Maryland Car Insurance Requirements for 2026 (What MD Drivers Need to Buy)

Uncover Maryland car insurance requirements, including $30,000 bodily injury liability per person, $60,000 per accident, and $15,000 for property damage liability. With MD car insurance rates starting at $43/mo, meeting these limits ensures compliance and protects Maryland drivers from financial risks.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated August 2025

Understanding Maryland car insurance requirements is essential for staying compliant and protecting yourself financially on the road. Drivers in Maryland must carry a minimum coverage of $30,000 bodily injury liability per person, $60,000 per accident, and $15,000 for property damage liability.

With rates starting as low as $43/month, meeting these limits is affordable and necessary to avoid penalties. This guide explores the mandatory coverage limits, optional policies like comprehensive and collision, and the consequences of driving uninsured.

Maryland Minimum Car Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $30,000 per person / $60,000 per accident |

| Property Damage Liability | $15,000 per accident |

Learn how to secure the right coverage, compare car insurance quotes, and maximize your savings. Stay informed and safeguard your driving experience.

To find the best MD car insurance rates, enter your ZIP code and compare quotes from top-rated insurance providers to secure affordable coverage.

- Maryland car insurance requirements mandate 30/60/15 minimum liability coverage

- USAA offers Maryland’s cheapest car insurance rates, starting at $43/month

- Driving without insurance in MD results in fines, license suspension, and other fees

Maryland Car Insurance Requirements & What They Cover

Understanding Maryland car insurance laws is essential for ensuring compliance and protecting yourself financially. All personal vehicles in the state must meet the Maryland auto insurance minimum requirements, which include liability coverage for both bodily injury and property damage.

The Maryland state minimum car insurance coverage limits are $30,000 for bodily injury per person, $60,000 per accident, and $15,000 for property damage. These Maryland auto insurance minimums are designed to provide basic financial protection in the event of an accident.

According to Maryland auto insurance laws and regulations, proof of insurance must be maintained at all times, and drivers may need to provide a Maryland Insurance Certification (FR-19) to verify compliance with Maryland insurance requirements. This document is often requested by the MVA or other authorities to confirm active coverage.

Failure to meet Maryland car insurance laws can result in severe penalties, including fines, license suspension, and the impounding of your vehicle. For drivers seeking affordable coverage, meeting the minimum auto insurance coverage in Maryland can often be achieved with rates as low as $43/month.

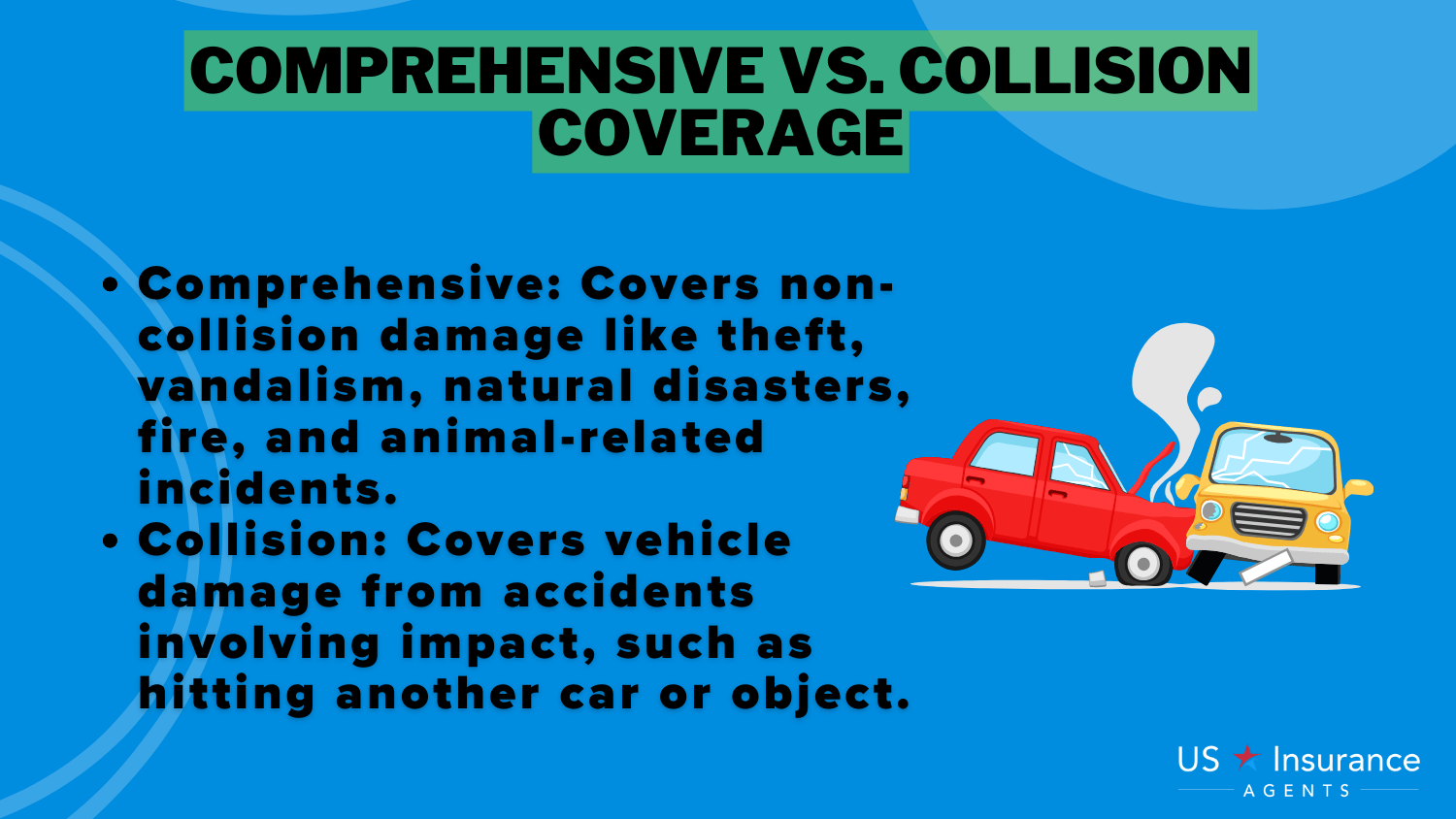

While the Maryland state minimum auto insurance meets legal requirements, additional coverage like comprehensive and collision car insurance is highly recommended for greater protection. Following this Maryland auto insurance guide ensures compliance and safeguards your financial well-being on the road.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Maryland

Finding affordable coverage that meets Maryland car insurance law is essential for staying compliant and minimizing costs. The cheapest provider in Maryland is USAA, with rates starting at just $43/month for drivers who qualify.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Maryland

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage in Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage in Maryland

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsTravelers is the second cheapest option at $55/month, while Nationwide offers coverage for $56/month. These rates satisfy Maryland liability insurance requirements, which include 30/60/15 minimum limits for bodily injury and property damage.

Maryland Car Min. Coverage Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Annapolis | $82 |

| Baltimore | $96 |

| Bowie | $78 |

| College Park | $85 |

| Columbia | $80 |

| Dundalk | $90 |

| Ellicott City | $83 |

| Frederick | $75 |

| Gaithersburg | $81 |

| Germantown | $84 |

| Hagerstown | $72 |

| Laurel | $79 |

| Rockville | $86 |

| Salisbury | $74 |

| Silver Spring | $88 |

| Towson | $91 |

| Waldorf | $77 |

Choosing affordable providers ensures compliance with Maryland auto insurance requirements without breaking the bank. Monthly rates for minimum car insurance in Maryland vary by city, reflecting local factors such as population density and accident rates. For instance, drivers in Frederick enjoy some of the lowest rates at $75/month, while Baltimore sees higher rates averaging $96/month.

Other cities, such as Annapolis ($82) and Columbia ($80), fall in the mid-range. These rates align with Maryland auto insurance laws and provide essential protection for all drivers. Ensuring your policy meets Maryland minimum car insurance requirements keeps you safe and legally compliant, regardless of where you live in the state.

Read more: Best Maryland Car Insurance Discounts

Other Coverage Options to Consider in Maryland

While meeting MD auto insurance requirements is mandatory, additional coverage can provide greater financial protection and peace of mind. Maryland drivers are required to carry the following beyond liability coverage:

-

Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist insurance coverage protects you if an at-fault driver lacks adequate insurance and covers damage to your vehicle caused by uninsured or underinsured drivers.

- Personal Injury Protection (PIP): Personal injury protection helps pay medical expenses and lost wages, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle from non-accident damages, such as theft, vandalism, or fire. Reviewing a list of the most stolen vehicles in Maryland can help assess your risk.

- Collision Coverage: Collision car insurance pays for repairs to or replacement of your vehicle after an accident, regardless of fault.

Although the Maryland insurance minimums address the question, “Is car insurance required in Maryland?” they might not provide sufficient coverage for all scenarios. Adding optional coverages ensures that you’re better protected from financial losses, aligning with the car insurance requirements in Maryland while offering broader security for unexpected events.

Penalties for Driving Without Auto Insurance in Maryland

Driving without auto insurance in Maryland comes with severe penalties that can impact your finances and driving privileges. Fines range from $150 for the first 30 days to $7 per day thereafter, with total penalties reaching up to $2,500.

Penalties for Driving Without Auto Insurance in Maryland

| Penalty Type | Details |

|---|---|

| Fines | Fines from $150 to $2,500 |

| License Suspension | License suspension up to 30 days |

| Vehicle Impoundment | Vehicle may be impounded |

| Court Appearance | Possible court appearance required |

| Reinstatement Fees | Fees from $25 to $100 for reinstatement |

Additionally, drivers may face license suspension for up to 30 days, vehicle impoundment, and mandatory court appearances. Registration can also be suspended, requiring a $25 reinstatement fee to restore it. More serious violations, such as repeated offenses, can result in fines of $1,000 or even up to one year of imprisonment.

Scott W. Johnson Licensed Insurance Agent

Maryland drivers must settle all fines before registering any vehicles, emphasizing the importance of complying with Maryland car insurance requirements to avoid these consequences.

Read more: Most Stolen Cars in Maryland

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get the Right Car Insurance in Maryland

Securing the right car insurance in Maryland starts with understanding the Maryland car insurance requirements and exploring coverage options that meet your needs and budget. Begin by comparing rates from top providers to find affordable policies, with options like USAA offering coverage from $43/month (Read more: USAA Insurance Review & Ratings).

Ensure your policy includes the state-mandated 30/60/15 minimums for liability coverage and consider additional protection like comprehensive or collision for greater financial security. Staying compliant with Maryland auto insurance laws protects you from penalties such as fines, license suspension, or vehicle impoundment.

Use these insights to make informed decisions, stay legally covered, and safeguard your financial well-being on the road. See if you’re getting the best deal on car insurance by entering your ZIP code here.

Frequently Asked Questions

What are the Maryland car insurance requirements?

Maryland car insurance requires a minimum of $30,000 bodily injury liability per person, $60,000 per accident, and $15,000 property damage liability. Additional required coverages include uninsured/underinsured motorist coverage and Personal Injury Protection (PIP).

What happens if I drive without insurance in Maryland?

Driving without insurance can result in fines of $150 for the first 30 days, $7 per day thereafter, license suspension, vehicle impoundment, and possible court appearances. Take the first step toward cheaper car insurance rates. Enter your ZIP code to see how much you could save.

What is the cheapest car insurance in Maryland?

USAA offers the cheapest rates in Maryland at $43/month, followed by Travelers at $55/month and Nationwide at $56/month.

Is car insurance required in Maryland?

Yes, car insurance is mandatory in Maryland. All drivers must maintain liability insurance coverage that meets the Maryland minimum car insurance requirements to drive legally.

What does Personal Injury Protection (PIP) cover in Maryland?

PIP covers medical expenses and lost wages for you and your passengers, regardless of fault, as required by Maryland auto insurance laws.

What is the FR-19 form, and when is it required in Maryland?

The FR-19 form verifies active insurance coverage and is often required by the Maryland Motor Vehicle Administration (MVA) after an accident or traffic violation.

What additional coverage options should Maryland drivers consider?

In addition to the state minimums, Maryland drivers should consider other types of car insurance coverage, such as comprehensive and collision coverage, for protection against theft, vandalism, or damage from accidents.

How do insurance rates vary across cities in Maryland?

Insurance rates vary by city due to factors like traffic density and accident rates. For example, Baltimore averages $96/month, while Frederick has lower rates at $75/month.

What discounts are available for car insurance in Maryland?

Discounts for Maryland drivers include safe driving, bundling multiple policies, good student car insurance discounts, and military discounts for eligible individuals.

How can I find the best car insurance rates in Maryland?

To find the best rates, compare quotes from multiple providers, ensure they meet Maryland auto insurance minimum requirements, and take advantage of available discounts. Find cheap car insurance quotes by entering your ZIP code here.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.