Does USAA home insurance cover roof replacement? (2026 Coverage Details)

Does USAA home insurance cover roof replacement? USAA provides comprehensive roof coverage starting at $125/month, offering repairs and full replacements for storm, fire, and hail damage through USAA's approved contractors, helping military families protect their biggest investment.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2025

Does USAA home insurance cover roof replacement? As a homeowner, protecting your biggest investment is crucial, especially when it comes to expensive roof repairs. Learn exactly what USAA covers for roof repairs that starts at $125/month, including coverage limits, claim processes, and qualifying events like storm damage.

We’ll guide you through filing a successful claim and working with USAA’s approved contractors to restore your roof. Discover policy requirements, deductible details, and how to maximize your coverage.

Our comprehensive guide helps military families understand their USAA homeowners insurance coverage and make informed decisions about their policy. Get the best homeowners insurance at the best price by using our free comparison tool above.

- USAA roof coverage costs average at $125 per month

- File claims through USAA’s 24/7 claims portal and work with approved contractors

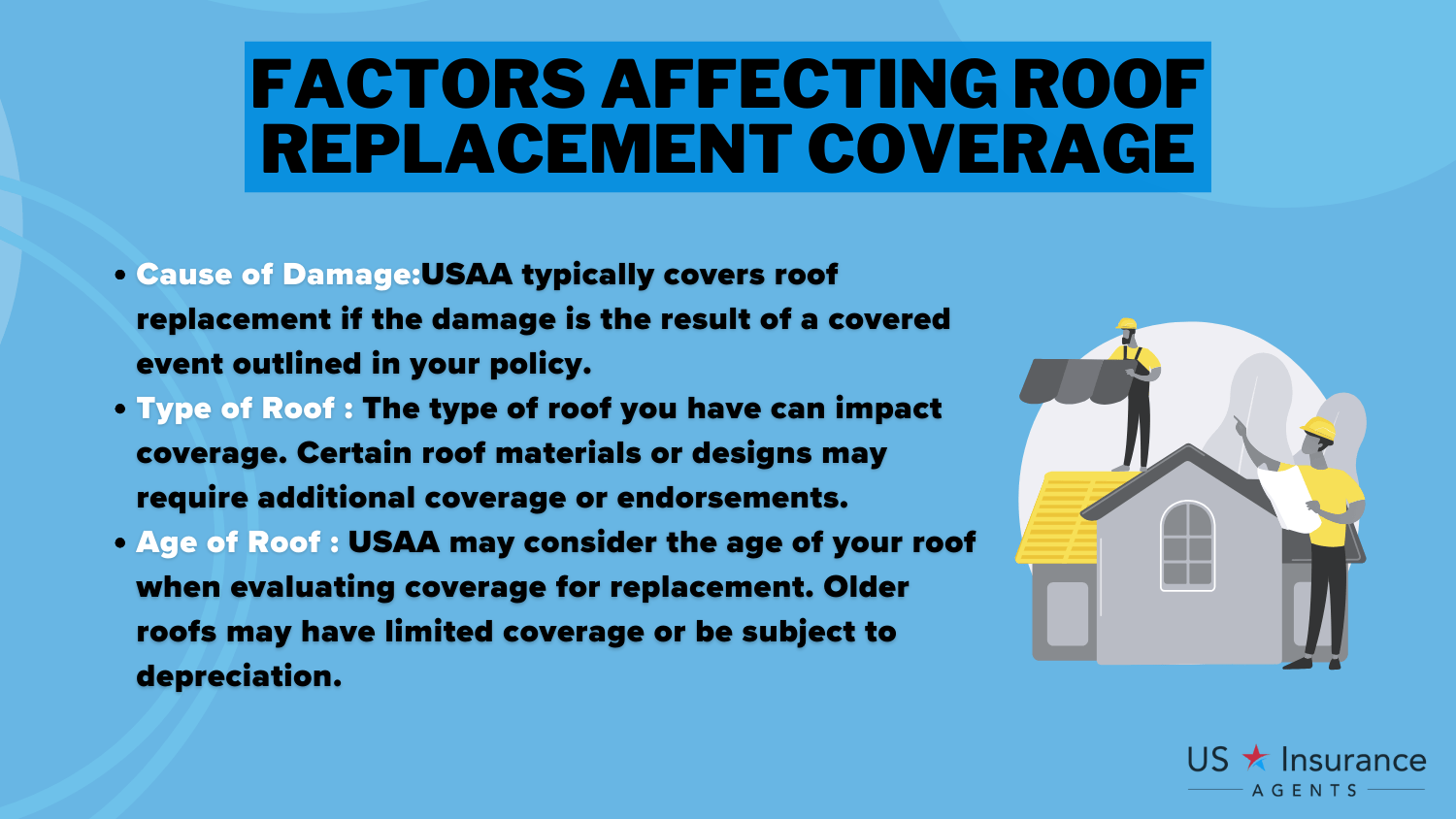

- Coverage depends on roof age, material type & cause of damage

Understanding Homeowners Insurance

Before delving into the specifics of USAA homeowners insurance, it’s essential to have a good understanding of homeowners insurance in general. Homeowners insurance is a type of insurance policy that protects your home and its contents in case of damage or loss due to covered events. These events may include theft, fire, natural disasters, or vandalism and costs may average about $125 per month.

Having comprehensive home insurance from USAA can provide roof replacement insurance coverage that protects you from unexpected damage.

The typical homeowners insurance coverage consists of various components that work together to provide comprehensive coverage. Understanding these key components is crucial in deciphering what your policy covers and what it does not. When it comes to homeowners insurance, there are several key components that you should be familiar with:

- Dwelling Coverage: This component of homeowners insurance covers the cost of repairing or rebuilding your home if it is damaged or destroyed by a covered event, such as a fire or storm.

- Personal Property Coverage: Personal property coverage helps protect your belongings, such as furniture, clothing, and electronics, from covered events such as theft or damage.

- Liability Coverage: Liability coverage provides financial protection in case someone is injured on your property and you are found legally responsible for the injury or damages.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered event, additional living expenses coverage can help pay for temporary housing and other related costs.

Understanding these key components of homeowners insurance can help you make informed decisions when selecting a policy that suits your needs. It is always advisable to consult with an insurance professional who can guide you through the process and help you navigate the intricacies of homeowners insurance.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Overview of USAA Homeowners Insurance

Now that we have a general understanding of homeowners insurance, let’s take a closer look at USAA homeowners insurance. USAA, or the United Services Automobile Association, was founded in 1922 and is known for providing insurance and financial services to members of the military community and their families.

Although membership is primarily exclusive to military personnel, certain eligibility criteria may allow others to become members.

USAA has a long-standing history of serving the military community. Initially formed to provide automobile insurance to military officers as well as their signature USAA car insurance discounts, the company has since expanded its offerings to include various insurance products, banking services, and investment options.

Over the years, USAA has become a trusted name in the insurance industry, recognized for its commitment to serving the unique needs of military personnel and their families. The company has continuously adapted to the changing landscape of the military community, offering innovative solutions and personalized services to its members.

USAA’s dedication to its members is evident in its strong financial stability and customer satisfaction ratings. The company has consistently received high ratings from reputable organizations, reflecting its commitment to providing reliable and comprehensive insurance coverage.

Types of Policies Offered by USAA

You may be wondering, “What does USAA home insurance cover?” USAA offers several types of insurance policies, including homeowners insurance. Their homeowners insurance policies provide coverage for your dwelling, personal property, liability insurance, and additional living expenses.

Furthermore, USAA offers optional coverage and endorsements that can be tailored to meet your specific needs, including USAA’s home circle and USAA’s home warranty plan.

When it comes to homeowners insurance, USAA understands that every individual and family has unique circumstances and requirements. That’s why they offer flexible coverage options, allowing you to choose the level of protection that suits your needs and budget through USAA’s homeowners insurance quote services.

In addition to the standard coverage, USAA provides additional benefits to its homeowners insurance policyholders. These benefits may include identity theft coverage, USAA’s lost jewelry claim coverage, and even coverage for military uniforms.

What’s a meaningful way to #GoBeyondThanks for someone’s service? Even small gestures of support can mean a lot. Learn more at https://t.co/fJDaa7FKUZ #VeteransDay pic.twitter.com/tmz1jrxQbW

— USAA (@USAA) November 11, 2024

USAA also offers a variety of discounts to help you save on your homeowners insurance premium, including USAA’s new roof discount. These discounts may be based on factors such as the age of your home, the presence of safety features, or even your membership tenure with USAA.

It’s important to note that the coverage provided by USAA homeowners insurance may vary depending on your location and the specific policy you choose. Be sure to review the terms of your policy or consult with a USAA representative to understand USAA requirements and the extent of your coverage.

When it comes to filing a claim, USAA aims to make the process smooth through USAA contractor portal. They have a dedicated claims team that is available 24/7 to assist you in the event of a covered loss.

USAA Homeowners Insurance Coverage

USAA homeowners insurance typically covers a wide range of perils, including fire, vandalism, and specific natural disasters. This means that if your home is damaged or destroyed by any of these covered events, USAA will be there to help you recover. If you’re asking whether USAA homeowners insurance covers theft, the answe is yes, USAA offers comprehensive coverage for theft incidents.

One of the most important aspects of homeowners insurance is coverage for the structure of your home. With USAA, you can rest easy knowing that your roof is included in this coverage. If your roof is damaged or destroyed by a covered event, USAA homeowners insurance will cover the cost to repair or rebuild it.

But USAA homeowners insurance doesn’t stop with roof insurance. It also provides coverage for your personal property, such as furniture, electronics, and clothing. If any of these items are damaged, stolen, or destroyed by a covered event, USAA will help you replace them. This means that you won’t have to bear the financial burden of replacing your belongings on your own.

In addition to protecting your home and personal property, USAA homeowners insurance also includes liability coverage. This means that if someone is injured on your property and you are found liable, USAA will help cover the costs associated with their medical expenses and legal fees.

Furthermore, USAA homeowners insurance offers additional living expenses coverage. If your home becomes temporarily uninhabitable due to a covered event, USAA will assist you with the costs of alternative accommodations, such as hotel stays or rental properties. This ensures that you and your family can continue to live comfortably while your home is being repaired or rebuilt.

Limitations and Exclusions of USAA Homeowners Insurance

While USAA homeowners insurance provides comprehensive coverage, it’s important to understand that there may be limitations and exclusions to coverage. These limitations and exclusions can vary depending on your specific policy and location.

For example, USAA homeowners insurance may have limits on coverage for certain high-value items such as jewelry, artwork, or collectibles. It’s important to review your policy or speak with a USAA representative to determine if you need additional coverage for these items.

Ty Stewart Licensed Insurance Agent

Additionally, USAA homeowners insurance typically does not cover damage caused by certain events, such as floods or earthquakes. If you live in an area prone to these types of events, you may need to consider purchasing separate insurance coverage or endorsements to safeguard against them.

USAA homeowners insurance is designed to provide you with comprehensive coverage and peace of mind. Whether it’s protecting the structure of your home, your personal belongings, or providing liability coverage, USAA has you covered.

Review your policy, speak with a USAA representative, and ensure that you have the right coverage for your specific needs. With USAA homeowners insurance, you can feel confident knowing that your home is protected.

Roof Replacement and Homeowners Insurance

Now that we have a better understanding of USAA homeowners insurance coverage, let’s explore the importance of roof maintenance and the typical causes of roof damage.

Typical Causes of Roof Damage

Maintaining a healthy roof is crucial to protecting your home from the elements. Regular roof maintenance can help identify and address potential issues before they become major problems. There are several factors that can cause damage to your roof.

Typical Causes of Roof Damage

| Cause | Description |

|---|---|

| Severe Weather Conditions | Heavy rain, hail, or strong winds that can weaken or damage roofing materials. |

| Impact from Falling Trees or Branches | Physical damage caused by debris or falling objects during storms or due to tree proximity. |

| Prolonged Exposure to Sunlight and UV Rays | Over time, sunlight and UV rays can degrade roofing materials, leading to cracks and weakness. |

| Poor Installation or Faulty Roofing Materials | Improper installation or substandard materials that make the roof vulnerable to damage and leaks. |

Understanding the potential causes of roof damage can help you take proactive measures to minimize the risk and protect your home. Performing routine inspections, cleaning gutters, and removing debris can prevent water damage, leaks, and other issues that may lead to costly repairs or the need for a roof replacement.

Read More: Does USAA homeowners insurance cover roof damage?

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding USAA’s Policy on Roof Replacement

USAA homeowners insurance typically covers the repair or replacement of your roof if it is damaged or destroyed as a result of a covered event, such as a storm or fire. This coverage extends to the materials and labor required to replace your roof. This USAA roof replacement coverage Reddit post demonstrates fast approval and excellent support:

However, it’s important to note that each claim is subject to a deductible. A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Be sure to review your specific policy details or consult with a USAA representative to understand your deductible and the coverage provided.

Frequently Asked Questions

Does USAA cover roof replacement?

Yes, USAA typically covers roof replacement when damage occurs from covered perils like storms, hail, or fire. Coverage depends on your specific policy terms and the cause of damage. Homeowners must meet their deductible before coverage applies. Documentation and professional assessment are required for claims.

Does USAA cover roof damage?

USAA covers roof damage from covered perils including storms, hail, wind, falling objects, and fire. The coverage extent depends on your policy type and damage cause. Claims require inspection and documentation, with coverage applying after meeting the deductible.

Don’t wait until it’s too late – protect your home by using our free quote comparison tool below to find affordable home insurance today.

How to get insurance to pay for roof replacement?

Document all damage thoroughly with photos and videos. Contact USAA immediately after damage occurs. Get professional inspection from approved contractors and . Maintain records of roof maintenance. Submit detailed claim with evidence of damage cause. Work with USAA’s claims adjusters throughout the process.

You should also make sure that USAA preferred roofers have the best business insurance for roofers so you’re protected against any potential liability issues or damages that may occur during the replacement process.

Does USAA cover roof leaks?

USAA covers roof leaks if caused by covered perils like storms or sudden damage. However, leaks from poor maintenance or wear-and-tear typically aren’t covered. Report leaks promptly and document the damage. Coverage depends on leak cause and policy terms.

Does USAA do home insurance?

Yes, USAA provides comprehensive home insurance for eligible members, including dwelling coverage, personal property protection, and liability insurance. Coverage options can be customized based on individual needs and location requirements.

Does USAA home insurance cover plumbing?

USAA covers sudden and accidental plumbing damage, including burst pipes and water damage. Coverage excludes gradual damage or maintenance issues. Claims require documentation and prompt reporting. Policy terms determine specific coverage limits. Find out if USAA homeowners insurance covers plumbing.

Does USAA home insurance cover roof leaks?

USAA covers roof leaks from sudden, accidental damage or covered perils. Regular maintenance issues or wear-and-tear leaks typically aren’t covered. Document damage immediately and contact USAA for claim assessment.

Does USAA homeowners insurance cover fences?

Yes, USAA’s other structures coverage typically includes fences. Coverage applies to damage from covered perils like storms or falling trees. Maintenance-related damage isn’t covered. Deductibles apply before coverage begins.

Does USAA homeowners insurance cover tornadoes?

Yes, USAA covers tornado damage to homes, including structural damage, personal property loss, and additional living expenses if home becomes uninhabitable. Coverage applies after deductible is met. Prompt damage documentation is essential.

Read More: What state has the most tornadoes?

Does USAA offer home warranty?

While USAA doesn’t directly provide home warranties, they partner with select providers to offer member discounts on home warranty plans. These warranties cover appliances and home systems beyond standard insurance coverage.

Compare quotes from the cheapest home insurance companies by entering your ZIP code into our free tool below.

How does the USAA hail damage claim process work?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.