Does Farmers homeowners insurance cover roof damage? (2026 Coverage Answers)

Does Farmers homeowners insurance cover roof damage? Farmers homeowners insurance coverage for roof replacement typically covers damage from covered perils like wind, hail, or fire, with premiums starting at $110 per month. However, wear and tear or poor maintenance aren’t covered by a Farmers homeowners policy.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

Does Farmers homeowners insurance cover roof damage? Farmers homeowners insurance typically covers roof damage caused by certain events, such as wind, hail, or fire. However, it does not cover damage due to wear and tear or lack of proper maintenance.

Roof replacement or repairs resulting from these covered events are generally included in the policy, although coverage may vary depending on the specific terms and conditions of your policy.

It’s important to carefully review your homeowners insurance policy to understand what is and isn’t covered, as well as any applicable deductibles or coverage limits.

For issues caused by non-covered events, such as aging or poor maintenance, you would be responsible for the costs of repairs or replacement.

Finding affordable premiums for home insurance is easy with our free quote comparison tool. Just enter your ZIP code above to find cheap coverage for your home.

- Farmers homeowners insurance covers roof damage from wind, hail, or fire

- Damage from wear and tear or lack of maintenance is not covered

- Check your policy for specific coverage details, deductibles, and claim procedures

Understanding Homeowners Insurance

Before delving into the specifics of Farmers homeowners insurance coverage for roof damage, it is important to grasp the fundamental concept of homeowners insurance and how it functions.

Homeowners insurance is a type of property insurance that provides financial protection in case of damage or loss to your home and its contents. It typically covers damage caused by hazards like fire, lightning, windstorms, Farmers insurance hail damage, theft, and vandalism.

Moreover, homeowners insurance usually offers liability coverage in case someone is injured on your property and you are found legally responsible.

Read more: Liability Insurance: A Complete Guide

Homeowners Insurance Explained

Homeowners insurance is an agreement between you and your insurer, where you pay a premium, and in return, the insurance company covers certain risks to your home and belongings. The most common home insurance coverage includes the main structure of your house, attached areas like garages or decks, and additional structures on your property, such as sheds or fences.

Farmers Homeowners Insurance for Roof Damage: Pros and Cons

| Category | Pros | Cons |

|---|---|---|

| Coverage Options | Extended coverage options available, including roof replacement. | Limitations on coverage for older roofs; may only provide actual cash value (depreciated value) instead of replacement cost. |

| Replacement Cost Value | Often covers roof damage at replacement cost, paying for a full replacement rather than depreciated value. | Coverage may exclude certain types of damage like wear and tear or maintenance issues. |

| Roof Types Covered | Wide range of roof types covered, including metal, asphalt, tile, and wood shingles. | Possible exclusions or limitations for specific roof types in high-risk areas, such as wood shake roofs in fire-prone regions. |

| Discounts | Discounts available for home safety features, potentially lowering premiums for preventive roof measures. | Premiums can be higher for comprehensive roof coverage, particularly for older or high-risk roofs. |

| Claims Support | 24/7 claims support available, making it easier to file and manage roof damage claims. | Deductibles may be high for roof damage caused by natural events like hail or wind, depending on policy specifics. |

Typically, ceilings are covered under homeowners insurance, although ceiling damage and repairs depend on the policy terms and cause of the damage. For example, accidental damage does not cover certain incidents unless specified. Most ceilings use drywall or plaster, which can be easily damaged.

Homeowners insurance also protects personal items like furniture, electronics, appliances, clothing, and jewelry if they are stolen or damaged. Some policies may include a scheduled roof payment option, helping you manage specific roof repair costs over time.

Discover what a typical homeowners insurance policy covers to understand the protection it offers for your home, belongings, and additional structures, helping you choose the right coverage for your peace of mind.

How Homeowners Insurance Work

Homeowners insurance helps cover repair or replacement costs when your property is damaged by a covered event, like fire or theft. With full coverage, the insurer pays for repairs after deducting the Farmers home insurance deductible. Before filing a claim for accidental damage, consider whether the repair cost is worth it, as frequent claims could raise your premium.

To file a claim, contact your insurer immediately with details of the incident. An adjuster will assess the damage to determine coverage. Be aware that the ceiling is not considered part of the roof, so some types of damage may not be included. Once approved, the insurance company provides payment minus the deductible.

Farmers Homeowners Insurance Monthly Rates for Roof Damage Coverage by State

| State | Monthly Rate for Roof Damage Coverage |

|---|---|

| California | $150 |

| Florida | $200 |

| Georgia | $145 |

| Illinois | $130 |

| Michigan | $110 |

| New York | $160 |

| North Carolina | $135 |

| Ohio | $120 |

| Pennsylvania | $125 |

| Texas | $140 |

Knowing your policy details, including the cost to cancel insurance policy, helps you make the best choices. Homeowners insurance motivates people to buy by providing peace of mind and financial protection against unexpected losses.

Farmers insurance has been a trusted provider of homeowners insurance since its establishment many years ago. With a strong reputation for outstanding customer service and comprehensive coverage options, Farmers insurance has become a popular choice among homeowners looking for reliable protection.

Read more: Best Homeowners Insurance

History of Farmers Homeowners Insurance

Farmers insurance, established in 1928, initially aimed to provide affordable coverage for farmers who were often overlooked by other insurers. Originally focused on insurance for farmers, the company expanded its offerings to include homeowners insurance coverage that protects against property damage, personal liability, and additional living expenses.

Over time, Farmers introduced specialized options like Farmers roofing insurance to cover roof damage. Their Farmers insurance homeowners policy grew popular for its comprehensive coverage, and the company’s reputation for service led many to believe that Farmers homeowners insurance is good for a wide range of needs.

Farmers’ local agents continue to offer personalized solutions for homeowners across the country.

Types of Policies Offered by Farmers

Farmers insurance offers a wide range of homeowners insurance policies to meet various needs, whether you’re a first-time homeowner or have a larger property. Here’s an overview of the policies available:

- Standard Homeowners Insurance: This covers property damage due to events like fire, theft, vandalism, and severe weather, ensuring you can repair or replace your damaged property.

- Personal Liability Coverage: This coverage helps protect homeowners in case someone is injured on their property and files a lawsuit. It covers legal costs, settlements, or judgments.

- Additional Living Expenses: If your home is uninhabitable due to a covered event, Farmers insurance will cover the costs of temporary housing, meals, and other necessary expenses.

- Optional Coverage Enhancements: These allow homeowners to add extra protection for valuable items like jewelry and artwork. Farmers also offers coverage for identity theft to help you recover if you’re a victim of fraud.

- Scheduled Roof Payment through Farmers Insurance in the US: This feature is available to help with roof repairs or replacements, offering financial assistance for homeowners in the US.

Farmers insurance is committed to providing reliable coverage, but it’s essential to understand that certain types of losses would not be covered by a homeowner’s policy. For instance, C coverage on a homeowners policy may not cover everything, and area not covered by most homeowners insurance should be carefully considered.

Additionally, it’s important to understand the difference between Type A and Type B insurance to choose the appropriate policy, whether you need A and B coverage or a more basic option. With a variety of coverage options, Farmers insurance continues to be a trusted provider for homeowners looking for comprehensive protection.

Read more: How does the insurance company determine my premium?

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverage for Roof Damage: The Basics

Roof damage can arise from diverse causes, often resulting from extreme weather conditions or aging materials, and may lead to significant financial losses for homeowners. Understanding how a homeowner’s insurance policy addresses such events is crucial.

Options like Farmers insurance coverage for roof replacement typically provide protection against weather-related damage caused by hail, wind, or heavy snow—common culprits of roof issues. For problems caused by wear and tear or poor upkeep, Farmers insurance coverage for roof leaks can offer valuable support.

Justin Wright Licensed Insurance Agent

If a full roof replacement is necessary, Farmers scheduled roof payment in the US helps homeowners cover costs through manageable payment plans. Filing a claim may require completing the Farmers confirmation of roof replacement form to document the extent of the damage and repairs.

Additionally, the Farmers insurance scheduled roof payment ensures transparency in the disbursement process, giving homeowners peace of mind as they address roof repairs or replacements.

Learn how replacement cost homeowners insurance protects your home and belongings by ensuring repairs or replacements match the current market value, giving you confidence in your policy choices.

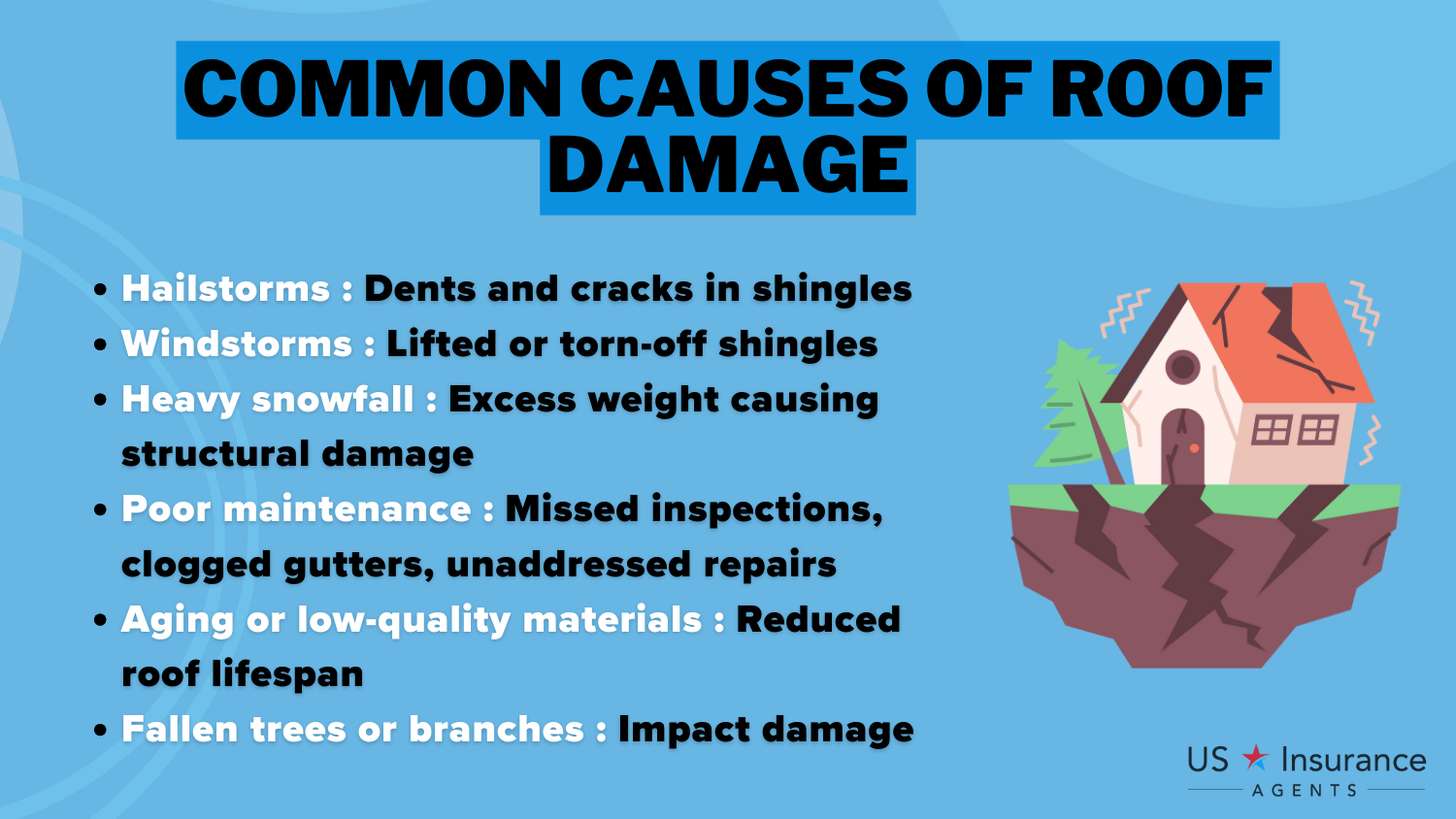

Common Causes of Roof Damage

Roof damage is commonly caused by severe weather, poor maintenance, and falling trees. Hailstorms can cause cracks in shingles, while wind damage to roofs can lift or tear off shingles, exposing your roof to water infiltration.

Heavy snowfall adds excessive weight, increasing the risk of collapse, and may require a roof materials loss settlement. Subsequently, neglecting maintenance, say for example, ignoring minor repairs or using outdated materials, can shorten your roof’s lifespan and might need a scheduled roof payment through Farmers insurance.

Fallen trees from storms can cause severe structural issues, so roof repair due to tree damage is essential. To address these issues, Farmers homeowners insurance provides coverage for roof damage caused by water, and Farmers insurance estate plans offer options to help cover repair and replacement costs.

Read more: Insurance-to-Value (ITV) Ratio: Homeowners Insurance Terms Explained

The Role of Homeowners Insurance in Roof Repairs

Homeowners insurance, including Farmers homeowners insurance in Hawaii, typically covers roof damage caused by covered perils such as severe weather, fire, or falling objects.

For example, Farmers homeowners insurance coverage for roof replacement in Denver may provide financial assistance for repairing or replacing a roof damaged by hailstorms or strong winds. Roof repairs due to tree damage or falling debris are also covered if the cause is a covered peril.

Policies like the Farm Bureau roof replacement policy often include deductibles, which are the out-of-pocket amounts you must pay, and coverage limits, which cap the insurer’s payment. For those with a Farmers insurance scheduled roof payment in Texas, understanding these terms ensures you are prepared for roof repair costs and know what your policy covers.

Check how to file a home insurance claim to make the claims process simple, ensuring you receive the compensation you deserve.

Farmers Homeowners Insurance Does Cover Roof Damage

Farmers insurance covers roof damage caused by covered perils in many of its Farmers homeowners insurance policies. However, it is essential to review your policy carefully, as some plans may offer limited or not full coverage.

Be aware of additional factors like the Farmers homeowners insurance cancellation fee and the Farmers homeowners insurance grace period, which may affect your policy management.

Comparing your plan with an insurance company with the best coverage can ensure you have the protection you need for roof repairs or replacement.

Read more: Not Having Homeowners Insurance Can Turn a Small Incident into a Financial Nightmare

Understanding Your Policy

When considering whether your Farmers homeowners insurance covers roof damage, carefully review your policy documents, including the coverage limitations, exclusions, and deductibles. Pay attention to the specific language regarding roof damage to determine the extent of coverage provided.

Factors Affecting Roof Damage Coverage

The coverage provided by Farmers insurance roof coverage can depend on factors like the cause of the damage, the age of your roof, and the type of policy you have. Regular maintenance and the use of high-quality roofing materials can also affect the level of coverage.

For those in California, scheduled roof payment through Farmers insurance in California is a helpful option that allows homeowners to manage the costs of roof repairs or replacement over time.

Read more: Raising Your Deductible – Weighing the Risks vs. the Benefits

Filing a Claim for Roof Damage With Farmers Homeowners Insurance

If your roof sustains damage and you believe it falls within the coverage provided by your Farmers homeowners insurance policy, you may need to file a claim. Promptly filing a Farmers roof claim is essential to ensure a smooth claims process and minimize any further damage resulting from the initial incident.

Steps to File a Claim

To file a claim for roof damage with Farmers insurance, follow these general steps:

- Contact your Farmers insurance agent or the claims department as soon as possible to report the damage.

- Provide your policy information and describe the nature and extent of the roof damage, including when it occurred and the probable cause.

- Cooperate in the claims process by documenting the damage, obtaining necessary estimates, and providing any additional information requested by Farmers Insurance.

- Follow any specific guidance provided by Farmers insurance to facilitate the claims settlement process.

- Anticipate an inspection by a Farmers insurance adjuster to assess the damage and determine the appropriate coverage.

- Once the Farmers insurance roof claim is evaluated and approved, you can proceed with the necessary repairs or replacements in consultation with Farmers insurance.

By following these steps, you can ensure a smooth claims process and get the support you need from Farmers insurance to repair or replace your roof efficiently.

Read more: Townhouse Homeowners Insurance: A Complete Guide

What to Expect During the Claims Process

During the claims process, expect open communication with Farmers Insurance representatives who can guide you through the necessary steps.

Be prepared to provide relevant documents, photographs of the roof damage, and any other information required to support your claim. It is important to remain patient throughout the process, as the evaluation of the roof damage and claims settlement may take some time.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Farmers Insurance Reviews

Farmers insurance reviews and ratings provide valuable insights into customer experiences. Feedback on the Farmers insurance roof replacement policy, Farmers homeowners insurance, and Farmers home insurance reviews on BBB highlights key strengths of the company’s services.

Sharon Mistowski's interview with Caroline Nix

Homeowners' insurance that covers your roof:

Your roof is more than just shelter—it's protection for your entire home. Roof insurance offers peace of mind, covering damages from storms, hail, and other unforeseen events. #fyp pic.twitter.com/ACEouq9XMn— Mistowski (@mistowski) November 18, 2024

Customers frequently commend the Farmers insurance roof replacement policy for its fast claims process and strong coverage. Farmers homeowners insurance offers some key strengths including ease of getting a quote and good customer service to its homeowner clients.

Farmer insurance BBB accredited with an A rating, which means that anyone with concerns about business was addressed and promised a good experience. Farmers insurance gives reliable insurance and calmness of mind to its shoppers.

Farmers Insurance as a Trusted Option for Homeowners

Farmers insurance is a well-established and reputable provider with a long history of offering reliable coverage to customers across the United States. Known for its wide range of insurance products and excellent customer service, Farmers insurance has earned a solid reputation.

Commonly, Farmers homeowners insurance includes coverage for roof damage caused by covered perils. By understanding your policy and filing a claim quickly when necessary, you can take full advantage of the protection Farmers insurance offers to help offset the costs of roof repairs or replacement.

Be sure to review your policy documents and consult with your Farmers insurance agent to ensure you have the right coverage for your roof, and enjoy the benefits of comprehensive homeowners insurance.

Find out what you need to do if homeowners insurance canceled your policy.

Protect your home with confidence. Use our free quote comparison tool below to find a reputable company offering the comprehensive coverage you need at low rates.

Frequently Asked Questions

What types of roof damage are covered by Farmers homeowners insurance?

Farmers homeowners insurance typically covers roof damage from wind, hail, fire, lightning, and falling objects. Coverage depends on your specific policy.

Are there any exclusions to roof damage coverage under Farmers homeowners insurance?

Yes, Farmers homeowners insurance may exclude roof damage from wear and tear, poor maintenance, floods, or earthquakes. Check your policy for details. Compare quotes from the cheapest home insurance companies by entering your ZIP code into our free tool below.

How can I file a roof damage claim with Farmers homeowners insurance?

To file a roof damage claim with Farmers, contact your agent or the claims department promptly and provide photos and repair estimates.

Read more: Homeowners of America Insurance Company Review & Ratings

Does Farmers Insurance cover roof leaks?

Yes, Farmers homeowners insurance may provide coverage for roof leaks if they are a result of covered perils, such as storm damage or a fallen tree. However, if the leak is due to wear and tear or lack of maintenance, it may not be covered. Review your policy or consult with your insurance agent to determine the specifics of your coverage.

What is a scheduled roof payment with Farmers insurance?

Farmers scheduled roof payment refers to an arrangement where the insurer agrees to cover the cost of repairing or replacing your roof according to a predetermined schedule. Scheduled roof payment with Farmers can involve regular payments towards maintaining or replacing your roof over a specified period.

Does Farmers insurance cover roof replacement?

Yes, Farmers insurance covers roof replacement for damage from covered perils like fire, wind, hail, and vandalism. Coverage details depend on your policy.

Learn more about mobile home insurance and make sure your mobile home is fully protected.

What is included in the Farm Bureau roof replacement policy?

In a Farm Bureau roof replacement policy, expenses related to repairing or replacing your roof due to covered perils such as storm damage, wind, or hail were usually covered.

What does Farmers homeowners insurance in Hawaii cover?

Farmers homeowners insurance in Hawaii typically provides coverage for your home and personal property against a range of perils such as fire, theft, vandalism, and liability. Specific coverage options may vary, so it’s essential to review your policy for details.

What is a roof materials loss settlement in insurance?

A roof materials loss settlement refers to the process by which an insurance company compensates policyholders for the repair or replacement of damaged roof materials. This settlement is typically based on factors such as the age, condition, and type of roofing materials.

Read more: How To File a Claim With Nationwide Homeowners Insurance

What does my Farmers homeowners insurance cover?

Your Farmers homeowners insurance typically covers your home’s structure, personal belongings, liability protection, and additional living expenses if your home becomes uninhabitable due to a covered peril. Specific coverage details may vary based on your policy.

Does Farmers insurance offer homeowners insurance in California?

What are the most common claims for home insurance?

Which homeowners policy provides the most coverage?

Which homeowners insurance company has the highest customer satisfaction?

How much is home insurance in Texas?

Which area is not covered by most homeowners insurance policies?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.