Cheap Scion iM Car Insurance in 2024 (Save Big With These 10 Companies!)

Progressive, USAA, and State Farm are the top picks for cheap Scion iM car insurance, with Progressive offering rates at $58/month. These companies excel in affordability, coverage options, and customer service, ensuring quality Scion iM car insurance at competitive rates to keep your expenses manageable.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated January 2025

Company Facts

Min. Coverage for Scion iM

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Scion iM

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Scion iM

A.M. Best

Complaint Level

Pros & Cons

When it comes to cheap Scion iM car insurance, Progressive, USAA, and State Farm emerge as the top pick, with rates starting at just $58/month. These leading providers offer a blend of competitive pricing and comprehensive coverage tailored to diverse needs.

In this article, we’ll delve into how each of these insurers stacks up against one another in terms of affordability, customer service, and coverage quality. For a comprehensive analysis, refer to our detailed guide titled “Car Insurance: A Complete Guide.”

Our Top 10 Company Picks: Cheap Scion iM Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $58 A+ Snapshot Program Progressive

#2 $61 A++ Military Rates USAA

#3 $64 B Mileage Discounts State Farm

#4 $67 A++ Safety Discounts Geico

#5 $72 A+ Drivewise Program Allstate

#6 $77 A Safety Features Liberty Mutual

#7 $83 A Customizable Coverage Farmers

#8 $89 A+ Competitive Rates Nationwide

#9 $94 A++ Hybrid Discounts Travelers

#10 $99 A Low Mileage American Family

By examining the strengths of these top picks, you’ll be equipped to make an informed decision on the best car insurance for your Scion iM.

Our free online comparison tool above allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

- Progressive is a top pick for competitive rates and comprehensive coverage

- Affordable Scion iM car insurance averages around $58/month

- Consider discounts for safety features and low mileage to lower costs

#1 – Progressive: Top Overall Pick

Pros

- Snapshot Program: Progressive’s Snapshot program can offer potential savings on cheap Scion iM car insurance by evaluating your driving habits. Safe driving with your Scion iM can lead to significant discounts.

- Flexible Coverage Options: Based on our Progressive insurance review & ratings , the company provides a variety of coverage options, which allows you to customize your policy for your Scion iM and potentially reduce costs.

- 24/7 Customer Service: Progressive offers 24/7 customer service, ensuring you have support available anytime you need assistance with your cheap Scion iM car insurance.

Cons

- Higher Rates for Some Drivers: Although Progressive’s rates are generally competitive, they might not always be the cheapest option for every driver, especially those with less favorable driving records, affecting the cost of cheap Scion iM car insurance.

- Snapshot Program Requirements: The Snapshot program requires the use of a tracking device, which might be seen as intrusive or inconvenient by some drivers seeking cheap Scion iM car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Rates

Pros

- Military Rates: USAA insurance review & ratings offers exclusive discounts for military members and their families, making it a top choice for those looking for cheap Scion iM car insurance if they qualify.

- Excellent Customer Service: Known for its high level of customer satisfaction, USAA provides strong support for Scion iM owners, ensuring a positive experience while seeking affordable coverage.

- Comprehensive Coverage Options: USAA offers extensive coverage options that can be customized to fully protect your Scion iM, potentially leading to better deals for those in search of cheap insurance.

Cons

- Eligibility Restrictions: USAA’s services are only available to military members and their families, so if you do not qualify, you won’t be able to access their potentially cheaper rates for Scion iM insurance.

- Higher Premiums for Some Vehicles: Depending on the specific model and risk profile, USAA’s premiums for certain Scion iM configurations might be higher compared to other providers, which could affect those looking for the cheapest options.

#3 – State Farm: Best for Mileage Discounts

Pros

- Mileage Discounts: State Farm offers discounts for low mileage, which can help reduce the cost of cheap Scion iM car insurance if you drive your Scion iM infrequently.

- Local Agents: With a wide network of local agents, State Farm provides personalized service, making it easier to manage and potentially find cheaper Scion iM car insurance.

- Customer Satisfaction: As per our State Farm insurance review & ratings, they are known for high customer satisfaction, which ensures a positive experience when handling claims and policy management for your cheap Scion iM car insurance.

Cons

- Higher Monthly Rates: State Farm’s rates may be higher compared to some competitors, which could impact the affordability of cheap Scion iM car insurance.

- Limited Discounts for New Drivers: State Farm may not offer as many discounts for new drivers, which might make it less affordable if you’re a new Scion iM owner seeking cheap car insurance.

#4 – Geico: Best for Safety Discounts

Pros

- Safety Discounts: Geico offers discounts for safety features, which can help reduce the cost of cheap Scion iM car insurance if your vehicle is equipped with advanced safety technology.

- User-Friendly App: Geico’s app simplifies policy management, claims, and roadside assistance, making it convenient for Scion iM owners to manage their cheap Scion iM car insurance.

- Competitive Pricing: Geico is known for its competitive rates, making it a strong option for finding affordable cheap Scion iM car insurance. For additional details, explore our comprehensive resource titled “How can I pay my Geico insurance premium?“

Cons

- Customer Service Variability: Although Geico generally provides good customer service, some customers report inconsistent experiences, which might affect your satisfaction with cheap Scion iM car insurance.

- Limited Personalization: Geico’s online platform may not offer as many personalized coverage options compared to other insurers, which could limit customization for your cheap Scion iM car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Allstate’s Drivewise program rewards safe driving habits with potential discounts, which can be particularly advantageous for Scion iM owners who maintain responsible driving practices.

- Wide Range of Discounts: Allstate offers a variety of discounts, including those for bundling multiple policies, which can help lower the cost of insurance for your Scion iM.

- Strong Claims Service: Allstate is recognized for its efficient claims service, a crucial factor when filing a claim for your Scion iM. See more details on our Allstate insurance review & ratings.

Cons

- Higher Premiums: Allstate’s premiums might be higher compared to some other insurers, potentially affecting your budget for cheap Scion iM car insurance.

- Complex Discount Structure: The numerous discounts and their application can be complex, which might require additional effort to fully grasp potential savings on your Scion iM insurance.

#6 – Liberty Mutual: Best for Safety Features

Pros

- Safety Features Discounts: According to our Liberty Mutual insurance review & ratings, the company offers discounts for advanced safety features, which can help lower the cost of insuring your Scion iM if it includes such features.

- Customizable Policies: Liberty Mutual allows you to customize your policy, which means you can tailor coverage specifically to the needs of your Scion iM and your personal preferences.

- Online Tools: The company provides convenient online tools to manage your policy and access information, making it easier to handle your Scion iM insurance.

Cons

- Higher Premiums: Liberty Mutual’s rates might be higher than some competitors, which could impact your budget when looking for cheap insurance for your Scion iM.

- Limited Local Agents: Depending on your location, there might be fewer options for in-person service and support, which could be a drawback if you prefer face-to-face interactions for your Scion iM insurance needs.

#7 – Farmers: Best for Customizable Coverage

Pros

- Customizable Coverage: Farmers offers a range of customizable coverage options, allowing you to tailor your insurance policy specifically for cheap Scion iM car insurance based on your specific needs.

- Bundling Discounts: In line with our Farmers insurance review & ratings, they provide discounts for bundling auto insurance with other types of coverage, which can help save money on cheap Scion iM car insurance.

- Personalized Service: Farmers’ local agents offer personalized service, which can be helpful in finding the most affordable coverage for cheap Scion iM car insurance.

Cons

- Higher Rates: Farmers’ insurance premiums can be higher compared to some competitors, which might impact the overall affordability of cheap Scion iM car insurance.

- Complex Policy Options: The wide range of policy options and add-ons can be overwhelming, making it challenging to select the best and cheapest coverage for your Scion iM.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Competitive Rates

Pros

- Competitive Rates: Nationwide offers competitive rates for car insurance, which can help keep costs down for insuring your Scion iM, potentially making it easier to find cheap Scion iM car insurance.

- Variety of Discounts: Nationwide provides a variety of discounts, including for safe driving and bundling policies, which can lower your overall premium and make cheap Scion iM car insurance more accessible.

- Strong Customer Service: Nationwide is known for its good customer service, ensuring you receive support when needed, which can be a valuable asset in maintaining affordable coverage for your Scion iM. Learn more in our Nationwide insurance review & ratings.

Cons

- Higher Rates for Some Drivers: Depending on your driving record and other factors, Nationwide’s rates might be higher compared to some other insurers, which could impact your search for cheap Scion iM car insurance.

- Limited Discounts for New Drivers: Nationwide may not offer as many discounts for new drivers, which could affect the affordability of cheap Scion iM car insurance for those who are new to driving.

#9 – Travelers: Best for Hybrid Discounts

Pros

- Hybrid Discounts: Travelers offers discounts for hybrid vehicles, which could be beneficial if your Scion iM is a hybrid or if you’re considering a hybrid model. This can help in finding cheaper Scion iM car insurance.

- Comprehensive Coverage Options: Travelers provides a variety of coverage options, enabling you to tailor your policy to fully protect your Scion iM. This flexibility can help in finding the most cost-effective Scion iM car insurance that meets your needs. Unlock details in our Travelers insurance review & ratings.

- Good Claims Service: Travelers is recognized for its efficient claims service, ensuring that you receive support when filing a claim for your Scion iM, which can be valuable for securing reliable and potentially cheaper Scion iM car insurance.

Cons

- Higher Premiums: Travelers’ rates can be higher compared to some other insurers, which might affect your budget and make it challenging to find cheap Scion iM car insurance.

- Limited Local Agents: Depending on your location, you might have fewer options for in-person support and service, which could be a drawback when seeking cheap Scion iM car insurance and personal assistance.

#10 – American Family: Best for Low Mileage

Pros

- Low Mileage Discounts: American Family offers discounts for low mileage, which can help make your Scion iM insurance more affordable if you drive less frequently.

- Strong Financial Stability: With a strong financial rating, American Family ensures reliability in claims, giving you peace of mind that your cheap Scion iM car insurance will be handled efficiently.

- Comprehensive Coverage: In accordance with our American Family insurance review & ratings, the company provides comprehensive coverage options, allowing you to tailor your policy to suit the needs of your Scion iM while keeping costs manageable.

Cons

- Higher Premiums for Some Drivers: American Family’s rates may be higher for certain drivers, potentially making it more challenging to find cheap insurance for your Scion iM.

- Complex Policy Options: The variety of policy options and add-ons may be complex, which could make it harder to select the most cost-effective insurance plan for your Scion iM.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Influence the Cost of Scion iM Car Insurance

When insuring a Scion iM, several factors come into play that can influence the cost of car insurance. One major factor is age and driving experience; younger drivers with less experience often face higher insurance premiums compared to their older, more experienced counterparts. Location also significantly impacts insurance costs; living in areas with high rates of car theft or accidents can result in higher premiums.

A clean driving record is crucial, as it typically leads to lower insurance costs by indicating responsible driving habits. Conversely, a history of accidents or traffic violations can increase your rates. Insurance history is another important consideration; previous claims or policy cancellations can negatively affect your premiums.

Schimri Yoyo Licensed Agent & Financial Advisor

In some states, insurers use credit scores to determine rates, with good credit potentially lowering your costs. The specifications of your Scion iM, including its year, make, model, and trim level, also play a role; newer or more expensive models generally incur higher premiums due to their greater replacement or repair costs.

Annual mileage is another key factor; insurers often view drivers with higher annual mileage as higher risk, leading to increased premiums. Conversely, driving fewer miles annually can make you eligible for discounts or lower rates. All these elements together shape the overall cost of insuring a Scion iM.

Scion iM Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $72 $142

American Family $99 $171

Farmers $83 $153

Geico $67 $135

Liberty Mutual $77 $148

Nationwide $89 $159

Progressive $58 $116

State Farm $64 $129

Travelers $94 $165

USAA $61 $123

This table provides a snapshot of monthly insurance rates for the Scion iM across various providers, categorized by coverage level. For minimum coverage, rates range from $58 with Progressive to $99 with American Family. For full coverage, rates vary from $116 with Progressive to $171 with American Family. The coverage levels reflect the base protection and comprehensive options offered by each company.

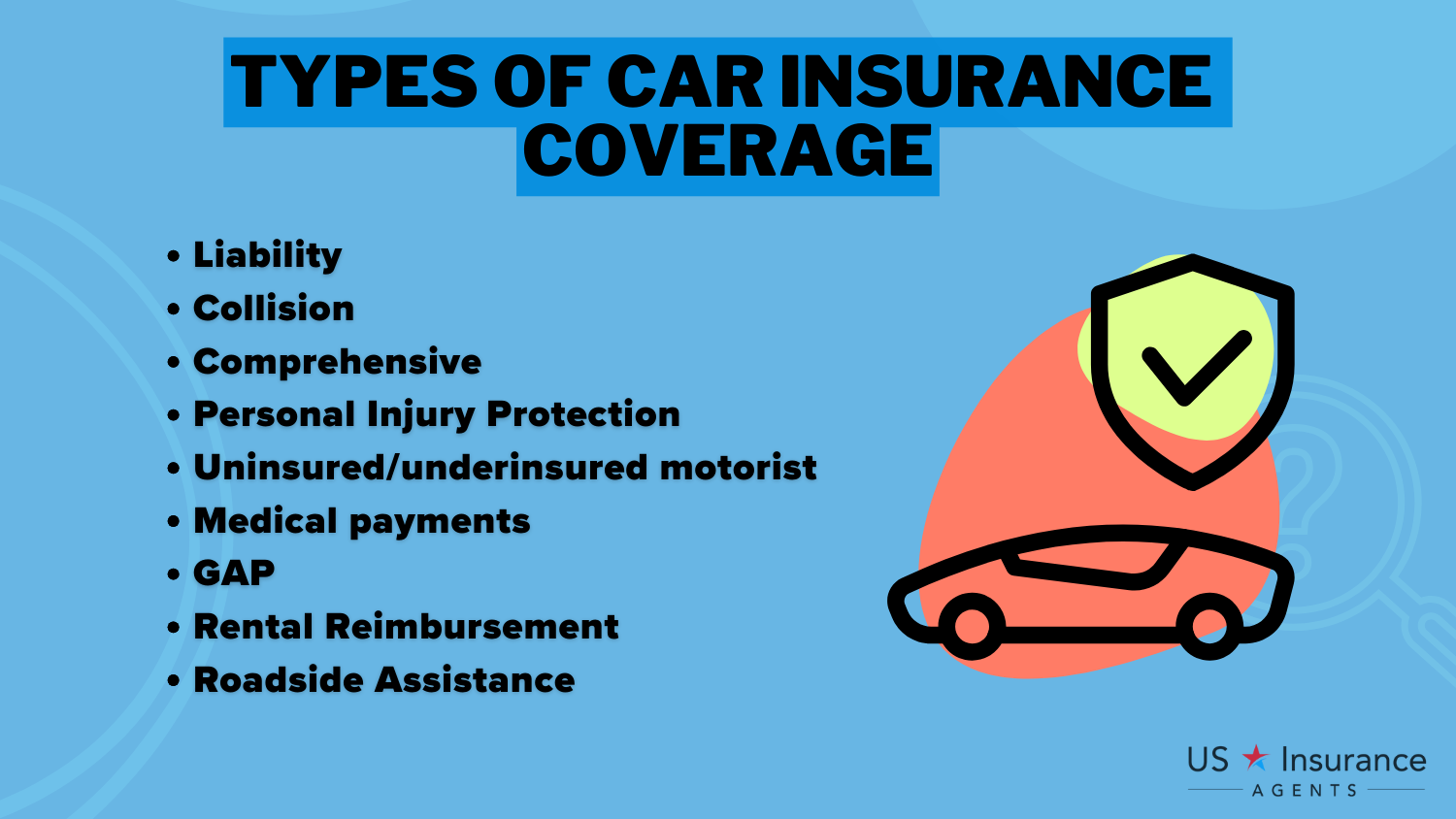

Understanding the Different Types of Car Insurance Coverage for Scion iM

When insuring your Scion iM, it’s crucial to understand the various types of car insurance coverage available. The most common options include liability coverage, which pays for damages and injuries you cause to others in an accident and typically includes bodily injury liability and property damage liability.

Collision coverage helps pay for repairs or replacement of your Scion iM if it’s damaged in a collision, regardless of fault. Comprehensive coverage protects your Scion iM against non-collision-related incidents such as theft, vandalism, fire, or natural disasters. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage to pay for all damages.

It’s important to evaluate your needs and consider the value of your Scion iM when selecting the appropriate coverage. Another type of car insurance coverage to consider is personal injury protection (PIP) coverage, which helps pay for medical expenses, lost wages, and other related costs if you or your passengers are injured in an accident, regardless of who is at fault.

Additionally, gap insurance is worth considering for your Scion iM. Gap insurance covers the difference between the actual cash value of your car and the amount you owe on your car loan or lease, which can be beneficial if your car is totaled or stolen, as it can help prevent you from owing money on a car you no longer have.

The Average Cost of Car Insurance for a Scion iM

The average cost of car insurance for a Scion iM can vary depending on various factors. On average, full coverage insurance for a Scion iM can range from around $1,200 to $1,500 per year. However, keep in mind that these figures are just estimates, and your actual premium may differ based on your specific circumstances and the insurance provider you choose.

One of the factors that can affect the cost of car insurance for a Scion iM is the driver’s age and driving history. Younger drivers or those with a history of accidents or traffic violations may face higher premiums compared to older, more experienced drivers with clean records.

Another factor that can impact the cost of insurance is the location where the vehicle is primarily driven and parked. Urban areas with higher rates of accidents or vehicle theft may result in higher insurance premiums compared to rural areas with lower risk factors.

This table outlines various discounts offered by leading car insurance providers for the Scion iM. It lists different insurance companies, each with its own set of available discounts, such as multi-policy, good student, safe driver, and others. Discounts vary by provider, including options for new cars, anti-theft devices, defensive driving, and more.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Car Insurance Rates for the Scion iM Across Different Providers

When shopping for car insurance for your Scion iM, it’s wise to compare rates from different insurance providers. Each company has its own formula for calculating premiums, and rates can vary significantly. By obtaining quotes from multiple insurers, you can ensure that you’re getting the best possible coverage at the most competitive price.

One important factor to consider when comparing car insurance rates is the level of coverage offered by each provider. While some insurers may offer lower rates, they may also provide less comprehensive coverage. It’s essential to carefully review the policy details and understand what is included and excluded in the coverage.

Additionally, it’s worth noting that car insurance rates can also be influenced by factors such as your driving record, age, and location. Insurers may take into account these variables when determining your premium. Therefore, it’s crucial to provide accurate information when requesting quotes to ensure that the rates you receive are reflective of your specific circumstances.

Tips to Save Money on Scion iM Car Insurance Premiums

If you’re looking to save money on your Scion iM car insurance premiums, consider the following tips:

- Shop Around and Compare Quotes: Compare quotes from different insurance providers to ensure you’re getting the best rate.

- Opt for a Higher Deductible: A higher deductible can lower your premiums, but make sure you can afford to pay the deductible amount in case of an accident.

- Take Advantage of Available Discounts: To save on car insurance, ask for insurance discounts like those for a good driving record, completing a defensive driving course, or bundling policies. This ensures you make the most of available savings.

- Install Safety Features: Add safety features like anti-theft devices or advanced safety systems in your Scion iM to potentially qualify for premium discounts.

- Maintain a Good Credit Score: Keep a good credit score, as insurance companies often consider credit history when determining rates. Pay bills on time and keep your credit utilization low to demonstrate responsible financial behavior, which may help lower insurance premiums.

By implementing these tips, you can potentially reduce your insurance costs and make the most of your coverage. Remember, every little bit of savings helps, and being proactive about managing your car insurance can lead to significant financial benefits over time.

Exploring Discounts and Incentives Available for Scion iM Car Insurance

When exploring discounts and incentives for Scion iM car insurance, it’s important to be aware of the variety of savings opportunities that insurance companies may offer. These discounts can differ between providers but generally include several common types.

Good driver discounts are available for those who maintain a clean driving record, helping to reward responsible driving behavior. Multi-policy discounts can be earned by bundling your Scion iM insurance with other types of coverage, such as homeowner’s or renter’s insurance, which can lead to significant savings.

Completing a defensive driving course or a driver’s education program can also qualify you for additional discounts, demonstrating a commitment to safer driving practices. For younger drivers, good student insurance discounts may be offered for maintaining good academic performance, acknowledging their responsibility both on and off the road.

To ensure you’re taking full advantage of these savings, be sure to ask about any applicable discounts when seeking quotes from insurance providers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Benefits of Bundling Your Scion iM Car Insurance With Other Policies

Bundling your Scion iM car insurance with other policies, like homeowner’s or renter’s insurance, offers several advantages. Firstly, it can lead to significant cost savings, as insurers often provide discounts for combining multiple policies. Additionally, managing all your insurance needs with one provider enhances convenience by reducing paperwork and simplifying administration.

Furthermore, if you ever need to file a claim that involves both your auto and home insurance, having them bundled can streamline the process. To ensure you’re getting the best value, it’s a good idea to compare the cost of a bundled package with that of individual policies.

Understanding the Claims Process for Scion iM Car Insurance Coverage

In the event of an accident or other covered incident involving your Scion iM, understanding the claims process for your car insurance coverage is crucial. The process generally begins with promptly reporting the incident to your insurance company. You will need to provide all necessary documentation, including a police report, photos of the damages, and any other evidence requested by your insurer.

Following this, you’ll consult with a claims adjuster from your insurance company, who will assess the damages and determine the applicable coverage under your policy. Next, you may need to obtain repair estimates from approved repair shops or undergo an inspection if required. Once the repairs are underway, you will pay your portion of the deductible, if applicable.

Finally, you will receive the insurance settlement, reimbursement, or a direct payment to the repair shop. It’s important to review your specific policy terms and contact your insurance provider for detailed guidance on the claims process to ensure a smooth and efficient resolution.

Choosing Comprehensive and Collision Coverage for Your Scion iM

Purchasing comprehensive and collision coverage for your Scion iM requires careful consideration of several factors. Begin by evaluating the current value of your vehicle and the potential repair or replacement costs in case of an accident or other covered incident. Conduct a cost-benefit analysis by comparing the cost of the coverage with the likelihood of needing it and the potential payout from a claim.

Additionally, assess your financial situation to determine if you can handle higher out-of-pocket expenses if you choose a higher deductible. By taking these aspects into account, you can make an informed decision about the appropriate level of coverage for your Scion iM.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Custom Coverage for Your Scion iM Car Insurance

In this exploration of fictional insurance scenarios, we’ll examine how different factors impact coverage and premiums for a Scion iM. These case studies, based on real-world elements, highlight flexible coverage options, military discounts, and personalized support. Note that these scenarios are fictional, meant to illustrate potential insurance outcomes and options.

- Case Study #1 – Flexible Coverage and Competitive Rates: Alex, 30-year-old graphic designer, chooses a flexible insurance plan from Progressive for their Scion iM. They pay $58 per month for comprehensive coverage, roadside assistance, and rental reimbursement. The competitive rate reflects Alex’s clean driving record and the vehicle’s safety features.

- Case Study #2 – Military Discounts and Exceptional Service: 28-year-old military officer Jamie selects a $61/month insurance plan from USAA for their Scion iM, benefiting from military insurance discounts. The plan includes accident forgiveness, rental car reimbursement, excellent customer service, and additional savings for safety features, making it an ideal choice for Jamie’s needs and budget

- Case Study #3 – Personalized Support and Comprehensive Coverage: Jordan, 40-year-old small business owner, selects a State Farm insurance plan for their Scion iM at $64/month. The plan includes liability, collision, and comprehensive coverage, with discounts for safe driving and anti-theft features. A local agent offers personalized service and policy management.

These fictional case studies provide a glimpse into how different insurance scenarios might unfold based on varying driver profiles and needs.

Daniel Walker Licensed Insurance Agent

While they reflect real-world considerations, they are illustrative examples and should not be considered actual quotes or offers. Always consult with insurance providers to tailor a plan that best suits your individual circumstances.

Summary: Smart Savings for Scion iM Insurance

The article offers tips for finding affordable car insurance for a Scion iM, recommending Progressive, USAA, and State Farm as top choices, with Progressive starting at $58 per month. These insurers are recognized for their competitive rates, comprehensive coverage, and excellent customer service. It also highlights the importance of comparing quotes from various providers to get the best deal.

Key factors influencing insurance costs include the driver’s age, driving history, location, and the vehicle’s specifics. The article advises leveraging discounts, maintaining good credit, and considering policy bundling to lower premiums. It outlines the insurance claims process and recommends using a free online comparison tool to find the most cost-effective insurance options for a Scion iM.

Frequently Asked Questions

How does my driving record affect the cost of cheap Scion iM car insurance?

Your driving record plays a significant role in determining your Scion iM car insurance rates. A clean driving record with no accidents or violations can help you secure cheaper insurance rates. Conversely, a history of accidents or traffic violations may lead to higher premiums.

Is it worth adjusting my coverage to get cheaper Scion iM car insurance?

Adjusting your coverage can be a way to reduce your Scion iM car insurance costs. However, it’s important to balance cost savings with adequate protection. Consider raising your deductible or opting for a basic coverage plan if you’re looking to lower your premium, but make sure you’re still covered for potential risks and damages.

To enhance your understanding, explore our comprehensive resource on insurance titled “What is the difference between a deductible and a premium in car insurance?”

Are there specific insurance providers that offer cheap Scion iM car insurance?

Insurance providers like USAA, Safeco, and Progressive often offer competitive rates for Scion iM car insurance. It’s a good idea to obtain quotes from these and other providers to find the best rate for your specific needs.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Which is the most expensive form of car insurance?

While more expensive, comprehensive insurance gives you peace of mind in the event of collision, fire, theft or other unforeseen circumstances.

Are Scion parts expensive?

No, their parts are very affordable compared to other brands.

What are some discounts that can help lower my Scion iM car insurance premium?

Discounts that can help lower your Scion iM car insurance premium include safe driver discounts, low mileage discounts, and discounts for having anti-theft systems installed. Additionally, bundling your car insurance with other types of insurance, such as home or renters insurance, can also lead to savings.

To gain profound insights, consult our extensive guide titled “Best Safe Driver Car Insurance Discounts.”

How long can a Scion last?

The well-maintained Scion can last more than 250,000 miles. There are even reports of their Scion lasting over 500,000 miles. As long as you’re aware of the common problems of the particular vehicle you’re planning to buy, you’ll know what to look out for.

How can I find the cheapest Scion iM car insurance rates?

To find the cheapest Scion iM car insurance rates, start by comparing quotes from different insurance companies. Look for discounts that may apply to you, such as safe driver discounts or multi-policy discounts. Additionally, increasing your deductible and maintaining a clean driving record can help lower your premiums.

For a comprehensive overview, explore our detailed resource titled “Best Car Insurance Discounts.”

What factors influence the cost of cheap Scion iM car insurance?

Several factors impact Scion iM insurance costs, including driving history, location, age, and coverage options. Providers also consider the vehicle’s safety features and repair costs. To find cheap Scion iM insurance, compare quotes from multiple providers and seek applicable discounts.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

What is the lowest level of car insurance?

The minimum amount of car insurance you’ll typically need is state-required liability coverage. This allows you to pay for some, if not all, injuries and damages you’re liable for in an accident.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.