Cheap Kia Rio Car Insurance in 2026 (Unlock Big Savings From These 10 Companies!)

The top picks for the cheap Kia Rio car insurance are Progressive, USAA, and State Farm, offering rates as low as $60/month. These companies offer comprehensive coverage, and excellent customer service, making them the best choices for Kia Rio owners seeking affordable and reliable insurance options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Updated September 2024

Company Facts

Min. Coverage for Kia Rio

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Kia Rio

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Kia Rio

A.M. Best

Complaint Level

Pros & Cons

The top providers for cheap Kia Rio car insurance are Progressive, USAA, and State Farm, with Progressive offering the lowest rates starting at $60/month.

This article explores how these companies provide comprehensive coverage, excellent customer service, and competitive premiums.

Our Top 10 Company Picks: Cheap Kia Rio Car Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $60 | A+ | Snapshot Program | Progressive | |

| #2 | $62 | A++ | Military Discounts | USAA | |

| #3 | $65 | B | Drive Safe | State Farm | |

| #4 | $67 | A+ | New Car | Allstate | |

| #5 | $70 | A+ | SmartRide Program | Nationwide |

| #6 | $73 | A | RightTrack Savings | Liberty Mutual |

| #7 | $75 | A | Signal App | Farmers | |

| #8 | $78 | A++ | IntelliDrive Program | Travelers | |

| #9 | $80 | A+ | Early Bird | American Family | |

| #10 | $82 | A | Membership Benefits | AAA |

Factors such as your driving history, location, and vehicle details also play a crucial role in determining your rates. Read on to learn more about finding the best insurance options for your Kia Rio. To gain further insights, consult our comprehensive guide titled “Car Driving Safety Guide for Teens and Parents.”

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

- Progressive, the top pick, offers the best coverage and customer service

- Discover cheap Kia Rio car insurance with rates starting at $60/month

- Comprehensive coverage and location affect your Kia Rio insurance rates

#1 – Progressive: Top Overall Pick

Pros

- Affordable Rates: Progressive insurance review & ratings highlight some of the lowest rates for Kia Rio car insurance, beginning at just $60 per month.

- Comprehensive Coverage Options: Progressive provides a variety of coverage options, including liability, comprehensive, and collision, ensuring comprehensive protection for Kia Rio owners.

- User-Friendly Online Tools: Progressive’s website and mobile app make it easy to manage policies, file claims, and compare quotes, enhancing customer convenience.

Cons

- Higher Rates for High-Risk Drivers: Progressive tends to charge higher premiums for drivers with a history of accidents or violations, which may be less favorable for some Kia Rio owners.

- Limited Availability of Local Agents: Progressive relies heavily on online services, which might not appeal to those who prefer face-to-face interactions with local agents.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

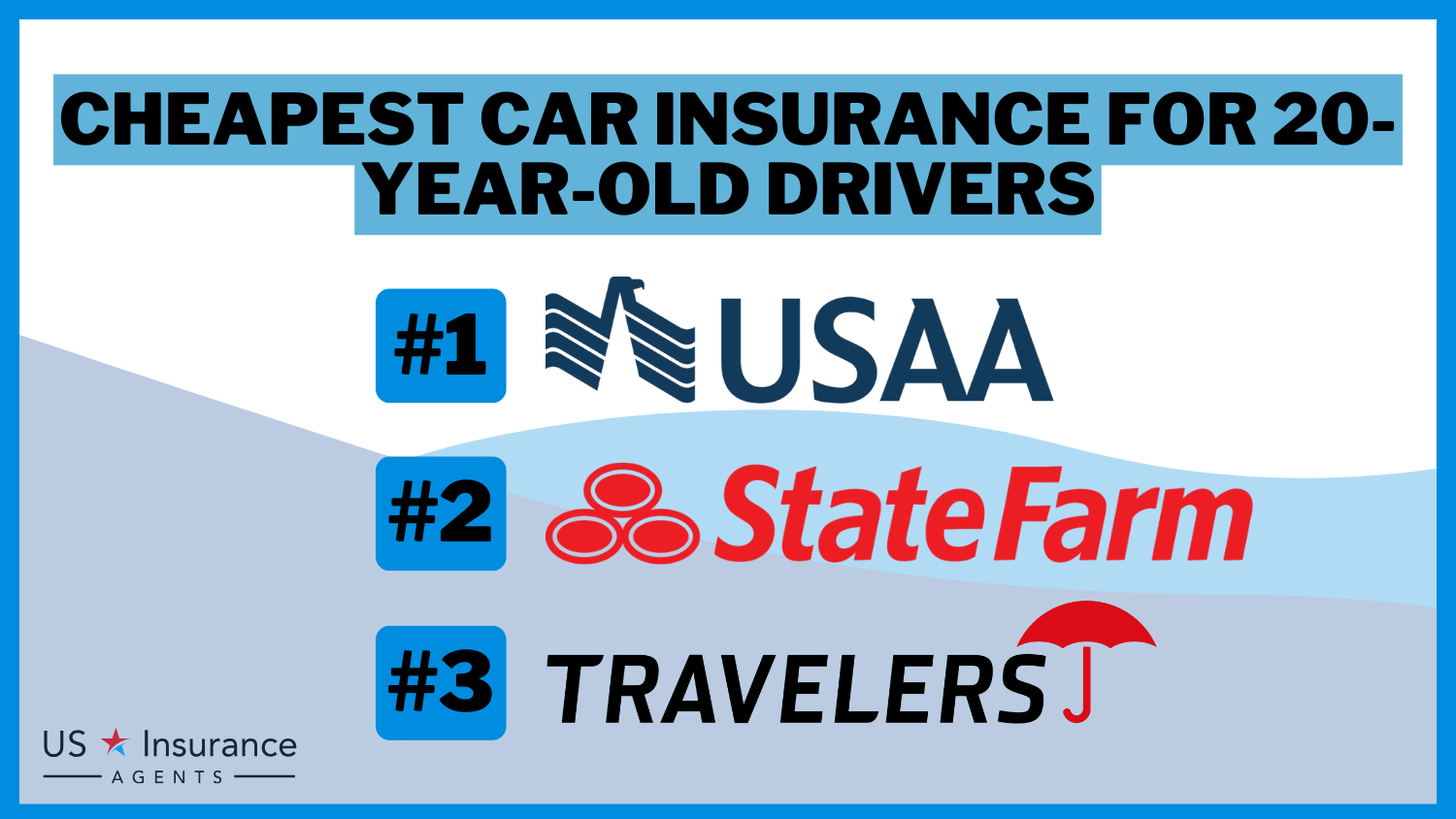

#2 – USAA: Best for Military Discounts

Pros

- Military Discounts: USAA offers significant discounts for military personnel and their families, making it a top choice for Kia Rio owners with a military background.

- Superior Customer Service: USAA insurance review & ratings highlight their outstanding customer service, offering timely and helpful support to ensure a smooth insurance experience.

- Extensive Coverage Options: USAA provides a wide range of coverage options, including comprehensive, collision, and roadside assistance, catering to the diverse needs of Kia Rio owners.

Cons

- Restricted Eligibility: USAA membership is limited to military personnel, veterans, and their families, excluding a significant portion of the general public.

- Potential Higher Rates for Non-Military Members: While USAA is highly competitive for military members, non-military members might find better rates elsewhere.

#3 – State Farm: Best for Safety Driving

Pros

- Safe Driving Discounts: State Farm insurance review & ratings highlight significant discounts for safe driving, making it a cost-effective choice for Kia Rio drivers with a clean record.

- Comprehensive Coverage Options: Provides a wide range of coverage options, allowing Kia Rio owners to customize their policies to suit their needs.

- Mobile App: The State Farm mobile app offers convenient features for policy management, claims filing, and accessing insurance ID cards, making it easier for Kia Rio owners to manage their insurance.

Cons

- Higher Premiums for High-Risk Drivers: Kia Rio drivers with a history of accidents or violations may face higher premiums compared to other insurers.

- Inconsistent Agent Experience: Service quality can vary depending on the local agent, which might affect the overall customer experience for Kia Rio insurance seekers.

#4 – Allstate: Best for New Car

Pros

- New Car Discount: Allstate insurance review & ratings highlights a new car discount, making it an attractive option for Kia Rio owners with newer models.

- Accident Forgiveness: Provides accident forgiveness, ensuring that your rates won’t increase after the first accident, which is beneficial for Kia Rio owners.

- Multi-Policy Discount: Bundling auto insurance with other types of insurance (e.g., home) can lead to significant savings for Kia Rio owners.

Cons

- Higher Base Rates: Allstate’s base rates can be higher than some competitors, which might be a drawback for budget-conscious Kia Rio drivers.

- Complex Discount Eligibility: Some discounts have complex eligibility requirements, which might make it harder for some Kia Rio owners to qualify for savings.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for SmartRide Program

Pros

- SmartRide Program: Nationwide insurance review & ratings highlights substantial discounts for safe driving behaviors, making it an excellent choice for Kia Rio drivers who drive responsibly.

- Comprehensive Coverage Options: Broad range of coverage types, ensuring Kia Rio drivers can find a policy that meets all their needs.

- Multi-Policy Discounts: Combining auto insurance with home or renters insurance can lead to substantial savings, perfect for Kia Rio owners looking to bundle.

Cons

- Higher Initial Premiums: Initial rates may be higher compared to other providers, making it less appealing for Kia Rio owners seeking immediate cost savings.

- Customer Service Variability: Reports of inconsistent customer service experiences, which could be a concern for Kia Rio owners needing dependable support.

#6 – Liberty Mutual: Best for RightTrack Savings

Pros

- RightTrack Program: Liberty Mutual insurance review & ratings highlights that drivers can save up to 30% for safe driving habits, which is advantageous for Kia Rio owners who maintain safe driving practices.

- Accident Forgiveness: First accident is forgiven, which can be a significant relief for Kia Rio drivers concerned about rate hikes after an accident.

- Flexible Payment Options: Various payment plans available to suit different budgets, helpful for Kia Rio owners managing their finances.

Cons

- Higher Premiums for Young Drivers: Younger Kia Rio drivers might face higher premiums, making it less cost-effective for this demographic.

- Limited Coverage Customization: Fewer options to customize policies compared to competitors, which might not meet all specific needs of Kia Rio owners.

#7 – Farmers: Best for Signal App

Pros

- Signal App Discounts: Farmers offers discounts for using their Signal app, which tracks driving behavior and rewards safe driving—ideal for Kia Rio owners looking to reduce premiums.

- Comprehensive Coverage Options: Farmers provides a range of coverage options, including liability, collision, and comprehensive, ensuring your Kia Rio is fully protected.

- Accident Forgiveness: Farmers insurance review & ratings highlights that the accident forgiveness program ensures your rates won’t rise after your first at-fault accident, providing peace of mind for Kia Rio drivers.

Cons

- Higher Premiums: Farmers’ comprehensive coverage options can be more expensive compared to other providers, which might not appeal to all Kia Rio owners seeking the lowest rates.

- Customer Service Variability: Customer service experiences can vary by location and agent, potentially leading to inconsistent support for Kia Rio owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for IntelliDrive Program

Pros

- IntelliDrive Program: Travelers insurance review & ratings highlight the IntelliDrive program, which utilizes a mobile app to monitor driving habits and can provide discounts for safe driving, offering benefits to Kia Rio owners.

- Gap Insurance: Travelers offers gap insurance to cover the difference between the car’s value and what you owe on a loan, which is helpful for Kia Rio drivers with financed vehicles.

- Multi-Policy Discounts: Similar to Farmers, Travelers provides discounts when you bundle car insurance with other policies, maximizing savings for Kia Rio owners.

Cons

- Usage-Based Program Limitations: The IntelliDrive program requires consistent and safe driving over a period to see significant discounts, which might not suit all Kia Rio drivers.

- Higher Premiums for High-Risk Drivers: Travelers may charge higher premiums for drivers with less favorable driving records, making it less attractive for some Kia Rio owners.

#9 – American Family: Best for Early Bird

Pros

- Discounts for Safe Drivers: American Family offers significant discounts for drivers with clean records, helping Kia Rio owners save on their insurance premiums.

- Multi-Policy Discounts: American Family insurance review & ratings highlights that Kia Rio owners can achieve significant savings on their overall insurance expenses by bundling auto insurance with home or other policies.

- Comprehensive Coverage Options: American Family provides extensive coverage options, including collision, comprehensive, and liability, to suit the specific needs of Kia Rio drivers.

Cons

- Higher Rates for Younger Drivers: American Family tends to have higher premiums for younger Kia Rio drivers, which might not be as budget-friendly for this demographic.

- Mixed Customer Service Reviews: While 24/7 service is available, some customers have reported inconsistent experiences with claims processing and customer support.

#10 – AAA: Best for Membership Benefits

Pros

- Membership Benefits: AAA insurance review & ratings highlight exclusive discounts and benefits for members, featuring savings on Kia Rio car insurance and additional perks such as roadside assistance.

- Comprehensive Roadside Assistance: AAA’s renowned roadside assistance is included with their insurance policies, providing peace of mind for Kia Rio drivers in case of emergencies.

- Accident Forgiveness: AAA offers accident forgiveness, meaning your rates won’t increase after your first at-fault accident, which is a valuable benefit for Kia Rio owners.

Cons

- Higher Premiums for High-Risk Drivers: Drivers with less-than-perfect records might face higher premiums with AAA, making it less affordable for some Kia Rio owners.

- Limited Online Services: AAA’s online insurance management tools are less comprehensive compared to other insurers, which might be inconvenient for tech-savvy Kia Rio owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Factors That Affect Kia Rio Car Insurance Rates

Several factors come into play when it comes to determining the cost of car insurance for a Kia Rio. These factors include, but are not limited to, your age, gender, driving record, credit score, and the average annual mileage you accumulate. Insurance companies use statistical data to assess the risk associated with insuring a particular vehicle and establish appropriate premiums.

Jeff Root Licensed Life Insurance Agent

So your personal characteristics and driving history can directly impact the cost of insuring your Kia Rio. In addition to personal characteristics and driving history, another factor that can affect the cost of insuring a Kia Rio is the location where the car is primarily driven and parked.

Insurance companies take into account the crime rate and accident frequency in the area where the vehicle is located, as these factors can increase the likelihood of theft or damage. Therefore, if you live in an area with a higher crime rate or accident frequency, you may expect to pay higher insurance premiums for your Kia Rio.

Kia Rio Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $82 $180

Allstate $67 $150

American Family $80 $175

Farmers $75 $165

Liberty Mutual $73 $160

Nationwide $70 $155

Progressive $60 $135

State Farm $65 $145

Travelers $78 $170

USAA $62 $140

When comparing Kia Rio car insurance rates, the cost varies by coverage level and provider. For minimum coverage, Progressive offers the most affordable rate at $60 per month, followed by USAA at $62, and Allstate at $67. To broaden your understanding, explore our comprehensive resource on insurance coverage titled “Full Coverage Car Insurance: A Complete Guide.”

Full coverage rates are generally higher, with Progressive again offering the lowest rate at $135 per month, USAA at $140, and State Farm at $145. Other providers such as AAA, American Family, and Travelers offer higher rates, reflecting the differences in pricing strategies among insurance companies. Overall, rates range from $60 to $82 for minimum coverage and $135 to $180 for full coverage.

Top car insurance providers offer a variety of discounts for Kia Rio drivers. AAA, Allstate, American Family, Farmers, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, and USAA provide savings for safe driving, multi-policy, anti-theft devices, new cars, loyalty, and more. These discounts help Kia Rio owners reduce their insurance premiums effectively.

Optimizing Insurance Coverage and Costs for Your Kia Rio

When selecting car insurance for your Kia Rio, you have several options, including liability coverage, which is the minimum requirement in most states, as well as comprehensive, collision, medical payments, and uninsured/underinsured motorist coverage.

Each type offers varying levels of protection and costs, so understanding these options is crucial to choosing the best fit for your needs and budget. The model year of your Kia Rio can also influence your premiums, with newer models typically costing more to insure due to higher repair or replacement costs, although they may qualify for safety feature discounts.

Your driving history is another key factor, as a clean record can lead to lower premiums, while a history of accidents or violations can increase costs. Additionally, the trim level of your Kia Rio impacts insurance rates; higher trims with more features or power can raise premiums due to increased repair costs or theft attractiveness.

Tips to Lower Your Kia Rio Car Insurance Premiums

Lowering your Kia Rio car insurance premiums doesn’t have to be a daunting task. By implementing a few strategic actions, you can significantly reduce your insurance costs while maintaining adequate coverage. Here are some practical tips to help you achieve lower premiums.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to demonstrate safe driving behavior, which can lead to lower insurance rates.

- Opt for a Higher Deductible: Choose a higher amount you’ll pay out of pocket before insurance kicks in. This lowers your premium but ensure you can afford the deductible if you need to make a claim.

- Bundle Car Insurance: Purchase multiple types of insurance (e.g., car, home, renters) from the same company to receive a discount.

- Compare Quotes: Shop around to get price estimates from different insurers to find the most cost-effective option for your coverage needs.

By implementing these tips, you can effectively reduce your Kia Rio car insurance premiums, ensuring you get the best coverage at the most affordable rate. For a comprehensive analysis, refer to our detailed guide titled “How does the insurance company determine my premium?”

Michelle Robbins Licensed Insurance Agent

Maintaining a clean driving record not only helps in avoiding potential fines and accidents but also demonstrates your responsibility as a driver, which insurers reward with lower premiums.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Essential Factors That Affect Your Kia Rio Insurance Rates

When insuring your Kia Rio, various factors influence insurance rates, including your location, which affects premiums due to accident frequency, theft rates, and local weather conditions. Urban areas with higher crime rates or extreme weather may incur higher costs. For detailed information, refer to our comprehensive report titled “Best Anti Theft System Car Insurance Discounts.”

Safety features like anti-lock brakes and airbags can lower premiums by reducing injury risks. The deductible you choose also impacts rates; higher deductibles often mean lower premiums but require careful financial consideration.

Comprehensive and collision coverage provide extra protection against non-collision incidents and collisions, respectively, though they can increase premiums. Researching car insurance providers involves comparing quotes, evaluating financial strength, and reading reviews. The color of your Kia Rio does not affect insurance prices, as insurers focus on model, year, and driving history.

Bundling car insurance with other policies can offer discounts and simplify management. Additionally, insurance providers offer various discounts, such as for safe driving, multi-vehicle policies, loyalty, and specific professions. Exploring these opportunities ensures you’re maximizing savings on Kia Rio insurance.

Tips for Getting Accurate Quotes on Kia Rio Car Insurance Online

Finding accurate car insurance quotes for your Kia Rio can be a straightforward process with the right approach. Accurate quotes not only ensure you get the best possible rate but also guarantee that your coverage meets your specific needs.

- Accurate Information: Ensuring that all the information you provide is correct and detailed will help in obtaining an accurate quote. This includes your address, annual mileage, and the use of the car (e.g., personal, business).

- Understand Coverage Levels: Familiarizing yourself with various coverage options (e.g., liability, collision, comprehensive, uninsured motorist) will help you choose the right one and get accurate quotes that match your needs. To enhance your understanding, explore our comprehensive resource on insurance titled “Collision Car Insurance: A Complete Guide.”

- Compare Multiple Quotes: Obtain quotes from several insurance providers. Comparing quotes from different companies can help you find the best rate and coverage. Each company may weigh factors differently, leading to varied quotes.

- Consider Deductibles: Choose the right deductible for your situation. Higher deductibles can lower your premiums, but ensure you can afford the deductible amount in case of a claim. Balance your deductible with your budget and risk tolerance.

- Review Your Needs Annually: Reevaluate your insurance needs and quotes each year. Your insurance needs may change over time, so it’s wise to review and compare quotes annually to ensure you’re still getting the best rate and coverage.

By following these tips, you can ensure that the car insurance quotes you receive for your Kia Rio are accurate and tailored to your needs. Accurate quotes help you find the best rates and coverage, saving you both time and money.

Jeff Root Licensed Life Insurance Agent

Remember to regularly review your insurance policy and update your information to maintain accurate quotes. Taking these steps will help you stay protected on the road while making informed decisions about your car insurance.

Comprehensive Guide to Managing Kia Rio Insurance Costs

Modifying your Kia Rio or adding aftermarket accessories can significantly impact your insurance costs, as providers often see these changes as increased risks due to potential effects on performance, value, and safety. For a comprehensive overview, explore our detailed resource titled “How much is car insurance?”

Engine enhancements, suspension modifications, or upgraded stereo systems may lead to higher premiums, making it essential to inform your insurer of any changes for appropriate coverage. Regular maintenance also plays a critical role in keeping insurance costs down, as well-maintained vehicles are seen as less risky and more reliable.

Adhering to the manufacturer’s maintenance schedule and keeping detailed records can prevent mechanical failures and support your vehicle’s longevity. Additionally, understanding the claims process is vital; promptly contacting your insurer, providing necessary documentation, and knowing their procedures can ensure efficient claim resolution in case of an accident or damage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Maximizing Savings and Coverage for you Kia Rio Insurance

These case studies provide real-life examples of how Kia Rio owners from various backgrounds and locations have successfully optimized their insurance coverage. By exploring their challenges, solutions, and outcomes, you can gain valuable insights to help you make informed decisions about your own car insurance needs.

- Case Study #1 – Young Driver in Urban Area: Sarah, a 22-year-old student in downtown Salt Lake City, reduced her high insurance premiums on her Kia Rio by using a comparison tool to find Progressive’s $70/month rate with a safe driver discount and a higher deductible, saving 20% on comprehensive coverage.

- Case Study #2 – Family Man in Suburban Area: John, a 35-year-old father of two in Provo, reduced his insurance expenses by 25% and ensured comprehensive protection for his Kia Rio by bundling his car and home insurance with State Farm, benefiting from multi-policy and new car discounts.

- Case Study #3 – Retired Individual With Low Mileage: Linda, a 68-year-old retiree in Ogden, lowered her high premiums for her Kia Rio by switching to USAA and enrolling in a usage-based insurance program, resulting in a reduced monthly premium of $50.

- Case Study #4 – High-Risk Driver in Rural Area: Mark, a 28-year-old mechanic from a rural area near Logan, reduced his Kia Rio insurance premiums by 15% by attending a defensive driving course and opting for minimum liability coverage with Allstate despite previous traffic violations and accidents.

- Case Study #5 – Tech-Savvy Young Professional: Emma, a 30-year-old IT professional in West Jordan, secured a $65 monthly premium for her Kia Rio by leveraging safety feature discounts and using an online comparison tool, ultimately choosing Progressive for its competitive rates and excellent customer service.

Whether you’re a young driver in a bustling city, a family man in the suburbs, a retiree with minimal driving requirements, or someone working to improve their driving record, there are strategies and solutions available to help you secure the best insurance rates for your Kia Rio.

Dani Best Licensed Insurance Producer

By leveraging discounts, utilizing comparison tools, and understanding the factors that affect your premiums, you can optimize your insurance coverage and achieve peace of mind on the road. To gain profound insights, consult our extensive guide titled “Types of Car Insurance Coverage.”

The Bottom Line: Understanding and Reducing Kia Rio Insurance Costs

The cost of car insurance for a Kia Rio depends on various factors, including your personal characteristics, driving history, location, and the features of your vehicle. Understanding these factors and their impact on insurance premiums can help you make an informed decision when choosing car insurance for your Kia Rio.

By comparing quotes, exploring discounts, and maintaining a clean driving record, you can potentially lower your insurance costs while ensuring adequate coverage for your Kia Rio. To expand your knowledge, refer to our comprehensive handbook titled “Car and Home Insurance Discounts.”

Avoid overpaying for your car insurance by entering your ZIP code below in our free comparison tool to find which company has the lowest rates.

Frequently Asked Questions

How much does Kia Rio5 car insurance cost?

The cost of insuring a Kia Rio5 varies by location, driving history, age, and coverage level. Minimum coverage starts around $60 per month, while full coverage ranges from $135 to $180 per month. Compare quotes from multiple insurers for the best rate.

What type of car insurance is cheapest?

Typically, fully comprehensive insurance is the least expensive, though prices are influenced by individual circumstances.

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

What is the lowest form of car insurance?

Liability insurance is generally the cheapest car insurance coverage because it only covers the cost of bodily injuries and property damages for another party if you’re at fault for an accident. It doesn’t cover damages to your vehicle or costs associated with your injuries.

For a thorough understanding, refer to our detailed analysis titled “Car Accidents: What to do in Worst Case Scenarios.”

What is the most basic car insurance?

You can buy many different types of car insurance policies. However, most basic car insurance includes liability protection. In fact, most states require a certain limit for these policies. They may also want you to have uninsured/underinsured protection and comprehensive coverage.

Which car insurance type is best?

Comprehensive Car Insurance Policy. This type of insurance policy provides complete protection. It covers both third-party liabilities as well as damages to your vehicle. Also, with a comprehensive cover, you can get compensation if the accident results in your death; the family members will receive the benefit.

Which is the most expensive form of car insurance?

While more expensive, comprehensive insurance gives you peace of mind in the event of collision, fire, theft or other unforeseen circumstances. At the end of the day, the only way to find out exactly how much you’ll pay for car insurance in Ireland is to compare quotes from different providers.

To delve deeper, refer to our in-depth report titled “Is car theft covered by car insurance?”

Is the Kia Rio a good car to buy?

With its competitive pricing and impressive specifications, the Kia Rio offers excellent value for money in the small car market. Whether you’re a first-time car buyer or looking for an affordable and practical daily driver, the Rio is a compelling choice.

What is the lowest category for car insurance?

Car insurance group 1If you’re thinking of buying or insuring a car, it’s worth knowing that cars in insurance group 1 are the cheapest to insure. If you’re thinking of buying or insuring a car, it’s worth knowing that cars in insurance group 1 are the cheapest to insure.

What is the least amount of car insurance you need?

The minimum amount of car insurance you’ll typically need is state-required liability coverage. This allows you to pay for some, if not all, injuries and damages you’re liable for in an accident. The most commonly required liability limits are $25,000/$50,000/$25,000, which mean: $25,000 in bodily injury per person.

To learn more, explore our comprehensive resource on insurance titled “Personal Injury Protection (PIP) Insurance: A Complete Guide.”

Which insurance cover is best for a car?

Comprehensive’ insurance cover provides the widest cover and covers for theft and hijacking, damages due to an accident, fire or explosion and natural disasters like hail and floods.

What type of insurance is most important for cars?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.