Erie vs. Chubb Homeowners Insurance in 2026 (Side-by-Side Review)

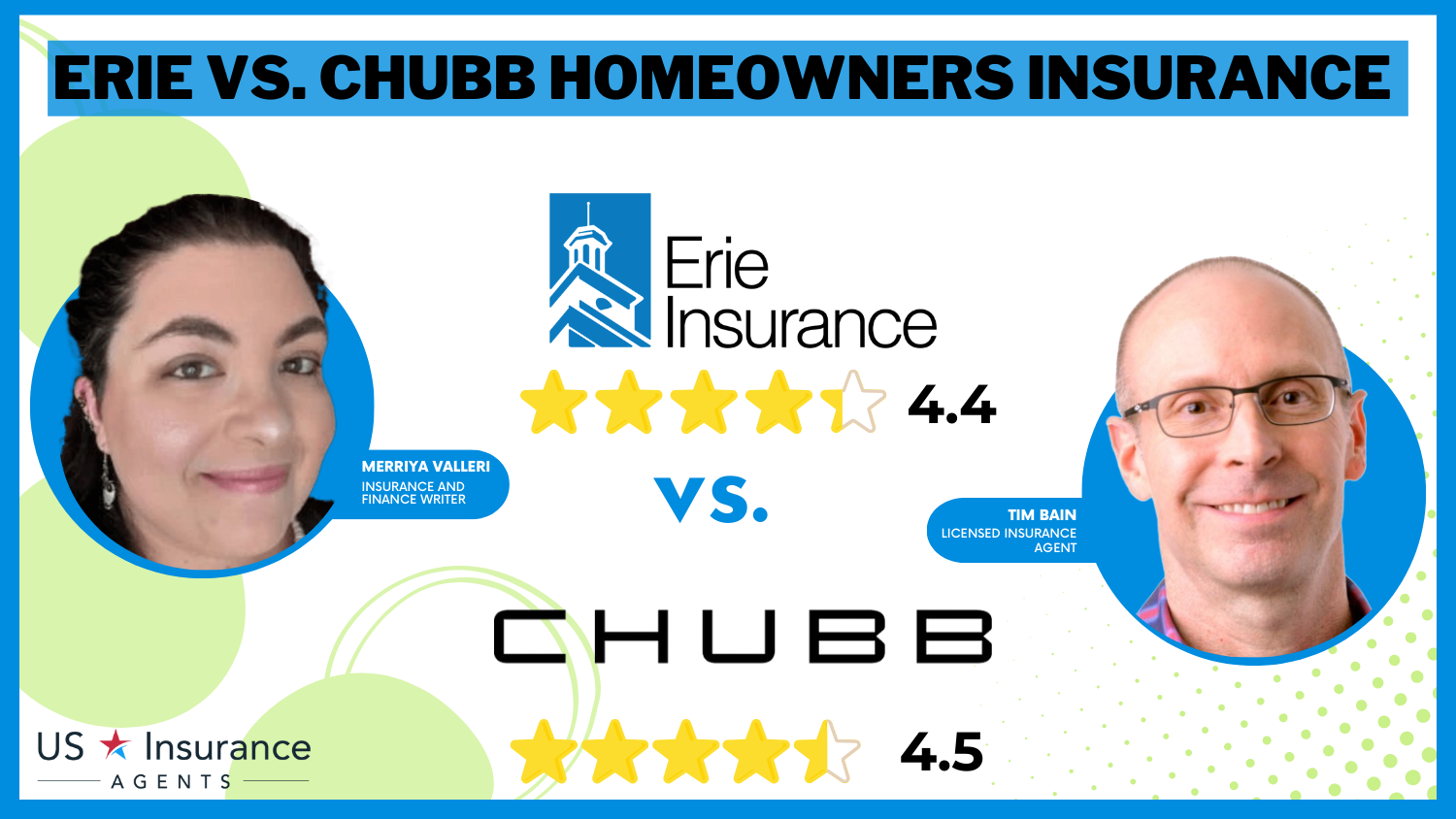

Compare Erie vs. Chubb homeowners insurance to find the right fit. Erie keeps it budget-friendly at $53/month, with perks like $25,000 identity theft protection and guaranteed replacement costs. At $125/month, Chubb offers premium coverage and extended replacement for high-value homes.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated January 2025

1,883 reviews

1,883 reviewsCompany Facts

Home Insurance Cost

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 82 reviews

82 reviewsCompany Facts

Home Insurance Cost

A.M. Best Rating

Complaint Level

Pros & Cons

82 reviews

82 reviewsErie vs. Chubb homeowners insurance gives you two strong options, with Erie offering identity theft protection up to $25,000 and Chubb providing extended replacement cost coverage for high-value homes.

Erie also includes increased limits for valuables like jewelry, making it an excellent choice for added security. On the other hand, Chubb guarantees complete rebuilds even when expenses surpass your policy limits, which suits people with premium properties well.

Erie vs Chubb Homeowners Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.4 | 4.5 |

| Business Reviews | 4.5 | 5.0 |

| Claim Processing | 4.3 | 5.0 |

| Company Reputation | 4.5 | 5.0 |

| Coverage Availability | 3.5 | 5.0 |

| Coverage Value | 3.4 | 4.5 |

| Customer Satisfaction | 4.3 | 4.2 |

| Digital Experience | 4.0 | 4.5 |

| Discounts Available | 4.7 | 5.0 |

| Insurance Cost | 0.0 | 4.1 |

| Plan Personalization | 4.5 | 5.0 |

| Policy Options | 5.0 | 3.8 |

| Savings Potential | 4.6 | 4.4 |

| Erie Review | Chubb Review |

Both present adaptable protection to satisfy your requirements, making finding the best homeowners insurance easier.

When you want affordable home insurance, the best place to start is to enter your ZIP code into our free comparison tool.

- Erie offers identity theft coverage starting at $53/month

- Chubb provides extended replacement costs for premium homes

- Compare Erie vs. Chubb to find the best fit for your needs

Comparing Erie vs. Chubb Insurance Costs

The table shows how monthly rates for full coverage differ between Erie and Chubb based on age and gender. It’s a simple way to see which insurer might fit your budget better.

Erie vs. Chubb Homeowners Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| Age: 16 Female | $218 | $570 |

| Age: 16 Male | $233 | $600 |

| Age: 30 Female | $63 | $190 |

| Age: 30 Male | $66 | $210 |

| Age: 45 Female | $59 | $175 |

| Age: 45 Male | $58 | $185 |

| Age: 60 Female | $53 | $160 |

| Age: 60 Male | $55 | $170 |

Erie keeps rates lower across the board, with 60-year-old females paying just $53 compared to $160 with Chubb. The gap is even wider for younger homeowners, like 16-year-old males—$233 with Erie versus $600 with Chubb. Chubb’s more expensive rates show it focuses on higher quality features, whereas Erie is a good choice for people wanting to save money.

For middle-aged individuals, such as those around 45 years old, the pattern stays the same: Erie costs about $59 for women, and Chubb costs about $175. Shop around to find the coverage that works best for you.

But you might be wondering, “Does Erie homeowners insurance go up after a claim?” Like most insurers, Erie may raise rates after a claim, depending on the situation. It’s worth chatting with your agent to see how a claim might affect your premium.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Erie Insurance Takes the Lead

Erie insurance is the top choice after carefully analyzing factors like premiums, coverage choices, and customer service.

- Competitive Affordability: Erie Insurance is known for having excellent rates compared to others. They give homeowners a cost-effective choice but still provide high-quality coverage.

- Many Options for Coverage: Erie Insurance offers many coverage options. For complete safety, they put in unique characteristics such as stopping identity theft and higher limits to necessary things.

- Excellent Customer Service: Erie’s fantastic customer service rightly deserves its name. They meet the needs of their customers, respond quickly, and handle claims efficiently. This creates a good experience for those who have policies with them.

Many homeowners also ask, “Does Erie home insurance cover animal damage?” If it results from a covered peril, Erie typically covers animal damage caused by wild animals, such as raccoons or squirrels. Still, it’s always best to confirm specifics with an Erie agent.

Erie Insurance’s affordability, diverse coverage, and top-tier customer service make it the best overall choice in this comparative analysis.

Understanding Homeowners Insurance

Before comparing, let’s ensure we understand what homeowners insurance entails. Insurance for homeowners is a type of insurance for property that gives coverage to your home’s structure and items inside it. It also protects if anybody gets hurt while on your property.

As a homeowner, insurance safeguards your money in unexpected situations like fire incidents, thefts, or natural calamities. Although there is no legal requirement for this kind of protection, most organizations providing mortgages usually insist homeowners have an insurance policy before they can approve the loan application.

Importance of Homeowners Insurance

You may be wondering why homeowners insurance is essential. Consider this: your home is most likely your most valuable asset. Your home and personal belongings could be severely damaged or destroyed in a disaster like a fire or severe storm.

If you do not have insurance, you must pay for everything, such as fixing or replacing your house. This can cause significant financial problems, debt, and worry too much. Homeowners insurance offers peace of mind. It covers repairs, rebuilds, or replacements to help you recover fast from losses that are covered.

Also, homeowners insurance ensures the safety of your physical belongings and includes liability insurance coverage.

Also, homeowners insurance can help with extra living costs. If your house cannot be lived in because of a covered problem like a fire, the insurance may pay for a temporary place to stay and other living expenses. This ensures you and your family can still live comfortably while the house is fixed or built again.

Key Elements to Look for in a Home Insurance Policy

Regarding home insurance, there are a few essential factors to consider. These elements help determine the level of ease and protection that insurance offers. A home insurance policy often covers the following:

- Dwelling Coverage: This is insurance for the main structure of your home and any attached parts, like a garage. It gives you money if there’s damage from things such as fire, vandalism, or other events listed in your policy.

- Personal Property Coverage: This helps protect your furniture, clothes, and electronics. It ensures you can get new items if yours are damaged or stolen without paying all the costs yourself.

- Additional Living Expenses Coverage: This pays for temporary housing and daily costs if your house cannot be lived in because of a covered problem. It helps you keep your usual way of life while they fix or build your home again.

- Deductible Choices: The deductible is how much you need to pay yourself before your insurance starts to cover costs. Find a policy with a deductible that matches what you can afford. Selecting a deductible that you can quickly pay if you need to file a claim is crucial, even though higher deductibles sometimes result in cheaper premiums.

By thinking carefully about these essential parts, you can choose a homeowners insurance plan that gives broad protection and fits your needs. It is good to look at different prices from many insurance companies to find the best deal for what you pay.

Company Overview

The fascinating histories of two well-known insurance businesses, Erie Insurance and Chubb Insurance, will be covered in detail here.

Brief History of Erie Insurance

First up is the respected and top-ranked insurance company Erie Insurance. It began covering the event in 1925 and has done so continuously ever since then. With almost 100 years in the insurance business, Erie Insurance has made a perfect name.

Erie Insurance has continuously expanded to satisfy client needs by upholding integrity, altruism, and high-quality services. Now, this company offers different insurance products, such as homeowners insurance, to more than 5 million people with policies.

If you need to file a claim with Erie homeowners insurance, the steps are simple and easy, showing their promise of excellent service. Erie ensures the claims process is fast so customers can recover quickly from surprise problems. Their team handles claims in a way that helps people feel taken care of and supported during tough times.

Erie Insurance works in 12 states around the Mid-Atlantic and Midwest. The company is respected very much in all these areas. They are known for promising to give good quality service to customers, which has built a strong reputation. Because of this, many people and families choose their trusted insurance services.

Brief History of Chubb Insurance

Now, we talk about Chubb Insurance. This company has a very long and famous history in the insurance industry. It started in 1882 as a marine underwriting business to help people with maritime activities.

Over the years, Chubb Insurance grew and expanded what it offers. Now, it is a global provider of many insurance products like homeowners insurance. Known for being excellent and focusing on high-net-worth people, Chubb Insurance has taken its place as a premier insurance provider.

Chubb Insurance is different from others because it focuses on personal service. They understand that everyone with a policy needs something unique and likes different things, so Chubb works hard to give coverage choices that precisely fit what each person or family needs.

Chubb Insurance offers many coverage choices that give policyholders confidence, as their valuable things are well protected. Whether it’s keeping a grand estate safe or securing precious belongings, Chubb Insurance has different options to meet the wide-ranging needs of its selective customers.

Jeff Root Licensed Insurance Agent

Looking at the insurance world, it is easy to see that both Erie Insurance and Chubb Insurance have done much for the field. They both have long histories full of achievements, focus on good customer service, and offer many coverage choices, which makes many people trust them and stay loyal as policyholders.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverage Options

The right insurance choices are critical when considering keeping your home and things safe. Erie and Chubb Insurance have different coverage options to fit your needs and help you feel secure.

Coverage Options Offered by Erie

Erie Insurance is popular for its complete homeowners’ insurance plans, providing many coverage choices. Their plans usually have dwelling coverage, which helps protect the building of your house if it gets damaged or destroyed. Erie homeowners insurance covers roof replacement if a covered peril, like a storm or fire, causes the damage. This way, homeowners can keep their houses strong and safe.

Besides dwelling coverage, Erie Insurance also offers personal property coverage. This means they will help pay to replace or fix your things if something happens to them like damage, theft, or destruction. Things like furniture, electronics, and appliances are included in this protection.

Erie Insurance also offers liability coverage, which is a crucial option. If someone is wounded at your property and decides to sue you, this insurance helps shield your finances. Medical expenditures, legal fees, and other incident-related costs may be partially covered.

Also, Erie Insurance knows that unexpected events can make you leave your home for a while. That’s why their homeowners’ insurance plans include extra living expenses coverage. This coverage helps pay for a temporary stay, food, and other living costs if your house cannot be lived in because of covered damage.

But this is not everything. Erie Insurance gives even more by providing extra coverage choices to add to your policy. For example, they offer identity theft coverage. This helps you recover from identity theft and pays for costs connected to fixing your identity.

Kristine Lee Licensed Insurance Agent

Expensive jewelry and collectibles are among the items for which Erie Insurance offers more extensive coverage. With this choice, your most prized belongings will be adequately safeguarded in the event of their loss or damage.

Alternatively, you can get equipment breakdown coverage from Erie Insurance. This protection helps cover the cost of repairing or replacing major home appliances, including kitchenware, electrical systems, and heating and cooling systems, if they malfunction due to mechanical or electrical issues.

Coverage Options Offered by Chubb

Chubb Insurance is famous for offering choices beyond regular homeowner’s insurance. They provide several ways to secure your home and personal belongings. Like Erie Insurance, Chubb has various homeowner’s plans offering coverage for the residence, individual property, liability issues, and extra living costs.

One unique coverage plan from Chubb Insurance is called extended replacement cost coverage. This policy ensures you can fix your home back to what it was, even if the repair costs exceed what your insurance usually covers. It gives more safety and comfort because you know your home can be fixed completely, no matter how much it costs.

Chubb Insurance understands the value of your valuable possessions. Because of this, they provide more significant policy limits for precious objects like jewelry and artwork. This option is excellent for those who have unique artifacts or precious collections that may require additional coverage.

As you can see, Erie Insurance and Chubb Insurance give many types of coverage to fit your needs. These insurance companies have options for essential protection or extra coverage for important things. It is necessary to think well about your choices and pick the coverage that matches your way of living and gives you the calm feeling you need.

Pricing Comparison

Erie and Chubb take different approaches to homeowners insurance rates. Erie keeps things affordable with competitive pricing and discounts, while Chubb’s higher rates come with extra coverage and higher limits for premium homes.

Erie Homeowners Insurance Rates

Erie Insurance is famous for giving reasonable prices to people who choose them. How much you pay for your homeowners’ insurance with Erie depends on many things, like where your home is, how big it is, what it’s worth, and the deductible and coverage limits you pick.

It is good to mention that Erie Insurance gives different discounts, like multi-policy and home safety discounts. These can lower the total cost of your homeowners’ insurance premium.

Chubb Homeowners Insurance Rates

Chubb Insurance is often seen as a more premium insurance company, so their prices might be higher than those of other companies. But Chubb’s plans usually come with extra coverage choices and more significant coverage amounts that can make the higher price worth it.

Like Erie Insurance, Chubb Insurance offers several discounts, including security systems and multi-policy discounts, which lower the cost of your home’s insurance premium.

Customer Service Review

Erie and Chubb are known for excellent customer service, each with their strengths. Erie is about quick claims and affordable options, while Chubb offers personalized support and premium coverage for high-value homes, earning both spots among the best insurance companies for homeowners.

Erie Customer Service Experience

Erie Insurance has made a perfect name because of its excellent customer service. They are famous for giving personal attention and ensuring customers’ needs and happiness come first.

Customers appreciate Erie’s responsive claims handling, with many reporting quick and hassle-free claims processes. Moreover, Erie Insurance has consistently high customer satisfaction ratings, indicating its commitment to providing excellent service.

Chubb Customer Service Experience

Chubb Insurance also became famous for excellent customer service. They feel happy about their unique way of helping each person and paying attention to small things.

Chubb’s customer service workers know a lot and can help clients anytime during the claims process. Also, many customers say good things about Chubb because they solve problems quickly and well.

Ty Stewart Licensed Insurance Agent

In conclusion, both Erie and Chubb give good choices for homeowners insurance with wide coverage options. Erie Insurance is known for being budget-friendly and having great customer service. On the other hand, Chubb Insurance targets homes with higher value and offers extra high-end coverage services.

It would help to consider your demands, budget, and the coverage elements most important to you while comparing the two firms. Everyone deserves peace of mind, and by carefully examining your options, you may select the house insurance that best suits your needs.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Financial Strength: Erie vs. Chubb Breakdown

Erie vs. Chubb shows how these two top insurance companies compare in ratings and reviews. From J.D. Power scores to A.M. Best ratings, this guide highlights what makes each stand out so you can choose confidently.

Insurance Business Ratings & Consumer Reviews Erie vs Chubb

| Agency |  | |

|---|---|---|

| Score: 880 / 1,000 Above Avg. Satisfaction | Score: 870 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A++ Excellent Business Practices |

|

| Score: 82/100 Positive Customer Feedback | Score: 82/100 Positive Customer Feedback |

|

| Score: 0.60 Fewer Complaints | Score: 0.60 Fewer Complaints |

|

| Score: A+ Superior Financial Strength | Score: A++ Superior Financial Strength |

Both Erie and Chubb have strong ratings and excellent customer feedback. Whether you value fewer complaints or excellent financial backing, this comparison helps you find the right fit.

The Erie vs. Chubb homeowners insurance market share comparison shows they may be minor players, with Erie at 1.1% and Chubb at 1.6%, but they pack a punch when it comes to tailored options for homeowners. Both bring unique advantages for those looking beyond the big providers.

Even though Erie and Chubb have a smaller slice of the market, they offer solid, specialized choices for homeowners. This breakdown helps you see what each insurer offers to pick the best option, especially if you’re looking for replacement-cost homeowners insurance.

Erie homeowners insurance is a topic of conversation on Reddit. Its extensive coverage and advantageous bonuses have caused many users to speak favorably of it. A feature of Erie’s Plus and Select packages is that they often include replacement cost coverage, as one commenter points out.

Comment

byu/asdfjkl826 from discussion

inInsurance

Reddit users think Erie is a good choice for home insurance because it offers strong coverage and extra benefits. Features like replacement cost coverage and customizable bundles make it a go-to option for many. If you’re looking for reliable protection with additional benefits, the Reddit crowd loves Erie.

Pros and Cons of Erie Insurance

Pros

- Guaranteed Rebuilds: Erie covers guaranteed replacement costs, so your home gets rebuilt exactly as it was.

- Affordable Options: Erie’s rates are budget-friendly, often lower than Chubb’s for similar coverage. Our Erie insurance review provides details.

- Extra Perks in Bundles: Their Plus and Select bundles add benefits like identity theft protection and higher limits for valuables.

Cons

- Non-Renewal Concerns: Erie might drop coverage after multiple claims, which can be frustrating.

- Limited Reach: Erie is only available in select states, so not everyone can get it.

Pros and Cons of Chubb Insurance

Pros

- Special Coverage for Expensive Homes: Chubb Insurance is very good at giving special insurance for high-value homes. This includes coverage that can pay more to replace the house if needed and higher limits on policies to cover valuable belongings.

- Global Coverage: Chubb’s liability insurance covers all around the world, giving extra safety for incidents outside your country.

- Excellent Customer Service: Like Erie, Chubb is famous for good customer service. The staff are well-informed and handle claims quickly and efficiently.

Cons

- Higher Premiums: Chubb Insurance is often seen as a more luxury provider. It gives lots of coverage, but it might cost more in premiums.

- Limited Availability: Chubb’s coverage may only be available in some states, potentially limiting options for specific customers. Learn more in our Chubb insurance review.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding the Best Fit for Your Home Insurance Needs

Picking between Erie and Chubb homeowners insurance comes down to what matters most to you—affordability, coverage, or protecting high-value properties. Erie is an excellent choice if you’re looking for budget-friendly rates with perks like identity theft protection and guaranteed replacement costs.

Chubb, however, is perfect for people with fancy homes. They offer more coverage if you need to rebuild your home and extra safety for expensive jewelry and art. When comparing these two, it’s also essential to consider how much homeowners insurance costs based on your needs and location, as Erie tends to be more affordable for standard coverage, while Chubb caters to luxury homes.

Both companies are strong in their ways, so choosing the one that matches your house needs and what matters most to you is essential. Why pay more to protect your home when you can find the same coverage for less? Enter your ZIP code to compare home insurance quotes with our free comparison tool.

Frequently Asked Questions

What do Chubb home insurance reviews highlight?

Chubb home insurance reviews emphasize its extended replacement cost coverage, premium service for high-value homes, and specialized options for valuables.

How does Allstate vs. Erie compare?

Allstate offers wider coverage options and an extensive agent network, while Erie focuses on affordability and localized customer care.

How does the American Family vs. Erie compare?

American Family offers customizable policies nationwide, while Erie emphasizes competitive rates and excellent service in regional markets.

Discover more about offerings in our article titled “American Family Insurance Review.”

What is the phone number of the Erie home insurance company?

The Erie home insurance phone number can be found on their official website or through a local Erie agent.

What do Chubb medical insurance reviews mention?

Chubb medical insurance reviews often highlight its tailored international coverage and premium service for policyholders.

The best place to start when you want affordable home insurance is to enter your ZIP code into our free comparison tool.

What do Erie home insurance reviews emphasize?

Erie home insurance reviews highlight its affordable rates, responsive claims process, and unique coverages, such as identity theft protection.

How does Liberty Mutual vs. Erie compare?

Liberty Mutual offers national availability with extensive discounts, while Erie is known for lower rates and excellent local service.

Discover insights in our guide titled “Liberty Mutual Insurance Review.”

How does Geico vs. Erie compare?

Geico offers competitive bundling discounts for auto and home insurance, while Erie emphasizes lower standalone home insurance rates.

How does Erie vs. Safeco compare?

Erie focuses on affordable monthly rates and identity theft coverage. At the same time, Safeco’s insurance review highlights its flexible bundling options and customizable coverage plans, making it a strong choice for diverse insurance needs.

How can I find Chubb insurance agents near me?

Visit the Chubb official website and use their agent locator tool to find nearby Chubb insurance agents.

How does Erie Insurance vs. Allstate compare?

How does MetLife vs. Erie compare?

What does a Chubb insurance review mention?

What does Erie equipment breakdown coverage include?

What does Erie Insurance homeowners policy cover?

How does Allstate vs. Erie Insurance compare?

How can I get a Chubb home insurance quote?

What does Chubb car insurance offer?

What do Chubb car insurance reviews say?

What does Chubb customer service provide?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.