Cheap Toyota C-HR Car Insurance in 2026 (Top 10 Companies for Savings)

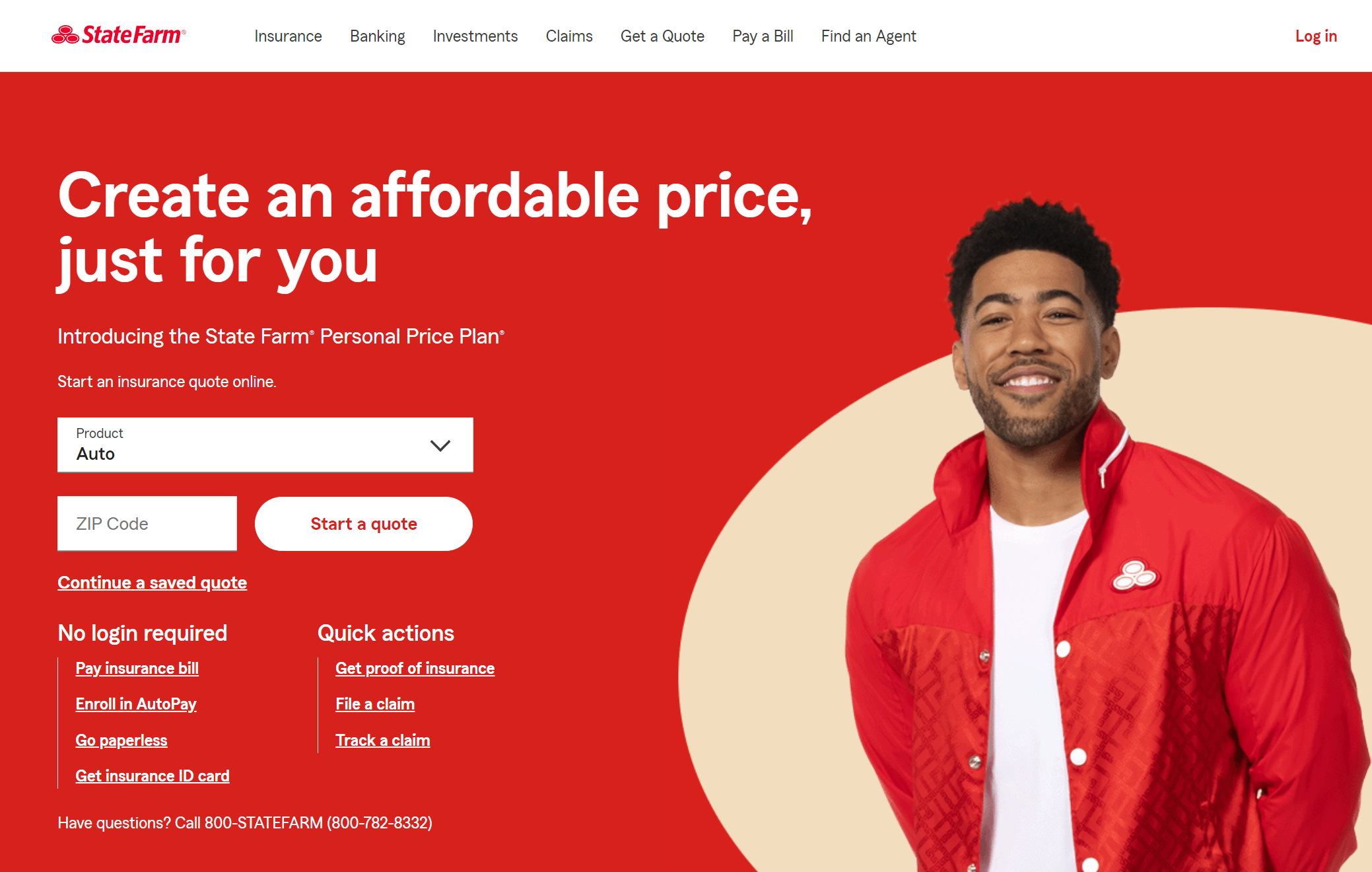

Progressive, State Farm, and Nationwide top the list for the best and cheapest Toyota C-HR car insurance, offering rates as low as $45 per month. These providers excel in affordability and comprehensive coverage options, making them ideal choices for Toyota C-HR owners seeking reliable and quality car insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Updated October 2024

Company Facts

Min. Coverage for Toyota C-HR

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota C-HR

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Toyota C-HR

A.M. Best

Complaint Level

Pros & Cons

Progressive, State Farm, and Nationwide offer the best and cheapest Toyota C-HR car insurance with rates as low as $45 per month.

These top providers stand out for their affordable coverage and strong customer service. In this article, we explore the key factors influencing insurance costs for the Toyota C-HR, compare the offerings from these leading insurers, and provide tips for finding the most budget-friendly and effective coverage for your vehicle.

Our Top 10 Company Picks: Cheap Toyota C-HR Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $45 A+ Qualifying Coverage Progressive

![]()

#2 $47 B Customer Service State Farm

#3 $50 A+ Widespread Availability Nationwide

#4 $52 A Group Discounts Farmers

#5 $54 A Diminishing Deductible Safeco

#6 $56 A++ Bundling Policies Travelers

#7 $59 A Costco Members American Family

#8 $62 A Add-on Coverages Liberty Mutual

#9 $65 A+ Tailored Policies The Hartford

#10 $68 A+ Infrequent Drivers Allstate

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Influence the Cost of Toyota C-HR Car Insurance

The cost of car insurance for a Toyota C-HR can be influenced by various factors. Insurance providers take into account the driver’s age, gender, driving experience, and location. Additionally, the model and year of the vehicle, as well as the frequency and severity of past claims associated with similar cars, can impact the cost of insurance.

Toyota C-HR Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $68 $150

American Family $59 $135

Farmers $52 $120

Liberty Mutual $62 $140

Nationwide $50 $115

Progressive $45 $105

Safeco $54 $125

State Farm $47 $110

The Hartford $65 $145

Travelers $56 $130

The availability of safety features, such as anti-theft systems, airbags, and collision avoidance technology, can also affect the premium. Furthermore, the individual’s driving record, annual mileage, and credit history can play a role in determining the insurance cost. Another factor that can influence the cost of car insurance for a Toyota C-HR is the level of coverage chosen by the driver.

Insurance providers offer different levels of coverage, such as liability-only or comprehensive coverage, and the cost of insurance will vary accordingly. Drivers who opt for higher coverage limits or additional coverage options may have higher premiums.

In addition, the driver’s occupation and usage of the vehicle can impact the cost of insurance. Some occupations may be considered higher risk by insurance providers, leading to higher premiums. Similarly, if the vehicle is used for business purposes or for ridesharing services, the insurance cost may be higher due to increased exposure to potential accidents.

Understanding the Insurance Requirements for Toyota C-HR

Before purchasing car insurance for your Toyota C-HR, it’s important to understand the insurance requirements in your jurisdiction. Every state or country has its own minimum liability coverage requirements, and failure to meet these requirements can result in penalties.

Liability insurance covers the costs associated with bodily injury and property damage to others in case of an accident for which the insured driver is at fault. It is crucial to familiarize yourself with the specific insurance requirements in your area to ensure compliance and proper protection.

Additionally, it’s worth noting that while liability insurance is the minimum requirement, it may not provide sufficient coverage for all situations. It’s recommended to consider purchasing additional coverage options such as collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Collision coverage helps pay for repairs or replacement of your vehicle in case of an accident, regardless of fault.

Daniel Walker Licensed Insurance Agent

Comprehensive coverage protects against non-collision incidents such as theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage provides coverage if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

Furthermore, it’s important to review your insurance policy periodically to ensure it still meets your needs. As your Toyota C-HR ages, its value may decrease, and you may want to adjust your coverage accordingly.

Additionally, if you make modifications to your vehicle, such as adding aftermarket parts or accessories, you should inform your insurance provider to ensure they are adequately covered. Regularly reviewing and updating your insurance policy can help ensure you have the right coverage in place to protect yourself and your Toyota C-HR.

Comparing Car Insurance Quotes for Toyota C-HR

When shopping for car insurance for your Toyota C-HR, it’s essential to compare quotes from multiple insurance providers. Each insurer has its own method for calculating premiums, which can result in significant variations in cost for the same coverage. By obtaining quotes from different companies, you can identify the most competitive offers and potentially save money on your insurance premium.

Comparing quotes allows you to consider different coverage options and select the policy that best suits your needs and budget. One important factor to consider when comparing car insurance quotes for your Toyota C-HR is the level of coverage provided. Different insurance providers may offer varying levels of coverage, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

It’s crucial to carefully review the details of each policy to ensure that it meets your specific needs and provides adequate protection in case of an accident or other unforeseen events. In addition to coverage options, it’s also worth considering the reputation and customer service of the insurance companies you are comparing.

Reading reviews and seeking recommendations from friends or family members can give you insights into the quality of service provided by each insurer. A company with a strong reputation for customer satisfaction and prompt claims handling may be worth paying a slightly higher premium for, as it can provide peace of mind and a smoother experience in the event of a claim.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Car Insurance for Toyota C-HR

Finding affordable car insurance for your Toyota C-HR can be a daunting task. However, there are several tips that can help you secure a more budget-friendly policy. First and foremost, maintain a clean driving record and avoid traffic violations as this can significantly impact insurance costs.

Additionally, consider increasing your deductibles, as higher deductibles can result in lower premiums. You may also qualify for discounts based on factors such as a good credit score, bundling multiple policies, or completing a defensive driving course.

Shopping around, reviewing your coverage regularly, and maintaining a good credit history can also help in finding affordable car insurance for your Toyota C-HR. Explore our detailed analysis on “Can I bundle my car insurance with other policies?” for additional information.

Average Toyota C-HR Car Insurance Costs by Location

The average cost of Toyota C-HR car insurance can vary depending on the location. Each area has unique insurance regulations, risk factors, and demographic characteristics that influence insurance pricing. Urban areas with higher traffic congestion and crime rates tend to have higher insurance costs compared to rural regions.

Other location-specific factors, such as the frequency of severe weather events, can also impact insurance rates. To determine the average cost of Toyota C-HR car insurance in your specific location, it is advisable to request quotes from local insurance providers or consult industry reports.

Exploring Different Types of Coverage Options for Toyota C-HR

When obtaining car insurance for your Toyota C-HR, it’s important to understand the different types of car insurance coverage options available. The most common types of coverage include liability coverage, which covers damages to others in an accident for which the insured driver is at fault, and collision coverage, which covers damages to the insured vehicle resulting from a collision.

Comprehensive coverage provides protection against damages unrelated to collisions, such as theft or natural disasters. Personal injury protection covers medical expenses for the insured driver and passengers in case of an accident. It’s important to carefully consider the coverage options and select the ones that provide adequate protection for your Toyota C-HR.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Age and Driving Experience Affect Toyota C-HR Car Insurance Rates

The age and driving experience of the insured driver can affect the cost of car insurance for a Toyota C-HR. Younger drivers generally face higher insurance premiums due to their limited driving experience and higher accident risk. On the other hand, more experienced drivers, particularly those with a clean driving record, often enjoy lower insurance rates.

Insurance companies consider statistics and actuarial data to assess the risk associated with different age groups and driving experience levels. It’s important to note that premiums can vary between insurance providers, so it’s always wise to compare quotes and explore different coverage options. Get more insights by reading our expert “How much is car insurance?” advice.

The Impact of Vehicle Value on Toyota C-HR Insurance Premiums

The value of your Toyota C-HR can impact your insurance premiums. Generally, more expensive vehicles tend to have higher insurance costs. This is because the replacement or repair costs associated with a higher-value vehicle are higher, hence increasing the insurer’s risk exposure. It’s essential to consider the vehicle’s value when selecting coverage limits and deductibles.

Additionally, newer Toyota C-HR models may have higher insurance costs compared to older ones due to their higher market value. By considering both the vehicle’s value and your individual needs, you can make an informed decision regarding coverage options and insurance costs.

How to Lower Your Toyota C-HR Car Insurance Premiums

Lowering your Toyota C-HR car insurance premiums requires a proactive approach. One effective strategy is to maintain a clean driving record by avoiding traffic violations and accidents.

Additionally, bundling your car insurance policy with other types of insurance, such as homeowners or renters insurance, can often result in discounted rates. Taking advantage of available discounts, such as those for safe driving, good grades (for student drivers), or anti-theft devices, can also help lower premiums.

Reviewing your coverage regularly, considering higher deductibles, and comparing quotes from different providers are other effective methods to potentially reduce your Toyota C-HR car insurance premiums. Continue reading our full “What are some ways to lower my car insurance premiums?” guide for extra tips.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Safety Features and Toyota C-HR Insurance Rates

The safety features present in your Toyota C-HR can influence the insurance rates. Insurance providers consider vehicles equipped with safety features as less risky, resulting in lower insurance premiums. Safety features such as anti-lock brakes, airbags, traction control, stability control, and collision avoidance systems can help reduce the risk of accidents and injuries.

Additionally, anti-theft devices such as alarms or immobilizers can lower the risk of vehicle theft, potentially leading to discounted insurance rates. When purchasing a Toyota C-HR, it’s advisable to opt for models equipped with advanced safety features to potentially lower your insurance costs. For more information, explore our informative “Safety Car Insurance Discounts” page.

Deductibles and Toyota C-HR Insurance Costs

The deductible is the amount you agree to pay out of pocket before your insurance provider covers the remaining expenses in case of a claim. Choosing a higher deductible can lead to lower insurance premiums since you are assuming a greater portion of the risk.

However, it’s important to ensure that you can afford to pay the deductible in case of an accident. It’s advisable to assess your financial situation and select a deductible that strikes the right balance between affordability and potential savings on insurance costs.

Understanding how deductibles impact Toyota C-HR car insurance costs can help you make an informed decision when selecting your coverage. Expand your understanding with our thorough “What is the difference between a deductible and a premium in car insurance?” overview.

Why Toyota C-HR Insurance Is More Expensive

Several factors contribute to making Toyota C-HR more expensive to insure compared to other vehicle models. Firstly, the Toyota C-HR is a relatively new model, which often leads to higher insurance costs due to limited historical data available for insurers to assess risk accurately.

Additionally, the Toyota C-HR’s design and features, such as its sleek appearance and advanced safety technology, can increase repair costs in case of an accident or damage. Read our extensive guide on “Insurance Quotes Online” for more knowledge.

Lastly, the Toyota brand’s reputation for reliability and safety can also contribute to higher insurance premiums. Understanding these factors can help you evaluate the potential costs associated with insuring a Toyota C-HR compared to other vehicle models.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Discounts and Savings for Toyota C-HR Insurance

Insurance providers often offer various discounts and savings opportunities that can help lower the cost of insuring your Toyota C-HR. Some common discounts include safe driver discounts for maintaining a clean driving record, good student discounts, multi-vehicle discounts for insuring multiple vehicles with the same provider, and bundling discounts for combining multiple types of insurance policies.

Additionally, specific safety features installed in your Toyota C-HR, such as anti-theft systems or lane departure warning systems, can also make you eligible for further discounts.

It’s essential to inquire about available discounts when obtaining quotes and compare the savings they offer to select the most advantageous option for your Toyota C-HR car insurance. Dive deeper into “Lesser Known Car Insurance Discounts for” with our complete resource.

Common Mistakes to Avoid When Insuring a Toyota C-HR

When insuring your Toyota C-HR, it’s important to be aware of common mistakes to avoid that could increase your insurance costs. Firstly, failing to compare quotes from multiple insurance providers can lead to paying higher premiums than necessary. Additionally, not reviewing your coverage regularly can result in inadequate or excessive coverage, which can impact your premiums.

Jeff Root Licensed Insurance Agent

Another mistake to avoid is not taking advantage of available discounts or failing to update your insurer on changes in circumstances, such as installing safety features or completing a defensive driving course. Learn more by visiting our detailed “Commonly Misunderstood Insurance Concepts” section.

By being proactive and avoiding these common mistakes, you can optimize your Toyota C-HR car insurance coverage and potentially save on insurance costs. By covering these topics in detail, we aim to provide comprehensive information on the factors influencing the cost of Toyota C-HR car insurance, the various coverage options available, and strategies for finding affordable insurance.

Whether you are a prospective Toyota C-HR owner or currently insuring one, this article will help you understand the intricacies of insuring this popular vehicle model. See if you’re getting the best deal on car insurance by entering your ZIP code below

Frequently Asked Questions

What affects Toyota C-HR insurance costs?

Factors affecting Toyota C-HR insurance costs include your age, location, driving record, credit score, coverage options, and deductible amounts.

Explore our detailed analysis on “How does the insurance company determine my premium?” for additional information.

Is Toyota C-HR car insurance more expensive than other Toyota models?

The cost of Toyota C-HR car insurance may vary compared to other Toyota models due to factors such as the vehicle’s value, safety features, repair costs, and theft rates. It is recommended to obtain quotes from insurance providers to determine the specific cost.

What is the Toyota C-HR insurance cost?

The cost of insuring a Toyota C-HR averages around $155 monthly, but rates can vary based on multiple factors.

Are there any discounts available for Toyota C-HR car insurance?

Yes, there are various discounts that may be available for Toyota C-HR car insurance. These can include discounts for safe driving records, bundling multiple policies, installing anti-theft devices, taking defensive driving courses, and maintaining good grades for student drivers.

Get more insights by reading our expert “What is Affordable coverage?” advice.

What are the average insurance rates for a Toyota C-HR?

The average insurance rates for a Toyota C-HR can vary depending on multiple factors. It is advisable to request quotes from different insurance companies to get a more accurate estimate based on your specific circumstances.

What are some tips for reducing the cost of Toyota C-HR car insurance?

Some tips for reducing the cost of Toyota C-HR car insurance include maintaining a clean driving record, bundling policies, and taking advantage of available discounts.

Do Toyota C-HR car insurance costs differ by state?

Yes, the cost of Toyota C-HR car insurance can vary by state. Each state has different insurance regulations, minimum coverage requirements, and varying levels of risk, which can affect the rates offered by insurance providers.

Continue reading our full “What states require car insurance?” guide for extra tips.

Which is the cheapest Toyota C-HR car insurance provider?

Progressive, State Farm, and Nationwide are the top three providers offering the cheapest rates for Toyota C-HR insurance.

Why is Toyota C-HR insurance so expensive?

Toyota C-HR insurance can be more expensive due to factors like repair costs, safety features, and the driver’s profile, including age and driving history.

Which Toyota C-HR car insurance company offers the best rates?

Progressive generally offers the best rates for Toyota C-HR car insurance, providing affordable options and comprehensive coverage.

For more information, explore our informative “Best Car Insurance by Vehicle” page.

What type of Toyota C-HR car insurance should I get?

Where can I find the cheapest full-coverage Toyota C-HR insurance?

At what age is Toyota C-HR insurance the cheapest?

What should I know about auto insurance for Toyota C-HR?

How does the Toyota C-HR insurance cost vary by age?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.