Cheap MINI Countryman Car Insurance in 2026 (Save Big With These 10 Companies!)

Progressive, State Farm, and Erie are top choices for cheap MINI Countryman car insurance, with rates starting at $48 per month. These providers are known for their excellent customer satisfaction, versatile coverage options, and comprehensive roadside assistance, specifically designed for MINI Countryman owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated August 2025

Company Facts

Min. Coverage for MINI Countryman

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for MINI Countryman

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for MINI Countryman

A.M. Best Rating

Complaint Level

Pros & Cons

If you are considering purchasing a MINI Countryman, it is important to understand the potential cost of car insurance. Car insurance rates can vary depending on a variety of factors, including the make and model of the vehicle.

Our Top 10 Company Picks: Cheap MINI Countryman Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $48 A++ Overall Value Progressive

![]()

#2 $52 B Customer Service State Farm

#3 $55 A+ Safe Drivers Erie

#4 $59 A+ Low-Mileage Drivers Geico

#5 $61 A+ Bundling Discounts Allstate

#6 $63 A++ Military Families USAA

#7 $68 A+ Accident Forgiveness Nationwide

#8 $72 A Customizable Policies Liberty Mutual

#9 $75 A++ Teen Drivers American Family

#10 $79 A High-Risk Drivers The General

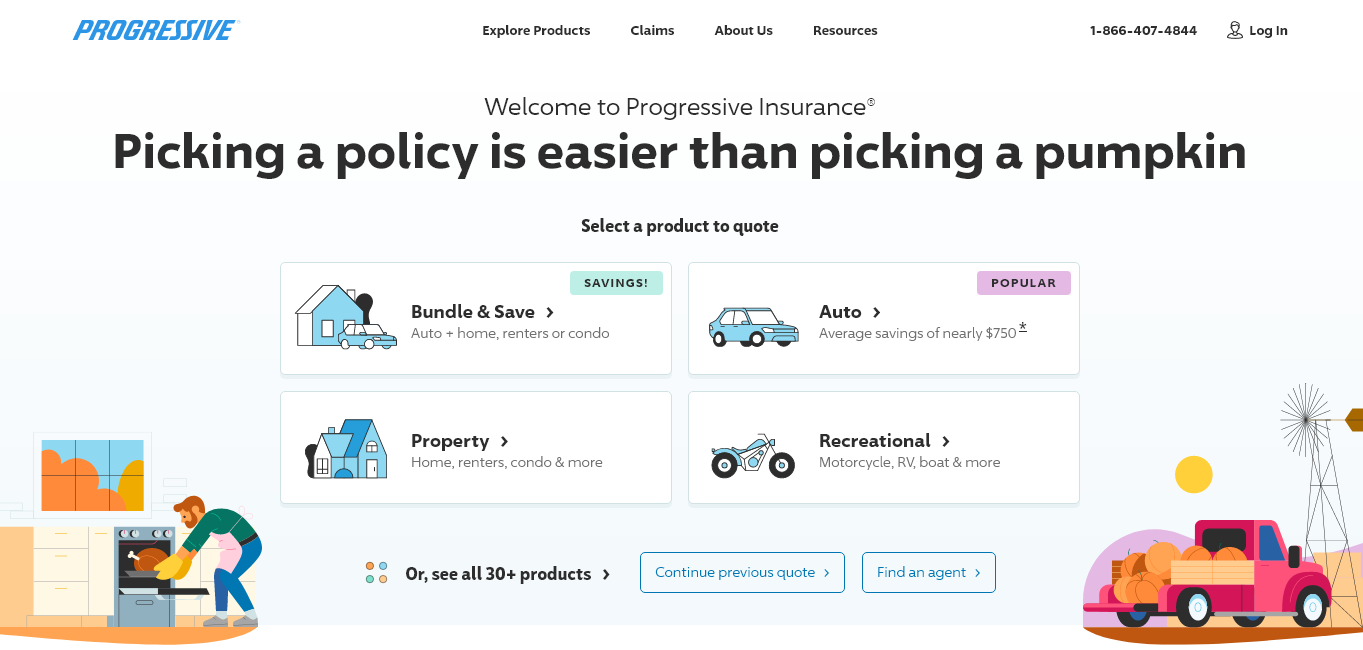

#1 – Progressive: Top Overall Pick

Pros

- Customizable Coverage Options: Progressive offers a variety of coverage options that allow MINI Countryman owners to tailor their policies according to their specific needs and budget. This flexibility ensures MINI Countryman drivers get the right level of protection without paying for unnecessary coverage.

- Snapshot Program Discounts: With their Snapshot program, Progressive rewards safe driving habits specific to MINI Countryman drivers, making it appealing for conscientious drivers looking to save on premiums. This program tracks driving behavior through a mobile app or device to determine personalized rates.

- User-Friendly Mobile App: Progressive insurance review & ratings highlights the Progressive mobile app, highly rated among MINI Countryman enthusiasts, is user-friendly and functional. It allows policyholders to manage their policies, file claims, and access roadside assistance easily, enhancing overall customer convenience.

Cons

- Potential Rate Increases: Despite initial competitive rates, Progressive’s premiums may increase notably after the initial policy term, especially for new or high-risk MINI Countryman drivers. It’s essential to monitor rate changes and explore options to mitigate increases.

- Mixed Customer Service Reviews: While Progressive offers extensive online and mobile support, customer service experiences can vary among MINI Countryman owners. Some policyholders report less satisfactory interactions with claims processing and support, which may impact overall satisfaction.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Local Agent Network: With a vast network of local agents across the country, State Farm offers personalized service and support specific to MINI Countryman drivers. This accessibility allows owners to receive in-person assistance and tailored advice, enhancing customer satisfaction.

- Accident Forgiveness Program: State Farm insurance review & ratings highlight State Farm’s accident forgiveness program prevents rate increases following an at-fault accident, which is beneficial for maintaining affordable premiums over time for MINI Countryman enthusiasts concerned about potential rate hikes.

- Good Student Discounts: State Farm provides significant discounts for students who maintain good grades, making it an attractive option for families with young MINI Countryman drivers looking to save on insurance costs.

Cons

- Higher Premiums: Compared to some competitors, State Farm tends to have higher premiums for MINI Countryman insurance, which may not be as budget-friendly for cost-conscious MINI Countryman owners seeking the lowest rates.

- Limited Coverage Options for High-Risk Drivers: State Farm may not offer competitive rates or extensive coverage options for high-risk MINI Countryman drivers, limiting choices for those with less favorable driving records or specific insurance needs.

#3 – Erie: Best for Safe Drivers

Pros

- Competitive Rates for Safe Drivers: Erie is recognized for offering some of the lowest rates in the industry for safe MINI Countryman drivers, making it an ideal choice for owners seeking affordability without compromising on coverage.

- Comprehensive Roadside Assistance: Erie’s roadside assistance program provides extensive coverage, including towing, fuel delivery, and lockout services, ensuring MINI Countryman owners have peace of mind on the road.

- High Customer Satisfaction: Erie consistently receives high customer satisfaction ratings among MINI Countryman enthusiasts, reflecting its commitment to service excellence and customer-centric policies that prioritize satisfaction and loyalty.

Cons

- Limited Availability: Erie’s coverage options may be limited to certain states, which can restrict access for MINI Countryman owners outside of these areas, requiring potential policyholders to verify availability in their region. Read more through our Erie insurance review.

- Fewer Online Tools: Compared to some larger insurers, Erie offers fewer online tools and digital resources for policy management and claims processing, which may be less convenient for tech-savvy MINI Countryman drivers accustomed to more advanced digital interfaces.

#4 – Geico: Best for Low-Mileage Drivers

Pros

- Low-Mileage Driver Discounts: Geico offers competitive rates tailored for MINI Countryman owners who drive fewer miles annually, making it a cost-effective choice for those who use their vehicles sparingly.

- Strong Financial Rating: Geico boasts an A+ rating from A.M. Best, ensuring MINI Countryman drivers of its financial stability and ability to handle claims efficiently and reliably. Learn more through our “How can I pay my Geico insurance premium?“

- User-Friendly Mobile App: Geico’s mobile app is highly rated among MINI Countryman enthusiasts for its ease of use and functionality, allowing policyholders to manage their policies, file claims, and access roadside assistance seamlessly.

Cons

- Average Customer Service: While Geico generally offers good customer service, some MINI Countryman owners report occasional delays in claims processing and less personalized service compared to other insurers.

- Limited Local Agent Network: Geico primarily operates through online and phone channels, which may be less appealing to MINI Countryman drivers who prefer face-to-face interactions with local agents.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Bundling Discounts

Pros

- Bundling Discounts: Allstate provides substantial discounts for MINI Countryman owners who bundle their auto insurance with other policies such as home or renters insurance, offering significant savings.

- Accident Forgiveness: Allstate insurance review & ratings highlight Allstate’s accident forgiveness program ensures that MINI Countryman drivers avoid rate increases after their first at-fault accident, maintaining affordable premiums over time.

- High Customer Satisfaction: Allstate consistently receives positive feedback from MINI Countryman enthusiasts for its customer service and claims handling, contributing to high satisfaction levels.

Cons

- Higher Premiums for Some Drivers: While Allstate offers competitive rates, premiums may be higher for MINI Countryman owners compared to other insurers, especially for those with less favorable driving records.

- Coverage Options Limitations: Allstate’s coverage options may not be as comprehensive or customizable as some competitors, potentially limiting choices for MINI Countryman owners seeking specific coverage needs.

#6 – USAA: Best for Military Families

Pros

- Specialized Coverage for Military Families: USAA offers tailored insurance solutions for MINI Countryman owners who are active duty or retired military members, including competitive rates and comprehensive coverage options.

- High Customer Satisfaction: USAA consistently receives top ratings for customer service and claims satisfaction among MINI Countryman enthusiasts, reflecting its commitment to serving military families.

- Member Benefits: USAA provides various perks such as accident forgiveness and flexible payment plans, making it a valuable choice for MINI Countryman drivers looking for added benefits. Learn more through our USAA insurance review.

Cons

- Limited Eligibility: USAA membership is limited to active and retired military personnel and their families, excluding civilians, which restricts access to its competitive insurance products.

- Availability: USAA’s services may not be available in all states, potentially limiting coverage options for MINI Countryman owners residing outside its service area.

#7 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide offers accident forgiveness programs that prevent rate increases after the first at-fault accident, providing peace of mind for MINI Countryman owners concerned about insurance premiums.

- Good Customer Service: Nationwide is known for its responsive customer service and claims handling, garnering positive reviews from MINI Countryman enthusiasts for its support and assistance.

- Multi-policy Discounts: Nationwide offers significant savings when bundling auto insurance with other policies, appealing to MINI Countryman owners looking to maximize savings.

Cons

- Higher Premiums in Some Regions: Nationwide insurance review & ratings highlight that while Nationwide offers competitive rates overall, premiums may vary significantly depending on the location and specific circumstances of MINI Countryman drivers.

- Claims Processing Times: Some MINI Countryman owners have reported longer-than-expected claims processing times with Nationwide, which may impact satisfaction during the claims process.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Coverage Options: Liberty Mutual insurance review & ratings highlight Liberty Mutual offers a range of coverage options that can be tailored to meet the unique needs of MINI Countryman owners, ensuring they have adequate protection.

- Online Policy Management: Liberty Mutual provides a user-friendly online platform and mobile app that MINI Countryman drivers can use to manage their policies, file claims, and access resources easily.

- 24/7 Claims Support: Liberty Mutual provides around-the-clock claims support, ensuring MINI Countryman owners can get assistance whenever they need it, enhancing overall customer satisfaction.

Cons

- Mixed Customer Service Reviews: While Liberty Mutual offers robust online and mobile tools, some MINI Countryman owners have reported mixed experiences with customer service, particularly regarding responsiveness and clarity.

- Higher Premiums for High-Risk Drivers: Liberty Mutual’s rates may be higher for MINI Countryman drivers with less favorable driving records or specific risk factors, potentially making it less affordable for some individuals.

#9 – American Family: Best for Teen Drivers

Pros

- Teen Driver Discounts: American Family offers substantial discounts for families with teen MINI Countryman drivers who maintain good grades and complete driver education courses, helping reduce insurance costs.

- Personalized Service: American Family emphasizes personalized service and support, with local agents available to assist MINI Countryman owners with their insurance needs and provide tailored advice.

- Strong Financial Stability: American Family has a strong financial stability rating (A++) from A.M. Best, ensuring MINI Countryman drivers of its ability to handle claims and financial obligations reliably. Learn more through our American Family insurance review.

Cons

- Availability: American Family’s coverage options may not be available in all states, limiting choices for MINI Countryman owners outside its service area.

- Claims Processing Complexity: Some MINI Countryman owners have reported challenges with the claims process, citing issues such as paperwork requirements and processing times that may affect overall satisfaction.

#10 – The General: Best for High-Risk Drivers

Pros

- Specialized High-Risk Coverage: The General specializes in providing insurance solutions for high-risk MINI Countryman drivers, offering competitive rates and tailored coverage options.

- Quick Online Quotes: MINI Countryman owners can obtain quick and easy online quotes from The General, simplifying the process of comparing rates and coverage options.

- Acceptance of SR-22: The General accepts SR-22 filings, making it accessible for MINI Countryman drivers who require this form for legal compliance or reinstating their driver’s license.

Cons

- Limited Coverage Options: While The General provides basic coverage, its options may be more limited compared to other insurers, potentially lacking comprehensive add-ons or specialized protections for MINI Countryman owners.

- Mixed Customer Service Reviews: MINI Countryman owners have reported mixed experiences with customer service at The General, with some expressing dissatisfaction with responsiveness and support during claims processes. Read more through our The General insurance review.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Affect Mini Countryman Car Insurance Rates

Understanding the Basics of Car Insurance for the Mini Countryman

Comparing Car Insurance Quotes for the Mini Countryman

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Mini Countryman Car Insurance

Frequently Asked Questions

What factors affect the cost of MINI Countryman car insurance?

The cost of MINI Countryman car insurance can be influenced by several factors, including the driver’s age, location, driving record, coverage options, deductible amount, and the level of insurance required by the state.

Is MINI Countryman car insurance more expensive than other car models?

The cost of MINI Countryman car insurance can vary depending on the insurance provider and the specific circumstances.

It is recommended to compare insurance quotes from different companies to find the best rate for your MINI Countryman. Enter your ZIP code now.

Are there any discounts available for MINI Countryman car insurance?

Does the MINI Countryman’s safety features impact insurance rates?

Yes, the safety features of the MINI Countryman can have an impact on insurance rates.

Vehicles equipped with advanced safety features such as anti-lock brakes, airbags, traction control, and electronic stability control may qualify for lower insurance premiums as they are considered safer to drive.

Can I save money on MINI Countryman car insurance by increasing my deductible?

Opting for a higher deductible can often result in lower monthly insurance premiums for your MINI Countryman.

However, it is important to consider your financial situation and ability to pay the deductible in case of an accident or claim. Enter your ZIP code now.

Which insurance provider offers the lowest monthly rate for MINI Countryman owners, according to the article?

What are some of the factors that can affect the cost of car insurance for a MINI Countryman?

Factors such as the driver’s age, location, driving record, and the specific model and year of the MINI Countryman can significantly influence car insurance costs.

How does Allstate differentiate itself in terms of discounts for MINI Countryman drivers?

Allstate stands out with bundling discounts, allowing MINI Countryman drivers to save money by combining their auto insurance with other policies like home or renters insurance. Enter your ZIP code now to begin.

What are the advantages of choosing USAA for MINI Countryman insurance, according to the article?

USAA is praised for its specialized coverage tailored for military families, including competitive rates and additional benefits like accident forgiveness. When determining your insurance needs, considering factors like your vehicle type, driving habits, and state requirements can help you decide how much insurance coverage do I need.

What are some potential drawbacks of selecting Liberty Mutual for MINI Countryman insurance, as mentioned in the article?

Liberty Mutual’s potential drawbacks for MINI Countryman owners include mixed customer service reviews and higher premiums for drivers with less favorable records or specific risk factors.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.