Cheap GMC Savana 3500 Passenger Car Insurance in 2026 (Top 10 Low-Cost Companies!)

Cheap GMC Savana 3500 Passenger car insurance starts at $42 per month with Liberty Mutual, Progressive, and State Farm. These companies offer the cheapest rates due to competitive pricing, comprehensive policies, and excellent service. Compare quotes to secure the best and most affordable coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Heidi Mertlich

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Updated October 2024

Company Facts

Min. Coverage for GMC Savana 3500 Passenger

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for GMC Savana 3500 Passenger

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for GMC Savana 3500 Passenger

A.M. Best

Complaint Level

Pros & Cons

If you’re seeking affordable GMC Savana 3500 Passenger car insurance, look no further than Liberty Mutual, Progressive, and State Farm, recognized for offering competitive rates as low as $42 per month. These top insurers stand out not only for their cost-effective premiums but also for their comprehensive coverage options and stellar customer service.

Whether you’re comparing quotes or exploring coverage specifics, understanding the factors influencing insurance costs—such as vehicle model, driving record, and location—is crucial.

Explore further in our article titled “Best Car Insurance.”

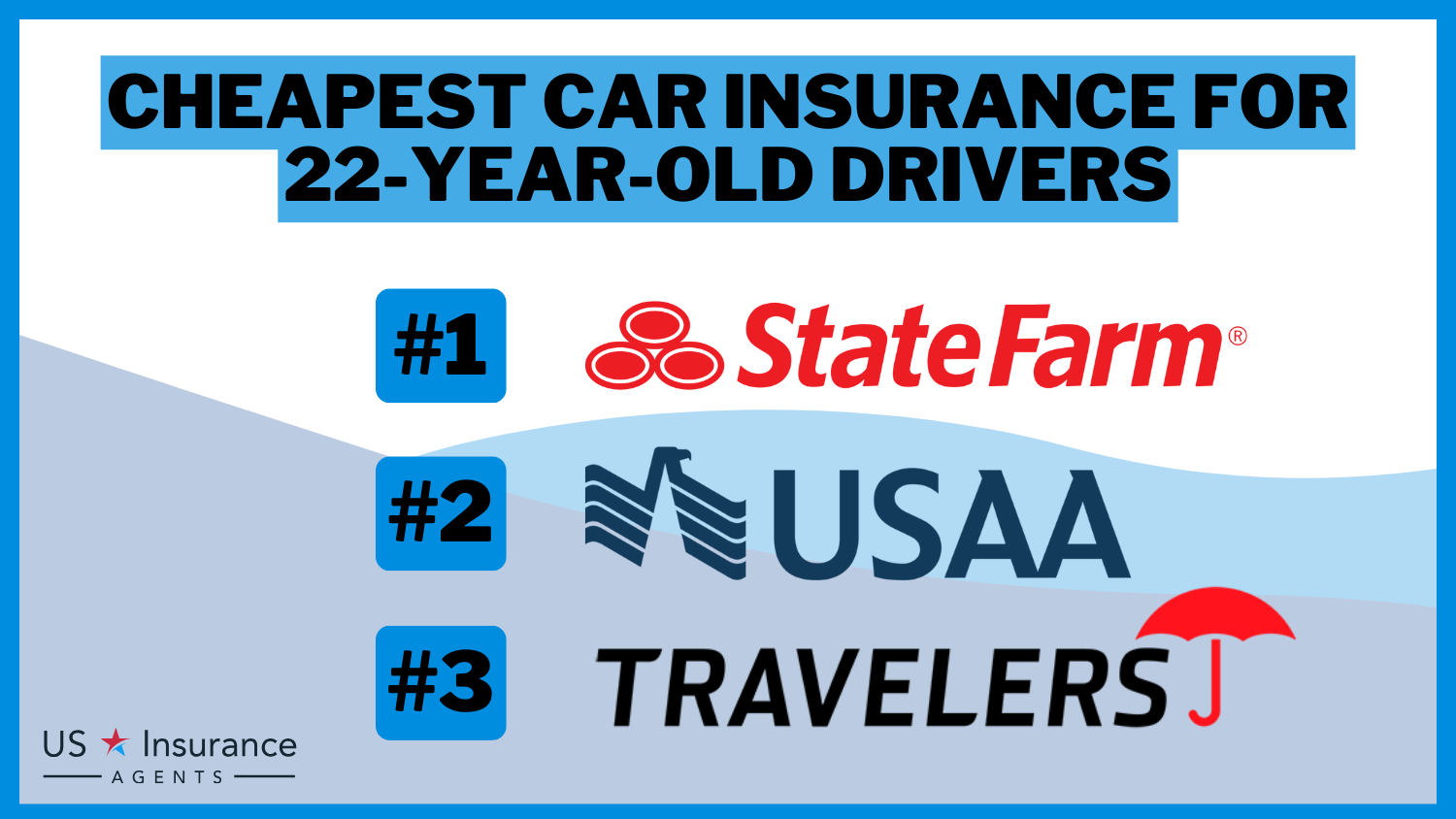

Our Top 10 Company Picks: Cheap GMC Savana 3500 Passenger

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $42 A Roadside Assistance Liberty Mutual

#2 $45 A+ Customized Policies Progressive

#3 $48 B Comprehensive Coverage State Farm

#4 $50 A Multiple Policy Farmers

#5 $52 A+ Safe Drivers Nationwide

#6 $55 A Customer Satisfaction American Family

#7 $57 A++ Online Purchases Geico

#8 $60 A++ Flexible Coverage Travelers

#9 $62 A+ Affordable Premiums Erie

#10 $65 A+ New Vehicle Allstate

By delving into these details and leveraging available discounts, like bundling policies or maintaining a clean driving history, you can secure the best possible insurance for your GMC Savana 3500 Passenger without compromising on quality or protection.

Find cheap car insurance quotes by entering your ZIP code .

- Cheap GMC Savana 3500 Passenger car insurance from $42 with Liberty Mutual

- Factors: vehicle model, driving record, location influence rates

- Top insurers offer competitive prices, comprehensive coverage

#1 – Liberty Mutual: Top Overall Pick

Pros

- Affordable Rates: Liberty Mutual offers competitive monthly rates at $42, making it one of the cheapest options available.

- A.M. Best Rating: With an A rating, Liberty Mutual demonstrates strong financial stability. Check out our Liberty Mutual review & ratings for more details.

- Roadside Assistance: Specializes in providing excellent roadside assistance, beneficial for drivers needing support on the go.

Cons

- Customer Service: Some customers report varying experiences with customer service responsiveness.

- Limited Discounts: Fewer discount options compared to other insurers might limit potential savings.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Customized Policies

Pros

- Customizable Policies: Progressive excels in offering highly customizable policies, catering to individual needs.

- A.M. Best Rating: Boasts a superior A+ rating, indicating excellent financial health. Explore our Progressive insurance review & ratings for more insights.

- Usage-Based Programs: Offers innovative usage-based insurance programs like Snapshot, which can lower premiums based on driving habits.

Cons

- Slightly Higher Rates: At $45 per month, Progressive is marginally more expensive than some competitors.

- Complex Policies: The high level of customization might be confusing for some customers.

#3 – State Farm: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Known for providing comprehensive coverage options that cover a wide range of scenarios.

- Extensive Agent Network: Offers a large network of agents, providing personalized service.

- Reliable Claims Process: Customers often praise State Farm for its efficient and reliable claims handling.

Cons

- Lower A.M. Best Rating: With a B rating, it has a lower financial stability rating compared to other top insurers.

- Higher Premiums: Monthly rates at $48 are higher than the top two picks. Please review our State Farm insurance review & ratings for additional information.

#4 – Farmers: Best for Multiple Policies

Pros

- Multiple Policy Discounts: Offers significant discounts for customers who bundle multiple policies.

- Strong Financial Rating: Rated A by A.M. Best, indicating strong financial stability.

- Personalized Service: Farmers is known for its personalized customer service and local agents.

Cons

- Moderate Rates: At $50 per month, Farmers’ rates are not the cheapest available. Explore our Farmers car insurance review & ratings for additional insights.

- Limited Online Tools: May lack the advanced online tools and mobile app functionalities found with some competitors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Safe Drivers

Pros

- Safe Driver Discounts: Nationwide offers substantial discounts for safe drivers. Please read our Nationwide insurance review & ratings for more information.

- Superior Financial Strength: An A+ rating from A.M. Best indicates strong financial stability.

- Vanishing Deductible: Features innovative programs like the Vanishing Deductible, which rewards safe driving.

Cons

- Higher Monthly Rates: With a monthly rate of $52, it is more expensive than the top four picks.

- Mixed Customer Reviews: Some customers report mixed experiences regarding customer service.

#6 – American Family: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Known for high levels of customer satisfaction and positive reviews.

- Financial Stability: Holds a solid A rating from A.M. Best. Check out our American Family insurance review & ratings for additional details.

- Diverse Policy Options: Offers a variety of policy options to suit different customer needs.

Cons

- Higher Premiums: Monthly rates are relatively high at $55.

- Limited Availability: Not available in all states, restricting some potential customers from access.

#7 – Geico: Best for Online Purchases

Pros

- Top Financial Rating: Geico boasts an A++ rating from A.M. Best, reflecting exceptional financial strength.

- Affordable Rates: Known for competitive pricing and affordable premiums. For further information, read our Geico car insurance discounts.

- Convenient Online Services: Excels in online purchases and offers a highly user-friendly mobile app.

Cons

- Minimal Personal Interaction: Limited interaction with agents might not appeal to customers who prefer personalized service.

- Mixed Claims Experience: Some customers report varying experiences with the claims process.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Flexible Coverage

Pros

- Flexible Coverage Options: Travelers is praised for its flexible coverage options that can be tailored to individual needs.

- Top Financial Strength: Holds an A++ rating, indicating excellent financial health.

- Strong Customer Support: Offers robust customer support and easy claims process.

Cons

- Higher Rates: At $60 per month, Travelers’ premiums are higher than many competitors. For more information, please refer to our Travelers insurance review & ratings.

- Discount Availability: Fewer discount options might limit savings potential for some customers.

#9 – Erie: Best for Affordable Premiums

Pros

- Affordable Premiums: Known for offering some of the most affordable premiums in the market.

- Strong Financial Rating: Holds an A+ rating from A.M. Best, indicating strong financial health. To find out more, please refer to our Erie insurance review & ratings.

- Excellent Customer Service: High customer satisfaction with personalized service and agent support.

Cons

- Availability: Coverage is limited to certain regions, which might exclude some potential customers.

- Digital Tools: Lacks advanced online tools and mobile app functionalities compared to larger insurers.

#10 – Allstate: Best for New Vehicle

Pros

- High Financial Rating: An A+ rating from A.M. Best reflects strong financial stability. To gather additional information, please read our Allstate insurance review & ratings.

- New Vehicle Discounts: Offers specific discounts for new vehicles, making it a good choice for new car owners.

- Comprehensive Coverage: Known for a wide range of comprehensive coverage options.

Cons

- Higher Premiums: At $65 per month, Allstate’s rates are among the highest in this list.

- Customer Service: Some customers report inconsistent experiences with customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

GMC Savana 3500 Passenger Car Insurance: Rates and Coverage Comparison

Explore monthly insurance rates for the GMC Savana 3500 Passenger across different coverage levels and providers. From basic to full coverage options, find the right balance of protection and cost-effective premiums for your vehicle.

GMC Savana 3500 Passenger Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Monthly Rates Full Coverage

Allstate $65 $140

American Family $55 $130

Erie $62 $145

Farmers $50 $135

Geico $57 $125

Liberty Mutual $42 $120

Nationwide $52 $130

Progressive $45 $125

State Farm $48 $135

Travelers $60 $140

Factors That Affect the Cost Of GMC Savana 3500 Passenger Car Insurance

The cost of car insurance for your GMC Savana 3500 Passenger can vary depending on several factors. These factors include:

- Vehicle Model and Age: The make and model of your vehicle can influence the cost of insurance. Newer models and vehicles with higher market values may have higher premiums.

- Driving Record: Your driving history plays a significant role in determining your insurance rates. If you have a clean driving record with no accidents or traffic violations, you are more likely to qualify for lower premiums.

- Location: Where you live can impact your car insurance rates. If you reside in an area with high rates of accidents or theft, your premiums may be higher.

- Insurance Coverage: The type and amount of coverage you choose will affect the cost of insurance. Comprehensive coverage, collision coverage, and liability coverage all have different premiums associated with them.

- Deductible: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your insurance premium, but it also means you will have to pay more in the event of a claim.

- Credit Score: In some states, insurance companies may take your credit score into account when determining your premium. A higher credit score may entitle you to lower rates.

Understanding the Insurance Requirements for GMC Savana 3500 Passenger

Before purchasing car insurance for your GMC Savana 3500 Passenger, it’s crucial to understand the insurance requirements in your state. Each state has its own minimum liability coverage limits that drivers must carry.

Liberty Mutual stands out as the top choice for affordable GMC Savana 3500 Passenger car insurance with competitive rates and comprehensive coverage options.

Liability insurance protects you financially if you are at fault in an accident and cause bodily injury or property damage to others. It’s important to make sure you meet the minimum requirements to avoid any legal consequences while driving your vehicle. Enhance your knowledge by reading our “Liability Insurance: A Complete Guide.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Insurance Rates for GMC Savana 3500 Passenger Across Different Providers

When shopping for car insurance, it’s wise to obtain quotes from multiple insurance providers. By comparing rates, you can ensure you are getting the best possible price for the coverage you need. Take the time to request quotes from different companies, and consider factors such as coverage options, deductible amounts, and customer reviews when making your decision.

Uncover more by delving into our article entitled “Compare Car Insurance Quotes.”

Tips for Finding Affordable Car Insurance for the GMC Savana 3500 Passenger

Finding affordable car insurance for your GMC Savana 3500 Passenger doesn’t have to be a daunting task. Here are some tips to help you secure a policy that fits your budget:

- Consider Your Coverage Needs: Assess your specific insurance needs and choose coverage options accordingly. Evaluating your driving habits, the value of your vehicle, and your financial situation can help you determine the most suitable coverage options.

- Bundle Your Policies: Some insurance companies offer discounts if you bundle your car insurance with other policies, such as homeowners or renters insurance. Bundling can lead to significant savings.

- Seek Available Discounts: Insurance companies often offer various discounts that can help lower your premiums. These discounts may include safe driver discounts, discounts for completing defensive driving courses, or discounts for installing anti-theft devices in your vehicle.

- Improve Your Credit Score: As mentioned earlier, having a good credit score can help lower your insurance rates. Work on improving your credit score by paying bills on time and reducing debt.

- Shop Around: As previously mentioned, don’t settle for the first insurance quote you receive. Take the time to shop around and compare rates from different insurers to ensure you’re getting the best deal available.

Exploring Different Coverage Options for GMC Savana 3500 Passenger Car Insurance

When it comes to car insurance for your GMC Savana 3500 Passenger, there are several coverage options to consider. Understanding each option can help you make an informed decision:

- Liability Coverage: Liability coverage is the most basic type of car insurance that every driver is required to have. It provides financial protection if you cause an accident and injure someone or damage their property.

- Collision Coverage: Collision coverage helps pay for the repairs or replacement of your vehicle if you collide with another vehicle or an object, regardless of who is at fault. For additional insights, refer to our “Collision Car Insurance.”

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damage or loss caused by events other than collisions. This can include theft, vandalism, natural disasters, or falling objects.

- Uninsured/Underinsured Motorist Coverage: This coverage is designed to protect you if you are involved in an accident with a driver who doesn’t have insurance or has insufficient coverage to fully compensate you for damages.

Selecting the appropriate coverage options for your GMC Savana 3500 Passenger ensures you’re adequately protected in various scenarios on the road.

Whether you opt for liability, collision, comprehensive, or uninsured/underinsured motorist coverage, each choice contributes to your overall peace of mind and financial security. Evaluate your needs carefully to build a policy that meets your specific requirements and budget constraints effectively.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Comprehensive Coverage for Your GMC Savana 3500 Passenger

Comprehensive coverage is an essential aspect of car insurance for your GMC Savana 3500 Passenger. While liability coverage is required by law, comprehensive coverage provides additional protection for your vehicle.

Brandon Frady Licensed Insurance Agent

With comprehensive coverage, you can have peace of mind knowing that you are financially safeguarded against a wide range of potential risks, including theft, vandalism, and natural disasters.

Gain deeper understanding through our article entitled “Best Car Insurance for Comprehensive Coverage.”

How to Save Money on GMC Savana 3500 Passenger Car Insurance Premiums

Car insurance premiums can be a significant expense, but there are ways to save money on your GMC Savana 3500 Passenger car insurance. Consider the following tips:

- Opt for a Higher Deductible: Choosing a higher deductible can lower your insurance premium. However, be sure to consider your financial situation and ability to pay the deductible if you need to file a claim.

- Take Advantage of Discounts: Many insurance companies offer a variety of discounts, such as safe driver discounts, multi-policy discounts, or discounts for installing safety features in your vehicle. Inquire about these discounts and see if you qualify.

- Maintain a Good Driving Record: Avoid accidents and traffic violations to maintain a clean driving record. This can help you qualify for lower insurance rates.

- Bundle Your Policies: As mentioned before, bundling your car insurance with other policies can lead to savings. Consider bundling your car insurance with your home, renters, or other insurance policies to receive discounts.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Mistakes to Avoid When Insuring a GMC Savana 3500 Passenger

When insuring your GMC Savana 3500 Passenger, there are common mistakes that you should avoid to ensure you have the right coverage at the best price:

- Not Comparing Quotes: Failing to compare insurance quotes from different providers can result in overpaying for your coverage. Take the time to shop around and obtain multiple quotes to determine the best rate. Explore further with our article entitled “Insurance Quotes Online.”

- Ignoring Coverage Options: It’s important to understand the coverage options available and select the ones that best suit your needs. Don’t overlook comprehensive coverage or other options that could provide additional protection.

- Underinsuring Your Vehicle: While it may be tempting to opt for minimum coverage to save on premiums, it can leave you financially vulnerable if you are involved in a significant accident. Make sure you have adequate coverage to protect your GMC Savana 3500 Passenger and your assets.

Understanding the Claims Process for GMC Savana 3500 Passenger Car Insurance

In the event of an accident or other covered incident, it’s important to understand the claims process for your GMC Savana 3500 Passenger car insurance. Here are the general steps involved:

- Report the Incident: Notify your insurance company as soon as possible following an accident or incident. Provide them with all relevant information, such as the location, date, and details of the incident.

- Documentation: Your insurance company may require documentation, such as police reports, photos of the damages, and any other relevant evidence to process your claim.

- Evaluation: Your insurance company will evaluate the damages and determine the coverage provided under your policy. They may request additional information if needed.

- Repair or Reimbursement: Depending on the circumstances, your insurance company will either arrange for repairs to your vehicle or provide you with the necessary reimbursement for the damages.

Expert Advice on Choosing the Right Deductible for Your GMC Savana 3500 Passenger Policy

Choosing the right deductible for your GMC Savana 3500 Passenger car insurance policy is a decision that requires careful consideration. Here are some expert tips to help you make an informed choice:

- Evaluate Your Financial Situation: Consider your financial capabilities and determine how much you can comfortably afford to pay if you need to file a claim. Choosing a higher deductible can help lower your premiums, but you should have the means to cover the deductible amount.

- Weigh the Risks: Assess the likelihood of filing a claim and the potential savings associated with a higher deductible. If you have a history of safe driving and few insurance claims, a higher deductible may be a viable option.

- Consider the Value of Your Vehicle: The value of your GMC Savana 3500 Passenger should also play a role in determining the appropriate deductible. If your vehicle is older or has a lower market value, a higher deductible may be more practical. For further details, consult our article named “Best New Vehicle Car Insurance Discounts.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Key Considerations When Purchasing Liability Coverage for Your GMC Savana 3500 Passenger

Liability coverage is a crucial component of car insurance for your GMC Savana 3500 Passenger. Here are some key considerations to keep in mind when purchasing liability coverage:

- Minimum Requirements: Familiarize yourself with the minimum liability coverage requirements in your state. Ensure that your policy meets or exceeds these requirements to avoid legal and financial consequences.

- Personal Injury and Property Damage Coverage: Liability coverage typically consists of two components: personal injury coverage and property damage coverage. Make sure you have adequate limits for both to protect against potential costs in the event of an accident.

- Consider Higher Limits: While meeting the minimum requirements is essential, it may be prudent to consider higher liability coverage limits. Doing so can provide added protection and peace of mind, especially in situations where damages exceed minimum coverage limits.

The Benefits of Bundling Your GMC Savana 3500 Passenger Car Insurance With Other Policies

One way to potentially save money on your GMC Savana 3500 Passenger car insurance is by bundling it with other policies. Here are some benefits of bundling:

- Discounts: Insurance companies often offer discounts for customers who bundle multiple policies. By combining your car insurance with other coverage, such as homeowners or renters insurance, you can unlock potential savings. Uncover additional insights in our article called “Best Car Insurance Discounts to Ask.”

- Convenience: Bundling your policies with one insurance provider simplifies your insurance management. You’ll have a single point of contact for multiple policies, making it easier to keep track of your coverage and payments.

- Potential for Enhanced Coverage: Insurance companies may offer additional benefits or enhanced coverage options for customers who bundle their policies. These additional perks can provide increased protection for your GMC Savana 3500 Passenger and other assets.

Specialized Insurance Options for Commercial Use Of The GMC Savana 3500 Passenger

If you are using your GMC Savana 3500 Passenger for commercial purposes, such as transporting passengers or goods for business, you may require specialized insurance coverage. Commercial auto insurance provides protection for vehicles used in business operations.

It typically includes higher liability limits and may offer additional coverage options tailored to meet the unique needs of commercial vehicle owners. Consult with an insurance professional to determine the most appropriate coverage for your commercial use of the GMC Savana 3500 Passenger.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Your Driving Record Impacts the Cost of Insuring a GMC Savana 3500 Passenger

Your driving record plays a significant role in determining the cost of insuring your GMC Savana 3500 Passenger. Insurance companies consider factors such as accidents, traffic violations, and claims history when calculating premiums.

Drivers with clean records and no history of accidents or violations are generally rewarded with lower insurance rates. On the other hand, drivers with a poor driving record may face higher premiums due to the increased risk they pose to insurers. Explore further details in our “Best Safe Driver Car Insurance Discounts.”

Tips for Maintaining a Good Driving Record and Reducing Insurance Costs

Maintaining a good driving record is not only essential for your safety but can also help reduce your insurance costs. Here are some tips to keep your driving record clean:

- Follow Traffic Laws: Observe speed limits, obey traffic signals, and avoid reckless driving behaviors to minimize the risk of accidents and traffic violations.

- Practice Defensive Driving: Be aware of your surroundings, anticipate potential hazards, and maintain a safe following distance to prevent accidents. Uncover more about our “Best Defensive Driver Car Insurance Discounts” by reading further.

- Avoid Distractions: Distracted driving, such as texting or using a cell phone while driving, increases the risk of accidents. Keep your focus on the road at all times.

Frequently Asked Questions

What factors affect the cost of insurance for a GMC Savana 3500 Passenger car?

The cost of insurance for a GMC Savana 3500 Passenger car can be influenced by several factors, including the driver’s age, driving history, location, coverage options chosen, deductible amount, and the insurance company’s rates.

Discover a wealth of knowledge in our “Cheap GMC Yukon Car Insurance.”

Is the cost of insurance higher for a GMC Savana 3500 Passenger compared to other vehicles?

The cost of insurance for a GMC Savana 3500 Passenger car may be higher compared to other vehicles due to its size, weight, and potential for higher repair costs. However, insurance rates can vary depending on individual circumstances and the insurance provider.

Are there any specific safety features that can lower the insurance cost for a GMC Savana 3500 Passenger?

Yes, certain safety features on a GMC Savana 3500 Passenger car, such as anti-lock brakes, airbags, stability control, and advanced driver assistance systems, may help lower the insurance cost. These features can reduce the risk of accidents and injuries, which can be reflected in lower insurance premiums.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code into our free comparison tool to find the lowest prices in your area.

Does the cost of insurance for a GMC Savana 3500 Passenger vary by location?

Yes, the cost of insurance for a GMC Savana 3500 Passenger can vary by location. Insurance companies consider factors like the frequency of accidents, theft rates, and local repair costs when determining premiums. Therefore, insurance costs may be higher in areas with higher levels of traffic congestion, crime rates, or expensive repair services.

How big is the fuel tank on a GMC Savana 3500?

The fuel tank capacity of a GMC Savana 3500 varies depending on the model year and configuration, but generally, it ranges between 31 to 33 gallons.

Expand your understanding with our “Cheap GMC Acadia Car Insurance.”

How big is the gas tank on a 3500 van?

For most 3500 vans, including the GMC Savana 3500, the gas tank capacity typically ranges from 31 to 33 gallons.

What is the difference between LS and LT Savana?

In the GMC Savana lineup, LS and LT are trim levels. The LT trim generally offers more features and amenities compared to the LS trim, which is more basic.

Ready to find affordable car insurance? Get started today by entering your ZIP code into our free comparison tool.

Are Chevy Express and GMC Savana the same?

Yes, the Chevy Express and GMC Savana are essentially the same vehicles under different brand names. They share the same platform and are manufactured by General Motors.

How many miles per gallon does a 3500 diesel get?

The fuel economy of a GMC Savana 3500 diesel varies, but generally, it achieves around 12 to 14 miles per gallon (mpg) in city driving and 16 to 18 mpg on the highway.

Learn more about our “Cheap GMC Hummer EV Pickup Car Insurance” for a broader perspective.

How many quarts of oil does a GMC Savana 3500 take?

A GMC Savana 3500 typically requires around 6 to 7 quarts of oil for an oil change, depending on the engine size and model year.

How big is the fuel tank on a GMC 3500?

Is GMC Savana gas or diesel?

How many Liters is a GMC Savana fuel tank?

What is the fuel economy of a 2005 GMC Savana 3500?

How many miles per gallon does a 2009 GMC Savana 3500 get?

What is the difference between Sprinter 2500 and 3500?

What is the fuel economy of a Sprinter Van in KM?

What is the gas mileage of a diesel van?

How much oil does a GMC Savana 3500 box truck take?

How many miles per gallon does a 2010 GMC Savana 3500 get?

Which is better Ram 2500 or 3500?

What is high mileage for a diesel?

What is the gas mileage on a Sprinter Van 3500?

What is the price of GMC Savana in UAE?

What is the difference between 2500 and 3500 Savana?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.