Kansas Car Insurance Requirements for 2026 (KS State-Mandated Coverage Guide)

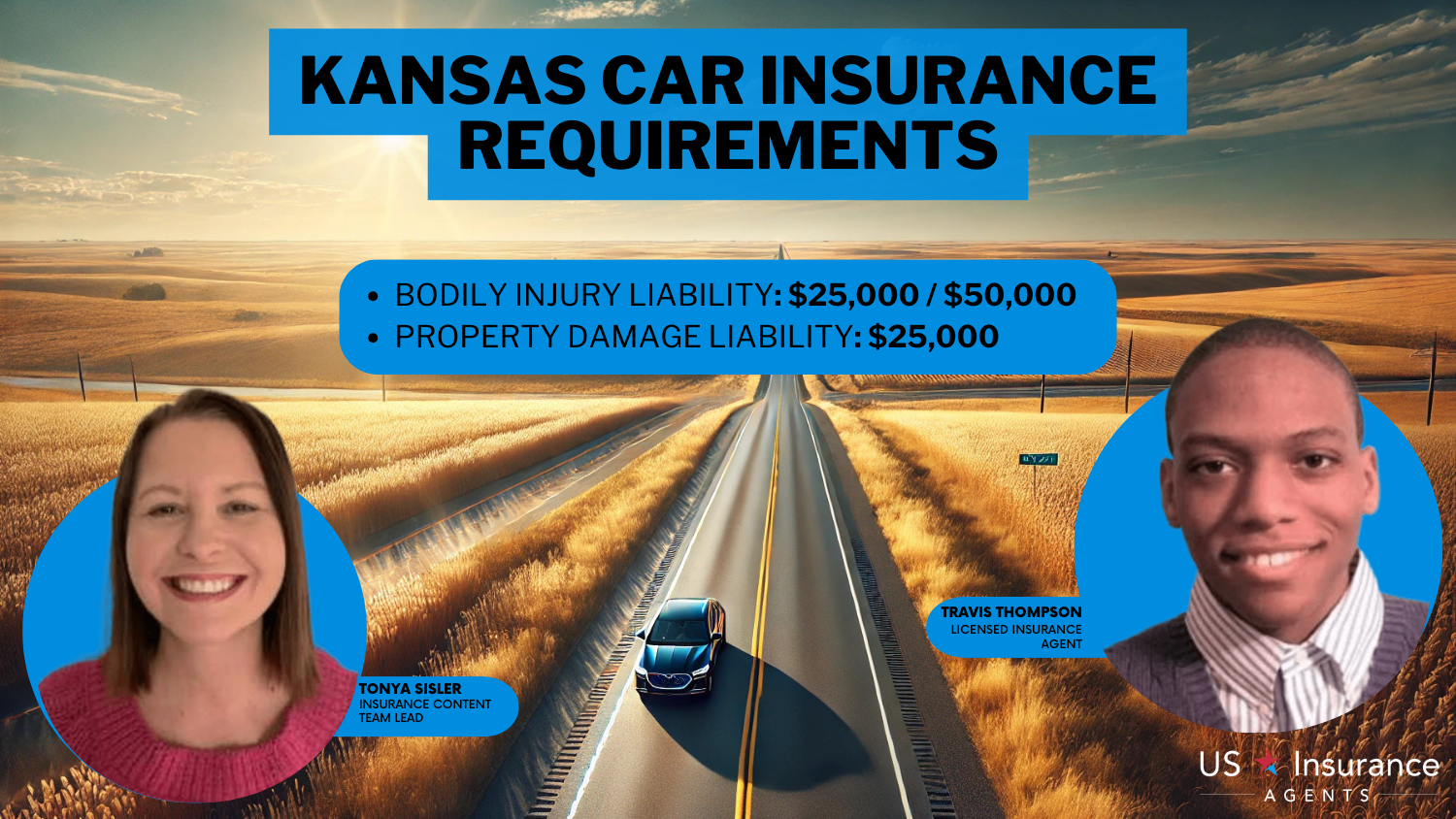

Discover Kansas car insurance requirements mandating minimum liability coverage of 25/50/25, which includes $25,000 for injury per person, $50,000 per accident, and $25,000 for property damage. Kansas car insurance rates start at $18/month, catering to budget-conscious Kansas drivers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated January 2025

Kansas car insurance requirements include minimum liability coverage of 25/50/25, which means $25,000 for injury per person, $50,000 per accident, and $25,000 for property damage, with rates starting as low as $18/month.

Meeting these requirements doesn’t have to be expensive. USAA, State Farm, and Travelers are the cheapest options for drivers, offering low rates and reliable coverage. Find more in our USAA Insurance Review & Ratings.

Kansas Minimum Car Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

USAA is ideal for military families, while State Farm is known for its excellent customer service and discounts. Travelers provide budget-friendly options with flexible policies to meet diverse needs.

To find the best insurance policy tailored to your needs, simply enter your ZIP code and compare rates from the top insurance providers in your area.

- Kansas car insurance requirements include minimum liability coverage of 25/50/25

- USAA offers the best rates at $18/month for Kansas drivers

- Driving uninsured in Kansas can result in fines, license suspension, and penalties

Kansas Car Insurance Requirements & What They Cover

Kansas car insurance laws require all drivers to have basic coverage to protect themselves and others. The Kansas minimum car insurance requirements include $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage.

This is known as liability insurance, which covers costs if you are at fault in an accident. These Kansas state minimum car insurance rules are designed to help pay for injuries or damage caused to other people or property.

Drivers in Kansas must also have personal injury protection (PIP), which helps cover medical bills and lost wages after an accident, no matter who caused it. Failing to meet these Kansas insurance requirements can lead to serious consequences, such as fines or a suspended license under the failure to comply with financial responsibility law in Kansas.

Whether you live in Emporia or elsewhere, understanding Kansas car insurance laws is key to staying legal. By following this Kansas auto insurance guide, you can ensure you meet the Kansas auto insurance requirements and avoid penalties while protecting yourself and others.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Kansas

Finding affordable coverage while meeting Kansas auto insurance laws is possible with some of the best providers in the state. USAA offers the cheapest rates at just $18 per month, making it an excellent choice for eligible drivers, particularly military members and their families.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Kansas

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in Kansas

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage in Kansas

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsFor others, State Farm is the second cheapest option, with rates starting at $26 per month, known for its reliable service and discounts. Travelers, offering rates as low as $28 per month, rounds out the top three, providing flexible options to fit different needs while staying compliant with Kansas car insurance laws and regulations.

Kansas Min. Coverage Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Dodge City | $62 |

| Emporia | $66 |

| Garden City | $63 |

| Hutchinson | $64 |

| Kansas City | $74 |

| Lawrence | $67 |

| Leavenworth | $67 |

| Lenexa | $69 |

| Manhattan | $66 |

| Olathe | $68 |

| Overland Park | $69 |

| Salina | $65 |

| Shawnee | $71 |

| Topeka | $70 |

| Wichita | $72 |

The cost of minimum car insurance in Kansas also varies by city. For example, car insurance in Emporia averages $66 per month, while Kansas City drivers pay about $74 per month for coverage.

Cities like Dodge City, Hutchinson, and Garden City have average rates ranging from $62 to $64 per month. Despite these differences, all policies must meet the Kansas liability insurance requirements, ensuring financial protection in accidents.

Understanding Kansas insurance laws and shopping around for providers helps drivers find coverage that fits their budget. Whether you need Kansas auto insurance coverage for city driving or smaller towns, comparing rates can save you money while meeting car insurance requirements in Kansas.

Read more: Most Stolen Cars in Kansas

Other Coverage Options to Consider in Kansas

While meeting the Kansas liability insurance requirements is essential, additional coverage can provide greater protection for you and your vehicle. These optional policies help safeguard against unexpected events and offer peace of mind beyond the minimum car insurance requirements in Kansas.

- Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist insurance coverage protects you if you’re involved in an accident with a driver who doesn’t have enough insurance or no insurance at all.

- Personal Injury Protection (PIP): Personal injury protection insurance covers medical expenses, lost wages, and other costs for you and your passengers, regardless of who caused the accident.

- Collision Coverage: Collision car insurance pays for damage to your vehicle caused by an accident, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage covers non-accident-related damage such as theft, flooding, or tornadoes. This is particularly valuable if your car is at high risk of being stolen or damaged by natural disasters.

Optional coverages like comprehensive and collision can save you from significant financial losses in the event of theft, severe weather, or accidents. By investing in these types of Kansas auto insurance coverage, you go beyond Kansas car insurance laws and regulations to ensure you’re fully protected.

Whether you’re in a busy city like Kansas City or a smaller area like Emporia, these policies offer valuable protection tailored to your needs.

Penalties for Driving Without Auto Insurance in Kansas

Driving without car insurance in Kansas comes with serious penalties. For a first offense, you can be fined $300 to $1,000, lose your license until you show proof of insurance, and even face up to 6 months in jail. You’ll also need to pay a $100 reinstatement fee to get your license back.

Penalties for Driving Without Auto Insurance in Kansas

| Offense | Penalties |

|---|---|

| First Offense | - Fine: $300–$1,000 - License suspension: Until proof of insurance is provided - Possible jail time: Up to 6 months - Reinstatement fee: $100 |

| Second Offense | - Fine: $800–$2,500 - License suspension: 1 year or until proof of insurance - Possible jail time: Up to 6 months - Reinstatement fee: $300 |

| Third or Subsequent | - Fine: $800–$2,500 - License suspension: 1 year or longer - Possible jail time: Up to 1 year - Reinstatement fee: $300 |

| Additional Penalties | - Vehicle registration suspension - Possible impoundment of vehicle - Requirement to file SR-22 insurance for reinstatement |

For a second offense, the fines go up to $800 to $2,500, and your license can be suspended for a year or until you provide proof of insurance. You could also spend up to 6 months in jail, and the reinstatement fee increases to $300.

Ty Stewart Licensed Insurance Agent

A third or later offense brings even harsher penalties, with fines between $800 and $2,500, license suspension for at least a year, and up to 1 year in jail. Your car registration could also be suspended, your vehicle might be impounded, and you’ll need to file SR-22 insurance to get your license back.

To avoid these costly penalties, make sure you have the minimum car insurance in Kansas and carry proof of insurance whenever you drive.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Meeting Car Insurance Requirements in Kansas

Meeting the car insurance requirements in Kansas is essential for staying legal on the road and protecting yourself financially. By understanding the Kansas liability insurance requirements, including the minimum coverage of 25/50/25, you can ensure compliance with Kansas auto insurance laws while securing peace of mind (Read more: What does car insurance cover?).

Finding the right policy is key, whether you choose affordable providers like USAA, State Farm, or Travelers or explore additional options like comprehensive and collision coverage. Avoiding the severe penalties for driving uninsured, such as fines, license suspension, and jail time, is another important reason to stay covered.

By comparing rates and understanding the various coverage options available, Kansas drivers can confidently meet state requirements and protect their finances. See if you’re getting the best deal on car insurance by entering your ZIP code here.

Frequently Asked Questions

What are Kansas minimum requirements for auto insurance?

Kansas requires a minimum liability coverage of 25/50/25, which includes $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage. Personal Injury Protection (PIP) is also mandatory.

Read more: Types of Car Insurance Coverage

Can you register a car without insurance in KS?

No, Kansas law requires proof of insurance to register a vehicle. You must provide documentation showing your policy meets the state’s minimum coverage requirements. Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

Does Kansas accept electronic proof of insurance?

Yes, Kansas allows drivers to show electronic proof of insurance, such as a digital insurance card on their smartphone, during traffic stops or inspections.

How much is car insurance in Kansas per month?

The average cost of car insurance in Kansas is approximately $18 to $28 per month for minimum coverage, depending on the provider and location.

Read more: Cheapest Car Insurance Companies

Is it illegal to drive without insurance in Kansas?

Yes, driving without insurance in Kansas is illegal and can result in fines, license suspension, and other penalties.

What happens if I’m caught driving without insurance in Kansas?

Penalties for driving without insurance include fines of up to $2,500, license suspension, vehicle registration suspension, and possible jail time. Reinstating your license also requires paying a fee and providing proof of insurance.

Do Kansas car insurance laws require uninsured motorist coverage?

Kansas requires uninsured motorist coverage for bodily injury but not for property damage. This helps protect you if you’re involved in an accident with an uninsured driver.

Can I lower my car insurance premiums in Kansas?

Yes, you can lower your premiums by comparing rates, bundling policies, maintaining a clean driving record, and qualifying for safe driver or multi-vehicle discounts (Read more: Best Multi-Policy Car Insurance Discounts).

Does Kansas offer pay-as-you-go or usage-based insurance options?

Yes, some providers in Kansas offer pay-as-you-go or usage-based insurance programs, which base premiums on your mileage and driving habits.

Are there special insurance considerations for areas like Emporia?

While state laws apply everywhere, car insurance rates can vary by city. In Emporia, for example, average rates for minimum coverage are about $66 per month due to local factors like traffic and claims history. Find cheap car insurance quotes by entering your ZIP code here.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.