Cheap Mazda MX-5 Miata Car Insurance in 2026 (Secure Low Rates With These 10 Companies)

State Farm, Progressive, and USAA are the top picks for cheap Mazda MX-5 Miata car insurance, with rates starting as low as $65 per month. These providers offer competitive pricing and excellent coverage options, making them the best choices for affordable and reliable insurance for Mazda MX-5 Miata owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated October 2024

Company Facts

Min. Coverage for Mazda MX-5 Miata

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mazda MX-5 Miata

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Mazda MX-5 Miata

A.M. Best

Complaint Level

Pros & Cons

State Farm, Progressive, and USAA offer the cheapest Mazda MX-5 Miata car insurance, with rates starting at just $65 per month.

These top providers stand out for their competitive pricing and comprehensive coverage options. Whether you’re looking for affordable premiums or excellent customer service, these companies deliver the best value for insuring your Mazda MX-5 Miata.

Our Top 10 Company Picks: Cheap Mazda MX-5 Miata Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $65 B Bundle Discounts State Farm

#2 $70 A+ Snapshot Program Progressive

#3 $75 A++ Military Drivers USAA

#4 $77 A Teen Safe American Family

#5 $78 A+ Vanishing Deductible Nationwide

#6 $80 A+ Safe Driver Allstate

#7 $82 A++ New Car Travelers

#8 $85 A Customized Policies Farmers

#9 $88 A+ AARP Discounts The Hartford

#10 $90 A Accident Forgiveness Liberty Mutual

Explore your options to find the perfect insurance plan for your budget and needs. Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

#1 – State Farm: Top Overall Pick

Pros

- Discounts: State Farm offers a comprehensive array of discounts, such as multi-policy, good driver, and student discounts, which can significantly lower premiums for Mazda MX-5 Miata owners, as highlighted in the State Farm insurance review & ratings.

- Coverage Options: The wide range of coverage options, including liability, comprehensive, collision, and rental reimbursement, allows Mazda MX-5 Miata owners to customize their policies to meet specific needs and preferences.

- Usage-Based Insurance: State Farm’s Drive Safe & Save program allows policyholders to potentially lower their rates based on their driving habits. This program benefits safe drivers by offering discounts for good behavior on the road.

Cons

- Cost: Despite the discounts, State Farm may not always offer the cheapest rates, particularly for younger or high-risk drivers. Some policyholders might find better rates with other insurers.

- Local Availability: The availability of certain discounts or coverage options can vary significantly by region. This variability can limit accessibility for some drivers who might not have access to all the benefits advertised.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive often provides competitive rates for sports cars like the Mazda MX-5 Miata. This affordability makes it a popular choice for budget-conscious drivers who want good coverage without breaking the bank, according to Progressive insurance review & ratings.

- Snapshot Program: Progressive’s usage-based insurance program, Snapshot, tracks driving habits and can lead to significant savings for safe drivers. This program rewards responsible behavior behind the wheel.

- Discounts: Numerous discounts are available, including multi-policy, good student, and homeowner discounts. These savings opportunities can make a significant difference in the overall cost of insurance.

Cons

- Customer Satisfaction: Progressive receives mixed reviews on customer satisfaction and claims handling. While some customers report positive experiences, others have encountered issues that could be a concern.

- Rate Increases: Some customers report substantial rate increases after the initial policy term, which can affect long-term affordability and satisfaction with Progressive’s pricing structure.

#3 – USAA: Best for Exclusive Benefits

Pros

- Exclusive Benefits: USAA offers exclusive benefits and competitive rates for military members and their families. These perks can provide significant savings and enhanced coverage options.

- Discounts: Various discounts are available, including those for garaging your car on a military base. These discounts can significantly lower insurance premiums for Mazda MX-5 Miata owners.

- Roadside Assistance: Comprehensive roadside assistance is available, adding another layer of convenience and security for Mazda MX-5 Miata owners, especially during long trips or unexpected breakdowns.

Cons

- Eligibility: USAA is only available to military members, veterans, and their families. This limitation restricts access to the general public, making it less inclusive compared to other insurers, as noted in the USAA insurance review & ratings.

- Limited Local Offices: There are fewer physical branches compared to some competitors. This might be a disadvantage for policyholders who prefer in-person service over online or phone-based interactions.

#4 – American Family: Best for Customizable Coverage

Pros

- Customizable Coverage: American Family offers a wide range of customizable coverage options. This flexibility allows Mazda MX-5 Miata owners to tailor their policies to meet their specific needs and preferences, as noted in the American Family insurance review & ratings.

- Discounts: Several discounts are available, including multi-vehicle, loyalty, and defensive driving course discounts. These savings opportunities can make a significant difference in the overall cost of insurance.

- Teen Safe Driver Program: This program helps young drivers improve their driving skills, potentially lowering insurance premiums. It’s an excellent option for families with teenage drivers.

Cons

- Availability: Coverage is not available in all states, which can limit options for some drivers. Potential policyholders need to check if American Family operates in their region.

- Rates: Insurance rates can be higher than some competitors for sports cars like the Mazda MX-5 Miata, especially for younger drivers. It’s essential to compare quotes to ensure competitive pricing.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a unique program where your deductible decreases for each year of safe driving. This feature rewards responsible driving and can lead to lower out-of-pocket costs in the event of a claim.

- Discounts: Numerous discount opportunities are available, including multi-policy, accident-free, and safe driver discounts. These savings can significantly reduce the overall cost of insurance, as noted in the Nationwide insurance review & ratings.

- Coverage Options: Nationwide provides a comprehensive range of coverage options, including roadside assistance, rental reimbursement, and accident forgiveness. These options allow for personalized policies that meet individual needs.

Cons

- Premiums: Nationwide may have higher premiums compared to budget insurers. While the coverage and services are robust, cost-conscious drivers might find better rates elsewhere.

- Customer Service: While generally good, customer service experiences can be mixed. Some customers report issues, which could be a consideration for those prioritizing consistent support.

#6 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: This usage-based insurance program tracks driving habits and can provide additional savings based on safe driving. It rewards responsible behavior on the road.

- Discounts: Allstate offers a variety of discounts, such as for new cars, safe drivers, and multiple policies. These discounts can significantly lower insurance premiums for Mazda MX-5 Miata owners.

- Claim Satisfaction Guarantee: Allstate offers a guarantee on their claims service, promising satisfaction. This commitment to service quality can be reassuring for policyholders.

Cons

- Rates: Allstate can be more expensive than some competitors, particularly for younger drivers or those with less driving experience. It’s essential to compare quotes to ensure competitive pricing, according to Allstate insurance review & ratings.

- Customer Reviews: There are mixed reviews regarding customer service and claims handling. While some customers report positive experiences, others have encountered issues that could be a concern.

#7 – Travelers: Best for Multiple Discounts

Pros

- Multiple Discounts: Travelers offers multiple discounts, including those for hybrid/electric cars and good payers. These discounts can significantly reduce insurance premiums for Mazda MX-5 Miata owners, as mentioned in the Travelers insurance review & ratings.

- Coverage Options: Travelers provides a comprehensive range of coverage options and customizations, such as accident forgiveness and gap coverage. This flexibility allows policyholders to tailor their policies to meet specific needs.

- Green Policy: Travelers offers discounts and incentives for environmentally friendly vehicles, encouraging eco-conscious driving choices.

Cons

- Rates: Rates can be higher for sports cars like the Mazda MX-5 Miata compared to other insurers. It’s essential to compare quotes to ensure competitive pricing.

- Online Tools: The website and online tools may not be as user-friendly as some competitors. This drawback can be a concern for tech-savvy customers who prefer digital interactions.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Personalized Coverage

Pros

- Personalized Coverage: Farmers offers customizable policies tailored to individual needs, ensuring comprehensive protection for Mazda MX-5 Miata owners, as highlighted in the Farmers insurance review & ratings.

- Discounts: Several discounts are available, including good student, multi-policy, and safe driver discounts. These savings opportunities can make a significant difference in the overall cost of insurance.

- Claims Service: Farmers has a good reputation for claims service, providing reliable support when needed. This reliability is crucial during stressful situations.

Cons

- Premiums: Generally higher premiums compared to some other insurers, which may not be ideal for budget-conscious drivers. It’s essential to compare quotes to ensure competitive pricing.

- Customer Satisfaction: Mixed reviews on customer service, with some customers reporting issues. This variability can be a concern for those prioritizing consistent support.

#9 – The Hartford: Best for AARP Member Benefits

Pros

- AARP Member Benefits: Special benefits and discounts for AARP members can lead to significant savings. These exclusive perks make The Hartford an attractive option for older drivers.

- Discounts: Various discounts are available, including those for vehicle safety features and bundling policies. These savings opportunities can significantly reduce insurance premiums.

- Coverage Options: Comprehensive coverage options, including roadside assistance and new car replacement, allow for personalized policies that meet individual needs.

Cons

- Eligibility: Primarily available to AARP members, which limits accessibility for younger drivers. Potential policyholders need to meet membership criteria to benefit from The Hartford’s offerings.

- Cost: May not be the cheapest option for younger drivers or those without AARP membership. It’s essential to compare quotes to ensure competitive pricing, as noted in the The Hartford insurance review & ratings.

#10 – Liberty Mutual: Best for Coverage Options

Pros

- Coverage Options: Broad range of coverage options and add-ons, such as accident forgiveness and new car replacement. This flexibility allows policyholders to tailor their policies to meet specific needs, as highlighted in the Liberty Mutual Review & Ratings.

- Discounts: Wide range of discounts available, including for new cars, good students, and safe drivers. These discounts can significantly lower insurance premiums for Mazda MX-5 Miata owners.

- RightTrack Program: Usage-based insurance program that rewards safe driving habits. This program tracks driving behavior and offers discounts for responsible driving.

Cons

- Premiums: Can be higher compared to some other insurers, particularly for high-risk drivers. It’s essential to compare quotes to ensure competitive pricing.

- Rate Increases: Some customers report significant rate increases over time. This variability can affect long-term affordability and satisfaction with Liberty Mutual’s pricing structure.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Influence the Cost of Mazda Mx-5 Miata Car Insurance

Insurance companies take various factors into account when determining the cost of Mazda MX-5 Miata car insurance. These factors include your age, gender, driving record, location, and the specific model and year of your MX-5 Miata. Younger drivers and those with a history of accidents or traffic violations typically pay higher premiums, as they are considered higher risk.

Additionally, where you live, including factors like crime rates and average traffic in your area, can also impact your insurance rates. The specific model and year of your MX-5 Miata can affect the cost of insurance since certain features and safety ratings may vary by model year.

Mazda MX-5 Miata Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $80 $145

American Family $77 $138

Farmers $85 $150

Liberty Mutual $90 $160

Nationwide $78 $140

Progressive $70 $135

State Farm $65 $120

The Hartford $88 $155

Travelers $82 $145

USAA $75 $140

Another factor that can influence the cost of Mazda MX-5 Miata car insurance is your credit score. Insurance companies often consider credit history as an indicator of financial responsibility. A lower credit score may result in higher insurance premiums, as it suggests a higher risk of filing claims.

Furthermore, the amount of coverage you choose for your MX-5 Miata can also affect the cost of insurance. Opting for higher coverage limits or additional coverage options, such as comprehensive or collision coverage, will generally result in higher premiums.

On the other hand, choosing a higher deductible can help lower your insurance costs, as you would be responsible for paying a larger portion of any potential claims.

Understanding the Insurance Rates for Mazda Mx-5 Miata

When it comes to insuring your Mazda MX-5 Miata, it’s important to understand how insurance rates are determined. Insurance companies evaluate the risk associated with insuring a specific vehicle type and model. Sports cars like the MX-5 Miata are generally considered higher risk due to their higher performance capabilities and the potential for increased speed.

As a result, insurance rates for sports cars tend to be higher compared to other vehicle types. However, it’s important to note that insurance rates can vary significantly between insurance providers, so it’s essential to shop around and compare quotes to find the best deal for your MX-5 Miata.

Tim Bain Licensed Insurance Agent

Another factor that can affect insurance rates for the Mazda MX-5 Miata is the age and driving history of the insured individual. Younger drivers or those with a history of accidents or traffic violations may face higher insurance premiums. This is because insurance companies consider these individuals to be higher risk due to their lack of experience or past behavior on the road.

On the other hand, older drivers with a clean driving record may be eligible for lower insurance rates. It’s important to provide accurate information about your age and driving history when obtaining insurance quotes to ensure that you receive an accurate rate for your MX-5 Miata. Explore our detailed analysis on “How much is car insurance?” for additional information.

Comparing Mazda MX-5 Miata Insurance Rates

When considering the cost of Mazda MX-5 Miata car insurance, it’s helpful to compare the rates with other sports cars. Insurance rates for sports cars can vary widely depending on factors such as the make and model, safety features, and the driver’s personal history.

While the MX-5 Miata is known for its affordability compared to other sports cars, insurance rates will still reflect its classification as a sports car. However, compared to some high-end sports cars, the MX-5 Miata may have lower insurance rates due to its lower price tag and potentially less expensive replacement parts.

It’s important to note that insurance rates can also be influenced by the driver’s age and driving record. Younger drivers or those with a history of accidents or traffic violations may face higher insurance premiums for sports cars like the MX-5 Miata. Get more insights by reading our expert “How much insurance coverage do I need?” advice.

Additionally, the location where the car is primarily driven and stored can also impact insurance rates. Areas with higher rates of theft or vandalism may result in higher premiums. Therefore, it’s advisable for potential MX-5 Miata owners to consider these factors when comparing insurance rates with other sports cars.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips to Save Money on Mazda Mx-5 Miata Car Insurance

While car insurance is a necessary expense, there are several strategies you can employ to save money on Mazda MX-5 Miata car insurance. One of the most effective ways to reduce your premiums is by maintaining a clean driving record.

By practicing safe driving habits and avoiding accidents and traffic violations, you can demonstrate to insurance companies that you are a low-risk driver, which can lead to lower insurance rates. Additionally, taking advantage of various discounts offered by insurance providers, such as multi-policy discounts or safety feature discounts, can help you save money on your MX-5 Miata insurance.

Exploring Insurance Providers for Mazda MX-5 Miata

When searching for car insurance for your Mazda MX-5 Miata, it’s essential to explore different insurance providers to find the best coverage and rates. Each insurance company has its own unique pricing structure and may offer different levels of coverage options. It’s a good idea to request quotes from multiple insurers and compare the coverage and premiums they offer.

Don’t be afraid to ask questions about specific coverage details and any additional benefits or discounts that may be available for MX-5 Miata owners. By doing thorough research and comparison, you can find an insurance provider that suits your needs and offers competitive rates. Continue reading our full “How To Get Free Insurance Quotes Online” guide for extra tips.

Importance of Comprehensive Coverage for Mazda MX-5 Miata

When considering insurance for your Mazda MX-5 Miata, it’s crucial to understand the importance of comprehensive coverage. Comprehensive coverage protects your vehicle from non-collision-related damages, such as theft, vandalism, and natural disasters. For more information, explore our informative “Collision vs. Comprehensive Car Insurance” page.

While comprehensive coverage may increase your insurance premiums, it provides peace of mind knowing that your MX-5 Miata is protected from a wide range of potential risks. Depending on your individual circumstances and preferences, it’s important to weigh the cost of comprehensive coverage against the potential expenses associated with repairing or replacing your vehicle.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Impact of Driving Record on Mazda MX-5 Miata Insurance

Your driving record plays a significant role in determining the cost of Mazda MX-5 Miata car insurance. Insurance companies assess the level of risk associated with insuring a driver based on their past driving history. If you have a clean driving record with no accidents or traffic violations, you are generally considered a low-risk driver, and as a result, you may qualify for lower insurance premiums.

On the other hand, if you have a history of accidents or traffic violations, insurance companies may perceive you as a higher risk driver, leading to higher insurance rates for your MX-5 Miata. It’s essential to practice safe driving habits and maintain a clean driving record to potentially lower your insurance costs. Expand your understanding with our thorough “Full Coverage Car Insurance: A Complete Guide” overview.

Common Misconceptions About Insuring a Mazda Mx-5 Miata

There are several common misconceptions about insuring a Mazda MX-5 Miata that are worth addressing. One misconception is that all sports cars have exorbitantly high insurance rates. While it’s true that sports cars generally have higher insurance rates due to their performance capabilities, the specific make and model, as well as your personal circumstances, can significantly impact the cost of insurance for your MX-5 Miata.

Another misconception is that older MX-5 Miatas have lower insurance rates compared to newer models. While older vehicles may have lower market values, insurance rates can be influenced by factors such as safety features and the availability of replacement parts, which can vary between model years. Read our extensive guide on “Commonly Misunderstood Insurance Concepts” for more knowledge.

Age and Location Impact on Mazda MX-5 Miata Insurance Rates

Your age and location are two significant factors that can impact the cost of Mazda MX-5 Miata car insurance. Younger drivers generally face higher insurance rates due to their lack of driving experience and statistically higher likelihood of being involved in accidents. However, as you gain more driving experience and reach certain age thresholds, such as 25, you may see a decrease in your insurance premiums.

Additionally, where you live can impact your insurance rates. If you reside in an area with high crime rates or heavy traffic congestion, your insurance premiums may be higher compared to a more rural or less densely populated area. Dive deeper into “What age do you get cheap car insurance?” with our complete resource.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

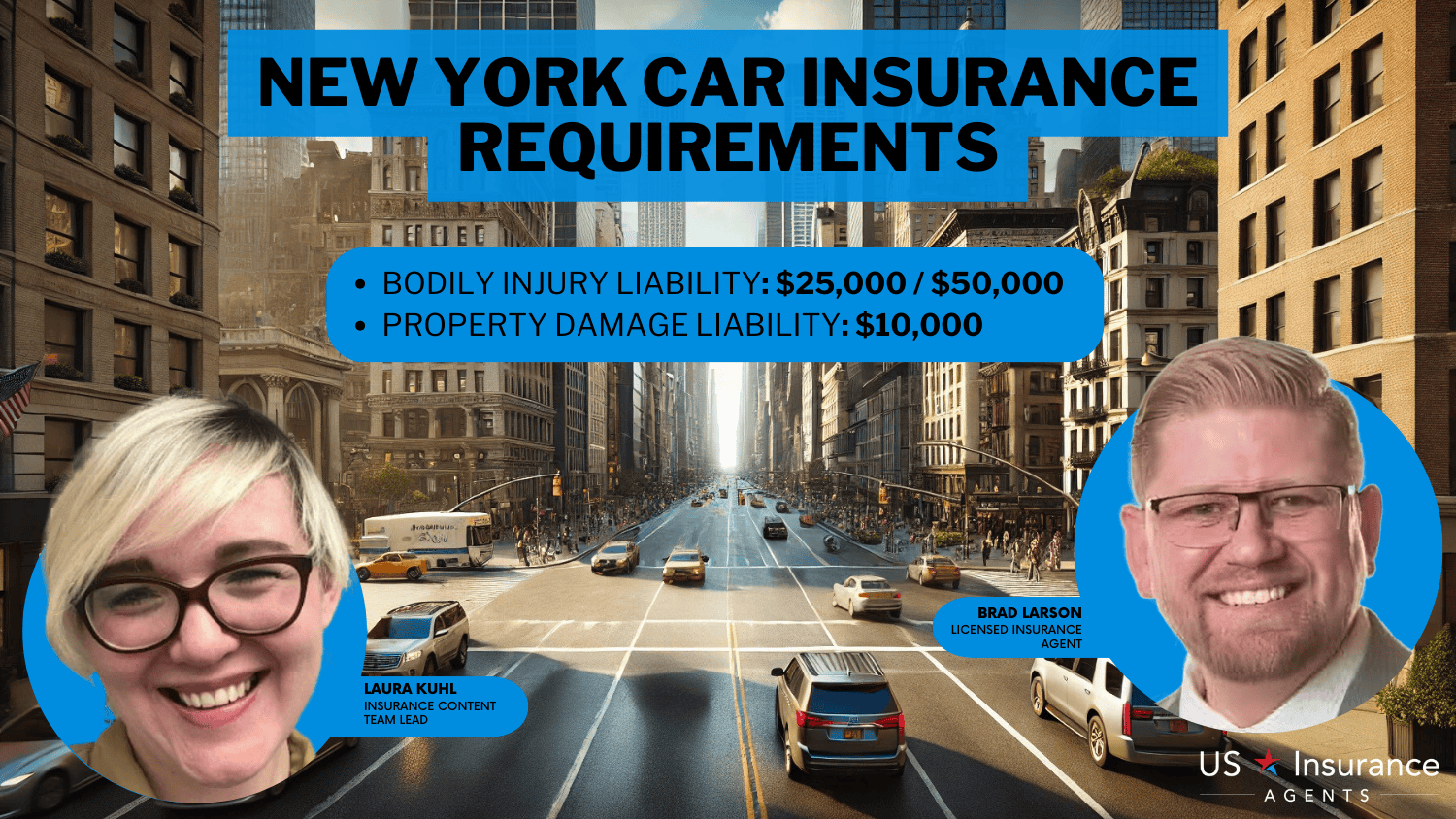

Types of Coverage for Your Mazda MX-5 Miata

When obtaining insurance for your Mazda MX-5 Miata, it’s crucial to understand the different types of car insurance coverage available. Liability insurance is typically required by law and covers damages and injuries to third parties in an accident where you are at fault. Collision insurance covers damages to your MX-5 Miata resulting from a collision with another vehicle or object.

Comprehensive insurance, as mentioned earlier, protects against non-collision damages. Additionally, you can consider additional coverage options such as uninsured/underinsured motorist coverage, personal injury protection, and medical payments coverage to ensure you have comprehensive protection for your MX-5 Miata.

Benefits of Bundling Mazda MX-5 Miata Insurance

Many insurance providers offer incentives for bundling multiple policies together, such as combining your MX-5 Miata insurance with your homeowners or renters insurance. Bundling policies can often lead to discounts on both policies, ultimately saving you money on your overall insurance costs.

Furthermore, bundling your insurance policies can simplify the process of managing your insurance coverage, as you can have all your policies with a single insurer. It’s worth exploring bundling options with insurance providers to see if you qualify for any multi-policy discounts and maximize your savings.

Tips for Finding Affordable Mazda MX-5 Miata Insurance Quotes

If you’re looking for affordable Mazda MX-5 Miata car insurance quotes, utilizing online resources can help streamline the process. Many insurance comparison websites allow you to input your information and receive quotes from multiple insurance providers quickly. It’s crucial to provide accurate and up-to-date information to ensure the quotes you receive are accurate.

Additionally, it’s essential to review the coverage details and compare not only the premiums but also the level of coverage provided. By leveraging online tools, you can efficiently gather and compare insurance quotes to find the most affordable option for insuring your MX-5 Miata. Learn more by visiting our detailed “Insurance Quotes Online” section.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mazda MX-5 Miata Insurance Discounts and Incentives

When it comes to insuring your Mazda MX-5 Miata, various discounts and incentives may be available to help reduce your insurance costs. Insurance providers commonly offer discounts for factors such as safe driving records, completing a defensive driving course, or having certain safety features installed in your vehicle.

It’s also worth inquiring about any loyalty discounts or special promotions that insurance companies may have available. By exploring the various discounts and incentives offered by insurance providers, you can potentially lower your insurance premiums for your MX-5 Miata. For further details, check out our in-depth “Lesser Known Car Insurance Discounts for” article.

Insurance Costs for New vs. Used Mazda MX-5 Miata

When considering insurance for your Mazda MX-5 Miata, it’s important to note that the cost of insuring a new MX-5 Miata may differ from that of a used model. Typically, new vehicles have higher insurance rates due to their higher value and the cost of potential repairs or replacements. As a vehicle ages and depreciates in value, insurance rates may decrease accordingly.

However, other factors such as safety features, model year, and the driver’s history will still impact insurance rates. It’s advisable to request insurance quotes for both new and used MX-5 Miatas to compare the differences in insurance premiums and make an informed decision based on your individual circumstances and budget.

Heidi Mertlich Licensed Insurance Agent

In conclusion, the cost of Mazda MX-5 Miata car insurance can vary based on several factors, including your age, location, driving record, and the type of coverage you choose. It’s important to shop around, compare quotes from different insurance providers, and take advantage of available discounts to find the most affordable coverage for your MX-5 Miata. See if you’re getting the best deal on car insurance by entering your ZIP code below.

By understanding the various factors that influence insurance rates and considering the different types of coverage options available, you can make an informed decision and ensure your MX-5 Miata is adequately protected without breaking the bank. Discover our comprehensive guide to “Car Insurance Startups Change How You Buy Car Insurance” for additional insights.

Frequently Asked Questions

What is the Mazda MX-5 Miata insurance cost?

The Mazda MX-5 Miata insurance cost varies depending on factors like location, driver age, and coverage. On average, you can expect to pay around $65 per month for basic coverage, with some companies offering cheaper rates.

How much is insurance on a Mazda Miata MX-5?

Insurance on a Mazda MX-5 Miata typically starts around $65 per month for basic coverage. Costs can vary based on your location, driving history, and coverage choices.

What is the cheapest insurance for a Mazda Miata?

State Farm offers some of the cheapest insurance rates for the Mazda Miata MX-5, with rates starting at approximately $65 per month. Other affordable options include Progressive and USAA.

Explore our detailed analysis on “Cheapest Car Insurance Companies” for additional information.

How do Mazda CX-5 insurance costs compare to the Miata?

Mazda CX-5 insurance costs are generally higher than those for the Mazda MX-5 Miata due to the CX-5 being an SUV, which is considered a higher risk for insurers compared to a sports car.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

How can I find Mazda MX-5 Miata insurance rates by company?

To find Mazda MX-5 Miata insurance rates by company, compare quotes from various insurers such as State Farm, Progressive, and USAA. Using online comparison tools can simplify this process.

What is the average monthly cost for Mazda MX-5 Miata insurance?

The average monthly cost for Mazda MX-5 Miata insurance is approximately $65/mo. This estimate can vary based on factors like your driving record and the insurance company you choose.

Continue reading our full “Liability Insurance: A Complete Guide” guide for extra tips.

How do Mazda MX-5 Miata insurance rates by state vary?

Mazda MX-5 Miata insurance rates vary by state due to differences in state regulations, risk factors, and average claim costs. For instance, rates may be higher in urban areas compared to rural locations.

What are the 2020 Mazda MX-5 Miata insurance rates?

For the 2020 Mazda MX-5 Miata, insurance rates generally start around $65 per month. Rates can differ based on factors like your driving history and location.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

How can I save money on Mazda MX-5 Miata insurance?

To save money on Mazda MX-5 Miata insurance, consider comparing quotes from different insurers, taking advantage of discounts, and adjusting your coverage limits to suit your needs.

Expand your understanding with our thorough “What are some ways to lower my car insurance premiums?” overview.

What are the 2019 Mazda MX-5 Miata insurance rates?

Insurance rates for the 2019 Mazda MX-5 Miata typically begin at about $65 per month. Variations can occur based on your personal risk profile and insurance provider.

How much are 2016 Mazda MX-5 Miata insurance rates?

How does the cost of insurance for Mazda MX-5 Miata change based on driver age?

What is the insurance cost for a 2015 Mazda MX-5 Miata?

Which are the cheapest insurance companies for Mazda MX-5 Miata?

What is the Mazda MX-5 Miata car insurance cost?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.