Cheap Scion xB Car Insurance in 2024 (Save Money With These 10 Companies)

Cheap Scion xB car insurance is best obtained from the top providers, Allstate, USAA, and State Farm, with rates starting at $50/month. These providers excel in affordability, comprehensive coverage, and customer service, making them the top choices for budget-friendly Scion xB insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated January 2025

Company Facts

Min. Coverage for Scion xB

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Scion xB

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Scion xB

A.M. Best

Complaint Level

Pros & Cons

The top pick for cheap Scion xB car insurance is Allstate, with USAA and State Farm also offering competitive rates. These providers stand out for their affordable premiums, extensive insurance coverage options, and excellent customer service, making them the best choices for protecting your Scion xB without breaking the bank.

Allstate provides a blend of cost-effectiveness and extensive policy customization while USAA offers unmatched affordability for eligible members. State Farm combines strong financial stability with accessible, well-rounded insurance solutions.

Our Top 10 Company Picks: Cheap Scion xB Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $50 A+ Drivewise Discounts Allstate

![]()

#2 $52 A++ Military Discount USAA

#3 $56 B Extensive Options State Farm

#4 $59 A+ Snapshot Program Progressive

#5 $63 A Specialized Coverage Farmers

#6 $67 A+ Vanishing Deductible Nationwide

#7 $71 A Customizable Coverage Liberty Mutual

#8 $74 A Loyalty Bundling American Family

#9 $79 A++ Comprehensive Coverage Travelers

#10 $83 A++ Competitive Rates Geico:

When considering the best value and service for insuring your Scion xB, these three providers offer the most reliable and budget-friendly choices.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

- Allstate offers top rates for cheap Scion xB car insurance at $50/month

- Look for affordable premiums and good coverage for the Scion xB

- Choose providers with discounts for Scion xB’s features

#1 – Allstate: Top Overall Pick

Pros

- Drivewise Discounts: Allstate’s Drivewise program offers significant discounts for safe driving behaviors, potentially lowering the cost of cheap Scion xB car insurance.

- Strong Financial Stability: With an A+ rating from A.M. Best, Allstate provides a reliable financial backing for claims, ensuring stability in your cheap Scion xB car insurance coverage.

- User-Friendly App: Allstate insurance review & ratings highlights their app that allows easy management of your policy, making it convenient to track your cheap Scion xB insurance details and discounts.

Cons

- Higher Base Rates: Although they offer discounts, Allstate’s base rates for cheap Scion xB car insurance may be higher compared to some competitors.

- Limited Discounts for High-Risk Drivers: If you have a spotty driving record, you might find fewer discounts available with Allstate for cheap Scion xB car insurance compared to other providers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Discount

Pros

- Military Discount: USAA offers substantial discounts for military personnel, making it an excellent choice for those eligible, with potential savings on cheap Scion xB car insurance.

- Excellent Customer Service: Known for its high customer satisfaction, USAA provides top-notch service, ensuring you get the support you need for your cheap Scion xB car insurance.

- Comprehensive Coverage Options: Based on our USAA insurance review & ratings, the company provides a range of coverage options, allowing you to tailor your policy to your specific needs for your cheap Scion xB car insurance.

Cons

- Eligibility Requirements: USAA insurance is only available to military members, veterans, and their families, which may exclude some drivers from obtaining their competitive rates on cheap Scion xB car insurance.

- Higher Rates for Non-Military: For those who do not qualify for military discounts, USAA’s rates might be higher compared to other providers offering cheap Scion xB car insurance.

#3 – State Farm: Best for Extensive Options

Pros

- Extensive Options: State Farm insurance review & ratings offers a wide range of coverage options, making it easy to find a policy that fits your needs for cheap Scion xB car insurance.

- Strong Local Presence: With numerous agents across the country, State Farm provides personalized service and local expertise, beneficial for managing your Scion xB insurance.

- Discount Programs: State Farm provides various discounts, including those for safe driving and multi-policy bundles, which can help reduce your Scion xB insurance costs.

Cons

- Higher Monthly Rates: State Farm’s rates for cheap Scion xB car insurance might be higher compared to some competitors.

- Less Flexible Online Tools: Compared to some rivals, State Farm’s online tools and mobile app may offer fewer features for managing your policy.

#4 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program rewards safe driving with discounts, potentially lowering your cheap Scion xB car insurance rates.

- Competitive Pricing: Progressive often offers competitive rates for car insurance, making it a strong contender for cheap Scion xB coverage.

- Flexible Payment Options: Progressive provides various payment plans, allowing you to choose a schedule that fits your financial situation for your Scion xB insurance. Learn more in our Progressive insurance review & ratings.

Cons

- Varied Customer Service: Progressive’s customer service can vary, which might affect the overall experience of managing your cheap Scion xB car insurance.

- Higher Rates for High-Risk Drivers: If you have a less-than-perfect driving record, you might find Progressive’s rates for cheap Scion xB car insurance to be on the higher side.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Specialized Coverage

Pros

- Specialized Coverage: Farmers offers specialized coverage options that can be tailored to the specific needs of your Scion xB, potentially providing you with cheap Scion xB car insurance that meets all your requirements.

- Customizable Policies: As per our Farmers insurance review & ratings, they allow customization in policies, enabling you to adjust coverage levels to match your budget and needs, making it easier to find cheap Scion xB car insurance.

- Comprehensive Discounts: Farmers provides a range of discounts, including those for bundling policies and safe driving, which can help reduce your Scion xB insurance costs and offer cheap Scion xB car insurance.

Cons

- Higher Premiums: Farmers’ premiums for cheap Scion xB car insurance may be higher compared to some other insurance providers.

- Complex Policy Options: The variety of coverage options and discounts can be overwhelming, making it difficult to choose the best policy for your Scion xB.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s Vanishing Deductible program rewards you with a lower deductible for each year of safe driving, which can be beneficial for securing cheap Scion xB car insurance.

- Strong Financial Rating: With an A+ rating from A.M. Best, Nationwide provides reliable financial stability and claims support, ensuring your cheap Scion xB car insurance is backed by a reputable company.

- Competitive Rates: Nationwide offers competitive rates, which can be advantageous for finding cheap Scion xB car insurance. See more details on our Nationwide insurance review & ratings.

Cons

- Higher Premiums for Younger Drivers: Nationwide’s rates may be higher for younger drivers, which could impact the affordability of insurance for a Scion xB.

- Limited Local Agents: Depending on your location, there may be fewer local Nationwide agents available for in-person service, potentially affecting the convenience of managing your cheap Scion xB car insurance in person.

#7 – Liberty Mutual: Best for Customizable Coverage

Pros

- Customizable Coverage: According to our Liberty Mutual insurance review & ratings, the company offers a range of customizable coverage options, allowing you to tailor your policy for cheap Scion xB car insurance to fit your specific needs.

- Strong Online Tools: Liberty Mutual’s online tools and mobile app provide easy access to manage your policy and track discounts, which can help you find cheap Scion xB car insurance.

- Accident Forgiveness: Liberty Mutual offers accident forgiveness, which can help keep your rates stable after a minor accident, making it easier to maintain cheap Scion xB car insurance.

Cons

- Higher Base Rates: Liberty Mutual’s starting rates for cheap Scion xB car insurance may be higher compared to some competitors, which could impact affordability.

- Discounts May Vary: The availability of discounts can vary based on location and personal factors, potentially affecting the overall savings on your cheap Scion xB car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Loyalty Bundling

Pros

- Loyalty Bundling: American Family offers discounts for bundling multiple policies, which can help reduce the cost of your cheap Scion xB car insurance.

- Comprehensive Coverage: American Family insurance review & ratings highlights the company’s comprehensive coverage options, ensuring that your cheap Scion xB car insurance provides excellent protection.

- Strong Customer Service: Known for good customer service, American Family offers support to help manage and understand your cheap Scion xB car insurance policy.

Cons

- Higher Premiums for Certain Drivers: American Family’s premiums might be higher for drivers with less favorable driving records, which could affect your ability to obtain cheap Scion xB car insurance.

- Limited Discounts for High-Risk Drivers: There may be fewer discount opportunities for high-risk drivers, potentially increasing the cost of cheap Scion xB car insurance.

#9 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Travelers offers a wide range of coverage options, providing robust protection for your Scion xB, ensuring you get cheap Scion xB car insurance without compromising on quality.

- Strong Financial Stability: With an A++ rating from A.M. Best, Travelers ensures strong financial support for claims, offering peace of mind for your cheap Scion xB car insurance.

- Variety of Discounts: Travelers provides numerous discounts, including those for safety features and bundling, which can help lower the cost of your Scion xB insurance, making it an attractive option for cheap Scion xB car insurance. Unlock details in our Travelers insurance review & ratings.

Cons

- Higher Rates: Travelers’ rates for cheap Scion xB car insurance may be on the higher end compared to some other providers, potentially making it less affordable.

- Complex Discount Structure: The various discount programs can be complex to navigate, which may make it challenging to fully utilize available savings on your cheap Scion xB car insurance.

#10 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Geico is known for offering competitive rates, making it a good option for finding affordable Scion xB car insurance.

- Easy Online Management: Geico provides a user-friendly online platform and mobile app for easy policy management and claims tracking, which is convenient for Scion xB owners seeking affordable insurance.

- Strong Customer Satisfaction: Geico consistently receives high marks for customer satisfaction, ensuring a positive experience for Scion xB insurance holders looking for cost-effective coverage. For a comprehensive overview, explore our detailed resource titled “How can I pay my Geico insurance premium?“

Cons

- Limited Local Agents: Geico’s focus on online services means fewer local agents for in-person assistance, which could be a drawback for Scion xB owners who prefer face-to-face interactions while seeking cheap insurance.

- Discounts May Not Be as Broad: While Geico offers several discounts, they may not be as extensive as those provided by other insurers, potentially affecting overall savings for Scion xB car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Determine the Cost of Scion xB Car Insurance

Several factors determine the cost of car insurance for a Scion xB. Insurance companies consider variables such as age, gender, location, driving record, and credit score. Younger drivers typically face higher premiums due to their perceived higher risk and lack of experience. Gender can also influence rates, with young males often paying more than females.

Your location significantly impacts insurance costs, as urban areas generally have higher rates due to the increased likelihood of accidents and theft compared to rural areas. A clean driving record and good credit score usually result in lower premiums, while a history of accidents or traffic violations can raise your rates.

Additionally, the type of coverage you select plays a crucial role in determining your premium. Comprehensive coverage, which offers more protection, is typically more expensive than liability-only coverage. It’s important to assess your coverage needs and budget when choosing a policy. The mileage you drive annually also affects your insurance costs, as higher mileage increases the risk of accidents, potentially leading to higher premiums.

Dani Best Licensed Insurance Producer

On average, the monthly cost of comprehensive insurance for a Scion xB ranges from $108 to $125, but this can vary based on individual circumstances. Factors such as age, driving record, location, and the level of coverage selected play significant roles in determining the insurance premium.

To get the best rate for your Scion xB, it’s essential to compare quotes from multiple insurance providers, ensuring you find a policy that offers the best combination of coverage and affordability tailored to your specific needs.

Scion xB Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $50 $100

American Family $74 $147

Farmers $63 $125

Geico $83 $162

Liberty Mutual $71 $140

Nationwide $67 $133

Progressive $59 $118

State Farm $56 $112

Travelers $79 $155

USAA $52 $104

The table shows insurance costs from various companies. Minimum coverage ranges from $50 with Allstate to $83 with Geico, while full coverage spans from $100 with Allstate to $162 with Geico. Notably, USAA offers $52 for minimum and $104 for full coverage, and Progressive provides $59 for minimum and $118 for full coverage.

Understanding the Different Types of Car Insurance for Scion xB

When it comes to car insurance for your Scion xB, there are several different types of coverage to consider. These include liability coverage, which is required by law in most states and covers the costs of damages to other vehicles or property if you are at fault in an accident.

Collision coverage, on the other hand, covers the cost of damages to your Scion xB if you are at fault in an accident. Comprehensive coverage is also available, which covers damages to your vehicle caused by factors such as theft, vandalism, or natural disasters. Understanding these different types of coverage is crucial in determining the right insurance for your Scion xB.

Additionally, there are other optional types of car insurance coverage that you may want to consider for your Scion xB. One such coverage is uninsured/underinsured motorist coverage, which protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages.

This type of coverage can help ensure that you are not left with significant expenses if you are hit by an uninsured or underinsured driver.

Tips for Finding Affordable Car Insurance for Your Scion xB

Finding affordable car insurance for your Scion xB doesn’t have to be a daunting task. By taking a strategic approach and leveraging available resources and discounts, you can secure a policy that fits your budget and offers the protection you need. Here are some practical tips to help you get started:

- Compare Quotes: Shop around and get quotes from multiple insurance providers to find the best rate.

- Increase Deductibles: Opting for higher deductibles can lower your premium.

- Maintain Clean Driving Record: A clean driving record can help reduce your insurance costs.

- Good Credit Score: Maintaining a good credit score can also lead to lower premiums.

- Ask for Discounts: Inquire about available discounts such as multi-car discounts, good student discounts, etc.

Another tip for finding affordable car insurance for your Scion xB is to consider bundling your insurance policies. Many insurers offer discounts for bundling car and homeowners or renters insurance. Regularly review your coverage to ensure it fits your current needs and avoid unnecessary costs. Adjust your policy as your circumstances change to maintain adequate protection.

By following these tips, you can effectively lower your car insurance costs while ensuring you have the necessary coverage for your Scion xB. Taking the time to explore your options and ask the right questions can lead to significant savings and peace of mind on the road.

This table outlines various discounts offered by top insurance providers for Scion xB owners. It features two columns detailing the insurance company and the discounts available. Discounts include options such as safe driver, good student, multi-policy, and more, tailored to help you maximize savings on your car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Can Lower Your Scion xB Car Insurance Premiums

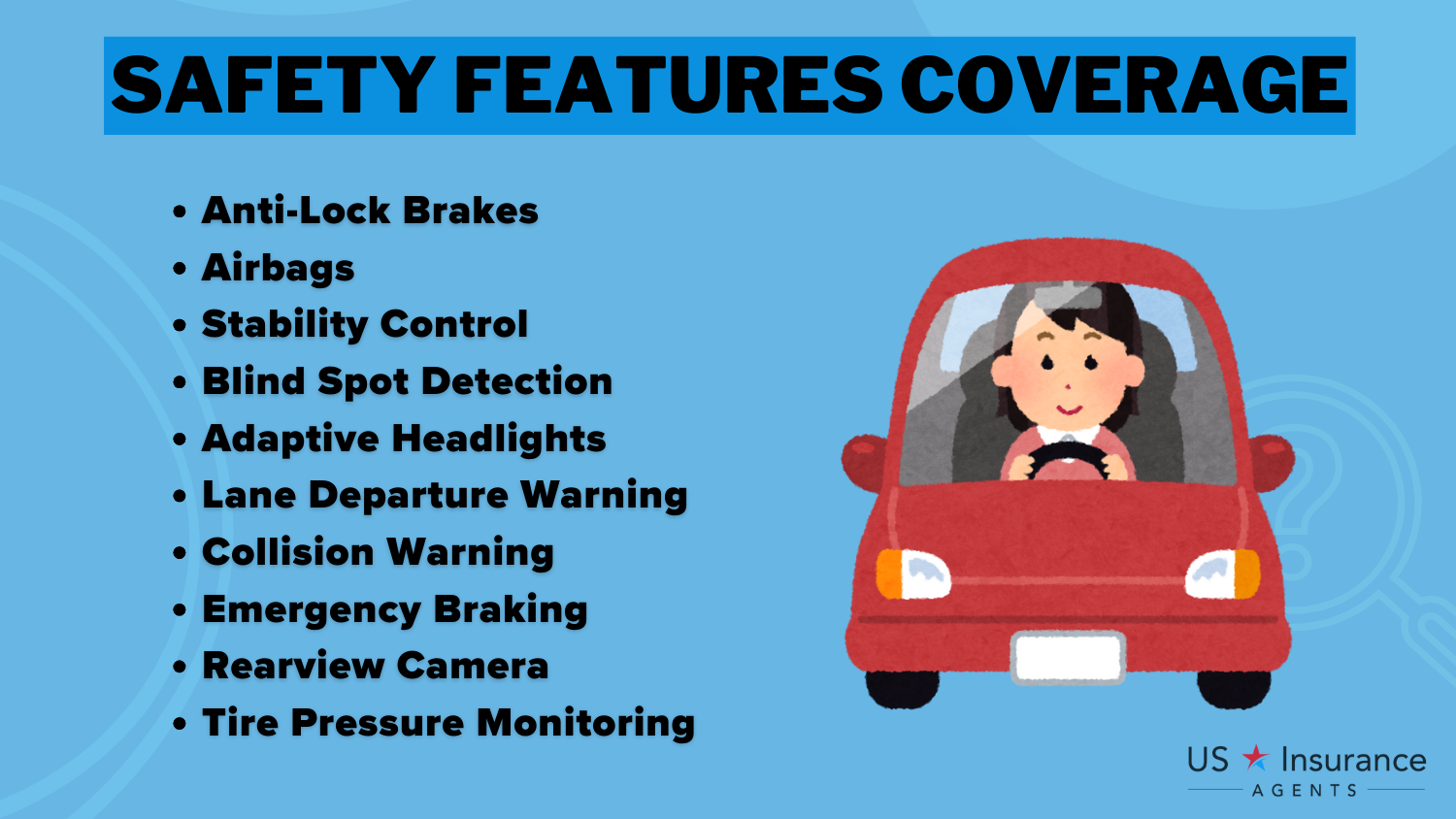

While some factors can increase the cost of your Scion xB car insurance, there are also factors that can help lower your premiums. Installing safety features in your vehicle can make you eligible for a safety feature insurance discount. Examples of safety features that may qualify for discounts include anti-lock brakes, airbags, and anti-theft systems.

Additionally, maintaining a clean driving record, completing defensive driving courses, or bundling your car insurance with other policies can also lead to reduced insurance costs. It’s important to discuss these factors with your insurance provider to maximize your savings.

Another factor that can lower your Scion xB car insurance premiums is your credit score. Insurance companies often consider credit history when determining rates. A good credit score indicates financial responsibility and can result in lower premiums. On the other hand, a poor credit score may lead to higher insurance costs.

The location where you live can also impact your car insurance premiums. If you reside in an area with low crime rates and minimal traffic congestion, you may be eligible for lower rates. Conversely, living in a high-crime area or an area prone to accidents can increase your insurance costs. It’s important to provide accurate information about your address when obtaining insurance quotes to ensure accurate pricing.

Impact of Your Driving Record on Scion xB Car Insurance Costs

Your driving record is one of the most critical factors insurance companies consider in determining the cost of your Scion xB car insurance. If you have a history of accidents, traffic violations, or speeding tickets, you are considered a higher risk to insure, which will result in higher premiums.

On the other hand, if you have a clean driving record with no accidents or violations, you can expect to pay less for insurance. It’s crucial to be a responsible and cautious driver to keep your premiums as low as possible. In addition to your driving record, insurance companies also take into account other factors when determining the cost of your Scion xB car insurance.

These factors may include your age, gender, location, and the type of coverage you choose. Younger drivers, especially those under the age of 25, typically have higher insurance rates due to their lack of driving experience. Similarly, male drivers tend to have higher premiums compared to female drivers.

Additionally, living in an area with high crime rates or a high number of accidents can also result in higher insurance costs. Lastly, the level of coverage you select, such as comprehensive or collision coverage, will also impact your premiums. It’s important to consider all these factors when shopping for car insurance to ensure you get the best coverage at the most affordable price.

Exploring Discounts and Savings Opportunities for Scion xB Car Insurance

Insurance providers frequently offer a range of discounts and savings opportunities that can significantly reduce the cost of your Scion xB car insurance. Here are some key ways to save:

- Safe Driver Discounts: If you have a clean driving record with no recent accidents or violations, you may qualify for a discount. Safe driving demonstrates lower risk, which can lead to lower premiums.

- Multi-Vehicle Discounts: Insuring more than one vehicle with the same provider can often result in reduced rates. This discount rewards customers who bundle their auto insurance policies.

- Low Mileage Discounts: Driving fewer miles each year may qualify you for a discount, as it reduces the risk of accidents. Check with your insurance provider to see if you can save on your premium through low mileage insurance discounts.

- Bundling Discounts: Combining your auto insurance with other policies, such as home insurance, from the same company can lead to savings. This is often referred to as a bundling or multi-policy discount.

To take full advantage of these potential savings, it’s important to discuss them with your insurance agent. They can provide detailed information on available discounts and guide you on how to apply for them. By exploring and utilizing these opportunities, you can achieve significant reductions in your Scion xB insurance premiums.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Comprehensive Coverage for Your Scion xB

Comprehensive coverage is an essential part of car insurance for your Scion xB, providing protection against non-collision risks such as theft, vandalism, and natural disasters. Although not legally required, it offers valuable peace of mind by covering damages not caused by accidents. This type of coverage can be especially useful if you live in areas prone to extreme weather or high crime rates.

Before opting for comprehensive coverage, consider the value of your vehicle, your budget, and your personal risk tolerance. If your Scion xB is relatively new or valuable, comprehensive coverage may be a wise investment. Evaluate how it fits within your financial situation and whether the added protection aligns with your needs.

Navigating the Claims Process For Your Scion xB Auto Insurance

In the event of an accident or damage to your Scion xB, understanding how to handle the claims process with your auto insurance is crucial. Begin by promptly reporting the incident to your insurance provider. They will assist you through the necessary steps, which include filing the insurance claim, submitting documentation, and coordinating repairs.

Make sure to document all damages, obtain copies of police reports if relevant, and keep records of all communication with your insurance company. Adhering to these steps will help ensure that the claims process is handled smoothly and efficiently.

The Impact of Credit Scores on Scion xB Insurance Rates

It might surprise you that your credit score can affect the cost of your Scion xB insurance. Insurance companies often use credit scores as a factor in determining premiums because they associate higher credit scores with financial responsibility and lower risk of filing claims. As a result, individuals with better credit scores typically enjoy lower insurance rates.

To keep your credit score high, it’s important to pay your bills on time, keep credit card balances low, and avoid excessive credit inquiries. Additionally, regularly monitoring your credit report and addressing any inaccuracies can help maintain or improve your credit score. By managing your credit wisely, you can potentially reduce your insurance costs and ensure better rates for your Scion xB.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Tailored Insurance Solutions for Your Scion xB

In the search for affordable and comprehensive car insurance, different scenarios can reveal how various insurance providers meet unique needs. The following fictional case studies, based on real-world scenarios, illustrate how diverse drivers might find optimal coverage solutions for their Scion xB.

- Case Study #1 – Affordable Coverage with Comprehensive Benefits: Emily, a 30-year-old software developer with a clean driving record, is looking for affordable insurance for her Scion xB. She values comprehensive coverage and strong customer service. Allstate offers a competitive rate of $50/month, with a reputation for excellent service and robust coverage, making it her top choice.

- Case Study #2 – Military Discounts for Cost-Effective Insurance: Mike, a 28-year-old active-duty military member, is seeking affordable insurance for his Scion xB. With USAA’s military discount, his premium is reduced to $48/month. USAA’s specialized discounts and coverage options for service members make it an ideal choice for Mike, who values their support and comprehensive benefits.

- Case Study #3 – Flexible Policy Options for Small Business Owners: Jessica, a 40-year-old small business owner, is looking for insurance for her Scion xB. State Farm offers her a $52/month rate with flexible coverage options that fit her needs, which she appreciates for its extensive customization.

These fictional case studies demonstrate how specific insurance providers cater to different needs, from strong customer service and military discounts to flexible policy options.

Kristen Gryglik Licensed Insurance Agent

Please note that these scenarios are based on real-world situations but are purely hypothetical. They aim to provide insight into how insurance options can vary based on individual circumstances and preferences.

Summary: Unlocking Saving Get the Best Deals on Scion xB Car Insurance

To secure affordable Scion xB car insurance, consider top providers like Allstate, USAA, and State Farm, with rates starting as low as $50 per month. Comparing quotes from multiple insurers is crucial, as factors such as age, driving history, and location can influence your premium. Maintaining a clean driving record can help reduce your rates, and increasing your deductible can further lower your monthly premiums.

Additionally, leverage discounts related to safety features, such as anti-theft systems and advanced driver-assistance technologies. Low mileage discounts and bundling your car insurance with other policies—like home or renters insurance—can also result in substantial savings. By evaluating these factors and actively pursuing discounts, you can secure a cost-effective and comprehensive insurance policy for your Scion xB.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Frequently Asked Questions

How can I find the cheapest Scion xB car insurance?

To find the cheapest Scion xB car insurance, compare quotes from multiple insurance providers, look for discounts such as safe driver or low mileage discounts, and consider raising your deductible. Additionally, maintaining a clean driving record and choosing the right coverage can help lower your premium.

Can I get cheap Scion xB car insurance if I have a poor driving record?

Yes, it’s possible to find cheap Scion xB car insurance even with a poor driving record. High-risk drivers can often find competitive rates through specialized insurers like The General or by taking defensive driving courses to demonstrate improved driving behavior.

To enhance your understanding, explore our comprehensive resource on insurance titled “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

What factors determine the cost of Scion xB car insurance?

The cost of Scion xB car insurance is determined by several factors including your driving record, age, location, the amount of coverage you choose, and the vehicle’s safety features. Additionally, insurance providers will consider your credit score and claims history.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Is the Scion xB a reliable car?

The Scion xB is generally regarded as a reliable compact car. Its simple yet sturdy design and minimal tech mean there’s less that can go wrong compared to more feature-heavy vehicles. However, as with any used car, reliability can vary based on factors such as maintenance history, usage, and model year.

What are the best providers for cheap Scion xB car insurance?

The top providers for cheap Scion xB car insurance include companies like Safeco, USAA, and Progressive. These insurers offer competitive rates, comprehensive coverage options, and excellent customer service.

Is it worth getting full coverage for my Scion xB?

Whether full coverage is worth it for your Scion xB depends on your circumstances. Full coverage provides comprehensive and collision protection, which is useful for broad risk protection. However, if your vehicle is older and less valuable, liability-only coverage might be a more cost-effective option.

For a comprehensive overview, explore our detailed resource titled “Full Coverage Car Insurance: A Complete Guide.”

Are Scion parts expensive?

No, their parts are very affordable compared to other brands.

How does the age of my Scion xB affect insurance rates?

The age of your Scion xB can impact insurance rates. Generally, older vehicles might have lower premiums due to reduced repair and replacement costs. However, if the car is modified or has higher mileage, it could influence the cost of coverage.

To gain profound insights, consult our extensive guide titled “What age do you get cheap car insurance?”

Are there any discounts available for Scion xB car insurance?

Yes, there are several discounts available for Scion xB car insurance. These can include discounts for safe driving, anti-theft devices, low mileage, and bundling multiple policies with the same insurer. Check with your provider to see which discounts you qualify for.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

How long do Scion xB engines last?

Drivers have reported the Scion xB lasting 300,000 miles or more. One driver reports 450,000 miles on the original transmission. To be safe, you’ll want to bet on 250,000 miles when deciding whether or not it’s worth the money, but don’t be surprised if it’s still humming 50,000 miles later.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.