Cheap Freightliner Sprinter 4500 Crew Car Insurance in 2026 (Cash Savings With These 10 Companies!)

State Farm, Progressive, and USAA are top providers of cheap Freightliner Sprinter 4500 Crew car insurance, with monthly rates starting at $45. Renowned for comprehensive coverage and excellent customer service, these insurers offer affordable options for Freightliner Sprinter 4500 Crew owners seeking reliable protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated January 2025

18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage for Freightliner Sprinter 4500 Crew

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage for Freightliner Sprinter 4500 Crew

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage for Freightliner Sprinter 4500 Crew

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviewsThe best providers for cheap Freightliner Sprinter 4500 Crew car insurance, offering competitive rates starting at $45 per month, are State Farm, Progressive, and USAA.

These companies stand out for their extensive coverage options tailored to commercial vehicle needs, including liability and comprehensive plans.

Our Top 10 Company Picks: Cheap Freightliner Sprinter 4500 Crew Car Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $45 | B | Full Coverage | State Farm | |

| #2 | $48 | A+ | Payment Options | Progressive | |

| #3 | $51 | A++ | Military Families | USAA | |

| #4 | $53 | A++ | Online Management | Geico | |

| #5 | $56 | A+ | Comprehensive Plans | Nationwide |

| #6 | $59 | A+ | Bundling Discounts | Allstate | |

| #7 | $61 | A | New Replacement | Liberty Mutual |

| #8 | $63 | A | Customer Service | Farmers | |

| #9 | $66 | A++ | Custom Coverage | Travelers | |

| #10 | $69 | A | Safe Driver | American Family |

Protect your car from financial setbacks. Enter your ZIP code above to shop for cheap commercial insurance rates from top providers near you.

With a focus on affordability and excellent customer service, they ensure Freightliner Sprinter 4500 Crew owners can find reliable protection without compromising on quality.

- Get cheap Freightliner Sprinter 4500 Crew insurance with State Farm at $45/month

- Tailor coverage for commercial vehicles, including liability and comprehensive plans

- Secure reliable protection and savings with top insurers known for great service

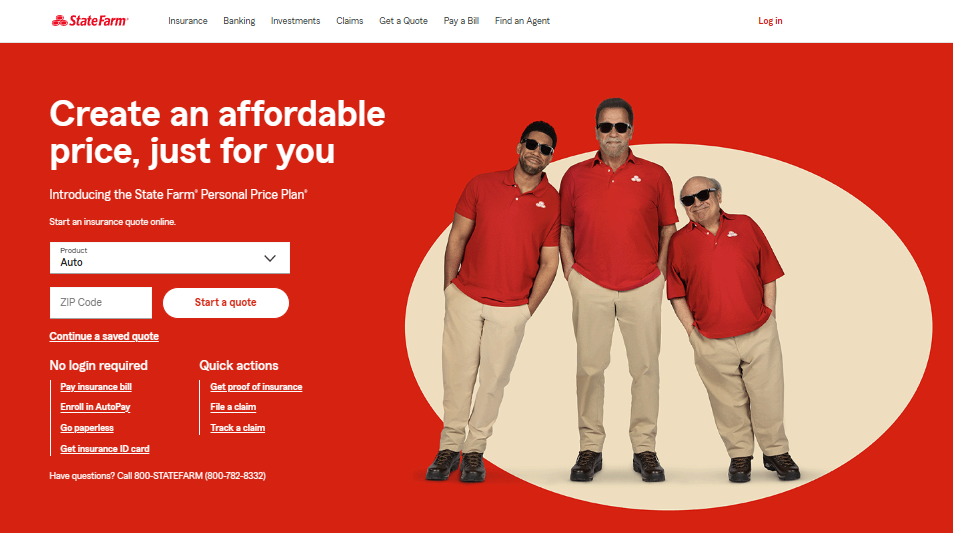

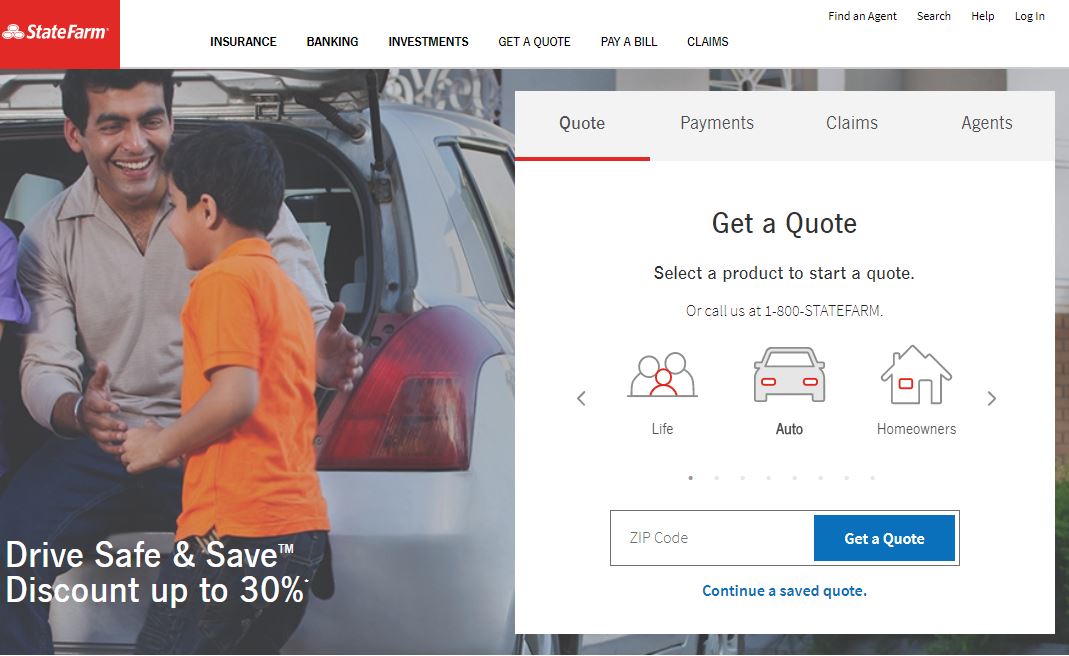

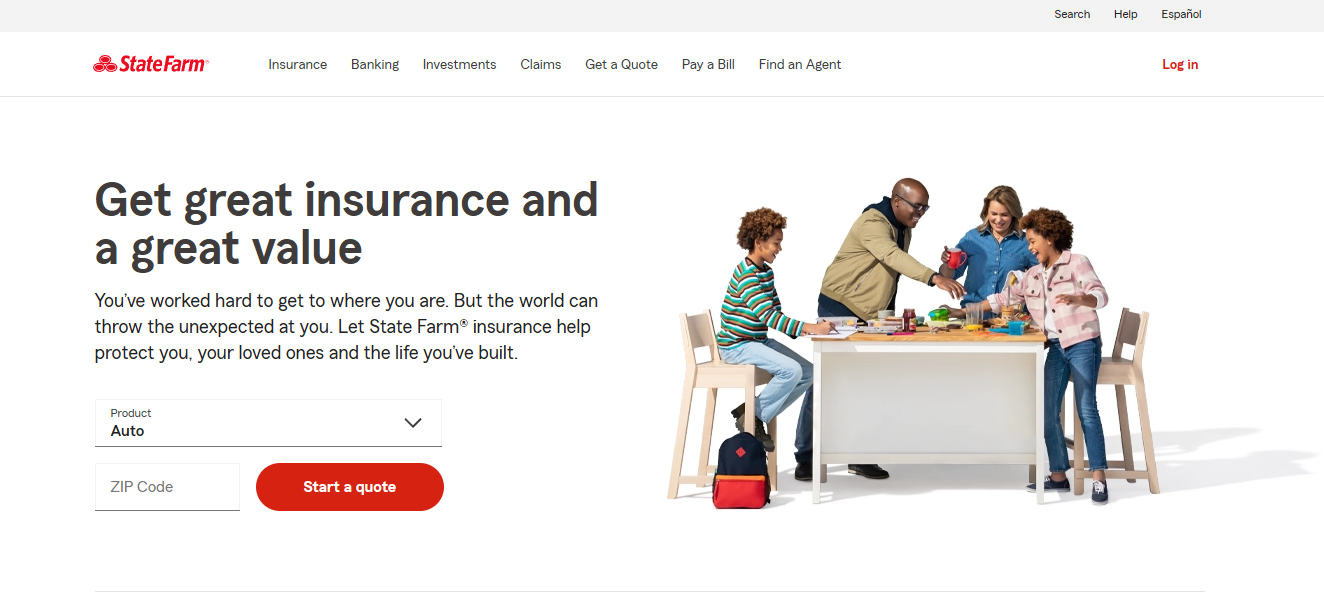

#1 – State Farm: Top Overall Pick

Pros

- Full Coverage Options: State Farm insurance review & ratings broadcast the company’s wide range of comprehensive coverage options, ensuring customers can find policies that meet their specific needs.

- Extensive Network: With a large network of agents and offices across the country, State Farm provides personalized customer service and convenient access for policyholders.

- Strong Reputation for Customer Service: State Farm is known for its reliable customer service, making it easy for customers to get assistance and support when needed.

Cons

- Potentially Higher Premiums: While rates are not specified, State Farm’s emphasis on full coverage and extensive agent network could lead to comparatively higher premiums in some cases.

- Limited to Average Financial Strength: Without specific financial ratings, State Farm’s financial stability might not be as high as some competitors, potentially affecting policy stability and claims processing during economic downturns.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Payment Options

Pros

- Wide Range of Payment Options: Progressive offers flexible payment plans and various payment methods, making it easier for customers to manage their insurance premiums.

- Innovative Online Tools: Progressive insurance review & ratings advertise the company’s user-friendly website and mobile app allow customers to manage policies, file claims, and access resources conveniently online.

- Strong Emphasis on Customer Convenience: Known for its streamlined processes and customer-focused approach, Progressive ensures a smooth experience for policyholders.

Cons

- Higher Premiums: Progressive is often associated with slightly higher premiums compared to some competitors, potentially due to its extensive payment options and strong online presence.

- Complex Discount Structure: Navigating and qualifying for Progressive’s various discounts may require more effort compared to other insurers, potentially adding complexity for some customers.

#3 – USAA: Best for Military Families

Pros

- Specialized for Military Families: USAA is highly regarded for its tailored insurance products and exceptional customer service designed specifically for military personnel, veterans, and their families.

- Comprehensive Member Benefits: USAA offers a range of benefits beyond insurance, including financial services and discounts, enhancing overall value for its members.

- Reputation for Member Satisfaction: USAA insurance review & ratings illustrate the company’s consistently ranks high in customer satisfaction surveys, reflecting its commitment to providing excellent service to its members.

Cons

- Membership Restrictions: USAA membership is limited to military personnel, veterans, and their families, potentially excluding the general public from accessing its services.

- Limited Physical Locations: USAA primarily operates online and through phone service, which may not suit individuals who prefer face-to-face interactions with agents or local branch support.

#4 – Geico: Best for Online Management

Pros

- Online Management: Geico car insurance discounts promote the company’s online policy management, offering a user-friendly website and mobile app that make it easy for customers to handle their insurance needs remotely.

- Competitive Rates: Geico is often known for competitive pricing, making it a popular choice for customers looking to save on their insurance premiums.

- Wide Range of Coverage Options: Geico provides a variety of coverage options, allowing customers to customize their policies to suit their individual needs.

Cons

- Customer Service Concerns: Some customers report mixed reviews regarding Geico’s customer service, with occasional challenges in resolving issues promptly.

- Limited Agent Interaction: Geico primarily operates through direct channels (online and phone), which may not appeal to customers who prefer in-person interactions with agents.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Comprehensive Plans

Pros

- Comprehensive Plans: Nationwide offers a range of comprehensive insurance plans, allowing customers to find coverage that meets their specific needs.

- Strong Customer Support: Nationwide insurance review & ratings unveil the company’s responsive customer service, providing assistance and support to policyholders when they need it.

- Multi-Policy Discounts: Nationwide offers bundling discounts for customers who combine multiple insurance policies, potentially saving money on premiums.

Cons

- Higher Premiums: Nationwide’s focus on comprehensive coverage and strong customer support may lead to higher premiums compared to some competitors.

- Limited Online Tools: While Nationwide provides basic online services, its digital tools may not be as advanced or user-friendly as those offered by other insurers.

#6 – Allstate: Best for Bundling Discounts

Pros

- Bundling Discounts: Allstate offers substantial discounts for customers who bundle multiple insurance policies together, potentially saving money on overall premiums.

- Innovative Tools and Resources: Allstate provides useful tools like Drivewise, which monitors driving habits to potentially earn discounts, and a user-friendly mobile app for policy management.

- Strong Financial Stability: Allstate insurance review & ratings spotlight the company’s robust financial stability provides reassurance to policyholders, ensuring the company’s ability to meet its obligations.

Cons

- Higher Costs for Additional Features: Some customers may find that additional features and options with Allstate come at a higher cost compared to basic coverage.

- Mixed Customer Service Reviews: Allstate’s customer service reviews are varied, with some customers expressing dissatisfaction with claim handling and support.

#7 – Liberty Mutual: Best for New Replacement Coverage

Pros

- New Replacement Coverage: Liberty Mutual review & ratings reveal the company’s new replacement coverage for vehicles and homes, providing added protection and peace of mind.

- Personalized Customer Service: Liberty Mutual emphasizes personalized customer service, with agents available to assist policyholders with their insurance needs.

- Range of Coverage Options: Liberty Mutual provides a variety of coverage options, allowing customers to tailor their policies to meet specific requirements.

Cons

- Higher Premiums: Liberty Mutual’s focus on comprehensive coverage and personalized service may result in higher premiums compared to some competitors.

- Complex Claims Process: Some customers have reported challenges with the claims process, citing potential delays or complications in claim resolution.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Customer Service

Pros

- Strong Customer Service: Farmers is recognized for its strong customer service, with agents available to provide personalized assistance and support.

- Customizable Coverage: Farmers insurance review & ratings highlight the company’s customizable insurance coverage options, allowing customers to tailor their policies to fit their individual needs.

- Educational Resources: Farmers provides educational resources and tools to help customers understand their insurance options and make informed decisions.

Cons

- Potentially Higher Rates: Farmers’ emphasis on personalized service and customizable coverage may lead to higher premiums compared to some competitors.

- Limited Online Tools: Farmers’ online tools and resources may not be as robust or user-friendly as those offered by other insurers, potentially impacting customer convenience.

#9 – Travelers: Best for Custom Coverage

Pros

- Custom Coverage Options: Travelers offers a wide range of customizable coverage options, allowing customers to build policies that suit their unique needs.

- Strong Financial Stability: Travelers’ solid financial stability provides reassurance to policyholders, ensuring the company’s ability to fulfill its commitments.

- Additional Benefits: Travelers insurance review & ratings exhibit the company’s additional benefits such as roadside assistance and rental car reimbursement, enhancing policyholder value.

Cons

- Complex Policy Structure: Travelers’ extensive range of coverage options and additional benefits may result in a more complex policy structure, requiring careful review and consideration.

- Mixed Customer Service Reviews: Customer reviews on Travelers’ customer service are mixed, with some customers expressing dissatisfaction with claims handling and communication.

#10 – American Family: Best for Safe Driver

Pros

- Safe Driver Discounts: American Family insurance review & ratings feature the company’s discounts for safe driving habits, potentially reducing premiums for policyholders who demonstrate responsible driving behavior.

- Customizable Policies: American Family provides flexible and customizable insurance policies, allowing customers to tailor coverage to their specific needs and preferences.

- Community Involvement: American Family is known for its community involvement and support initiatives, fostering a positive brand image among customers.

Cons

- Limited Availability: American Family’s insurance products may not be available nationwide, potentially limiting options for customers in certain regions.

- Customer Service Variability: Some customers have reported varying experiences with American Family’s customer service, with occasional challenges in communication and claims handling.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Influencing Freightliner Sprinter 4500 Crew Car Insurance Rates

Insurers base insurance rates for a Freightliner Sprinter 4500 Crew on several key factors. Vehicle value is crucial, as more expensive models generally mean higher premiums. Additionally, vehicle age, condition, and safety features influence costs. Insurers also assess theft risk and repair expenses for commercial vehicles like the Freightliner Sprinter 4500 Crew.

Personal factors like driving record, age, and location are also considered. A clean record often lowers premiums, indicating responsible driving. Younger drivers may face higher rates due to less experience, while congested areas or high-accident regions may also affect rates.

The vehicle’s purpose matters too. If it’s used primarily for commercial activities, such as transportation or services, insurance costs may be higher due to increased mileage and potential wear and tear. To gain further insights, consult our comprehensive guide titled “Mileage-Based Car Insurance: A Complete Guide.”

Insurance Coverage for Your Freightliner Sprinter 4500 Crew

Ensuring proper insurance coverage for your Freightliner Sprinter 4500 Crew is crucial, whether you use it for personal or commercial purposes. Insurance provides essential protection against unforeseen incidents, safeguarding you from financial burdens and ensuring peace of mind in your daily operations.

- Insurance coverage is essential whether your Freightliner Sprinter 4500 Crew is used for personal or commercial purposes. It provides crucial financial protection in case of accidents, damage, or theft, preventing potential financial strain from covering costs out of pocket. For additional details, explore our comprehensive resource titled “How to Document Damage for Car Insurance Claims.”

- Commercial vehicles like the Freightliner Sprinter 4500 Crew often require specialized insurance due to their unique usage. Business-related activities, such as transporting goods or providing services other necessities.

- Liability protection is paramount for your Freightliner Sprinter 4500 Crew. This coverage helps manage costs if you’re liable for injury or property damage while driving.

Comprehensive insurance offers peace of mind by protecting against non-collision incidents like fire, vandalism, or natural disasters.

Zach Fagiano Licensed Insurance Broker

It ensures comprehensive financial security against a broad spectrum of risks, further emphasizing the importance of securing adequate insurance coverage for your Freightliner Sprinter 4500 Crew.

Understanding Insurance Costs for Your Freightliner Sprinter

Determining the cost of insuring a Freightliner Sprinter 4500 Crew involves various critical factors. These include the vehicle’s value, condition, and safety features, along with personal details like driving history, age, and location. Being mindful of these factors is essential as they directly influence your insurance premiums.

Moreover, your choice of coverage level plays a significant role in determining costs. Opting for comprehensive coverage, which shields against theft, vandalism, and other non-collision incidents, typically results in higher premiums compared to basic liability coverage. To delve deeper, refer to our in-depth report titled “Collision Car Insurance: A Complete Guide.”

Freightliner Sprinter 4500 Crew Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $59 | $176 |

| American Family | $69 | $160 |

| Farmers | $63 | $172 |

| Geico | $53 | $184 |

| Liberty Mutual | $61 | $168 |

| Nationwide | $56 | $196 |

| Progressive | $48 | $192 |

| State Farm | $45 | $180 |

| Travelers | $66 | $164 |

| USAA | $51 | $188 |

By assessing your specific requirements and familiarizing yourself with available coverage options, you can make informed decisions that align with your financial planning and protection needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing Insurance for Your Freightliner Sprinter 4500 Crew

When selecting insurance for your Freightliner Sprinter 4500 Crew, it’s essential to compare providers to ensure you get the best rates and coverage options. Understanding the factors that influence insurance costs can help you make an informed decision.

- Compare Insurance Providers: When selecting insurance for your Freightliner Sprinter 4500 Crew, compare multiple providers to find competitive rates and coverage options. Obtain quotes and thoroughly review policy terms, including coverage limits, deductibles, and additional benefits.

- Evaluate Customer Experience: Consider customer reviews and feedback on insurer reliability and claims processing. A reputable insurer with good customer service can significantly enhance your overall insurance experience. For a thorough understanding, refer to our detailed analysis titled “What is claim?“

- Strategies for Affordability: Maintain a clean driving record to qualify for lower premiums. Explore bundling discounts with other policies and inquire about potential discounts for safety features or defensive driving courses. Consider adjusting deductibles to manage monthly costs effectively while ensuring financial preparedness for any future claims.

By evaluating quotes, considering coverage details, and assessing customer feedback, you can find insurance that meets your needs and budget for your Freightliner Sprinter 4500 Crew. Taking these steps will help you secure reliable coverage for your vehicle.

Insuring Your Freightliner Sprinter 4500 Crew

When insuring a Freightliner Sprinter 4500 Crew, it’s important to dispel misconceptions that personal auto insurance suffices for commercial use, as specialized policies are typically necessary.

Additionally, understanding that insurance providers vary in coverage, pricing, and customer service is crucial for securing the right protection at the best rates tailored for your commercial vehicle needs.

For the Freightliner Sprinter 4500 Crew, explore options ranging from essential liability coverage to comprehensive plans that safeguard against accidents, theft, vandalism, and more, ensuring comprehensive protection that aligns with your specific business requirements. To expand your knowledge, refer to our comprehensive handbook titled “Best Business Insurance: A Complete Guide.”

Ensure you choose a policy that not only meets legal requirements but also adequately protects your business assets and operations.

Insurance Costs for Your Freightliner Sprinter 4500 Crew

Understanding how age and driving history influence insurance rates for your Freightliner Sprinter 4500 Crew is crucial when seeking affordable coverage. Factors like experience and past driving behavior significantly impact the premiums you pay.

- Age and Driving History Impact: Younger drivers and those with limited experience typically face higher insurance rates for a Freightliner Sprinter 4500 Crew due to increased risk. A clean driving record with no accidents or violations can lead to lower premiums, reflecting safe driving habits.

- Discounts and Savings Options: Insurance companies offer various discounts for insuring a Freightliner Sprinter 4500 Crew. These include safe driving discounts, multi-policy discounts, and loyalty rewards. Installing safety features like anti-theft devices or telematics systems may also qualify you for additional savings on insurance premiums.

- Choosing Comprehensive Coverage: Opting for comprehensive insurance not only meets legal requirements but also protects your business assets and operations, ensuring comprehensive protection tailored to your specific needs. To gain profound insights, consult our extensive guide titled “What is comprehensive coverage?“

Exploring discounts and choosing comprehensive coverage can help mitigate insurance costs for your Freightliner Sprinter 4500 Crew, ensuring you receive adequate protection without overspending.

By leveraging savings opportunities and maintaining a clean driving record, you can effectively manage your insurance expenses while safeguarding your commercial vehicle operations.

Optimizing Insurance for Your Freightliner Sprinter 4500 Crew

Lowering insurance premiums and avoiding common pitfalls when insuring your Freightliner Sprinter 4500 Crew is essential for cost-effective coverage.

- Tips for Lowering Premiums: Maintain a good driving record, leverage available discounts like safe driving and policy bundling, and consider a higher deductible to reduce monthly costs while ensuring adequate coverage.

- Common Mistakes to Avoid: Avoid underinsuring your Freightliner Sprinter 4500 Crew and solely focusing on price when selecting insurance. Research insurer reputation and policy details to ensure comprehensive coverage.

- Exploring Additional Coverage: Enhance your policy with options like roadside assistance for breakdowns and rental reimbursement for vehicle repairs, providing added security and financial protection. For an in-depth examination, consult our thorough guide entitled “Roadside Assistance Coverage: A Complete Guide.”

By strategically choosing discounts such as safe driving incentives and policy bundling, avoiding underinsurance pitfalls, and exploring additional coverage options like roadside assistance and rental reimbursement, you can enhance your insurance policy’s value.

Case Studies: Insurance for Your Freightliner Sprinter 4500 Crew

Discover how practical approaches helped individuals secure budget-friendly insurance for their Freightliner Sprinter 4500 Crew, offering insights to streamline costs while ensuring comprehensive coverage.

- Case Study #1 – Safe Driver Discounts: Sarah, operating a Freightliner Sprinter 4500 Crew for her delivery service, benefited from a safe driver discount due to her impeccable driving record. For more details, explore our comprehensive guide on “Safe Driver Car Insurance Discounts.”

- Case Study #2 – Comprehensive Coverage and Beyond: Mike, managing a fleet of Freightliner Sprinter 4500 Crews for his construction business, opted for comprehensive coverage and added roadside assistance to protect his vehicles and ensure operational continuity. Learn more about “Enhancing Commercial Vehicle Insurance with Comprehensive Coverage and Additional Options.”

- Case Study #3 – Strategic Policy Bundling: Alex, a small business owner, reduced insurance costs by bundling his Freightliner Sprinter 4500 Crew insurance with other business policies.

These case studies underscore that affordable insurance for your Freightliner Sprinter 4500 Crew is attainable through practical strategies such as safe driver discounts, comprehensive coverage enhancements, and strategic policy bundling.

Scott W. Johnson Licensed Insurance Agent

By implementing these approaches, you can effectively manage insurance expenses while safeguarding your commercial vehicle operations against unforeseen risks.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Final Verdict: Affordable Insurance for Freightliner Sprinter 4500 Crew

When it comes to car insurance for your Freightliner Sprinter 4500 Crew, selecting the right coverage is crucial. Providers such as State Farm, Progressive, and USAA offer competitive rates starting at $45 per month, tailored to meet the unique needs of commercial vehicles.

By exploring comprehensive options and comparing quotes, you can ensure your vehicle is adequately protected against potential risks, providing both security and peace of mind on the road. To enhance your understanding, explore our comprehensive resource on business insurance titled “Compare Car Insurance Quotes.”

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

Frequently Asked Questions

What is the cheapest full coverage insurance for a Freightliner Sprinter 4500 Crew?

State Farm, Progressive, and USAA offer competitive rates for full coverage insurance tailored to a Freightliner Sprinter 4500 Crew, ensuring comprehensive protection at affordable premiums.

Which insurance company typically offers the cheapest full coverage for a Freightliner Sprinter 4500 Crew?

Geico, Progressive, and USAA are known for providing affordable full coverage options for a Freightliner Sprinter 4500 Crew, with flexible payment plans and comprehensive benefits.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

What company provides the cheapest full coverage insurance for a Freightliner Sprinter 4500 Crew in Texas?

Geico, Progressive, and USAA are noted for their competitive rates on full coverage insurance in Texas for a Freightliner Sprinter 4500 Crew, offering reliable customer service and extensive coverage options.

For detailed information, refer to our comprehensive report titled “Cheapest Car Insurance Companies.”

What is the cheapest insurance company for a Freightliner Sprinter 4500 Crew in NJ?

Geico, Progressive, and NJM Insurance are among the insurers known for competitive rates on insurance for a Freightliner Sprinter 4500 Crew in New Jersey, with tailored policies to suit commercial vehicle needs.

What is the cheapest comprehensive insurance for a Freightliner Sprinter 4500 Crew?

Comparing quotes from insurers like State Farm, Progressive, and USAA can help find affordable comprehensive insurance options for a Freightliner Sprinter 4500 Crew, with customizable plans and competitive rates.

At what age is insurance cheapest for a Freightliner Sprinter 4500 Crew?

Insurance premiums for a Freightliner Sprinter 4500 Crew typically start decreasing around age 25, reflecting improved driving experience and reduced risk factors for insurers.

To gain in-depth knowledge, consult our comprehensive resource titled “How does the insurance company determine my premium?”

What is the cheapest insurance group for a Freightliner Sprinter 4500 Crew?

Commercial vehicles with good safety ratings are usually in lower insurance groups, offering cost-effective premiums for a Freightliner Sprinter 4500 Crew, based on reduced perceived risk.

Which insurance company gives the best coverage options for a Freightliner Sprinter 4500 Crew?

State Farm, Progressive, and USAA are recognized for offering comprehensive coverage options tailored to the needs of a Freightliner Sprinter 4500 Crew, ensuring adequate protection and peace of mind.

What is the cheapest form of insurance for a Freightliner Sprinter 4500 Crew?

Liability-only insurance is often the most economical choice for a Freightliner Sprinter 4500 Crew, covering damages to others while keeping premiums low, ideal for budget-conscious owners.

For a comprehensive analysis, refer to our detailed guide titled “Liability Insurance.”

What’s the best insurance coverage for a new driver of a Freightliner Sprinter 4500 Crew?

New drivers of a Freightliner Sprinter 4500 Crew may benefit from comprehensive coverage options that include liability, collision, and comprehensive protections, ensuring full coverage against various risks on the road.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.