Cheap Chevrolet SSR Car Insurance in 2026 (Find Savings With These 10 Companies!)

Discover the best providers of cheap Chevrolet SSR car insurance: Erie, Auto-Owners, and Mercury lead with rates starting at just $52/month. These companies offer competitive premiums and excellent coverage for Chevrolet owners, ensuring value and reliability in your insurance choice.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Updated August 2025

Company Facts

Min. Coverage for Chevrolet SSR

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Chevrolet SSR

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Chevrolet SSR

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for cheap Chevrolet SSR car insurance are Erie, Auto-Owners, and Mercury, known for their affordable rates and robust coverage.

This article delves into how various factors like your driving history, the model year of your SSR, and your geographic location can influence your premiums. Discover insights in our “Chevrolet Car Insurance Discount.”

Our Top 10 Company Picks: Cheap Chevrolet SSR Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $52 A+ Customer Satisfaction Erie

#2 $54 A++ Financial Stability Auto-Owners

#3 $55 A Affordable Rates Mercury

#4 $56 A+ Excellent Service Amica

#5 $57 A+ Competitive Rates Progressive

#6 $58 A+ Comprehensive Coverage Nationwide

#7 $59 A Multiple Discounts American Family

#8 $60 A++ Variety Discounts Travelers

#9 $61 A Good Service Farmers

#10 $63 A Coverage Options Liberty Mutual

We also provide tips on how to navigate the insurance market to find the best policy that offers both comprehensive protection and value for money. Understanding these elements will equip you with the knowledge to secure the most cost-effective insurance for your Chevrolet SSR.

Searching for more affordable premiums? Insert your ZIP code above to get started on finding the right provider for you and your budget.

- Erie is the top choice for affordable Chevrolet SSR car insurance

- Chevrolet SSR insurance rates vary by model year and safety features

- Location and driving history significantly impact Chevrolet insurance costs

#1 – Erie: Top Overall Pick

Pros

- Exceptional Claims Service: Erie is renowned for its customer-first approach during claims.

- Rate Lock Feature: Erie offers a rate lock option to keep your premiums consistent. Learn more in our Erie insurance review & ratings.

- Comprehensive Discounts: Multiple discounts available for bundling, safety features, and more.

Cons

- Regional Availability: Erie’s insurance products are not available nationwide.

- Limited Online Tools: Compared to competitors, Erie offers fewer online management tools.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Auto-Owners: Best for Financial Stability

Pros

- High Financial Ratings: With an A++ from A.M. Best, Auto-Owners is extremely reliable.

- Personalized Agent Service: Offers dedicated agents to provide personalized customer service.

- Discounts for Multiple Policies: Significant savings when you bundle policies. See more details on our Auto-Owners insurance review & ratings.

Cons

- No Online Claims: Claims must be filed through an agent, not online.

- Limited Digital Experience: Fewer digital tools for policy management compared to others.

#3 – Mercury: Best for Affordable Rates

Pros

- Competitive Pricing: Known for offering some of the most affordable rates. More information is available about this provider in our Mercury insurance review & ratings.

- Good Range of Discounts: Includes good driver, multi-car, and anti-theft device discounts.

- Customizable Coverage Options: Allows for tailored coverage to meet individual needs.

Cons

- Customer Service Variability: Some regions report less satisfactory customer service.

- Basic Online Services: Online services are more limited than some larger insurers.

#4 – Amica: Best for Excellent Service

Pros

- Top-tier Customer Service: Frequently recognized for superior customer support.

- High Customer Loyalty: High rates of customer retention and satisfaction. Read up on the “Amica Car Insurance Discounts” for more information.

- Diverse Policy Options: Offers a wide range of coverage options and riders.

Cons

- Higher Price Point: Generally more expensive than some competitors.

- Quote Process: The process can be more time-consuming than with other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Competitive Rates

Pros

- Name Your Price Tool: Innovative tool that helps tailor plans to your budget.

- Loyalty Rewards: Progressive offers benefits like accident forgiveness over time.

- Wide Acceptance: Welcomes drivers with varied driving records. Check out insurance savings in our complete Progressive car insurance review & ratings.

Cons

- Variable Customer Service: Service quality may vary significantly by region.

- Complex Policies: Some customers find their policy options confusing.

#6 – Nationwide: Best for Comprehensive Coverage

Pros

- Wide Coverage Options: Extensive options from auto to pet insurance.

- SmartRide Program: Offers discounts based on driving behavior. Discover more about offerings in our Nationwide insurance review & ratings.

- Strong Mobile App: Efficient policy management and claims filing via app.

Cons

- Costly Without Discounts: Base rates can be high unless discounts are applied.

- Selective Coverage Availability: Not all coverage options are available everywhere.

#7 – American Family: Best for Multiple Discounts

Pros

- Variety of Discounts: Offers a wide range of discounts including loyalty and defensive driving.

- Flexible Policies: Customizable coverage options to fit different needs. Access comprehensive insights into our American Family insurance review & ratings.

- Enhanced Equipment Coverage: Offers unique add-ons like equipment and personal property coverage.

Cons

- Inconsistent Pricing: Rates can vary significantly between states.

- Limited Availability: Services are not offered in all states.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Variety Discounts

Pros

- Broad Range of Discounts: Offers discounts for multiple policies, new car owners, and more.

- Green Home Discount: Additional discounts for eco-friendly practices and equipment. Delve into our evaluation of Travelers insurance review & ratings.

- Coverage Options: Extensive coverage options including gap insurance and ride-sharing.

Cons

- Higher Premiums for Some: Certain policies come with higher premiums compared to competitors.

- Complexity in Policy Details: Some customers find the policy options and details overwhelming.

#9 – Farmers: Best for Good Service

Pros

- Customizable Packages: Offers a range of customizable coverage options.

- Helpful Agent Network: Large network of agents providing personalized service.

- Incident Forgiveness: Policies include accident forgiveness features. Unlock details in our Farmers car insurance review & ratings.

Cons

- Higher Rates: Generally higher rates compared to some major competitors.

- Limited Online Features: Fewer online tools and resources available for policy management.

#10 – Liberty Mutual: Best for Coverage Options

Pros

- Extensive Coverage Variety: Offers a wide array of coverage options, including rare inclusions.

- Accident Forgiveness: Available as an add-on to prevent rate increases after the first accident.

- Online Policy Management: Strong online and mobile tools for policy management. If you want to learn more about the company, head to our Liberty Mutual car insurance review & ratings.

Cons

- Variable Rate Increases: Some customers report significant rate increases at renewal.

- Customer Service Complaints: Some reports of less responsive customer service in certain areas.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Insurance Rates for Chevrolet SSR: Minimum vs. Full Coverage

Understanding the monthly rates for Chevrolet SSR car insurance is crucial for owners seeking both minimal and comprehensive coverage options. The following breakdown illustrates how premiums can vary significantly depending on the chosen level of coverage and the provider.

Chevrolet SSR Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

American Family $59 $127

Amica $56 $120

Auto-Owners $54 $116

Erie $52 $110

Farmers $61 $130

Liberty Mutual $63 $132

Mercury $55 $118

Nationwide $58 $125

Progressive $57 $124

Travelers $60 $128

For those considering the least expensive options, Erie offers the lowest monthly rate for minimum coverage at $52, closely followed by Auto-Owners at $54. Conversely, Liberty Mutual presents the highest minimum coverage rate at $63. When it comes to full coverage, Erie remains the most cost-effective choice at $110 per month, providing a balanced offer of affordability and extensive protection.

On the higher end, Liberty Mutual and Farmers are tied, both charging $132 for full coverage. This detailed comparison allows Chevrolet SSR owners to gauge potential expenses and align their insurance choices with both their budgetary constraints and coverage needs. Learn more in our “Full Coverage Car Insurance: A Complete Guide.”

Factors That Affect the Cost of Chevrolet SSR Car Insurance

Several factors influence the cost of Chevrolet SSR car insurance. One of the primary considerations is the model and year of your SSR. Newer models tend to have higher insurance rates due to their higher value and the potential for more expensive repairs. Additionally, insurance companies take into account the SSR’s engine size, safety features, and theft rates when calculating premiums.

Another factor that affects insurance rates is your driving history. If you have a history of accidents, traffic violations, or claims, you are generally considered a higher risk driver, resulting in higher premiums. On the other hand, having a clean driving record can help lower insurance costs for your Chevrolet SSR. See more details on our “Car Driving Safety Guide for Teens and Parents.”

Furthermore, the location where you reside also plays a role in determining your insurance rates. If you live in an area with high rates of car theft or a higher population density, you may experience higher insurance premiums for your Chevrolet SSR. Insurance companies consider these factors when calculating the risk associated with insuring your vehicle.

Your age also influences the cost of Chevrolet SSR car insurance. Younger drivers, especially those under 25, typically face higher rates due to their perceived lack of driving experience and higher likelihood of being involved in accidents. Similarly, older drivers may also face higher premiums due to factors like declining vision or slower reflexes.

Additionally, your credit score can impact the cost of Chevrolet SSR car insurance. Insurance companies often use credit-based insurance scores to assess the risk of insuring a driver. A lower credit score may result in higher premiums, as it is seen as an indicator of potential financial instability and a higher likelihood of filing claims.

Jeff Root Licensed Life Insurance Agent

Furthermore, the level of coverage you choose for your Chevrolet SSR can also affect insurance costs. Opting for comprehensive coverage, which includes protection against theft, vandalism, and other non-collision incidents, will generally result in higher premiums compared to basic liability coverage. It’s important to carefully consider your coverage needs and budget when selecting the type and amount of insurance for your SSR.

Understanding the Insurance Rates for Chevrolet SSR

Insurance rates for Chevrolet SSR can vary significantly depending on the specific insurance provider and the coverage options you choose. It’s important to research and compare multiple insurance quotes to find the best rates for your specific needs. Discover insights in our “Insurance Quotes Online.”

When determining insurance rates for your Chevrolet SSR, insurance companies consider various factors, such as the ones mentioned earlier. They also take into account statistical data related to the SSR, including its safety ratings, historical claims data, and the likelihood of theft. By analyzing all these factors, insurance companies can assess the risk associated with insuring a specific model of the Chevrolet SSR.

It’s worth noting that insurance rates can also be influenced by the insurance provider’s underwriting guidelines and their target market. Additionally, market factors such as the competition between insurance companies in your area and economic conditions can affect premium prices. To obtain accurate and up-to-date quotes, it is advisable to reach out to several insurance providers and compare their offerings.

Another factor that can impact insurance rates for Chevrolet SSR is the driver’s personal profile. Insurance companies often consider factors such as the driver’s age, gender, driving history, and credit score when determining premiums. Younger drivers or those with a history of accidents or traffic violations may face higher insurance rates compared to older, more experienced drivers with clean records.

In addition to the driver’s profile, the location where the Chevrolet SSR is primarily driven and parked can also affect insurance rates. Areas with higher rates of accidents, theft, or vandalism may result in higher premiums. Similarly, urban areas with more traffic congestion and a higher likelihood of accidents may also lead to increased insurance costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Car Insurance for Your Chevrolet SSR

While insurance premiums for the Chevrolet SSR can vary, there are several strategies you can employ to find affordable coverage:

- Shop Around: Obtain quotes from various insurance providers to compare rates and coverage options. Each insurer may have different criteria and discounts, so exploring multiple options can help you find the best deal.

- Maintain a Clean Driving Record: Having a history of safe driving, free from accidents and traffic violations, can positively impact your insurance rates. Drive responsibly to enjoy lower premiums.

- Increase Your Deductible: Choosing a higher deductible can lower your insurance premiums. However, make sure you can comfortably afford the deductible amount in case of an incident.

- Bundle Your Policies: Consider bundling your Chevrolet SSR car insurance with other policies, such as homeowners or renters insurance, to potentially secure a discounted rate.

- Check for Discounts: Inquire with your insurance provider about any available discounts. Some common discounts include multi-car or multi-policy discounts, good student discounts, and safe driver discounts.

- Maintain a Good Credit Score: Insurance companies often consider your credit score when determining your premiums. By maintaining a good credit score, you may be eligible for lower insurance rates.

- Install Anti-Theft Devices: Equipping your Chevrolet SSR with anti-theft devices, such as an alarm system or a tracking device, can help reduce the risk of theft and potentially lower your insurance premiums.

Finding affordable car insurance for your Chevrolet SSR involves a few key strategies. By shopping around, maintaining a clean driving record, and increasing your deductible, you can significantly influence the cost of your premiums.

Additionally, bundling policies, checking for various discounts, maintaining a good credit score, and investing in anti-theft devices can further reduce your expenses, ensuring you secure the best possible rate while maintaining the coverage you need. Unlock details in our “Best Anti Theft System Car Insurance Discounts.”

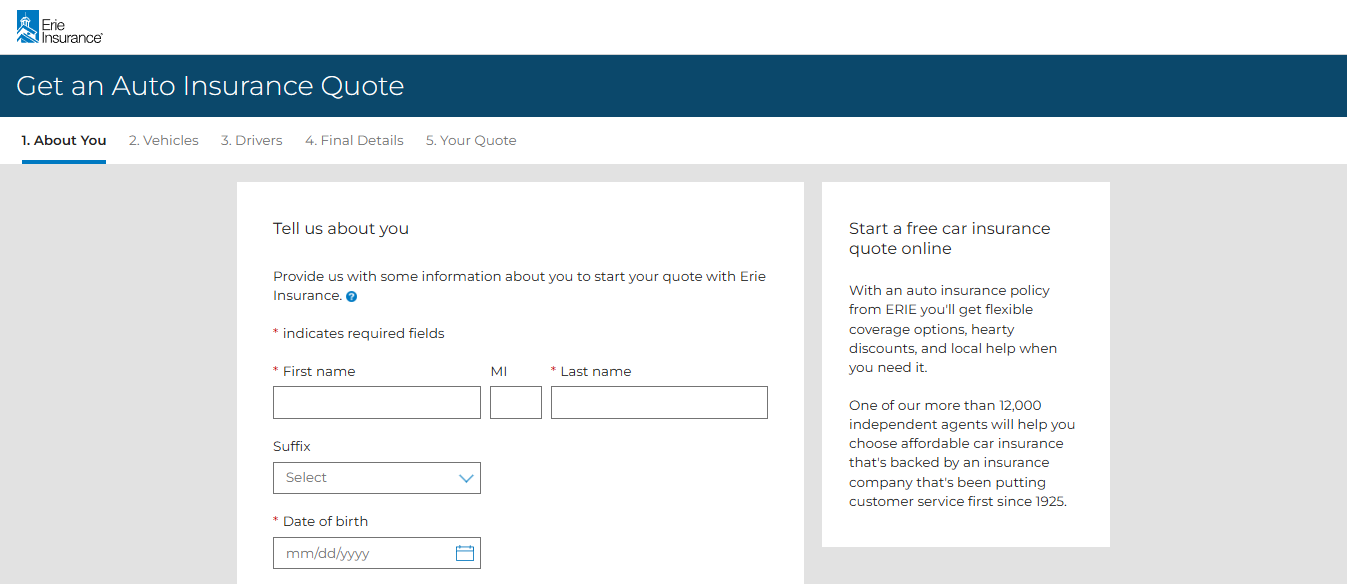

Comparing Insurance Quotes for the Chevrolet SSR

When searching for the right insurance for your Chevrolet SSR, obtaining and comparing multiple quotes is essential. This strategy ensures you receive a comprehensive view of the market, helping you make an informed decision that best suits your needs. Delve into our evaluation of “How To Get Free Insurance Quotes Online.”

Start by evaluating the types of coverage each insurer offers, ensuring they provide the protection your Chevrolet SSR requires. Look at the deductibles; remember, opting for a higher deductible can reduce your monthly premiums, though it means more out-of-pocket expenses during a claim.

Don’t overlook potential discounts; many insurers provide reductions for specific vehicle features or for bundling multiple insurance policies. Investigate each provider’s customer service reputation and the experiences of other customers to gauge reliability and support levels.

Lastly, consider any extra coverage options like roadside assistance or gap insurance, which might bring additional value depending on your individual needs. By scrutinizing these aspects, you can choose the most suitable insurance coverage for your Chevrolet SSR, balancing cost and protection effectively.

Exploring Different Coverage Options for Chevrolet SSR Car Insurance

When considering insurance coverage for your Chevrolet SSR, it’s important to understand the different types available:

- Liability Coverage: This coverage is typically required by law and protects you financially if you are found liable for injuring someone else or damaging their property in an accident.

- Collision Coverage: Collision coverage pays for repairs to your Chevrolet SSR if you get into an accident with another vehicle or object, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against non-collision incidents, such as theft, vandalism, or damage caused by severe weather.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage to pay for damages.

- Medical Payments Coverage: This coverage helps pay for medical expenses if you or your passengers are injured in an accident, regardless of who is at fault.

- Personal Injury Protection (PIP): PIP coverage provides broader medical expense coverage, including additional benefits such as lost wages and rehabilitation expenses. When selecting coverage for your Chevrolet SSR, consider the value of your vehicle, your budget, and the level of financial protection you want in case of an accident or other incidents.

- Gap Insurance: Gap insurance is an optional coverage that can be beneficial if you have a loan or lease on your Chevrolet SSR. It covers the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease in the event of a total loss. Discover more about offerings in our “Is Gap Insurance transferable from one vehicle to another?“

When deciding whether to add gap insurance to your coverage, consider the depreciation rate of your vehicle and the length of your loan or lease.

Melanie Musson Published Insurance Expert

Gap insurance can provide peace of mind knowing that you won’t be left with a financial burden if your car is totaled and the insurance payout doesn’t cover the remaining balance.

Enter your ZIP code below to compare rates from the top providers near you.

Frequently Asked Questions

What factors affect the cost of Chevrolet SSR car insurance?

The cost of Chevrolet SSR car insurance can be influenced by various factors such as the driver’s age, driving history, location, coverage limits, deductible amount, and the insurance company’s pricing policies.

For additional details, explore our comprehensive resource titled “Best Safe Driver Car Insurance Discounts.”

Are Chevrolet SSR cars expensive to insure?

Insurance rates for Chevrolet SSR cars can vary depending on the factors mentioned above. Generally, sports cars like the Chevrolet SSR tend to have higher insurance premiums due to their higher risk of accidents and theft.

What are some ways to lower the cost of Chevrolet SSR car insurance?

There are several methods to potentially reduce the cost of Chevrolet SSR car insurance. These include maintaining a clean driving record, opting for a higher deductible, bundling car insurance with other policies, taking advantage of available discounts, and comparing quotes from different insurance providers.

Is it possible to get cheap Chevrolet SSR car insurance?

While the term “cheap” is subjective, it is possible to find more affordable Chevrolet SSR car insurance by shopping around, maintaining a good driving record, and exploring available discounts. However, it’s important to balance cost with the coverage and protection you need.

What are some common mistakes to avoid when insuring a Chevrolet SSR?

When insuring a Chevrolet SSR or any vehicle, it’s important to avoid common mistakes such as not comparing quotes from multiple insurance companies, neglecting to review and understand the coverage terms and conditions, failing to disclose accurate information, and not considering the long-term costs of insurance.

To find out more, explore our guide titled “Compare Car Insurance Quotes.”

How much is Chevrolet car insurance?

Chevrolet vehicles are generally less expensive to insure compared to many other brands. On average, liability insurance for a Chevy costs about $102 per month, and full coverage averages around $193. However, insurance rates can differ across different models and years.

What type of car insurance is cheapest?

Generally, fully comprehensive insurance tends to be the most affordable option, although individual factors can affect the cost.

What is the best car insurance for older cars?

Hagerty, Grundy, American Collectors, American Modern, and Heacock are the top choices for insurance for classic cars. These companies offer the best coverage for vintage vehicles due to their competitive pricing, wide availability, and extensive industry experience.

What is the lowest form of car insurance?

Liability insurance is typically the most affordable type of car insurance since it only pays for the bodily injuries and property damage of the other party if you cause an accident. It does not cover damage to your own vehicle or your own injury-related expenses.

To learn more, explore our comprehensive resource on “How to Document Damage for Car Insurance Claims.”

Why is my car insurance so expensive?

Auto insurance rates are personalized, but shifts in the overall insurance sector can affect all customers. Your premium might have gone up due to updates in your driving record or changes in your driving habits, like getting a speeding ticket or driving more miles each year.

Instantly compare quotes by entering your ZIP code below.

Who is offering cheapest car insurance?

Is it worth having full coverage on a 10 year old car?

Is Chevrolet a good car company?

Is insurance cheaper if your car is paid off?

Does credit score affect car insurance?

Which cars are uninsurable?

Is a 20 year old car too old?

Who pays more for car insurance, males or females?

Is Chevrolet a premium car?

Are Chevy cars worth buying?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.