Erie vs. Amica Homeowners Insurance in 2026 (Head-to-Head Review)

Erie vs. Amica homeowners insurance comes down to your priorities; with Erie at $22/month, it is great for water backup coverage and identity restoration to keep things secure. Amica stands out at $46/month with identity fraud protection and home business coverage, perfect for entrepreneurs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated August 2025

Company Facts

Homeowners Policy

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Homeowners Policy

A.M. Best Rating

Complaint Level

Pros & Cons

When evaluating Erie vs. Amica homeowners insurance, it’s clear that both companies provide unique programs designed to meet specific homeowner needs.

Erie offers water backup coverage for damages caused by sewer backups and includes identity restoration assistance, helping homeowners recover quickly from theft. Amica, on the other hand, is prominent for providing identity fraud protection that covers legal expenses and credit control.

Erie vs. Amica Homeowners Insurance Review Rating

Rating Criteria

![]()

Overall Score 4.3 4.3

Business Reviews 4.5 4.5

Claim Processing 4.3 4.8

Company Reputation 4.5 4.5

Coverage Availability 3.5 5.0

Coverage Value 4.6 4.3

Customer Satisfaction 2.2 2.1

Digital Experience 4.0 4.5

Discounts Available 4.7 5.0

Insurance Cost 4.7 4.0

Plan Personalization 4.5 4.5

Policy Options 5.0 4.1

Savings Potential 4.7 4.4

Erie Review Amica Review

It also extends insurance to home-based businesses by safeguarding tools and equipment along with potential liability from business activities. Two companies provide specialized solutions that are designed to assist property owners in safeguarding their most valued assets, as well as addressing specific dangers.

For those seeking the best homeowners insurance, secure affordable coverage using our free quote comparison tool.

- Erie offers water backup coverage and identity restoration at $22/month

- Amica excels with identity fraud protection and home business coverage

- Erie vs. Amica homeowners insurance compares unique programs for all needs

Erie vs. Amica Insurance Pricing Breakdown

This table highlights the monthly rates for homeowners insurance from Erie and Amica, segmented by age and gender. It clearly compares how rates vary between the two providers across different demographics.

Erie consistently offers lower rates than Amica, with noticeable savings for both genders and all age groups. A sixteen-year-old girl, for example, pays $218 with Erie instead of $695 with Amica, and a sixty-year-old man pays $55 with Erie instead of $140 with Amica.

Erie vs. Amica Homeowners Insurance Monthly Rates by Age & Gender

Age & Gender

![]()

Age: 16 Female $218 $695

Age: 16 Male $233 $735

Age: 30 Female $63 $168

Age: 30 Male $66 $176

Age: 45 Female $59 $153

Age: 45 Male $58 $151

Age: 60 Female $53 $136

Age: 60 Male $55 $140

Evidence shows that Erie is the more economical choice in every category. However, Amica offers other advantages like identity fraud protection, which some people may find justified the increased premiums. Reviewing these rates helps you understand which provider aligns with your budget and priorities.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Best Homeowners Insurance: Erie vs. Amica

Amica and Erie are top picks among homeowners with their many practical applications. Amica provides extensive and reliable coverage Through user-friendly methods such as mobile apps and online policy administration.

The company has been around for more than a century. Their A+ financial strength grade guarantees rapid claims processing, and policyholders get unique benefits, including protection against identity theft and coverage for home businesses.

Jeff Root Licensed Insurance Agent

Erie can provide competitive prices and attentive service. Their comprehensive coverage guarantees full compensation for rebuilding your home, even if construction prices continue to climb. So you won’t have to worry about paying more than necessary. Erie offers affordable options and add-ons like earthquake and water backup protection for customizable coverage.

Amica is the best option for homeowners who value specialist coverage and cutting-edge equipment, while Erie offers reasonably priced options with a personal touch. Your choice will depend on whether you value cost-effective, customized plans or unique features.

Erie vs. Amica Rate Insights

Homeowners searching for cost-effective insurance may find Erie’s $22 monthly entry point appealing. Important features like identity restoration and water backup coverage are included in this package, which offers up to $25,000 for resolving stolen personal data.

Amica serves customers who value more comprehensive insurance for $46 a month. It is perfect for business owners or people who require more coverage flexibility because its features include home business coverage and identity fraud protection up to $15,000.

Amica offers cutting-edge features for people prepared to make more significant investments, while Erie offers affordable insurance with necessary protections. Both are top contenders among the best insurance companies, and your decision will depend on whether you value improved options or price.

Real Customer Review of Erie vs. Amica Insurance

The main ratings and customer reviews for Amica and Erie homeowners insurance are displayed in this table. The information provides a clear side-by-side assessment of their financial health, business procedures, and consumer happiness.

Amica excels in customer satisfaction with a J.D. Power score of 746 out of 1,000, surpassing Erie’s score of 733. Similarly, Amica edges ahead in Consumer Reports ratings, earning an 85/100 compared to Erie’s 82/100.

Insurance Business Ratings & Consumer Reviews: Erie vs. Amica Homeowners

Agency

![]()

Score: 733 / 1,000

Above Avg. SatisfactionScore: 746 / 1,000

Above Avg. Satisfaction

Score: A+

Excellent Business PracticesScore: A+

Great Business Practices

Score: 82/100

Positive Customer FeedbackScore: 85/100

Excellent Customer Feedback

Score: 0.60

Fewer Complaints Than Avg.Score: 0.73

Fewer Complaints Than Avg.

Score: A+

Superior Financial StrengthScore: A+

Superior Financial Strength

Both companies, however, show good financial stability, earning an A+ rating from A.M. Best rating. Regarding complaints, Erie somewhat outshines Amica with a ratio of 0.60, whereas Amica’s is 0.73. In this comparison, Amica stands out as the market leader in consumer feedback, whereas Erie stays ahead of the competition when efficiently addressing concerns.

While their shares are smaller compared to bigger players, they still make an impact. The remainder of the market is divided among bigger rivals, with Erie controlling 4% and barely surpassing Amica at 3%.

Both companies are notable, even with lower shares: Amica for its high-end features and Erie for its affordable offerings. They have developed devoted clientele by concentrating on the things that are most important to their policyholders. This analysis emphasizes their distinct position in a cutthroat industry.

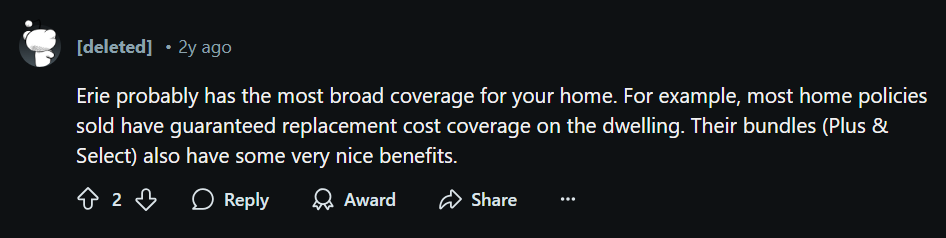

A user pointed out some great things about Erie homeowners insurance in a Reddit thread. They mentioned Erie’s guaranteed replacement cost, which covers rebuilding your home no matter how much costs increase. They also gave a shoutout to the Plus and Select bundles for adding some nice perks.

This review demonstrates why Erie is a solid option for homeowners looking for dependable, adaptable coverage. Erie offers policyholders good value and peace of mind with features like guaranteed replacement costs and numerous bundle options.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Erie Insurance

Pros

- Family-Friendly Pricing: Erie delivers economical premiums, such as $58/month for a 45-year-old man, making it an excellent choice for households aiming to save.

- Enhanced Sewer Backup Safeguard: Provides protection against overflow damages from sewers or drains, a feature missing in many standard policies.

- Local Support With Dedication: Erie gives customers tailored advice and trustworthy help through a broad network of agents. Unlock details in our Erie insurance review.

Cons

- Coverage Areas With Restrictions: The services are only available in a few states; this limits its reach to a broader audience.

- Simple Digital Tools: The platform is missing up-to-date features such as live claim tracking or adaptable policy changes on the internet

Pros and Cons of Amica

Pros

- Outstanding Support for Recovery From Fraud: This covers costs such as legal help and restoring credit, which is perfect for protecting oneself against identity theft.

- Customized Coverage for Home Office: Gives protection to work instruments, inventory, and responsibility. It is designed for small business owners who run their businesses from home.

- Highly Rated for Claims Service: Known for quick, efficient claims resolution and frequently praised in customer feedback.

Cons

- Expensive for Young Drivers: Monthly rates like $735 for a 16-year-old male are high. Learn more in our Amica insurance review.

- Limited In-Person Interaction: Heavily dependent on virtual communication, which may not appeal to clients who prefer face-to-face consultations.

Key Features of Erie and Amica Homeowners Insurance

Erie vs. Amica homeowners insurance revealed key strengths and drawbacks for each provider, helping highlight who might benefit most from their offerings. Erie stands out with affordable rates, such as $58/month for a 45-year-old male, and unique water backup coverage.

However, Amica has a J.D. Power and Associates insurance company ratings score of 903/1,000, great identity fraud protection, including reimbursement for legal fees, and a stellar customer satisfaction rating. Due to these unique qualities, both companies are positioned as competitive choices for homeowners looking for specific advantages and good value.

Spend time comparing several home insurance companies online to ensure you have the best coverage at the best cost. You can get a policy that precisely suits your needs for coverage and price by weighing your possibilities. Get started today by entering your ZIP code into our free quote tool.

Frequently Asked Questions

What makes Erie vs. Amica a strong choice for homeowners?

Amica is the best at resolving claims and offers benefits like various coverage options and identity fraud protection, while Erie provides reasonable prices and individualized local service.

How does AAA compare to Amica for homeowners insurance?

AAA offers discounts and extra benefits like roadside assistance, while Amica has a stellar reputation for its easy claims procedure and adaptable insurance options.

Which offers better value for homeowners, Erie or Safeco?

Safeco provides substantial discounts and customizable policy options, while Erie is known for its affordable prices and excellent agent service. According to Safeco’s insurance review, the company’s flexible policies and generous discount programs make it a good pick for homeowners with a wide range of needs.

What should homeowners know about USAA versus Amica insurance?

USAA serves military families with exclusive benefits and discounts, while Amica offers excellent customer service, identity protection, and home business coverage.

Which offers better budget-friendly coverage, Safe Auto or Amica?

Safe Auto provides low-cost, basic coverage, but Amica delivers greater value with premium features, superior claims service, and tailored policy options.

How does USAA compare to Erie for homeowners insurance?

USAA specializes in military-specific benefits, while Erie focuses on budget-friendly rates, personalized local service, and extensive coverage options. A USAA insurance review highlights its exclusive offerings for military families, including tailored discounts and exceptional customer support.

Are Amica insurance reviews consumer reports reliable for making decisions?

Yes, Consumer Reports is a dependable source for reviewing Amica because it offers extensive and trustworthy insights into the company’s operations.

How does Allstate compare to Amica for homeowners?

Amica is commended for its sophisticated coverage options, including home business insurance and prompt claims processing, while Allstate provides a broad range of coverage and discounts.

What sets State Farm apart from Amica for homeowners?

State Farm is well-known for its vast coverage options and huge agent network, but Amica is notable for its high client satisfaction and additional benefits like fraud protection. A review of State Farm homeowners insurance highlights the reliable alternative that the company offers.

What makes Safeco or Amica better for homeowners?

Safeco offers a variety of user-friendly savings and plans, while Amica is recognized for its responsive claims process and focus on customers.

How does Geico compare to Erie for homeowners insurance?

How does Amica compare to Geico for homeowners insurance?

Which offers more value for homeowners, Liberty Mutual or Erie?

How do AAA and Erie compare for homeowners insurance?

What is the better choice for homeowners, Nationwide or Erie?

Who offers better coverage for budget-conscious homeowners, Erie or Safe Auto?

How does MetLife compare to Amica for homeowners insurance?

Does Amica pay out claims?

Does Amica have a cancellation fee?

Can you cash out on an Amica insurance claim?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.