Lemonade vs. Toggle Renters Insurance in 2026 (Side-by-Side Review)

When comparing Lemonade vs. Toggle renters insurance, Lemonade comes in strong at $58 monthly with flat-rate pricing, fast digital claims, and a Giveback fund. Toggle costs $105 monthly and includes $10K electronics coverage and pet injury protection. At a $500 deductible, Lemonade leads.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated August 2025

0 reviews

0 reviewsCompany Facts

$500 Deductible

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews 35 reviews

35 reviewsCompany Facts

$500 Deductible

A.M. Best Rating

Complaint Level

Pros & Cons

35 reviews

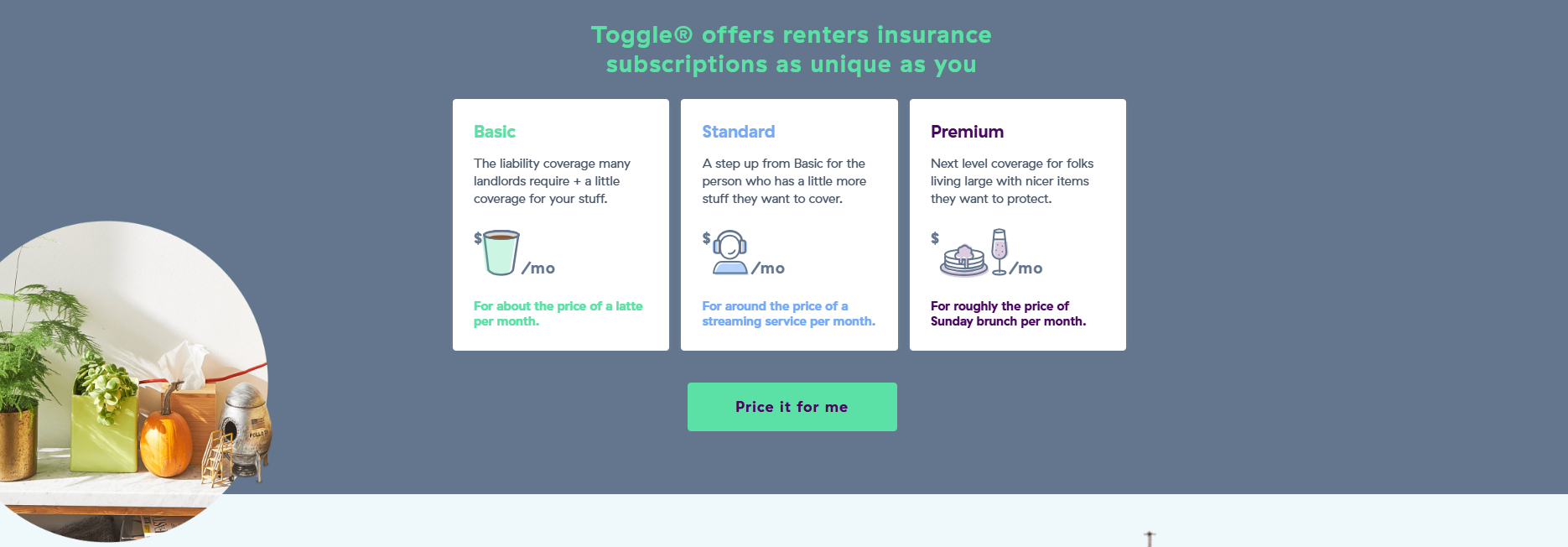

35 reviewsLemonade vs. Toggle renters insurance starts with rates based on a $500 deductible. Lemonade offers a $58 monthly premium backed by flat-rate pricing, fast AI-driven claims, and a Giveback program that donates unused funds to nonprofits like the ACLU.

That same deductible with Toggle costs $105 monthly, but the higher rate brings added value through $10,000 in electronics protection, pet injury coverage, and endorsements tailored to freelancers and side hustlers.

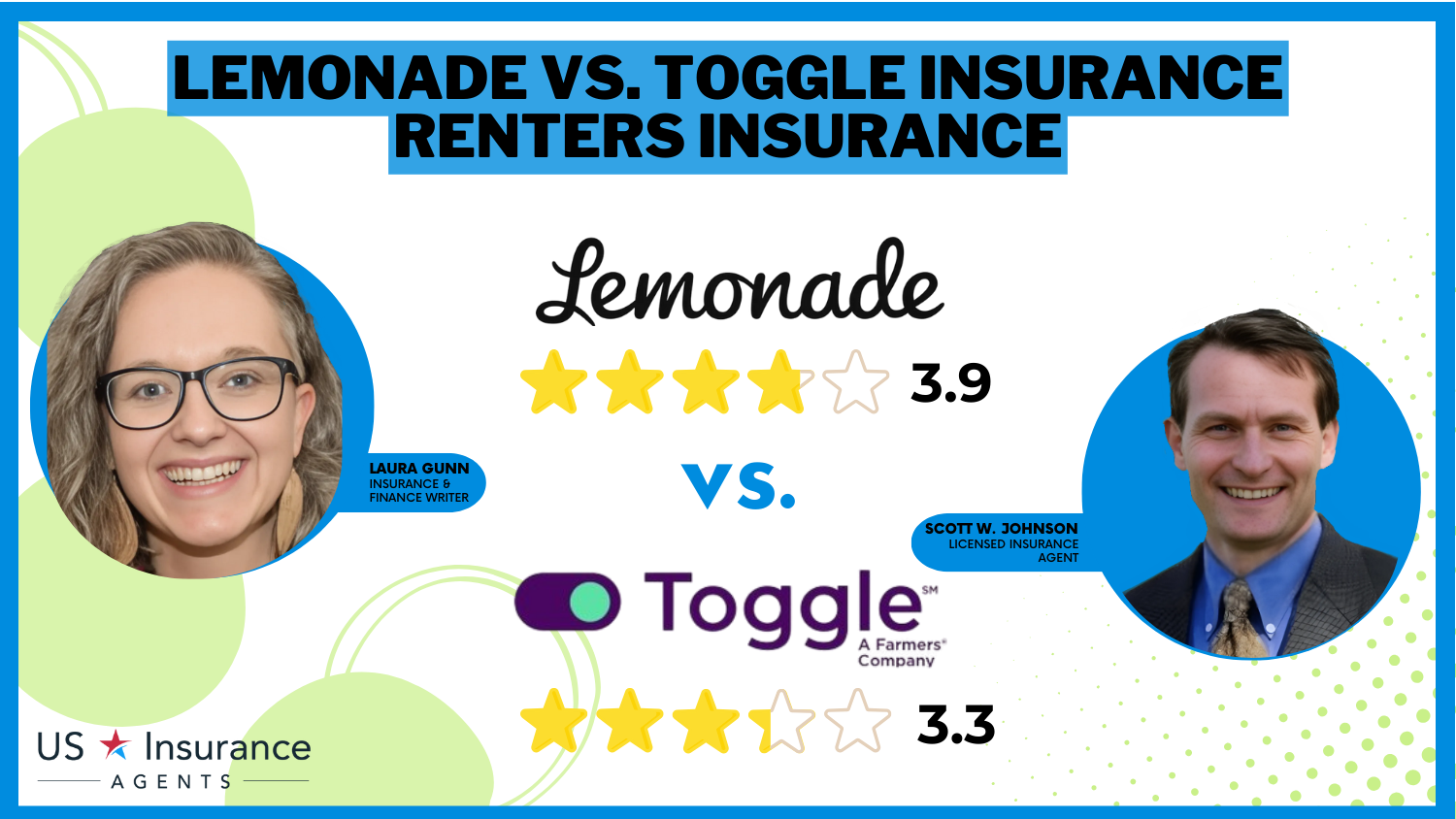

Lemonade vs. Toggle Renters Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.9 | 3.3 |

| Business Reviews | 4.0 | 3.0 |

| Claim Processing | 4.0 | 4.0 |

| Company Reputation | 4.0 | 4.0 |

| Coverage Availability | 4.3 | 3.5 |

| Coverage Value | 3.5 | 3.3 |

| Customer Satisfaction | 4.8 | 2.7 |

| Digital Experience | 4.5 | 4.0 |

| Discounts Available | 5.0 | 3.0 |

| Insurance Cost | 3.8 | 3.0 |

| Plan Personalization | 4.0 | 4.0 |

| Policy Options | 2.2 | 3.0 |

| Savings Potential | 4.2 | 3.0 |

| Lemonade Review | Toggle Review |

Lemonade focuses on speed, transparency, and social impact with a mobile-first design, while Toggle attracts renters looking for flexible coverage that protects high-value items and unique situations.

Their differences go beyond pricing and highlight how each company meets distinct renter needs and priorities.

- Lemonade processes claims in under 3 minutes via the app

- Compares nonprofit-backed pricing to bundled policy extras

- Toggle features optional ID theft protection and valuables cover

Use our free comparison tool to check insurance quotes online and discover options matching your lifestyle.

Comparing Lemonade vs. Toggle Renters Insurance Rates

Lemonade and Toggle take very different approaches to pricing and features, and the monthly rate differences by age and gender reinforce those contrasts. Lemonade promotes flat-rate affordability, offering faster digital claims and a Giveback program, while Toggle rental insurance prices are more risk-based and come with high-value protections and a range of optional coverages.

Lemonade vs. Toggle Renters Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $284 | $801 |

| 16-Year-Old Male | $227 | $814 |

| 30-Year-Old Female | $63 | $131 |

| 30-Year-Old Male | $66 | $136 |

| 45-Year-Old Female | $59 | $112 |

| 45-Year-Old Male | $58 | $105 |

| 60-Year-Old Female | $53 | $92 |

| 60-Year-Old Male | $55 | $95 |

For 16-year-olds, the price gap is huge—$284 for a female renter with Lemonade versus $801 from Toggle. That trend continues across all ages: a 30-year-old male pays $66 with Lemonade and $136 with Toggle, while at age 60, rates drop to $55 with Lemonade but still sit at $95 with Toggle.

Toggle’s higher prices come with extras like $10K in electronics coverage and pet injury protection, which can be helpful for renters concerned about common pet insurance claims such as accidental injury, ingestion of foreign objects, or emergency vet visits. Lemonade excludes these features to maintain a leaner, low-cost structure.

Melanie Musson Published Insurance Expert

Toggle might be a better fit for renters who want extra coverage options, while Lemonade works well for those who prefer simple, affordable insurance they can manage easily online. At the end of the day, it really comes down to what you value more—steady pricing or more flexible protection.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lemonade and Toggle Discounts Depend on Your Habits

Comparing Lemonade vs. Toggle renters insurance shows how discounts can really impact what you pay each month. These offers aren’t just percentages—they show what each company values in a renter and how you might qualify for the cheapest renters insurance based on your habits.

Renters Insurance Discount Percentages: Lemonade vs. Toggle

| Discount Type | ||

|---|---|---|

| Annual Payment (Paid in Full) | 7% | 7% |

| Association/Group Membership | X | 7% |

| AutoPay / Automatic Billing | 6% | 6% |

| Claims-Free Discount | X | 10% |

| Decreasing Deductible | X | 5% |

| Good Credit / Tenant History | 10% | 10% |

| Loyalty Discount (Renewal) | X | 5% |

| Paperless Billing | 3% | 3% |

| Policy Bundling | 10% | 10% |

| Protective Devices (Alarms, Locks) | 5% | 8% |

| Student / Senior / Military | X | X |

Toggle offers more ways to save if you’ve stayed claims-free or plan to stick around long-term. A 10% discount for having no past claims and 5% off for renewing show how stability is rewarded. If you’ve taken extra steps like adding locks or alarms, Toggle knocks 8% off, while Lemonade offers 5% off.

On the other hand, Lemonade gives 10% off based on credit or tenant history, which could be helpful if you’ve built a solid record. Both insurers give the same discount—7% for paying annually and 6% for using autopay—making those options easy wins no matter which one you choose. In the end, your savings depend on how you manage risk, loyalty, and payment style.

Lemonade vs. Toggle Renters Insurance: What’s Really Covered

When comparing Lemonade vs. Toggle renters insurance, the biggest differences come down to how each company handles coverage flexibility and extras. Both include standard protections like personal property and liability, but Toggle gives renters more control by letting them adjust personal property coverage in $10,000 increments—great if you’ve got expensive electronics or home items.

Coverage Comparison Table: Lemonade vs. Toggle Renters Insurance

| Coverage Type | ||

|---|---|---|

| Personal Property | Standard; customizable limits | Core coverage; customizable in $10K increments |

| Liability Coverage | Included; up to $500,000 | Included; customizable limits |

| Medical Payments to Others | Included; typically $1,000–$5,000 | Included; adjustable |

| Loss of Use (Additional Living Expenses) | Included; covers hotel stays, meals, etc. | Included; flexible payout options |

| Deductible Options | Ranges from $250 to $2,500 | Flexible, starting from $100 |

| Valuable Items (Jewelry, etc.) | Add-on coverage available for high-value items | Add-on coverage available |

| Water Backup Coverage | Optional add-on | Optional add-on |

| Earthquake Coverage | Available in select states | Available in select states |

| Pet Damage Coverage | Not standard; pet health insurance offered separately | Optional add-on (covers pet damage to belongings) |

| Identity Theft Protection | Optional add-on | Included or optional depending on package |

| Customizable Packages | Limited customization; mostly straightforward coverage | Highly customizable (add-ons like electronics, bikes, travel, etc.) |

| Monthly Subscription Style | Traditional renters insurance premium model | Subscription-style model with à la carte coverage |

| Claim Filing | Mobile app; AI-powered instant approval for simple claims | Online/app; straightforward digital process |

Lemonade keeps it simpler with set limits and fewer adjustments. Both policies include liability coverage, but while Lemonade tops out at $500,000, Toggle lets you choose your own limit, which is helpful if you host guests or live in a shared space. Medical payments to others are included in both and typically cover injuries like a guest slipping in your kitchen, usually between $1,000 and $5,000.

Loss of use is also part of both policies, helping you cover hotel stays, meals, or temporary housing if your rental becomes unlivable. Toggle gives you more flexibility in how that benefit is paid out, while Lemonade sticks to a straightforward structure. One key difference is in deductibles: Lemonade starts at $250, but Toggle gives you the option to go as low as $100, which can lower the upfront cost when you file a claim.

Toggle really stands out when it comes to add-ons. It offers optional coverage for pet damage, identity theft, and even travel-related protection—ideal for renters with pets, frequent travelers, or those wanting more personalized plans. Lemonade doesn’t include those in its base coverage, but it does offer extras like high-value item protection and water backup coverage if you want to add them.

What sets Lemonade apart is its fast, AI-powered claim process that can approve simple claims in minutes. If you want a straightforward, no-fuss policy, Lemonade keeps it easy. But if you’re looking for more ways to customize your renters and liability insurance, Toggle gives you that flexibility.

Consumer Satisfaction and Financial Strength of Toggle vs. Lemonade

When it comes to Lemonade vs. Toggle renters insurance, third-party scores show clear performance gaps in customer satisfaction, complaint volume, and overall business conduct. These aren’t just numbers—they reflect real renter experiences and how each company handles service, trust, and reliability.

Insurance Business Ratings & Consumer Reviews: Lemonade vs. Toggle

| Agency | ||

|---|---|---|

| Score: 807 / 1,000 Below Avg. Satisfaction | Score: 857/1,000 Above Avg. Satisfaction |

|

| Score: B Fair Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 70/100 Average Customer Satisfaction | Score: 74/100 Good Customer Satisfaction |

|

| Score: 2.50 More Complaints Than Avg. | Score: 0.55 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A Excellent Financial Strength |

Toggle received an 857/1,000 from J.D. Power, placing it above average in customer satisfaction, while Lemonade scored 807 and fell below average. The Better Business Bureau rated Toggle an A+ for business practices, compared to Lemonade’s B. Consumer Reports gave Toggle a 74/100, while Lemonade landed at 70/100, showing a modest edge in customer approval.

Most notably, Lemonade’s complaint index sits at 2.50—well above the norm—while Toggle is just 0.55, signaling far fewer customer issues.

When looking at Lemonade vs. Toggle renters insurance, their market presence is still pretty limited compared to traditional providers. The chart gives a clear picture of where these newer players stand.

Lemonade holds 9% of the renters’ insurance market, while Toggle makes up just 2%. That leaves 89% in the hands of other, more established companies. It shows that while both are gaining traction—especially among tech-savvy renters—they’re still carving out their place in a crowded field.

On Reddit, a user shared a real-life experience that shows how Lemonade handles claims when they matter. They said they pay just $6 a month, and after getting mugged and losing their phone, Lemonade reimbursed them right after they sent in a police report.

Comment

byu/brokenimage321 from discussion

inpersonalfinance

Even though they were told their rates might go up, they never did—and they’re still using the service. It’s a good reminder that beyond all the numbers, how a company handles tough moments really counts.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Is Renters Insurance and Why Does It Matter

Renters insurance is there to cover your stuff—like your laptop, TV, clothes, or furniture—if it gets damaged or stolen in situations like a fire or break-in. It also helps out if someone gets hurt in your place and you’re on the hook for their medical bills or legal fees.

One helpful feature is that it often covers your belongings even when you’re not at home. So, if your phone gets stolen from your car or your laptop disappears while you’re traveling, you’re still covered. It can also pay for a place to stay, like a hotel, if your rental becomes unlivable due to something like a fire.

Most policies cost less than a few cups of coffee a month, making it one of the easiest ways to protect yourself from unexpected expenses. If you’re curious about what your rate might look like, getting a Toggle quote is a quick way to see your options. Even though it’s not required, renters insurance is a smart, low-cost way to avoid major out-of-pocket expenses when something unexpected happens.

See more: Best Renters Insurance for Short-Term Renters

A Closer Look at Lemonade Renters Insurance

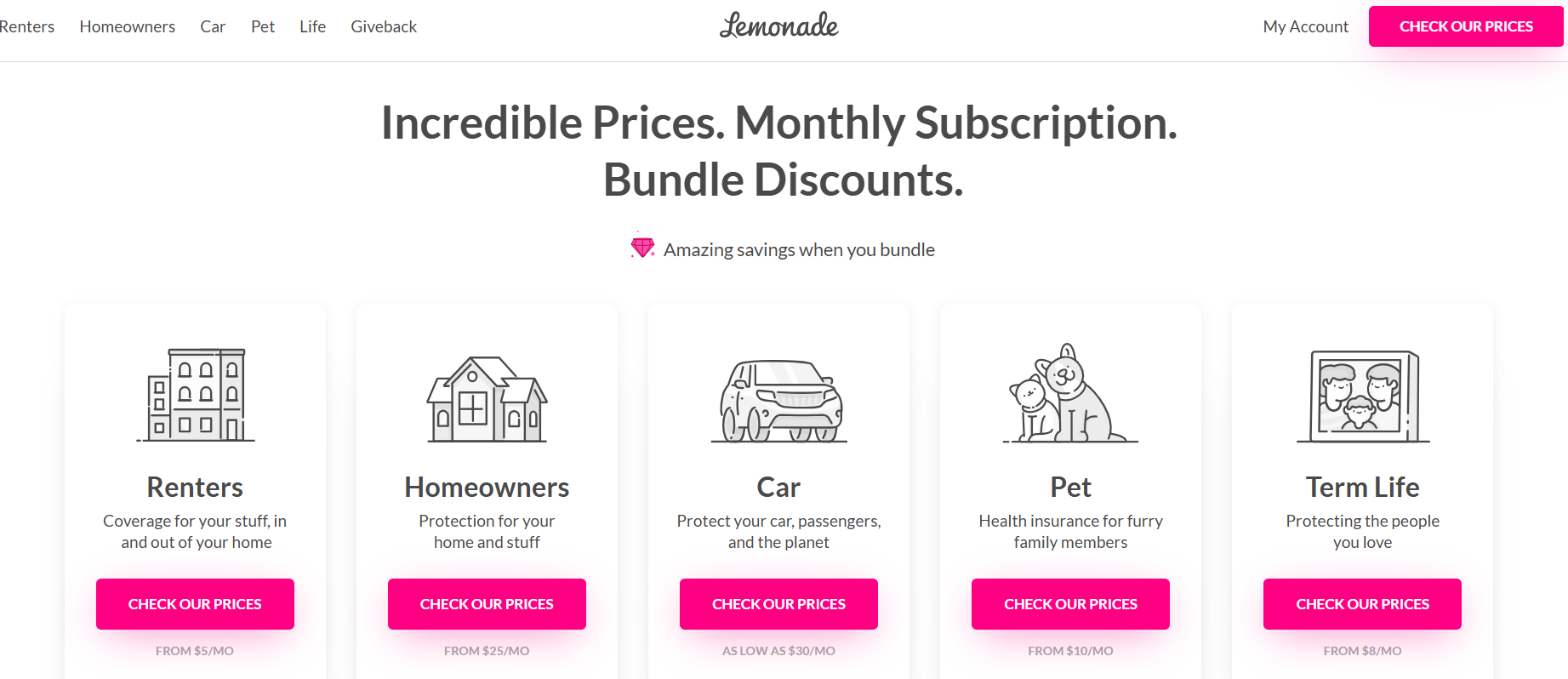

Lemonade, Inc. makes getting renters insurance quick and easy, all through their app. Whether you’re renting your first place or just want simple, no-hassle coverage, you can get started in just a few minutes. Backed by Lemonade Insurance Company, your policy covers personal items like electronics, clothes, and furniture, along with liability insurance in case someone gets hurt in your space.

Lemonade lets you add coverage for valuables and helps with temporary housing if your place becomes unlivable due to things like fire or water damage. Its standout feature is an AI-powered claims system that can approve simple claims in just minutes. That speed and simplicity are a big reason why Lemonade was named one of the best renters insurance companies by Forbes.

Lemonade makes it easy to manage everything through its app, from setup to claims. What really sets Lemonade apart is its Giveback program, where leftover premium money goes to nonprofits like the ACLU or Red Cross—adding a feel-good, community-focused touch to your coverage. They also offer tailored products like Lemonade stand insurance, providing unique coverage options for small, home-based business ventures.

And for those interested in auto coverage, Lemonade acquired Metromile in 2022, bringing its pay-per-mile tech into the Lemonade Car offering—ideal for low-mileage drivers who want smarter, usage-based pricing. Together, these features continue to push Lemonade closer to the top of the list among today’s best insurance companies.

A Closer Look at Toggle Renters Insurance

Toggle Insurance Company is a modern branch of Farmers Insurance, built for renters who want something simple, flexible, and digital. With Toggle Insurance, there’s no paperwork, no phone calls, and no long-term contracts—just quick quotes and monthly billing, and everything is handled online. It’s designed for people who’d rather manage their insurance with a few taps than sit through a phone call.

Coverage includes essentials like personal belongings and liability insurance, but what really makes Toggle stand out is how customizable it is. You can add protection for pet damage, identity theft, or high-value items and adjust your deductible to match your budget. The quote process is detailed, asking the right questions upfront so your coverage reflects your actual lifestyle—not just a standard template.

It’s a smart way to get Toggle renters insurance that works for how you really live. Everything runs through the Toggle Mobile App, which makes managing your policy or filing a claim quick and easy. Their support staff is available and willing to help if you ever need it. Renters insurance seems like it fits into your life rather than the other way around with Toggle’s straightforward setup, flexible coverage, and clean design.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lemonade Insurance: Pros and Cons

Pros

- $6 Monthly Renters Insurance: One thing that stands out in any Lemonade insurance review is how you can get coverage starting at just $6 a month, which makes it a solid pick for renters trying to keep costs low.

- AI-Powered Claims Approval: Lemonade’s mobile app can approve qualifying claims in under 3 minutes using AI, ideal for straightforward losses like theft, lost electronics, or minor fire damage.

- Giveback Program Supports Charities: Instead of keeping leftover premium funds, Lemonade donates them to nonprofits chosen by policyholders, such as the ACLU or American Red Cross, adding a layer of social impact to your policy.

Cons

- No Pet Damage Coverage: Lemonade does not include pet damage to property under its standard renters insurance, which can be a drawback for renters with dogs or cats that may cause wear and tear.

- Capped Liability Insurance at $500K: While Toggle allows users to adjust liability limits beyond $500,000, Lemonade maxes out at that figure, which may fall short for renters who host events or have higher personal risk exposure.

Toggle Insurance: Pros and Cons

Pros

- Covers Pet Damage: A common highlight in any Toggle renter insurance review is the option to add pet damage protection to your policy, which is great if you have a dog or cat and want coverage for scratched floors or chewed furniture.

- Flexible Property Coverage: You can bump up your personal property coverage in $10,000 increments, which makes it easy to match your policy to the actual value of your stuff—especially if you own pricey tech or collectibles.

- Extra Perks for Lifestyle Needs: Toggle stands out by offering optional coverage for things like identity theft and travel theft—features that aren’t usually included in standard renters insurance.

Cons

- Higher Monthly Rates: For a 45-year-old renter, Toggle charges about $105 a month, which is almost twice what Lemonade charges for similar coverage, so it may not be the best fit if you’re trying to save money.

- Delayed Discounts: Toggle offers savings like loyalty and claims-free discounts, but they only kick in over time, so new customers won’t see those benefits right away.

Lemonade vs. Toggle Renters Insurance: Pricing and Value Comparison

Lemonade keeps pricing simple, usually charging between $6 and $15 a month, depending on where you live and the coverage you choose. It keeps things simple and budget-friendly. Plus, any unused premiums after claims go to charities through its Giveback program—turning leftover funds into donations and giving your renters insurance a positive, community-focused impact.

Renters insurance through Toggle takes a more customized approach, adjusting pricing based on your location, rental size, and coverage preferences. A 45-year-old renter might pay around $105 a month, but you can tailor coverage in $10,000 increments, add identity theft protection, and include pet liability insurance for renters.

It’s also great for short-term renters thanks to its month-to-month billing and no long-term commitment. If you want fast, no-fuss insurance with a social impact twist, Lemonade makes a strong case. But if you’re after more customization and coverage built around your lifestyle, Toggle gives you the freedom to make it your own. If you’re not sure which insurer is right for you, use our free comparison tool.

Frequently Asked Questions

What should I know about the comparison between Toggle vs. Lemonade renters’ insurance?

The Toggle vs. Lemonade renters insurance comparison highlights Lemonade’s flat-rate pricing, starting as low as $6 per month with an AI-driven claims system and Giveback program. Toggle, by contrast, offers customizable coverage in $10K property increments, optional identity theft protection, and pet liability insurance for renters, with average rates of around $105 a month for older renters.

Does Toggle home insurance offer customizable policy options?

Yes, Toggle home insurance lets homeowners build policies with adjustable coverage levels, protection for electronics, and add-ons like earthquake insurance where available. It’s built for digital convenience and works well for tech-savvy homeowners who prefer managing everything through an app.

How does eRenterPlan vs. Lemonade differ for renters?

The comparison between eRenterPlan and Lemonade shows that Lemonade offers better transparency, app-based setup, and faster claims. Both renters’ insurance covers theft, but Lemonade makes filing easier and adds value through its Giveback program, which eRenterPlan lacks.

Does Lemonade rental car insurance cover accidents during travel?

Lemonade rental car insurance isn’t a standalone policy but may be part of Lemonade Car. If you rent a car, coverage for accidents may apply if it’s added to your Lemonade Car policy. It uses Metromile’s pay-per-mile tech and is ideal for drivers with lower mileage.

What does Toggle apartment insurance include?

Toggle apartment insurance covers theft, water damage, and liability, and offers extras like pet damage and identity protection. It’s ideal for renters needing month-to-month flexibility and the option to customize policies based on valuables or lifestyle.

Is Toggle homeowners insurance available nationwide?

Toggle homeowners insurance is not available in all states. Where offered, it includes the protections you’d expect in a typical homeowners insurance policy, with add-ons like electronics coverage. Backed by Farmers Insurance, it blends modern flexibility with the stability of a well-established provider.

Is Toggle a good renters insurance?

Yes, Toggle is a good renters insurance option if you want flexible coverage like pet damage protection, identity theft add-ons, and electronics coverage. It also offers month-to-month billing and allows you to adjust personal property coverage in $10,000 increments.

What is the difference between Toggle and Lemonade insurance?

The main difference between Toggle and Lemonade insurance is how coverage and pricing are structured. Lemonade offers flat-rate premiums with AI-powered claims processing that can approve payouts in under three minutes, while Toggle customizes premiums based on risk, offering optional extras like pet liability and travel protection.

Is Lemonade a good renters insurance?

Yes, Lemonade is a good renters insurance provider, especially for tech-savvy renters looking for affordable plans starting around $6 per month, fast digital claims, and unique features like the Giveback program, which donates unused premiums to charities. For more complex situations, Lemonade also offers a helpful guide to handling large insurance claims, making the process more manageable for policyholders.

What are the downsides of Lemonade insurance?

Some downsides of Lemonade insurance include limited customization, no standard pet damage coverage under renters insurance, and a liability cap of $500,000. It’s also not ideal for renters who prefer traditional customer service by phone.

Does Lemonade cover identity theft?

Does Lemonade renters insurance cover jewelry?

How to extend renters insurance on Lemonade?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.