Does State Farm home insurance cover sewer backup? (2026 Coverage Details)

Does State Farm home insurance cover sewer backup? A standard State Farm policy doesn’t cover sewer lines unless the damage is caused by a covered peril. However, optional State Farm sewer line coverage is available, typically with $10,000–$20,000 limits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated January 2025

Does State Farm home insurance cover sewer backup? Standard State Farm policies don’t typically cover sewer line backup unless the damage results from a covered peril, like sudden pipe collapse. However, homeowners can add optional State Farm sewer and drain coverage to help offset repair costs.

Depending on the specific policy, this add-on typically provides coverage limits of $10,000–$20,000 and may cover damages caused by backups, clogs, or structural failures in sewer lines. It’s important to note that this coverage often excludes certain situations, such as damage caused by normal wear and tear or flooding.

Reviewing the details of your homeowner’s insurance policy to grasp what is included and what is excluded is essential. Homeowners should consult their State Farm agent about optional endorsements and coverage to protect against unexpected expenses. Enter your ZIP code above to learn more and check what coverage options are available in your area.

- State Farm policies exclude sewer line backup unless from a covered peril

- Optional State Farm sewer and drain coverage adds $10K–$20K for repairs

- Coverage excludes damage from wear, tear, and flooding; check policy for details

Understanding Homeowners Insurance

Does homeowners insurance cover sewer backup? Homeowners insurance is a vital policy designed to protect homeowners from financial setbacks due to property damage or loss. It provides coverage for the structure of your home, personal belongings, liability concerns, and additional living expenses. Some policies may also include protection against incidents like sewer backup.

When you purchase homeowners insurance, you enter into a contract with an insurance provider. In return for your premium payments, the insurer agrees to cover costs related to repairing or replacing your home and belongings in case of a covered loss.

Typical Coverage Provided by Homeowners Insurance

Most homeowners insurance policies include coverage for:

- Property Damage: Covers perils like fire, windstorms, theft, and vandalism.

- Personal Belongings: Protects items such as furniture, electronics, and valuables.

- Liability Protection: Covers medical expenses and legal fees if someone is injured on your property.

- Additional Living Expenses: Pays for temporary housing and meals if your home becomes uninhabitable due to a covered event.

Important Considerations

- Exclusions: Standard policies often exclude floods, earthquakes, and wear and tear. Additional coverage may be required.

- Lender Requirements: Mortgage lenders usually require homeowners insurance to protect their investment.

Homeowners insurance is a key safeguard for protecting your home, belongings, and finances from unexpected events. Understanding your policy’s coverage, including any exclusions or limitations, ensures you have adequate protection tailored to your needs. Review your policy regularly and consider additional coverage if necessary to stay fully prepared.

Read More:

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm Homeowners Insurance: An Overview

State Farm is a reputable provider of homeowners insurance, delivering dependable coverage to safeguard your home and belongings. With an extensive network of agents and a commitment to prioritizing customer needs, State Farm is ready to assist you at every step, whether you’re managing routine coverage or facing unforeseen challenges.

About State Farm Insurance

State Farm Insurance is one of the largest insurance providers in the United States, serving millions of policyholders. With a history dating back to 1922, State Farm has established itself as a trusted and reliable source of insurance protection for homeowners nationwide.

State Farm is renowned for its commitment to customer service and its extensive network of agents, who are dedicated to assisting policyholders in understanding the complexities of homeowners insurance.

Whether it’s answering questions, providing guidance, or aiding with claims, State Farm agents are there every step of the way, including in situations such as dealing with a flooded basement or navigating through the intricacies of State Farm hazard insurance.

Coverage Options Offered by State Farm

So, does State Farm cover sewer lines? State Farm offers customizable homeowners insurance options, including dwelling coverage, personal property protection, liability insurance, and specific risk add-ons. Additional coverages include State Farm home systems protection for comprehensive protection.

Dwelling coverage protects the home’s structure, including walls, roof, and foundation, from covered perils like fire and windstorms. Personal property protection covers belongings like furniture, appliances, and electronics. The service line coverage by State Farm highlight the thorough nature of this protection.

Liability coverage helps pay medical expenses, legal fees, and related costs if someone is injured on the property and the homeowner is held liable. Optional coverages include identity theft, water backup, and personal injury protection, allowing homeowners to customize their policies.

Policyholders can choose coverage levels based on their home’s value, possessions, and insurance endorsements. State Farm agents help assess needs and recommend tailored options.

Read More: State Farm Insurance Review & Ratings

Sewer Backup: What it is and Why it Matters

Experiencing sewer backup, a distressing situation that can wreak havoc on your home and pose serious health risks, prompts the question: do I need sewer backup insurance? This problem arises when the sewer lines responsible for transporting wastewater from a property encounter blockages or overwhelming flow, leading to the unfortunate backflow of sewage into the home.

Tim Bain Licensed Insurance Agent

Such blockages may stem from various causes, such as infiltration by tree roots, obstructions, or underlying structural deficiencies. When a sewer backup happens, it can lead to extensive damage to a home and its contents.

The contaminated water can flood the basement or lower levels, causing significant damage to walls, flooring, electrical systems, and personal belongings. The aftermath of a sewer backup is not only financially burdensome but also emotionally draining.

Causes of Sewer Backup

Tree root infiltration is one of the common causes of sewer backup. Over time, tree roots can grow into sewer lines, causing blockages and hindering the flow of wastewater. As the roots continue to expand, they can exert pressure on the pipes, leading to cracks and even complete collapse.

Clogs are another prevalent cause of sewer backup. These clogs can result from a variety of materials, such as grease, debris, or foreign objects, being flushed down the drains. Over time, these substances accumulate and create blockages, preventing the proper flow of wastewater.

Structural issues within the sewer system can also contribute to backup problems. Aging pipes, corrosion, or misaligned connections can all lead to blockages and sewage flowing back into your home. These issues often require professional intervention to rectify and prevent future occurrences.

The Impact of Sewer Backup on Your Home

The impact of a sewer backup on your home can be devastating. The contaminated water that floods the basement or lower levels can cause extensive damage to the structural integrity of your property. The walls may become weakened, and the flooring may need to be completely replaced. Electrical systems can be compromised, posing a significant safety hazard.

In addition to the physical damage, the presence of sewage in your home poses serious health risks. Sewage contains harmful bacteria, viruses, and other hazardous substances that can contaminate the air and surfaces. Exposure to these contaminants can lead to various health issues, including gastrointestinal problems, respiratory infections, and skin irritations.

Comparison of Standard Homeowners Insurance vs. Sewer Backup Endorsement

| Feature | Standard Homeowners Insurance | Sewer Backup Endorsement |

|---|---|---|

| Applicability | General home structure and contents | Targeted sewer or drain-related issues |

| Claims for Sewer Overflows | X | Specifically covered |

| Cost | Included in base premium | Additional premium for endorsement |

| Coverage Customization | Limited customization | Allows specific sewer-related coverage |

| Coverage for Sewer Backups | X | Specifically includes sewer backups |

| Damage from Flooding | Excluded (requires separate flood policy) | Excluded (requires separate flood policy) |

| Ice Dam Water Damage | Covered under standard policy | X |

| Water Damage from Burst Pipes | Covered if sudden and accidental | Covered if endorsement is added |

It is crucial to address a sewer backup promptly to minimize the damage and prevent further health risks. Professional cleanup and restoration services should be sought to ensure thorough cleaning, disinfection, and proper disposal of contaminated materials.

Taking proactive measures to prevent sewer backup, such as regular maintenance and inspections of your sewer lines, can also help safeguard your home from this unfortunate event.

Read More: Does homeowners insurance cover sewer backup?

State Farm’s Coverage for Sewer Backup

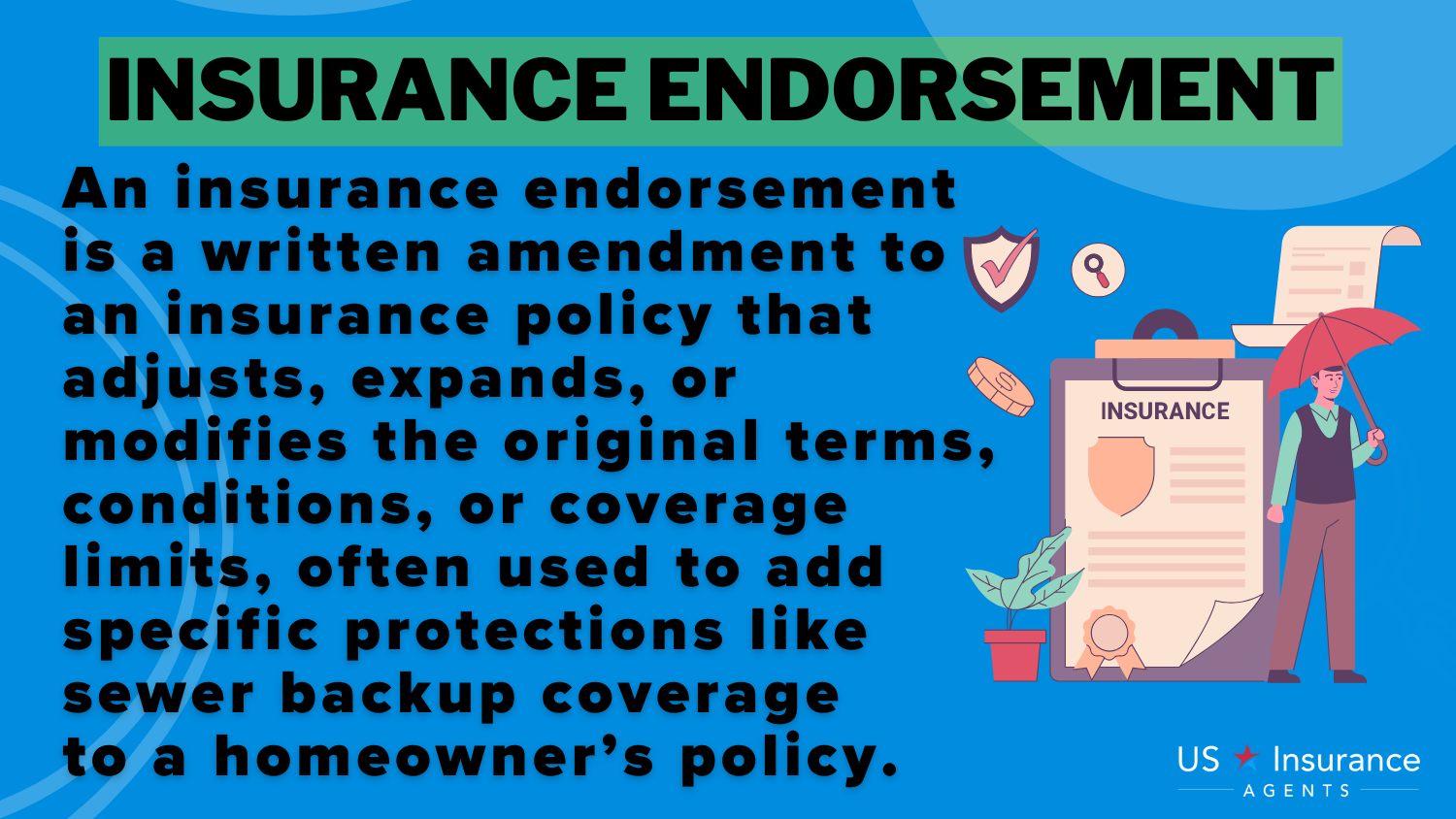

What does State Farm home insurance cover when it comes to sewer backup incidents? State Farm’s standard homeowners insurance policy doesn’t inherently incorporate protection for such incidents. However, the insurer provides optional endorsements or riders that allow homeowners to augment their policies, specifically to address this risk.

When it comes to protecting your home from unexpected events, it’s crucial to understand the details of your insurance policy. Sewer backup can lead to costly damages, so it’s essential to explore your options for coverage.

It is important for homeowners to review their policies and consult with their State Farm agent to determine the extent of their coverage and if any endorsements are necessary to protect against sewer backup. Your agent can provide valuable insights into the potential risks and the best course of action to safeguard your home.

Instances Where Sewer Backup is Covered

State Farm offers optional sewer backup coverage, which may include reimbursement for damages to the home structure, personal property, and cleanup or restoration expenses. Sewer backup incidents often impact not just the home but also personal belongings, causing financial loss. State Farm’s coverage can help offset these costs by providing compensation for damages.

Coverage limits and deductibles apply, so homeowners should review their policy documents and consult their State Farm agent to understand their protection against sewer backups.

State Farm Sewer Backup Coverage Scenarios and Details

| Scenario | Coverage Details |

|---|---|

| Frozen/Burst Pipes with Maintenance | Protected if maintenance verified |

| Sewer Backup Endorsement Added | Covered if endorsement purchased |

| Sudden and Accidental Pipe Leaks | Included in basic policy |

| Water Damage from Ice Dams | Addressed in standard policy |

By taking the time to thoroughly review your policy and discussing your needs with your agent, you can make informed decisions about the coverage options available to you. State Farm is committed to providing comprehensive coverage to homeowners, and their optional endorsements for sewer backup are just one example of how they strive to meet the unique needs of their policyholders.

Remember, insurance policies can be complex, and it’s always a good idea to seek professional guidance to ensure you have the right coverage for your specific situation. Your State Farm agent is there to help you navigate the intricacies of your policy and provide you with the peace of mind you deserve.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to File a Claim for Sewer Backup with State Farm

If you experience sewer backup and have purchased the necessary endorsement through State Farm, follow these steps to file a claim:

- Document the damage: Take photos or videos of the affected areas and any damaged property for evidence.

- Contact State Farm: Notify your State Farm agent or contact the claims department to initiate the claims process.

- Provide documentation: Provide all necessary documentation, including the details of the incident, photos/videos, and any invoices or estimates for repairs.

- Cooperate with the adjuster: State Farm may assign an adjuster to assess the extent of the damage. Cooperate and provide any requested information.

- Review the settlement: Once the claim is processed, review the settlement offer from State Farm. If satisfactory, accept the offer.

- Repair and restore: Use the settlement funds to repair and restore your home to its pre-loss condition, following any local regulations and building codes.

Filing a claim for sewer backup with State Farm involves clear documentation, prompt communication, and cooperation throughout the process. By following these steps, you can ensure a smoother claims experience and help restore your home and belongings effectively. Always review your policy to understand your coverage and limits fully.

What to Expect After Filing a Claim

After filing a claim, State Farm will review the information provided and assess the validity of the claim. They may contact you for additional information or send an adjuster to inspect the damages.

Once the claim is approved, State Farm will provide the appropriate reimbursement according to the terms of your policy. Keep in mind that deductibles may apply, and it is essential to review the settlement offer to ensure it adequately covers your expenses.

Sewer backup coverage is not automatically included in State Farm’s homeowners insurance policies. However, homeowners can discuss their specific needs with a State Farm agent and consider adding the necessary endorsements to obtain coverage for sewer backup. Additionally, understanding the steps to file a claim is essential to navigate the claims process effectively and ensure prompt reimbursement in case of a covered loss.

Read More:

- How To File a Claim With State Farm Homeowners Insurance

- How long does it typically take for State Farm to process an car insurance claim?

Protecting Your Home with State Farm’s Sewer Backup Coverage

Is sewer backup insurance worth it? While State Farm’s standard homeowners insurance does not cover sewer backup, homeowners can secure additional protection through optional sewer and drain coverage. This add-on offsets repair costs for home structure, personal property, and cleanup, but it has exclusions like wear and tear and flooding.

By understanding your policy and collaborating with a State Farm agent, you can customize your coverage to safeguard your home against unforeseen events like sewer backups. Staying informed and proactive helps you prepare for potential risks, ensuring peace of mind and financial stability.

Your insurance agent’s role in the claims process is crucial, offering guidance and support to navigate coverage options and streamline the claims experience. Always remember to document damages and follow the claims process to ensure a smooth experience when you need it most. Enter your ZIP code below to check available coverage options in your area and speak with a State Farm agent for further assistance.

Frequently Asked Questions

Does State Farm homeowners insurance cover sewer backup?

Does homeowners cover sewer backup? Yes, State Farm’s homeowners insurance cover sewer backup. The coverage is typically included in their standard homeowners insurance policy, providing assurance for State Farm sewer line insurance and State Farm sewer backup coverage.

What are State Farm’s endorsement codes for homeowners insurance?

State Farm’s endorsement codes offer insights into extra coverage choices for homeowners, including options like State Farm water line coverage. These codes are beneficial for understanding the additional protection available under State Farm’s homeowners insurance policies.

Learn more about the most common insurance acronyms.

What does sewer backup coverage include?

What does sewer backup insurance cover? State Farm’s backup of sewer and drain insurance coverage usually encompasses covering expenses for repairing or substituting property that incurred damage due to a sewer backup. Additionally, it involves covering the expenses associated with cleansing and sanitizing the impacted area.

What are some common causes of sewer backups?

Typical reasons for sewer backups encompass substantial precipitation, infiltration of tree roots into sewer lines, obstructions from grease or debris, and the aging or degradation of sewer infrastructure. These factors can directly impact backup sewer and drain coverage provided by State Farm and underscore the importance of State Farm’s backup of sewer and drain endorsement.

Is sewer backup coverage available as an add-on or is it included in the standard policy?

State Farm usually incorporates sewer backup coverage into its standard homeowners insurance policy. Nonetheless, it’s advisable to examine your policy or seek guidance from your State Farm agent to verify the precise terms of your coverage, including State Farm’s septic system coverage and backup of sewer and drain coverage.

Are there any limits to the sewer backup coverage provided by State Farm?

Yes, State Farm typically imposes limitations on its insurance for sewer backup. These restrictions may differ based on the individual policy, underscoring the importance of examining your policy documents or reaching out to your State Farm agent for precise details regarding the coverage limits related to State Farm sewer line coverage.

Are there any exclusions to State Farm’s sewer backup coverage?

While State Farm generally offers backup sewer and drain coverage, there could be specific exceptions. For instance, damages resulting from flooding or water seepage through the foundation might not be included. It’s crucial to thoroughly examine your policy or consult your State Farm agent to grasp any potential exclusions, especially concerning state farm service line coverage.

Does State Farm homeowners insurance cover roof leaks?

Depending on the reason for the damage and the specifics of the coverage, State Farm’s homeowners insurance might provide protection for roof leaks. This applies similarly to the backup of sewer and drain insurance coverage and State Farm’s hazard insurance.

For more details on roof leak coverage, check out whether State Farm homeowners insurance covers roof leaks.

Does State Farm homeowners insurance cover sewer line replacement?

Yes, State Farm homeowners insurance provides coverage for sewer line replacement if the damage is caused by a covered peril, including State Farm sump pump coverage and State Farm water backup coverage.

Does State Farm homeowners insurance cover septic systems?

Does State Farm cover septic systems? Yes, State Farm homeowners insurance typically extends coverage to septic systems, including protection against sewer backup incidents and backup of sewer and drain coverage.

To get all the details about septic coverage, read our article, “Does State Farm home insurance cover septic tanks?”

Are solar panels covered under State Farm homeowners insurance?

Does State Farm homeowners insurance cover sewage backup incidents?

How does State Farm handle debris removal coverage?

What does State Farm’s service line coverage entail?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.