Illinois Car Insurance Requirements for 2026 (Learn What IL Drivers Require)

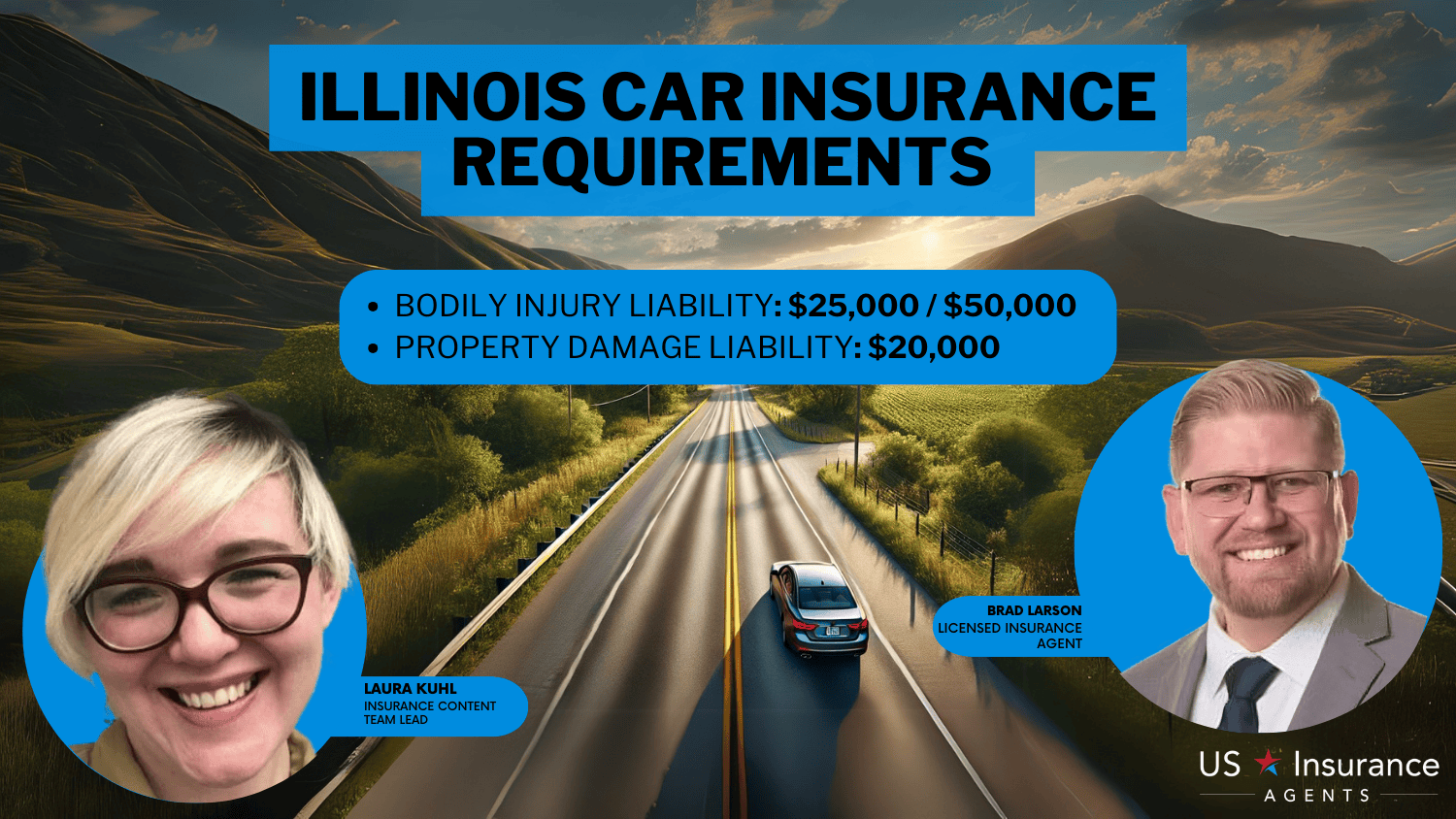

Illinois car insurance requirements include minimum coverage limits of $25,000 bodily injury per person, $50,000 per accident, and $20,000 property damage per accident. IL drivers can find rates as low as $24/month by meeting these requirements and comparing providers to ensure affordable and compliant coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

Illinois car insurance requirements mandate minimum coverage of $25,000 bodily injury per person, $50,000 per accident, and $20,000 for property damage liability. Meeting these requirements ensures you comply with state law while protecting your finances in case of an accident.

Drivers in Illinois can find affordable options, with rates starting as low as $24/month. Top providers like USAA, State Farm, and Liberty Mutual offer competitive pricing and comprehensive coverage options tailored to meet your needs.

Illinois Car Minimum Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $20,000 per accident |

Whether you’re looking for basic liability insurance or additional protections like collision and comprehensive coverage, comparing quotes can help you secure the best deal.

Stay informed and confidently navigate your car insurance choices. To ensure you find the best insurance coverage for your needs, simply enter your ZIP code.

- Illinois car insurance requirements include 25/50/20 minimum liability coverage

- USAA offers the best rates at 24/month and coverage options for eligible IL drivers

- Penalties in Illinois for no insurance include fines and license suspension

Illinois Car Insurance Requirements & What They Cover

All personal vehicles in Illinois must meet specific liability coverage limits to ensure financial protection in accidents. Drivers are required to carry at least $25,000 in bodily injury coverage per person, $50,000 per accident, and $20,000 for property damage liability.

These limits cover medical expenses, compensation for injuries, and repairs to another person’s property. Meeting these requirements not only ensures legal compliance but also offers essential protection against costly accidents.

View this post on Instagram

Many drivers opt to increase these limits or add optional coverages like comprehensive and collision for greater peace of mind (Read more: Collision vs. Comprehensive Car Insurance).

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Illinois

For Illinois drivers seeking affordable coverage, USAA offers the cheapest car insurance at just $24/month for minimum liability coverage. Close behind is State Farm at $25/month, known for its customer service and discounts.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Illinois

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in Illinois

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage in Illinois

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsLiberty Mutual takes the third spot, providing competitive rates starting at $29/month with flexible policy options. Comparing these top providers can help drivers find the best deal tailored to their needs.

Illinois Car Min. Coverage Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Aurora | $79 |

| Bloomington | $70 |

| Champaign | $67 |

| Chicago | $90 |

| Cicero | $88 |

| Decatur | $65 |

| Elgin | $78 |

| Evanston | $85 |

| Joliet | $76 |

| Naperville | $75 |

| Normal | $68 |

| Oak Park | $83 |

| Peoria | $71 |

| Rockford | $73 |

| Schaumburg | $80 |

| Skokie | $82 |

| Springfield | $66 |

| Waukegan | $74 |

Car insurance rates vary across Illinois cities, with Chicago being the highest at $90/month and Decatur the most affordable at $65/month. Cities like Bolingbrook, while not listed, typically fall within a similar range.

To find the best deal, it’s essential to compare Bolingbrook car insurance quotes and explore options from providers like USAA, State Farm, and Liberty Mutual. By shopping around, drivers can secure coverage that meets their budget and state requirements.

Read more: Best Illinois Car Insurance Discounts

Other Coverage Options to Consider in Illinois

Illinois requires uninsured and underinsured bodily injury coverage to protect drivers against accidents involving uninsured or underinsured motorists. This ensures financial support for medical expenses and related costs when the at-fault party lacks adequate coverage.

- Comprehensive Insurance: Comprehensive insurance covers damage from non-collision events like theft, natural disasters, or vandalism.

- Collision Insurance: Collision car insurance pays for repairs if your vehicle is damaged in an accident.

- Accidental Death Benefit: Provides a payout in case the insured dies in a car accident.

- Custom/Non-Factory Equipment Insurance: Covers damages to aftermarket additions like custom sound systems.

- Gap Insurance: Gap insurance is essential for leased or financed vehicles, it covers the difference between the car’s value and the loan amount if totaled.

- Medical Payments Insurance: Covers medical expenses for you and your passengers, regardless of fault.

- Physical Damage/Repair/Replace Coverage: Pays for repairing or replacing your vehicle after a covered incident.

- Rental Reimbursement: Covers costs of a rental car while your vehicle is being repaired.

- Towing Insurance: Pays for roadside assistance and towing services.

- Uninsured Motorist Property Damage: Provides up to $15,000 for vehicle repairs if hit by an uninsured driver.

Collision and comprehensive insurance are highly recommended, especially for drivers of high-risk or frequently stolen vehicles in Illinois. These coverages, along with options like gap insurance and medical payments insurance, provide essential financial protection and peace of mind.

Penalties for Driving Without Auto Insurance in Illinois

Driving without auto insurance in Illinois carries serious penalties designed to enforce compliance with state requirements. Offenders face a minimum fine of $500 for the first offense, increasing to $1,000 for subsequent violations.

Penalties for Driving Without Auto Insurance in Illinois

| Penalty | Details |

|---|---|

| Fines | $500 minimum for the first offense, up to $1,000 for subsequent offenses. |

| Vehicle Registration Suspension | Suspension of the vehicle's registration for at least 3 months. |

| Reinstatement Fees | $100 fee to reinstate the vehicle's registration after suspension. |

| License Suspension | Possible suspension of driver's license after repeated violations. |

| Court Appearance | Required for some offenses; failure to appear may lead to additional penalties. |

| Insurance Requirements | Must provide proof of valid auto insurance to the court for reinstatement of registration. |

| Community Service | May be required as an alternative to paying fines for certain offenses. |

| Increased Penalties for Repeated Violations | Penalties can increase for multiple offenses. |

Vehicle registration is suspended for at least three months, and reinstating it requires proof of insurance and a $100 fee. Repeat offenses can result in longer suspensions and additional fines. In some cases, a driver’s license may be suspended, and offenders may need to appear in court or complete community service instead of paying fines.

Kristine Lee Licensed Insurance Agent

Failure to comply with court mandates or provide proof of insurance can lead to further penalties. To avoid these consequences, ensure your vehicle is properly insured and always carry proof of coverage while driving.

Read more: Most Stolen Cars in Illinois

Frequently Asked Questions

What are the auto insurance requirements in Illinois?

Illinois requires a minimum of $25,000 bodily injury liability per person, $50,000 per accident, and $20,000 property damage liability (Read more: Types of Car Insurance Coverage).

What is the basic car insurance in Illinois?

Basic car insurance in Illinois includes the state minimum liability coverage of 25/50/20 for bodily injury and property damage. See how much you’ll pay for car insurance by entering your ZIP code into our free comparison tool.

Do I need insurance to register a car in Illinois?

Yes, proof of insurance is required to register a car in Illinois.

Do I need car insurance before I buy a car in Illinois?

Yes, you need insurance coverage before driving a newly purchased car in Illinois.

Read more: Compare Car Insurance Quotes

How much is car insurance in Illinois per month?

Car insurance in Illinois starts as low as $24/month for minimum coverage, depending on the provider.

What happens if you don’t have car insurance in Illinois?

Driving without insurance in Illinois can result in fines, registration suspension, and possible license suspension.

How much is Illinois car registration?

The cost for car registration in Illinois is $151 for a standard passenger vehicle.

Read more: Does your car insurance and registration have to be under the same name?

What is the most important type of car insurance you should buy in Illinois?

Liability insurance is essential to comply with state laws, but comprehensive and collision coverage provides additional financial protection.

Is the car insured or the driver in Illinois?

In Illinois, insurance generally follows the car, but the driver’s insurance may also apply in specific situations.

What do I need to register my car in Illinois?

To register a car in Illinois, you need proof of insurance, a completed registration form, the vehicle title, and payment for registration fees.

Read more: How to Find a Car Insurance Company Using the Policy Number

When did car insurance become mandatory in Illinois?

How long do you have to get insurance on a car in Illinois?

Does Illinois require title insurance?

What is full coverage insurance in Illinois?

Can I drive a car without insurance if I just bought it in Illinois?

When did Illinois require auto insurance?

Do you need car insurance to get a driver’s license in Illinois?

What is the most important type of car insurance you should buy in Illinois?

How long do you have to get insurance on a vehicle in Illinois?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.