Cheap Polestar 2 Car Insurance in 2026 (Unlock Big Savings From These 10 Companies!)

The best providers for cheap Polestar 2 car insurance are Erie Insurance, Progressive, and Nationwide, offering rates as low as $58 per month. Erie Insurance leads with low premiums, Progressive excels with online tools, and Nationwide provides broad coverage, making them top choices for budget-friendly coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

Company Facts

Min. Coverage for Polestar 2

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Polestar 2

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Polestar 2

A.M. Best

Complaint Level

Pros & Cons

Erie Insurance, Progressive, and Nationwide are leading providers for cheap Polestar 2 car insurance, with rates starting as low as $58 per month.

Each company offers a range of coverage options and competitive pricing designed to fit various driving profiles and vehicle requirements. To enhance your understanding, explore our comprehensive resource on business insurance titled “Multiple owner vehicle who is required to carry insurance.”

Our Top 10 Company Picks: Cheap Polestar 2 Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $58 A+ Low Premiums Erie

#2 $59 A+ Online Tools Progressive

#3 $60 A+ Broad Coverage Nationwide

#4 $61 A Customer Service Safeco

#5 $62 B Policy Options State Farm

#6 $63 A Reliable Claims Farmers

#7 $64 A+ Financial Strength Allstate

#8 $65 A++ Competitive Rates Auto-Owners

#9 $66 A Flexible Policies Liberty Mutual

#10 $67 A++ High Limits Chubb

Factors like your driving history and location can affect these rates, emphasizing the need to compare quotes to secure the best coverage for your Polestar 2.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool above to find the best policy for you.

- Erie insurance leads with rates as low as $58 per month for Polestar 2

- Top providers offer budget-friendly premiums for Polestar 2 owners

- Compare quotes to find the best coverage for your Polestar 2

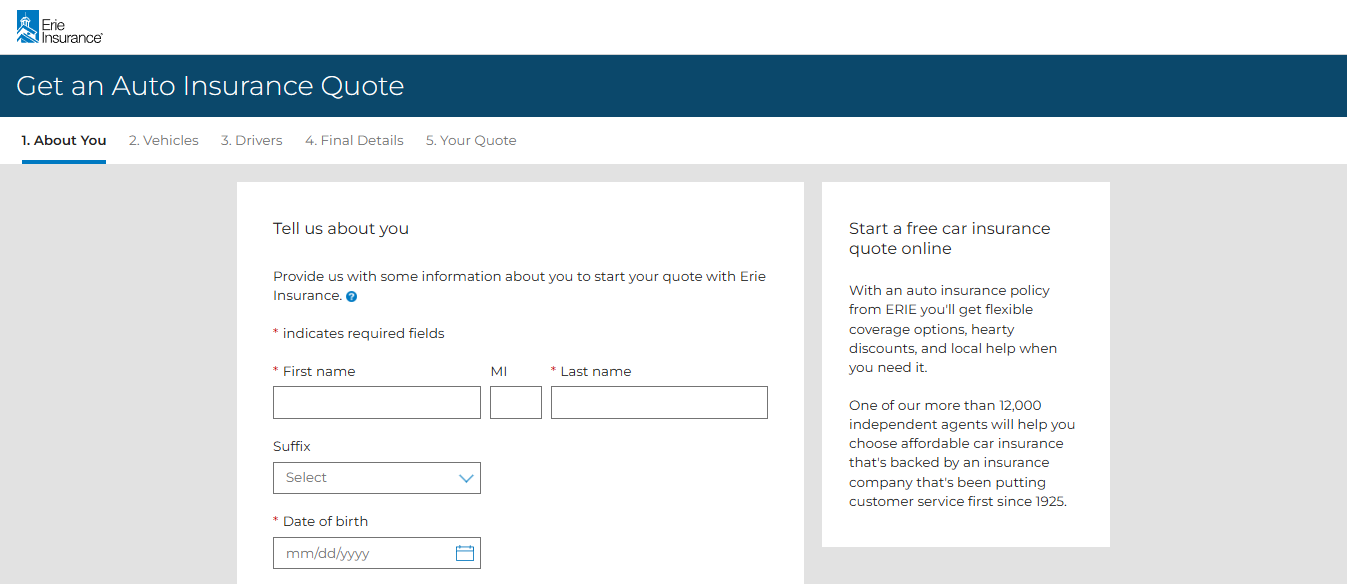

#1 – Erie Insurance: Top Overall Pick

Pros

- Comprehensive Electric Vehicle Coverage: Erie insurance review & ratings emphasize the company’s specialized policies that cater specifically to electric vehicles like the Polestar 2. This includes coverage for unique aspects such as battery damage, charging station mishaps, and specialized repair services.

- Superior Customer Service: Erie is known for its exceptional customer service, ensuring Polestar 2 owners receive prompt and knowledgeable support. Their agents are well-versed in the specifics of electric vehicles, which can be crucial for handling claims and questions.

- Customizable Policies: Erie provides flexible policy options that can be tailored to the specific needs of Polestar 2 drivers. Whether it’s additional coverage for high-tech components or roadside assistance tailored for electric vehicles, Erie has a variety of options to suit different requirements.

Cons

- Limited Availability: Erie insurance is not available in all states, which could be a significant drawback for Polestar 2 owners who live in areas where Erie does not operate. This limits access to their specialized coverage and customer service.

- Potentially Higher Repair Costs: While Erie offers comprehensive coverage, the specialized repair shops for electric vehicles like the Polestar 2 might result in higher repair costs, potentially leading to increased premiums over time.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Online Tools

Pros

- Advanced Online Tools: Progressive excels in offering advanced online tools and resources, making it easier for Polestar 2 owners to manage their policies, file claims, and receive quotes. Their user-friendly platform simplifies the insurance process for tech-savvy customers.

- Snapshot Program: Progressive insurance review & ratings display the company’s snapshot program allows Polestar 2 drivers to potentially lower their premiums based on driving habits. This usage-based insurance program can be particularly beneficial for those who drive efficiently and safely.

- Mobile App Functionality: The Progressive mobile app provides numerous features tailored for electric vehicle owners, such as locating nearby charging stations, tracking battery levels, and accessing policy details on the go.

Cons

- Mixed Customer Reviews: Progressive has received mixed reviews regarding its claims process. Some Polestar 2 owners might experience delays or dissatisfaction with how their claims are handled, which can be crucial for high-value electric vehicles.

- Higher Premiums for Comprehensive Coverage: While Progressive offers various discounts, their premiums for comprehensive coverage options might be higher compared to other providers. This could be a consideration for Polestar 2 owners looking for extensive coverage.

#3 – Nationwide: Best for Broad Coverage

Pros

- Broad Coverage Options: Nationwide provides a wide array of coverage options that can be customized to meet the specific needs of Polestar 2 owners. This includes comprehensive and collision coverage, as well as coverage for high-tech equipment and battery replacement.

- Strong Financial Stability: Nationwide’s solid financial standing ensures that Polestar 2 owners can rely on the company to pay out claims efficiently and without hassle, providing peace of mind for policyholders.

- Discounts for Electric Vehicles: Nationwide insurance review & ratings exhibit the company’s various discounts that can be particularly beneficial for Polestar 2 owners. These include discounts for having multiple policies, safe driving, and even specific savings for electric vehicle owners.

Cons

- Complex Policy Options: The wide range of coverage options can sometimes be overwhelming for Polestar 2 owners. Understanding and choosing the right coverage may require more effort and time, especially for those new to electric vehicles.

- Less Competitive Rates for High-Risk Drivers: Nationwide tends to have less competitive rates for drivers with a history of accidents or violations. Polestar 2 owners who fall into this category might find their premiums higher than expected.

#4 – Safeco: Best for Customer Service

Pros

- Exceptional Customer Service: Safeco insurance review & ratings present the company’s excellent customer service, providing personalized assistance to Polestar 2 owners. Their representatives are well-trained to handle inquiries specific to electric vehicles.

- Roadside Assistance Program: Safeco offers a comprehensive roadside assistance program that includes services specifically useful for Polestar 2 owners, such as towing to the nearest charging station and battery jump-starts.

- Bundle Discounts: Polestar 2 owners can take advantage of Safeco’s bundle discounts by combining their car insurance with other policies like home or renters insurance, leading to significant savings.

Cons

- Limited Online Tools: Compared to other insurers, Safeco’s online tools and mobile app are less advanced. Polestar 2 owners who prefer managing their insurance digitally may find this aspect lacking.

- Higher Premiums for Low-Mileage Drivers: Safeco’s premiums might not be as competitive for Polestar 2 owners who drive fewer miles annually, as their pricing structure doesn’t always favor low-mileage discounts.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Policy Options

Pros

- Extensive Agent Network: State Farm has a large network of agents who can provide personalized service to Polestar 2 owners, helping them choose the best coverage options tailored to their specific needs.

- Comprehensive Coverage Options: State Farm insurance review & ratings highlight the company’s variety of coverage options that can be customized for the Polestar 2, including liability, collision, comprehensive, and special add-ons for electric vehicles.

- Safe Driving Discounts: State Farm’s Drive Safe & Save program rewards Polestar 2 owners with discounts for safe driving habits, which can significantly lower premiums over time.

Cons

- Mixed Claims Process Reviews: State Farm has received mixed reviews regarding its claims process. Some Polestar 2 owners might experience delays or dissatisfaction with how their claims are handled.

- Higher Rates for Young Drivers: State Farm tends to have higher premiums for younger drivers, which could be a drawback for young Polestar 2 owners looking for affordable insurance.

#6 – Farmers: Best for Reliable Claims

Pros

- Reliable Claims Service: Farmers is known for its reliable and efficient claims service, ensuring that Polestar 2 owners receive quick and fair settlements in the event of an accident or damage.

- Specialized Coverage Options: Farmers offers specialized coverage options for electric vehicles like the Polestar 2, including protection for high-tech components and battery replacement coverage.

- Strong Customer Support: Farmers insurance review & ratings feature the company’s strong customer support, with knowledgeable agents available to assist Polestar 2 owners with their insurance needs and answer any questions they may have.

Cons

- Higher Premiums for Full Coverage: Farmers’ premiums for full coverage options can be higher compared to other insurers, which might be a consideration for Polestar 2 owners looking for extensive protection.

- Limited Online Management Tools: Farmers’ online tools and mobile app are not as advanced as some competitors, which can be a drawback for Polestar 2 owners who prefer managing their policies digitally.

#7 – Allstate: Best for Financial Strength

Pros

- Strong Financial Stability: Allstate’s strong financial stability ensures that Polestar 2 owners can rely on the company to pay out claims efficiently and without hassle, providing peace of mind for policyholders.

- Comprehensive Coverage Options: Allstate insurance review & ratings demonstrate the company’s wide array of coverage options that can be customized to meet the specific needs of Polestar 2 owners, including coverage for high-tech equipment and battery replacement.

- Drivewise Program: Allstate’s Drivewise program allows Polestar 2 drivers to potentially lower their premiums based on driving habits. This usage-based insurance program can be particularly beneficial for those who drive efficiently and safely.

Cons

- Mixed Customer Service Reviews: Allstate has received mixed reviews regarding its customer service. Some Polestar 2 owners might experience delays or dissatisfaction with how their queries and claims are handled.

- Higher Premiums for Certain Drivers: Allstate tends to have higher premiums for drivers with a history of accidents or violations. Polestar 2 owners who fall into this category might find their premiums higher than expected.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Auto-Owners: Best for Competitive Rates

Pros

- Competitive Rates for High-Tech Vehicles: Auto-Owners offers competitive rates specifically for high-tech vehicles like the Polestar 2, providing affordable options for electric vehicle owners.

- Strong Customer Satisfaction: Auto-Owners insurance review & ratings flaunt the company’s consistently receives high marks for customer satisfaction, ensuring that Polestar 2 owners receive top-notch service and support.

- Flexible Policy Options: Auto-Owners provides flexible policy options that can be tailored to the specific needs of Polestar 2 drivers, including additional coverage for high-tech components and roadside assistance.

Cons

- Limited Availability: Auto-Owners Insurance is not available in all states, which could be a significant drawback for Polestar 2 owners who live in areas where Auto-Owners does not operate.

- Less Advanced Online Tools: Compared to other insurers, Auto-Owners’ online tools and mobile app are less advanced. Polestar 2 owners who prefer managing their insurance digitally may find this aspect lacking.

#9 – Liberty Mutual: Best for Flexible Policies

Pros

- Flexible Policies: Liberty Mutual offers flexible policies that can be customized to meet the specific needs of Polestar 2 owners. This includes coverage for high-tech components and optional add-ons.

- New Car Replacement: Liberty Mutual provides new car replacement coverage, which is particularly beneficial for Polestar 2 owners. If the car is totaled within the first year, they will replace it with a brand new one.

- Convenient Online Tools: Liberty Mutual review & ratings parade the company’s user-friendly online tools and a mobile app that allow Polestar 2 owners to manage their policies, file claims, and get quotes easily.

Cons

- Higher Premiums for Comprehensive Coverage: Liberty Mutual’s premiums for comprehensive coverage options might be higher compared to other providers. This could be a consideration for Polestar 2 owners looking for extensive coverage.

- Mixed Customer Reviews: Liberty Mutual has received mixed reviews regarding its claims process and customer service. Some Polestar 2 owners might experience delays or dissatisfaction with how their claims are handled.

#10 – Chubb: Best for High Limits

Pros

- High Coverage Limits: Chubb insurance review & ratings spotlight the company’s high coverage limits, providing extensive protection for high-value electric vehicles like the Polestar 2. This can include high-tech equipment and specialized repair services.

- Agreed Value Coverage: Chubb offers agreed value coverage, which means Polestar 2 owners will receive the agreed value of their car in the event of a total loss, ensuring full compensation without depreciation.

- Exceptional Customer Service: Chubb is known for its exceptional customer service, providing personalized assistance to Polestar 2 owners and ensuring a smooth claims process.

Cons

- Premium Pricing: Chubb tends to be on the higher end in terms of premiums, which might be a consideration for Polestar 2 owners looking for affordable insurance options.

- Limited Online Management Tools: Chubb’s online tools and mobile app are not as advanced as some competitors, which can be a drawback for Polestar 2 owners who prefer managing their policies digitally.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Key Factors Influencing Polestar 2 Car Insurance Costs

When it comes to determining car insurance rates for the Polestar 2, several factors come into play. Insurance providers consider the make and model of the vehicle, the age and driving history of the driver, the location where the car will primarily be driven, and the coverage options selected.

The Polestar 2 is an all-electric vehicle that boasts impressive performance and advanced safety features. However, its high-end technology and materials may lead to higher costs for repairs and replacements, which can impact insurance rates.

Another influential factor is the driver’s age and driving history. Younger drivers or those with a history of accidents or traffic violations are considered higher risk by insurance companies, which typically results in higher premiums.

Polestar 2 Car Insurance Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $64 $135

Auto-Owners $65 $140

Chubb $67 $150

Erie $58 $125

Farmers $63 $134

Liberty Mutual $66 $145

Nationwide $60 $128

Progressive $59 $127

Safeco $61 $132

State Farm $62 $130

The location where the Polestar 2 will be primarily driven also plays a role in car insurance costs. Insurance providers assess the likelihood of accidents, theft, vandalism, and natural disasters in a particular area. For detailed information, refer to our comprehensive report titled “Why You Should Always Take Pictures After a Car Accident.”

Lastly, the coverage options you choose will also impact the overall cost of car insurance for your Polestar 2. Higher coverage limits and additional add-ons such as comprehensive and collision coverage will result in higher premiums. It’s essential to strike a balance between adequate coverage and affordability.

Finding the Best Insurance for Your Polestar 2

Researching car insurance options for your Polestar 2 is essential for finding the best coverage. Start by comparing quotes from multiple insurers to understand the price range and identify cost-effective options.

While well-known companies are popular, specialized insurers focusing on electric vehicles might offer tailored coverage better suited to your Polestar 2.

If it’s cold outside, the warm air inside your car likely contains more moisture – and things can fog up even quicker with your breathing or a steaming hot cup of coffee. ☕

Try these quick tips to defog your car’s windshield. 🚘 https://t.co/bWIq7doNOs

— Erie Insurance (@erie_insurance) November 14, 2023

Assess the financial stability, customer service, and claim handling of each provider, and check their reputation and customer reviews to ensure reliable coverage. To gain in-depth knowledge, consult our comprehensive resource titled “How to File a Car Insurance Claim.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Polestar 2 Insurance Rates

The make and model of your Polestar 2 significantly impact insurance rates. As an advanced electric vehicle, the Polestar 2’s unique technology and materials can lead to higher premiums due to increased repair and replacement costs.

Its higher value also contributes to these elevated rates. Additionally, a driver’s age and history are crucial factors; younger drivers and those with a record of accidents or violations often face higher premiums. To broaden your understanding, explore our comprehensive resource on insurance coverage titled “How does the insurance company determine my premium?”

If you’re looking to car #shop this weekend and find that perfect ride, will it be covered when you drive it off the lot — even if your insurance agent’s office is closed ’til Monday? 🚗

The short answer: Yes. Learn how coverage rollover works here ➡️ https://t.co/mLoXvNziIU pic.twitter.com/UwCBAsjZdq

— Erie Insurance (@erie_insurance) September 14, 2023

Moreover, insurance costs for the Polestar 2 vary by region, with higher rates in areas with dense populations, higher crime rates, or severe weather conditions. When comparing rates, consider how regional cost of living and risk factors affect your premium.

Optimizing and Bundling Your Polestar 2 Insurance

Regularly reviewing and updating your car insurance policy for your Polestar 2 is crucial to ensure adequate coverage and optimal value.

Changes in your driving habits, address, or the addition of new drivers should prompt a policy review. Adjusting coverage as the value of your Polestar 2 depreciates can prevent overpayment.

Common Misconceptions About Insuring A Polestar 2 And Debunking Them

When insuring a Polestar 2, several misconceptions can lead to confusion and misinformed decisions. Understanding the truth behind these common myths is crucial for making well-informed insurance choices.

- Myth 1: Electric vehicles are more expensive to insure than traditional gas-powered vehicles. While the cost of repairs may be higher for some electric cars, insurance rates are not necessarily higher across the board. Factors such as the make and model of the vehicle, driving history, and location influence rates more significantly.

- Myth 2: Electric vehicle owners are only limited to specialized insurers. While specialized insurers may offer tailored coverage options, traditional insurance providers also offer coverage for electric vehicles, including the Polestar 2. It’s essential to compare quotes from different insurers to find the best fit for your needs.

- Myth 3: Electric vehicles are more susceptible to accidents. Electric vehicles, like the Polestar 2, are equipped with advanced safety features that can help prevent accidents. Additionally, proper maintenance, responsible driving, and following all traffic rules can reduce the risk of accidents.

By debunking these misconceptions, you can better navigate your insurance options and make informed decisions about coverage for your Polestar 2.

Armed with accurate information, you can avoid unnecessary costs and ensure that you have the protection you need, tailored to your specific vehicle and driving habits. For a thorough exploration, delve into our extensive guide titled “Fleet Vehicle Insurance: A Complete Guide.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Specialized Insurers and Deductibles for the Polestar 2

While traditional insurers offer coverage for the Polestar 2, specialized insurers focusing on electric vehicles may provide additional benefits tailored to its unique features and risks. Researching these insurers and comparing their quotes with those from traditional providers can help you find the best coverage for your needs. For a detailed breakdown, consult our comprehensive guide named “Types of Car Insurance Coverage.”

Additionally, understanding deductibles is crucial; higher deductibles often lead to lower premiums but require a larger out-of-pocket expense in the event of a claim. Evaluate your financial situation to choose a deductible that balances savings with your ability to cover potential costs.

Credit Scores and Polestar 2 Insurance Rates

Many insurance providers consider an individual’s credit score when determining car insurance rates. “For an exhaustive analysis, check out our complete guide entitled “Understanding Credit: A Score that Impacts Everything from Your Cell Phone Bill to Car Insurance.” A higher credit score is perceived as an indication of responsible financial management, resulting in lower insurance premiums.

It’s important to maintain a good credit score by paying bills on time, minimizing outstanding debts, and correcting any inaccuracies on your credit report. Regularly monitor your credit score and address any issues promptly to help secure lower car insurance rates for your Polestar 2.

Case Studies: Customized Insurance for Your Polestar 2

Choosing the right insurance for your Polestar 2 involves evaluating coverage options and costs. Top insurers like Erie Insurance, Progressive, and Nationwide offer specialized plans tailored to electric vehicles, ensuring comprehensive protection and value.

- Case Study #1 – Tech-Savvy Coverage: Samantha chooses Erie Insurance for her Polestar 2, benefiting from its advanced coverage options and competitive rates. Erie’s comprehensive policies offer great protection for tech-focused drivers. For a detailed overview, refer to our extensive guide called “What is comprehensive coverage?“

- Case Study #2 – Budget-Friendly Solutions: James selects Progressive for its affordable rates and extensive coverage. Progressive’s cost-effective plans and online tools help him manage insurance efficiently while keeping costs down.

- Case Study #3 – Comprehensive Protection and Support: Natalie, a loyal Nationwide customer, enjoys robust coverage and exceptional support for her Polestar 2. Nationwide’s extensive insurance solutions and responsive service ensure reliable protection.

Erie Insurance, Progressive, and Nationwide provide tailored insurance options for Polestar 2 owners. Whether you value tech-focused coverage, budget-friendly solutions, or comprehensive support, these insurers offer flexible plans to meet your specific needs and preferences.

Chris Abrams Licensed Insurance Agent

By understanding these options, you can make an informed decision and ensure optimal protection for your electric vehicle.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Conclusion: Affordable Car Insurance for Your Polestar 2

Finding affordable car insurance for your Polestar 2 doesn’t have to be a daunting task. With options from leading providers like Erie Insurance, Progressive, and Nationwide, you can secure competitive rates and comprehensive coverage tailored to your needs.

By comparing quotes and understanding the factors that influence insurance costs—such as your driving history, location, and vehicle features—you can make informed decisions that ensure optimal protection for your electric vehicle. For an in-depth investigation, peruse our comprehensive guide named “Compare Car Insurance Quotes.”

Utilize our free quote tool to explore various options and discover the best policy for your Polestar 2, balancing coverage and cost effectively. Remember, regular policy reviews and considering specialized insurers for electric vehicles can further enhance your insurance experience.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Frequently Asked Questions

What is the Polestar 2 insurance cost in Hawaii?

The insurance cost for a Polestar 2 in Hawaii varies based on coverage levels and individual factors but generally ranges between $100 and $150 per month.

How much is the Polestar 2 car and its insurance cost?

The Polestar 2 starts around $45,900, and its insurance cost typically ranges from $100 to $150 per month, depending on coverage and personal factors.

Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

Which insurance company offers the cheapest car insurance for full coverage on a Polestar 2?

Companies like State Farm and Geico often offer the cheapest car insurance for full coverage on a Polestar 2, with monthly premiums generally ranging from $100 to $150.

For a thorough examination, take a look at our detailed guide entitled “Full Coverage Car Insurance: A Complete Guide.”

Is the Polestar 2 a luxury car and what is its insurance cost?

Yes, the Polestar 2 is considered a luxury car, which can influence its insurance cost, typically ranging from $100 to $150 per month.

How much is Tesla insurance a month in California compared to Polestar 2 insurance cost?

Tesla insurance in California can cost between $100 to $150 a month, similar to the monthly insurance cost for a Polestar 2, which also ranges from $100 to $150 depending on coverage.

What is the most affordable auto insurance for a Tesla compared to Polestar 2 insurance?

The most affordable auto insurance for a Tesla and Polestar 2 is often offered by companies like State Farm and Geico, with monthly premiums generally ranging from $100 to $150.

For an extensive exploration, refer to our detailed guide entitled “Do Geico employees get car insurance discounts?”

Is the Polestar 2 100% electric and what is its insurance cost?

Yes, the Polestar 2 is 100% electric, and its insurance cost typically ranges from $100 to $150 per month, reflecting the higher cost of repairs and specialized parts.

Does Tesla have their own insurance and how does it compare to Polestar 2 insurance?

Yes, Tesla offers their own insurance in some states, which can be competitive with traditional insurers like State Farm and Geico that provide coverage for the Polestar 2.

Are Teslas expensive to maintain compared to Polestar 2 insurance cost, including liability coverage?

Teslas can be expensive to maintain, which is reflected in their insurance costs, including liability coverage. Polestar 2 insurance costs are comparable, generally ranging from $100 to $150 per month.

To gain further insights, consult our comprehensive guide titled “Best Car Insurance for Liability Insurance.”

Is Polestar 2 a Chinese car and what is its insurance cost?

The Polestar 2 is manufactured by Polestar, a Swedish automotive brand with Chinese parent company Geely. Its insurance cost typically ranges from $100 to $150 per month.

Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.

Make informed decisions to protect your investment and enjoy peace of mind on the road. Make informed decisions to protect your investment, enjoy peace of mind on the road, and ensure the safety and security of yourself and your passengers, knowing that your vehicle is covered in case of accidents, theft, or other unexpected events.

Make informed decisions to protect your investment and enjoy peace of mind on the road. Make informed decisions to protect your investment, enjoy peace of mind on the road, and ensure the safety and security of yourself and your passengers, knowing that your vehicle is covered in case of accidents, theft, or other unexpected events.