Cheap Volkswagen Cabrio Car Insurance in 2026 (10 Most Affordable Companies)

Discover the best providers for cheap Volkswagen Cabrio car insurance from Progressive, State Farm, and Allstate, starting at just $58 per month. These companies offer competitive rates, comprehensive coverage, and reliable customer service, making them the top choices for your Volkswagen Cabrio insurance needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated January 2025

Company Facts

Min. Coverage for Volkswagen Cabrio

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Volkswagen Cabrio

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Volkswagen Cabrio

A.M. Best

Complaint Level

Pros & Cons

These companies excel in customer satisfaction and offer a range of options tailored to meet the specific needs of Volkswagen Cabrio owners. With their competitive pricing and robust policy offerings, securing the right coverage becomes both economical and straightforward.

Our Top 10 Company Picks: Cheap Volkswagen Cabrio Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $58 A+ Qualifying Coverage Progressive

#2 $62 B Customer Service State Farm

#3 $64 A+ Infrequent Drivers Allstate

#4 $67 A Customizable Policies Liberty Mutual

#5 $70 A Policy Options Farmers

#6 $73 A++ Bundling Policies Travelers

#7 $76 A+ Vanishing Deductible Nationwide

#8 $79 A Costco Members American Family

#9 $81 A Diminishing Deductible Safeco

#10 $85 A+ Dividend Payments Amica

Choosing any of these car insurance companies ensures reliable protection for your vehicle, backed by excellent service and support. See details on our article titled “Cheapest Car Insurance Companies.”

Use our free quote comparison tool above to find the cheapest coverage in your area.

- Progressive is the top pick for cheap Volkswagen Cabrio car insurance

- Coverage options cater specifically to the unique features of the Volkswagen Cabrio

- Tailored policies meet the specific needs of Volkswagen Cabrio owners

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates: Progressive offers a low monthly rate of $58 for Volkswagen Cabrio car insurance. Read up on the “Progressive Insurance Review & Ratings” for more information.

- Strong Financial Stability: With an A+ rating from A.M. Best, Progressive ensures reliable claims handling for Volkswagen Cabrio owners.

- Tailored Discounts: Progressive provides discounts for various qualifying conditions which can reduce premiums for Volkswagen Cabrio insurance.

Cons

- Variable Customer Satisfaction: Feedback varies, with some Volkswagen Cabrio owners experiencing less than satisfactory service.

- Coverage Limitations: Certain desirable options may not be available or are more costly for Volkswagen Cabrio insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Bundling Policies: Offers significant discounts for Volkswagen Cabrio owners who bundle multiple policies.

- High Low-Mileage Discount: Provides substantial savings for Volkswagen Cabrio drivers with low annual mileage.

- Wide Coverage: Extensive options tailored specifically for the needs of Volkswagen Cabrio owners. Learn more about our offerings in the article titled “State Farm Insurance Review & Ratings.”

Cons

- Limited Multi-Policy Discount: Compared to competitors, the discount for multiple policies for Volkswagen Cabrio is lower.

- Premium Costs: Even with discounts, premiums for Volkswagen Cabrio may be higher than average at State Farm.

#3 – Allstate: Best for Infrequent Drivers

Pros

- Discounts for Low Usage: Allstate offers tailored discounts for Volkswagen Cabrio owners who drive infrequently. Discover information in our article titled “Allstate Insurance Review & Ratings.”

- A+ Financial Rating: Ensures robust support and claim servicing for Volkswagen Cabrio insurance due to its high A.M. Best rating.

- Customizable Policies: Allstate allows Volkswagen Cabrio owners to customize their policies to match their driving habits.

Cons

- Higher Rates for Frequent Drivers: Volkswagen Cabrio owners with higher mileage might face steeper premiums.

- Policy Costs: While offering specific benefits, Allstate’s general rates for Volkswagen Cabrio can be less competitive without discounts.

#4 – Liberty Mutual: Best for Customizable Policies

Pros

- Policy Flexibility: Liberty Mutual offers highly customizable insurance policies for Volkswagen Cabrio owners, allowing for tailored coverage.

- Competitive Premiums: With rates starting at $67, Liberty Mutual provides competitive pricing for Volkswagen Cabrio insurance. To discover more about the company, check out our article titled “Liberty Mutual Review & Ratings.”

- A Rated Stability: A strong A rating from A.M. Best assures dependable service and financial reliability for Volkswagen Cabrio claims.

Cons

- Cost Variability: Premiums can vary widely for Volkswagen Cabrio owners based on customization features, potentially leading to higher costs.

- Customization Complexity: While customization is a benefit, it can also complicate the selection process for Volkswagen Cabrio insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Policy Options

Pros

- Wide Range of Options: Farmers offers a variety of policy options that cater to the specific needs of Volkswagen Cabrio drivers.

- A-Rated Insurance: With an A rating from A.M. Best, Farmers is well-equipped to handle claims for Volkswagen Cabrio insurance reliably.

- Dedicated Coverage Plans: Specialized plans that cater specifically to the unique aspects of insuring a Volkswagen Cabrio. Discover insights in our article titled “Farmers Insurance Review & Ratings.”

Cons

- Higher Starting Rates: Starting at $70, Farmers may be more expensive than some competitors for Volkswagen Cabrio insurance.

- Policy Premiums: Despite the range of options, overall premiums can be high depending on the chosen coverage levels for a Volkswagen Cabrio.

#6 – Travelers: Best for Bundling Policies

Pros

- Discounts for Bundling: Travelers offers significant discounts for Volkswagen Cabrio owners who bundle their car insurance with other policies.

- Highest Financial Rating: With an A++ rating from A.M. Best, Travelers promises exceptional financial stability and claim support for Volkswagen Cabrio insurance.

- Policy Integration: Easy integration of multiple insurance needs, providing a streamlined approach for Volkswagen Cabrio owners. Delve into our evaluation of our article titled “Travelers Insurance Review & Ratings.”

Cons

- Bundling Dependency: To achieve the best rates for Volkswagen Cabrio insurance, bundling is often necessary, which may not be ideal for all customers.

- Rate Adjustments: Periodic rate adjustments can affect the long-term affordability of Volkswagen Cabrio insurance at Travelers.

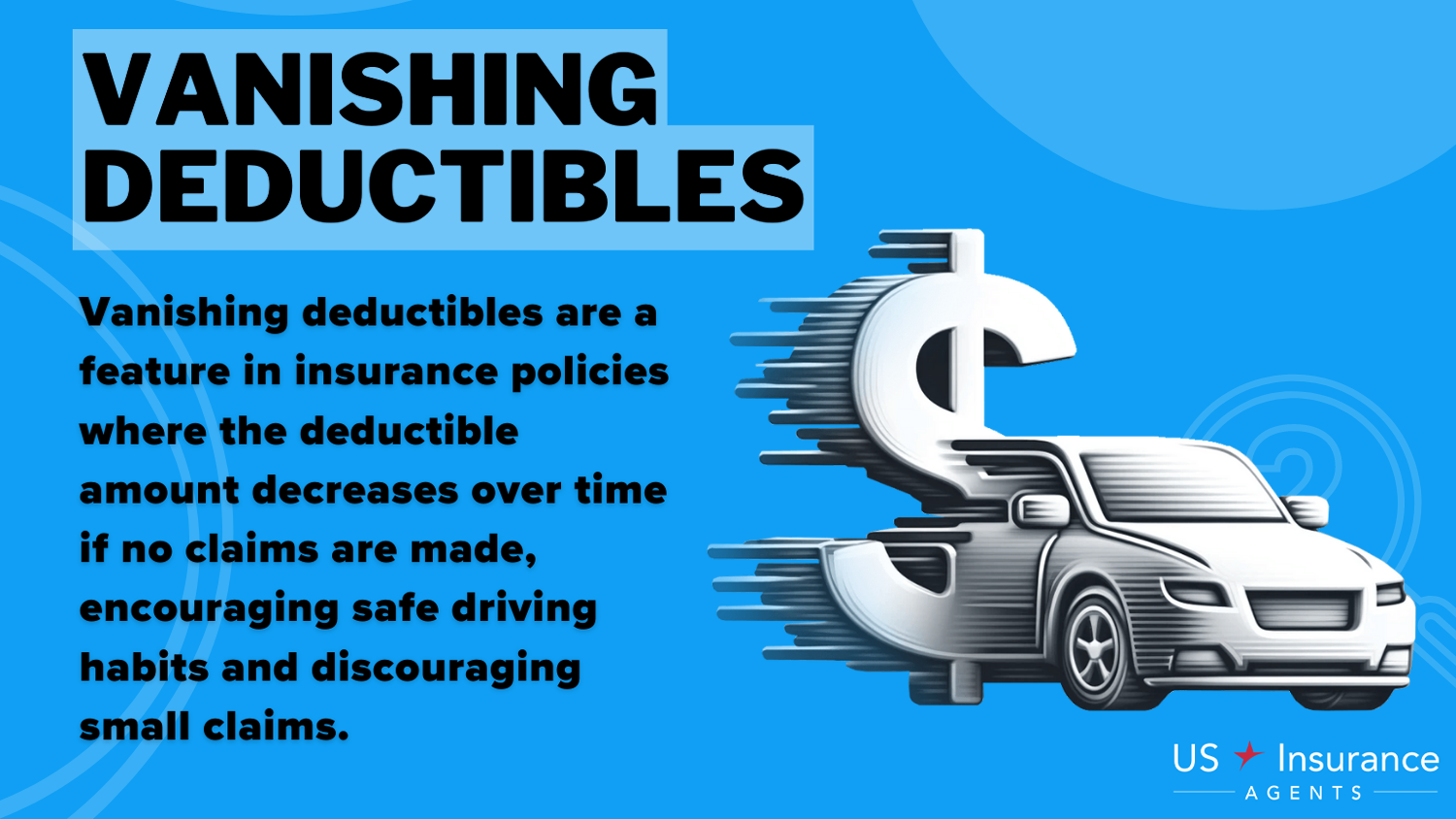

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible that decreases for each year of safe driving, benefiting Volkswagen Cabrio owners.

- A+ Financial Rating: Strong financial stability with an A+ rating from A.M. Best ensures reliable claim services for Volkswagen Cabrio policies. More information is available about this provider in our article titled “Nationwide Insurance Review & Ratings.”

- Flexible Payment Options: Nationwide provides various payment plans, making it easier for Volkswagen Cabrio owners to manage their insurance costs.

Cons

- Premium Adjustments: Nationwide’s premiums may increase after the initial policy period, affecting long-term affordability for Volkswagen Cabrio insurance.

- Deductible Conditions: The vanishing deductible feature requires continuous coverage and no claims, which may not be achievable for all Volkswagen Cabrio owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Costco Members

Pros

- Exclusive Discounts for Members: American Family offers special rates for Costco members, which can significantly lower Volkswagen Cabrio insurance costs.

- Comprehensive Coverage Options: Extensive coverage options are available, providing Volkswagen Cabrio owners with protection tailored to their needs. Access comprehensive insights into our article titled “American Family Insurance Review & Ratings.”

- A Rated Insurer: With an A rating from A.M. Best, American Family promises reliability and solid financial backing for claims involving the Volkswagen Cabrio.

Cons

- Membership Requirement: Discounts and some benefits are contingent on Costco membership, limiting accessibility for non-members with a Volkswagen Cabrio.

- Coverage Limitations: While offering extensive options, some desired features may be available only at higher premium levels for Volkswagen Cabrio insurance.

#9 – Safeco: Best for Diminishing Deductible

Pros

- Diminishing Deductible: Safeco reduces your deductible for each claim-free period, rewarding safe driving for Volkswagen Cabrio owners.

- Custom Policy Adjustments: Safeco allows for detailed customization of policies, which can optimize coverage for the specific needs of Volkswagen Cabrio owners.

- Competitive Rates: Offers some of the more competitive rates within the market, particularly appealing for Volkswagen Cabrio insurance. Unlock details in our article titled “Safeco Insurance Review & Ratings.”

Cons

- Policy Complexity: The range of customizable options can make understanding and choosing the right policy challenging for Volkswagen Cabrio owners.

- Rate Fluctuations: Premium rates may fluctuate based on policy adjustments and claim history, potentially increasing costs over time for Volkswagen Cabrio insurance.

#10 – Amica: Best for Dividend Payments

Pros

- Dividend Payment Policies: Amica offers policies that can return a portion of your premiums as dividends, potentially lowering the effective cost for Volkswagen Cabrio insurance.

- Highest Financial Rating: With an A+ rating from A.M. Best, Amica ensures top-notch financial reliability and service for Volkswagen Cabrio claims. Check out insurance savings in our complete article titled “Amica Car Insurance Discounts.”

- Customer Service Excellence: Known for outstanding customer service, providing supportive and responsive interactions for Volkswagen Cabrio owners.

Cons

- Higher Initial Premiums: Amica’s rates, including dividend-paying policies, may start higher than some competitors for Volkswagen Cabrio insurance.

- Dividend Eligibility: Not all policyholders may qualify for dividends, and the benefits may vary, affecting the predictability of savings on Volkswagen Cabrio insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Monthly Insurance Rates for Volkswagen Cabrio

Understanding the varying rates for minimum and full coverage car insurance can significantly impact your decision when choosing a provider for your Volkswagen Cabrio. See more details on our article titled “Best Car Insurance for Full Coverage.”

Volkswagen Cabrio Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $64 $153

American Family $79 $175

Amica $85 $182

Farmers $70 $162

Liberty Mutual $67 $157

Nationwide $76 $170

Progressive $58 $145

Safeco $81 $178

State Farm $62 $150

Travelers $73 $167

The monthly rates for Volkswagen Cabrio car insurance exhibit notable differences between minimum and full coverage across various providers. For instance, Progressive offers the most affordable minimum coverage at $58, while also providing competitive full coverage at $145. In contrast, Amica presents the highest rates with minimum coverage at $85 and full coverage extending up to $182.

Other insurers like State Farm and Allstate offer middle-ground options, with State Farm charging $62 for minimum and $150 for full coverage, and Allstate at $64 and $153, respectively. This spread in pricing highlights the importance of comparing both coverage levels when selecting an insurance provider, ensuring that you balance cost with the comprehensiveness of coverage for your Volkswagen Cabrio.

Factors That Influence the Cost of Volkswagen Cabrio Car Insurance

Several factors, including personal attributes and car features, impact the cost of insurance for a Volkswagen Cabrio. Insurers assess a driver’s age, gender, and experience to gauge risk, with younger, inexperienced drivers facing higher premiums, while experienced drivers with clean records generally enjoy lower rates. Living in high crime or densely populated areas can raise premiums due to increased theft and accident risks.

Additionally, your credit score is surprisingly significant, as insurers use it to gauge the likelihood of claims, with higher scores often leading to lower rates. The value of your Volkswagen Cabrio directly impacts premiums, with higher-value vehicles costing more to insure due to expensive repairs and replacements.

Safety features like anti-lock brakes and airbags can reduce premiums by mitigating risks. The theft rate of Volkswagen Cabrios in your area can also elevate insurance costs if they are commonly targeted. Repair costs play a crucial role; expensive or hard-to-find parts can raise premiums. Your driving record is another critical factor, where a history free of accidents and violations can decrease costs.

Finally, annual mileage affects rates, with higher mileage increasing risk and potential claims, whereas lower mileage might qualify you for discounts. These factors collectively determine the insurance rates for a Volkswagen Cabrio, underscoring the importance of a comprehensive evaluation to secure favorable rates. Unlock details in our article titled “Best Low Mileage Car Insurance Discounts.”

Understanding the Insurance Rating for Volkswagen Cabrio

Insurance companies use a specific insurance rating system to determine the cost of insuring a vehicle like the Volkswagen Cabrio. This rating system considers the factors mentioned above, along with statistical data and historical claims data. Learn more in our article titled “A.M. Best Ratings Explained.”

Understanding this rating system can provide you with insights into how your premium is calculated and potentially help you find ways to lower your insurance costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips to Lower Your Volkswagen Cabrio Car Insurance Premiums

The cost of insuring a Volkswagen Cabrio varies based on several factors, but you can potentially lower your premiums by comparing quotes from multiple providers to secure the most competitive rate. Opting for higher deductibles is another strategy that can reduce your monthly payments, though it’s important to ensure you can comfortably afford the deductible in case of a claim.

Bundling your Volkswagen Cabrio insurance with other policies, such as homeowners or renters insurance, can also lead to significant premium discounts. Maintaining a clean driving record by practicing safe driving and avoiding traffic violations will make you eligible for better rates. See more details on our article titled “Best Safe Driver Car Insurance Discounts.”

Additionally, inquire about discounts that may apply to you, such as those for defensive driving courses, being a safe driver, or holding multiple policies with the same insurer. Finally, installing safety features like anti-lock brakes, airbags, and anti-theft devices in your vehicle can further decrease insurance costs by mitigating risks associated with accidents and theft.

Comparing Insurance Quotes for a Volkswagen Cabrio

When looking for car insurance for your Volkswagen Cabrio, it’s essential to compare quotes from different insurance providers. Prices can vary significantly, so obtaining multiple quotes allows you to identify the most competitive rates and coverage options suited for your needs. One important factor to consider when comparing insurance quotes for a Volkswagen Cabrio is the level of coverage provided.

Different insurance providers may offer varying levels of coverage, such as liability coverage, comprehensive coverage, and collision coverage. It’s crucial to carefully review the coverage options and ensure that they meet your specific needs and requirements. Discover insights in our article titled “Collision vs. Comprehensive Car Insurance.”

Jeff Root Licensed Insurance Agent

In addition to comparing prices and coverage, consider the reputation and customer service of the insurance providers. Reading reviews from other Volkswagen Cabrio owners can provide insights into the service quality of various insurance companies. Choosing an insurance provider with a strong reputation for customer satisfaction ensures prompt and reliable assistance for any claims or issues.

The Importance of Comprehensive Coverage for Your Volkswagen Cabrio

Comprehensive coverage is vital for protecting your Volkswagen Cabrio against various risks. This type of coverage typically includes protection against theft, vandalism, natural disasters, and collisions with animals. Given the potential costs associated with repairing or replacing your vehicle, comprehensive coverage offers peace of mind knowing that you are protected in a wide range of scenarios.

In addition to the protection it offers against theft, vandalism, natural disasters, and collisions with animals, comprehensive coverage for your Volkswagen Cabrio also includes coverage for damage caused by falling objects. This means that if a tree branch were to fall on your vehicle, comprehensive coverage would help cover the cost of repairs.

This additional coverage is especially important for those who live in areas with a high risk of falling debris, such as near wooded areas or construction sites.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What to Do if You Can’t Afford Volkswagen Cabrio Car Insurance

If you find yourself struggling to afford car insurance for your Volkswagen Cabrio, there are a few options to consider:

- Adjust Coverage: Evaluate your coverage needs and consider adjusting your coverage to fit within your budget. However, be cautious not to jeopardize essential protections.

- Look for Discounts: Explore various discounts offered by insurance providers. Taking advantage of available discounts can help reduce your premiums.

- Increase Deductibles: Increasing your deductible amounts can result in lower premiums. However, ensure that you have enough savings to cover the deductible in case of an accident.

- Seek Assistance: In certain cases, you may qualify for financial assistance or state programs that can help offset the cost of car insurance.

If you’re struggling to afford Volkswagen Cabrio car insurance, consider adjusting your coverage levels, seeking available discounts, increasing deductibles, exploring financial assistance programs, or opting for a vanishing deductible option.

These strategies can help make your insurance more affordable while ensuring you still receive necessary protection. These strategies can help make your insurance more affordable while ensuring you still receive necessary protection. Delve into our evaluation of our article titled “What is the difference between a deductible and a premium in car insurance?”

Common Mistakes to Avoid When Purchasing Car Insurance for a Volkswagen Cabrio

When purchasing car insurance for your Volkswagen Cabrio, it’s crucial to avoid common mistakes that may result in higher premiums or inadequate coverage:

- Not Researching Insurance Providers: Failing to research and compare insurance providers can lead to higher premiums.

- Underinsuring: Choosing lower coverage limits to save on premiums may leave you exposed to financial risks in the event of an accident.

- Not Reading the Policy: It’s crucial to review your insurance policy thoroughly to understand the coverage and any exclusions or limitations.

- Ignoring Discounts: Failing to inquire about available discounts can lead to missed opportunities for significant savings.

- Not Re-Evaluating Coverage: Regularly re-evaluate your coverage needs to ensure you have adequate protection as circumstances change.

When purchasing car insurance for your Volkswagen Cabrio, it’s essential to make informed decisions to avoid paying higher premiums or receiving inadequate coverage.

Be diligent in researching providers, understanding your policy, seeking out discounts, and regularly assessing your coverage needs to ensure financial protection and cost-effectiveness. Access comprehensive insights into our article titled “What does it mean when a policy is fully paid up?”

How Your Driving Record Affects the Cost of Insuring a Volkswagen Cabrio

Your driving record is a significant factor in determining the cost of insuring your Volkswagen Cabrio. Traffic violations, accidents, and other negative incidents on your record can result in higher insurance premiums. It’s essential to practice safe driving habits and maintain a clean driving record to potentially lower your insurance costs. Unlock details in our article titled “Best Car Insurance for Drivers with Speeding Ticket in New Hampshire.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Different Types of Coverage Options for Your Volkswagen Cabrio

When insuring your Volkswagen Cabrio, it’s important to understand the various coverage options available to best meet your needs. Liability coverage is essential as it covers costs if you’re responsible for injuring someone or damaging property in an accident. Collision coverage pays for repairs or replacement of your Volkswagen Cabrio regardless of fault in an accident.

Laura Walker Former Licensed Agent

Comprehensive coverage shields you from financial loss due to theft, vandalism, natural disasters, and other non-collision damages. Additionally, uninsured/underinsured motorist insurance coverage is crucial for protecting yourself against losses caused by accidents with inadequately insured or uninsured drivers.

The Benefits of Bundling Your Volkswagen Cabrio Insurance With Other Policies

Bundling your Volkswagen Cabrio insurance with other insurance policies, such as homeowners or renters insurance, can offer several advantages. By consolidating your policies with one insurance provider, you may be eligible for discounts, simplifying your insurance management and potentially saving on premiums. Discover more about offerings in our article titled “What is Payment bundling?”

Tips for Finding the Best Insurance Provider for Your Volkswagen Cabrio

When searching for the best insurance provider for your Volkswagen Cabrio, consider the following tips:

- Research Reputation and Financial Stability: Look for insurance providers with a good reputation for customer service and financial stability.

- Compare Quotes: Obtain quotes from multiple providers to ensure you are getting the best insurance rates and coverage.

- Customer Reviews: Read customer reviews and ratings to gain insights into others’ experiences with the provider.

- Available Discounts: Inquire about the various discounts available to potential policyholders.

- Customer Support: Assess the accessibility and responsiveness of the insurance company’s customer support.

When choosing the best insurance provider for your Volkswagen Cabrio, thorough research is key. Make sure to compare quotes, read customer reviews, assess support quality, and inquire about discounts to secure the best rates and service. See more details on our article titled “Is an unregistered car covered by car insurance?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Age and Experience Impact the Cost of Insuring a Volkswagen Cabrio

Age and driving experience are significant factors that can influence the cost of insuring a Volkswagen Cabrio. In general, younger, less experienced drivers are considered higher risk and may face higher insurance premiums. As drivers gain more experience and maintain a clean driving record, insurance premiums can decrease. Discover insights in our article titled “What age do you get cheap car insurance?”

Understanding Deductibles and Their Effect on the Cost of Insuring a Volkswagen Cabrio

A deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. When selecting a deductible for your Volkswagen Cabrio insurance, it’s important to find a balance between a deductible you can comfortably afford and the impact it has on your annual premium.

Higher deductibles typically result in lower premiums, but it’s crucial to ensure that the deductible amount is manageable in case of an accident. Access comprehensive insights into our guide titled “Who is responsible if a secondary driver of a vehicle has an accident?”

The Role of Vehicle Safety Features in Determining Insurance Costs for a Volkswagen Cabrio

The presence of advanced safety features in your Volkswagen Cabrio can play a significant role in determining your insurance costs. Insurance providers consider features such as anti-lock brakes, airbags, stability control, and alarm systems when assessing the risk associated with insuring your vehicle. Delve into our evaluation of our article titled “Does my car insurance cover damage caused by a brake failure?”

Vehicles with safety features are often seen as safer and may qualify for insurance premium discounts. As you can see, several factors impact the cost of insuring a Volkswagen Cabrio. Understanding these factors, evaluating coverage options, comparing quotes, and adopting safe driving habits can help you secure the most affordable and comprehensive car insurance policy for your Volkswagen Cabrio.

Remember, each insurance provider may have its own specific policies, guidelines, and rates. Be sure to reach out to various insurance companies, provide accurate information, and discuss your specific needs to obtain the best insurance coverage and rates for your Volkswagen Cabrio.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

Frequently Asked Questions

What factors affect the cost of Volkswagen Cabrio car insurance?

The cost of Volkswagen Cabrio car insurance can be affected by various factors such as the driver’s age, location, driving history, coverage limits, deductible amount, and the insurance company’s rating.

For additional details, explore our comprehensive resource titled “Best Car Insurance for Teens in Colorado.”

Are Volkswagen Cabrio cars expensive to insure?

The cost of insuring a Volkswagen Cabrio can vary depending on several factors, but generally, it is considered to have average insurance rates compared to other vehicles in its class.

Is it cheaper to insure an older or newer Volkswagen Cabrio?

In general, older Volkswagen Cabrio models may have slightly lower insurance costs compared to newer models. This is because older cars typically have lower market values, which can result in lower insurance premiums.

What are some tips for finding affordable Volkswagen Cabrio car insurance?

To find affordable Volkswagen Cabrio car insurance, you can consider shopping around and comparing quotes from different insurance companies, maintaining a clean driving record, opting for higher deductibles, and taking advantage of any available discounts such as multi-policy or safe driver discounts.

To find out more, explore our guide titled “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

Does the Volkswagen Cabrio’s safety rating affect insurance costs?

Yes, the safety rating of the Volkswagen Cabrio can impact insurance costs. Cars with higher safety ratings are generally considered less risky to insure, which can lead to lower insurance premiums.

Can I get discounts on Volkswagen Cabrio car insurance?

Yes, you may be eligible for various discounts on Volkswagen Cabrio car insurance. These can include discounts for having multiple policies with the same insurance company, being a safe driver, having anti-theft devices installed, completing defensive driving courses, and maintaining a low annual mileage.

Are Volkswagen Cabrio cheap on insurance?

Yes, Volkswagen Cabrio can be relatively inexpensive to insure due to its modest repair costs and safety features.

What is the lowest form of Volkswagen Cabrio car insurance?

The lowest form of Volkswagen Cabrio car insurance is typically minimum liability coverage.

To learn more, explore our comprehensive resource on “Best Car Insurance for Liability Insurance.”

Who is cheaper for Volkswagen Cabrio, Geico or Progressive?

Progressive often offers cheaper rates for Volkswagen Cabrio than Geico, especially with discounts applied.

Which type of car insurance is the cheapest for Volkswagen Cabrio?

Liability insurance is usually the cheapest type of car insurance for a Volkswagen Cabrio.

What is the lowest car insurance group for Volkswagen Cabrio?

Which insurance company is usually the cheapest for Volkswagen Cabrio?

Is there a way to lower Volkswagen Cabrio car insurance?

What are the cheapest full coverage Volkswagen Cabrio car insurance?

Is insurance lower for older cars like the Volkswagen Cabrio?

Is Allstate cheaper than Geico for Volkswagen Cabrio car insurance?

How to lower car insurance rates for Volkswagen Cabrio?

Which is the most expensive form of Volkswagen Cabrio car insurance?

What is the least amount of car insurance you need for Volkswagen Cabrio?

What age group has the cheapest Volkswagen Cabrio car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.