Does State Farm home insurance cover roof replacement? (2026 Insurance Facts)

Does State Farm home insurance cover roof replacement? State Farm insurance covers approved claims after their adjusters complete a thorough roof inspection through their 24/7 claims service. Additionally, State Farm home insurance coverage includes damage from storms, wind, and hail.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2025

Does State Farm home insurance cover roof replacement? With their 24/7 claims service, homeowners can get clear answers about their roof coverage options and requirements. State Farm’s roof inspection process evaluates damage from storms, wind, and other covered perils. Think of it like a four-point home insurance inspection.

With nearly a century of experience providing homeowners insurance, State Farm offers various coverage options tailored to different roof types and conditions, though coverage amounts depend on factors like age and maintenance.

Don’t overpay on your home insurance – enter your ZIP code above into our free comparison tool to find affordable coverage for your home today.

- State Farm covers roof replacement through their 24/7 claims service

- Coverage amounts vary based on roof age, material type, and maintenance history

- Homeowners can choose from State Farm approved contractors or their own roofers

Understanding Homeowners Insurance

A homeowners insurance policy serves as a safeguard for your residence and possessions against specified risks. To ensure adequate coverage, insurers use the insurance-to-value (ITV) ratio to determine the appropriate level of financial protection for your dwelling, personal belongings, and additional structures on your premises, alongside liability insurance.

And when it comes to State Farm and its stance on roof replacement claims, you might encounter situations where they seem reluctant to cover the costs. Understanding State Farm roof coverage and State Farm roof replacement requirements is essential before filing a claim.

Additionally, the role of a State Farm roof adjuster becomes pivotal in determining the outcome of such claims, particularly in cases of State Farm roof replacement wind damage. Having homeowners insurance is crucial as it protects your major investment, providing vital financial security in unforeseen circumstances like storms, fires, or burglaries.

Without this coverage, you might encounter significant expenses for repairing or replacing your home and possessions. It’s important to be aware of your State Farm roof replacement deductible and potential State Farm roof replacement cost before making a claim.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

An Overview of State Farm Homeowners Insurance

State Farm is one of the largest providers of homeowners insurance in the United States. With a history spanning nearly a century, State Farm has established a reputation for reliable coverage and exceptional customer service.

Types of Coverage Offered by State Farm

State Farm offers a typical homeowners insurance policy options to meet the unique needs of homeowners. Their policies typically include:

| Coverage Type | Description |

|---|---|

| Dwelling | Protects home structure |

| Personal Property | Covers personal belongings |

| Liability Protection | Protects injury/damage costs |

| Additional Living Expenses | Offers temporary living costs |

State Farm provides optional enhancements alongside their standard coverage options. These additional offerings, like identity restoration coverage, earthquake coverage, and home systems protection, give homeowners the flexibility to tailor their policies to meet their unique requirements.

This ensures that individuals can customize their insurance plans according to their specific needs, including addressing concerns such as State Farm roof hail damage and staying updated through the State Farm roof inspector update.

State Farm acknowledges the uniqueness of every home and homeowner, which is why they offer customized insurance solutions. Their knowledgeable agents work closely with customers to assess their individual risks and recommend appropriate coverage options, including those related to State Farm roof insurance and State Farm roof policy.

When it comes to filing a claim, State Farm strives to make the process as smooth and hassle-free as possible. They have a 24/7 claims support hotline, online claims filing, and a network of trusted contractors and service providers to help homeowners get back on their feet quickly after a loss.

State Farm remains a top choice for homeowners seeking reliable insurance protection, offering comprehensive coverage options. Whether you’re a first-time homeowner or have owned your home for years, State Farm is dedicated to providing the peace of mind you deserve, particularly when it comes to state farm roof replacement coverage and state farm roof replacement depreciation.

State Farm Homeowners Insurance and Roof Replacement

Many homeowners need clarity if State Farm will cover their roof costs. How to get State Farm to pay for a new roof and getting a roof claim from State Farm processes are common concerns.

While State Farm home insurance roof replacement offers protection, cases of State Farm denying roof claims exist. Your State Farm roof deductible affects coverage amounts and repair approvals.

State Farm Insurance Roof Coverage

State Farm homeowners insurance policies may cover roof replacement, but coverage depends on factors like roof claims and your homeowners insurance deductible from State Farm. Some homeowners report State Farm only paying for half roof repairs based on age and condition.

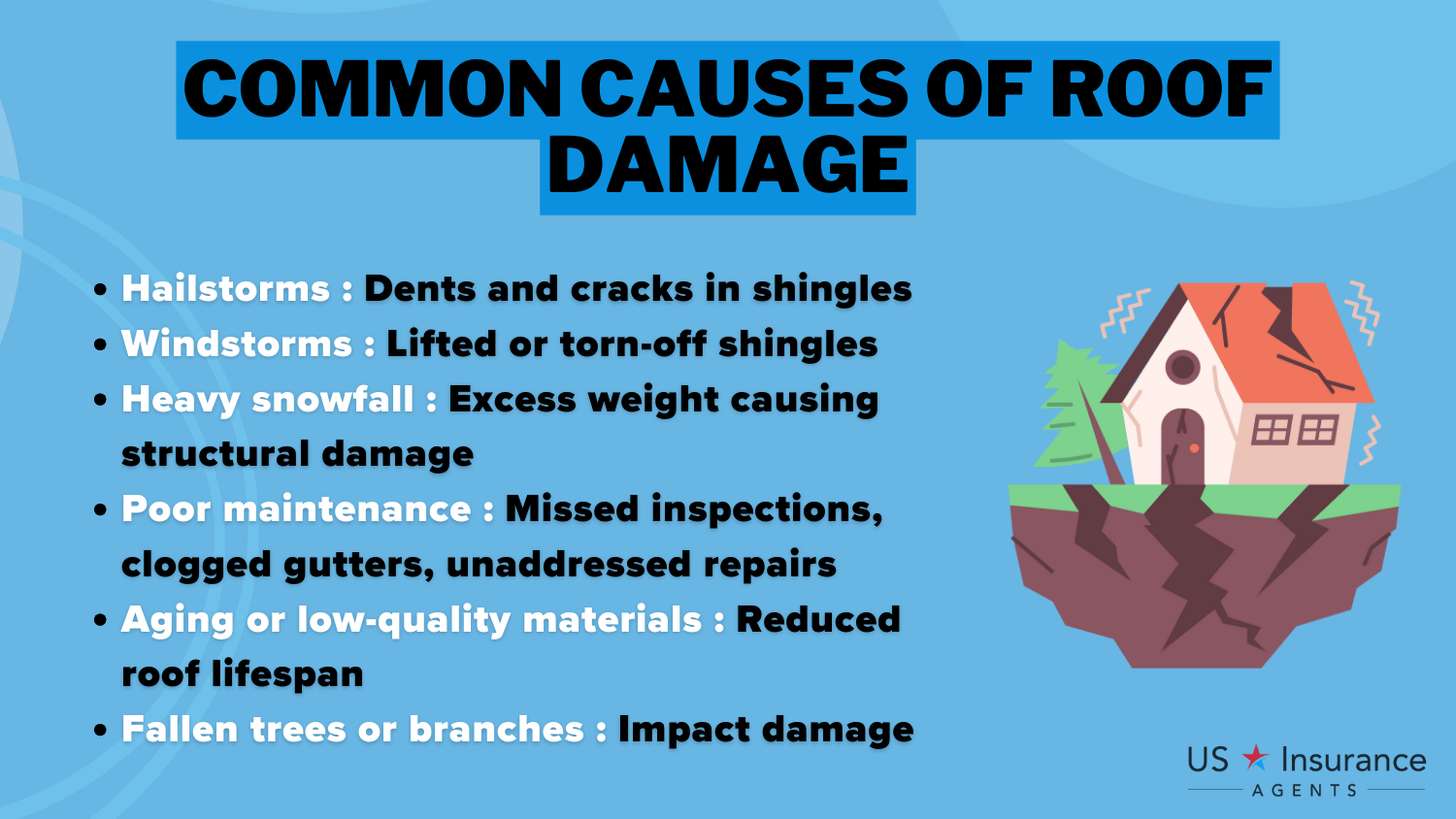

When assessing State Farm roof repair needs, policies typically cover damage from storms or fire. For hail damage roof insurance claim at State Farm, complete replacement may be necessary. The Fair Insurance Act protects homeowners during these claims. State Farm roof claims are processed based on each covered perils.

Additionally, your roof’s age impacts coverage. Older roofs nearing their lifespan’s end may receive less coverage compared to newer ones, as insurance companies consider natural wear and tear.

Chris Abrams LICENSED INSURANCE AGENT

Understanding what a deductible is and coverage limits outlined in your policy is crucial. It’s important to thoroughly examine your policy to grasp the deductible you’re obligated to pay and the maximum coverage permitted.

Being aware of these specifics empowers you to make well-informed choices regarding your roof replacement and guarantee that you have the essential financial backing from your insurance policy. This is especially relevant in cases like a TN Farm Bureau roof replacement policy or if you’ve faced a denied roof claim from USAA.

Factors Influencing Roof Replacement Coverage

When filing a claim for roof replacement, several factors affect your coverage. If your roof sustains damage from storms or fire, State Farm processes roof claims and provides coverage through State Farm approved contractors.

They consider your roof’s age and roof ratings for insurance. A new roof installation can help you qualify for a State Farm discount for a new roof, and you can add roof surfaces extended coverage for extra protection.

Your deductible and coverage limits determine out-of-pocket costs before insurance applies. Understanding these factors helps plan your budget and ensures proper protection for your home.

State Farm Roof Claim Process

If you experience roof damage and need to file a claim with State Farm, it’s essential to know how to file a claim with State Farm homeowners insurance to ensure a smooth experience. Dealing with roof damage can be stressful, but knowing how to navigate the claim process can help ease your worries and get your roof repaired as quickly as possible.

When filing a claim for roof replacement, the first step is to contact your State Farm agent directly. They will guide you through the process and provide you with the necessary information and forms. Alternatively, you can also file the claim online or by phone. State Farm offers multiple channels to make the claim process convenient for their policyholders.

When filing the claim, it’s crucial to provide all necessary details. This includes explaining the cause of the damage, whether it was due to a storm, falling debris, or any other reason. Be as specific as possible and provide any supporting documentation or photos you may have. These can help expedite the claim process and ensure that the damage is accurately assessed.

What to Expect During the Claim Process

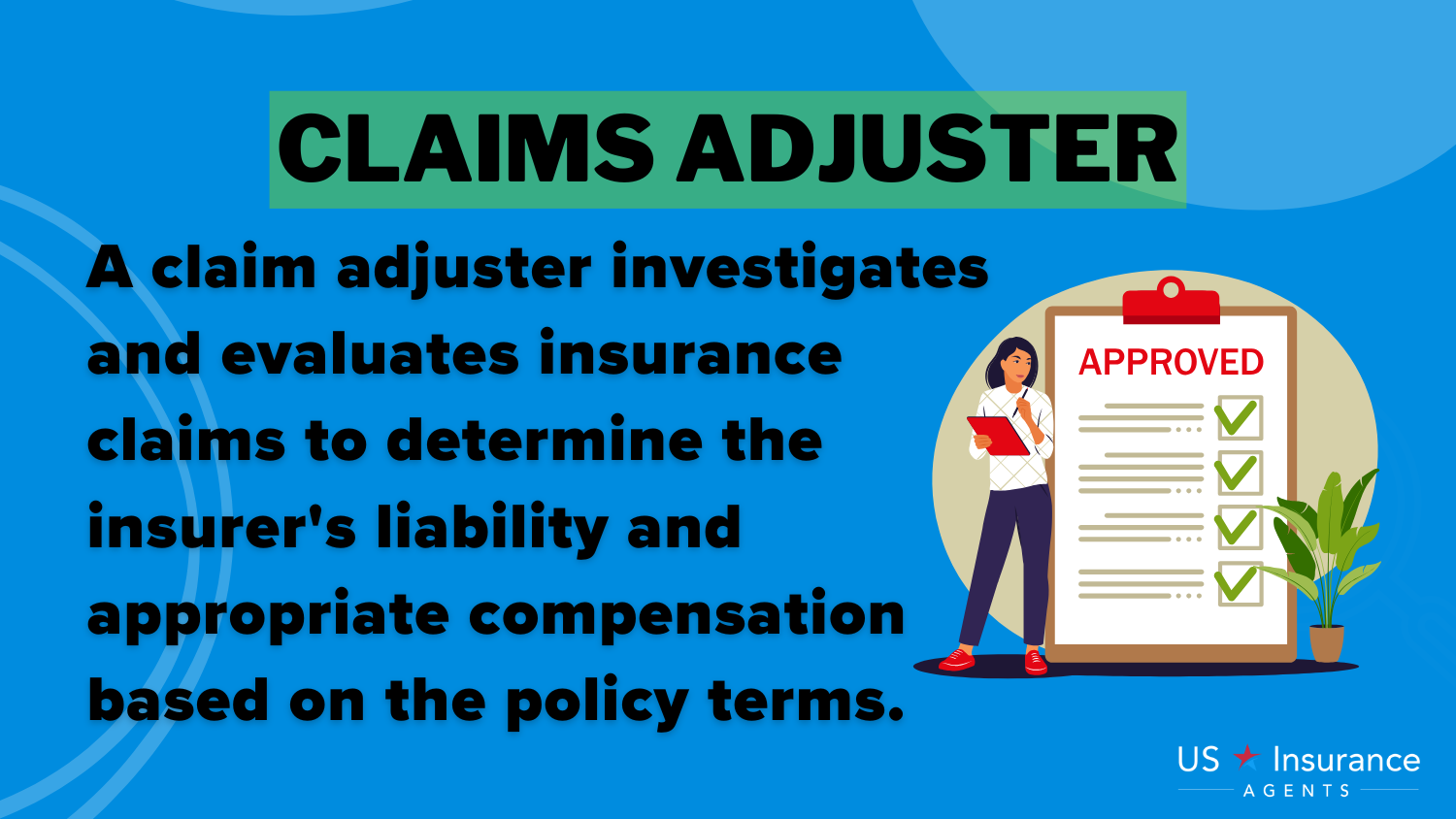

Once your claim is submitted, a claims adjuster from State Farm will be assigned to your case. The adjuster will contact you to schedule an inspection of the roof damage. During the inspection, the adjuster will thoroughly assess the extent of the damage and determine if it qualifies for coverage under your policy. They will also review your policy to understand the coverage limits and any applicable deductibles.

State Farm takes the claim process seriously and aims to provide a fair assessment of the damage.

The claims adjuster will consider various factors, such as the age of the roof, the cause of the damage, and the overall condition of the property. They may also take into account any previous claims you have made in the past.

If your claim is approved, you will receive compensation based on your policy coverage and any deductibles. State Farm insurance roof replacements are handled through State Farm approved roofers, though you may choose your own contractor. They’ll guide you through the State Farm roofing claim process and explain any roof depreciation rate that may apply.

If you have small business insurance questions, we can help personalize your coverage to meet your specific needs. #SmallBusinessTips https://t.co/FbZQZjwh6a pic.twitter.com/QTBdUFtB6v

— State Farm (@StateFarm) November 4, 2024

The claims adjuster will explain why State Farm won’t replace your roof, which could be due to lack of coverage, pre-existing conditions, or other policy factors. Some homeowners may qualify for the State Farm new roof program instead of a full replacement.

If your claim is denied, explore options like appealing the decision or getting additional contractor estimates. State Farm’s claims department can help you understand the denial and explore alternatives. Remember to communicate openly with your State Farm agent throughout the process to address any concerns.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maximizing Your Roof Replacement Coverage

While homeowners insurance can mitigate the costs of roof replacement, there are ways to maximize your coverage and ensure you’re adequately protected as well as knowing how to document damage for homeowners insurance claims.

Regular Roof Maintenance and Inspection

Maintaining your roof is crucial for extending its lifespan and preventing potential damage. Regular inspections and maintenance can help identify and address small issues before they escalate into more significant problems.

By effectively maintaining your roof, you decrease the risk of damage and increase the likelihood of receiving coverage if a claim is necessary.

Choosing the Right State Farm Home Insurance

In conclusion, homeowners insurance is a vital investment that provides financial protection for your property and belongings. State Farm homeowners insurance may cover roof replacement, but coverage depends on various factors, including the cause of damage, the age of the roof, and policy-specific details.

The type of roofing materials used can impact both your roof’s longevity and the coverage provided by your insurance policy. Some roofing materials, such as impact-resistant shingles or metal roofs, may qualify for discounts or enhanced coverage due to their durability and resistance to damage.

Understanding your policy, filing a claim correctly, and taking proactive roof maintenance measures will enable you to get cheap home insurance and make the most of your homeowners insurance coverage. Explore home insurance costs in your area by entering your ZIP code into our free comparison tool below.

Frequently Asked Questions

Does State Farm cover roof damage?

State Farm covers roof damage from covered perils, including storms, wind, fire, and hail, which are subject to your deductible and policy terms.

How much does State Farm pay for a new roof?

Payment varies based on your policy, deductible, roof age, and damage type. Coverage is determined after adjuster inspection and may cover full or partial replacement costs.

Does State Farm cover roof leaks?

Yes, State Farm covers sudden and accidental roof leaks caused by covered perils, but not leaks from poor maintenance or wear and tear.

Read more: Does State Farm homeowners insurance cover roof leaks?

How long does it take to put on a new roof?

Standard residential roof replacement typically takes 1-3 days for average-sized homes, depending on weather conditions, roof complexity, and material type. Make sure your home is protected by entering your ZIP code into our home insurance comparison tool below today.

Does State Farm cover gutters?

Gutters are typically covered under dwelling coverage when damaged by covered perils like storms or fallen trees.

Does State Farm cover wind damage?

Wind damage is a covered peril under standard State Farm homeowners policies, subject to deductible.

Read More: Homeowners Preparedness Guide for Disasters and Emergencies

Will my homeowners insurance go up if I file a roof claim with State Farm?

Rates may increase after filing a claim, depending on claim history, damage type, and state regulations.

What does State Farm homeowners insurance cover?

Coverage includes dwelling, personal property, liability protection, additional living expenses, storm, fire, and theft damage, plus other structures on property.

Does State Farm homeowners insurance cover foundation repair?

Foundation repairs are covered if damage is caused by covered perils like water line bursts or natural disasters, but not for settling, age-related issues, or poor maintenance. We covered this entirely in our article “Does State Farm homeowners insurance cover foundation repair?”

Does State Farm pay for roof replacement?

Yes, State Farm covers roof replacement costs for damage caused by covered perils, after deductible and subject to policy terms and roof condition.

Don’t wait until it’s too late – enter your ZIP code below into our free home insurance comparison tool to find affordable coverage today.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.