Farm, Nationwide, and Allstate offer the best homeowners insurance starting at just $66 monthly. These providers excel by combining comprehensive coverage, competitive pricing, and top-notch customer service, ensuring optimal protection for homeowners seeking reliable and affordable insurance solutions.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated December 2025

The top picks for the best homeowners insurance are State Farm, Nationwide, and Allstate, renowned for their extensive coverage and reliable customer service.

These companies stand out in the market by offering tailored policies that address the unique needs of homeowners, ensuring comprehensive coverage protection against a variety of risks. Each provider also supports their clients with robust customer service resources, making policy management and claim filing processes smooth and efficient.

Our Top 10 Company Picks: Best Homeowners Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 27% B Comprehensive Coverage State Farm

#2 28% A+ Customizable Policies Nationwide

![]()

#3 23% A+ Discount Variety Allstate

#4 26% A+ Customer Satisfaction Amica

#5 21% A++ Military Focus USAA

#6 19% A Flexible Policies Liberty Mutual

#7 20% A+ Bundling Discounts Progressive

#8 25% A+ Competitive Rates Erie

#9 22% A++ Broad Coverage Travelers

#10 15% A+ AARP Member Benefits The Hartford

By choosing one of these insurers, homeowners can secure their property with confidence, knowing they are backed by some of the industry’s leaders.

Searching for more affordable premiums? Insert your ZIP code above to get started on finding the right provider for you and your budget.

- State Farm leads as the top pick for best homeowners insurance

- Tailored policies meet diverse homeowner needs, ensuring thorough protection

- Robust customer support simplifies management and claim processes

#1 – State Farm: Top Overall Pick

- Best Home Insurance

- Alfa Homeowners Insurance Review

- Farmers vs. Geico Homeowners Insurance Review

- Farmers vs. Country Financial Homeowners Insurance Review

- Farmers vs. State Farm Homeowners Insurance Review

- Farmers vs. Liberty Mutual Homeowners Insurance Review

- Farmers vs. USAA Homeowners Insurance Review

- Farmers vs. Nationwide Homeowners Insurance Review

- Farmers vs. American Family Homeowners Insurance Review

- Farmers vs. Erie Homeowners Insurance Review

- Farmers vs. Geovera Homeowners Insurance Review

- Farmers vs. Hippo Homeowners Insurance Review

- Farmers vs. Alfa Homeowners Insurance Review

- Farmers vs. Lemonade Homeowners Insurance Review

- Travelers vs. Alfa Homeowners Insurance Review

- Farmers vs. Travelers Homeowners Insurance Review

- Travelers vs. Geovera Homeowners Insurance Review

- Travelers vs. Country Financial Homeowners Insurance Review

- Allstate vs. Erie Homeowners Insurance Review

- Amica vs. Nationwide Homeowners Insurance Review

- Erie vs. Country Financial Homeowners Insurance Review

- The Hartford vs. Liberty Mutual Homeowners Insurance Review

- USAA vs. Country Financial Homeowners Insurance Review

- Liberty Mutual vs. USAA Homeowners Insurance Review

- Erie vs. Auto Owners Homeowners Insurance Review

- Erie vs. Hippo Homeowners Insurance Review

- Erie vs. Liberty Mutual Homeowners Insurance Review

- Erie vs. Nationwide Homeowners Insurance Review

- Erie vs. The Hartford Homeowners Insurance Review

- Erie vs. USAA Homeowners Insurance in 2026 (Who Wins?)

- Geico Homeowners Insurance Review

- Lemonade vs. American Family Homeowners Insurance Review

- Lemonade vs. Chubb Homeowners Insurance Review

- Lemonade vs. USAA Homeowners Insurance Review

- Liberty Mutual vs. Country Financial Homeowners Insurance Review

- USAA vs. American Family Homeowners Insurance Review

- Auto Owners vs. Nationwide Homeowners Insurance Review

- The Hartford vs. Nationwide Homeowners Insurance Review

- State Farm vs. American Family Homeowners Insurance in 2026 (Who’s Better?)

- State Farm vs. The Hartford Homeowners Insurance Review

- Erie vs. Lemonade Homeowners Insurance Review

- The Hartford vs. USAA Homeowners Insurance Review

- Chubb vs. Hippo Homeowners Insurance Review

- Progressive vs. Nationwide Homeowners Insurance Review

- The Hartford vs. Amica Homeowners Insurance Review

- Hippo vs. Travelers Homeowners Insurance Review

- Amica vs. Chubb Homeowners Insurance in 2026 (Head-to-Head Review)

- The Hartford vs. Geico Homeowners Insurance Review

- American Family vs. Alfa Homeowners Insurance Review

- Auto Owners vs. Country Financial Homeowners Insurance Review

- State Farm vs. Allstate Homeowners Insurance Review

- Allstate vs. Alfa Homeowners Insurance Review

- Amica vs. Alfa Homeowners Insurance Review

- The Hartford vs. Hippo Homeowners Insurance Review

- The Hartford vs. Travelers Homeowners Insurance 2026 (Side-by-Side Review)

- Erie vs. Amica Homeowners Insurance in 2026 (Head-to-Head Review)

- Chubb vs. Geovera Homeowners Insurance Review

- Progressive vs. USAA Homeowners Insurance (Head-to-Head Review)

- Nationwide vs. Country Financial Homeowners Insurance Review

- USAA vs. Nationwide Homeowners Insurance Review

- Country Financial vs. Alfa Homeowners Insurance Review

- The Hartford vs. Country Financial Homeowners Insurance Review

- Erie vs. Chubb Homeowners Insurance in 2026 (Side-by-Side Review)

- Allstate vs. American Family Homeowners Insurance Review

- Allstate vs. Amica Homeowners Insurance Review

- Allstate vs. Auto Owners Homeowners Insurance Review

- Allstate vs. Chubb Homeowners Insurance Review

- Allstate vs. COUNTRY Financial Homeowners Insurance in 2026 (Side-by-Side Comparison)

- Allstate vs. Geico Homeowners Insurance Review

- Allstate vs. Geovera Homeowners Insurance Review

- Allstate vs. Hippo Homeowners Insurance Review

- Allstate vs. Lemonade Homeowners Insurance Review

- Allstate vs. Liberty Mutual Homeowners Insurance Review

- Allstate vs. Nationwide Homeowners Insurance Review

- Allstate vs. Progressive Homeowners Insurance in 2026 (Side-by-Side Review)

- Allstate vs. The Hartford Homeowners Insurance Review

- Allstate vs. Travelers Homeowners Insurance in 2026 (Side-by-Side Review)

- Allstate vs. USAA Homeowners Insurance Review

- American Family vs. Travelers Homeowners Insurance Review

- Amica vs. American Family Homeowners Insurance Review

- Amica vs. Country Financial Homeowners Insurance Review

- Amica vs. Hippo Homeowners Insurance Review

- Amica vs. Lemonade Homeowners Insurance Review

- Amica vs. Liberty Mutual Homeowners Insurance Review

- Amica vs. Progressive Homeowners Insurance Review

- Amica vs. Travelers Homeowners Insurance Review

- Amica vs. USAA Homeowners Insurance Review

- Auto Owners vs. Alfa Homeowners Insurance Review

- Auto Owners vs. American Family Homeowners Insurance Review

- Auto Owners vs. Chubb Homeowners Insurance Review

- Auto Owners vs. Geico Homeowners Insurance Review

- Auto Owners vs. Liberty Mutual Homeowners Insurance Review

- Auto Owners vs. Progressive Homeowners Insurance Review

- Auto Owners vs. Travelers Homeowners Insurance Review

- Auto Owners vs. USAA Homeowners Insurance Review

- Lemonade vs. Alfa Homeowners Insurance Review

- Chubb vs. Travelers Homeowners Insurance Review

- Erie vs. Progressive Homeowners Insurance Review

- Erie vs. Travelers Homeowners Insurance Review

- Geico vs. Alfa Homeowners Insurance Review

- Geico vs. American Family Homeowners Insurance Review

- Geico vs. Amica Homeowners Insurance Review

- Geico vs. Chubb Homeowners Insurance Review

- Geico vs. Country Financial Homeowners Insurance Review

- Geico vs. Geovera Homeowners Insurance Review

- Geico vs. Hippo Homeowners Insurance Review

- Geico vs. Lemonade Homeowners Insurance Review

- Geico vs. Liberty Mutual Homeowners Insurance Review

- Geico vs. Nationwide Homeowners Insurance Review

- Geico vs. Progressive Homeowners Insurance in 2026 (Side-by-Side Review)

- Lemonade vs. Geovera Homeowners Insurance Review

- Lemonade vs. Hippo Homeowners Insurance Review

- Lemonade vs. Liberty Mutual Homeowners Insurance Review

- Lemonade vs. Nationwide Homeowners Insurance Review

- Lemonade vs. Progressive Homeowners Insurance Review

- Lemonade vs. Travelers Homeowners Insurance Review

- Liberty Mutual vs. Alfa Homeowners Insurance Review

- Liberty Mutual vs. Chubb Homeowners Insurance Review

- Liberty Mutual vs. Hippo Homeowners Insurance Review

- Liberty Mutual vs. Nationwide Homeowners Insurance Review

- Nationwide vs. Alfa Homeowners Insurance Review

- Nationwide vs. American Family Homeowners Insurance Review

- Nationwide vs. Chubb Homeowners Insurance Review

- Nationwide vs. Hippo Homeowners Insurance Review

- Nationwide vs. Travelers Homeowners Insurance Review

- Progressive vs. Alfa Homeowners Insurance Review

- Progressive vs. American Family Homeowners Insurance Review

- Progressive vs. Chubb Homeowners Insurance Review

- Progressive vs. Country Financial Homeowners Insurance Review

- Progressive vs. Geovera Homeowners Insurance Review

- Progressive vs. Hippo Homeowners Insurance Review

- Progressive vs. Liberty Mutual Homeowners Insurance Review

- Progressive vs. Travelers Homeowners Insurance for 2026 (See Who Wins)

- State Farm vs. Alfa Homeowners Insurance Review

- State Farm vs. Amica Homeowners Insurance Review

- State Farm vs. Auto Owners Homeowners Insurance Review

- State Farm vs. Chubb Homeowners Insurance Review

- State Farm vs. Country Financial Homeowners Insurance Review

- State Farm vs. Erie Homeowners Insurance Review

- State Farm vs. Hippo Homeowners Insurance Review

- State Farm vs. Lemonade Homeowners Insurance Review

- State Farm vs. Liberty Mutual Homeowners Insurance (Head-to-Head Review)

- State Farm vs. Nationwide Homeowners Insurance Review

- State Farm vs. Progressive Homeowners Insurance Review

- State Farm vs. Travelers Homeowners Insurance in 2026 (Head-to-Head Review)

- State Farm vs. USAA Homeowners Insurance Review

- USAA vs. Geovera Homeowners Insurance Review

- USAA vs. Hippo Homeowners Insurance Review

- USAA vs. Travelers Homeowners Insurance Review

- Liberty Mutual vs. American Family Homeowners Insurance Review

- Farmers vs. Amica Homeowners Insurance Review

- State Farm Homeowners insurance Review

- Geico vs. Travelers Homeowners Insurance Review in 2026 (Head-to-Head: Discounts & Coverage)

- USAA vs. Chubb Homeowners Insurance in 2026 (Head-to-Head Review)

- Farmers vs. Progressive Homeowners Insurance Review

- Farmers vs. The Hartford Homeowners Insurance in 2026 (Head-to-Head Review)

- Erie vs. American Family Homeowners Insurance Review

- State Farm vs. Geovera Homeowners Insurance Review

- USAA vs. Alfa Homeowners Insurance Review

- Farmers vs. Chubb Homeowners Insurance Review

- Farmers vs. Allstate Homeowners Insurance Review

- Amica Homeowners Insurance Review

- Geovera Homeowners Insurance Review

- Hippo Homeowners Insurance Review

- Chubb vs. Country Financial Homeowners Insurance Review

- Erie vs. Geico Homeowners Insurance Review

- Liberty Mutual vs. Travelers Homeowners Insurance Review

- The Hartford vs. Auto Owners Homeowners Insurance Review

- The Hartford vs. Chubb Homeowners Insurance Review

- The Hartford vs. American Family Homeowners Insurance Review

- American Family vs. Geovera Homeowners Insurance Review

- Country Financial vs. Geovera Homeowners Insurance Review

- American Family vs. Chubb Homeowners Insurance Review

- Erie vs. Alfa Homeowners Insurance Review

- Lemonade Homeowners Insurance Review

- Progressive Homeowners Insurance Review

- The Hartford vs. Progressive Homeowners Insurance Review

- The Hartford vs. Lemonade Homeowners Insurance Review

- Chubb vs. Alfa Homeowners Insurance Review

- American Family vs. Country Financial Homeowners Insurance Review

- Allstate Homeowners Insurance Review

- Auto Owners Homeowners Insurance Review

- The Hartford Homeowners insurance Review

- Auto Owners vs. Amica Homeowners Insurance Review

- American Integrity Homeowners Insurance Review & Ratings (2026)

- Universal Property Insurance Review & Ratings (2026)

- Security First Insurance Company Insurance Review & Ratings (2026)

- Homeowners of America Insurance Company Review & Ratings (2026)

- Builders Insurance Group Insurance Review & Ratings (2026)

- Southern Oak Homeowners Insurance Review & Ratings (2026)

- Goodville Mutual Property Insurance Review & Ratings (2026)

- Narragansett Bay Homeowners Insurance Review & Ratings (2026)

- American Strategic Insurance Review & Ratings (2026)

- Southern Fidelity Insurance Company Insurance Review & Ratings (2026)

- Spinnaker Insurance Company Review & Ratings (2026)

- Swyfft Homeowners Insurance Review & Ratings (2026)

- Frontline Insurance Homeowners Insurance Review & Ratings (2026)

- Arch Insurance Review & Ratings (2026)

- FedNat Insurance Review & Ratings (2026)

- American Risk Insurance Review & Ratings (2026)

- Centauri Homeowners Insurance Review & Ratings (2026)

- Wellington Insurance Review & Ratings (2026)

- Assurant Mobile Home Insurance Review & Ratings (2026)

- SageSure Insurance Review & Ratings (2026)

- Adirondack Homeowners Insurance Review & Ratings (2026)

- Nationwide Home Insurance Review & Ratings (2026)

- Castle Key Homeowners Insurance Review & Ratings (2026)

- UPC Homeowners Insurance Review & Ratings (2026)

- Kingstone Homeowners Insurance Review & Ratings (2026)

- Deans & Homer Insurance Review & Ratings (2026)

- Berkshire Hathaway Homestate Companies Insurance Review & Ratings (2026)

- American Modern Home Insurance Review & Ratings (2026)

- Home Insurance by State

- Best Homeowners Insurance in California

- Best Homeowners Insurance in Idaho

- Best Homeowners Insurance in Louisiana

- Best Homeowners Insurance in Maryland

- Best Homeowners Insurance in Michigan

- Best Homeowners Insurance in Montana

- Best Homeowners Insurance in New Jersey

- Best Homeowners Insurance in New Mexico

- Best Homeowners Insurance in Oklahoma

- Best Homeowners Insurance in Oregon

- Best Homeowners Insurance in Orlando, FL

- Best Homeowners Insurance in Rhode Island

- Best Homeowners Insurance in Florida

- Best Homeowners Insurance in Kentucky

- Best Homeowners Insurance in Cincinnati, OH

- Best Homeowners Insurance in Delaware

- Best Homeowners Insurance in Indiana

- Best Homeowners Insurance in Sacramento, CA

- Best Utah Homeowners Insurance Agents & Brokers (2026)

- Best South Carolina Homeowners Insurance Agents & Brokers (2026)

- Best Wisconsin Homeowners Insurance Agents & Brokers (2026)

- Best Alaska Homeowners Insurance Agents & Brokers (2026)

- Best Kansas Homeowners Insurance Agents & Brokers (2026)

- Best Rhode Island Homeowners Insurance Agents & Brokers (2026)

- Best Pennsylvania Homeowners Insurance Agents & Brokers (2026)

- Best Massachusetts Homeowners Insurance Agents & Brokers (2026)

- Best Wyoming Homeowners Insurance Agents & Brokers (2026)

- Best West Virginia Homeowners Insurance Agents & Brokers (2026)

- Best North Carolina Homeowners Insurance Agents & Brokers (2026)

- Best Kentucky Homeowners Insurance Agents & Brokers (2026)

- Best Iowa Homeowners Insurance Agents & Brokers (2026)

- Best New Hampshire Homeowners Insurance Agents & Brokers (2026)

- Best Texas Homeowners Insurance Agents & Brokers (2026)

- Best South Dakota Homeowners Insurance Agents & Brokers (2026)

- Best Florida Homeowners Insurance Agents & Brokers (2026)

- Best Delaware Homeowners Insurance Agents & Brokers (2026)

- Home Insurance by Applicant Profile

Pros

- Bundling Policies: Significant discounts for bundling multiple insurance policies.

- Wide Coverage: Offers a variety of coverage options tailored for different needs. See more details on our article titled State Farm insurance review & ratings.

- High Customer Satisfaction: Known for high customer satisfaction in service and claims.

Cons

- Limited Multi-Policy Discount: Multi-policy discount not as competitive as others.

- Higher Premium Costs: Premiums can be relatively higher for certain coverage levels.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Customizable Policies

Pros

- Customizable Policies: Offers a wide range of policy customization options. Learn more in our article titled Nationwide insurance review & ratings.

- Strong Financial Stability: Rated A+ by A.M. Best, indicating strong financial health.

- High Multi-Policy Discount: Provides a 28% discount for multiple policies.

Cons

- Variable Customer Service: Customer service quality can vary regionally.

- Complex Policy Options: Some customers may find the array of options overwhelming.

#3 – Allstate: Best for Discount Variety

Pros

- Diverse Discounts: Offers a variety of discounts including new homebuyer and loyalty.

- Innovative Tools: Provides digital tools for policy management and claims. If you want to learn more about the company, head to our article titled Allstate insurance review & ratings.

- Strong Agent Network: Extensive network of agents for personalized service.

Cons

- Higher Rates for Some Policies: Can be more expensive for certain policies without discounts.

- Claims Process Issues: Some users report delays in the claims process.

#4 – Amica: Best for Customer Satisfaction

Pros

- Top-rated Customer Service: Consistently high ratings in customer satisfaction surveys.

- High-Quality Coverage: Offers comprehensive and high-quality policy options. Discover insights in our article titled Amica homeowners insurance review.

- Dividend Policies: Provides dividend policies that can return a portion of premiums.

Cons

- Limited Availability: Not available in all states.

- Premium Pricing: Higher-end pricing compared to some competitors.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Focus

Pros

- Tailored for Military: Specializes in services for military members and their families.

- Exceptional Financial Stability: Rated A++ by A.M. Best. Unlock details in our article titled USAA insurance review & ratings.

- Comprehensive Benefits: Offers extensive benefits and discounts for military personnel.

Cons

- Eligibility Restrictions: Only available to military members, veterans, and their families.

- Limited Physical Locations: Fewer in-person service locations compared to others.

#6 – Liberty Mutual: Best for Flexible Policies

Pros

- Flexible Coverage Options: Offers a wide range of flexible policies to meet diverse needs.

- Disaster Preparedness Support: Provides resources and support for disaster-prone areas.

- Multi-Policy Discounts: Competitive multi-policy discounts available. Delve into our evaluation of our article titled Liberty Mutual review & ratings.

Cons

- Inconsistent Pricing: Customers may experience variability in pricing.

- Mixed Customer Reviews: Customer satisfaction varies significantly by region.

#7 – Progressive: Best for Bundling Discounts

Pros

- Aggressive Bundling Discounts: Notable for offering substantial discounts on bundling.

- Wide Reach: Available widely across the country with varied insurance products. Read up on the “Progressive Insurance Review & Ratings” for more information.

- Online Resources: Extensive online tools for managing policies and filing claims.

Cons

- Customer Service Variability: Inconsistent customer service experiences reported.

- Basic Policy Offerings: Some policies may lack depth in coverage options.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Erie: Best for Competitive Rates

Pros

- Competitive Pricing: Known for competitive pricing in the insurance market.

- Personalized Service: Strong focus on personalized customer service. Access comprehensive insights into our Erie insurance review & ratings.

- Rate Lock Feature: Offers a rate lock feature to keep premiums stable.

Cons

- Regional Availability: Limited to certain states.

- Less Flexibility: Fewer options for policy customization compared to larger insurers.

#9 – Travelers: Best for Broad Coverage

Pros

- Extensive Coverage Options: Offers a broad range of coverage options. Discover more about offerings in our Travelers insurance review & ratings.

- Strong Financial Rating: Rated A++ by A.M. Best, ensuring financial reliability.

- Green Home Discount: Provides discounts for environmentally-friendly home improvements.

Cons

- Pricing Above Average: Premiums can be higher than average for comparable coverage.

- Complex Policies: Policies can be complex and difficult for some to understand.

#10 – The Hartford: Best for AARP Member Benefits

Pros

- AARP Endorsement: Exclusively offers benefits and discounts for AARP members.

- Specialized Coverage: Provides tailored policies for seniors. Check out insurance savings in our complete The Hartford insurance review & ratings.

- Lifetime Renewability: Offers a lifetime renewability feature for AARP members.

Cons

- AARP Membership Required: Coverage is limited to AARP members.

- Higher Costs for Non-Members: Non-members may find similar coverage at lower costs elsewhere.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Monthly Rates for Homeowners Insurance by Provider and Coverage Level

When selecting homeowners insurance, understanding the monthly rates based on coverage levels across different providers is crucial. This table provides a snapshot of what you might expect to pay for minimum and full coverage policies from various insurance companies.

Homeowners Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $80 $200

Amica $70 $165

Erie $68 $155

Liberty Mutual $72 $180

Nationwide $82 $205

Progressive $75 $190

State Farm $76 $185

The Hartford $66 $160

Travelers $74 $180

USAA $78 $190

The table indicates that The Hartford offers the lowest monthly rate for minimum coverage at $66, while Nationwide commands the highest rate for full coverage at $205. Providers like Allstate and Amica offer a range of rates from $80 to $200 and $70 to $165, respectively, illustrating a significant variance in pricing between minimum and full coverage options.

Other companies like State Farm and USAA also show a consistent range in their pricing, emphasizing the importance of comparing rates to find the best fit for one’s specific needs and budget. Learn more in our “How much insurance coverage do I need?”

What Are the Best Home Insurance Companies

The best homeowners insurance companies for you depend on a variety of factors, including where you live and how old your house is. However, some companies generally have better reviews than others.

Listed below are some of the top home insurance companies on the market. Although there are several things to consider before choosing a policy, the following home insurance companies are an excellent place to start looking for coverage.

Lemonade Home Insurance

Lemonade is a little different than many of its competitors. Rather than offering physical offices customers can visit, Lemonade offers a completely virtual insurance experience.

Although Lemonade is only available in 37 states and the District of Columbia, it still receives top marks for home insurance. It’s also one of the most expensive homeowners insurance companies, with only Allstate beating it for the highest rates.

Lemonade offers one of the longest lists of home insurance add-on lists, including equipment breakdown, water backup, and swimming pool coverage.

Despite having higher rates, most customers love Lemonade home insurance. One of the most popular reasons why people love Lemonade home insurance is that filing claims, managing policies, and getting help are incredibly easy with its online tools. Moreover, Lemonade car insurance discounts can further sweeten the deal for homeowners looking to bundle their coverage and save on multiple policies.

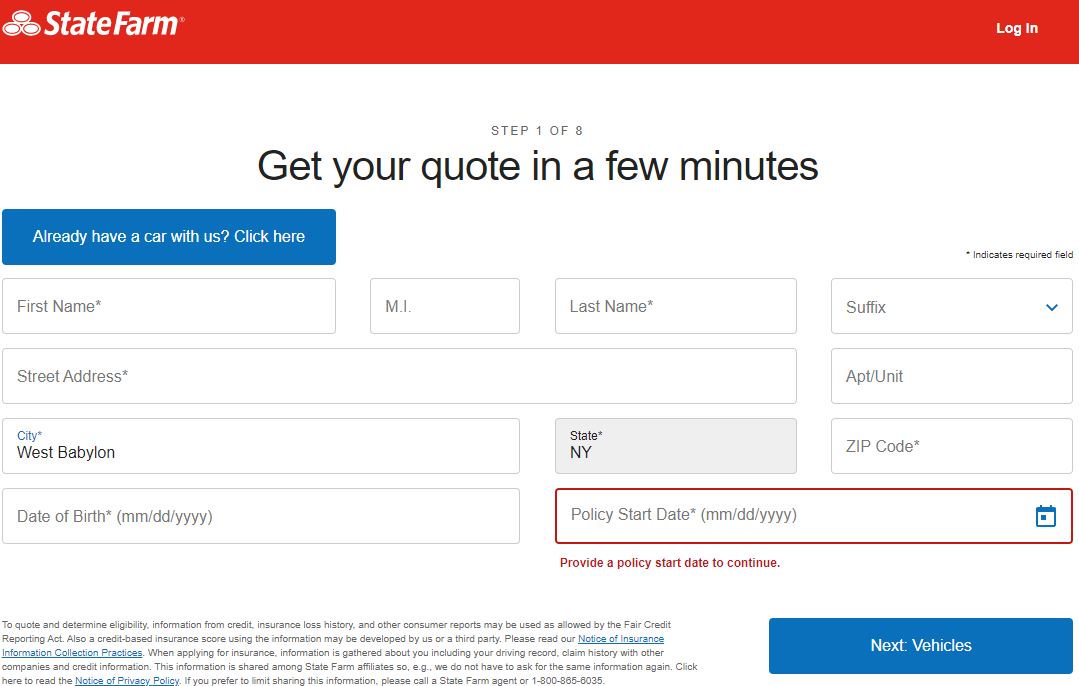

State Farm Home Insurance

While State Farm car insurance is probably better known, State Farm also has excellent home insurance. When you buy a homeowners insurance policy from State Farm, you’ll have the option for a bundling discount if you also purchase coverage for your vehicle.

State Farm home insurance is available in all 50 states. It also receives better reviews for its home insurance than car insurance. Although State Farm has quality policies, it’s one of the cheapest house insurance companies on the market.

State Farm doesn’t have as many add-ons as Lemonade, but it does offer some valuable protection. It provides protection from identity theft and inflation, as well as extra coverage for your most valuable possessions.

American Family Home Insurance

Another company better known for its car insurance, American Family sells home insurance in only 23 states. American Family runs CONNECT, which sells and manages home insurance policies for Costco customers. If you buy homeowners insurance through Costco, CONNECT operates in 44 states.

American Family has the benefit of being one of the cheapest companies for home insurance. It doesn’t have the most add-ons, but there are a few good ones to choose from. One that stands out is its matching siding add-on. It will replace all the sidings on your house if one gets damaged so that everything matches.

Like State Farm, you’ll likely get a discount if you bundle multiple insurance policies. You’ll have multiple ways to manage your policy as well — American Family customers can use the website or mobile app, speak with a representative on the phone, or visit a local office.

Check out our American Family insurance review to learn more.

Nationwide Home Insurance

Despite what its name suggests, Nationwide home insurance is not available in every state. Residents of Alaska, Hawaii, Louisiana, New Mexico, Florida, Massachusetts, and New Jersey will need to look elsewhere for homeowners insurance.

If you live in a state Nationwide operates in, it will probably be one of your cheapest options. As a bonus, Nationwide includes identity theft protection in every standard homeowners insurance policy it sells.

Nationwide offers several add-ons for your home insurance, including earthquake and flood coverage, upgraded roof replacement, and extra coverage for valuable possessions like antiques and art. Along with a solid list of add-ons, Nationwide also offers several discounts.

Visit our Nationwide home insurance review to learn more.

What Are the Cheapest Home Insurance Companies

While the companies listed above offer some of the best home insurance on the market, they’re not always the cheapest. If sticking to a budget is important to you, the following companies usually offer cheap home insurance rates:

- Erie Insurance

- Auto-Owners Insurance

- State Farm

- Nationwide

- Travelers

See our Auto-Owners insurance review for details.

While these are some of the cheapest companies for home insurance, you might find lower rates elsewhere. Companies look at a variety of factors when determining your rates, so it’s important to compare multiple quotes when determining how much home insurance costs.

When obtaining home insurance quotes, several factors influence your rates. Location impacts costs, with higher rates in areas prone to crime or severe weather. The cost to rebuild your home also affects premiums, as more expensive homes lead to higher repair or replacement costs. Older homes generally incur higher rates due to costly materials and frequent repairs, often necessitating a 4-point inspection.

Jeff Root Licensed Life Insurance Agent

The amount of coverage correlates with cost; more coverage leads to higher premiums. Installing safety features like smoke alarms can reduce rates, while your credit history also impacts costs, with lower scores increasing them. Therefore, it’s crucial to compare quotes, as some companies may offer more favorable rates for factors like a low credit score, such as Kemper Insurance.

Read more: Kemper Car Insurance Discounts

Your location significantly influences which insurance provider offers the most cost-effective rates. For instance, while Allstate typically ranks among the pricier choices for home insurance, it emerges as a notably affordable option in Oklahoma. This factor is crucial when considering what does homeowners insurance cover and finding the best price.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which Companies Offer the Best Home and Car Insurance Bundles

Bundling different types of insurance policies from the same company is a great way to earn a discount on your coverage. Home and car insurance are some of the most commonly purchased policies, so most major companies sell both.

If you’re looking for the best car and home insurance discounts, here are the companies that offer bundle options:

- State Farm: According to State Farm, customers can save up to 20% on their policies for bundling home and car insurance. You can also earn this discount if you have a condo or renters insurance policy.

- Allstate: It might not be the cheapest company, but bundling home and car insurance can save you up to 25% on your Allstate policy.

- Farmers: Farmers offers up to 20% off your insurance if you buy a new car and homeowners policy at the same time. You’ll still get a discount if you add them separately, but it will be a little less.

- Nationwide: Nationwide is one of the few companies that offers a bundling discount for more than just car and home insurance combinations. If you buy home, car, and life insurance, you’ll see even bigger savings.

- American Family: You can save up to 23% on your home and car insurance if you bundle both from American Family.

Learn more through our Farmers insurance review.

Another key advantage of bundling your insurance, besides the cost savings, is the convenience it provides in managing multiple policies. With all policies consolidated into one account, making payments and initiating claims becomes notably easier, particularly if you’re searching for cheap house insurance near me.

What Does Home Insurance Cover

Most homeowners insurance policies include several key features. Dwelling protection covers the structure of your home and detached buildings from damage due to incidents like fire or theft. Personal liability ensures coverage if someone is injured on your property, handling legal and medical expenses. Personal property coverage protects items inside your home, such as appliances and clothing.

Moreover, should your home become uninhabitable, the policy includes coverage for living expenses while repairs are underway. It’s crucial to understand that standard policies usually exclude earthquakes and floods, hence, additional coverage might be required in areas susceptible to these events. Ensure your insurance company home policy is adequately tailored to your needs.

You should also consider alternative insurance if you have a mobile or manufactured home. Manufactured and mobile home insurance works similarly to a standard home policy but is specially crafted for prefab homes.

How Do You Choose the Best Home Insurance Policy

Selecting the appropriate home owners insurance policy may seem daunting, but it can be straightforward. Begin by determining the necessary amount of coverage, taking into account the rebuilding costs of your house, the worth of your belongings, and the specific risks of your location.

Next, pick a company; as you’ve seen, prices and available coverage options, along with discounts, vary significantly between companies. Finally, choose your policy. It’s crucial to compare multiple quotes to ensure you find the most competitive price for the coverage you require. This process can help simplify the task of finding the ideal home insurance plan to meet your needs.

When you’re looking for the best homeowners insurance policy, you must compare rates with multiple companies. Home insurance can be expensive, and you’ll likely overpay if you don’t compare rates. See more details on our “Best Home Insurance for Renovations.”

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Home Insurance Policy Today

No matter if your residence is a grand estate or a small dwelling, home property insurance is vital for safeguarding your property. Evaluating various options is a key part of ensuring that all aspects that make your house a home are protected.

Laura Walker

Former Licensed Agent

When you are preparing to purchase a homeowners insurance policy, comparing various quotes is crucial to securing affordable coverage. Although certain insurers may offer the lowest average rates, the ideal company for you could vary. Delve into our evaluation of guide titled “22 Tips for How to Get Cheap Home Insurance.”

Use our free quote comparison tool below to find the cheapest coverage in your area.

Frequently Asked Questions

What is home insurance?

Home insurance, also known as homeowner’s insurance, is a type of insurance policy that provides financial protection against damage or loss to your home and its contents caused by certain perils, such as fire, theft, and weather events.

For additional details, explore our comprehensive resource titled “Home insurance for a house damaged by fire.”

What does home insurance typically cover?

Home insurance typically covers damage or loss caused by fire, lightning, windstorm or hail, theft, vandalism, and other specific perils. It also covers liability protection for accidents that occur on your property, as well as additional living expenses if your home is uninhabitable due to covered damage.

What is not covered by home insurance?

Home insurance typically does not cover damage or loss caused by floods, earthquakes, and other natural disasters. It also typically does not cover wear and tear, intentional damage, and damage caused by neglect or lack of maintenance.

What factors affect the cost of home insurance?

The cost of home insurance can be affected by various factors, including the location and age of your home, its construction materials, the coverage limits you choose, and your deductible. Your credit score and claims history can also affect your premium.

How much home insurance do I need?

The amount of home insurance you need depends on various factors, including the value of your home and its contents, your liability risks, and your budget. It’s important to ensure that you have enough coverage to fully protect your home and assets in the event of a loss.

To find out more, explore our guide titled “What is the difference between property owners liability insurance and public liability insurance?”

What is the most affordable house insurance?

The most affordable house insurance varies by location, property type, and coverage needs, but you can find the lowest rates by comparing quotes from multiple companies and looking for discounts such as those for security enhancements or bundling policies.

Where can I find the cheapest home and car insurance bundle?

You can find the cheapest home and car insurance bundle by comparing offers from several insurance providers, as many companies offer significant discounts for bundling multiple policies.

How to compare house insurance?

To compare house insurance, gather quotes from multiple insurers, evaluate the extent of coverage provided, check customer reviews for claims satisfaction, and consider the overall cost and deductible amounts.

Why is home owners insurance important?

Home owners insurance is crucial as it provides financial protection against losses or damages to your property and possessions, and it covers liability for accidents that may occur at your home.

To learn more, explore our comprehensive resource on “Insurance Quotes Online.”

What is homeowners insurance?

Homeowners insurance is a form of property insurance that covers losses and damages to an individual’s house and assets in the home, providing liability coverage against accidents in the home or on the property.

What is home insurance?

How can I get online homeowners insurance?

How does homeowners insurance work?

What is home ownership insurance?

How does hoe insurance work?

Is homeowners insurance included in mortgage?

What should I know about insurance on a home?

What does houses insurance typically cover?

How can I obtain house insurance estimates?

What is another name for homeowners insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.