How to Track the Progress of Your Root Car Insurance Claim in 2026 (6 Simple Steps)

How to track the progress of your Root car insurance claim is simple. Log in to your account, visit the claims page, choose your claim, and view updates. Turn notifications for alerts on and contact Root's customer support if needed. Top car insurance providers offer rates starting at $32 monthly.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated August 2025

How to track the progress of your Root car insurance claim is quick and hassle-free with their user-friendly mobile app. By logging into your account, you can easily access the claims section, view real-time updates, and check the status of your claim.

The app has a timeline for each stage, from filing to resolution, so you’ll always know what’s going on. For additional support, you can enable notifications for instant alerts or contact Root’s customer service team directly for assistance.

- Step #1: Log In to Your Account — Access your Root car insurance policy details

- Step #2: Navigate to the Claims Section — View current and past claims easily

- Step #3: Select Your Claim — See real-time updates and required actions

- Step #4: Check Status and Updates — Track progress through a detailed timeline

- Step #5: Enable Notifications — Get instant alerts on claim developments

- Step #6: Contact Root Support — Reach out for help with issues or questions

Take the first step toward cheaper car insurance rates. Enter your ZIP code to see how much you could save.

6 Steps to Track the Progress of Your Root Car Insurance Claim

Tracking the progress of your Root car insurance claim involves a sequence of easy steps that allow you to stay updated in every step. They are logging into your account, going to the claims page, selecting your claim, and looking at the status and updates.

Enable notifications and contact Root support for real-time alerts and extra help. For clarity, further details on each step will be discussed below.

Step #1: Log In to Your Root Car Insurance Account

To begin tracking your claim, open the Root Insurance mobile app or visit their website. Login using your credentials to sign in securely and access your policy details. Once logged in, you will be able to see your Root claim status and access the claims page.

This allows you to track live updates and receive updates throughout the Root insurance claims process. Ensuring you are signed in also makes it easier to contact Root car insurance customer service if you have any questions or need assistance.

Read more: How to Document Damage for Car Insurance Claims

Step #2: Navigate to the Claims Section

Once you have logged in safely, go to the menu or dashboard and choose the “Claims” tab. This area presents a complete overview of your Root insurance claims status, including both current and previous claims. You can track the status of your Root car insurance claim with ease, see recent activity, and view critical information like claim numbers, filed dates, and next steps.

Laura Berry Former Licensed Insurance Producer

In this section, you will also be able to get information on whether Root auto insurance requires additional documentation, like pictures, police reports, or estimates.

Also, if you hold a Root insurance full coverage policy, you can check what kinds of damages or accidents are covered under your claim. This feature keeps you up to date throughout the Root claim process and enables you to take action if necessary.

Read more: Why You Should Always Take Pictures After a Car Accident

Step #3: Select Your Claim

In the “Claims” section, look for your active Root Insurance claim and select it to view detailed information. You can check the current status of the claim, recent updates, and what needs to be done on your part. This possibly includes verifying if Root Auto Insurance requires more documentation, possible photos, police reports, or repair estimates.

If you hold a Root car insurance full coverage plan, you also have the opportunity to review the damages that come with it. You’ll be able to get supporting documents and correspondence concerning your claim, enabling you to receive updates on your Root claims process.

Step #4: Check Status and Updates

Track the full progress of your claim by viewing a comprehensive timeline in the Root Insurance app or website. The timeline describes every step of your claim, from filing to resolution, and gives you real-time updates on the current status, recent activity, and next steps. You can view when Root Insurance starts the investigation, examines documents, and processes the payment.

If you have a Root Insurance full coverage policy, this section will also break down what damages are covered and whether additional documentation, such as photos or repair estimates, is required.

Monitoring this timeline enables you to remain aware throughout the Root car insurance claim process and not miss any critical updates.

Read more: Can you lend your car to an uninsured driver?

Step #5: Enable Notifications

Activate real-time alerts in the Root Insurance app to get immediate updates on your claim status. This feature keeps you abreast of any status changes, actions you may need to take, or resolutions without the need to constantly check the app.

You can monitor your Root Insurance claim reviews and respond promptly if more documents, like photos or repair estimates, are needed by enabling alerts. This proactive approach will prevent you from facing delays and a smoother Root, Inc. car insurance claims process

Read more: Best Car Insurance for High-Risk Drivers

Step #6: Contact Root Customer Support if Needed

If you require additional assistance or have pending issues regarding your claim, contact Root Insurance’s customer support team.

If you have questions regarding how Root Insurance works, want more details about your Root Insurance policy, or need confirmation of Root Insurance liability coverage, their agents can provide personalized support.

They can be contacted by phone, email, or live chat to assist with document requests, claim misalignment, or payment details. This assists in ensuring that you are offered the information and guidance you need in the Root Insurance Company car insurance claim process, enabling you to be well-informed and address any issues effectively.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

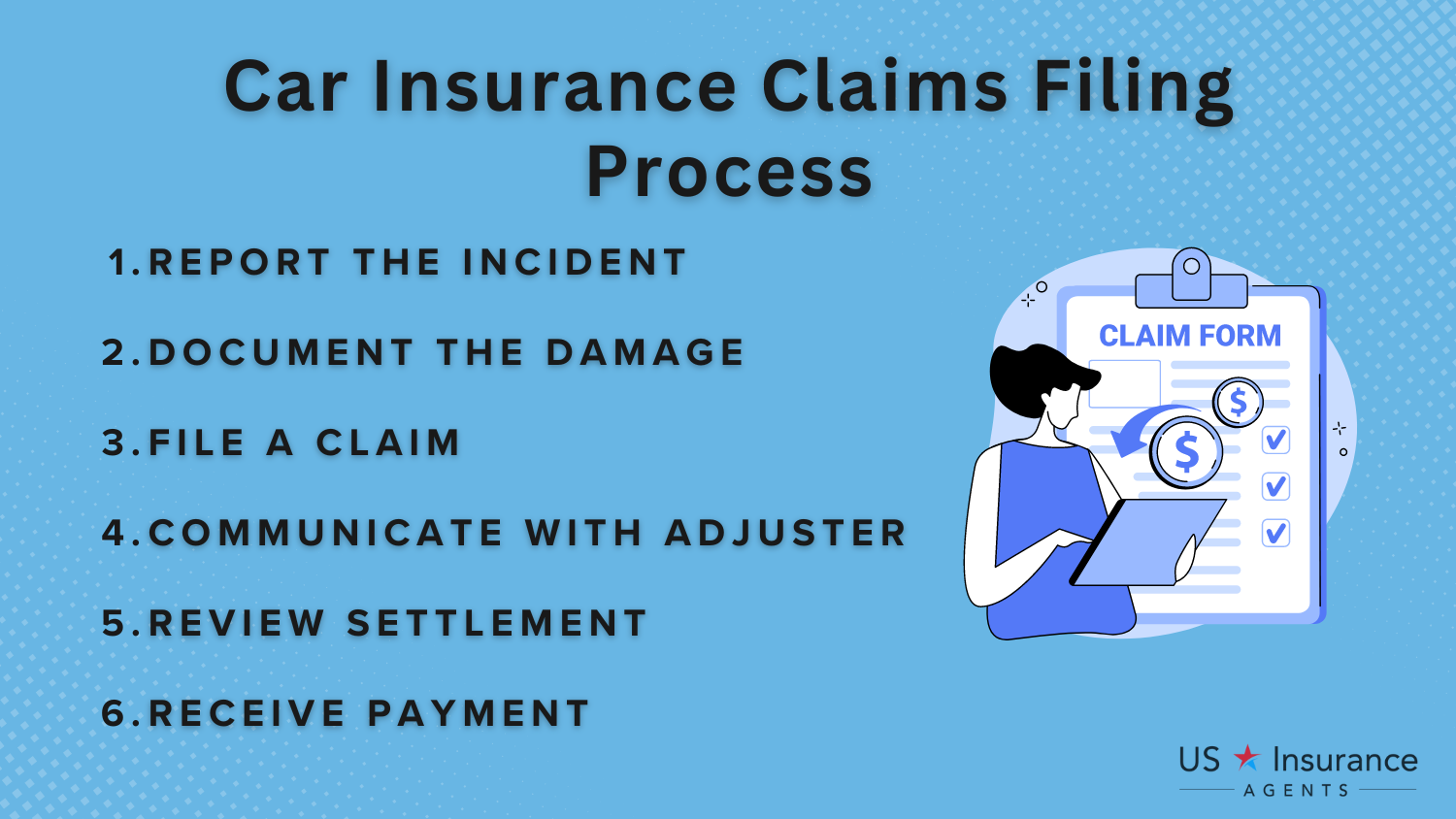

Knowing the Claims Process at Root Insurance

If you are involved in a car accident or any other incident covered, the claims procedure starts. This includes reporting an incident, giving information related to it, and letting Root Insurance investigate the claim. The claims procedure is in place to get a fair assessment and timely settlement.

At Root Insurance, the claims process is not all about paperwork and procedures. It is more about helping and guiding policyholders through a tough time. When you call Root Insurance to report an incident, their experienced claims team will be there to help you along the way.

After you report the incident, Root Insurance will gather all the necessary information to initiate the claims process. This includes details about the incident, such as the date, time, and location, as well as any other relevant information, such as the names and contact information of other parties involved.

Schimri Yoyo Licensed Agent & Financial Advisor

Once the information is gathered, Root Insurance will then thoroughly examine all of the facts surrounding the incident and review the coverage under your policy. They will examine the situation of the incident and decide whether and to what degree liability falls on you. This thorough review is conducted to ensure that you receive a fair evaluation of your claim.

Root Insurance realizes how significant it is for issues to be resolved quickly, particularly where this might have caused damage to your vehicle or personal property.

That is why they do everything possible to maintain a quick claims process. Their efficient claims-handling process, backed by advanced technology, provides you with frequent updates and progress reports, regardless of the type of car insurance coverage.

How Root Insurance Processes Claims

Root Insurance has a customer-centric method of handling claims efficiently. They strive to provide their policyholders with a simple experience through the use of creative technology and professional claims staff. Their information gathering, review, and updates all through the life cycle of a claim from beginning to end.

When you report a claim to Root Insurance, their claims team will guide you through the process, ensuring that you understand each step and what is required from you. They understand that filing a claim can be stressful, so they keep things straightforward with clear and concise instructions to ease any anxiety or confusion.

Root Insurance’s claims team is comprised of experienced professionals who have a deep understanding of the insurance industry. They have the knowledge and expertise to handle various types of claims, from minor fender benders to more complex incidents. Rest assured that your claim will be in capable hands.

Throughout the claims process, Root Insurance will keep you informed about the progress of your claim. They believe in transparency and open communication, so you can expect regular updates on the status of your claim. Whether it’s through phone calls, emails, or their user-friendly online portal, Root Insurance ensures that you are always in the loop.

In addition to their excellent customer service, Root Insurance uses cutting-edge technology to make the claims process quick and convenient. They have created advanced systems that allow easy data collection and analysis. That kind of technology brings about faster processing of the claim, getting you quicker resolutions and less waiting time.

Root Insurance understands that accidents happen, and its goal is to make the claims process as smooth and stress-free as possible. They are committed to providing exceptional service, prompt resolutions, and fair evaluations to all their policyholders. With Root Insurance, you can have peace of mind knowing that you are in good hands when it comes to handling your claims.

Read more: How Do I Renew My Car Insurance Policy With Root Insurance?

Initiating a Car Insurance Claim with Root Insurance

Root Insurance wants the process of filing auto insurance claims to be as easy and hassle-free as possible. You must have specific information on hand when submitting a claim in order to guarantee a smooth process.

This will help you to initiate the process properly and quickly. There are some details that you will need to include in order for Root Insurance to file a claim on your behalf, with the hope that it will go quickly. You should be sure to have the following information at hand:

- Date, Time, and Location of the Incident: Giving the date, time, and place of the incident will enable Root Insurance to evaluate the situation correctly. With this information, they are able to decide the conditions under which the claim has been made and offer necessary help.

- Policyholder and Driver Information: On filing the claim, one should state the policyholder’s name, address, and policy number. If there is a third-party driver involved, provide their details to enable Root Insurance to identify and reach all parties.

- Details of the Other Parties Involved: Aside from your details, it is important to gather information about the other parties involved in the case with respect to their names, phone numbers, insurance details, etc. This helps Root Insurance reach them and streamline the claims process.

- Police Report, if Applicable: If a law enforcement agency responded to the accident, send the police report to Root Insurance. That document will disclose numerous pieces of very important information like witnesses’ statements and determination of fault, all in aid of your claim.

- Photos or Videos of the Accident Scene and Damages: Ensure to take clear photos or videos of the scene of the accident, damage to the vehicle, and any other associated factors. Such visual evidence then helps Root Insurance best assess what happened and what the proper settlement should be.

Once you have gathered all the necessary information, follow these steps to file a claim with Root Insurance:

- Step #1: Notify Root Insurance Immediately: Contact Root Insurance as soon as possible after the incident. Prompt reporting allows them to initiate the claims process quickly and provide you with essential guidance.

- Step #2: Provide Accurate Incident Details: When communicating with a Root Insurance representative, be concise and accurate with the incident information. Detailed information enables them to understand the situation more accurately and provide the right kind of assistance.

- Step 3: Submit Supporting Documentation or Evidence: Provide any relevant supporting documentation, such as a police report, photographs, or videos, that they can use to confirm your claim and provide a better understanding of the event.

- Step #4: Cooperate During the Investigation Process: Root Insurance will investigate your claim, and you should be prepared to provide any additional information or documentation they may request. Cooperation will speed up the process and help ensure a smoother resolution.

Following all of these procedures, along with the required information, will enable an uncomplicated and effective car insurance claim process with Root Insurance.

Remember, they are in business to help settle your claim as promptly and quickly as possible so that you can get back on the road.

Monthly Auto Insurance Rates by Provider: Minimum vs. Full Coverage

Understanding how auto insurance cost differ by provider and coverage level can assist you in making better decisions when handling your Root insurance claim. This breakdown provides you with a clear view of the monthly rates for minimum and full coverage from some of the leading companies, allowing you to more easily see where you can save.

Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $62 | $166 | |

| $47 | $124 | |

| $32 | $84 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 |

How much car insurance costs can differ quite a bit from company to company. For minimum coverage, Erie offers the lowest price at $32 per month, while Liberty Mutual charges the most at $96 per month. If you’re looking for full coverage, Erie is still the cheapest at $84 per month, while Liberty Mutual tops the list at $248 per month.

Comparing these rates can help you determine whether Root Insurance offers a good deal or if switching providers might save you money.

Taking the time to compare insurance rates by provider and coverage level can help you spot potential savings. Whether you’re sticking with Root Insurance or considering other options, knowing how their rates stack up ensures you get the best value for your coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What to Expect Under the Root Insurance Claims Review Process

The process of Root Insurance claims review begins with careful examination. This includes contacting all concerned parties, looking at evidence provided, and analyzing coverage and liability to determine whether the evaluation can be fair.

After review, Root decides on the suitable settlement amount. If your claim is successful, you will receive a comprehensive settlement offer.

Root Insurance strives to settle damages and losses through simple and fast settlement. You can inquire about your Root Insurance claims through the mobile app or the website.

Read more: Collision vs. Comprehensive Car Insurance

Tips for a Smooth Claim Process with Root Insurance

Having a claim with Root Insurance is simpler if you’re ready. When you get into an accident, be sure to get clear photos or videos of what happened, the road conditions, and the environment. Whenever possible, collect witness contact information and statements and report the accident to the police when necessary.

Angie Watts Licensed Real Estate Agent

Providing complete documentation, like repair estimates or medical reports, will help Root process your claim quickly and effectively. The more proof you can provide—like repair quotes or medical history—the faster and more accurately Root can settle your claim.

It’s also really important to stay in touch with Root during this time. Answer their questions promptly and give accurate, concise information. It is a good idea to keep a record of your interactions—by phone or by email—and it can prevent misunderstandings. If something is not clear, ask for clarification. Good communication and documentation will ease the process and make it less stressful.

For a better understanding of what your policy includes, check out what car insurance covers.

Ways to Track the Progress of Your Root Car Insurance Claim

Knowing how to track the progress of your Root car insurance claim makes you well-informed and stress-free during the process. By logging into your account through the app or website, you can easily navigate to the claims section, choose your claim, and check the real-time status.

Enabling notifications helps ensure that you’re immediately informed about any updates, so you won’t need to keep checking repeatedly.

Root’s user-friendly platform allows you to track your claim every step of the way to facilitate timely resolutions with proper communication.

In order to make it a smooth process, one should finalize the incident report in correct order, share full information, and reach Root’s customer service in case any support is needed. Similarly, Root can ensure you a thoughtful procedure of your claim, carried out efficiently as well as fairly.

Understand how Root compares to other providers and compare car insurance quotes to find the best coverage and rates for your needs.

Your car insurance rates will likely increase after an at-fault accident, but you can find your cheapest coverage option by using our free quote comparison tool today.

Frequently Asked Questions

How do I track the progress of my Root car insurance claim?

To track the progress of your Root car insurance claim, log in to the Root app or website, navigate to the claims section, select your claim, and view real-time updates. You can also enable notifications for instant alerts.

How often does Root update the progress of my car insurance claim?

Root provides real-time updates on the progress of your car insurance claim. You can enable notifications to receive instant alerts whenever there is a status change or new information.

Explore your car insurance options by entering your ZIP code and finding which companies have the lowest rates.

What is Root Insurance Agency, and how does it handle claims?

Root Insurance Agency, part of Root, Inc., uses telematics to assess driving habits and offer personalized rates. Understanding usage-based car insurance policies and how I can qualify for them is key, as safe driving during the test period helps you qualify for lower premiums.

How long does it take to process a car insurance claim with Root Insurance?

When it comes to car insurance claims, Root Insurance might take a little time to process depending on the complexity of the claim, availability of documentation, and everyone’s cooperation involved. However, generally speaking, Root Insurance does try to process claims as quickly as possible so that the majority of straightforward claims can be resolved within days. However, some might even take weeks or longer, depending on their nature.

Is Root car insurance available for Carvana customers?

Yes, Carvana customers can purchase Root car insurance as part of their vehicle financing package. Root Insurance Agency partners with Carvana to offer coverage directly through their platform.

How does Root car insurance work for claim processing?

Root car insurance uses app-based technology to simplify claim processing. You can file claims, upload photos, and track the status through the app, making the process faster and more efficient.

What is Root auto insurance, and what makes it different?

Root auto insurance is a telematics-based provider that tracks driving behavior to determine rates. In line with this Root car insurance review and ratings, responsible drivers enjoy cheaper premiums compared to standard policy, which qualifies it as the best affordable alternative for safe motorists.

Can I track the progress of my Root car insurance claim on my phone?

Yes, you can track the progress of your Root car insurance claim through their mobile app. The app provides a detailed timeline of your claim’s status, recent activity, and next steps.

What information do I need to track the progress of my Root car insurance claim?

To track the progress of your Root car insurance claim, you’ll need your login credentials and claim number. You may also need to provide additional documents if Root requests them during the claims process.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code into our free comparison tool.

What should I do if I can’t track the progress of my Root car insurance claim?

If you’re unable to track the progress of your Root car insurance claim, contact Root customer support via phone, email, or live chat. They can provide detailed information and assist with any technical issues.

Read more: Does Root Insurance car insurance cover damage caused by a DUI or other criminal activity?

How is Root, Inc. Family of Companies involved in car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.