Cheap Mercedes-Benz Mercedes-EQ EQB Car Insurance in 2026 (Save Big With These 10 Companies!)

USAA, State Farm, and Progressive are leading options for cheap Mercedes-Benz Mercedes-EQ EQB car insurance. With competitive rates starting at $41 per month, these providers excel in offering comprehensive policies for Mercedes-Benz Mercedes-EQ EQB owners looking for cost-effective insurance solutions.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated January 2025

Company Facts

Min. Coverage for Mercedes-Benz Mercedes-EQ EQB

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mercedes-Benz Mercedes-EQ EQB

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mercedes-Benz Mercedes-EQ EQB

A.M. Best Rating

Complaint Level

Pros & Cons

As electric vehicles continue to gain popularity, it is crucial to understand the factors that affect insurance rates and how they compare to traditional SUVs.

Our Top 10 Company Picks: Cheap Mercedes-Benz Mercedes-EQ EQB Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $41 A++ Military Savings USAA

![]()

#2 $45 B Student Savings State Farm

#3 $52 A+ Customer Service Progressive

#4 $57 A Roadside Assistance AAA

#5 $65 A+ Exclusive Benefits The Hartford

#6 $73 A Loyalty Rewards American Family

#7 $74 A Group Discounts Farmers

#8 $78 A++ Coverage Options Travelers

#9 $90 A+ Vanishing Deductible Nationwide

#10 $106 A+ Add-on Coverages Allstate

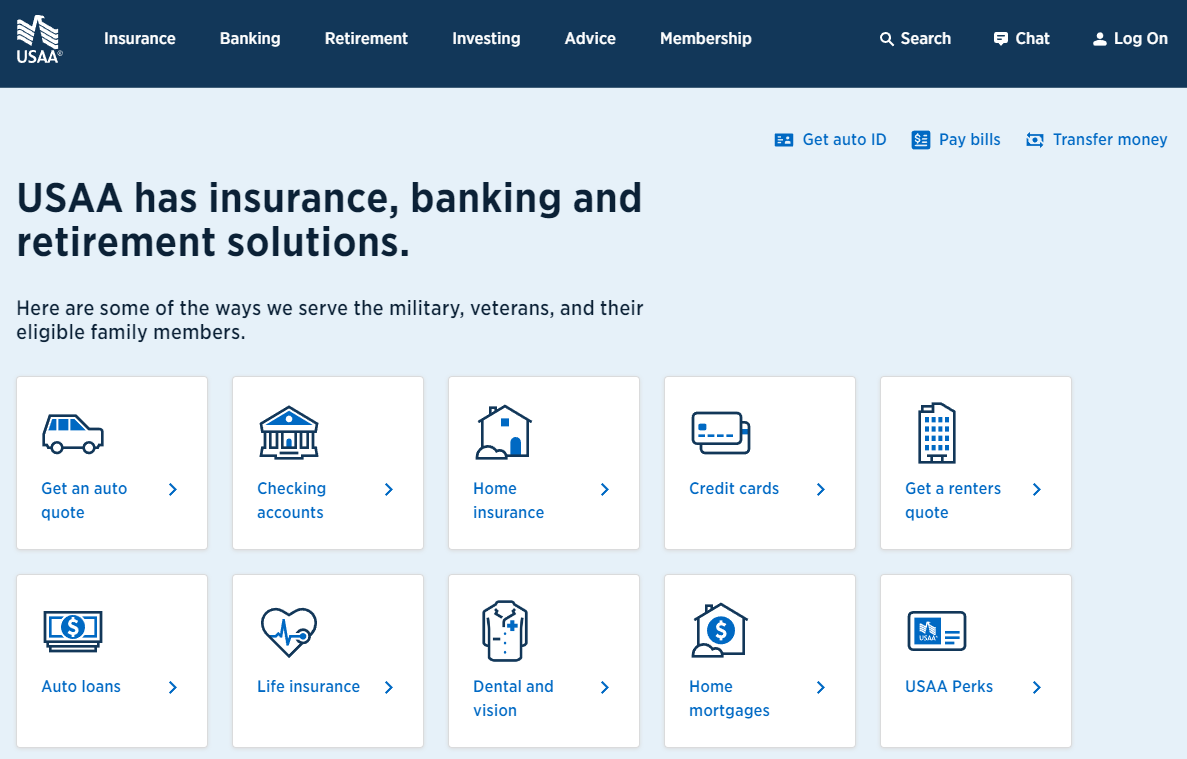

#1 – USAA: Top Overall Pick

Pros

- Military Focus: USAA offers specialized policies and discounts tailored for military members, veterans, and their families, including those who own a Mercedes-Benz Mercedes-EQ EQB, ensuring they receive competitive rates and comprehensive coverage options.

- Top-Rated Customer Service: USAA is known for excellent customer service, which is beneficial for Mercedes-Benz Mercedes-EQ EQB owners who value personalized attention and efficient claims processing, as highlighted in the USAA insurance review & ratings.

- Financial Stability: A.M. Best gives USAA the highest ratings (A++) for financial strength, providing Mercedes-Benz Mercedes-EQ EQB owners confidence in the insurer’s ability to handle claims and meet obligations.

Cons

- Limited Eligibility: USAA is only available to military personnel, veterans, and their families, which restricts access for non-military Mercedes-Benz Mercedes-EQ EQB owners seeking its favorable rates and benefits.

- Online-Only Service: While USAA offers robust online services, its limited physical branch locations may be a drawback for Mercedes-Benz Mercedes-EQ EQB owners who prefer in-person interactions with insurance agents.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Student Savings

Pros

- Extensive Agent Network: State Farm boasts a vast network of local agents across the country, ensuring Mercedes-Benz Mercedes-EQ EQB owners have easy access to personalized service and assistance when selecting coverage options.

- Customizable Coverage Options: State Farm offers a wide range of policies and discounts, allowing Mercedes-Benz Mercedes-EQ EQB owners to tailor their insurance plans to meet specific needs and preferences. Read more through our State Farm insurance review.

- Outstanding Customer Service: State Farm is acclaimed for its excellent customer service, delivering prompt support and efficient claims management, which is advantageous for Mercedes-Benz Mercedes-EQ EQB owners seeking trustworthy insurance coverage.

Cons

- Potentially Higher Rates: While State Farm offers extensive coverage options, rates may be higher for certain demographics or specific types of coverage, potentially making it less competitive in price for Mercedes-Benz Mercedes-EQ EQB owners.

- Claims Handling Variability: Some Mercedes-Benz Mercedes-EQ EQB owners report inconsistencies in the claims handling process depending on the local State Farm agent, which could impact overall satisfaction.

#3 – Progressive: Best for Customer Service

Pros

- Customer Service Excellence: Progressive is recognized for its strong customer service, offering responsive support and efficient claims processing, which is beneficial for Mercedes-Benz Mercedes-EQ EQB owners seeking reliable insurance coverage.

- Varied Discount Opportunities: Progressive provides numerous discount options, such as bundling policies, safe driving discounts, and incentives for anti-theft devices, helping Mercedes-Benz Mercedes-EQ EQB owners save on premiums.

- User-Friendly Online Tools: Progressive’s intuitive online platform allows Mercedes-Benz Mercedes-EQ EQB owners to manage policies, file claims, and obtain quotes easily, enhancing convenience and accessibility.

Cons

- Potential Premium Costs: Depending on individual circumstances and coverage needs, Progressive’s premiums may be on the higher side compared to other insurers, particularly for Mercedes-Benz Mercedes-EQ EQB owners in certain demographics or high-risk categories.

- Complexity for In-Person Service: Despite its strong online presence, Mercedes-Benz Mercedes-EQ EQB owners seeking face-to-face interactions may find Progressive’s physical office locations limited, which could impact accessibility, according to Progressive insurance review & ratings.

#4 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA offers excellent roadside assistance coverage, which can be particularly beneficial for Mercedes-Benz Mercedes-EQ EQB owners who value peace of mind while traveling.

- Strong Financial Stability: AAA has a high rating of A from A.M. Best, indicating strong financial stability and reliability in handling claims for Mercedes-Benz Mercedes-EQ EQB owners.

- Member Benefits: AAA provides additional benefits and discounts to its members, including savings on travel and retail purchases, enhancing value for Mercedes-Benz Mercedes-EQ EQB owners.

Cons

- Membership Requirements: Access to AAA’s insurance products and services requires membership, which may involve additional fees and is not available to non-members.

- Limited Coverage Options: While AAA offers comprehensive coverage, Mercedes-Benz Mercedes-EQ EQB owners may find fewer customization options compared to other insurers. Learn more through our AAA insurance review.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – The Hartford: Best for Exclusive Benefits

Pros

- Exclusive Benefits: The Hartford offers exclusive benefits such as disappearing deductibles and lifetime repair guarantees, appealing to Mercedes-Benz Mercedes-EQ EQB owners looking for comprehensive coverage and added peace of mind.

- Strong Financial Reputation: With an A+ rating from A.M. Best, The Hartford demonstrates strong financial stability and reliability in handling claims for Mercedes-Benz Mercedes-EQ EQB owners.

- Personalized Service: The Hartford provides personalized service through its network of agents, ensuring Mercedes-Benz Mercedes-EQ EQB owners receive tailored advice and support.

Cons

- Higher Premiums: The Hartford’s comprehensive coverage and exclusive benefits may come with higher premiums, making it potentially less affordable for some Mercedes-Benz Mercedes-EQ EQB owners.

- Limited Availability: The Hartford’s insurance products may not be as widely available in all regions, limiting options for Mercedes-Benz Mercedes-EQ EQB owners in certain locations. Read more through our The Hartford insurance review.

#6 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: American Family offers loyalty rewards and discounts for long-term customers, which can be advantageous for Mercedes-Benz Mercedes-EQ EQB owners seeking to save on insurance premiums over time.

- Community Involvement: Known for community engagement, American Family may appeal to Mercedes-Benz Mercedes-EQ EQB owners interested in supporting socially responsible companies.

- Comprehensive Coverage Options: American Family provides a variety of coverage options and customizable policies to meet the unique needs of Mercedes-Benz Mercedes-EQ EQB owners, as noted in the American Family insurance review & ratings.

Cons

- Customer Service Variability: Some Mercedes-Benz Mercedes-EQ EQB owners report mixed experiences with American Family’s customer service, with satisfaction levels varying by location and agent.

- Limited Discounts: While American Family offers some discounts, Mercedes-Benz Mercedes-EQ EQB owners may find fewer opportunities for savings compared to other insurers.

#7 – Farmers: Best for Group Discounts

Pros

- Group Discounts: Farmers offers significant discounts for group policies, which can benefit Mercedes-Benz Mercedes-EQ EQB owners insuring multiple vehicles or bundling with other insurance products.

- Coverage Options: Farmers provides a wide range of coverage options and add-ons, allowing Mercedes-Benz Mercedes-EQ EQB owners to customize their policies according to their specific needs.

- Strong Financial Stability: Farmers holds an A rating from A.M. Best, indicating strong financial stability and reliability in handling claims for Mercedes-Benz Mercedes-EQ EQB owners.

Cons

- Customer Service Challenges: Some Mercedes-Benz Mercedes-EQ EQB owners have reported issues with Farmers’ customer service, citing delays in claims processing and communication, as highlighted in the Farmers insurance review & ratings.

- Higher Premiums in Certain Areas: Premium rates may vary significantly depending on the location and demographic factors, potentially making Farmers less competitive in certain regions.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Coverage Options

Pros

- Coverage Options: Travelers offers a wide range of coverage options and add-ons, providing flexibility for Mercedes-Benz Mercedes-EQ EQB owners to tailor their policies to meet specific needs, as mentioned in the Travelers insurance review & ratings.

- Strong Financial Stability: Travelers boasts an A++ rating from A.M. Best, indicating the highest level of financial strength and stability, which is reassuring for Mercedes-Benz Mercedes-EQ EQB owners.

- Innovative Tools and Resources: Travelers provides innovative tools and resources online, making it convenient for Mercedes-Benz Mercedes-EQ EQB owners to manage policies, file claims, and obtain support.

Cons

- Complex Claims Process: Mercedes-Benz Mercedes-EQ EQB owners may encounter a more complex claims process with Travelers, especially when dealing with non-standard claims or intricate policy details.

- Limited Local Agent Availability: Travelers’ reliance on online and phone support may be less appealing to Mercedes-Benz Mercedes-EQ EQB owners who prefer face-to-face interactions with local agents.

#9 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible option, which rewards safe driving behavior and can lead to reduced out-of-pocket expenses for Mercedes-Benz Mercedes-EQ EQB owners over time.

- Coverage Options: Nationwide provides a variety of coverage options and discounts, allowing Mercedes-Benz Mercedes-EQ EQB owners to customize their policies to fit their lifestyle and budget.

- Strong Financial Reputation: Nationwide holds an A+ rating from A.M. Best, indicating strong financial stability and reliability in handling claims for Mercedes-Benz Mercedes-EQ EQB owners.

Cons

- Potentially Higher Premiums: Depending on the Mercedes-Benz Mercedes-EQ EQB owner’s location and driving record, premiums with Nationwide may be higher compared to other insurers offering similar coverage.

- Customer Service Issues: Some Mercedes-Benz Mercedes-EQ EQB owners have reported challenges with Nationwide’s customer service, particularly in claims processing and responsiveness, as noted in the Nationwide insurance review & ratings.

#10 – Allstate: Best for Add-on Coverages

Pros

- Add-On Coverages: Allstate offers a wide range of add-on coverages and optional features, allowing Mercedes-Benz Mercedes-EQ EQB owners to enhance their policies with additional protections and benefits.

- Innovative Tools: Allstate provides innovative tools and resources online, such as the Drivewise program, which can help Mercedes-Benz Mercedes-EQ EQB owners save on premiums by tracking safe driving habits.

- Strong Financial Stability: Allstate maintains an A+ rating from A.M. Best, indicating strong financial stability and reliability in handling claims for Mercedes-Benz Mercedes-EQ EQB owners. Learn more through our Allstate insurance review.

Cons

- Higher Premiums: Mercedes-Benz Mercedes-EQ EQB owners may experience higher premiums with Allstate, particularly when adding optional coverages or due to specific demographic factors.

- Mixed Customer Satisfaction: Some Mercedes-Benz Mercedes-EQ EQB owners have reported mixed experiences with Allstate’s customer service, citing issues with claims handling and policy clarity.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Mercedes-Benz Mercedes-EQ EQB: A Luxurious Electric SUV

The Rise of Electric Vehicles: Exploring the Mercedes-EQ EQB

Factors Affecting the Cost of Mercedes-Benz Mercedes-EQ EQB Car Insurance

Another important factor that can affect the cost of car insurance for the Mercedes-EQ EQB is the driver’s age and driving experience. Younger and less experienced drivers are often considered higher risk by insurance providers, which can result in higher insurance premiums. On the other hand, drivers with a clean driving record and many years of experience may be eligible for lower insurance rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Car Insurance Rates for the Mercedes-Benz Mercedes-EQ EQB With Other Electric SUVs

Frequently Asked Questions

What factors affect the cost of Mercedes-Benz Mercedes-EQ EQB car insurance?

The cost of car insurance for a Mercedes-Benz Mercedes-EQ EQB can be influenced by various factors such as the driver’s age, location, driving history, coverage options, deductible amount, and the level of insurance required by the state.

Is Mercedes-Benz Mercedes-EQ EQB car insurance more expensive than regular car insurance?

Car insurance for a Mercedes-Benz Mercedes-EQ EQB may be slightly more expensive than insurance for regular cars due to its higher value and potentially higher repair costs.

However, the actual insurance premium will depend on individual circumstances and other factors. Enter your ZIP code now.

Are there any discounts available for Mercedes-Benz Mercedes-EQ EQB car insurance?

Can I get insurance coverage for a leased or financed Mercedes-Benz Mercedes-EQ EQB?

Yes, it is typically required to have insurance coverage for a leased or financed Mercedes-Benz Mercedes-EQ EQB. The leasing or financing company will usually require collision and comprehensive coverage to protect their investment in the vehicle.

What are the specific discounts available for Mercedes-Benz Mercedes-EQ EQB owners with USAA, State Farm, and Progressive?

Discounts for Mercedes-Benz Mercedes-EQ EQB owners with USAA, State Farm, and Progressive include military savings with USAA, student savings with State Farm, and various discounts for good driving and safety features with Progressive. Enter your ZIP code now.

How does The Hartford differentiate its insurance offerings for Mercedes-Benz Mercedes-EQ EQB owners compared to other insurers?

The Hartford stands out among the best insurance companies, offering exclusive benefits like disappearing deductibles and lifetime repair guarantees tailored to Mercedes-Benz Mercedes-EQ EQB owners.

These features distinguish its insurance offerings, providing added peace of mind and comprehensive coverage options.

What factors contribute to higher insurance premiums for luxury electric SUVs like the Mercedes-Benz Mercedes-EQ EQB?

Higher insurance premiums for luxury electric SUVs like the Mercedes-Benz Mercedes-EQ EQB are influenced by factors such as the vehicle’s higher value, specialized components requiring costly repairs, and potentially higher risk profiles associated with luxury vehicle ownership.

How does Progressive’s customer service compare to other top insurers when dealing with claims for Mercedes-Benz Mercedes-EQ EQB owners?

Progressive is noted for its strong customer service reputation, often providing efficient claims processing and responsive support, which can be advantageous for Mercedes-Benz Mercedes-EQ EQB owners navigating insurance claims. Enter your ZIP code now.

What are the benefits of opting for roadside assistance with AAA when insuring a Mercedes-Benz Mercedes-EQ EQB?

Can Nationwide’s vanishing deductible feature effectively reduce long-term costs for Mercedes-Benz Mercedes-EQ EQB owners?

Nationwide’s vanishing deductible feature rewards safe driving habits over time, potentially reducing out-of-pocket expenses for Mercedes-Benz Mercedes-EQ EQB owners who maintain a clean driving record and adhere to safe driving practices.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.