Cheap MAZDA MAZDA6 Car Insurance in 2026 (Earn Savings With These 10 Companies)

Progressive, State Farm, and Nationwide offer the best rates for cheap MAZDA MAZDA6 car insurance, starting at just $48 monthly. Discover why these providers lead the market in affordability and coverage for your MAZDA6, and how you can benefit from their competitive policies and services.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Benjamin Carr

Updated January 2025

13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage for Mazda6

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage for Mazda6

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage for Mazda6

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsThese companies excel by providing tailored, affordable policies for MAZDA6 owners with comprehensive protection. Understanding how your driving history, model, and location affect premiums is crucial when insuring your MAZDA6. Gain a thorough understanding from our article titled “Best MAZDA Car Insurance Discounts.”

Our Top 10 Company Picks: Cheap Mazda Mazda6 Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $48 A+ Qualifying Coverage Progressive

![]()

#2 $52 B Customer Service State Farm

#3 $55 A+ Widespread Availability Nationwide

#4 $59 A+ Infrequent Drivers Allstate

#5 $63 A+ Filing Claims Erie

#6 $67 A Discount Variety Farmers

#7 $71 A Occupational Discount Liberty Mutual

#8 $74 A Claims Service American Family

#9 $79 A++ Bundling Policies Travelers

#10 $83 A Online Tools Safeco

This guide will help you navigate the complexities of choosing the right insurance provider while ensuring you get the best possible deal.

Instantly compare quotes by entering your ZIP code above.

- Progressive is the top pick for cheap MAZDA MAZDA6 car insurance

- MAZDA6 insurance rates are influenced by model, age, and safety features

- Location and driving history significantly affect MAZDA6 insurance costs

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates: Offers the lowest monthly rate at $48 for MAZDA6 owners. Read up on the “Progressive Insurance Review & Ratings” for more information.

- High A.M. Best Rating: Progressive holds an A+ rating, indicating strong financial stability for MAZDA6 policies.

- Customizable Coverages: Provides a variety of coverage options tailored to meet specific MAZDA6 driver needs.

Cons

- Variable Customer Feedback: Some MAZDA6 owners report mixed experiences with claims processing.

- Policy Limitations for MAZDA6: Coverage features may vary significantly by state, affecting availability for MAZDA6 owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- High Customer Satisfaction: Renowned for excellent customer service and support for MAZDA6 owners.

- Wide Range of Coverage Options: State Farm insurance review & ratings offers diverse insurance solutions to suit different MAZDA6 customer needs.

- Competitive Discounts: Provides substantial discounts for low-mileage MAZDA6 drivers and policy bundling.

Cons

- Higher Premiums in Some Areas: Premiums can be relatively higher for MAZDA6 depending on geographic location.

- B Grade from A.M. Best: Slightly lower financial stability rating compared to peers, affecting long-term MAZDA6 insurance plans.

#3 – Nationwide: Best for Widespread Availability

Pros

- Broad Availability: Insurance coverage accessible for MAZDA6 owners across a wide geographic area.

- Strong Financial Rating: An A+ rating from A.M. Best ensures reliability for MAZDA6 policies. More information is available about this provider in our article titled “Nationwide Insurance Review & Ratings.”

- Flexible Policy Options: Offers a variety of coverages that can be customized for individual MAZDA6 needs.

Cons

- Higher End of Monthly Rates: At $55, rates can be higher than some competitors for MAZDA6 insurance.

- Inconsistencies in Service: MAZDA6 customer experience may vary depending on the region.

#4 – Allstate: Best for Infrequent Drivers

Pros

- Optimized for Low Usage: Ideal for MAZDA6 drivers who use their vehicles infrequently. For further information, refer to our article titled “Allstate Insurance Review & Ratings.”

- Robust Coverage Options: Provides extensive coverage suited to various MAZDA6 driver needs.

- High A.M. Best Rating: Maintains an A+ rating, indicating strong financial health for MAZDA6 policies.

Cons

- Higher Monthly Premiums: Monthly rates are higher at $59 compared to some other insurers for MAZDA6.

- Policy Restrictions: Certain discounts and coverages may not be available for all MAZDA6 drivers in all areas.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Erie: Best for Filing Claims

Pros

- Efficient Claims Process: Known for a smooth and efficient claims handling experience for MAZDA6 owners.

- Customizable Coverage Options: Erie insurance review & ratings offers tailored policies that can be adjusted to meet specific MAZDA6 needs.

- Strong Agent Network: Provides personalized service through a dedicated network of local agents for MAZDA6 drivers.

Cons

- Limited State Availability: Coverage for MAZDA6 is not available nationwide.

- Slightly Higher Monthly Rates: At $63, monthly premiums for MAZDA6 are above some competitors.

#6 – Farmers: Best for Discount Variety

Pros

- Wide Range of Discounts: Farmers insurance review & ratings offers a variety of discounts including multi-car, safe driver, and more for MAZDA6 owners.

- Customized Insurance Packages: Allows MAZDA6 owners to build personalized coverage packages.

- Solid Financial Rating: Holds an A rating from A.M. Best, supporting reliable MAZDA6 insurance.

Cons

- Higher Pricing: Monthly premiums are on the higher side at $67 for MAZDA6 insurance.

- Mixed Customer Reviews: Some MAZDA6 owners report variability in customer service quality.

#7 – Liberty Mutual: Best for Occupational Discount

Pros

- Occupational Discounts Available: Offers discounts for certain professions and affiliations beneficial for MAZDA6 owners.

- Flexible Coverage Options: Wide range of options to suit different MAZDA6 insurance needs. If you want to learn more about the company, head to our article titled “Liberty Mutual Review & Ratings.”

- Strong Financial Health: Rated A by A.M. Best, ensuring reliable coverage for MAZDA6 policies.

Cons

- Higher Monthly Cost: Premiums start at $71, which can be pricey for MAZDA6 budgets.

- Customer Service Variability: Customer satisfaction for MAZDA6 policies can vary significantly across different regions.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Claims Service

Pros

- Exceptional Claims Handling: Known for quick and effective claims resolution for MAZDA6 owners.

- Wide Coverage Selection: Offers a broad array of coverage options for diverse MAZDA6 needs.

- Solid Financial Stability: Rated A by A.M. Best, ensuring reliable MAZDA6 insurance services. Check out insurance savings in our complete article titled “American Family Insurance Review & Ratings.”

Cons

- Higher Monthly Premiums: At $74, rates are higher compared to some other insurers for MAZDA6.

- Limited Availability: Coverage for MAZDA6 is not available in all states.

#9 – Travelers: Best for Bundling Policies

Pros

- Attractive Bundling Options: Offers significant discounts for combining multiple policies, ideal for MAZDA6 owners.

- Highest A.M. Best Rating: Boasts an A++ rating, indicating top-tier financial stability for MAZDA6 policies.

- Customizable Plans: Wide variety of plans that can be tailored to individual MAZDA6 needs. Delve into our evaluation of our article titled “Travelers Insurance Review & Ratings.”

Cons

- Higher Cost: One of the higher monthly premiums at $79 for MAZDA6 insurance.

- Complex Policy Structure: Some MAZDA6 owners find the policy options complex and difficult to navigate.

#10 – Safeco: Best for Online Tools

Pros

- Advanced Online Management Tools: Provides comprehensive online resources for managing MAZDA6 policies.

- Competitive Coverage Options: Safeco insurance review & ratings offers a range of coverages that cater to different MAZDA6 driving habits and needs.

- Solid Financial Rating: Rated A by A.M. Best, ensuring reliability for MAZDA6 insurance.

Cons

- Premium Costs: At $83, it has one of the highest monthly rates among the listed companies for MAZDA6.

- Customer Service Concerns: Some MAZDA6 users report less than satisfactory interactions with customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparative Monthly Insurance Rates for MAZDA MAZDA6

The table below offers a detailed comparison of monthly car insurance rates for a MAZDA MAZDA6, broken down by coverage level and provider. This data can help potential policyholders make informed decisions based on their needs for minimum versus full coverage.

Mazda Mazda6 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $59 $155

American Family $74 $179

Erie $63 $160

Farmers $67 $168

Liberty Mutual $71 $174

Nationwide $55 $147

Progressive $48 $135

Safeco $83 $190

State Farm $52 $142

Travelers $79 $185

For MAZDA MAZDA6 owners, choosing the right insurance policy involves comparing both minimum and full coverage options across various insurers. Progressive presents the most affordable rates, offering minimum coverage at $48 and full coverage at $135 monthly. On the higher end, Safeco’s rates stand at $83 for minimum and $190 for full coverage.

Notably, Nationwide also offers competitive rates with $55 for minimum and $147 for full coverage. This spectrum of pricing illustrates the significant range in potential insurance costs, reflecting the diverse offerings in the market tailored to different budgets and coverage requirements. Gain detailed understanding from our article titled “Best Car Insurance for Full Coverage.”

Factors That Influence the Cost of Mazda MAZDA6 Car Insurance

Several factors influence MAZDA6 car insurance costs. Your driving history is paramount; a clean record typically means lower premiums, while accidents or violations can increase rates. Age also affects costs, with younger, less experienced drivers paying more, which generally decreases as drivers age.

Additionally, location impacts rates, with urban areas often having higher premiums due to increased accidents and thefts compared to rural areas. The coverage options you choose also impact insurance costs. Opting for comprehensive coverage that includes protection against theft, vandalism, and natural disasters will generally result in higher premiums compared to basic liability-only coverage.

Additionally, the type of MAZDA6 model you own can affect your car insurance rates. Insurance companies take into consideration factors such as the car’s value, safety features, and repair costs when determining premiums. Generally, more expensive and high-performance models may have higher insurance costs compared to base models.

Furthermore, your credit score can also impact the cost of MAZDA6 car insurance. Insurance companies often use credit-based insurance scores to assess risk. A lower credit score may result in higher insurance premiums, as it is seen as an indicator of potential financial instability and a higher likelihood of filing claims. Check out the “Best Car Insurance for Drivers with Bad Credit in Texas” for additional details.

Understanding the Insurance Rates for Mazda MAZDA6 Vehicles

Insurance rates for the MAZDA6 vary by factors such as model, age, and safety features. Newer models with technologies like automatic emergency braking often have lower rates than older, basic models. Additionally, the value of the MAZDA6, including pricier trims and options, can impact premiums as insurers consider repair and replacement costs after accidents or theft.

Another factor that can affect insurance rates for MAZDA6 vehicles is the driver’s personal driving history. Insurance providers often consider factors such as the driver’s age, driving experience, and previous claims or accidents. Drivers with a clean driving record and a history of responsible driving may be eligible for lower insurance rates compared to those with a history of accidents or traffic violations.

The location where the MAZDA6 is driven and parked affects insurance rates; urban areas with more accidents, theft, or congestion typically face higher premiums than less congested rural areas. Unlock details in our article titled “Determining Fault in a Multiple Car Accident.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Impact of Vehicle Make and Model on Car Insurance Premiums

The make and model of a vehicle, including the MAZDA MAZDA6, have a significant impact on car insurance premiums. Insurance providers assess the risk associated with specific makes and models, considering factors such as theft rates, crash test results, and repair costs. Generally, vehicles with a higher risk of theft or expensive repair costs tend to have higher insurance premiums.

The MAZDA6 is a popular midsize sedan known for its stylish design, sporty performance, and advanced safety features. Insurance providers often take these factors into account when determining insurance rates.

However, it’s important to note that insurance premiums can still vary across different insurance companies, so it’s advisable to compare quotes from multiple providers to find the best coverage options at the most competitive rates. Learn more about what we offer in our article titled “Do auto and renters insurance claims affect my home insurance rates?”

Analyzing the Safety Features of the Mazda MAZDA6 and Its Effect on Insurance Costs

The MAZDA MAZDA6 is equipped with a range of advanced safety features designed to enhance driver and passenger safety. These features include a suite of active safety technologies such as blind-spot monitoring, rear cross-traffic alert, adaptive cruise control, and automatic emergency braking.

Insurance providers often offer discounts for vehicles equipped with safety features that reduce the risk of accidents and injuries. By providing an extra layer of protection, these features can potentially lower insurance costs. However, the exact impact of safety features on insurance premiums can vary across insurers, so it’s important to discuss potential discounts with your insurance provider.

Comparing Insurance Prices for Different Trim Levels of the Mazda MAZDA6

The MAZDA MAZDA6 is available in various trim levels, each offering different features and specifications. Insurance rates for different trim levels may vary due to factors such as the vehicle’s value, repair costs, and safety features. For further information, refer to our article titled “Car Driving Safety Guide for Teens and Parents.”

Kristine Lee Licensed Insurance Agent

Generally, higher-priced trim levels with additional features tend to have higher insurance premiums. It’s essential to consider these cost differences when choosing the right trim level for your MAZDA6, ensuring that insurance costs align with your budget and coverage needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring the Average Insurance Rates for Mazda Sedans, Including the MAZDA6

While specific insurance rates for MAZDA6 sedans may differ, it’s helpful to explore the average insurance rates for MAZDA sedans in general. MAZDA vehicles are known for their excellent safety ratings and reliability, which can positively impact insurance costs. Additional details about this provider can be found in our article titled “Lesser Known Car Insurance Discounts.”

According to industry data, the average insurance cost for MAZDA sedans, Including The Mazda6, tends to be relatively affordable compared to some luxury vehicle brands. However, individual factors such as your driving record, location, and coverage options will ultimately determine your insurance premiums.

How Does the Age and Driving History of the Insured Affect Mazda MAZDA6 Insurance Rates?

The age and driving history of the insured individual significantly impact MAZDA MAZDA6 insurance rates. Younger drivers, especially those with limited driving experience, are typically considered higher risk by insurance providers, resulting in higher insurance premiums.

On the other hand, mature drivers with a clean driving record and many years of experience are often rewarded with lower insurance rates. Insurance companies tend to view cautious and low-risk drivers favorably, as they are less likely to get involved in accidents. Find additional information in our article titled “Does my car insurance cover damage caused by a construction zone accident?”

Looking to #writeoff 🚙 insurance on your taxes this year? See below for a few tips and don’t forget to keep those receipts! #TaxSeasonhttps://t.co/WQLzXOLiv4 pic.twitter.com/3xCNcsFQWj

— Progressive (@progressive) April 3, 2024

It’s worth noting that different insurance providers may have varying criteria for determining the impact of age and driving history on insurance rates. Thus, it’s essential to compare quotes from multiple insurers to find the most competitive rates tailored to your specific circumstances.

Tips for Finding Affordable Car Insurance for Your Mazda MAZDA6

To secure affordable car insurance for your MAZDA MAZDA6, consider implementing several effective strategies.

Start by comparing quotes from multiple insurers to evaluate the most budget-friendly policy that suits your needs. Increasing your deductible can also reduce your monthly premiums, but ensure the amount is manageable for your budget. Additionally, capitalize on any discounts offered by insurance providers, such as safe driving rewards, bundled policy savings, and reductions for anti-theft installations.

Lastly, maintaining a clean driving record by avoiding accidents and traffic violations can lead to lower premiums over time, reflecting your lower risk to insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Coverage Options Available for Insuring a Mazda MAZDA6

When insuring your MAZDA MAZDA6, it’s essential to understand the different coverage options available. The most common types of car insurance coverage include:

- Liability Coverage: This covers damages and injuries you cause to others in an accident.

- Collision Coverage: This covers repairs to your vehicle after a collision, regardless of who is at fault.

- Comprehensive Coverage: This covers non-collision-related damages to your vehicle, such as theft, vandalism, and damage from natural disasters.

- Personal Injury Protection (PIP): This coverage pays for medical expenses for you and your passengers in case of an accident.

- Uninsured/Underinsured Motorist Coverage: This covers you if you get involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

Understanding these coverage options and selecting the ones that suit your needs and budget is crucial for obtaining an insurance policy that adequately protects you and your MAZDA6.

Is It Cheaper to Insure a New or Used Mazda MAZDA6

The cost of insuring a new or used MAZDA MAZDA6 can vary depending on several factors. Typically, insuring a used MAZDA6 tends to be cheaper compared to insuring a brand-new vehicle. This is primarily because used vehicles generally have a lower market value and may have lower repair costs.

Additionally, insurance providers consider the age of the vehicle when calculating insurance premiums. Discover insights in our article titled “What age do you get cheap car insurance?”

However, it’s important to note that individual factors, such as the specific model year, condition of the used vehicle, and the amount of coverage you choose, will also influence insurance costs. It’s advisable to obtain insurance quotes for both new and used MAZDA6 vehicles to compare the potential cost savings before making a final decision.

Comparing Insurance Costs for Similar Vehicles in the Same Segment as the Mazda MAZDA6

When researching insurance costs for the MAZDA MAZDA6, it can be helpful to compare them with similar vehicles in the same segment. Competing midsize sedans, such as the Honda Accord, Toyota Camry, and Nissan Altima, often have comparable insurance rates. Delve into our evaluation of our article titled “Honda Car Insurance Discount.”

Insurance providers assess various factors, including crash test ratings, safety features, repair costs, and theft rates when calculating insurance premiums. Therefore, insurance costs for similar vehicles within the same segment can provide useful context when determining if the MAZDA6 offers competitive insurance rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Regional Variations in Car Insurance Rates for the Mazda MAZDA6

Car insurance rates can also vary regionally, including for the MAZDA MAZDA6. Insurance providers consider factors such as local accident rates, crime rates, and population density when assessing insurance premiums. Therefore, the cost of insuring a MAZDA6 may differ across different states, cities, or even neighborhoods.

Ty Stewart Licensed Insurance Agent

Additionally, state laws and regulations regarding mandatory minimum coverage and insurance requirements can impact insurance rates. It’s essential to consider these regional variations when researching and comparing car insurance options for your MAZDA6.

The Importance of Comparing Quotes From Different Insurers When Insuring a MAZDA6

When seeking car insurance for your MAZDA6, it’s crucial to compare quotes from different insurance providers. Insurance rates can vary significantly between companies, even for the same coverage and vehicle. Comparing quotes allows you to find the most competitive rates available to you.

Using online comparison tools or working with an independent insurance agent can streamline the process of obtaining and comparing multiple quotes. It’s important to review each quote carefully, considering factors such as coverage limits, deductibles, and any additional benefits or discounts offered. Check out insurance savings in our complete article titled “What is Out-of-pocket maximum/limit?”

Exploring Potential Discounts and Savings Opportunities on Car Insurance for a MAZDA6 Owner

As a MAZDA6 owner, you may be eligible for various discounts and savings opportunities on car insurance. Insurance providers often offer discounts for factors such as safe driving records, completing a defensive driving course, or bundling multiple policies (e.g., auto and home insurance) with the same insurer.

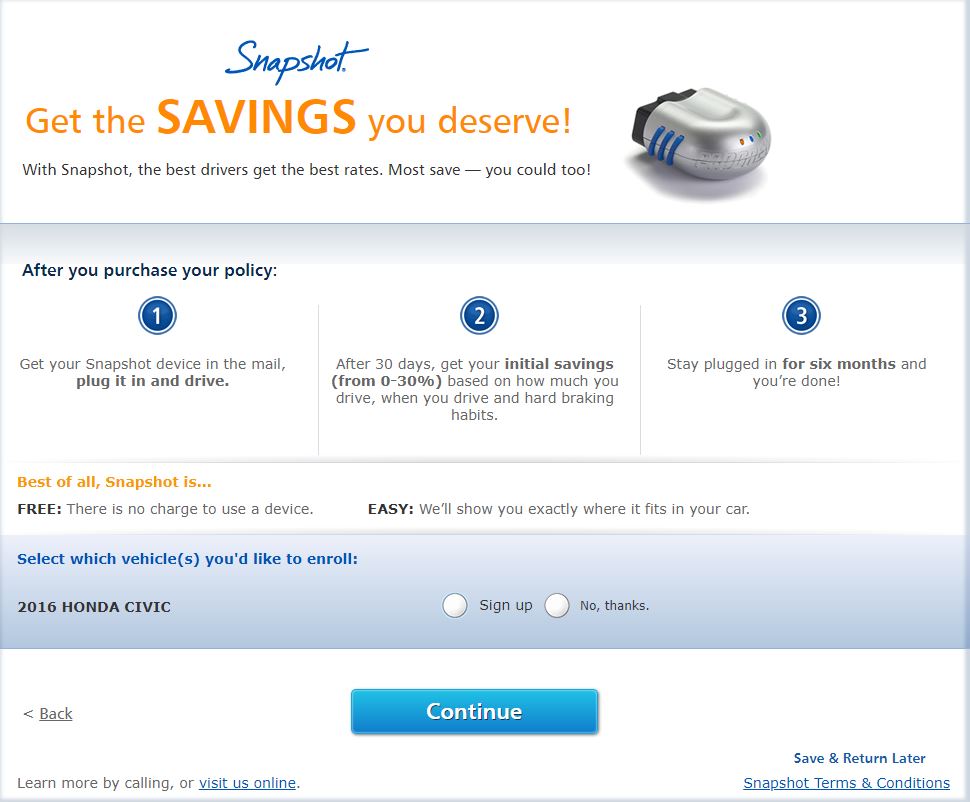

Additionally, you may be able to save on insurance costs by installing anti-theft devices or using telematics devices that monitor your driving behavior. By demonstrating responsible driving habits, you can potentially benefit from lower insurance premiums.

It’s important to explore the different discounts available from insurance providers and determine which ones you may qualify for. Not all insurers offer the same discounts, so comparing quotes from multiple providers will help you identify the greatest potential savings.

In conclusion, MAZDA MAZDA6 insurance costs vary based on factors like driving history, age, and location. Comparing quotes, utilizing discounts, and choosing the right coverage can help secure affordable insurance for your MAZDA6. Remember to review your policy regularly and shop around periodically to ensure you are getting the best car insurance rates available to you.

Enter your ZIP code below to get personalized insurance quotes tailored to your needs and budget.

Frequently Asked Questions

What factors affect the cost of MAZDA MAZDA6 car insurance?

The cost of MAZDA MAZDA6 car insurance can be influenced by several factors. These include the driver’s age, driving history, location, coverage limits, deductible amount, and the insurance provider’s pricing policies.

For additional details, explore our comprehensive resource titled “What is embedded deductible?”

Are there any specific safety features of the MAZDA MAZDA6 that can lower insurance costs?

Yes, the MAZDA MAZDA6 comes equipped with various safety features that can potentially lower insurance costs. These may include advanced driver assistance systems, anti-lock brakes, airbags, stability control, and other safety technologies. Insurance providers often consider these features when determining premiums.

Does the cost of MAZDA MAZDA6 car insurance vary depending on the model year?

Yes, the model year of the MAZDA MAZDA6 can affect the cost of car insurance. Generally, newer models may have higher insurance premiums due to their higher market value and potentially costlier repairs or replacement parts. However, factors such as safety ratings and available safety features can also influence insurance costs.

Do insurance rates for the MAZDA MAZDA6 differ based on location?

Yes, insurance rates for the MAZDA MAZDA6 can vary based on the location of the insured driver. Factors such as the local crime rate, population density, and historical accident statistics in a particular area can impact insurance premiums. Areas with higher risks may result in higher insurance costs.

Are there any discounts available for MAZDA MAZDA6 car insurance?

Yes, MAZDA MAZDA6 car insurance often comes with several discounts such as safe driver, multi-car, bundling policies, anti-theft device, and defensive driving course discounts to help reduce premiums.

To find out more, explore our guide titled “What is premium subsidies?”

Are Mazda 6 cheap to insure?

Similar to other Mazda sedans, the Mazda6 tends to be pricier to insure, costing roughly $17 more per month than the average rate for 2021 models, and it shares a comparable insurance expense with the Mazda3 Hatchback and Sedan.

What is the cheapest insurance for a Mazda?

The Mazda CX-5 has an average insurance cost of about $110 per month, which is relatively inexpensive compared to other vehicles. State Farm provides the most affordable coverage, with rates influenced by factors like the car’s model year, the driver’s age, and the chosen insurer.

Why is Mazda insurance so high?

Newer or pricier Mazda models typically incur higher monthly insurance rates because of their increased risk of accidents or theft.

Is Mazda 6 high maintenance?

Mazda is highly regarded for its reliability and is among the more economical car brands for maintenance and repairs. The average Mazda maintenance cost is about $36 per month, lower than the $54 monthly average for the top 32 car brands.

To learn more, explore our comprehensive resource on “Cheap MAZDA MAZDA3 Car Insurance.”

Can a Mazda 6 last 300000 miles?

A Mazda vehicle is built to endure. Known for their longevity, Mazdas often last more than a decade and can cover between 200,000 and 250,000 miles, with some exceeding even those high mileages. Regular service and proper maintenance are crucial for extending the lifespan of a Mazda.

Is Mazda 6 a good reliable car?

Is the Mazda 6 a good car to drive?

What type of car insurance is cheapest?

Does Mazda have a bad reputation?

Is owning a Mazda expensive?

What color car is the most expensive to insure?

How long will a Mazda 6 last?

Is a Mazda 6 good on gas?

What is the common problem with the Mazda 6?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.