Iowa Car Insurance Requirements for 2026 (Coverage IA Drivers Need)

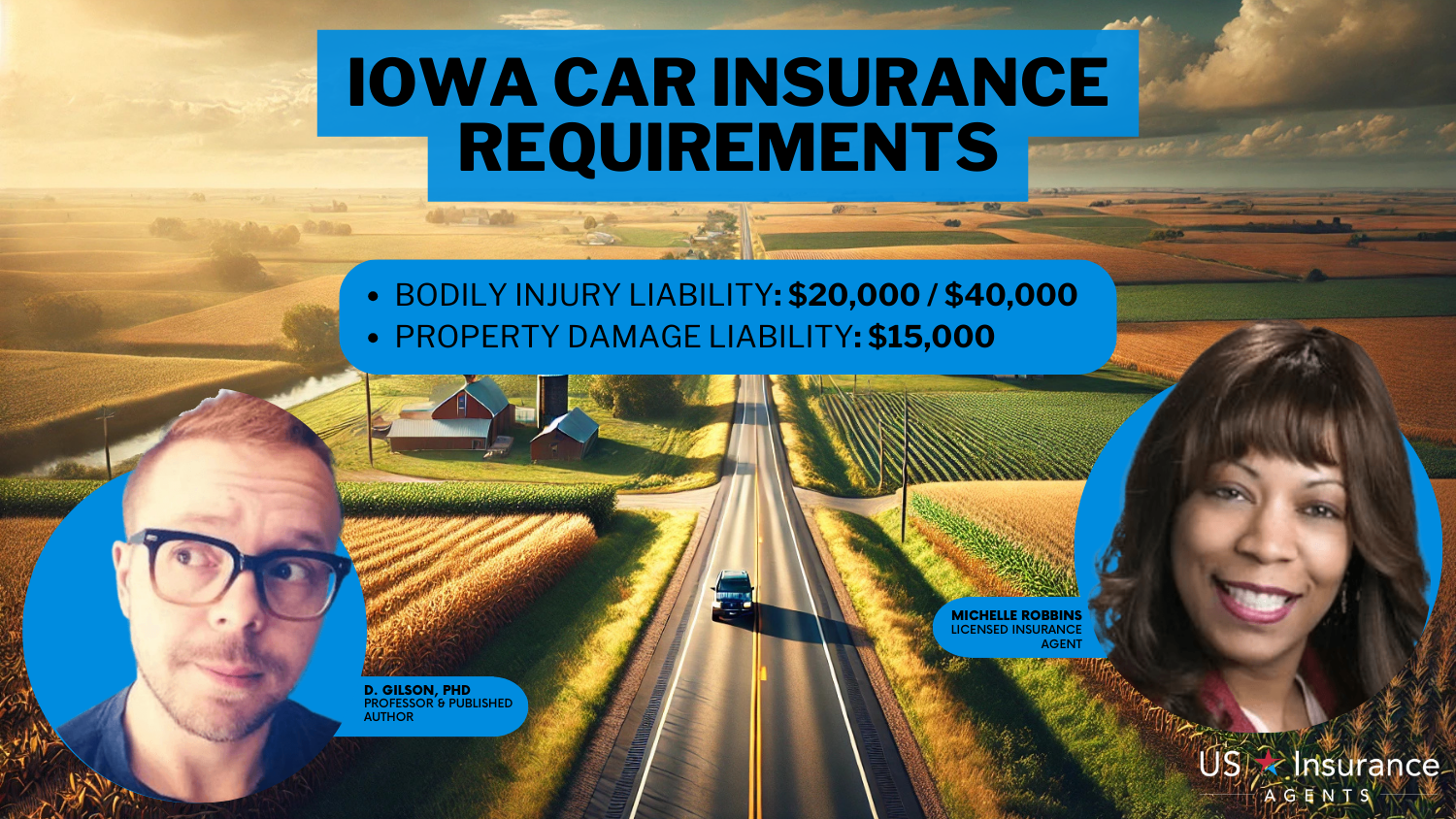

Iowa car insurance requirements mandate minimum bodily injury liability coverage of $20,000 per person and $40,000 per accident, plus $15,000 for property damage liability. Starting at $13/month, Iowa car insurance rates are quite affordable, making it easy for IA drivers to meet legal requirements.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2025

Iowa car insurance requirements mandate minimum liability limits of 20/40/15, ensuring drivers carry $20,000 per person and $40,000 per accident for bodily injury, plus $15,000 for property damage.

Meeting these requirements protects drivers financially and keeps them legal on the road. With rates starting as low as $13/month, companies like USAA, State Farm, and Nationwide offer affordable options tailored to Iowa drivers.

Iowa Minimum Car Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $20,000 per person / $40,000 per accident |

| Property Damage Liability | $15,000 per accident |

These providers are known for competitive pricing, excellent customer service, and customizable policies that fit different budgets.

Take advantage of our free quote comparison tool. Simply enter your ZIP code to compare rates from the top insurance providers in Iowa and make an informed decision. Protect yourself and your vehicle by finding the right car insurance policy today.

- Iowa car insurance requirements include 20/40/15 liability limits for all drivers

- USAA offers the cheapest car insurance in Iowa, starting at just $13/month

- Driving without IA insurance can lead to fines, license suspension, and SR-22 filings

Iowa Car Insurance Requirements & What They Cover

Iowa auto liability insurance requirements ensure that all personal vehicles carry essential coverage to protect drivers and others on the road. The minimum Iowa car insurance requirements include $20,000 per person and $40,000 per accident for bodily injury liability, as well as $15,000 for property damage liability.

These coverages safeguard against the financial burden of accidents, ensuring victims receive compensation for injuries or damages caused by at-fault drivers.

Understanding these minimums is key, and an Iowa auto insurance guide can help drivers explore additional coverage options like comprehensive or collision insurance for enhanced protection.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Iowa

Finding affordable car insurance in Iowa is easier than ever, with providers like USAA, State Farm, and Nationwide offering competitive rates.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Iowa

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in Iowa

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage in Iowa

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsUSAA leads as the cheapest option, with rates starting at just $13/month for minimum coverage, making it an excellent choice for military members and their families. State Farm follows as the second cheapest provider, with monthly premiums averaging $16, known for its reliable customer service and extensive agent network.

Nationwide rounds out the top three, offering rates as low as $18/month while providing flexible policy options to meet diverse needs. Each of these insurers offers a balance of affordability and coverage, helping Iowa drivers meet the state’s minimum liability requirements without overspending.

Iowa Car Min. Coverage Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Ames | $64 |

| Cedar Rapids | $66 |

| Council Bluffs | $70 |

| Davenport | $68 |

| Des Moines | $72 |

| Dubuque | $65 |

| Iowa City | $67 |

| Sioux City | $71 |

| Waterloo | $63 |

| West Des Moines | $69 |

Monthly car insurance rates in Iowa vary by city, with Waterloo boasting the lowest average rate of $63/month for minimum coverage, while Des Moines drivers pay the highest at $72/month. Cedar Rapids and Ames are close behind, with rates averaging $66 and $64, respectively.

Other cities, like Iowa City and West Des Moines, fall in the middle range at $67 and $69/month. These city-based rate variations highlight the importance of comparing quotes to find the most affordable coverage tailored to your location.

By shopping around, drivers can secure the cheapest car insurance while ensuring they meet Iowa’s auto liability insurance requirements.

Read more: Best Car Insurance for Drivers with a DUI in Iowa

Other Coverage Options to Consider in Iowa

While meeting Iowa’s minimum auto liability insurance requirements is essential, additional coverage options provide enhanced financial protection for drivers. These policies can shield you from costly out-of-pocket expenses and give you peace of mind on the road. Below are some key coverage types to consider:

- Comprehensive: Comprehensive coverage protects your vehicle against non-collision incidents like floods, tornadoes, or theft. This coverage is especially important if your car is listed among the most stolen vehicles in Iowa. A deductible applies before you receive compensation.

- Collision Coverage: Collision car insurance covers repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Like comprehensive insurance, collision coverage requires you to pay a deductible before your insurance kicks in.

- Uninsured/Underinsured Motorist Insurance: Uninsured/underinsured motorist insurance coverage offers protection if you’re hit by a driver without insurance, with insufficient coverage, or in a hit-and-run accident. This type of coverage ensures you aren’t left covering expenses caused by an uninsured or irresponsible driver.

Adding these optional policies to your plan can save you from significant financial strain in the event of unforeseen circumstances. By exploring these options and comparing quotes tailored to your needs, you can create a well-rounded insurance policy that offers both security and value.

Proof of Insurance and Financial Responsibility

In Iowa, drivers must show proof of insurance or financial responsibility to meet state laws. This can be done by getting a standard car insurance policy or posting a bond, cash, or securities worth at least $55,000.

If you’re in an accident, you can prove financial responsibility by getting agreements or payments to cover damages, filing proof of a settlement, or creating a payment plan with the Office of Driver Services. These steps help protect your ability to drive legally.

Required Documentation

To prove you have insurance, you can show your insurance ID card or other approved documents, like proof of financial responsibility, from the Office of Driver Services.

Chris Abrams Licensed Insurance Agent

You must have this proof when asked by the police, after an accident, or when registering or renewing your vehicle. Always keeping this documentation handy helps you avoid penalties or issues with your driving record.

Penalties for Driving Without Auto Insurance in Iowa

Driving without auto insurance in Iowa can result in serious penalties, including fines of up to $1,000 for not having proof of insurance and $500 for operating without insurance registration.

Penalties for Driving Without Auto Insurance in Iowa

| Violation | Penalty |

|---|---|

| Driving without proof of insurance | Fine: $1,000 |

| Operating without insurance registration | Fine: $500 |

| Repeat offenders | Fines, suspension, or imprisonment |

| Failure to maintain responsibility | License and registration suspension |

Repeat offenders face harsher consequences such as license and registration suspension or even imprisonment. Additionally, failing to maintain financial responsibility can lead to a requirement to file an SR-22 certificate for three years, proving continuous coverage. These penalties emphasize the importance of maintaining proper insurance to avoid financial and legal issues.

Read more: Best Car Insurance for Drivers with a Speeding Ticket in Iowa

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Right Car Insurance for Iowa Drivers

Finding the right car insurance in Iowa means balancing affordability with adequate coverage to meet your needs and state requirements.

Whether you opt for minimum liability limits or enhanced protection like comprehensive or collision coverage, comparing car insurance quotes from top providers like USAA, State Farm, and Nationwide can help you secure the best deal. By staying insured, you not only comply with Iowa’s laws but also protect yourself financially on the road.

Take the time to explore your options and choose a policy that provides the coverage and peace of mind you deserve. Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code into our free comparison tool to find the lowest rates in your area.

Frequently Asked Questions

What vehicle insurance is required in Iowa?

Iowa requires drivers to carry liability insurance with minimum coverage limits of $20,000 per person and $40,000 per accident for bodily injury, and $15,000 for property damage. Learn about the different types of car insurance here.

How do I prove I have car insurance in Iowa?

You can provide proof of insurance in Iowa by showing your insurance ID card or any official document issued by your insurance company. You may also need to provide proof when registering your vehicle, after an accident, or if requested by law enforcement. By entering your ZIP code, you can get instant car insurance quotes from top providers.

Can I drive a car without insurance if I just bought it in Iowa?

No, driving without insurance is illegal in Iowa. You should have insurance in place before driving your newly purchased car. If you already have an existing policy, it may temporarily cover the new vehicle, but check with your insurer for specifics.

How much is car insurance in Iowa per month?

Car insurance in Iowa costs an average of $13–$18 per month for minimum liability coverage from top providers like USAA, State Farm, and Nationwide (Read more: Nationwide Insurance Review & Ratings).

Can I get car insurance without a license in Iowa?

Yes, you can get car insurance without a license in Iowa. However, you may need to list a primary driver with a valid license on the policy to comply with insurer requirements.

How do you qualify for state insurance in Iowa?

Qualifying for Iowa’s state-sponsored insurance plans usually requires meeting specific income guidelines or demonstrating a need for financial assistance. Contact your local Department of Human Services for more details.

Does insurance follow the car or the driver in Iowa?

In Iowa, insurance typically follows the car. This means that if someone else drives your insured car with your permission, your insurance policy will likely cover the damages. Discover what car insurance covers.

Can you insure a car not in your name in Iowa?

Yes, you can insure a car not in your name in Iowa, but you may need to provide proof of an insurable interest, such as a close relationship with the vehicle owner.

Is there a grace period for car insurance in Iowa?

Iowa does not have a mandated grace period for car insurance. You must always have coverage in place to avoid fines, suspension, or other penalties.

How long does it take to register a car in Iowa?

You have 30 days from the date of purchase to register your vehicle in Iowa. Failure to register within this timeframe can result in late fees.

Can I drive a car I just bought without plates in Iowa?

Is Iowa a no-fault accident state?

What is the cheapest insurance in Iowa?

Is title insurance required in Iowa?

Does insurance follow the car or the driver in Iowa?

What state has the worst insurance rates?

What is the minimum car insurance coverage in Iowa?

Does Iowa require motorcycle insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.