Indiana Car Insurance Requirements in 2026 (IN State-Mandated Coverage Guide)

Indiana car insurance requirements include minimum liability coverage of $25,000 per person/$50,000 per accident for bodily injury and $25,000 for property damage. Indiana insurance rates start as low as $15/month, helping IN drivers meet minimum limits while ensuring financial protection.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated January 2025

Indiana car insurance requirements mandate a minimum coverage of 25/50/25, which includes $25,000 per person and $50,000 per accident for bodily injury liability, plus $25,000 for property damage liability.

With rates starting as low as $15/month, drivers can find affordable coverage from top companies like USAA, Progressive, and Travelers. These companies offer competitive options to meet state-mandated limits while providing additional coverage choices for added protection.

Indiana Minimum Car Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

Ensuring compliance with these requirements not only protects your finances but also helps you avoid penalties for insufficient coverage.

Understanding your options and comparing quotes can help Indiana drivers secure the best rates and coverage for their needs. See if you’re getting the best deal on car insurance by entering your ZIP code here.

- Indiana requires a minimum of 25/50/25 liability car insurance

- USAA offers the cheapest rates for Indiana drivers, starting at just $15/mo

- Failing to meet IN insurance requirements can lead to fines and license suspension

Indiana Car Insurance Requirements & What They Cover

Indiana car insurance laws require all personal vehicles to maintain liability coverage that includes $25,000 per person and $50,000 per accident for bodily injury, along with $25,000 for property damage.

These Indiana state minimum car insurance requirements ensure drivers meet financial responsibility standards while protecting against potential accidents. Understanding Indiana auto insurance requirements is essential to avoid penalties for failure to provide proof of insurance in Indiana, which can lead to fines and license suspension.

Drivers seeking additional protection beyond the state minimum car insurance in Indiana can explore Indiana’s full coverage insurance requirements, including options like collision and comprehensive coverage, for broader financial security.

This Indiana auto insurance guide highlights the importance of maintaining compliance with Indiana insurance requirements to safeguard your vehicle, finances, and legal standing.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Indiana

Finding the cheapest car insurance in Indiana can help drivers save money while meeting Indiana minimum car insurance requirements. USAA offers the most affordable rates at just $15/month, followed by Progressive at $24/month and Travelers at $25/month.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Indiana

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage in Indiana

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage in Indiana

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsThese providers ensure compliance with Indiana state minimum car insurance while delivering competitive rates and quality coverage. For drivers wondering, “Does Indiana require car insurance?” The answer is yes—state laws mandate liability insurance coverage to protect against bodily injury and property damage, making affordable options crucial for meeting these requirements.

Indiana Min. Coverage Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Bloomington | $80 |

| Carmel | $84 |

| Evansville | $77 |

| Fishers | $82 |

| Fort Wayne | $79 |

| Gary | $85 |

| Hammond | $86 |

| Indianapolis | $83 |

| Lafayette | $78 |

| South Bend | $81 |

Monthly rates for minimum car insurance in Indiana vary by city, with Evansville offering the lowest average rate at $77 and Hammond being the highest at $86. Cities like Fort Wayne and Lafayette also provide relatively affordable rates at $79 and $78, respectively.

By understanding Indiana auto insurance laws and comparing rates, drivers can find the best deals to stay compliant with Indiana state minimum insurance and protect their finances.

Additional Coverage Options to Consider in Indiana

While meeting the Indiana minimum car insurance requirements is essential for legal compliance, additional coverage options can provide greater financial protection and peace of mind. Below are the key additional coverage types to consider:

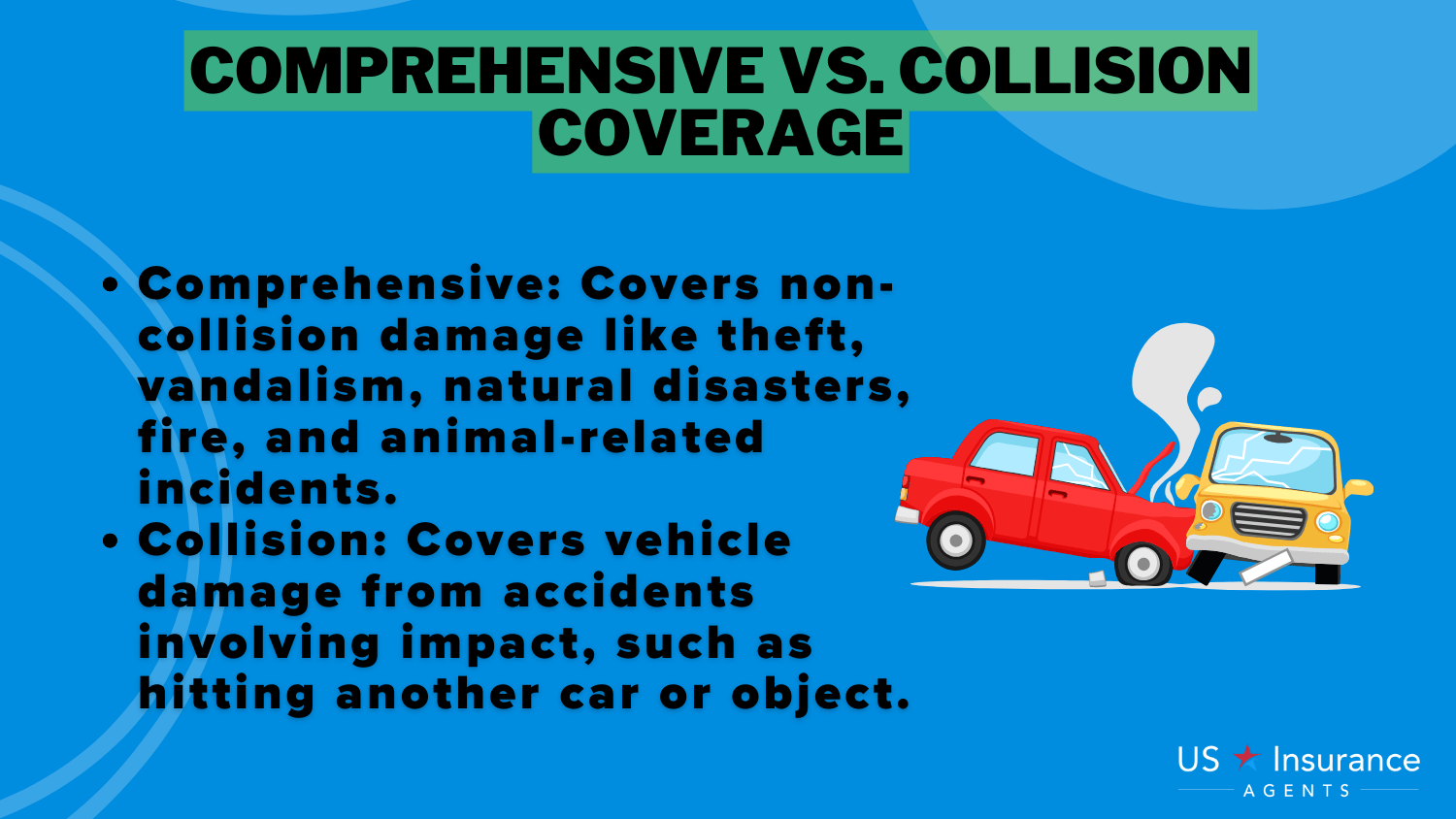

- Comprehensive Coverage: Comprehensive coverage protects against non-collision events like theft, vandalism, or natural disasters, such as tornadoes. It’s particularly valuable if your vehicle is on Indiana’s most-stolen cars list.

- Collision Coverage: Collision car insurance pays for vehicle repairs following an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist insurance coverage covers damages to you, your passengers, and your vehicle when the at-fault driver lacks sufficient insurance. In Indiana, $50,000 coverage must be offered, though drivers can opt-out.

- Medical Payments (MedPay): Covers medical expenses for you and your passengers, regardless of fault, providing vital support after an accident.

- Rental Reimbursement Coverage: Covers transportation costs while your car is being repaired after an accident.

- Towing Coverage: Pays for towing expenses if your car breaks down or needs repairs after an accident.

Adding these coverage options enhances protection beyond the Indiana minimum insurance requirements, helping drivers prepare for a wide range of scenarios. Whether you’re protecting against uninsured drivers or ensuring you’re not stranded after an accident, these policies provide valuable peace of mind on Indiana roads.

Proof of Insurance and Financial Responsibility

To meet Indiana car insurance laws, drivers must establish proof of insurance and financial responsibility. This can be done by obtaining a standard liability car insurance policy, making a $40,000 deposit with the state treasurer, creating a trust fund worth $40,000, or securing a bond from an Indiana surety company that meets the Bureau of Motor Vehicles (BMV) requirements.

These options ensure compliance with Indiana state minimum insurance standards.

Required Documentation

Proof of insurance can be shown through an insurance ID card or documentation of a deposit, trust fund, or surety bond. Drivers must carry proof at all times and present it when requested by law enforcement, after an accident, or when registering or renewing a vehicle.

Failing to provide proof of insurance can result in penalties under Indiana auto insurance laws, making it crucial to always have proper documentation available.

Penalties for Driving Without Auto Insurance in Indiana

Driving without insurance in Indiana can result in severe penalties, as car insurance is required in Indiana to ensure financial responsibility. For a first offense, drivers face a 90-day license suspension and must provide an SR-22 to reinstate their license.

Penalties for Driving Without Auto Insurance in Indiana

| Offense | Penalty | Details |

|---|---|---|

| First Offense | License Suspension (90 days) | Requires proof of insurance (SR-22) to reinstate license. |

| Second Offense | License Suspension (1 year) | Requires proof of insurance (SR-22) and reinstatement fee. |

| Subsequent Offenses | License Suspension (1 year) | Additional fines and potential for vehicle impoundment. |

| Failure to Show Proof | Fine ($250 - $1,000) | Must provide valid proof of insurance to avoid fines. |

| Accident Without Insurance | Suspension + Financial Penalties + Lawsuits | May lead to personal liability and legal consequences for damages caused. |

A second or subsequent offense results in a one-year suspension, additional fines, and potential vehicle impoundment. Failing to show proof of insurance can result in fines ranging from $250 to $1,000 while being involved in an accident without coverage may lead to suspension, financial penalties, lawsuits, and personal liability for damages.

Ty Stewart Licensed Insurance Agent

Drivers must maintain an SR-22 filing for three years following reinstatement. To avoid these consequences, it’s essential to meet Indiana state minimum on car insurance and carry proof of coverage at all times.

Read more: Best Car Insurance for Drivers with a Speeding Ticket in Indiana

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ensuring Compliance With Indiana Car Insurance Laws

Meeting Indiana car insurance requirements is essential to stay compliant with state laws and protect yourself financially. Maintaining the state minimum car insurance in Indiana, including 25/50/25 liability coverage, ensures you avoid penalties such as license suspension, fines, and potential legal consequences.

By comparing car insurance quotes and rates from top providers and exploring additional coverage options, Indiana drivers can secure affordable policies tailored to their needs while safeguarding against unexpected accidents or damages.

Staying informed and insured not only provides peace of mind but also keeps you legally protected on the road. Our free online comparison tool allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Frequently Asked Questions

What are the Indiana state minimum car insurance requirements?

Indiana requires liability coverage of 25/50/25: $25,000 per person and $50,000 per accident for bodily injury, plus $25,000 for property damage.

Read more: What does car insurance cover?

Does Indiana require insurance to register a car?

Yes, you must show proof of insurance that meets Indiana car insurance laws to register a vehicle in the state. Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool to instantly compare quotes near you.

Do you need insurance to buy a car in Indiana?

No, car insurance is not required to purchase a vehicle, but you must have coverage before driving it off the lot.

What happens if you drive without insurance in Indiana?

Driving without insurance in Indiana can result in license suspension, fines, and the requirement to file an SR-22 for three years.

Read more: Does my car insurance cover damage caused by a DUI or other criminal activity?

Can you waive uninsured motorist coverage in Indiana?

Yes, uninsured motorist coverage is required to be offered in Indiana, but you can choose to reject it in writing.

What is SR-22 insurance in Indiana?

SR-22 insurance is a certificate of financial responsibility required for drivers reinstating their license after a violation, such as driving without insurance.

How much does car insurance cost in Indiana?

The cost varies, but minimum liability coverage starts as low as $15/month with providers like USAA, while rates depend on factors like location and driving record (Read more: USAA Car Insurance Discounts).

What are the penalties for not showing proof of insurance in Indiana?

Failing to show proof of insurance can result in fines between $250 and $1,000, license suspension, and possible vehicle impoundment.

Are there additional coverage options beyond the state minimum?

Yes, options like collision and comprehensive car insurance, as well as uninsured motorist coverage, provide enhanced protection beyond the Indiana minimum car insurance requirements.

What should you do after an accident in Indiana?

You must exchange insurance information, report the accident if there are injuries or damages exceeding $1,000, and notify your insurance provider immediately. Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.