Cheap Toyota Tacoma Xtracab Car Insurance in 2024 (Save Money With These 10 Companies)

State Farm, Progressive, and Erie are the top picks for cheap Toyota Tacoma Xtracab car insurance, with rates as low as $41/month. These companies offer competitive rates, comprehensive coverage, and strong customer service, ensuring reliable and affordable protection for your Toyota Tacoma Xtracab.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2025

Company Facts

Min. Coverage for Toyota Tacoma Xtracab

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota Tacoma Xtracab

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota Tacoma Xtracab

A.M. Best Rating

Complaint Level

Pros & Cons

The top pick for cheap Toyota Tacoma Xtracab car insurance is State Farm, followed closely by Progressive and Erie. These providers stand out for their competitive rates, comprehensive coverage options, and exceptional customer service.

When seeking affordable insurance for your Toyota Tacoma Xtracab, State Farm leads the way with its attractive pricing and robust policy features. Progressive and Erie also offer great value, combining budget-friendly rates with reliable protection.

Our Top 10 Company Picks: Cheap Toyota Tacoma Xtracab Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $41 B Low Rates State Farm

#2 $45 A+ Snapshot Program Progressive

#3 $47 A+ Customer Service Erie

#4 $48 A Comprehensive Plans AAA

#5 $49 A++ Military Benefits USAA

#6 $51 A++ Claims Satisfaction Auto-Owners

#7 $52 A+ SmartRide Program Nationwide

#8 $55 A+ Drivewise Program Allstate

#9 $60 A RightTrack Program Liberty Mutual

#10 $63 A Signal App Farmers

Each of these companies excels in providing tailored coverage that meets both your financial and protection needs, making them the best choices for insuring your Toyota Tacoma Xtracab.

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool above to see affordable car insurance quotes.

- State Farm offers Toyota Tacoma Xtracab insurance starting at $41/month

- Tailor coverage for your Toyota Tacoma Xtracab to save on premiums

- Leverage safety features and low mileage for lower insurance rates

#1 – State Farm: Top Overall Pick

Pros

- Low Rates: State Farm insurance review & ratings offers competitive rates starting at $41/month for cheap Toyota Tacoma Xtracab car insurance, making it a cost-effective option for budget-conscious drivers

- Extensive Network: With a large network of agents and repair shops, State Farm ensures convenient and accessible service for those seeking affordable Toyota Tacoma Xtracab car insurance across the country.

- Flexible Coverage Options: State Farm provides a variety of coverage options for cheap Toyota Tacoma Xtracab car insurance, allowing you to tailor your policy to fit your specific needs and preferences.

Cons

- Customer Service Variability: While generally reliable, the quality of customer service can vary depending on the local agent, which may affect your experience with cheap Toyota Tacoma Xtracab car insurance.

- Limited Discounts: Compared to some competitors, State Farm may offer fewer discounts, potentially limiting your opportunities for additional savings on cheap Toyota Tacoma Xtracab car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program offers personalized discounts based on your driving habits, potentially lowering your cheap Toyota Tacoma Xtracab car insurance rates..

- Competitive Rates: With rates starting at $45/month, Progressive provides budget-friendly coverage options without compromising on quality for cheap Toyota Tacoma Xtracab car insurance.

- 24/7 Customer Service: Based on our Progressive insurance review & ratings, the company offers around-the-clock customer support, ensuring you have access to help whenever you need it, which is a great advantage for cheap Toyota Tacoma Xtracab car insurance.

Cons

- Potential for Higher Rates: If you don’t participate in the Snapshot program or have less-than-ideal driving habits, your rates might be higher compared to other providers, which could affect the affordability of your cheap Toyota Tacoma Xtracab car insurance.

- Complex Policy Terms: Progressive’s policy terms and options can be complex, potentially making it challenging to fully understand your coverage and affecting how straightforward it is to get cheap Toyota Tacoma Xtracab car insurance.

#3 – Erie: Best for Customer Service

Pros

- Excellent Customer Service: Erie is renowned for its high-quality customer service, providing helpful and responsive support for cheap Toyota Tacoma Xtracab car insurance inquiries.

- Strong Financial Stability: With an A+ rating from A.M. Best, Erie is a financially stable company, ensuring reliable coverage and claims handling for cheap Toyota Tacoma Xtracab car insurance. See more details on our Erie insurance review & ratings.

- Comprehensive Coverage Options: Erie offers a wide range of coverage options to suit different needs, enhancing your ability to customize your policy for cheap Toyota Tacoma Xtracab car insurance.

Cons

- Higher Rates: Erie’s rates start at $47/month, which may be higher than some competitors, potentially impacting affordability for those seeking cheap Toyota Tacoma Xtracab car insurance.

- Limited Availability: Erie’s insurance services may not be available in all states, restricting access for some potential policyholders looking for cheap Toyota Tacoma Xtracab car insurance.

#4 – AAA: Best for Comprehensive Plans

Pros

- Comprehensive Plans: AAA offers extensive coverage options starting at $48/month for cheap Toyota Tacoma Xtracab car insurance, ensuring thorough protection.

- Roadside Assistance: In line with our AAA insurance review & ratings, the company provides included roadside assistance, offering peace of mind for unexpected breakdowns or emergencies for those seeking cheap Toyota Tacoma Xtracab car insurance.

- Discount Opportunities: AAA offers various discounts that can help reduce your premiums, making cheap Toyota Tacoma Xtracab car insurance more affordable.

Cons

- Membership Requirement: To access some benefits, you need to be a AAA member, which involves additional costs beyond the premium for cheap Toyota Tacoma Xtracab car insurance.

- Higher Rates: AAA’s rates may be higher compared to some other providers, potentially impacting your budget for cheap Toyota Tacoma Xtracab car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA offers tailored benefits and discounts for military personnel and their families, starting at $49/month for cheap Toyota Tacoma Xtracab car insurance.

- Exceptional Customer Service: USAA is renowned for its top-notch customer service, providing highly-rated support for its members seeking cheap Toyota Tacoma Xtracab car insurance.

- Competitive Rates: USAA provides competitive rates for its members, ensuring good value for your cheap Toyota Tacoma Xtracab car insurance coverage. Learn more in our USAA insurance review & ratings.

Cons

- Eligibility Restrictions: USAA’s services are only available to military members, veterans, and their families, limiting availability for non-military individuals looking for cheap Toyota Tacoma Xtracab car insurance.

- Limited Discounts for Non-Military: Discounts and benefits are primarily geared towards military members, which may not be as beneficial for non-military customers searching for cheap Toyota Tacoma Xtracab car insurance.

#6 – Auto-Owners: Best for Claims Satisfaction

Pros

- High Claims Satisfaction: According to our Auto-Owners insurance review & ratings, the company is known for its high claims satisfaction rates, offering reliable service when you need to file a claim for your cheap Toyota Tacoma Xtracab car insurance.

- Strong Financial Stability: With an A++ rating from A.M. Best, Auto-Owners provides a stable and dependable cheap Toyota Tacoma Xtracab car insurance option.

- Flexible Coverage Options: Auto-Owners offers a variety of coverage options, allowing you to customize your cheap Toyota Tacoma Xtracab car insurance policy according to your needs.

Cons

- Higher Rates: Starting at $51/month, Auto-Owners’ rates for cheap Toyota Tacoma Xtracab car insurance may be higher compared to some other insurance providers.

- Limited Discounts: Auto-Owners may offer fewer discounts on cheap Toyota Tacoma Xtracab car insurance compared to competitors, potentially affecting overall savings.

#7 – Nationwide: Best for SmartRide Program

Pros

- SmartRide Program: Nationwide’s SmartRide program offers discounts based on your driving habits, potentially lowering your affordable Toyota Tacoma Xtracab car insurance rates.

- Comprehensive Coverage Options: Nationwide provides a wide range of coverage options to meet diverse needs and preferences, making it easier to find cheap Toyota Tacoma Xtracab car insurance.

- Reliable Customer Service: As per our Nationwide insurance review & ratings, the company is known for its dependable customer service, ensuring support when needed for your affordable Toyota Tacoma Xtracab car insurance needs.

Cons

- Higher Premiums: With rates starting at $52/month, Nationwide’s premiums for cheap Toyota Tacoma Xtracab car insurance may be higher than some other providers.

- Limited Discounts: Nationwide’s discount offerings may be less extensive than some competitors, which could impact potential savings on your affordable Toyota Tacoma Xtracab car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Allstate’s Drivewise program provides potential savings based on your driving behavior, which can reduce your cheap Toyota Tacoma Xtracab car insurance costs.

- Comprehensive Coverage: Allstate offers a wide variety of coverage options, allowing you to tailor your policy to your needs, ensuring you get affordable Toyota Tacoma Xtracab car insurance.

- Strong Financial Rating: With an A+ rating from A.M. Best, Allstate insurance review & ratings offer reliable financial stability and protection for your Toyota Tacoma Xtracab car insurance needs.

Cons

- Higher Rates: Allstate’s rates starting at $55/month may be higher compared to some other options, affecting the affordability of Toyota Tacoma Xtracab car insurance.

- Complex Policy Terms: The range of coverage options and discounts can make understanding Allstate’s policies more complex, potentially complicating your pursuit of cheap Toyota Tacoma Xtracab car insurance.

#9 – Liberty Mutual: Best for RightTrack Program

Pros

- RightTrack Program: Liberty Mutual’s RightTrack program offers potential discounts based on your driving habits, which can lower your cheap Toyota Tacoma Xtracab car insurance rates.

- Customizable Coverage: Liberty Mutual provides a range of customizable coverage options to fit your specific needs, helping you find cheap Toyota Tacoma Xtracab car insurance tailored to your requirements.

- Various Discounts: Liberty Mutual offers numerous discounts that can help reduce your cheap Toyota Tacoma Xtracab car insurance premiums. Discover more about offerings in our Liberty Mutual insurance review & ratings.

Cons

- Higher Starting Rates: With rates beginning at $60/month, Liberty Mutual’s premiums may be higher compared to other providers, making it more challenging to find cheap Toyota Tacoma Xtracab car insurance.

- Mixed Customer Reviews: Customer service experiences with Liberty Mutual can be inconsistent, leading to mixed reviews, which might impact your satisfaction with cheap Toyota Tacoma Xtracab car insurance from them.

#10 – Farmers: Best for Signal App

Pros

- Signal App: Farmers’ Signal app tracks driving behavior and offers potential discounts based on your driving habits, which can help secure affordable Toyota Tacoma Xtracab car insurance.

- Comprehensive Coverage Options: Farmers provides a range of coverage options to suit various needs and preferences, making it easier to find a plan that offers economical Toyota Tacoma Xtracab car insurance.

- Strong Customer Support: In accordance with our Farmers insurance review & ratings, the company is known for its responsive customer service, ensuring you receive the support needed to maintain budget-friendly Toyota Tacoma Xtracab car insurance.

Cons

- Higher Rates: Farmers’ rates start at $63/month, which may be higher compared to some other providers, potentially impacting the affordability of Toyota Tacoma Xtracab car insurance.

- Discount Eligibility: The availability of certain discounts may vary, potentially affecting your ability to secure low-cost Toyota Tacoma Xtracab car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

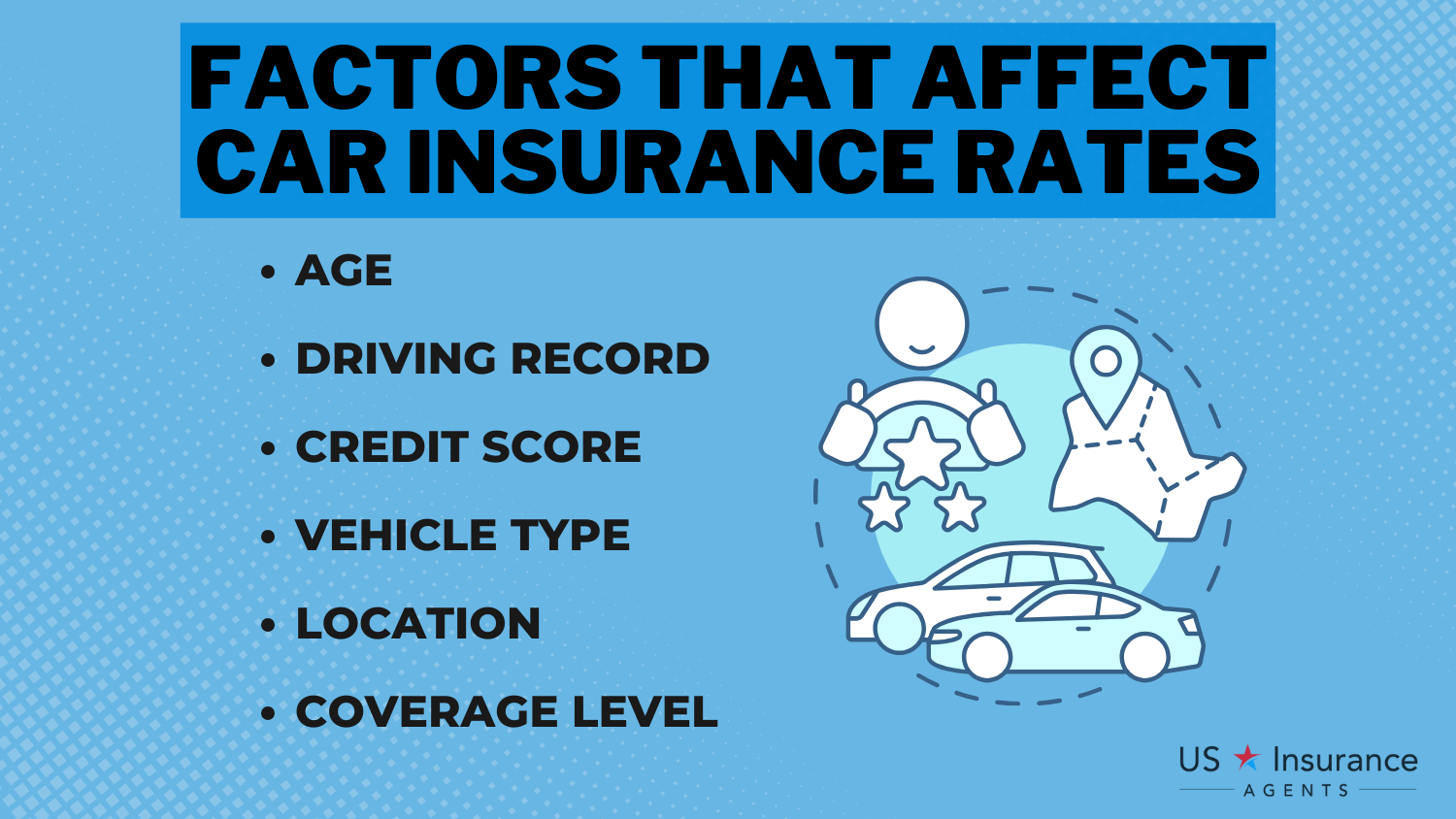

Factors That Impact the Cost of Toyota Tacoma Xtracab Car Insurance

Several factors influence the cost of car insurance for a Toyota Tacoma Xtracab. Key considerations include the driver’s age and gender, as younger drivers and those with a history of accidents or traffic violations are typically viewed as higher risk, leading to higher premiums.

The driver’s location also plays a crucial role; areas with high rates of accidents or thefts can result in increased insurance costs. Additionally, the type and amount of coverage selected will affect the premium, with more comprehensive coverage generally leading to higher costs.

The value and safety features of the Toyota Tacoma Xtracab impact insurance rates as well. Vehicles equipped with advanced safety features and those with higher values may have different premiums compared to vehicles lacking these attributes. Insurance companies use data and statistical models to assess risk, including the frequency and severity of accidents and thefts involving similar vehicles.

Jeffrey Manola Licensed Insurance Agent

Credit history is another important factor. Many insurers consider an individual’s credit score when determining premiums, with lower credit scores often resulting in higher insurance costs due to perceived financial instability.

Furthermore, the driver’s occupation can influence insurance rates. Occupations involving extensive driving or higher stress levels may lead to increased premiums, especially if the vehicle is used for business rather than personal purposes. Each of these elements contributes to the overall cost of car insurance for a Toyota Tacoma Xtracab, illustrating how the insurance company determines the premium.

Toyota Tacoma Xtracab Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $48 $96

Allstate $55 $110

Auto-Owners $51 $87

Erie $47 $89

Farmers $63 $129

Liberty Mutual $60 $125

Nationwide $52 $105

Progressive $45 $119

State Farm $41 $86

USAA $49 $99

The table shows monthly insurance rates for the Toyota Tacoma Xtracab. For minimum coverage, State Farm is the lowest at $41, while Farmers is the highest at $63. For full coverage, State Farm is also the most affordable at $86, with Farmers being the highest at $129. This comparison helps evaluate cost-effectiveness among providers.

Understanding Types of Car Insurance Coverage for a Toyota Tacoma Xtracab

When it comes to insuring your Toyota Tacoma Xtracab, it is important to understand the different types of insurance coverage available. Most car insurance policies include the following types of coverage:

- Liability coverage: This type of coverage protects you if you are at fault in an accident and cause damage to someone else’s property or injure others.

- Collision coverage: Collision coverage pays for the repair or replacement of your vehicle if it is damaged in a collision, regardless of fault.

- Comprehensive coverage: Comprehensive coverage provides protection against non-collision-related incidents such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This coverage helps protect you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

The specific coverage options and their associated costs can vary depending on the insurance provider and your individual needs. It is essential to carefully review your options and select coverage that adequately protects you and your Toyota Tacoma Xtracab.

This table outlines the various discounts available from leading insurance companies for the Toyota Tacoma Xtracab. It includes different providers and the types of discounts they offer. They offer a range of discounts including multi-policy, safe driver, good student, and anti-theft device discounts. Other discounts include options for new cars, military personnel, and usage-based insurance programs.

Tips for Finding the Best Car Insurance Rates for a Toyota Tacoma Xtracab

Now that we have discussed the various factors that impact insurance costs and the different types of coverage available, let’s explore some tips for finding the best car insurance rates for your Toyota Tacoma Xtracab:

- Shop Around and Compare Quotes: Start by comparing quotes from multiple insurance providers to ensure you’re getting the best deal.

- Consider Bundling Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Maintain a Good Driving Record: Practice safe driving habits and avoid accidents and violations to keep your driving record clean.

- Take Advantage of Discounts: Look for discounts for completing defensive driving courses or having specific vehicle safety features installed.

- Opt for a Higher Deductible: If financially feasible, choosing a higher deductible can potentially lower your premiums.

By implementing these tips and being proactive in your search for the best rates, you can potentially save a significant amount on your Toyota Tacoma Xtracab car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Car Insurance Quotes for a Toyota Tacoma Xtracab

Comparing car insurance quotes for your Toyota Tacoma Xtracab requires a thorough approach that goes beyond just the price. Start by evaluating the reputation and financial stability of the insurance providers to ensure they offer reliable service and can handle claims effectively. Look for companies with strong customer service ratings and positive reviews.

Next, carefully examine the coverage options each policy provides, including liability, collision, comprehensive, and any optional add-ons like roadside assistance or rental car reimbursement. It’s important to ensure the coverage limits meet your needs and to review the policy for any exclusions or limitations to understand what is not covered.

Additionally, consider available discounts, such as those for safe driving, multi-policy arrangements, or safety features on your vehicle, as these can significantly affect your premium. Exploring usage-based insurance options, which might offer savings based on your driving habits, can also be beneficial.

Don’t hesitate to ask questions to clarify any aspects of the policy you don’t fully understand, including details about deductibles and the claims process. By obtaining quotes from multiple providers and using online comparison tools, you can effectively compare costs and coverage to make an informed decision and choose the best insurance policy for your Toyota Tacoma Xtracab.

The Average Cost of Car Insurance for a Toyota Tacoma Xtracab

Determining the average cost of car insurance for a Toyota Tacoma Xtracab can be challenging as it varies based on factors such as location and individual circumstances. While it is difficult to provide an exact figure without these specifics, you can obtain an estimate by using online insurance comparison tools or consulting with insurance agents.

These resources offer a general idea of the average insurance cost in your area. Keep in mind that this estimate serves as a starting point; the actual premium you pay will be influenced by various personal factors including your driving history, age, and coverage preferences.

Exploring Discounts and Savings on Toyota Tacoma Xtracab Car Insurance

Exploring discounts and savings opportunities can play a crucial role in reducing the cost of Toyota Tacoma Xtracab car insurance. Insurance companies typically offer a variety of discounts designed to help policy holders lower their premiums. One significant discount is for safe drivers, which benefits those who maintain a clean driving record with no accidents or violations.

Another valuable opportunity is the multi-policy discount, which rewards customers who bundle multiple types of insurance, such as home and auto, with the same provider. Students who achieve good grades may qualify for good student discounts, reflecting their responsible behavior. Vehicles equipped with advanced anti-theft devices can also earn additional discounts due to the reduced risk of theft.

Additionally, completing an approved defensive driving course often results in further savings, as it demonstrates a commitment to safe driving. To ensure you are capitalizing on all available savings, it’s important to ask about these discounts when obtaining insurance quotes and to explore every possible avenue for reducing your Toyota Tacoma Xtracab insurance costs.

By being proactive and informed, you can maximize your savings and secure the most affordable coverage for your vehicle.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Impact of Safety Features on Toyota Tacoma Xtracab Insurance Costs

The safety features of your Toyota Tacoma Xtracab can significantly affect your insurance costs. Vehicles equipped with advanced safety technologies like anti-lock brakes (ABS), airbags, electronic stability control (ESC), and adaptive cruise control are typically seen as safer.

This improved safety can lead to lower insurance premiums, as insurers often offer safety features insurance discounts due to the reduced risk of accidents and injuries.

When purchasing a Toyota Tacoma Xtracab, choosing models with these safety features can not only enhance your safety but also potentially lower your insurance costs. Always check with your insurance provider to ensure you receive any applicable Safety Features Insurance Discounts for these features.

Tips for Keeping Your Toyota Tacoma Xtracab Insurance Rates Low Over Time

Once you’ve secured affordable car insurance rates for your Toyota Tacoma Xtracab, it’s crucial to take proactive measures to maintain those rates over time. Here are some key tips:

- Practice Safe Driving Habits: Maintain a clean driving record to positively impact your insurance premiums.

- Regularly Review Your Coverage: Ensure your policy continues to meet your needs and make adjustments as necessary.

- Take Advantage of Discounts: Look for and utilize available insurance discounts and savings opportunities.

- Periodically Compare Quotes: Shop around to ensure you’re getting the best rate from various providers.

- Stay in Communication With Your Insurance Agent: Keep informed about changes in coverage and new discount offerings.

By following these steps, you can help maintain affordable car insurance rates for your Toyota Tacoma Xtracab and ensure you’re getting the best value for your premium.

Key Factors for Choosing an Insurance for Your Toyota Tacoma Xtracab

Choosing the right insurance provider for your Toyota Tacoma Xtracab is crucial and requires careful consideration. Start by evaluating the reputation and financial stability of potential insurance companies to ensure they are reliable and able to meet their obligations. Assess their customer service and claims processing track record to gauge how effectively they handle claims and support their clients.

Jimmy McMillan Licensed Insurance Agent

Review the coverage options and discounts they offer, as well as their expertise and experience with insuring Toyota Tacoma Xtracab vehicles, which can impact the adequacy of their coverage for your specific needs. Additionally, consider their responsiveness and willingness to address any questions or concerns you may have.

Conduct thorough research and read reviews from other customers to make an informed decision and select the best insurance provider for your Toyota Tacoma Xtracab.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Impact of Customizations on Tacoma Xtracab Insurance Rates

If you’re planning to modify or add aftermarket accessories to your Toyota Tacoma Xtracab, it’s essential to understand how these changes can affect your insurance costs. Modifications that increase the vehicle’s value or performance, like engine upgrades or custom parts, can lead to higher premiums due to the increased risk of repair or replacement.

Additionally, accessories such as custom rims or advanced stereo systems can make your vehicle more attractive to thieves or more vulnerable to vandalism, potentially driving up your insurance costs.

A key consideration is whether your car insurance covers aftermarket rims. Standard policies often do not cover aftermarket modifications unless they are specifically declared and added to the policy. It’s crucial to notify your insurance provider of any modifications or additions. Some changes may not be covered under your standard policy, and you might need to adjust your coverage or add endorsements.

Keeping detailed records of all modifications and reporting them to your insurer can help prevent coverage gaps or issues with claims. Being proactive about these updates ensures that your vehicle is properly protected while avoiding potential surprises with your insurance.

Case Studies: Tailoring Insurance Coverage for Your Toyota Tacoma Xtracab

In today’s competitive insurance market, finding the right coverage can be a challenging yet crucial task. To illustrate how different drivers approach this decision, we’ve created fictional case studies based on real-world scenarios. These examples highlight the diverse needs of drivers and how various insurance providers cater to those needs with their unique offerings and services.

- Case Study #1 – Navigating Competitive Rates for a Safe Driver: John, a 30-year-old teacher with a clean driving record, recently bought a Toyota Tacoma Xtracab. He chose State Farm for its excellent customer service and competitive rates starting at $41/month. State Farm’s comprehensive coverage and strong agent network made it the perfect fit for John’s needs.

- Case Study #2 – Leveraging Technology for Customized Insurance: Emily, a 28-year-old graphic designer with a Toyota Tacoma Xtracab, is using Progressive’s Snapshot program to cut her insurance costs. The program tracks her driving habits, potentially lowering her premium based on safe driving. With rates from $45/month, it suits Emily’s tech-savvy approach, offering flexibility and savings.

- Case Study #3 – Exceptional Customer Service and Reliable Coverage: Michael, a 45-year-old business owner with a Toyota Tacoma Xtracab, values customer service and reliability. He chose Erie Insurance for its exceptional service and competitive rates starting at $47/month, finding the support and claims process exactly what he needed.

These fictional case studies are designed to reflect real-world scenarios and the varied preferences drivers might have when selecting insurance.

Chris Abrams Licensed Insurance Agent

By examining how different drivers prioritize aspects such as customer service, technology, and competitive rates, we hope to provide insight into finding the right insurance provider for your needs.

Summary: Best Insurance Deals on Toyota Tacoma Xtracab Insurance

For those seeking affordable car insurance for a Toyota Tacoma Xtracab , State Farm, Progressive, and Erie are top contenders, with rates beginning at $41 per month. These providers are noted for their competitive pricing, extensive coverage options, and strong customer support. Comparing quotes from these insurers will help you identify the best rate based on factors such as your driving history, location, and coverage requirements.

Insurance costs for the Toyota Tacoma Xtracab vary based on factors like age, location, and driving record. Advanced safety features and higher vehicle values can impact premiums. To find the most cost-effective insurance, understand coverage types, use available discounts, and compare insurance options. Comprehensive coverage provides broad protection but may increase premiums.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Frequently Asked Questions

What should I look for to get cheap insurance for my Toyota Tacoma Xtracab?

When looking for cheap insurance for your Toyota Tacoma Xtracab, seek a policy with low premiums and adequate coverage. Consider higher deductibles, safe driving discounts, and bundle deals. Ensure the coverage fits your needs while providing essential protection.

How does the Toyota Tacoma Xtracab’s model year affect insurance costs?

The model year of your Toyota Tacoma Xtracab influences insurance costs. Newer models often have higher rates due to their value and repair costs, while older models may be cheaper to insure due to lower repair costs and fewer modern safety features.

To gain profound insights, consult our extensive guide titled “Best Car Insurance by Vehicle.”

What are the best ways to find cheap Toyota Tacoma Xtracab car insurance?

To find cheap Toyota Tacoma Xtracab car insurance, compare quotes from multiple providers, take advantage of discounts, and consider increasing your deductibles. Providers like Safeco, USAA, and Progressive often offer competitive rates.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

What factors affect getting the cheapest insurance for my Toyota Tacoma Xtracab?

To get the cheapest insurance, consider factors such as your driving history, coverage limits, deductible amounts, and the specific safety features of your Tacoma Xtracab. Comparing quotes from different insurers and reviewing your coverage annually can also help.

Which insurers offer cheap Toyota Tacoma Xtracab car insurance?

Insurers like Safeco, USAA, and Progressive are known for offering competitive rates on Toyota Tacoma Xtracab car insurance. It’s beneficial to get quotes from these providers to find the best deal for your specific needs.

How can I lower my Toyota Tacoma Xtracab insurance costs with an accident history?

If you have a history of accidents, consider improving your driving record through a defensive driving course, which can sometimes lead to discounts. Additionally, explore options like increasing your deductible, qualifying for low mileage discounts, or choosing insurers known for offering competitive rates for high-risk drivers.

For a comprehensive overview, explore our detailed resource titled “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

Can installing safety features in my Toyota Tacoma Xtracab reduce insurance costs?

Yes, installing safety features such as anti-theft systems, advanced driver assistance systems (ADAS), and other safety technologies can potentially lower your insurance premiums. Many insurers offer discounts for vehicles equipped with these features.

How often should I review my Toyota Tacoma Xtracab insurance for the best rate?

It’s a good practice to review your car insurance policy annually or whenever you experience significant changes, such as purchasing a new vehicle, moving, or having a change in your driving habits. Regular reviews can help ensure you’re getting the best rate and coverage for your Toyota Tacoma Xtracab.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

How can I qualify for discounts on my Toyota Tacoma Xtracab car insurance?

You can qualify for discounts by maintaining a clean driving record, bundling your car insurance with other policies, installing safety features, and taking advantage of good driver discounts. Some insurers also offer discounts for low mileage and anti-theft systems.

For a comprehensive overview, explore our detailed resource titled “Lesser Known Car Insurance Discounts.”

Does the age of my Toyota Tacoma Xtracab affect insurance rates?

Yes, the age of your Toyota Tacoma Xtracab can impact insurance rates. Newer models may have higher premiums due to higher repair costs, while older models might be cheaper to insure, depending on their condition and safety features.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.