How to Appeal a Denied Car Insurance Claim with Progressive in 2026 (6 Simple Steps)

How to appeal a denied car insurance claim with Progressive starts by reviewing the denial letter, gathering evidence, and contacting Progressive for clarification. Submit a formal appeal with supporting documents and escalate if needed. Some providers offer cheaper car insurance options for $34 per month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated August 2025

How to appeal a denied car insurance claim with Progressive is based on knowing the process and providing solid supporting evidence. Denials may occur because of policy exclusions, disputed liability, or insufficient documentation, but you have the right to challenge the decision.

A successful appeal entails checking over your claim carefully, gathering additional evidence, and going through Progressive’s process of appeal. In this article, we will outline the key steps, explain common reasons for denial, and give you tips to ensure your success.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool to instantly compare quotes near you.

- Step #1: Review the Denial Letter — Examine Progressive’s reason for denial

- Step #2: Gather Evidence — Collect documents to support your appeal

- Step #3: Contact Progressive — Ask why your claim was denied

- Step #4: Submit an Appeal — Send a written appeal with proof

- Step #5: Request Re-Evaluation — Ask Progressive to review the claim

- Step #6: Escalate the Appeal if Necessary — Contact a supervisor or file a complaint

6 Steps to Appeal a Denied Car Insurance Claim with Progressive

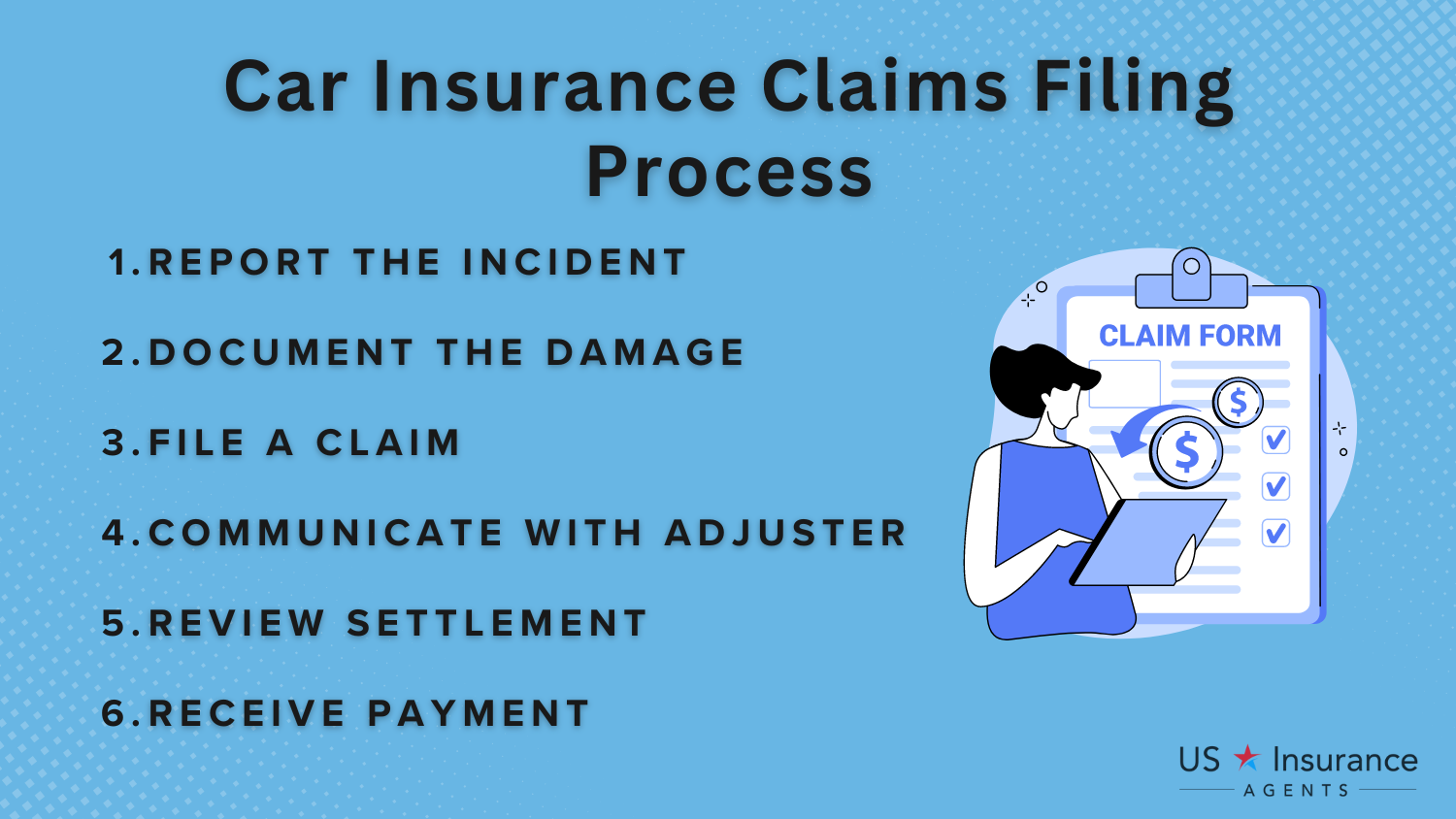

Appealing a denied car insurance claim with Progressive involves several key steps to challenge the decision effectively. These include reviewing the denial letter, gathering supporting evidence, contacting Progressive for clarification, submitting a formal appeal, requesting a claim re-evaluation, and escalating the appeal if necessary.

Each step plays a crucial role in increasing the chances of a successful outcome, which will be further explained for clarity.

Step #1: Review the Denial Letter

When Progressive denies your claim, they will issue a formal denial letter that specifies the specific reasons for their denial. As the first step in the appeals process, read this letter carefully in order to know why your claim was denied. Typical reasons are policy exclusions, lack of evidence, missed deadlines, or liability disputes. Carefully read the language used and any particular documentation or proof of Progressive references.

Then, compare the reasons for denial with your insurance policy’s terms and conditions. Check for any inconsistencies, ambiguous language, or potential misinterpretations. Finding these details early will assist you in deciding your next course of action in the appeal process.

Dani Best Licensed Insurance Producer

In case any part of the denial is unclear, highlight the areas that need clearer explanations prior to going forward to obtain supportive proof and notifying Progressive. The car insurance coverage type can also play a role in understanding if your claim was wrongfully denied.

Step #2: Gather Supporting Evidence

Building an effective appeal means having solid, well-supported facts to counter the Progressive’s denial. Begin by organizing all relevant materials that support your claim, ensuring they directly address the reasons outlined in the denial letter.

- Original Claim Submission & Denial Letter: Keep a copy of your original claim and Progressive’s response for future use.

- Police Reports & Witness Statements: If law enforcement was involved, obtain a copy of the official accident report. Witness testimonies can provide independent validation of the incident.

- Photographic & Video Evidence: Clear images or footage of vehicle damage, road conditions, traffic signs, and injuries (if applicable) can help dispute liability or claim rejection.

- Repair Estimates & Medical Bills: Obtain itemized repair quotes from certified mechanics and medical documentation if injuries are involved. These records substantiate the financial impact of the incident.

- Correspondence with Progressive: Maintain a record of all emails, letters, and call logs related to your claim, noting any inconsistencies in Progressive’s reasoning.

Ensure that every piece of evidence is well-labeled and organized. If important documents do not exist, contact the involved parties—like police stations, medical professionals, or repair stores—to try and find other records before continuing with the appeal. Having a solid case will make your position stronger in the subsequent steps of the appeals process.

Understanding how to document damage for car insurance claims properly will significantly improve your chances of a successful appeal.

Step #3: Contact Progressive for Clarification

After reviewing the denial letter and gathering supporting evidence, contact Progressive’s claims department to discuss the next steps in the Progressive insurance appeal process. Ask for a detailed explanation of why your claim was denied and whether submitting additional documentation could change their decision.

If you believe your claim was wrongfully denied, request clarification on the specific policy provisions Progressive used to justify the rejection.

Keep detailed records of all communications, including dates, representative names, and key points discussed. If necessary, request a Progressive appeal form or inquire about the process for submitting an appeal letter for a car insurance claim. If Progressive’s denial contradicts the evidence you’ve gathered, ask them to provide a written statement supporting their decision.

Additionally, confirm how to formally dispute the claim and whether Progressive requires specific documentation, such as a Progressive accident report or a Progressive loss run request. These records will help you navigate the Progressive insurance appeal process and strengthen your appeal.

Knowing the insurance agent’s role in the claims process can also provide insight into how claims are evaluated and what additional steps you can take.

Step #4: Submit a Formal Appeal

If Progressive rejects your claim, you are entitled to appeal their decision by writing a formal appeal. This action is essential if you feel Progressive got the facts wrong, ignored crucial evidence, or made a mistake in evaluating your case.

Your appeal letter should be well-written and compelling. Put the following:

- Policy & Claim Information: Start by providing your full name, Progressive claim file number, policy number, and contact details.

- Reference to Denial Letter: Clearly mention the date of Progressive’s denied claim letter and the specific reason(s) cited for the rejection.

- Statement of Dispute: Explain why you believe the denial was incorrect, referencing Progressive Insurance accident report details, policy provisions, or errors in the adjuster’s findings.

- Supporting Evidence: List new evidence you are submitting, such as accident photos, repair estimates, police reports, medical records, or Progressive third-party claim details that support your argument.

- Request for Reconsideration: Politely but assertively ask for the reconsideration of your claim, outlining why Progressive should reconsider its denial based on the new evidence submitted.

To formally dispute a denied claim with Progressive, submit your appeal through certified mail, email, or Progressive’s online claims portal to ensure proper tracking. After sending your Progressive dispute claim letter, follow up with Progressive call claim services to confirm receipt and inquire about the estimated review timeline.

Keeping detailed records of all communications, including emails, letters, and call logs, is essential for accountability. To strengthen your case, write a convincing demand letter to settle your insurance claim by clearly outlining the reasons your claim should be approved and providing supporting evidence.

If Progressive denied your claim due to missing documentation, misinterpretation of evidence, or other issues, the appeal process allows you to correct these discrepancies and strengthen your case. If the appeal is unsuccessful, consider requesting a claim re-evaluation or escalating the dispute to your state’s insurance regulatory agency.

If Progressive denied your claim due to missing documentation, misinterpretation of evidence, or other issues, this appeal process gives you the chance to correct those discrepancies.

Step #5: Request a Claim Re-Evaluation

If Progressive denied your claim, you have the option to request a claim re-evaluation by a different adjuster. This step allows for a fresh review of your case, which may result in a different outcome, especially if there were errors in the initial assessment. Get in touch with Progressive Insurance Claims and formally request a re-examination, outlining any misreadings, ignored evidence, or omitted paperwork that might influence the ruling.

If you are wondering what to do if car insurance denies your claim, providing additional proof can strengthen your case. If your Progressive insurance claim was denied without a police report, consider submitting alternative evidence, such as witness statements, surveillance footage, or expert evaluations.

If someone with Progressive Insurance hits you, but your claim is rejected, highlight liability inconsistencies and demand further investigation.

Maintain detailed records of all claims at Progressive, including names of adjusters, response timelines, and written correspondence. In the event Progressive refuses to back down on its decision even when presented with substantial evidence, this step lays the groundwork for higher escalation, for example, reporting a claim against a Progressive driver to your state’s insurance department or pursuing litigation.

Read more: If Someone Hits My Car, Whose Insurance Do I Call

Step #6: Escalate the Appeal if Necessary

If Progressive denies your appeal again, there are still other ways you can challenge their decision. Begin by asking for a review at a higher level within Progressive, as a senior claims adjuster may take a more thorough approach. If the denial remains, file a complaint with your state’s Department of Insurance, which can investigate whether Progressive mishandled your claim.

Brad Larson Licensed Insurance Agent

Consumer protection agencies, such as the NAIC, can also help resolve the issue. If your claim involves significant financial loss, consult an insurance lawyer to determine whether legal action is necessary. Arbitration or small claims court could prove to be a budget-friendly means of disputing the denial based on your policy and state regulations.

By escalating your appeal strategically, you improve your chances of securing a fair outcome. Learn more about car insurance laws to understand your rights and how regulations affect claim disputes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Basics of Car Insurance Claims

A car insurance claim is a formal request to your insurance provider for financial compensation due to damage or loss of your vehicle. Common reasons for filing a claim include accidents, theft, vandalism, and natural disasters.

When you file a claim with an insurer like Progressive, they assess the incident by reviewing evidence such as police reports, photographs, and witness statements. If the claim is approved, the insurer provides funds for repairs or replacement. However, if a claim is denied, you have the right to appeal the decision by providing additional evidence or clarifying disputed details.

The cost of car insurance varies based on the provider and the level of coverage you choose. The table below compares the monthly rates for minimum and full coverage across different insurance companies:

Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $69 | $216 | |

| $50 | $145 | |

| $62 | $198 | |

| $34 | $108 | |

| $58 | $179 |

| $47 | $138 |

| $46 | $148 | |

| $39 | $124 | |

| $44 | $133 | |

| $52 | $157 |

The table reflects the variation of insurance prices by protection levels. Minimum coverage, which typically meets state requirements, is more affordable but provides minimal protection. Full coverage, like liability, collision, and comprehensive insurance coverage, offers greater protection but at a higher cost.

For example, Geico offers one of the most affordable minimum and full coverage options at $34 and $108 per month, respectively, while Allstate has some of the highest rates at $69 for minimum and $216 for full coverage per month. Choosing the right insurer depends on factors like claim processing efficiency, customer service, and appeal policies, especially if you ever need to dispute a denied claim.

By understanding both the claims process and the cost of coverage, you can make informed decisions when selecting an insurance provider and handling any potential claim disputes.

Reasons for Filing a Car Insurance Claim

There are several reasons why you may need to file a car insurance claim. Here are some common examples:

- Accidents Caused by Other Drivers: If you are involved in an accident that is the fault of another driver, you may file a claim with Progressive for compensation for your vehicle’s damages and any related medical expenses.

- Theft or Vandalism: If your vehicle is stolen or vandalized, you can file a claim to recover the value of the stolen items or repair the damage caused by the vandalism.

- Natural Disasters: If your car is damaged due to a natural disaster, such as a hurricane or flood, you can file a claim for reimbursement for the repairs.

In addition to these common reasons, there are other situations where filing a car insurance claim may be necessary. For example, if your vehicle is damaged in a hit-and-run accident, you can file a claim to cover the repair costs. Similarly, if your car is damaged by a flying object or by a falling tree, you may need to file a claim to receive compensation for the damages.

It is important to note that filing a car insurance claim does not automatically guarantee that you will receive compensation. Your insurance company will carefully evaluate the details of your claim and determine if it meets the criteria for coverage. It is essential to provide accurate and detailed information when filing a claim to increase your chances of a successful outcome.

Understanding the basics of car insurance claims can help you navigate the process more effectively and ensure that you receive the compensation you deserve. Whether it’s a minor fender bender or a major accident, knowing your rights and responsibilities as a policyholder can make a significant difference in the outcome of your claim.

The Progressive Insurance Claim Process

When you file a car insurance claim with Progressive, there are several steps involved in the process. Understanding these steps can help you navigate through the claim process more effectively.

At Progressive, they prioritize making the claims process as seamless as possible for our customers. Their dedicated team of claims adjusters is committed to providing you with the support and assistance you need during this time.

Reporting the Incident to Progressive

The first step in the claim process is reporting the incident to Progressive. Once you’ve ensured your safety and the safety of others involved in the accident, contact your insurance company to report the claim. Progressive has a 24/7 claims hotline that you can call to report the incident. Their friendly and knowledgeable claims representatives will guide you through the reporting process and gather all the necessary information.

When reporting the incident, it is crucial to provide accurate and detailed information. This includes the date, time, and location of the accident, as well as a description of what happened. The more information you provide, the better they can assess your claim and initiate the necessary steps.

It is also important to report the incident as soon as possible to avoid any delays in the claim process. Progressive understands that accidents can be stressful, and they strive to make the reporting process quick and efficient.

After you’ve reported the incident, Progressive may ask you to provide additional information or documentation, such as a police report or photographs of the damages. This helps them gather all the necessary evidence to evaluate your claim accurately. Read more: Does Progressive Car Insurance Cover Damage Caused by a Fallen Power Line?

Investigation and Evaluation of the Claim

After you’ve reported the incident, Progressive will assign a claims adjuster to your case. The claims adjuster will be your main point of contact throughout the claim process and will guide you through each step.

Their experienced claims adjusters will conduct a thorough investigation to gather all the relevant information and evidence. They may visit the accident scene to assess the damages firsthand, take photographs, speak to witnesses, and review any available police reports. This meticulous investigation ensures that they have a comprehensive understanding of the incident and can make an informed decision regarding your claim.

During the evaluation process, Progressive will determine whether the incident is covered under your policy and whether you are eligible for compensation. Claims adjusters will carefully review your policy to understand the extent of your coverage and any applicable deductibles or exclusions.

Progressive Insurance understands that every claim is unique, and they take the time to evaluate each one thoroughly. The goal is to provide you with a fair and accurate assessment of your claim, ensuring that you receive the compensation you deserve.

Claim Settlement and Payment

Once the evaluation is complete, Progressive will send you a settlement offer based on our findings. The settlement offer will outline the amount of compensation they are willing to provide for the damages or losses you’ve incurred.

If you agree with the settlement offer, you can accept it, and Progressive will process the payment promptly. They understand that timely payment is crucial for their customers to recover from the incident and move forward.

However, if the settlement offer is not satisfactory or you believe it does not adequately compensate you, you have the option to appeal the decision. Claims adjusters will be available to discuss your concerns and work toward a resolution that meets your needs.

Progressive is committed to providing exceptional customer service throughout the claims process and strives to make the experience as smooth as possible, ensuring that you feel supported and informed every step of the way.

Read more: How Long Does it Typically Take for Progressive to Process a Car Insurance Claim?

Reasons for Claim Denial by Progressive

When it comes to car insurance claims, there are several reasons why Progressive may deny your claim. It’s important to understand these reasons so that you can determine whether you have grounds for an appeal.

Let’s delve deeper into some of the common reasons for claim denial:

Policy Exclusions

One of the most common reasons for claim denial is policy exclusions. Insurance policies often have specific situations or circumstances that they do not cover. These exclusions can vary from one policy to another and may include things like intentional damage, racing, or driving under the influence of drugs or alcohol.

Kristen Gryglik Licensed Insurance Agent

It’s crucial to review your policy carefully to understand what is covered on car insurance and what is excluded. If your claim falls under a policy exclusion, Progressive may deny it on that basis.

Late Reporting

Another reason for claim denial is late reporting. It’s essential to report the incident to Progressive as soon as possible. Failure to report the incident promptly may result in a denial of your claim.

However, there may be valid reasons for late reporting, such as hospitalization or extenuating circumstances. If you find yourself in such a situation, it’s important to provide a valid explanation and any necessary documentation to support your car insurance claim. This can help you establish grounds for an appeal.

Misrepresentation of Facts

Progressive may deny your claim if they believe that you have misrepresented facts related to the accident. This can include providing false information about the incident, the extent of the damages, or your involvement in the event.

When filing a claim, it’s absolutely vital to provide accurate and truthful information. Failing to do so can lead to a denial on the basis of misrepresentation. It’s always best to be transparent and honest throughout the claims process.

Understanding these reasons for claim denial by Progressive can help you navigate the claims process more effectively. Remember to review your policy, report incidents promptly, and provide accurate information to increase your chances of a successful claim.

Read more: Determining Fault in a Multiple Car Accident

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Appealing a Denied Car Insurance Claim with Progressive: Key Steps and Tips

Understanding how to appeal a denied car insurance claim with Progressive is important in order to get a fair settlement. Begin by going through the denial letter to determine the reason for the denial. Gather solid evidence, such as accident reports, medical records, and witness statements. Contact Progressive to discuss the denial and confirm the appeals process.

Submit a formal appeal with all necessary documents and a clear argument. If rejected, request a review by another adjuster. Escalate to senior representatives, state regulators, or legal experts if necessary. With minimum coverage starting at $34 per month, knowing the appeals process ensures you get the best car insurance in your state while protecting your financial interests.

Your car insurance rates will likely increase after an at-fault accident, but you can find your cheapest coverage option by using our free quote comparison tool today.

Frequently Asked Questions

What does it mean when a claim is closed with Progressive?

A closed claim with Progressive means the insurer has completed processing it, either through approval and payment, denial, or policyholder withdrawal. If you disagree with the outcome, you may still have the option to reopen or appeal the claim within a specific timeframe.

What services does Progressive Advantage Agency, Inc. provide?

Progressive Advantage Agency, Inc. is an insurance brokerage affiliated with Progressive Corporation that helps customers find coverage beyond auto insurance. It connects consumers with third-party insurers for home, renters, business, and other specialty insurance policies.

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool to see affordable car insurance quotes.

What are the common reasons for a claim denial, and how can you strengthen your appeal with Progressive?

Progressive may deny claims due to lack of evidence, policy exclusions, or liability disputes. Strengthen your appeal by providing accident reports, witness statements, photos, and medical records while citing relevant policy terms. For coverage related to injuries, consider car insurance for medical payments coverage to help with medical expenses regardless of fault.

How long does Progressive take to process an insurance claim appeal?

The timeline for an insurance claim appeal with Progressive varies based on the complexity of the case. Typically, the review process takes a few weeks. For faster resolution, ensure you provide all required documentation and follow up regularly with the claims department.

How to appeal a denied car insurance claim with Progressive?

If Progressive denies your claim, you can appeal by reviewing the denial letter, gathering supporting documents (such as repair estimates and accident reports), and submitting a written appeal. Contact Progressive’s claims department to understand their specific appeal process and deadlines.

What is Progressive Casualty Insurance Company?

Progressive Casualty Insurance Company, a subsidiary of Progressive Corporation, offers auto, home, and commercial insurance. As part of Progressive Casualty Ins. Co. & Affiliates, it provides coverage across multiple states with various policy options. This Progressive insurance review explores its offerings, benefits, and potential drawbacks.

What should I do if Progressive denies my car insurance claim?

If Progressive denies your car insurance claim, carefully review the denial reasons, request clarification if needed, and gather evidence such as photos, witness statements, and repair estimates. You can then submit an appeal and, if necessary, escalate the dispute to external mediation.

How to write an appeal letter for a car insurance claim?

An effective appeal letter for a car insurance claim should include your policy number, claim details, reasons for disputing the decision and supporting evidence. Be concise and professional, clearly explaining why the claim should be reconsidered. Address the letter to the appropriate claims adjuster or department at Progressive.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code into our free comparison tool.

How to appeal a car insurance claim decision?

To appeal any car insurance claim decision, start by reviewing the insurer’s explanation, collecting evidence that supports your case, and submitting an appeal in writing. If the insurer upholds the denial, you may escalate the matter to your state’s insurance regulator or seek legal assistance.

For more guidance on handling difficult situations, check out Car Accidents: What to Do in Worst-Case Scenarios.

Can you cancel an insurance claim with Progressive?

Yes, you can cancel an insurance claim with Progressive before it is settled. Contact your claims adjuster to request cancellation, but be aware that withdrawing a claim does not remove it from your insurance history, and your insurer may still record it in your file.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.