How To Cancel Ace Insurance Company of the Midwest Car Insurance

Learn the step-by-step process to cancel your car insurance policy with Ace Insurance Company of the Midwest and discover helpful tips for a smooth cancellation experience.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated September 2024

As a car insurance policyholder, there may come a time when you need to cancel your coverage with Ace Insurance Company of the Midwest. To ensure a smooth and hassle-free cancellation process, it is important to understand the need for cancellation, consider key factors, explore available options, and gather the necessary documents and information. Additionally, knowing how to seek assistance from Ace Insurance Company, understanding refund options and potential penalties, and exploring alternatives for coverage after cancellation are all crucial steps in the process. In this comprehensive guide, we will walk you through each of these steps, providing you with the knowledge and understanding you need to cancel your Ace Insurance Company car insurance policy confidently and efficiently.

Understanding the Need to Cancel Car Insurance Policies

Before diving into the cancellation process, let us first discuss the reasons why you may consider cancelling your car insurance policy with Ace Insurance Company of the Midwest. Life circumstances change, and the need for car insurance coverage may shift accordingly. You may be selling your vehicle, no longer driving, or moving to a different state or location where Ace Insurance Company does not offer coverage. Understanding why you need to cancel your policy will help guide you through the rest of the cancellation process.

Another reason why you may need to cancel your car insurance policy is if you find a better deal with another insurance provider. It’s important to regularly review your insurance options to ensure you are getting the best coverage at the most affordable price. If you come across a policy that offers better benefits or lower premiums, it may be worth considering cancelling your current policy and switching to the new provider. However, before making any decisions, make sure to carefully compare the terms and conditions of both policies to ensure you are making an informed choice.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Key Factors to Consider Before Cancelling Your Ace Insurance Company of the Midwest Car Insurance

Prior to cancelling your car insurance policy, it is essential to consider a few key factors. Firstly, review the terms and conditions of your policy and take note of any cancellation fees or penalties that may apply. Determine whether you have any upcoming claims or pending tickets, as these could impact your ability to cancel and obtain refunds. Additionally, consider your future insurance needs and compare alternative coverage options to ensure you have a plan in place after cancelling with Ace Insurance Company.

Another important factor to consider before cancelling your car insurance policy is the potential impact on your driving record. Some insurance companies may report cancellations to the Department of Motor Vehicles, which could result in higher insurance premiums or difficulty obtaining coverage in the future. It is advisable to contact your local DMV to understand the specific regulations and consequences in your state.

Furthermore, before making a final decision, it is recommended to reach out to Ace Insurance Company directly. They may have options or solutions that could address your concerns or provide alternatives to cancelling your policy. It is always beneficial to have a conversation with your insurance provider to explore all available options and make an informed decision.

Exploring Different Options for Cancelling Your Car Insurance with Ace Insurance Company of the Midwest

When it comes to cancelling your car insurance policy, Ace Insurance Company of the Midwest provides different channels through which you can initiate the cancellation process. These options may include contacting their customer service directly through phone or email, visiting a local branch, or submitting a cancellation request through their online portal. Understanding these available options will help you choose the most convenient and efficient method for your cancellation.

Additionally, Ace Insurance Company of the Midwest offers a hassle-free cancellation policy that allows customers to cancel their car insurance policy at any time without incurring any penalties or fees. This flexibility ensures that customers have the freedom to make changes to their insurance coverage as needed, without any financial repercussions. Whether you are switching to a different insurance provider or no longer require car insurance, Ace Insurance Company of the Midwest strives to make the cancellation process as smooth and convenient as possible.

Step-by-Step Guide to Cancelling Your Ace Insurance Company of the Midwest Car Insurance

Now that you have established the need for cancellation, considered key factors, and explored different options, it is time to delve into the step-by-step process of cancelling your Ace Insurance Company car insurance policy. We will guide you through the necessary actions, including gathering required information, providing notice of cancellation, and confirming the termination of your policy. Following these steps will ensure a seamless cancellation experience.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

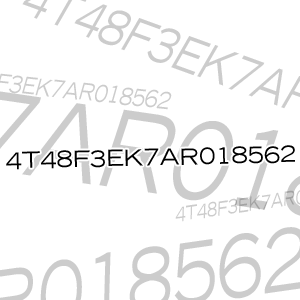

Important Documents and Information Required for Cancelling Your Car Insurance Policy with Ace Insurance Company of the Midwest

When initiating the cancellation process with Ace Insurance Company, you will need to gather and submit certain documents and information. These may include your policy number, personal identification details, proof of your new insurance coverage, and a written cancellation request. Having these documents in order will facilitate the cancellation process and prevent any delays or complications.

Seeking Assistance: Contacting Ace Insurance Company of the Midwest for Car Insurance Cancellation

If you require assistance or have any questions during the cancellation process, it is important to know how to contact Ace Insurance Company of the Midwest. Their customer service team can provide guidance, clarify any doubts, and assist you with any specific concerns related to your cancellation. Including all relevant contact information and understanding their availability and response times will ensure a seamless communication experience.

Exploring Refund Options and Potential Penalties While Cancelling Ace Insurance Company of the Midwest Car Insurance

When cancelling your car insurance policy with Ace Insurance Company, it is crucial to understand the refund options and potential penalties that may apply. Depending on the timing of your cancellation and any outstanding payments, you may be eligible for a prorated refund. However, cancellation fees or penalties may offset a portion of this refund. Knowing the details of Ace Insurance Company’s refund policies and penalty structures will help manage your expectations during the cancellation process.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Impact of Cancelling Your Car Insurance Policy: Potential Consequences and Alternatives

Before finalizing your decision to cancel your car insurance policy with Ace Insurance Company, it is important to understand the potential consequences and explore alternative coverage options. Cancelling your policy may result in the loss of certain benefits or discounts, and being uninsured leaves you financially vulnerable in case of an accident or unforeseen circumstances. Consider alternative coverage options, such as short-term or temporary insurance solutions, to ensure you are adequately protected and comply with legal requirements.

Common Questions and Answers Regarding Cancelling Ace Insurance Company of the Midwest Car Insurance

When cancelling your car insurance policy with Ace Insurance Company, you may have specific questions and concerns. This section addresses some of the most frequently asked questions and provides detailed answers to help you navigate the cancellation process. From issues related to refunds and penalties to queries about documentation and timing, we aim to provide you with all the information you need to make informed decisions.

Exploring Other Car Insurance Providers: Comparing Options After Cancellation with Ace Insurance Company of the Midwest

If you decide to cancel your car insurance policy with Ace Insurance Company, it is essential to explore other insurance providers and compare your options. Research and evaluate different companies, considering factors such as coverage offerings, customer reviews, pricing, and available discounts. By conducting thorough research and obtaining quotes from various providers, you can select a new insurance policy that meets your needs and provides peace of mind.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Choosing a New Car Insurance Policy After Cancelling with Ace Insurance Company of the Midwest

After cancelling your car insurance policy with Ace Insurance Company, selecting a new policy is a critical step. This section provides you with valuable tips and insights to help you choose the right insurance coverage. Consider factors such as the level of coverage you require, deductibles, policy limits, and any specialized coverage options that may be relevant to your situation. Taking time to evaluate these factors will ensure you find a new policy that meets your criteria and protects you adequately.

Navigating the Process of Transferring Your No Claims Bonus After Cancelling Ace Insurance Company of the Midwest Car Insurance

If you had a no claims bonus with Ace Insurance Company, it is essential to understand how to transfer this bonus to your new insurance policy. This section provides you with a detailed explanation of the process and the necessary steps involved. By following these guidelines, you can ensure that you retain your no claims bonus and enjoy the benefits it offers, such as lower premiums and discounts.

Understanding the Importance of Properly Cancelling Your Car Registration and Plates After Ending Coverage with Ace Insurance Company of the Midwest

When cancelling your car insurance policy, it is important to understand the associated requirements for car registration and plates. This section outlines the reasons why proper cancellation is essential and provides guidance on fulfilling these requirements. By following the necessary steps, you can comply with legal obligations and prevent any complications or penalties related to your car registration and plates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Changes in Personal Circumstances Can Impact Your Decision to Cancel Ace Insurance Company of the Midwest Car Insurance

Your personal circumstances may change over time, affecting your car insurance needs and coverage requirements. This section discusses various scenarios and explains how changes in personal circumstances can impact your decision to cancel your car insurance policy with Ace Insurance Company of the Midwest. Understanding these implications will help you make informed choices and ensure that your coverage aligns with your current situation.

Steps to Take to Ensure a Smooth Transition After Cancelling Your Ace Insurance Company of the Midwest Car Insurance Policy

To ensure a smooth transition after cancelling your car insurance policy with Ace Insurance Company, there are several steps you should take. This section provides you with a comprehensive list of actions to consider, including notifying relevant parties, updating your records, and managing any outstanding payments or claims. By following these steps, you can avoid any potential complications and ensure a seamless transition to your new insurance policy.

Avoiding Common Mistakes When Trying to Cancel Your Car Insurance with ACE Insurance Company of the Midwest

When cancelling your car insurance policy with Ace Insurance Company, it is important to avoid common mistakes that could lead to delays or complications. This section highlights some of the most common errors and provides practical tips to help you navigate the cancellation process smoothly. By being aware of these mistakes and taking the necessary precautions, you can streamline the cancellation process and minimize any potential issues.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance Of Regularly Reviewing And Assessing Your Auto Insurance Needs

Cancelling your car insurance policy with Ace Insurance Company provides an excellent opportunity to assess and review your overall auto insurance needs. This section emphasizes the importance of regularly reviewing your coverage and offers guidance on evaluating your insurance requirements. By periodically reassessing your needs and adapting your coverage accordingly, you can ensure that you are adequately protected and not paying for coverage you no longer require.

Exploring Alternative Coverage Options: Temporary or Short-Term Auto Insurance Solutions After Cancellation with ACE Insurance Company of the Midwest

If you find yourself needing temporary or short-term coverage after cancelling your car insurance policy with Ace Insurance Company, this section provides insights into alternative coverage options. Understanding temporary insurance solutions, such as pay-as-you-go or usage-based insurance, can be beneficial when you require coverage for a limited period. Exploring these alternatives will help you find the best solution that meets your needs and preferences.

Understanding Your Rights and Protections as a Consumer When Cancelling Car Insurance with ACE Insurance Company of the Midwest

As a consumer, it is essential to understand your rights and protections when cancelling your car insurance policy with Ace Insurance Company. This section explores the regulations and consumer protections in place to ensure fair treatment during the cancellation process. Being aware of your rights will empower you to advocate for yourself and make informed decisions throughout the cancellation process.

By following this comprehensive guide, you will have the knowledge and understanding required to navigate the cancellation process effectively and efficiently. Remember to consider your individual circumstances, gather all necessary documents, and explore alternative coverage options. Cancelling your car insurance policy with Ace Insurance Company of the Midwest should be a straightforward and seamless process when armed with the information provided in this guide.

Frequently Asked Questions

How do I cancel my car insurance policy with Ace Insurance Company of the Midwest?

To cancel your car insurance policy with Ace Insurance Company of the Midwest, you will need to contact their customer service department. You can find their contact information on their website or your policy documents. Reach out to them and inform them of your intention to cancel. They will guide you through the cancellation process and provide any necessary forms or documentation.

Is there a cancellation fee for terminating my car insurance policy with Ace Insurance Company of the Midwest?

The presence of a cancellation fee depends on the terms and conditions of your policy with Ace Insurance Company of the Midwest. Review your policy documents or contact their customer service to understand if there are any applicable cancellation fees. They will provide you with the accurate information regarding any fees associated with cancelling your car insurance policy.

Can I cancel my car insurance policy with Ace Insurance Company of the Midwest at any time?

Generally, you have the right to cancel your car insurance policy with Ace Insurance Company of the Midwest at any time. However, it’s essential to consider the specific terms and conditions outlined in your policy. Some policies may have specific cancellation clauses or requirements, such as providing a notice period. Refer to your policy documents or contact their customer service to understand the cancellation provisions applicable to your policy.

What is the process for requesting a refund after canceling my car insurance policy with Ace Insurance Company of the Midwest?

To request a refund after canceling your car insurance policy with Ace Insurance Company of the Midwest, you will need to reach out to their customer service. They will guide you through the refund process and inform you about any applicable refund policies. It’s important to note that refund policies may vary depending on the specific terms of your policy. Contact their customer service for accurate information regarding the refund procedure.

Can I cancel my car insurance policy with Ace Insurance Company of the Midwest online?

The ability to cancel your car insurance policy with Ace Insurance Company of the Midwest online depends on their specific procedures and online capabilities. Visit their website and check if they provide an online cancellation option. If such an option is available, follow the provided instructions to cancel your policy online. If not, you will need to contact their customer service through other means, such as phone or email, to initiate the cancellation process.

What information do I need to provide when canceling my car insurance policy with Ace Insurance Company of the Midwest?

When canceling your car insurance policy with Ace Insurance Company of the Midwest, you will likely need to provide certain information for

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.