Cheap Subaru Legacy Car Insurance in 2026 (Cash Savings With These 10 Companies)

Liberty Mutual, Nationwide, and Travelers are the top picks for cheap Subaru Legacy car insurance, starting at $70/month. These providers stand out due to their competitive rates, comprehensive coverage options, and outstanding customer satisfaction levels among Subaru Legacy owners across various regions.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated September 2024

Company Facts

Min. Coverage for Subaru Legacy

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Subaru Legacy

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Subaru Legacy

A.M. Best Rating

Complaint Level

Pros & Cons

These companies offer exceptional value, balancing cost with the quality of service, which is a key consideration for Subaru Legacy owners seeking reliable and economical insurance options. By focusing on these providers, Subaru Legacy owners can benefit from competitive rates and policies tailored to their specific needs. Explore insights in our article titled “Subaru Car Insurance Discount.”

Our Top 10 Company Picks: Cheap Subaru Legacy Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $70 A Add-on Coverages Liberty Mutual

#2 $71 A+ Widespread Availability Nationwide

#3 $73 A++ Coverage Options Travelers

#4 $76 A+ Infrequent Drivers Allstate

#5 $78 A Customizable Policies Farmers

#6 $82 A Costco Members American Family

#7 $96 A+ Tailored Policies The Hartford

#8 $105 A Diminishing Deductible Safeco

#9 $108 B Many Discounts State Farm

#10 $113 A+ Qualifying Coverage Progressive

This approach ensures that drivers secure the best possible insurance, enhancing their overall driving experience and financial security.

Enter your ZIP code above to compare quotes instantly and find the cheapest insurance available.

- Liberty Mutual is the top choice for Subaru Legacy car insurance

- Tailored coverage options meet the unique needs of Subaru Legacy owners

- Policies focus on affordability and customer satisfaction for Legacy drivers

#1 – Liberty Mutual: Top Overall Pick

Pros

- Affordable Base Rate: Liberty Mutual offers Subaru Legacy car insurance starting at $70 per month, providing a competitive rate.

- Strong Financial Stability: Rated ‘A’ by A.M. Best, Liberty Mutual ensures reliable claims processing for Subaru Legacy owners. To find out more about the company, check out our article titled “Liberty Mutual Review & Ratings.”

- Diverse Add-on Options: Offers various add-on coverages specifically tailored for Subaru Legacy, enhancing protection and flexibility.

Cons

- Higher Costs for Add-ons: While base rates are competitive, the cost for additional coverages for Subaru Legacy can accumulate.

- Selective Coverage Approval: Certain add-ons for Subaru Legacy may not be available or might require eligibility criteria, limiting accessibility.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Widespread Availability

Pros

- Slightly Higher Base Rate: Nationwide provides Subaru Legacy insurance at $71/month, supported by an A+ A.M. Best rating, indicating strong backing.

- Extensive Network: With widespread availability, Nationwide ensures that Subaru Legacy owners can easily find service no matter where they are. Additional details about this provider can be found in our article titled “Nationwide Insurance Review & Ratings.”

- Dependable Customer Service: Nationwide is known for reliable customer service, beneficial for Subaru Legacy owners requiring frequent interaction.

Cons

- Variable Rates by Location: For Subaru Legacy insurance, rates may vary significantly based on the owner’s location.

- Limited High-Risk Coverage: Subaru Legacy owners with a high-risk profile might find it challenging to obtain favorable rates from Nationwide.

#3 – Travelers: Best for Coverage Options

Pros

- Competitive Pricing for Features: At $73/month, Travelers offers a diverse range of coverage options for Subaru Legacy at competitive pricing.

- Top Industry Rating: Holds an A++ from A.M. Best, the highest rating, ensuring superior financial health for handling claims for Subaru Legacy.

- Adaptable Coverage Plans: Provides multiple adaptable coverage options, allowing Subaru Legacy owners to tailor their policies extensively. Explore our analysis of the article titled “Travelers Insurance Review & Ratings.”

Cons

- Premium Costs: Despite a variety of options, premium costs for comprehensive coverage for Subaru Legacy might be higher.

- Complex Policy Options: The wide array of options can be overwhelming and confusing for new Subaru Legacy insurance buyers.

#4 – Allstate: Best for Infrequent Drivers

Pros

- Optimized for Low Usage: Allstate offers competitive rates at $76/month for Subaru Legacy owners who drive infrequently, making it an economical choice.

- Strong Financial Rating: Backed by an A+ rating from A.M. Best, Allstate is dependable for claims settlement for Subaru Legacy.

- Discounts for Low Mileage: Provides significant discounts for Subaru Legacy owners who report low annual mileage. For additional details, refer to our article titled “Allstate Insurance Review & Ratings.”

Cons

- Higher Rates for Regular Drivers: Regular drivers of Subaru Legacy may find the rates less competitive compared to those for infrequent drivers.

- Fewer Customization Options: Compared to competitors, Allstate offers fewer customization options for Subaru Legacy policies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Customizable Policies

Pros

- Customization at the Forefront: Farmers allows extensive policy customization, making it ideal for Subaru Legacy owners with specific needs, priced at $78/month.

- Robust Financial Health: Rated ‘A’ by A.M. Best, Farmers ensures solid support for claims related to Subaru Legacy.

- Dedicated Agents: Offers dedicated agent support for personalizing Subaru Legacy insurance policies. Discover insights in our article titled “Farmers Insurance Review & Ratings.”

Cons

- Higher Cost for Customization: Customization can lead to higher premiums for Subaru Legacy insurance.

- Complexity in Policy Management: The wide variety of options might make managing the policy more complex for Subaru Legacy owners.

#6 – American Family: Best for Costco Members

Pros

- Exclusive Discounts for Members: American Family offers exclusive discounts to Costco members, making it a cost-effective choice for Subaru Legacy insurance at $82/month.

- Strong Financial Rating: With an A rating from A.M. Best, American Family provides dependable support for Subaru Legacy insurance claims.

- Member Benefits: Costco members benefit from additional perks and services, enhancing the value for Subaru Legacy owners. Explore insurance savings in our full article titled “American Family Insurance Review & Ratings.”

Cons

- Membership Requirement: Discounts and some benefits for Subaru Legacy insurance are exclusive to Costco members, limiting availability.

- Standard Rates Higher: Non-Costco members may find the standard rates for Subaru Legacy insurance less competitive.

#7 – The Hartford: Best for Tailored Policies

Pros

- Custom-Fit Policies: The Hartford excels in offering tailored policies, particularly beneficial for Subaru Legacy owners, with rates starting at $96/month.

- High Financial Stability: An A+ rating from A.M. Best assures strong backing for Subaru Legacy insurance claims. Delve into our evaluation of our article titled “The Hartford Insurance Review & Ratings.”

- Specialized Services for Seniors: Offers services and discounts tailored for senior drivers of Subaru Legacy, enhancing accessibility and affordability.

Cons

- Premium Pricing: Tailored policies for Subaru Legacy come at a higher price, potentially increasing overall insurance costs.

- Age-Specific Benefits: While beneficial for seniors, younger Subaru Legacy owners might find fewer advantages or higher rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Safeco: Best for Diminishing Deductible

Pros

- Diminishing Deductible: Safeco’s unique diminishing deductible option rewards Subaru Legacy owners with claim-free records, starting at a rate of $105/month.

- Robust Financial Foundation: Rated ‘A’ by A.M. Best, Safeco ensures reliability in handling claims for Subaru Legacy. See more details on our article titled “Safeco Insurance Review & Ratings.”

- Flexible Payment Options: Offers flexible payment plans, making it easier for Subaru Legacy owners to manage their insurance costs.

Cons

- Higher Initial Rates: Starting rates for Subaru Legacy insurance are higher, which might not be ideal for budget-conscious owners.

- Deductible Dependency: The benefits, including diminishing deductibles, are contingent on maintaining a claim-free record, which may not benefit all Subaru Legacy owners.

#9 – State Farm: Best for Many Discounts

Pros

- Wide Range of Discounts: State Farm offers a variety of discounts that can significantly lower the cost of Subaru Legacy insurance, initially priced at $108/month.

- Extensive Coverage Options: Provides a broad array of coverage options, allowing Subaru Legacy owners to customize their policies extensively.

- Solid Financial Standing: An ‘B’ rating by A.M. Best still ensures a reasonable level of reliability in financial matters for Subaru Legacy claims. Discover more about offerings in our article titled “State Farm Insurance Review & Ratings.”

Cons

- Higher Base Rates: Despite the discounts, base rates for Subaru Legacy insurance may still be high compared to competitors.

- Limited High-Value Discounts: The most valuable discounts are often reserved for customers with multiple policies or long-term relationships, which may not apply to all Subaru Legacy owners.

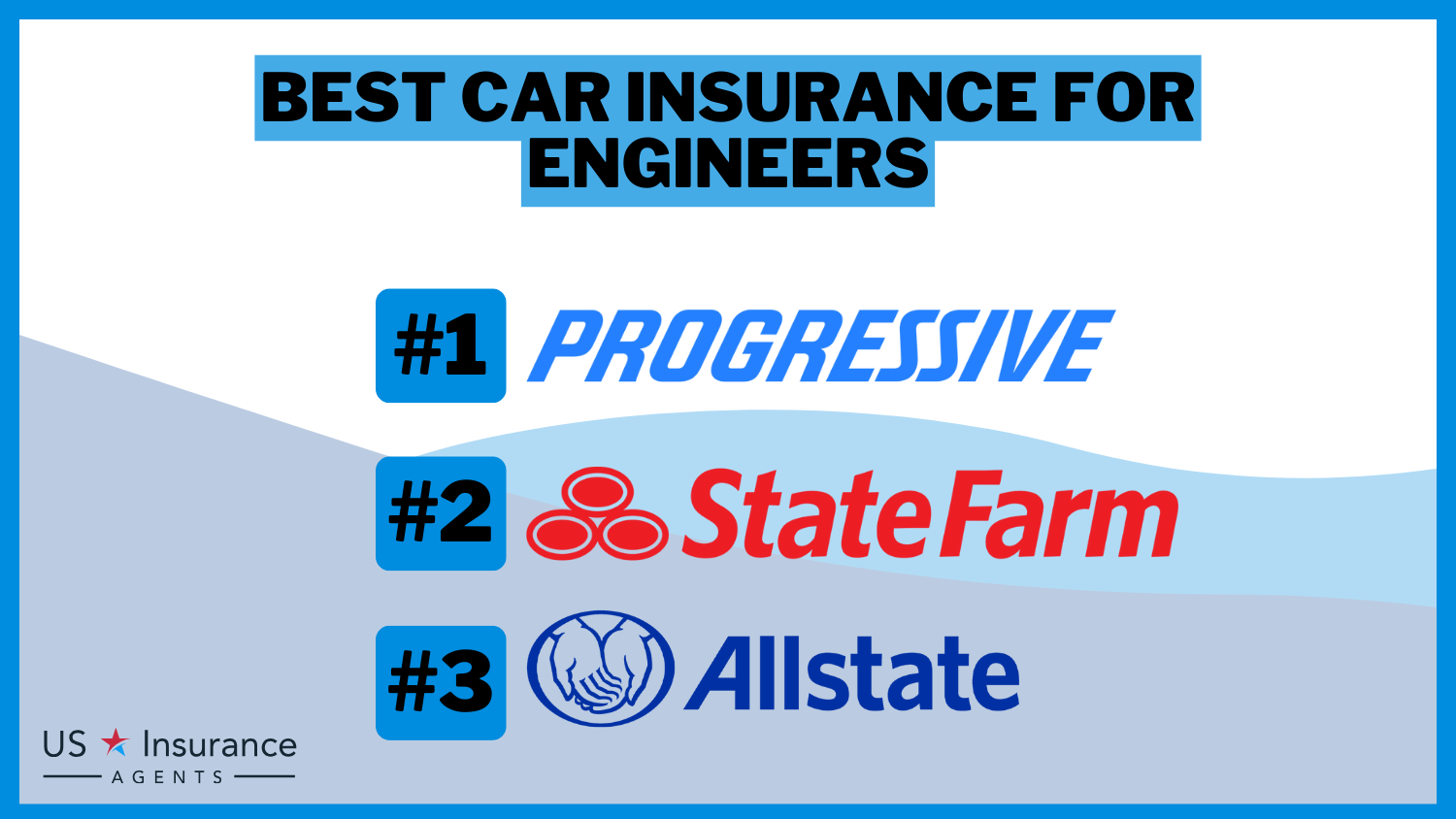

#10 – Progressive: Best for Qualifying Coverage

Pros

- Tailored Qualifying Coverages: Progressive offers innovative coverage options that qualify for discounts, making Subaru Legacy insurance starting at $113/month more attractive.

- Top-Tier Financial Rating: With an A+ rating from A.M. Best, Progressive stands out for its financial robustness in handling Subaru Legacy claims. Learn more by reading the article titled “Progressive Insurance Review & Ratings”.

- Technology-Driven Services: Utilizes technology like mobile apps and online tools to enhance user experience and management of Subaru Legacy policies.

Cons

- Higher Premiums for Advanced Features: Advanced features and comprehensive coverage for Subaru Legacy come with higher premiums.

- Complex Discount Structures: While discounts are available, they often require specific qualifications that may not be straightforward for all Subaru Legacy owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Monthly Insurance Rates for Subaru Legacy: Minimum vs. Full Coverage

When selecting car insurance for a Subaru Legacy, understanding how rates vary by coverage level and provider is crucial. Below is a breakdown of the monthly rates for both minimum and full coverage across several insurance providers. Unlock details in our article titled “Full Coverage Car Insurance: A Complete Guide.”

Subaru Legacy Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $76 $161

American Family $82 $177

Farmers $78 $242

Liberty Mutual $70 $211

Nationwide $71 $250

Progressive $113 $219

Safeco $105 $178

State Farm $108 $199

The Hartford $96 $209

Travelers $73 $221

For Subaru Legacy owners, the cost of minimum coverage starts as low as $70 with Liberty Mutual and can go up to $113 with Progressive. When considering full coverage, rates increase significantly, reflecting the broader protection offered. Nationwide presents the highest rate for full coverage at $250, whereas Safeco offers a more moderate option at $178.

Factors That Determine Subaru Legacy Car Insurance Rates

Several factors influence the insurance rates for your Subaru Legacy, including its model and year. Newer models often have higher premiums due to greater replacement costs, whereas older models typically have lower rates due to decreased risk. Additionally, your driving record significantly affects your rates; a history of accidents or violations can increase costs, while a clean record may lower them.

Your location can impact your Subaru Legacy’s insurance costs. High traffic or crime rates may increase premiums due to greater risk of accidents or theft. The coverage type chosen also affects rates. Comprehensive coverage, which provides protection against theft, vandalism, and other non-collision incidents, typically results in higher premiums compared to basic liability coverage.

Furthermore, your age and gender can also influence your Subaru Legacy’s insurance rates. Younger drivers, especially those under the age of 25, often face higher insurance costs due to their perceived higher risk of accidents. Additionally, statistics show that male drivers tend to have higher insurance rates compared to female drivers.

Understanding the Cost of Insuring a Subaru Legacy

The cost of insuring your Subaru Legacy involves more than basic factors. Insurers evaluate statistics and data, including crash-test ratings, safety features, and claim frequencies for specific models. The Subaru Legacy’s reputation as a safe and reliable vehicle, underscored by excellent safety ratings and advanced features, can lead to lower insurance premiums compared to other models.

However, other factors like age, gender, and credit history also impact your insurance rates. Younger drivers and those with poor credit scores typically face higher premiums. Additionally, the location where your Subaru Legacy is primarily driven and parked influences costs too. High crime rates or frequent accidents in an area can raise premiums. Learn more in our article titled “Does Liberty Mutual car insurance cover a stolen car?”

Additionally, your driving record impacts your Subaru Legacy insurance costs. Insurers evaluate your accident history, traffic violations, and claims to set rates. If you have a clean driving record with no accidents or violations, you may be eligible for lower insurance premiums. On the other hand, if you have a history of accidents or traffic violations, you may face higher insurance costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Average Insurance Premiums for Subaru Legacy Owners

The average insurance premiums for Subaru Legacy owners can vary depending on multiple factors. According to industry data, the average monthly insurance cost for a Subaru Legacy ranges between $100 to $125. However, it is crucial to remember that these figures are estimates and can differ based on several individualized factors outlined earlier.

A key factor affecting Subaru Legacy insurance premiums is the driver’s age and experience. Drivers under 25 often face higher costs due to their increased accident risk. On the other hand, more experienced drivers with a clean driving record may be eligible for lower premiums. See more details on our article titled “Car Driving Safety Guide for Teens and Parents.”

Another factor that can impact insurance premiums is the location where the Subaru Legacy is primarily driven and parked. Urban areas with higher rates of accidents and thefts may result in higher insurance costs compared to rural areas with lower risk factors. Additionally, the specific state and local regulations regarding insurance requirements and coverage options can also affect the premiums.

Comparing Insurance Rates for Different Subaru Legacy Models

When comparing insurance rates for different Subaru Legacy models, aspects such as engine size, trim level, and optional features can influence the premiums. Generally, high-performance or turbocharged models may have higher insurance rates due to their increased risk of accidents or theft. On the other hand, base models or those equipped with additional safety features may qualify for lower insurance rates.

Another factor that can affect insurance rates for Subaru Legacy models is the driver’s age and driving history. Younger drivers or those with a history of accidents or traffic violations may face higher premiums compared to older, more experienced drivers with clean records. Discover insights in our article titled “How does my driving record affect my parents insurance rates?”

In addition to the car’s specifications and the driver’s profile, the location where the Subaru Legacy is primarily driven and parked can also impact insurance rates. Areas with higher rates of accidents, theft, or vandalism may result in higher premiums, while safer neighborhoods or regions with lower crime rates may lead to lower insurance costs.

Tips for Finding Affordable Car Insurance for Your Subaru Legacy

Finding affordable car insurance for your Subaru Legacy involves careful consideration and comparison. To secure the best insurance deal, start by shopping around and obtaining quotes from multiple insurance companies to compare rates and coverage options. Delve into our evaluation of our article titled “Cheapest Car Insurance Companies.”

Melanie Musson Published Insurance Expert

Maintaining a clean driving record by driving responsibly and avoiding accidents or traffic violations is also crucial. Consider raising your deductible, as a higher deductible usually results in lower insurance premiums. Additionally, take advantage of any available discounts offered by insurance companies, such as safe driver discounts or bundling multiple policies.

Installing additional safety features in your Subaru Legacy, such as anti-theft devices or advanced safety systems, may also qualify you for insurance discounts. Implementing these tips can significantly increase your chances of finding affordable car insurance that meets your needs and budget.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors to Consider When Shopping for Subaru Legacy Car Insurance

When shopping for Subaru Legacy car insurance, it’s important to consider several factors to ensure you select the right coverage for your vehicle. These factors include:

- Liability Coverage: Understand the minimum liability coverage required by your state and consider higher coverage limits to protect yourself financially in the event of an accident.

- Comprehensive and Collision Coverage: Evaluate whether you need comprehensive and collision coverage to protect your Subaru Legacy from non-collision-related damage, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Determine whether it is necessary to have this coverage to protect yourself if you are involved in an accident caused by an uninsured or underinsured driver.

- Medical Payments Coverage: Consider adding medical payments coverage to help cover medical expenses, regardless of who is at fault in an accident. Access comprehensive insights into our article titled “Best Car Insurance for Medical Payments Coverage.”

- Gap Insurance: If you are financing or leasing your Subaru Legacy, consider adding gap insurance to cover potential gaps between the vehicle’s value and what you owe in the event of a total loss.

In conclusion, selecting the right car insurance for your Subaru Legacy involves a careful evaluation of various coverage options to ensure comprehensive protection and financial security. By considering factors such as liability, comprehensive, uninsured motorist, and medical payments coverage, you can tailor your policy to meet your specific needs and safeguard against a wide range of potential risks.

How to Save Money on Subaru Legacy Car Insurance

To save money on Subaru Legacy car insurance, you can adopt several effective strategies. First, maintaining a good driving record through safe driving habits and avoiding accidents is crucial. Additionally, consider bundling your Subaru Legacy insurance with other policies, like home or renters insurance, to benefit from multi-policy discounts.

You should also explore available discounts for good students, safe drivers, or for installing certain safety features in your Subaru Legacy. Opting for a higher deductible can reduce your monthly premiums, but make sure it’s an amount you can comfortably afford in case of a claim.

Finally, regularly review and update your insurance coverage to ensure you’re receiving the most favorable rates and coverage for your Subaru Legacy.

Common Mistakes to Avoid When Insuring Your Subaru Legacy

When insuring your Subaru Legacy, it’s crucial to avoid common mistakes that can lead to higher insurance costs. One frequent error is failing to shop around for insurance quotes and simply accepting the first offer you receive.

Additionally, many overlook the need to review and update their coverage as personal circumstances change, such as relocating or adding a new driver to the policy. Another oversight is not taking advantage of available discounts or failing to inquire about potential cost-saving opportunities. Unlock details in our article titled “How do I add or remove drivers from my Safeco car insurance policy?”

Equally important is maintaining a good driving record, as it significantly impacts your insurance rates. By being proactive and sidestepping these pitfalls, you can potentially save money on your Subaru Legacy car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Relationship Between Your Driving Record and Subaru Legacy Insurance Rates

Your driving record plays a significant role in determining your Subaru Legacy insurance rates. Insurance companies assess your driving history to determine your risk level as a driver. If you have a history of accidents, traffic violations, or filed claims, you may be considered a higher-risk driver, resulting in increased insurance premiums.

On the other hand, having a clean driving record with no accidents or violations can work in your favor and potentially lead to lower insurance rates. It demonstrates to insurance providers that you are a responsible and safe driver, reducing the likelihood of filing claims.

How the Age and Mileage of Your Subaru Legacy Impact Insurance Costs

The age and mileage of your Subaru Legacy can influence your insurance costs. Newer Subaru Legacy models may have higher insurance premiums due to their higher market value and replacement costs. As a vehicle ages, it may be considered less valuable, resulting in potentially lower insurance rates. Discover more about offerings in our article titled “Low Mileage Car Insurance Discount.”

Additionally, the mileage on your Subaru Legacy can also impact your insurance costs. Vehicles with higher mileage tend to be associated with increased wear and tear and a higher risk of mechanical issues. Insurance providers may view these vehicles as more likely to be involved in accidents or breakdowns, potentially leading to higher insurance premiums.

The Impact of Location on Your Subaru Legacy Car Insurance Premiums

Your location can have a significant impact on your Subaru Legacy car insurance premiums. Insurance rates are influenced by the level of traffic congestion, crime rates, and even the likelihood of natural disasters in your area. See more details on our article titled “Does Nationwide car insurance cover damage caused by a natural disaster if I only have liability coverage?”

Ty Stewart Licensed Insurance Agent

If you live in a highly populated urban area or an area with a higher crime rate, insurance providers may deem your vehicle at a higher risk of accidents, theft, or vandalism, leading to higher insurance premiums. On the other hand, residing in a rural area with less traffic and lower crime rates can result in potentially lower insurance costs for your Subaru Legacy.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Deductible and Its Effect on Your Subaru Legacy Insurance Rate

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. It can impact your Subaru Legacy insurance rate. Generally, selecting a higher deductible can lower your insurance premiums and vice versa.

While choosing a higher deductible may result in immediate cost savings, it’s important to consider whether you can comfortably afford to pay the deductible in the event of a claim. Balancing your deductible amount with your financial situation is essential to ensure you can afford out-of-pocket expenses if needed.

Why It’s Important to Shop around for the Best Subaru Legacy Car Insurance Deal

Shopping around for the best Subaru Legacy car insurance deal is crucial for several reasons. Insurance rates can vary significantly between providers, and by obtaining quotes from multiple insurance companies, you can compare rates and coverage options to find the most suitable and affordable policy for your Subaru Legacy.

Additionally, insurance needs can change over time, whether due to personal circumstances, changes in coverage requirements, or shifts in insurance providers’ offerings. Periodically reviewing your insurance options allows you to ensure you are receiving the best deal and coverage for your Subaru Legacy. Discover insights in our article titled “Best Car Insurance Discounts to Ask for.”

Would you know what to do if someone hit your parked car? Here are some tips on what to do if this happens to you. https://t.co/jGoBYAFD12 pic.twitter.com/hsrMs9Qka5

— Liberty Mutual (@LibertyMutual) October 19, 2023

In conclusion, Subaru Legacy car insurance costs vary based on your vehicle’s model and year, driving history, location, and chosen coverages. By considering these factors and comparing quotes, you can secure affordable insurance for your Subaru Legacy. Ensure to shop around and evaluate all aspects to make a well-informed insurance decision.

Don’t let expensive insurance rates hold you back. Enter your ZIP code below and shop for affordable premiums from the top companies.

Frequently Asked Questions

What factors affect the cost of Subaru Legacy car insurance?

The cost of Subaru Legacy car insurance can be influenced by various factors such as the driver’s age, location, driving history, coverage options, deductibles, and the insurance company’s pricing policies.

Access comprehensive insights into our guide titled “Best Car Insurance for Teens in California.”

Are Subaru Legacies expensive to insure?

The insurance rates for Subaru Legacies are generally affordable compared to many other vehicles in its class. However, the actual cost of insurance can vary depending on individual circumstances and the factors mentioned above.

Is it more expensive to insure a new Subaru Legacy compared to an older model?

In most cases, insuring a new Subaru Legacy may be slightly more expensive than insuring an older model. This is because new vehicles tend to have higher overall values and may require more costly repairs or replacement parts in the event of an accident.

How can I find the best insurance rates for a Subaru Legacy?

To find the best insurance rates for a Subaru Legacy, it is recommended to shop around and compare quotes from multiple insurance providers. Additionally, maintaining a clean driving record, opting for higher deductibles, and taking advantage of available discounts can help in securing more affordable insurance premiums.

Learn more by reading our guide titled “Multi Vehicle Car Insurance Discount.”

Can I get discounts on Subaru Legacy car insurance?

Yes, many insurance companies offer discounts that can help lower the cost of Subaru Legacy car insurance. These discounts may be based on factors such as having a good driving record, bundling multiple policies, installing safety features, or being a member of certain organizations.

Enter your ZIP code below to get personalized insurance quotes tailored to your needs and budget.

Does the Subaru Legacy’s safety rating affect insurance costs?

Yes, the Subaru Legacy’s safety rating affects insurance costs. Higher safety ratings can lead to lower premiums as they indicate a lower risk of injury and damage, making the vehicle cheaper to insure.

What are the different types of cheap car insurance for Subaru Legacy?

The types of cheap car insurance for Subaru Legacy include liability coverage, collision coverage, and comprehensive coverage, all offering various levels of protection at competitive rates.

How do Geico vs Progressive insurance rates compare for Subaru Legacy?

For Subaru Legacy, Geico generally offers more competitive rates compared to Progressive, with specifics varying based on individual profiles and location.

To learn more, explore our comprehensive resource on “Do Geico employees get car insurance discounts.”

How does age affect car insurance rates for the Subaru Legacy?

Age significantly impacts car insurance rates for the Subaru Legacy; younger drivers typically face higher rates due to perceived inexperience, while older drivers may benefit from lower rates due to their driving history.

Who are the cheapest car insurance providers for Subaru Legacy owners?

The cheapest car insurance providers for Subaru Legacy owners are Liberty Mutual, Nationwide, and Travelers, known for their affordable rates and comprehensive coverage options.

Is insurance high on a Subaru Legacy?

Are Subarus high in insurance?

How do I compare Subaru Legacy insurance quotes?

Can I get discounts on Subaru Legacy car insurance?

What is the average Subaru Legacy insurance cost?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.