Cheap Nissan TITAN XD Single Cab Car Insurance in 2026 (Save Money With These 10 Companies)

If looking for cheap Nissan TITAN XD Single Cab car insurance, Travelers, Progressive, and State Farm stand out as the top picks, offering rates as low as $70 per month. Discover why these companies are praised for their affordability and coverage options tailored for Nissan TITAN XD Single Cab owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated October 2024

Company Facts

Min. Coverage for Nissan TITAN XD Single Cab

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Nissan TITAN XD Single Cab

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Nissan TITAN XD Single Cab

A.M. Best

Complaint Level

Pros & Cons

If seeking for cheap Nissan TITAN XD Single Cab car insurance, this guide explores the top insurance providers known for their affordability and tailored coverage options.

Discover why Travelers, Progressive, and State Farm stand out as the best choices for Nissan TITAN XD Single Cab owners seeking reliable and cost-effective insurance solutions.

Our Top 10 Company Picks: Cheap Nissan TITAN XD Single Cab Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $70 A++ Diverse Offerings Travelers

#2 $75 A+ Flexible Plans Progressive

#3 $78 B Reliable Rates State Farm

#4 $80 A Customer Service American Family

#5 $83 A++ Military Focus USAA

#6 $85 A+ Comprehensive Coverage Allstate

#7 $88 A+ Policy Discounts Nationwide

#8 $90 A Specialized Programs Farmers

#9 $92 A+ Senior Benefits The Hartford

#10 $95 A Custom Options Liberty Mutual

In this article, we will explore what these factors are and how they impact the cost of Nissan TITAN XD Single Cab car insurance. Discover insights in our guide titled “Compare Car Insurance Quotes.”

#1 – Travelers: Top Overall Pick

Pros

- Competitive Monthly Rates: Travelers offers a monthly rate of $70, which is among the most affordable for the TITAN XD Single Cab. Read up on the “Travelers Insurance Review & Ratings” for more information.

- Comprehensive Discounts: Travelers provides significant discounts for bundling multiple policies, which can be advantageous for owners of the TITAN XD Single Cab.

- High A.M. Best Rating: With an A++ rating, Travelers is highly rated for financial stability and reliability.

Cons

- Availability of Discounts: While discounts are available, they may not be as extensive for specific coverage options related to the TITAN XD Single Cab compared to other insurers.

- Customer Service: Some customers have reported slower response times, which could impact policy management for TITAN XD Single Cab owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Flexible Plans

Pros

- Flexible Coverage Options: Progressive offers customizable coverage plans that can be tailored to the specific needs of the TITAN XD Single Cab. See more details on our guide “Progressive Insurance Review & Ratings.”

- Usage-Based Discounts: Progressive provides discounts based on driving habits, which can be beneficial for TITAN XD Single Cab drivers who maintain low mileage.

- Solid A.M. Best Rating: Progressive’s A+ rating indicates strong financial stability and trustworthiness for Nissan TITAN XD Single Cab insurance.

Cons

- Higher Monthly Premiums: Progressive’s monthly rate of $75 is higher compared to some competitors, which might impact affordability for Nissan TITAN XD Single Cab owners.

- Complex Discount Structure: The range of discounts and options can be complex, potentially making it challenging for Nissan TITAN XD Single Cab owners to maximize savings.

#3 – State Farm: Best for Reliable Rates

Pros

- Competitive Pricing: State Farm offers a monthly rate of $78 for the Nissan TITAN XD Single Cab, providing reliable and affordable coverage. Learn more in our article called “State Farm Insurance Review & Ratings.”

- Bundling Savings: State Farm provides substantial discounts for bundling multiple policies, which can be advantageous for Nissan TITAN XD Single Cab owners looking to save.

- Consistent Service: Despite a B rating from A.M. Best, State Farm is known for its reliable service and support for Nissan TITAN XD Single Cab insurance needs.

Cons

- Lower Multi-Policy Discount: State Farm’s multi-policy discount is relatively lower, which may impact overall savings for Nissan TITAN XD Single Cab owners compared to other insurers.

- Potentially Higher Premiums: Even with discounts, the premiums for the Nissan TITAN XD Single Cab might be higher than some competitors.

#4 – American Family: Best for Customer Service

Pros

- Exceptional Customer Service: American Family is renowned for its customer service, offering personalized support for Nissan TITAN XD Single Cab owners.

- Strong Financial Stability: With an A rating from A.M. Best, American Family demonstrates solid financial strength and reliability for Nissan TITAN XD Single Cab coverage.

- Comprehensive Coverage Options: American Family provides a range of coverage options suited for the needs of Nissan TITAN XD Single Cab owners. Check out insurance savings in our complete article called “American Family Insurance Review & Ratings.”

Cons

- Higher Premiums: The monthly rate of $80 is on the higher end, which may be less ideal for budget-conscious Nissan TITAN XD Single Cab owners.

- Limited Discount Options: Discounts available may not be as competitive compared to other insurance providers for the Nissan TITAN XD Single Cab.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Focus

Pros

- Exclusive Military Discounts: USAA offers specialized discounts for military members, which can be advantageous for eligible Nissan TITAN XD Single Cab owners.

- Top-Tier Financial Strength: With an A++ rating from A.M. Best, USAA ensures excellent financial stability and reliability for Nissan TITAN XD Single Cab insurance.

- Competitive Monthly Rate: At $83 per month, USAA provides competitive pricing for Nissan TITAN XD Single Cab coverage, especially for military families. Check out insurance savings in our complete “USAA Insurance Review & Ratings.”

Cons

- Eligibility Restrictions: USAA’s coverage is only available to military personnel and their families, limiting access for general Nissan TITAN XD Single Cab owners.

- Higher Cost: The monthly premium of $83 may be higher than some other insurers, potentially affecting affordability for Nissan TITAN XD Single Cab drivers.

#6 – Allstate: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Allstate provides comprehensive coverage for the Nissan TITAN XD Single Cab, including various add-ons and optional protections.

- Multiple Discounts: Allstate offers several discounts, such as safe driver and bundling discounts, which can benefit Nissan TITAN XD Single Cab owners.

- Strong A.M. Best Rating: With an A+ rating, Allstate demonstrates solid financial strength and reliability for Nissan TITAN XD Single Cab insurance. Check out insurance savings in our complete article called “Allstate Insurance Review & Ratings.”

Cons

- Higher Premiums: The monthly rate of $85 may be relatively high compared to other insurers, which could impact budget-conscious Nissan TITAN XD Single Cab owners.

- Complex Discount Structure: The range of discounts and options can be complex, making it challenging for Nissan TITAN XD Single Cab owners to maximize their savings.

#7 – Nationwide: Best for Policy Discounts

Pros

- Attractive Discount Opportunities: Nationwide offers competitive discounts for various aspects of coverage, which can be advantageous for Nissan TITAN XD Single Cab owners.

- Reasonable Monthly Rates: At $88 per month, Nationwide provides a balanced pricing structure for the Nissan TITAN XD Single Cab. Learn more in our guide titled “Nationwide Insurance Review & Ratings.”

- Good A.M. Best Rating: With an A+ rating, Nationwide is financially stable and reliable, ensuring solid coverage for the Nissan TITAN XD Single Cab.

Cons

- Potentially Limited Coverage Options: Some specialized coverage options might be limited compared to other insurers, which may affect Nissan TITAN XD Single Cab owners.

- Moderate Premiums: The monthly rate of $88 may be on the higher side for some Nissan TITAN XD Single Cab owners, impacting overall affordability.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Specialized Programs

Pros

- Tailored Insurance Programs: Farmers offers specialized programs and coverage options for the Nissan TITAN XD Single Cab, catering to specific needs.

- Variety of Discounts: Farmers provides various discounts, including safe driver and multi-policy discounts, which can benefit Nissan TITAN XD Single Cab owners.

- Solid A.M. Best Rating: With an A rating, Farmers ensures reliable coverage and financial stability for the Nissan TITAN XD Single Cab. Discover more about offerings in our article called “Farmers Insurance Review & Ratings.”

Cons

- Higher Premium Costs: At $90 per month, Farmers’ premiums might be higher compared to other insurers, potentially affecting affordability for Nissan TITAN XD Single Cab owners.

- Complex Policy Options: The range of specialized programs may be complex, making it challenging for Nissan TITAN XD Single Cab owners to navigate and choose the best option.

#9 – The Hartford: Best for Senior Benefits

Pros

- Senior-Specific Benefits: The Hartford offers specialized benefits and discounts for seniors, which can be advantageous for older Nissan TITAN XD Single Cab drivers.

- Strong Financial Stability: With an A+ rating from A.M. Best, The Hartford provides reliable and financially stable coverage for the Nissan TITAN XD Single Cab.

- Comprehensive Coverage: The Hartford offers extensive coverage options, including various add-ons and protections for the Nissan TITAN XD Single Cab. Discover more about offerings in our guide titled “The Hartford Insurance Review & Ratings.”

Cons

- Higher Monthly Premiums: The $92 monthly rate may be on the higher side for some Nissan TITAN XD Single Cab owners, impacting overall affordability.

- Limited General Discounts: The focus on senior benefits may result in fewer discounts for non-senior Nissan TITAN XD Single Cab drivers.

#10 – Liberty Mutual: Best for Custom Options

Pros

- Customizable Coverage Plans: Liberty Mutual provides customizable insurance plans that can be tailored specifically for the Nissan TITAN XD Single Cab.

- Various Discounts Available: Liberty Mutual offers a range of discounts, including bundling and safe driver discounts, which can benefit Nissan TITAN XD Single Cab owners.

- A.M. Best Rating: With an A rating, Liberty Mutual offers reliable coverage and financial stability for the Nissan TITAN XD Single Cab. Discover more about offerings in our article titled “Liberty Mutual Review & Ratings.”

Cons

- Higher Premiums: At $95 per month, Liberty Mutual’s premiums are higher compared to many competitors, which might impact affordability for Nissan TITAN XD Single Cab owners.

- Complex Policy Options: The range of custom options and discounts might be complex, potentially making it difficult for Nissan TITAN XD Single Cab owners to navigate.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Affordable Insurance Rates for Nissan TITAN XD Single Cab

The following table highlights the monthly rates for minimum and full coverage car insurance for the Nissan TITAN XD Single Cab across various providers. It provides a clear comparison to help you choose the best option for your needs.

Nissan TITAN XD Single Cab Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $85 $145

American Family $80 $135

Farmers $90 $150

Liberty Mutual $95 $160

Nationwide $88 $140

Progressive $75 $130

State Farm $78 $132

The Hartford $92 $155

Travelers $70 $125

USAA $83 $138

The monthly rates for insuring a Nissan TITAN XD Single Cab vary significantly based on the coverage level and provider. Travelers offers the most affordable options with minimum coverage starting at $70 per month and full coverage at $125 per month.

Progressive follows closely with rates of $75 for minimum coverage and $130 for full coverage. On the higher end, Liberty Mutual charges $95 for minimum coverage and $160 for full coverage, reflecting the range of options available depending on the insurer’s specific offerings and the coverage desired.

Other providers like State Farm, American Family, and USAA offer competitive rates that balance between cost and coverage, ensuring you can find a plan that fits your budget and protection needs.

Factors That Impact the Cost of Nissan Titan XD Single Cab Car Insurance

There are several factors that can affect the cost of car insurance for your Nissan TITAN XD Single Cab. One of the most significant factors is your driving record. If you have a history of accidents or traffic violations, insurance companies may consider you a higher risk driver, resulting in higher premiums. On the other hand, having a clean driving record can help lower your insurance costs.

Another factor that can impact insurance rates is the age of the driver. Younger drivers, especially those under the age of 25, are often considered higher risk due to their lack of driving experience. As a result, insurance premiums for young drivers may be higher compared to older, more experienced drivers.

The location where you live can also influence insurance costs. If you reside in an area with high crime rates or a high number of accidents, insurance companies may charge higher premiums to offset the increased risk. Additionally, urban areas tend to have higher insurance rates compared to rural areas due to the higher volume of traffic and higher likelihood of accidents.

In addition to these factors, the type of coverage you choose for your Nissan TITAN XD Single Cab can also affect the cost of insurance. Comprehensive coverage, which includes protection against theft, vandalism, and other non-collision-related damages, typically comes with a higher price tag compared to basic liability coverage.

Factors Affecting Nissan TITAN XD Single Cab Insurance Rates

To determine the average insurance cost for a Nissan TITAN XD Single Cab, it is important to consider the different factors that insurance companies take into account when determining rates. These factors can include the age and driving record of the primary driver, the location where the vehicle will be primarily used, the coverage options selected, and the deductible amount chosen.

When it comes to insurance rates for different Nissan truck models, Including The Titan Xd Single Cab, it’s important to note that rates can vary based on the specific features and specifications of the vehicle. Insurance companies typically consider factors such as the vehicle’s age, value, safety features, and repair costs when determining rates.

Additionally, the cost of parts and labor for repairs can also impact insurance rates for a specific model. If you want to learn more about the company, head to our article called “How much is car insurance?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverage Options for Nissan TITAN XD Insurance

When it comes to insuring your Nissan TITAN XD Single Cab, there are several coverage options to consider. The most basic type of coverage is liability insurance, which is required in most states. Liability insurance covers damages or injuries you may cause to others in an accident. It does not cover damages to your own vehicle.

If you want additional protection for your Nissan TITAN XD Single Cab, you can choose to add comprehensive and collision coverage. Comprehensive coverage protects against theft, vandalism, and non-collision-related damages such as fire or weather-related events. Collision coverage, on the other hand, covers damages to your vehicle in the event of a collision.

It’s important to carefully consider your coverage options and assess your needs before selecting a policy. Keep in mind that while comprehensive and collision coverage can provide added protection, they also come with higher premiums. Evaluate the value of your vehicle and your risk tolerance when deciding whether to add these coverages to your policy. To learn more, explore our comprehensive resource on “What is Premium?”

Nissan Truck Insurance Rates Comparison, Including TITAN XD Single Cab

When comparing insurance rates for different Nissan truck models, Including The Titan Xd Single Cab, it’s important to keep in mind the various factors that insurers consider when determining rates. While certain factors, such as the age and driving record of the primary driver, can have a significant impact on insurance costs, other factors, such as the specific model and its features, may also play a role.

Insurance companies typically evaluate the risk associated with insuring a particular vehicle model by considering factors such as the vehicle’s safety record, repair costs, and overall value. Additionally, certain features of the TITAN XD Single Cab, such as its towing capacity or off-road capabilities, may also affect insurance rates.

To get an accurate comparison of insurance rates, it is recommended to obtain quotes from multiple insurance providers. Access comprehensive insights into our guide titled “Best Safe Driver Car Insurance Discounts.”

Affordable Insurance Tips for Nissan TITAN XD Single Cab

Finding affordable insurance for your Nissan TITAN XD Single Cab doesn’t have to be a daunting task. Here are some tips to help you secure the best insurance rates:

First, shop around and get quotes from multiple insurance providers. Each company may offer different rates based on their unique calculations and risk assessments. By comparing quotes, you can find the most competitive rates for your Nissan TITAN XD Single Cab.

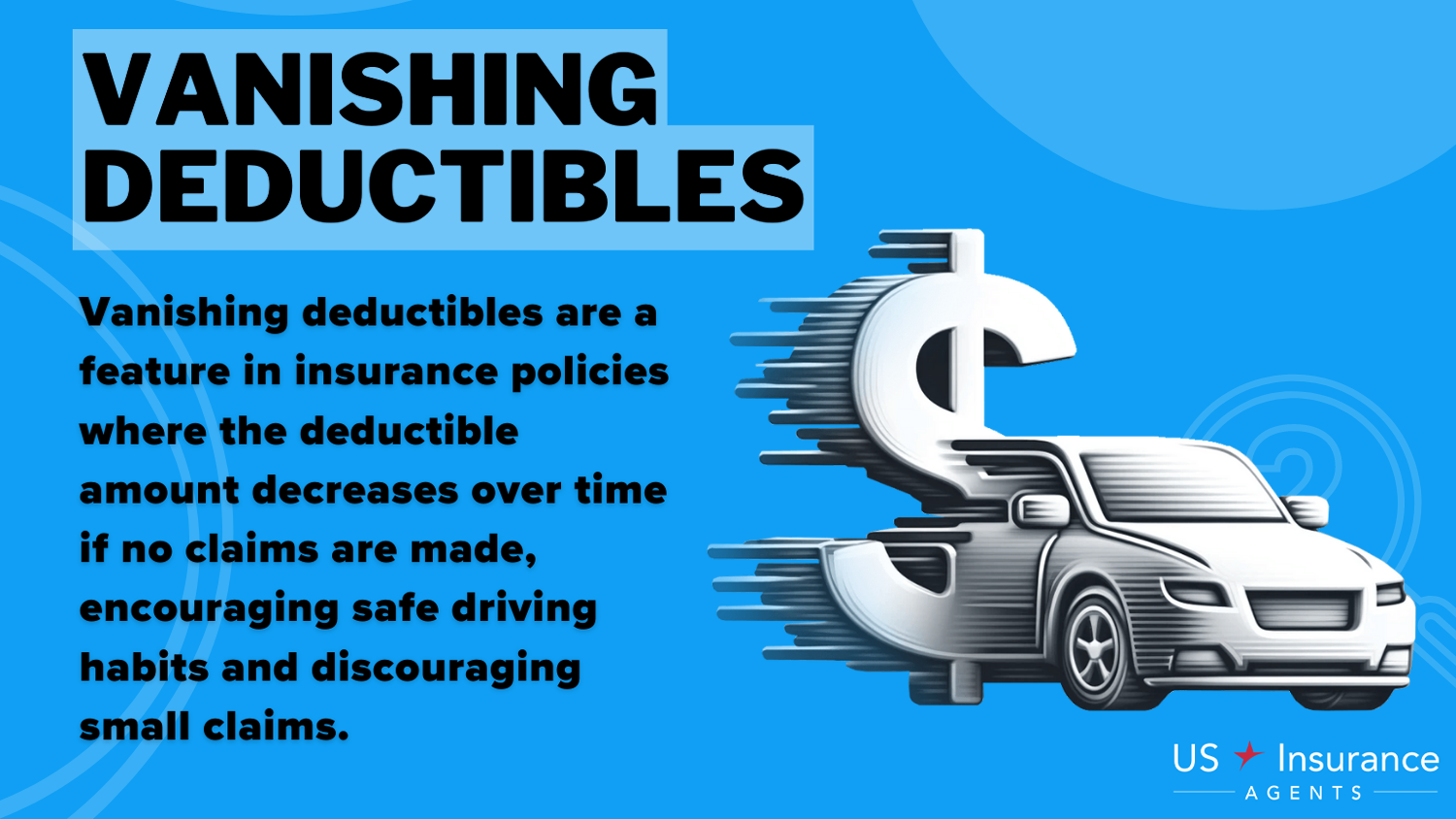

Kristine Lee Licensed Insurance Agent

Second, consider increasing your deductibles. A higher deductible means you’ll pay more out of pocket in the event of a claim, but it can also lower your insurance premiums. Evaluate your financial situation and choose a deductible that makes sense for you.

Additionally, ask your insurance provider about any available discounts that you may qualify for. Many insurance companies offer discounts for factors such as bundling policies, having a good driving record, or installing safety features in your vehicle.

Finally, maintain a good driving record. Avoid accidents and traffic violations to keep your insurance premiums low. Safe driving habits are not only important for your safety but can also help you save on insurance costs. Discover insights in our article called “Forward Collision Warning Car Insurance Discount.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Saving on Nissan TITAN XD Single Cab Insurance

Looking for ways to save money on your Nissan TITAN XD Single Cab car insurance premiums? Here are a few strategies you can consider:

First, consider bundling your car insurance policy with other types of insurance, such as homeowners or renters insurance. Many insurance companies offer discounts for bundling policies, which can help you save money on your overall insurance costs.

Second, ask your insurance provider about any available discounts. Some insurance companies offer discounts for factors such as having a good driving record, being a member of certain organizations, or completing a defensive driving course.

Additonally, consider increasing your deductibles. By choosing a higher deductible, you can lower your monthly premiums. However, make sure you have enough funds set aside to cover the deductible in the event of a claim.

Lastly, maintain a good credit score. Insurance companies often take your credit history into account when determining rates. By maintaining a good credit score, you can potentially qualify for lower insurance premiums.

Why Shop Around for the Best Nissan TITAN XD Insurance Rates

When it comes to finding the best insurance rates for your Nissan TITAN XD Single Cab, it is crucial to shop around and compare quotes from different insurance providers. Each insurance company uses its unique formulas and risk assessments to determine rates, which means that prices can vary significantly between providers.

By taking the time to research and obtain quotes from multiple insurance companies, you can ensure that you are getting the most competitive rates for your Nissan TITAN XD Single Cab. Additionally, reviewing and comparing coverage options and policy terms can help you find the best overall value and ensure that you are adequately protected.

Debunking Common Misconceptions About Insuring a Nissan TITAN XD Single Cab

When it comes to insuring a Nissan TITAN XD Single Cab, there are some common misconceptions that may lead to confusion. Let’s debunk a few of them:

First, some may believe that insuring a TITAN XD Single Cab is more expensive compared to other truck models. While insurance rates can vary based on various factors, including the model of the vehicle, it is important to note that insurance costs are determined by a range of factors beyond just the vehicle itself.

Factors such as the driver’s age, driving history, location, and coverage options selected also play a significant role in determining insurance rates.

Ty Stewart Licensed Insurance Agent

Second, some may assume that comprehensive coverage is unnecessary for a TITAN XD Single Cab since it’s primarily a work truck. While comprehensive coverage is optional, it can provide valuable protection against non-collision-related damages such as theft, vandalism, and weather-related events.

Additionally, comprehensive coverage can help cover the costs of repairing or replacing your vehicle in the event of fire or flood damage, which can occur regardless of the vehicle’s primary use.

Lastly, some may think that all insurance providers offer the same rates for a Nissan TITAN XD Single Cab. In reality, insurance companies use different risk assessments and formulas to calculate rates, resulting in variations in pricing. Shopping around and obtaining quotes from multiple insurance providers is essential to ensure you are getting the best rates for your specific circumstances.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Impact of Safety Features on Nissan TITAN XD Single Cab Insurance Rates

Safety features play a significant role in determining insurance rates for the Nissan TITAN XD Single Cab. Insurance companies often consider the presence of certain safety features when calculating rates, as these features can reduce the risk of accidents and injuries.

Some common safety features that can impact insurance rates include anti-lock brakes, traction control, stability control, and airbags. These features are designed to enhance the safety of the vehicle and its occupants, and insurance companies may offer discounts or lower rates for vehicles equipped with such features.

Additionally, the presence of advanced driver assistance systems (ADAS) can also affect insurance rates. ADAS features, such as lane departure warning, automatic emergency braking, and adaptive cruise control, can help prevent accidents and reduce the severity of collisions. As a result, some insurance companies may offer discounts for vehicles equipped with these advanced safety features.

It is important to note that the specific impact of safety features on insurance rates can vary between insurance providers and policies. To fully understand how these features can affect your insurance premiums, it is recommended to discuss with your insurance provider directly. Learn more in our guide titled “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

Consider Comprehensive Coverage for Your Nissan TITAN XD Single Cab

While comprehensive coverage is not required by law, it is an important option to consider for insuring your Nissan TITAN XD Single Cab. Comprehensive coverage provides protection against a wide range of risks and events that can cause damage to your vehicle.

Comprehensive coverage typically includes protection against theft, vandalism, fire, natural disasters, and other non-collision-related damages. Without comprehensive coverage, you may be responsible for covering the costs of repairing or replacing your vehicle if it incurs damages from these events.

Considering the versatility and functionality of the Nissan TITAN XD Single Cab, it is likely to be used for various purposes, including work-related activities. This makes it especially important to have comprehensive coverage in order to mitigate potential risks and financial losses. Delve into our evaluation of “What is comprehensive coverage?”

When deciding whether to add comprehensive coverage to your policy, consider factors such as the value of your vehicle, the potential costs of repairs or replacements, and your overall risk tolerance. Although comprehensive coverage comes with an additional cost, having the peace of mind and financial protection it provides can outweigh the expense in the long run.

Understanding Liability Coverage for Insuring a Nissan TITAN XD Single Cab

Liability coverage is a fundamental component of car insurance and is required by law in most states. When insuring a Nissan TITAN XD Single Cab, liability coverage helps protect you financially if you are responsible for causing injuries or property damage to others in an accident.

Liability coverage typically consists of two main components: bodily injury liability and property damage liability. Bodily injury liability covers the medical expenses, lost wages, and legal fees associated with injuries sustained by others in the accident for which you are at fault. Access comprehensive insights into our guide titled “Liability Insurance: A Complete Guide.”

Property damage liability, on the other hand, covers the costs of repairing or replacing other people’s property that is damaged in the accident. This can include vehicles, buildings, fences, or any other property that you may be deemed responsible for damaging.

When choosing liability coverage for your Nissan TITAN XD Single Cab, it’s important to select coverage limits that adequately protect your assets. Insufficient liability coverage can leave you financially vulnerable in the event of a serious accident, as you may be personally responsible for any damages or injuries beyond your coverage limits.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Bundling Benefits for Nissan TITAN XD Single Cab Car Insurance

Bundling your Nissan TITAN XD Single Cab car insurance with other policies can offer several benefits. Many insurance companies offer discounts for customers who bundle multiple policies with them, such as auto and homeowners insurance.

One of the main advantages of bundling is the potential for cost savings. By purchasing multiple policies from the same insurance provider, you may be eligible for a multi-policy discount. This can result in significant savings on your overall insurance premiums.

There are also convenience benefits to bundling. Managing multiple insurance policies with a single provider can make it easier to keep track of your coverage and premiums. It simplifies administrative tasks, such as payments and policy renewals, as everything is consolidated with one insurance company.

Jeff Root Licensed Insurance Agent

Another advantage is the potential for improved customer service. When you bundle your policies with a single provider, you only have to deal with one insurance company for all your insurance needs. This can result in a smoother claims process and better communication between you and your insurance provider.

However, it’s important to evaluate the coverage and pricing of each individual policy when considering bundling. While bundling can provide benefits, it’s essential to ensure that each policy meets your specific needs and that the overall cost is competitive compared to purchasing separate policies from different providers.

Impact of Your Driving Record on Nissan TITAN XD Single Cab Insurance Costs

Your driving record significantly influences the insurance costs for your Nissan Titan XD Single Cab. A clean record with no accidents or violations typically qualifies for lower premiums, reflecting your lower risk as a driver.

Conversely, a record with speeding tickets, accidents, or DUI convictions can increase insurance rates due to perceived higher risk. Insurance providers assess driving history closely to determine premiums, emphasizing safe driving practices to maintain affordable coverage for your vehicle.

Unlock details in our guide titled “Best Car Insurance for Drivers with Speeding Ticket in Washington.”

Frequently Asked Questions

What factors impact the cost of insurance for a Nissan TITAN XD Single Cab?

The cost of insurance for a Nissan TITAN XD Single Cab is influenced by several factors, including the driver’s age, driving history, location, coverage limits, deductible amount, and the insurance company’s specific policies. Additionally, factors such as the vehicle’s size and repair costs can also affect premiums.

Learn more in our guide titled “What age do you get cheap car insurance?“

Are insurance premiums for a Nissan TITAN XD Single Cab typically higher than for other vehicles?

Yes, insurance premiums for a Nissan TITAN XD Single Cab are often higher compared to smaller vehicles due to its larger size and potentially higher repair costs. The cost will also depend on individual driving factors and the insurance provider’s pricing structure.

Do insurance rates vary based on the model year of a Nissan TITAN XD Single Cab?

Yes, the model year of a Nissan TITAN XD Single Cab can impact insurance rates. Newer models generally have higher premiums due to their higher value and increased repair costs compared to older models.

Can I get discounts on insurance for a Nissan TITAN XD Single Cab?

Yes, many insurance companies offer discounts that can help reduce the cost of insuring a Nissan TITAN XD Single Cab. Discounts may include safe driver discounts, multi-policy discounts, and anti-theft device discounts. It is advisable to inquire with insurers about specific discounts available for this vehicle.

Is comprehensive and collision coverage necessary for a Nissan TITAN XD Single Cab?

While comprehensive and collision coverage are not legally required for a Nissan TITAN XD Single Cab, they are highly recommended. Comprehensive coverage protects against damages from events other than collisions (like theft or natural disasters), and collision coverage protects against damage from accidents.

To find out more, explore our guide titled “Collision vs. Comprehensive Car Insurance.”

What is the most affordable type of car insurance for a Nissan TITAN XD Single Cab?

Liability insurance is generally the most affordable type of car insurance. It covers bodily injuries and property damage to others if you are at fault in an accident. However, it does not cover damage to your own Nissan TITAN XD Single Cab or personal injuries.

What does CTPL stand for in car insurance?

CTPL stands for Compulsory Third Party Liability. It is a mandatory insurance required in some regions that covers damages and injuries to third parties caused by your vehicle.

Which type of car insurance is recommended for a Nissan TITAN XD Single Cab?

A Comprehensive Car Insurance Policy is recommended for a Nissan TITAN XD Single Cab as it provides extensive coverage, including third-party liabilities and protection for damages to the vehicle itself. This policy also includes compensation for family members in the event of accident-related fatalities.

Which insurance providers offer affordable full coverage for a Nissan TITAN XD Single Cab?

Insurance providers such as USAA, Nationwide, and Erie are known for offering competitive full-coverage policies that may be cost-effective for a Nissan TITAN XD Single Cab. For more information, check out resources on “Insurance Quotes Online.”

To learn more, explore our comprehensive resource on “Insurance Quotes Online.”

What is the most economical insurance coverage for a Nissan TITAN XD Single Cab?

The three main levels of car insurance coverage are Third Party Only, Third Party, Fire and Theft, and Comprehensive. Third Party Only is typically the most economical option, but it does not cover damages to the Nissan TITAN XD Single Cab.

What is the least expensive car insurance available for a Nissan TITAN XD Single Cab?

Is TPL or comprehensive insurance better for a Nissan TITAN XD Single Cab?

Which category of cars is the most affordable to insure?

Does the color of a Nissan TITAN XD Single Cab affect insurance costs?

What is the most expensive type of car insurance for a Nissan TITAN XD Single Cab?

Which type of insurance is best for a Nissan TITAN XD Single Cab?

Which insurance coverage is most suitable for a Nissan TITAN XD Single Cab?

What is the best car for a first-time driver?

Which insurance company offers the most affordable rates for a Nissan TITAN XD Single Cab?

What is the most affordable category for car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.