Lemonade vs. Progressive Renters Insurance in 2026 (Side-by-Side Review)

Lemonade vs. Progressive renters insurance provides unique benefits at $22/month for Lemonade and $39/month for Progressive. Lemonade uses a peer-to-peer model for quick claims and charitable giving, while Progressive offers customizable policies and discounts, making each ideal for specific renter needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated August 2025

0 reviews

0 reviewsCompany Facts

Monthly Rate

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews 13,285 reviews

13,285 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsLemonade vs. Progressive renters insurance shows two good choices with unique features to fit renters’ wants and needs.

Lemonade’s peer-to-peer model ensures claims are processed in as little as three minutes and donates leftover funds to charity. Progressive provides multi-policy discounts and coverage for temporary living expenses.

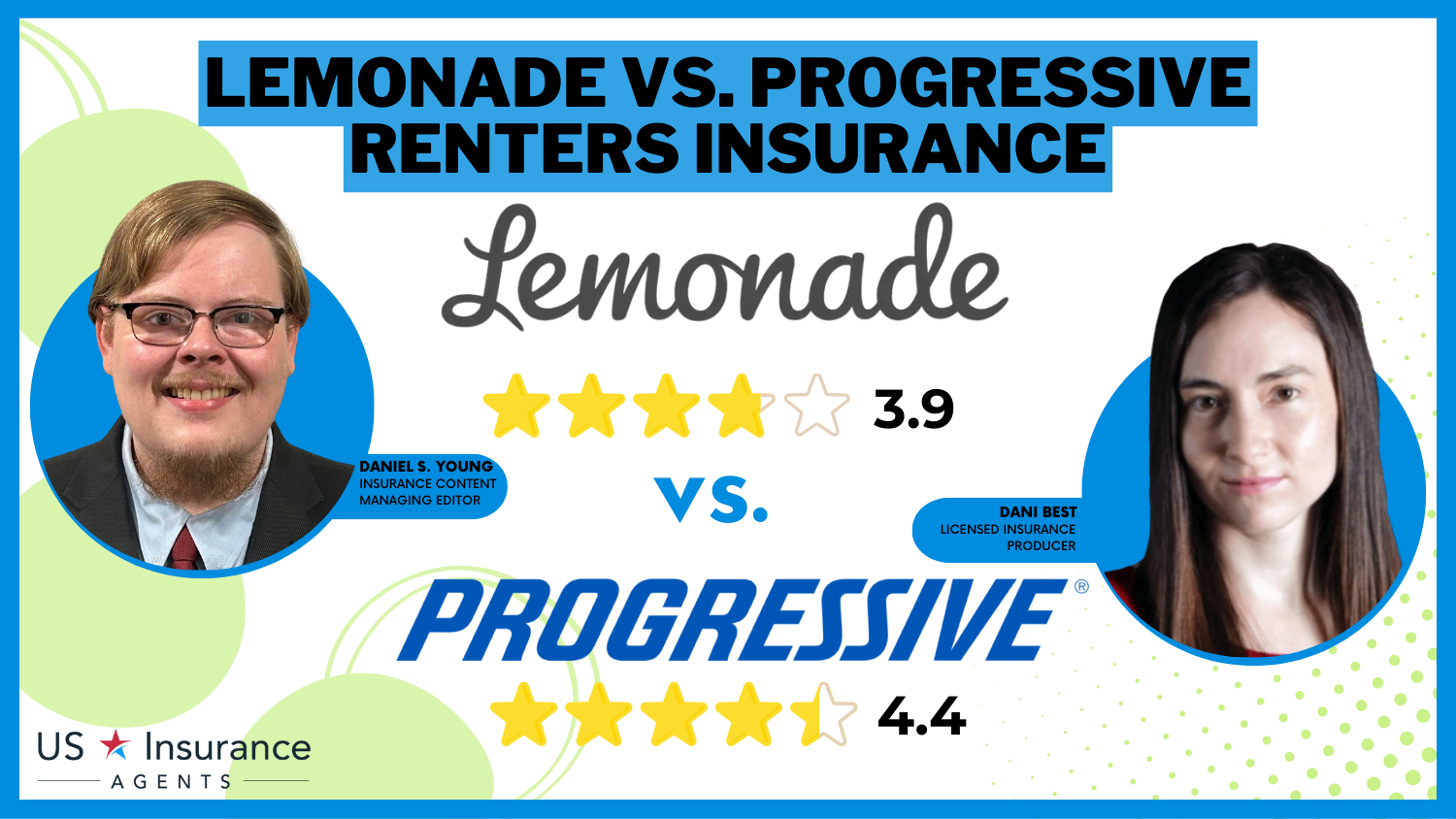

Lemonade vs. Progressive Renters Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.9 | 4.4 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 4.0 | 3.5 |

| Company Reputation | 4.0 | 4.5 |

| Coverage Availability | 4.3 | 5.0 |

| Coverage Value | 3.5 | 4.2 |

| Customer Satisfaction | 4.8 | 4.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.8 | 4.3 |

| Plan Personalization | 4.0 | 4.5 |

| Policy Options | 2.2 | 5.0 |

| Savings Potential | 4.2 | 4.5 |

| Lemonade Review | Progressive Review |

Both cater to renters with unique needs, making this comparison essential for informed decisions.

Explore home insurance costs in your area by using our free comparison tool.

- Lemonade starts at $22/month, offering fast claims and a peer-to-peer model

- Progressive provides $39/month coverage with multi-policy discounts and flexibility

- Compare Lemonade vs. Progressive renters insurance for unique features

Lemonade vs. Progressive: Comparing Monthly Premium Trends

Renters’ insurance premiums are substantially determined by age and gender. This table illustrates the extent to which rates are contingent upon these variables by analyzing the monthly premiums of Progressive and Lemonade.

Lemonade vs. Progressive Renters Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $284 | $801 |

| Age: 16 Male | $227 | $814 |

| Age: 30 Female | $63 | $131 |

| Age: 30 Male | $66 | $136 |

| Age: 45 Female | $59 | $112 |

| Age: 45 Male | $58 | $105 |

| Age: 60 Female | $53 | $92 |

| Age: 60 Male | $55 | $95 |

Premiums are highest for 16-year-olds, with Lemonade charging $284 for females and $227 for males, while Progressive’s rates skyrocket to $801 for females and $814 for males. As people hit their 30s, rates drop significantly—Lemonade costs $63 for females and $66 for males, compared to Progressive’s $131 and $136.

By age 45, prices stabilize further, with Lemonade offering $59 for females and $58 for males, while Progressive charges $112 and $105. The lowest premiums go to 60-year-olds; females pay $53 with Lemonade and $92 with Progressive, while males see $55 and $95. Age makes a huge difference in rates, and gender adds another layer of variation.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Decisive Verdict: Lemonade Takes the Lead

When we look in-depth at Lemonade and Progressive renters insurance, Lemonade is the better option for renters looking for a great mix of innovation, honesty, and cost-effectiveness.

- Innovative Friend-to-Friend Model: Lemonade’s unique friend-to-friend model makes it different from traditional insurance companies, removing conflicting interests. This creative method and a dedication to social effect build an honest and new base for the insurance experience.

- Digital Smooth Experience: Lemonade’s platform focuses first on digital, providing a smooth and easy experience for those who hold the policy. There is no need for paperwork because AI-driven processes simplify managing policies and claims, giving unmatched ease.

- Fairness and Transparency: Lemonade has an interesting open pricing system. Without hidden fees or costs, the fixed fee structure guarantees policy owners pay for what they pay for. With clearly defined deductibles and no financial gain to reject claims, Lemonade’s pledge of fairness is even more strengthened.

- Adjustments for Personal Needs: Lemonade knows every renter has different needs. They give policies that can be changed to fit those needs. This way, renters can make their coverage match what they need. It offers a customizable and adaptable insurance solution to them.

Even though Progressive is known well for its good reputation, full coverage, and intense focus on customer needs, Lemonade’s new innovative approach, commitment to transparency, and digital technology make it a better choice for renters insurance. For people who want a modern, ethical, and easy-to-use insurance experience, Lemonade stands out as the top overall pick.

Understanding Renters Insurance

Tenants must obtain renters’ insurance to guard and cover their belongings should mishaps occur. It’s your safety net for life’s shocks—a fire, theft, or a place to stay following a calamity.

Protecting Your Belongings and Liability as a Renter

Insurance for renters is a special kind of insurance policy created only for people who rent houses. This type protects your things from financial loss if they are stolen, damaged by fire, or affected by other dangers in the policy. It also covers liability protection that can be useful when someone gets hurt within your rented place and takes legal action against you.

Knowing about diverse coverage types is critical in the context of renters insurance. Coverage for personal property represents a basic type and takes care of costs regarding replacement or repairs of your properties if damaged or lost. This may cover furniture, electronic devices, apparel, and other personal possessions.

Besides providing coverage for personal belongings, renters insurance also provides liability insurance protection. This helps safeguard you if a person gets hurt on your rented site and chooses to legally challenge you for medical costs and other losses. It can even assist in handling legal expenses if any lawsuit is connected with your rental property.

The Importance of Renters Insurance

Insurance for renters is critical because it safeguards your possessions against unforeseen happenings. Consider a situation in which a fire erupts in the apartment you are renting, causing a total loss of all that belongs to you. If there’s no insurance coverage for renters, the burden falls on you to replace everything with your own money.

However, if you possess tenants’ insurance, you can lodge a claim and receive reimbursement for your misplaced assets based on their worth. This only applies up to the highest limit permitted by that particular policy.

Renters insurance not only pays for the replacement of your belongings but also helps with additional living expenses should a covered disaster make you unable to remain in your rented property. So, you must temporarily move to a hotel or rent another apartment while they fix yours. In that case, renters insurance is there to help manage those costs.

Kristine Lee Licensed Insurance Agent

Renters’ insurance often includes liability coverage. Suppose guests get hurt while in your apartment; they can legally request reimbursement for their losses. With renters’ insurance, you get peace of mind as it will cover these costs.

Renters’ insurance also protects against theft, which is a significant concern. Suppose your things get stolen from the property you rented, and this insurance could assist in paying you back for the worth of those stolen items. This is particularly important if you own expensive equipment like electronics, high-priced ornaments, or other valuable possessions.

Introduction to Lemonade Renters Insurance

With its tech-driven, hassle-free approach, Lemonade renters insurance simplifies the process of obtaining coverage so that it is both affordable and rapid.

Overview of Lemonade Insurance

Lemonade is an online insurance firm that provides a range of insurance goods, such as renters’ coverage. Being technology-oriented, Lemonade aims to make getting insurance easier and give a smooth client experience. They use artificial intelligence and machine learning methods for speedy claims assessment and offer attractive premium costs.

You can eliminate the trouble of documents and lengthy waiting periods with Lemonade. Their online system lets you buy and control your rental insurance from home, making it very convenient for you. It makes insults easy to understand.

Lemonade has a distinctive structure; it takes a set fee from premiums, and the remaining is used for claims. Any leftover money goes to a charity you pick. This guarantees there’s no motivation to reject claims while making insurance that positively influences society.

Coverage Options with Lemonade

Among the various risks covered by Lemonade’s renters’ insurance policies are water damage, theft, fire, and vandalism. They try to ensure you’re protected when accidents happen because they understand.

What if you have some valuables that need to be protected? You don’t need to worry when you use Lemonade. They extend extra coverage choices for belongings such as jewelry or electronic devices. Whether it is an antique necklace of your grandmother or the latest cellphone, Lemonade can assist you in protecting your most valuable things.

Four years straight on @Forbes‘ list of America’s Best Insurance Companies 🎉

Check it out: https://t.co/u4splq4q0p pic.twitter.com/UBUVUMI0Ds

— Lemonade (@Lemonade_Inc) September 24, 2024

Let’s also remember about liability coverage. Mishaps can occur to anyone, and if the individual is harmed on your hired property, Lemonade’s liability protection will safeguard you. It provides tranquility of mind since it means you’re safe should something unforeseen happen.

Do you have special requirements? Lemonade realizes that not all renters are the same. Therefore, they offer tailored coverage options to match your particular needs. If you are searching for basic coverage or extra safeguarding for valuable items, Lemonade provides choices to adjust your policy as needed. It is insurance that can change depending on your needs.

Pricing and Discounts with Lemonade

Lemonade offers reasonably priced renters insurance policies. But what is the exact meaning of this? It means you can get the protection you need without breaking the bank.

Lemonade stands out for its transparent pricing system. They don’t have any concealed charges or commissions; thus, you are fully aware of what your payment covers. The insurance they provide is uncomplicated and straightforward to comprehend.

But this is only part of the story. Lemonade also provides discounts to help you save even more money. If there have been no claims from your side for a specific duration, you could qualify for a discount. If you have safety measures like smoke detectors or security systems in your rental property, there is a possibility for extra savings. This insurance gives benefits to those who act responsibly.

In Lemonade, insurance should be reachable and cost-effective for all people. That’s why they have formulated their rates justly and competently. They aspire to ensure you can safeguard what is essential without causing financial distress.

Read more: “Lemonade vs. Assurant Renters Insurance.”

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

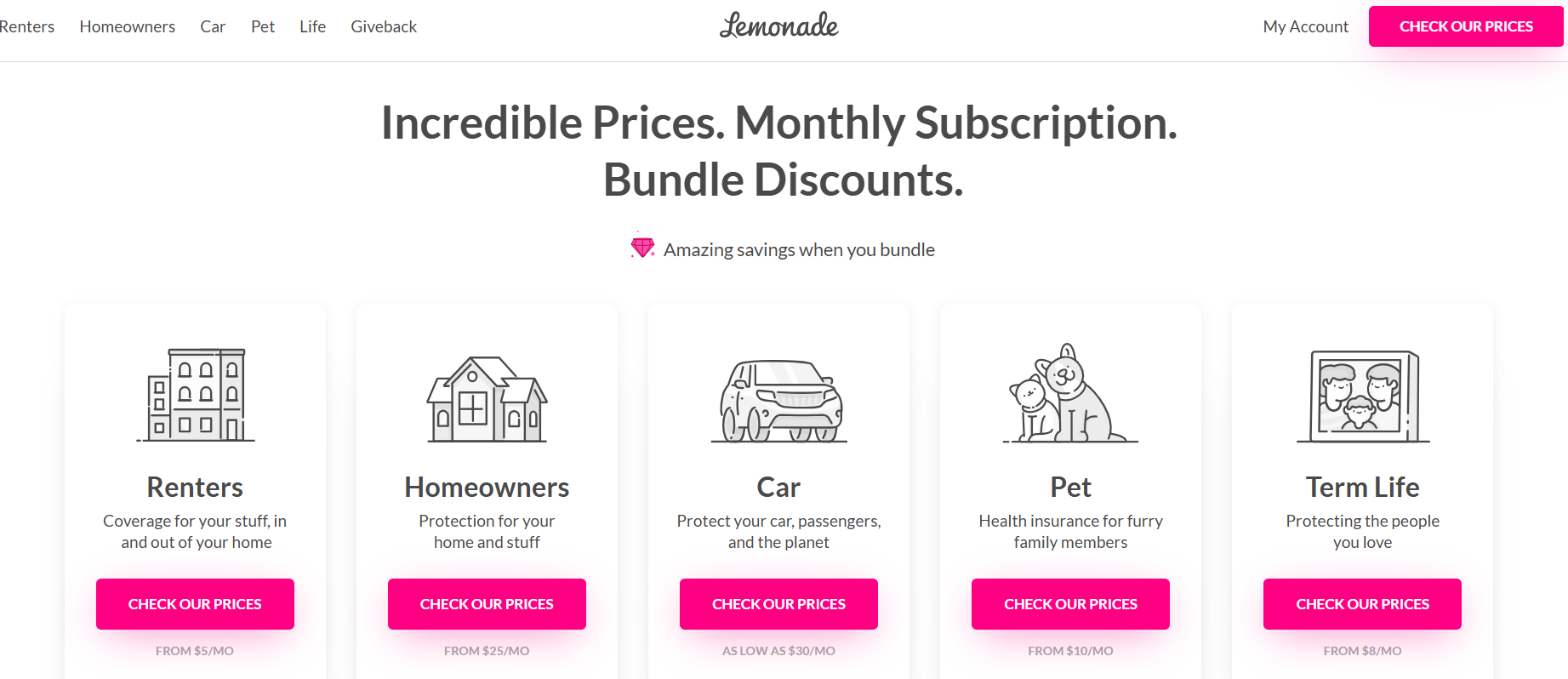

Introduction to Progressive Renters Insurance

A well-known insurance company subsidiary, Progressive, is dedicated to providing some of the cheapest renters insurance with a customer-focused approach and various coverage choices. For security against liability and property damage, you can count on our many years of experience in the insurance business.

Overview of Progressive Insurance

Progressive has been a well-recognized brand in the insurance sector for several years. Our promise of superior quality and customer happiness has made us an ideal pick for individuals or families looking for trustworthy insurance protection. Whether automobile, home, or renter’s insurance, Progressive gives numerous product options to fulfill your demands.

Coverage Options with Progressive

About renters insurance, Progressive is offering you protection. Our policies protect your things, protecting you against risks like fire, theft, and damage from water. We also provide additional coverage for items of high value and temporary living costs to ensure you’re secured when unforeseen incidents happen.

At Progressive, our policies should be adapted to satisfy your particular needs. We acknowledge that every renter is distinct, so we provide options for coverage that can be adjusted. Suppose you require extra safeguarding for items of significant value or wish to ensure you possess coverage for provisional living costs when your rented property is uninhabitable. In that case, we have solutions that are suitable for you.

Pricing and Discounts with Progressive

With rates comparable to our renters’ insurance, Progressive is a good choice. The place where you rent your home and the types of coverage you choose are some things we look at when selecting your premium. We make security options that fit your budget available.

Apart from our reasonable costs, we give further reductions to increase your savings. You can receive a multiple-policy discount if you own several Progressive insurance policies. We provide reduced prices for safety measures such as smoke detectors and histories without claims, emphasizing loyalty and accountability.

Ty Stewart Licensed Insurance Agent

Because Progressive offers renters insurance, you can rest easy knowing your homes are safe. Residents all over the country choose us as their insurance provider because we offer a wide range of coverage options.

Comparing Lemonade and Progressive Renters Insurance

Lemonade and Progressive renters insurance both have their perks, giving you solid protection for your stuff and liability coverage. A closer look at their coverage, prices, and customer service can help you determine which fits your needs and budget best.

Coverage Comparison

Lemonade and Progressive offer full-coverage renters insurance that protects your possessions and the rental property from financial loss in an accident. Their plans are designed to address a broad variety of potential threats. That way, you won’t have to worry about how you’ll pay for unforeseen expenses.

The insurance for renters offered by Lemonade covers your items like furniture, electronics, and clothes. They also provide liability coverage that could be beneficial in case someone gets hurt in your rented property. Furthermore, they have a provision of loss-of-use coverage, which implies that if any insured event makes the rental uninhabitable, it will assist you with expenses related to temporary accommodation.

Also, Progressive provides renters with pet liability insurance, which guarantees that they are protected in the event that their companion injures or damages the property.

Price Comparison

When looking at the costs of Lemonade and Progressive renters insurance, a few things can impact what you need to pay. Where you live, how much your items cost, and what type of coverage options were picked all affect figuring out the price of your policy.

Lemonade uses different pricing methods to make insurance less expensive. They put people with similar things like where they live and what kind of coverage in “peer groups.” This helps keep costs low for everyone—their ability to provide competitive rates and reduce premiums results from this.

Looking to rent? Great! These questions will help you decide if the place is right for you. #Renting #Landlord pic.twitter.com/Ya49qaU5I3

— Progressive (@progressive) September 12, 2024

Progressive uses a more old-fashioned way of setting the cost of renters insurance. They look at things like how much your possessions are worth, where you live, and any claims you have made in the past when they decide on your premium. Plus, they give discounts if you combine renters insurance with other policies like car insurance.

Customer Service Comparison

Customer service is essential when picking an insurance company. Both Lemonade and Progressive are good at having firm online services, offering digital support options that make it easier to handle your policy and file claims.

Lemonade uses technology to make the application and claim process very smooth. They have AI-powered chatbots that help customers and an easy-to-use mobile app where you can see your policy details and file claims without trouble. Their service team can talk with customers using email and chat, giving quick help to people who hold policies.

On the other hand, Progressive has a lot of experience in the insurance business and is proud to be trustworthy and customer-centered. They have a special team for helping customers that can be called or emailed, so you can talk to a real person when you need help.

When people give reviews and ratings for insurance, Lemonade and Progressive get good comments. Customers like Lemonade because it is clear about everything and makes claims easy to handle. On the other hand, customers praise Progressive for being quick to help with any problems and always ready to support those who have policies with them.

Lemonade and Progressive both give good coverage and have prices that compete well. To find the best choice for what you need, it is essential to look at how their coverage works, how much they charge, and how they treat customers. Renters insurance gives you peace of mind and guards your money, so it is essential to find the best company.

Choosing Between Lemonade and Progressive for Renters

Lemonade and Progressive represent two top insurance companies with different customer satisfaction and business ratings strengths. They range from J.D. Power scores to A.M. Best financial strength rankings, providing diverse experiences tailored for various renter requirements while emphasizing the significant differences in customer comments and complaint ratios.

Insurance Business Ratings & Consumer Reviews: Lemonade vs. Progressive

| Agency | ||

|---|---|---|

| Score: 807 / 1,000 Below Avg. Satisfaction | Score: 832 / 1,000 Avg. Satisfaction |

|

| Score: B Fair Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 72/100 Avg. Customer Feedback |

|

| Score: 2.50 More Complaints Than Avg. | Score: 1.11 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A+ Superior Financial Strength |

Lemonade and Progressive show how their financial capability and customer satisfaction link with their diverse business strategies. Each of these firms provides services to renters who have different priorities. Therefore, their strong points are crucial in deciding which insurance company better fits particular requirements.

The comparison of market share in renters’ insurance between Lemonade and Progressive shows their effect in a very competitive area. While 8% of the market belongs to Progressive and 5% is taken by Lemonade, there’s still a significant percentage left — about 89%. This market is dominated by other providers, highlighting its diversity and competitive challenges.

Lemonade and Progressive make their unique places in the renters’ insurance market with their strengths. Even though they have smaller shares, their new methods and customer-based plans keep shaping competition in an already crowded area.

A Reddit user shared their thoughts on Progressive vs. Lemonade renters insurance, breaking down their experience with coverage, cost, customer service, and claims. Try both to see which one works better for your situation.

They pointed out that Lemonade is cheaper and faster but sometimes tricky due to AI-based support. However, Progressive is dependable and provides excellent bundle discounts, even though claims may take longer. They advise comparing quotes from both to determine which best suits your needs.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lemonade Renters Insurance

Pros

- Fast Claims Procedure: Lemonade can handle claims in just 3 minutes, offering unparalleled quickness for tenants.

- Monthly Payment Quite Low: With a price range of $53-$284 depending on age, Lemonade always provides smaller fees for younger and older renters.

- Social Impact Model: Lemonade donates unused premiums to policyholder-chosen charities, appealing to socially conscious renters.

Cons

- AI-Heavy Support: Customer service relies heavily on bots, which can feel impersonal for trickier issues. Discover more about offerings in our Lemonade insurance review.

- Limited High-Value Coverage: Coverage options might fall short if you own pricey items like jewelry or tech.

Progressive Renters Insurance

Pros

- Savings on Multiple Policies: Progressive gives significant reductions when you combine renter’s insurance with car or other types of policies.

- Flexible Add-Ons: Progressive provides coverage options like identity theft protection and temporary housing expenses.

- Trustworthy Choice: With years of experience, Progressive brings reliable coverage you can count on. Access comprehensive insights into our Progressive insurance review.

Cons

- Claims Settlement Process: Progressive may settle claims more slowly than Lemonade.

- High Cost for Young Tenants: The rates, which can be challenging to accept, range from $801 to $814 for 16-year-olds.

Key Features That Set Lemonade and Progressive Apart

Lemonade and Progressive, two of the best renters insurance, each offer unique strengths and challenges in the renters’ insurance market. Lemonade stands out for its quick process of claims, which gets done in minutes, along with a Giveback program helpful to charities. However, it’s unavailable everywhere, which can be seen as unfavorable.

Progressive stands out with its discounts for multiple policies and broad coverage options. But, the higher costs for young renters may discourage some people. Lemonade’s peer-to-peer system makes it unique as a ground-breaking changer, whereas Progressive’s excellent financial strength rating (A+) guarantees steadiness and trustworthiness.

These distinctions help renters choose the insurer that aligns best with their priorities, whether it’s affordability, innovation, or coverage flexibility. Get the perfect home insurance policy at the best price using our free comparison tool.

Frequently Asked Questions

What are the differences between Lemonade and Progressive renters insurance?

Lemonade excels with fast claims and a Giveback program, starting at $5/month, while Progressive offers customizable policies and multi-policy discounts starting at $13/month.

How do Lemonade and Progressive compare for overall insurance options?

Lemonade’s peer-to-peer model focuses on speed and affordability, with rates starting at $5/month, while Progressive provides broader coverage options and reliable customer service starting at $13/month.

How does Goodcover compare to Lemonade renters insurance?

Goodcover emphasizes member savings with rates starting at $8/month, highlighting why you need renters insurance, such as protecting your personal belongings and covering liability risks. Lemonade, conversely, provides AI-driven claims processing and social impact through charity donations, starting at $5/month.

Which is better for renters, Progressive or Lemonade?

Progressive is ideal for bundling and coverage flexibility, starting at $13/month, while Lemonade shines with quick claims and lower costs, starting at $5/ month in certain states.

How can I get a Progressive renters insurance quote?

Visit Progressive’s website, input your location and coverage details, and instantly get a free insurance quote online, with personalized rates starting at $13/month.

How does Hippo compare to Lemonade renters insurance?

Hippo focuses on extended smart home coverage, with rates starting at $10/month, while Lemonade provides simple, affordable policies with rapid claims and customization, starting at $5/ month.

What is covered under Progressive renters insurance policies?

Progressive covers personal belongings, liability, temporary living expenses, and optional add-ons like pet liability and identity theft protection, starting at $13/month.

Does Progressive offer pet liability insurance for renters?

Yes, Progressive provides pet liability insurance for renters, with policies starting at $13/month. These policies cover damages or injuries caused by pets and ensure renters are financially protected in such situations. Some common pet insurance claims include property damage, bites, or injuries caused by pets.

What is Progressive rental property insurance?

Progressive rental property insurance protects landlords by covering their property, liability risks, and potential income loss. It starts at $25/month.

How do I add additional interest to Progressive renters insurance?

Log into your Progressive account, navigate the policy details, and update the “additional interest” section to include the required party.

Where can I find a Lemonade renters insurance promo code?

Does Lemonade offer rental car insurance coverage?

What makes Lemonade insurance for renters policies unique?

How do I add additional interest to Lemonade renters insurance?

Is Lemonade renters insurance available in Arizona?

How does Lemonade compare to State Farm renters insurance?

Are there any hidden Progressive discounts renters should know about?

Is Lemonade car insurance available in Colorado?

What does Lemonade apartment insurance cover?

Does Lemonade car insurance cover drivers in Nevada?

What are Lemonade insurance phone numbers and hours of operation?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.